The legal purity of real estate is one of the most important aspects for the buyer. Checking it, first of all, consists of finding out whether there are arrests and encumbrances on the property. If they exist, then in the future this may become a serious stumbling block on the path to the transfer of ownership.

On the official website you will find apartments in Sochi without encumbrances. Every day the catalog is updated with new current offers in a variety of price segments. With our help, you are guaranteed to find your ideal option that suits all parameters.

What is an encumbrance

There is such a thing as “legal purity of real estate.”

This purity is checked when concluding a real estate transaction - be it a sale, donation, exchange or any other procedure. Cleanliness implies the absence of hidden or obvious problems that prevent you from concluding a deal here and now. Or these problems can lead to termination of the concluded deal after some time (in most cases, this is the next three years after the conclusion of the contract).

Among other obstacles (claims of third parties, the presence of citizens who have been deregistered but have not lost the right to this property, and so on) there is a certain encumbrance.

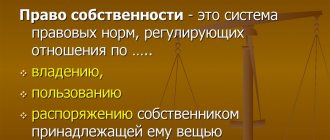

The essence of the encumbrance is as follows. This is a kind of restriction that does not allow the owner to fully exercise his rights in relation to the apartment. Article 209 of the Civil Code of the Russian Federation determines that the owner of property has the right to own, dispose of and use the object. The imposed encumbrance, as a rule, limits the owner's disposal of the property. That is, the owner still remains the owner and owns the property, and can also safely use it. In relation to an apartment - live in it, make repairs, and even act as a tenant. At the same time, he cannot sell, bequeath, or donate the apartment due to the existing encumbrance.

In other words, encumbrance is also called seizure of property. It sounds scary, but no one will lock up your apartment for 15 days. It’s just that restrictions on actions related to it are imposed on residential premises. Sometimes this is not only a restriction on the right to sell, but also registration bans may apply - for example, a ban on registration/registration of citizens.

Arrest

This measure limits the right to dispose of property. It cannot be sold or given away, but it can be used without additional restrictions. A record of the imposition of an encumbrance on a property is indicated in the Unified Register of Rights to Real Estate.

Seizure can be imposed by a court, preliminary investigation, or a bailiff on certain property. Once the need for it ceases, the arrest will be lifted. The owner is obliged to ensure the safety of the property during its validity.

Types of encumbrance

Depending on the type of permitted use of the property, its purpose, possible claims of other owners and to protect the interests of minor children, there are several types of encumbrances:

Limitation under the rental agreement:

this document protects the rights of the tenant. They do not fully restrict the owner’s right to sell, for example. But when selling an apartment, the owner “sells” it together with the tenant, since the lease agreement cannot be terminated before the specified period. This document also prohibits the owner of the property from renting it out to other persons, just as the owner himself cannot move into the apartment until the expiration date established by the contract.

Guardianship restrictions:

if minors are among the owners, the state additionally controls all transactions related to the transfer of the rights of its small citizens. Guardianship and trusteeship authorities vigilantly ensure that the rights of children are not violated during the sale of housing. Therefore, when making such transactions, the selling party must obtain written consent from the guardianship to sell the apartment. The trustee bodies ensure that when purchasing a new home, the child is given ownership of no less square meters than he had in the previous apartment. To do this, the former owners of the sold apartment must submit to the authorized bodies information about what share in the new housing was allocated to the minor owner.

Mortgage encumbrance:

The very concept of a mortgage implies the issuance of a loan for the purchase of real estate secured by the property being purchased. The fact that until the debt is fully repaid, the housing will be pledged to the bank disciplines the borrower to repay the loan in a timely manner and in full. During payments, the borrower is the owner, he can use and own the acquired property. If the loan is not repaid, the bank will be able to sell the collateral and return the invested funds.

Easement encumbrances:

The funny word easement significantly limits the owner’s rights to the property he owns. An easement provides additional opportunities to persons who do not have ownership rights to real estate or, for example, to a land plot. In the case of the latter, an easement restriction is established if it is impossible to get to your own land plot without passing the neighbor’s, or to lay communications to your own plot without “climbing” onto the adjacent plot. As for the apartment, the object of the easement may be passage rooms in communal apartments, for example.

Encumbrance under the rent agreement:

This is a special agreement that implies the full participation of the rental debtor in the life of the rental creditor. Paying monthly maintenance, buying groceries, cleaning the area and maintaining the apartment in proper condition - all this and much more must be done until the death of the current owner of the apartment. Only after this unfortunate fact does the rent debtor receive full ownership of the apartment.

Arrest:

We have already mentioned this concept in a general sense. But he still has a very specific story. Typically, seizure is imposed by judicial authorities as a result of the owner's failure to fulfill financial obligations to someone, or after the owner's arrest. Also, real estate can be seized while there is a legal battle between the owners, or with third parties at the request of one of the parties.

