Every officially employed person, in case of injury, illness or other health problems, goes to the clinic at his place of residence to open a sick leave certificate, which is important for both the employee and the employer and is confirmation of absence due to illness.

The law requires each employee to provide sick leave, otherwise absence from work is considered absenteeism. This official form also gives the right to be treated at home and receive benefits during forced “rest.”

What is the difference from regular sick leave?

Regular sick leave opens and closes within one month. For example, an employee fell ill on November 5, and went to work on the 15th and provided sick leave, opened on November 5 and closed on November 14. This is a regular sick leave.

If the certificate of incapacity for work is open in one month and closed in another, then this is a rolling sick leave. For example, an employee fell ill on May 28 and returned to work on June 10.

Typically, rolling leave refers to sick leave opened in December and closed in January. But this may also apply to other months of the year.

Maximum period

According to clause 19 of the Order, the maximum duration of sick leave, which is prescribed by the attending physician, is 15 calendar days. The maximum period for which a hospital dentist and paramedic can open is 10 days.

If during this period the patient has not recovered, he is sent for examination by a medical commission, which can extend the period up to 10 months in the case of serious illnesses, injuries and complex operations. When treating tuberculosis - up to 12 months.

In this situation, the sick employee must come for examination by a medical commission every 15 days. The commission evaluates the progress of treatment, rehabilitation and makes a decision to extend or close the certificate of temporary incapacity for work.

Who can issue a rolling sick leave?

The legislation allows the issuance of sick leave only to licensed medical institutions:

- These can be public clinics or hospitals and private medical centers that have licenses and certificates. Forms must be filled out in accordance with established rules, dates must be accurately and clearly stated.

- The document can also be obtained from a foreign clinic if the employee falls ill during a business trip. In this case, sick leave is issued according to the laws of this country, and upon return it is provided to the personnel department.

The minimum period for which sick leave is opened is 3 days. Even if the employee feels better, he cannot begin his job duties on the second day.

The maximum period for opening a sick leave is a month. If recovery has not occurred during this time, and it is necessary to continue treatment, the head physician of the medical institution gathers a council of doctors, at which the issue of further treatment or closure of sick leave is decided.

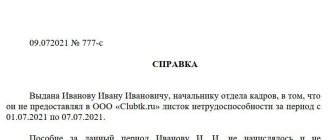

Unclosed sick leave: treatment continues

So, the employee brought in sick leave for payment with the “Start work” line blank. But in the “Other” line, code 31 is indicated (continues to hurt). Empty lines in the “Exemption from work” table are crossed out with a horizontal line. The required lines contain the continuation number of the certificate of incapacity for work, the signature of the doctor and the seal of the medical organization.

Such registration of a certificate of incapacity for work is expressly provided for by the Procedure specifically for cases of long-term treatment, so that a person can receive benefits in parts.

That is, sick leave with code 31 not only can, but must be paid after presentation.

When will sick leave be issued?

A sick leave certificate will only be issued to a truly sick person (illness or injury). This does not apply to a person under the influence of drugs or alcohol.

The following situations are also possible:

- If a relative is sick and needs care.

- Health problems due to pregnancy.

- Childbirth is coming.

- The person is in quarantine.

Important! If an employee falls ill during vacation, the vacation can be extended after recovery.

General requirements

The rules by which a document on illness is issued are approved by Order of the Ministry of Health of the Russian Federation dated September 1, 2020 No. 925N (hereinafter referred to as the Order). The Order states that only insured persons can receive a certificate of incapacity for work: citizens of the Russian Federation, foreigners and stateless persons permanently or temporarily residing in the Russian Federation, as well as foreign citizens and stateless persons temporarily staying in the Russian Federation. This procedure applies to:

- those working under an employment contract, including managers who are the only founders (the guarantees of the Labor Code of the Russian Federation do not apply to those working under GPC contracts);

- state civil servants, municipal employees;

- clergy;

- lawyers, individual entrepreneurs, members of peasant farms, notaries;

- women who were fired due to the liquidation of an enterprise and became pregnant within twelve months before being declared unemployed;

- unemployed citizens who are registered with the employment service, with temporary loss of ability to work.

Sick leave is issued only by attending physicians, paramedics and dentists in licensed medical institutions. The medical staff of blood transfusion services, ambulances, mud baths and balneological hospitals, the forensic medical examination bureau and other specialized institutions do not have the right to issue this document.

