An online work record calculator is a tool that will allow you to accurately and accurately determine the total duration of an employee’s work, even if it covers several periods of time with different employers.

Add period Calculate

Result

To correctly calculate the duration of work and take into account all periods, use the materials and instructions of ConsultantPlus for free:

- Guide: procedure for calculating length of service.

- Guide: regional coefficients and allowances for work in the Far North and other areas.

- Expert consultation: calculating the length of service for a pension.

- Ready-made solution: how to calculate length of service for additional leave for work in hazardous working conditions.

- We determine the length of service for calculating benefits.

- Sick leave, vacation, northern: what it affects and what is included in it.

How to use the calculator

Instructions for using the experience calculator

- If you know your length of service as of a certain date, then enter in the “Experience as of date” field the specific day and the number of years, months, days of experience as of that day. These fields are optional, but if you have this data, it will significantly reduce your calculations.

- In the “Date of hiring” and “Date of dismissal” fields, enter your dates, for example, according to your work book. You must fill out at least one line of this table.

- The “Additional periods” may include such periods as: being in the state or municipal service, the period of work as an individual entrepreneur, the period of receiving unemployment benefits, caring for a disabled person or an elderly relative, and others. The full list of such periods is described below, in the paragraph “What is included in the insurance period”.

- Select the desired value from the drop-down lists if you served in the military or were on maternity leave.

- Click "CALCULATE". You can save the result as a doc file.

Please also take into account:

- Use the Today button (circle with a dot) to quickly insert the current date.

- Use the appropriate buttons to add, delete and clear required fields for faster and more convenient entry and change of information.

Calculation example

For an example of calculation using the first proposed formula, let’s take the following initial data:

- 04/01/1996 (hiring) – 09/01/2001 (dismissal) = 00 days. 05 months 05 years old.

- 09/02/2001 – 12/15/2015 = 13 days. 03 months 14 years old.

- 04/05/2016 – 09/01/2017 = 26 days. 05 months 1 year.

- Total: 39 days. 13 months 20 years.

- We round up 39 days. = 1 month and 9 days

- 14 months this is 1 year and 2 months.

- We get a total length of service of 21 years, 2 months and 9 days.

In the second case:

- Point 4 is translated into days 20*365 = 7300, 13*30 = 390.

- Let’s sum everything up: 7300+390+39=7729 days.

- 7729/30=257,63.

- 257,63/12= 21,47

That makes 21 years 1 month and 17 days. The difference between the amounts obtained is due to rounding when calculating in the second case. But this does not affect the final result, because only years are taken into account when serving, but not days.

Legislative basis for calculating seniority

Citizens of the Russian Federation calculate their length of service according to the Federal Law “On Labor Pensions in the Russian Federation” No. 173, which entered into force on January 1, 2002.

Currently, the law does not have the concept of “work experience”; since December 31, 2001, it has been replaced by the clarified term “insurance period” , that is, the period during which a working citizen made contributions from his salary to the Pension Fund of the Russian Federation, and added other periods are legally justified for them. However, the phrase “seniority” is often used synonymously.

The insurance period is the duration of periods of work and other activities during which insurance contributions were paid to the Pension Fund of the Russian Federation.

More about the calculator

We have developed a calculator for you to make it easier to calculate your insurance work history. Using it, you can accurately calculate your length of service in years, months and days. You can calculate both the total amount of the period worked and the amount of time devoted to service at one place of work.

If you need to know the size of your current pension, use our online pension calculator.

Young people need this because in the first years of work, sick leave is paid 100% only if the person has worked for a total of more than 8 years in a Russian company.

What is included in the insurance period

The legislation of the Russian Federation clearly defines the periods that are taken into account as insurance experience . These include, first of all, those months of work in which deductions were made as contributions to the Pension Fund. They may be:

- cooperation in accordance with the concluded employment contract;

- being in the state civil service;

- municipal service;

- period of work as an individual entrepreneur.

Citizens accumulate insurance experience not only during actual work, but also during other periods provided for by the Federal Law, if after or before this period the person was officially employed:

- time of military service or equivalent activity;

- the first part of maternity leave (for pregnancy and childbirth);

- the period of receiving unemployment benefits, the period of participation in paid public works and the period of moving or resettlement in the direction of the state employment service to another area for employment;

- in the case of detention of persons unjustifiably brought to criminal liability, unreasonably repressed, as well as in the case of these persons serving their sentences in places of imprisonment and exile;

- care for a baby up to 1.5 years old (separately for mom or dad);

- caring for a disabled person of group 1, a disabled child or an elderly relative who has reached the age of 80;

- for spouses of military or diplomatic representatives - the time that they accompanied their spouses and at the same time did not have the opportunity to find a job (no more than 5 years in total).