Encumbrance relating to unsafe houses:

If a house is declared unfit for habitation and subject to demolition, local government authorities impose a corresponding encumbrance on the apartments in this house. It does not interfere with the sale of an emergency apartment. But the buyer will be warned that the apartments will soon be purchased by the municipality in accordance with current legislation, and it is unlikely that they will be able to live happily ever after.

Encumbrance for architectural monuments:

There are houses that were built more than a dozen years ago. These houses are protected by special authorities and have the status of cultural or architectural monuments. Any action with apartments in historical buildings must be coordinated with cultural heritage support committees. This fact will not prevent you from selling the apartment, but the next owner must receive some kind of “security obligation” - instructions on what can and cannot be done with this premises.

Encumbrance when registering trust management:

is issued if the owner of the apartment lives in another city and cannot constantly deal with all the problems that entail the responsibilities of the owner. For this purpose, a manager is hired who can perform any actions not prohibited by law with the apartment. Except for the sale of an apartment. The document is drawn up by a notary and automatically becomes invalid when the owner changes.

There is another type of encumbrance. The owner of the apartment can submit a statement that all transactions made with his property can only be registered in the personal presence of the owner. In this way, you can avoid fraudulent schemes involving powers of attorney and signature forgery. This record will be stored in the information about the apartment, and if someone comes to conclude a transaction on your behalf, they will be denied registration, citing the statement of the owner.

What risks might there be for the buyer and seller?

When carrying out transactions in relation to real estate under encumbrance, a fairly extensive list of risks arises for both the buyer and the seller. These include:

For the seller

- If encumbrances are imposed by guardianship authorities, then the home can be sold only if the living children are provided with equivalent living conditions.

- When housing is seized, the process of alienation is possible only after the elimination of onerous obligations.

- If there is an annuity, there is a high degree of risk that the annuitant will refuse the already signed agreement.

- As for trust management, the owner may receive losses as a result of dishonest management of the provided property. And in this case, he does not receive any benefit from such an agreement.

For the buyer

The differences are that when buying a property with restrictions, the buyer takes on much more risk than the seller:

- When an apartment, its share, a residential building or a plot of land for development was taken out on a mortgage, and the interest and the loan itself were not paid, the buyer may be left without the purchased property as a result.

- The existence of a lease relationship is also transferred to the buyer if the corresponding agreement was signed before the alienation by the seller.

- There is also a risk area for the person who purchased the property that the transaction may be declared invalid by interested parties.

- In the event of a legal challenge, there is a high probability of loss of residential premises.

- The annuitant may terminate the annuity agreement at any time.

- There is a possibility of claims from third parties for the seizure of acquired property.

Regardless of whether it is the buyer or the owner of the property, it is recommended that before carrying out any transactions in relation to real estate, find out the information about encumbrances. This can be done directly to the Unified State Register of Real Estate by writing a corresponding application. An extract from the unified register is a very significant document that allows you to avoid possible risks of purchasing housing or other property with encumbrances.

How to impose an encumbrance

In some cases, it is not necessary to apply to the court or other authorized bodies to impose an encumbrance. One of the owners can achieve restrictions on their own, without resorting to the help of third-party organizations. This measure is necessary if the owner wants to avoid fraud on the part of tenants, or suspects possible encroachments on the property by other people when receiving an inheritance

Encumbrances are registered by Rosreestr, the only body in the country that stores all data on real estate transactions completed since 1998. Any transactions are registered here, so information about prohibitions on sales or other actions is also recorded by Rosreestr specialists.

In order to register a restriction, the owner must present:

- applicant's passport;

- certificate of ownership or a document replacing it;

- certificate of opening of an inheritance case from a notary.

If the encumbrance affects the legal rights and interests of other owners, their consent to this action is required. It can be expressed in person with a passport, or in writing (a statement certified by a notary).

Instead of going to Rosreestr, you can apply to the nearest branch of the MFC to impose an encumbrance. The law does not prohibit sending an application by mail; on the contrary, it encourages it in every possible way. But keep in mind that in this case, making a decision may be delayed, and during this time the ill-wisher may have time to do everything that you were so afraid of.

How to find out about an encumbrance

Before you buy an apartment, it is best to have reliable information about the legal purity of the transaction. In order to find out whether any restrictions have been imposed on actions with the apartment, you need to contact the organization that imposes these encumbrances. In our country, all information about possible encumbrances is stored in the Unified State Register of Real Estate, and Rosreestr has access to this data storage.

You can contact this organization online or in person. The MFC can provide such information, but in the latter case you will receive the information several days later than you otherwise would.