A paper certificate of incapacity for work is issued using an identification document. For electronic sick leave, you will additionally need SNILS. If, at the time of maternity leave or temporary disability, the sick person works for two or more employers and has worked for them for the previous two years, he is issued several paper sick leaves or one electronic sick leave number.

As a rule, opening and closing the disability form is done in one medical institution. If the patient was sent for treatment to another organization, a new form (continued) is issued there.

How does payment work?

After recovery, the sick leave is transferred to the accounting department. But no later than six months from the date of termination of the sick leave. Otherwise, benefits will not be accrued.

In accordance with Federal Law No. 255 of 03/09/16, after submitting a certificate of incapacity for work, benefits are accrued within 10 days and issued together with the next salary or advance payment.

Benefit payment calculation

To calculate the payment amount you need to know:

- How many days did the sick leave officially last?

- Official work experience.

- Average wage for one day.

Benefit amount

The amount of the benefit directly depends on the length of service, as well as on the salary of the last two years:

- If the experience is less than 2 years, then provide a certificate from a previous job for correct calculation.

- If the work experience is more than 8 years, then the amount of benefits for one day of sick leave is equal to the average income per day.

- From 5 to 8 years - 80% of average income.

- Up to 5 years - 60% of average income.

- Up to 6 months - payments are calculated according to the minimum wage.

The calculation of rolling sick leave is made using the same formula as for regular sick leave.

The average salary per day is calculated as follows: the annual salary for the two previous years is divided by 730 days. Then it is multiplied by the number of days of sick leave and by a coefficient (0.8; 0.6 or according to the minimum wage).

Let's look at an example

Employee A.A. Petrov provided sick leave, which was opened on December 25, 2021, and closed on January 10, 2021. On January 11, the employee began his official duties. Thus, he was sick for 7 days in December and 10 in January - a total of 17 days.

The amount of his income for the previous 2 years:

- For 2015 - 300 thousand rubles.

- For 2021 - 350 thousand rubles.

Total 650 thousand rubles for two years.

Let's calculate the average income for one working day: 650,000/731=889 rubles. 2021 was a leap year, so you need to divide by 731, not 730. The employee’s work experience is more than 10 years, so his payment per day will be equal to the average income per day. If the total length of service was, for example, 6 years, then the payment per day would be 889 * 0.8 = 711 rubles.

So, the total payment for 17 days of sick leave will be 889 * 17 = 15,113 rubles.

Important! The employee will not receive the entire amount: taxes will be deducted.

Sick leave payment period

Temporary disability benefits are paid by the employer or directly by the social insurance fund in the regions participating in the Social Insurance Fund pilot project. However, even in those regions where direct payments are made, the employer independently pays for the first 3 days of illness.

For the payment of accrued benefits, paragraph 1 of Article 15 of Law No. 255-FZ establishes a certain period - the day closest to the date of payment of wages after the assignment of benefits.

The benefit may be paid in installments. Each of these parts has its own payment date.

In general, payments of parts of one benefit may occur in different months or quarters, and the conditions for calculating personal income tax may differ. The date of actual receipt of income in the form of temporary disability benefits is determined as the date of payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Consequently, if benefits for one sick leave are paid in several parts, then each of these parts corresponds to its own payment date and the date of actual receipt of income.

What difficulties arise when paying for temporary sick leave?

Difficulties with calculating and paying for transitional sick leave usually do not arise.

You need to know some nuances:

- A sick leave sheet opened in December and closed after the new year contains at least 2 forms, one of which relates to the new year, and the other to the previous year.

- Sheets can be provided at different times, then payment will be calculated for each form separately.

- If the sick leave is provided with a complete set of forms after the sheet is closed, then the payment will be calculated in the total amount within 10 days from the date of provision of the papers.

Reflection of personal income tax from sick leave in the 6-NDFL report

The difficulty in understanding the rules for filling out the 6-NDFL report arises when accruals for sick leave were made in one quarter, and payment in the next. Such sick leave will not be reflected in the 6-NDFL report (neither in Section 1 nor in Section 2) in the quarter in which it was accrued, but will appear in both Sections of the report in the quarter in which it is paid.

The procedure for filling out and submitting the calculation, approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] and given in Appendix No. 2, provides for the indication in Section 1 of the amounts of accrued income, calculated and withheld tax, summarized for all individuals, on an accrual basis from the beginning of the tax period to the corresponding tax rate. However, the definition of the concept of “amounts of accrued income” indicated in line 020 of Section 1 is not given either in the Procedure or in the Tax Code of the Russian Federation.