The length of service required both for calculating a pension and for sending on paid leave includes the following periods:

- actual days worked;

- weekends, holidays and time off;

- the time for retaining a position for an employee who, for some reason, does not actually perform work duties (maternity leave, vacation, sick leave, etc.);

- travel time to another location in the direction of public service;

- unjustified detention;

- forced absenteeism;

- time of public works, if they are paid.

Calculation of temporary disability benefits

A program such as a length of service calculator will be needed to find out the amount of benefits for temporary disability, pregnancy and childbirth. It will also help when calculating retirement dates.

The amount of temporary disability benefits (sick leave) directly depends on how much the person has worked:

- 8 or more years - 100% of the employee’s average earnings;

- from 5 to 8 years - 80% of average earnings;

- up to 5 years - 60% of average earnings.

Maternity benefits, if the employee worked for more than 6 months, are paid based on 100% of the average daily earnings, and if less than 6 months, a calculation is applied based on the minimum wage.

IMPORTANT!

If an accident occurred at work or an employee received an occupational disease, then calculating the length of service according to the work book using a calculator will not be necessary. The amount of the benefit in such cases does not depend on how much the employee works, and is always calculated based on 100% of average earnings.

What is not included in the insurance period

All other periods of time not provided for by law.

Counting Features

When entering data into the calculator, you must adhere to the requirements prescribed in the relevant article of the Federal Law on the calculation of pensions.

- Calendar order . It is necessary to take into account the dates indicated in the work book or tax returns (for individual entrepreneurs). If two or more insurance periods coincide, as a rule, one of them is taken into account (more profitable for the pension recipient).

- Only RF . If a citizen has the right to a pension according to foreign laws, then to the extent that they do not coincide with the norms of the Russian Federation, this time will not be taken into account when calculating the length of service.

- Labor in subsistence farming . Self-supporting people, members of farms and various communities can include their labor time in their length of service if they have made contributions to the Pension Fund.

- Work for an individual . If a person worked for another person in accordance with a concluded contract, this period is considered an insurance period if the corresponding contributions were paid.

- Copyright royalties . Persons who sold copyrights to their works, as well as licenses, patents, etc., if they paid contributions to the Pension Fund of the Russian Federation from the funds received no less than the established amount, can include a period proportional to their contributions in their length of service.

- Does not have retroactive effect . If, according to the previously effective legislation of the Russian Federation, certain periods were included in the length of service, which was subsequently changed, they can be added to their total insurance experience.

The danger of errors in calculating periods of work

Incorrect calculation of work hours often results in the payment of the incorrect benefit amount. In this case, the Social Insurance Fund has the right to make claims to the employer and refuse to reimburse the amount spent. If the amount of payment is underestimated by employees, claims also arise, which lead to an unscheduled inspection of the organization or litigation. It is necessary to treat this issue carefully and calculate your work experience using an online calculator to be reliable.

After the period of time when a person worked and the employer paid insurance premiums for him has been determined, the accountant enters it in the appropriate line on the sick leave. Indicated:

- Number of complete years.

- The number of complete months worked by the employee.

The days are not specified.

Regarding military service

According to paragraph 3 of Article 10 of the Federal Law of May 27, 1998 N 76-FZ “On the status of military personnel”:

The time spent by citizens in military service under a contract is counted in their total length of service, included in the length of service of a civil servant and in the work experience in their specialty at the rate of one day of military service for one day of work , and the time spent by citizens in military service by conscription (in including officers called up for military service in accordance with the decree of the President of the Russian Federation) - one day of military service for two days of work .

However, there is also such a thing as insurance experience. It replaced the length of service from January 1, 2007. Until January 1, 2007, 1 day of service under a contract was counted as 1 day in the insurance and work experience, and 1 day of conscription service was counted as 1 day in the insurance period, and as 2 days in the work experience. Also, if the length of service before January 1, 2007 is greater than the insurance period, it will be taken into account.