Online information is provided quickly and free of charge:

The Rosreestr website provides a brief reference with information about the object and its encumbrances. True, there are cases when this information does not coincide with reality. It’s incredible, but true – this happens. Therefore, the most reliable information will be provided on paper with the signature of a specialist and the seal of the organization.

You will not receive a paper copy within an hour, as you can with an electronic one. Usually it is issued within the first day or three after the request. If the application was received through the MFC, the issuance period may increase to a week. But you will have reliable information on your hands. And for issuing information on paper you will have to pay a state fee.

Information about the presence/absence of an encumbrance is indicated in the extract in the column “Restriction of rights and encumbrance of the property.” If there are restrictions, then the date and number of the document that imposes it, the grounds for the encumbrance, and information about the person or organization in whose favor the restriction applies are indicated here.

If the apartment is clean, instead of all the above data, the document will contain the phrase “not registered.”

How to remove an encumbrance

If you are the “lucky” owner of an apartment with an encumbrance, then sooner or later you begin to take actions to remove all restrictions from the property.

To do this, you need to remember the main rule: the encumbrance is removed by the person or body that created it, and restrictions are removed when the circumstances in connection with which this encumbrance arose end.

Simply put, the encumbrances associated with the conclusion of the contract end upon the expiration of its validity or the occurrence of the events specified in the document. This applies to a mortgage (removal of the encumbrance after full repayment of the debt), a lifelong maintenance agreement (the encumbrance is removed after the death of the annuity lender), and a lease agreement (ends upon expiration of the lease term).

Some encumbrances cannot be removed. For example, a house that belongs to an architectural monument or cultural heritage site is unlikely to cease to be such. Or a house recognized as unsafe and subject to demolition will ultimately be destroyed. Therefore, there is no need to talk about lifting the encumbrance here.

A judicial arrest is lifted by an appropriate judicial act - decision or decree.

You can only remove the encumbrance yourself if you created it yourself, fearing fraudulent schemes or the secret sale of your property.

Remember, in any case, the encumbrance is not automatically canceled! To make the apartment “clean”, the owner needs to contact Rosreestr with a document confirming the cancellation of the encumbrance. To cancel restrictions, in most cases, a representative of the party that imposed the encumbrance is needed. For example, to remove a mortgage, an authorized representative of the bank is present when submitting the application.

Since laws and regulations in our country change like the weather in March, before submitting an application, it is better to clarify the required list of documents before your visit.

Short

- There are different types of encumbrances - for example, the object may be mortgaged or under arrest, pledged or in the custody of a guardian.

- The encumbrance can be either voluntary or forced.

- You can check the encumbrance on real estate on the website of Rosreestr or MFC.

- An encumbrance can be imposed not only by creditors or the state, but also by the homeowner - to do this, you need to submit a package of documents with an application to Rosreestr.

- It is not always possible to remove restrictions - for example, the encumbrances for a dilapidated house or architectural monument are not removed.

Sale of an apartment with an encumbrance

Is it possible to sell and buy an apartment with an encumbrance? Can. And in some cases it's even relatively safe. For example, there is a widespread practice of buying/selling an apartment with a mortgage, when the new owner simply pays the remaining amount to the bank instead of the previous one.

Encumbrances associated with the historical value of the house do not interfere with transactions at all. Emergency housing can also be purchased, knowing the consequences. However, some cunning citizens specifically buy emergency apartments at a very low price, and then, through legal proceedings, try to inflate compensation by one and a half to two times.

The only encumbrance that completely makes it impossible to transfer ownership is a court arrest or a ban on one of the owners from performing registration actions.

If you buy an apartment with encumbrances, do not hesitate to reduce the price. As a rule, mortgaged apartments on the market are presented at a cost that is less than the average of 10 percent. For apartments with other types of encumbrances, their value can be reduced by up to 50% of the market price.

Pledge

This is one of the forms of securing a transaction. The best known use is the use of collateral to secure a loan. It is stipulated that in case of full or partial non-payment of the loan, the bank can sell the collateral to compensate for its losses. It is important to note that if the proceeds exceed the required amount, the balance must be returned to the collateral owner. This method should compensate not only the principal amount of the debt, but also the interest specified in the agreement.

Sometimes it is possible that the collateral reduces its value or loses it completely. For example, if a house collapses, the apartment that was in it and was collateral can no longer be sold. If a car was left as collateral, but it was involved in an accident or was stolen, then it cannot be used to compensate for losses.

To prevent this from happening, the borrower must insure the property against damage or destruction. If the events listed above occur, the corresponding amount will be paid and the bank will not lose anything. Such a requirement is usually not specified directly in the contract; however, without an insurance contract, the loan may not be issued at all or issued on less attractive terms.