Therefore, when filling out Section 1, you should take into account the control ratios (CR) for checking the report, brought to the attention of the Federal Tax Service of Russia letter dated March 10, 2016 No. BS-4-11 / [email protected] In this letter, the tax department explains how the report will be checked.

According to KS 1.3, accrued income, applied deductions and calculated tax must be consistent. In contrast to the term “accrued income,” the concept of “tax calculation date” is defined in accordance with Article 223 of the Tax Code of the Russian Federation. As noted earlier, for temporary disability benefits, the date of actual receipt of income is determined as the date of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Since the payment date falls on the next quarter, the date of calculation and withholding of the tax falls on the quarter following the one in which the benefit was accrued. And indicating accrued benefit amounts in Section 1 before benefits are paid will violate the benchmark ratios.

The reflection in Section 2 in this case does not raise any questions. The dates of actual receipt of income by individuals and withholding of tax, and the timing of tax remittance are indicated here. And it is clear that Section 2 can only be completed in the quarter when the benefit was paid.

| 1C:ITS For detailed information on preparing calculations using Form 6-NDFL in 1C programs, see the reference book “Reporting on personal income tax” in the “Reporting” section. |

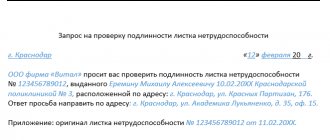

Transition to electronic sick leave certificates

In 2021, a new federal law No. 86 was issued on the transition from paper sick leave certificates to electronic ones for all medical institutions. This will simplify and speed up the transfer of documents via the Internet to the accounting department and the Social Insurance Fund. The law does not deprive an employee of the right to receive a certificate of incapacity for work in traditional paper form, and in electronic form the papers are sent to the relevant organizations only with voluntary consent.

From July 1, 2021, a smooth transition to electronic hospital clinics and hospitals connected to the Medical Information System began. The sick leave certificate is signed electronically, and the discharged employee is given his number, with which he goes to the accounting department. As soon as the sick leave is closed, at that very second it is transferred to the work organization and the Social Insurance Fund. Using the number in the database, the accountant will find a document with the necessary information for calculating benefits. It is impossible to falsify such a document, since the communication channels through which it is transmitted are reliably protected.

Rolling sick leave is practically no different from regular sick leave, except that it is open in one month and closed in another. You can obtain the document at any licensed medical institution. Calculating and paying disability benefits is not difficult. The only thing you need to be careful with: if you choose a sick leave certificate on paper, then it must be submitted to the accounting department within the time limits established by law.

How quickly the payment will be calculated depends on the employee: the faster the documents are provided, the faster the money will be transferred to the account.

Form of certificate of incapacity for work

The form of the certificate of incapacity for work was approved by order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n. The sheet consists of two parts. The first is filled out by the medical organization, the second by the employer.

Entries on the certificate of incapacity for work are made in Russian in printed capital letters. For the paper version, it is important to choose the right ink color. This can be black ink, and entries are made with a gel, capillary or fountain pen, or using a printing device. Entries are made in specially designated cells, starting from the first, with one space between words.

In cases where it is necessary to indicate coded information, the appropriate code is entered from the list of codes proposed on the back of the sick leave certificate.

Stamps may protrude beyond the specially designated space, but should not fall into the cells of the information field of the certificate of incapacity form - the seal should not cover the information.

When closing sick leave, the free lines of the “Exemption from work” table should be carefully crossed out with one horizontal line.

When accepting a paper sick leave from an employee, check whether there are any errors in it, because of which social insurance will find fault and may refuse to offset the expense.

What to do if an employee brings in an unclosed sick leave? The decision depends on what exactly is meant by open sick leave.

Results

Payment for long-term sick leave depends on the cause of disability. Legislators have established a number of restrictions depending on the category of the patient and the type of disease itself. In addition, there are restrictions on the duration of sick leave issued by a medical institution. But an error made by a medical institution when issuing sick leave, including when determining its maximum duration, is not an obstacle to the payment of sickness benefits by the employer. Although there is a possibility that the right to reimbursement of such benefits from the Social Insurance Fund will have to be defended in court.

Sources:

- Labor Code of the Russian Federation

- Federal Law of November 21, 2011 No. 323-FZ

- Federal Law of December 29, 2006 No. 255-FZ

- Order of the Ministry of Health of Russia dated November 28, 2017 No. 953n

- Order of the Ministry of Health and Social Development of Russia dated February 20, 2008 No. 84n

- letter of the FSS of the Russian Federation dated August 18, 2004 No. 02-18/11-5676

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.