Our calculator asks you to select the most common periods of military service. However, in specific cases, the service may not last the even periods indicated in the list, but more precise ones, containing, in addition to years, also months and days. This is especially true for contract service. In this case, we recommend that you use the “Additional periods” block instead of selecting a value from the block regarding military service. In the “Additional periods” block, you can set the beginning and end of the period of military service under the contract, in which case the calculation will be as accurate as possible.

Formula and methods for calculating length of service

The algorithm for calculating the insurance period for a pension is given in paragraph 47 of the Rules, approved by Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015.

It says that the calculation is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days are taken as a full month, and every 12 months - as a full year.

In practice, as a rule, they think so. A full calendar month is considered to be 1 month, regardless of how many days it has. Next, add up the days in partial months, and divide the resulting number by 30.

Example

The insurance period included the period from April 5, 2021 to September 20, 2021.

There are 4 full months: May, June, July and August.

2 partial months: April (26 days included in the length of service) and September (20 days included in the length of service).

In total, 46 days were worked in partial months (26 + 20). We take them for 1 full month plus 16 days (46 - 30).

Total in the specified period is 5 months (4+1) and 16 days.

How to calculate manually

Depending on the purpose of the calculations, different methods are used:

- for sickness and maternity benefits, the rules approved by order of the Ministry of Health and Social Development dated 02/06/2007 No. 91 apply;

- To determine pensions, you must refer to the standards set out in Federal Laws No. 166 dated December 15, 2001 and No. 400 dated December 28, 2013.

Read more: Calculation of length of service for sick leave

The basic principle that both the calculation program and the specialist uses when calculating manually from a book is the summation of time periods of a person’s work activity, confirmed by documents. If you do not have a work book or if it contains inaccurate or incomplete information, it is permissible to calculate your work experience using an online calculator on the basis of other supporting documents:

- written contracts;

- certificates issued by the employer or government agency;

- extracts from orders;

- personal accounts or payroll statements.

The difference is that when calculating benefits, insurance periods are taken as a basis, where breaks do not matter, and when calculating a pension, information about work over a lifetime is taken.

Read more: Continuous work experience upon dismissal of one's own free will

If you want to calculate it yourself, without using an online calculator for calculating work experience in 2021, use the following algorithm (clause 21 of the calculation rules, letter of the Social Insurance Fund dated October 30, 2012 No. 15-03-09/12-3065P):

- We count the number of complete calendar years for the period of interest.

- We count the number of full calendar months that are not included in the year.

- Calculate the number of remaining days.

- We convert days into months based on 30 days in one month; we discard what doesn’t fit.

- Converting 12 months to 1 year.

- We count the total number of years and the remaining number of months.

The formula and the calculations themselves are quite labor-intensive, so it’s easier to calculate the duration of work using an online calculator.

Read more: Is military service included in seniority?

Main types

All experience is divided into several categories:

- General;

- Insurance;

- Continuous;

- Work experience provided for under special conditions.

The concept of total length of service is no longer as relevant an indicator as it was, for example, a few years ago. The total can be understood as the sum of all years worked by an employee. This concept comes into force from the moment the employee retires or when calculating sick leave.

Insurance is considered to be the total number of years worked by an employee and who necessarily paid all mandatory insurance contributions during the period of his activity at the enterprise or organization.

Continuous means time actually worked for one or more employers. This concept is used when calculating many benefits or other financial charges for an employee.

The last type is the type of calculation of the employee’s time indicator, after which he has the right to early retirement.

What else is worth considering

The length of service calculator is not suitable for calculating length of service for military personnel and employees of law enforcement agencies, for whom length of service is calculated according to length of service due to the lack of insurance experience as employees.

For self-employed people, individual entrepreneurs, lawyers, notaries, authors receiving fees and other persons engaged in private practice, pension calculations are based on the amount of a fixed payment and 1% of the amount over 300,000 rubles, which is annually transferred to the Pension Fund.

The result obtained after the calculation is considered approximately conditional. This is done in order to understand how the process of forming pension rights and the rules for calculating future pensions occurs. An accurate calculation of the pension will be made by a Pension Fund employee after studying the materials of the payment file.

Specifics of justifying the experience of individual entrepreneurs

Before calculating the length of service for an individual entrepreneur’s pension, it is worth considering that three groups of entrepreneurship are legally distinguished:

- Individual entrepreneurs who ran a business before the beginning of 2001 and paid income tax.

- Individual entrepreneurs working from January 2001 to January 2002 paid a single social tax.

- Individual entrepreneurs located on the simplified tax system or UTII (“imputation”).

For each category of businessman, there are nuances of confirming insurance. For individual entrepreneurs operating before the beginning of 1991, the insurance period is supported by certificates from financial institutions or archival organizations that the entrepreneur made mandatory payments.

For individual entrepreneurs with periods of activity from 1991 to 2001, insurance coverage is confirmed by a certificate from the local branch of the Pension Fund of Russia. Since January 2001, such a certificate has been issued by the local tax office.

Individual entrepreneurs, on a simplified taxation system, the period before 2001 is confirmed by a certificate from the Pension Fund, after 2001 - by a certificate from the tax office. An individual entrepreneur on imputed tax confirms insurance periods with a certificate of payment of a single tax.

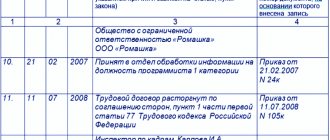

Online calculation using work book

To calculate the time spent on work in a particular place, or rather its total value, does not require much knowledge and time.

Today this work can be done using various programs and Internet sites.

You need to start the process with preparing documents. These include:

- employment history;

- labor contract;

- collective agreement.

You take the dates when you started working in a particular place, as well as the end dates of your work, enter them into calculation programs and get the result online.

Counting Features

Continuous work experience does not affect the amount of the pension. This mattered during the Soviet era, when the calculation of pensions, benefits and benefits depended on the length of service. However, for certain professions the relevance of continuous professional experience has not lost its importance. For example, to receive compensation for citizens working in difficult climatic conditions (Order of the Ministry of Labor No. 3 of 1990).

To understand how the length of service for a pension is calculated, you can use an online calculator. But the calculation will be inaccurate. This applies to those circumstances when there are no supporting documents and the fact of work will have to be proven in court.

It is not difficult to calculate the length of service for a pension yourself. It is enough to add up the calendar segments of work for each position, as well as the employment that is legally included in the length of service. You can write down working periods on a piece of paper in chronological order, subtracting the date of starting a new job from the date of dismissal. Then all periods are added up and converted into accepted units of counting - months, years.

Upon termination of the employment relationship, the calculation of terms begins on the day that follows the day of dismissal, and not from the date specified in the dismissal order (Article 14 of the Labor Code of the Russian Federation). Correct calculation of length of service is needed not only for calculating pensions, but also for paying sick leave benefits and other social benefits.

Pros of an online calculator

Currently, this is a truly convenient and accessible resource for everyone.

Its undoubted advantages are:

- simplicity;

- lack of special knowledge;

- counting speed;

- automatic operating mode.

All the user needs to do is enter the data known to him in special fields, and then click on the “Calculate” button. Next, the calculator will do everything itself and provide the finished result.

You can use any calculator by entering “Online experience calculator” in the search bar. Information about it can be found on the first pages of search engine results. You can also use the sites listed above.

By old age

To receive a pension after reaching retirement age, you must deliver your application and a package of necessary documents to the pension fund. You can deliver the data in person, send it by mail, send it through a single portal on the Internet, and, as a last resort, ask your current employer.

The pension fund employee will have all the data, he will check the correctness and reliability of the completed data and independently make all the necessary copies of the documents.

After the documents are accepted, you will be entered in a special journal and you will be given a notification of registration and acceptance of the application. If any documents are missing, then everything will be indicated in this paper. The notification will contain your details and a list of all documents that you submitted. And there will definitely be a date for accepting the application.

If any document is missing, you will be given a period of three months to submit them to the Pension Fund. Otherwise, registration will have to be completed again, which means the period for receiving pension payments will shift.

Once you have submitted all the necessary documents, you will have to wait while the staff carefully checks each piece of paper and calculates your insurance pension. On average, the time required to carry out this reconciliation and accounting does not exceed ten days from the time of receipt of notification of the provision of a complete package of documents.

If during the inspection, the inspectors have doubts about any matter, the procedure may take about one month.

If there is no labor

Sometimes employers are faced with a situation in which:

- no workbook;

- the work book is available, but there are no records in it for any periods of the person’s work;

- erroneous or incorrect information has been entered.

In the listed cases, in order to calculate the length of service correctly and confirm the period, a written work agreement is required. It is drawn up according to the legislation in force at that time;

- collective farmer's workbook;

- certificate provided by the employer (or government agencies);

- extracts from orders;

- extracts from personal accounts;

- salary slip.