There are situations when an employee needs to receive vacation days ahead of schedule, using a kind of “vacation advance”. If “shock work” then follows, as a result of which the vacation turns out to be spent, the situation is not fraught with anything. But if an employee quits without “covering” the rest days provided to him with working time, the employer remains at some loss. The law allows him to recover the “advance” issued in the form of vacation in cash.

Let’s look at cases in which an employer does not have the right to withhold funds from a departing employee for used vacation, and we’ll look at how to calculate the amount of withholding and correctly formalize this process.

Question: How to record the deduction from an employee upon dismissal of the amount paid for unworked vacation days, if the next paid vacation for the current working year was provided to the employee in advance in December of the previous calendar year? Deductions are made from the employee’s wages based on the relevant order of the manager. Upon dismissal in March of this year, the employee received a salary of 48,000 rubles. The amount of vacation pay for unworked vacation days accrued to the employee in December last year amounted to 8,000 rubles. It was paid to the employee minus the withheld personal income tax. Tax deductions for personal income tax are not provided to employees. According to the accounting policy for profit tax purposes, the organization does not create a reserve for upcoming expenses for vacation pay. Tax accounting uses the accrual method. View answer

When do unearned vacation pay appear?

The following example will help you understand the mechanism by which unearned vacation pay appears.

Technical University graduate P. N. Ptichkin got a job at a helicopter plant on July 1, 2020, and in January 2021 he received the right to go on vacation (paragraph 2 of Article 122 of the Labor Code of the Russian Federation) and took advantage of this opportunity. The duration of his vacation was 28 calendar days (Article 115 of the Labor Code of the Russian Federation).

Find out more about the provision of leave and its duration from the article “Annual paid leave under the Labor Code (nuances).”

During his vacation, he received a more lucrative job offer and immediately after returning from vacation, he quit the plant.

Thus, by the time of his dismissal, P.N. Ptichkin had earned only half of his legal leave: 14 days (6 months × 28 days / 12 months), and used all 28 days. There were 14 vacation days unworked at the time of dismissal (28 – 14).

Since the employee received the full amount of vacation pay before going on vacation, by the time of dismissal he had a debt to the company for the 14 days of vacation paid in advance.

IMPORTANT! The right to vacation for the first working year arises after six months of work in the organization (Article 122 of the Labor Code of the Russian Federation). Subsequent vacations are issued according to the approved schedule.

What the lack of a vacation schedule in a company can lead to, see the material “Unified Form No. T-7 - Vacation Schedule” .

"Vacation" rights and obligations

Upon termination of the employment relationship, the employer must perform many mandatory actions regulated by labor legislation. Among them is the obligation to give the employee everything he earned by the time of dismissal.

Vacation payments are one of the elements of the final settlement with a resigning employee. Their composition depends on how many vacation days have been accumulated and whether the employee has exercised his right to vacation in the current period (Article 127 of the Labor Code of the Russian Federation).

For information on the circumstances affecting the calculation of vacation days upon termination of an employment contract, see the material “How to calculate the number of vacation days upon dismissal?” .

In addition to this obligation, the employer has the right to withhold from the resigning employee’s income the amount of advance vacation pay (Article 137 of the Labor Code of the Russian Federation).

This right may not be exercised in all cases. If the dismissal of an employee occurs on the grounds listed in Art. 137 of the Labor Code of the Russian Federation, it will not be possible to withhold overpaid vacation pay from him. For example, such a prohibition on retention applies to the situation of dismissal due to staff reduction or closure of a company, as well as in other cases provided for by law.

Find out how the latest judicial practice on this issue is shaping up from the analytical collection from ConsultantPlus. Get trial access to the system and access the material for free.

In addition, the employer can deal with the employee’s debt in a different way. We'll talk about this in the next section.

Find out how to calculate the number of vacation days in 2021 from this publication.

Summary

So, we found out that compensation for vacation can be provided upon dismissal and to some categories of working employees. In general, it is calculated in proportion to the length of leave, and in the event of a change in salary, it is subject to indexation. This payment is subject to personal income tax, insurance premiums and must be reflected in the accounting records.

Don't stop at accounting! Take the comprehensive IPFM: Professional Finance Manager course to learn IFRS, internal auditing, management accounting and strategic management. Register and take the 1st module of the course for free!

Professional Financial Director Course

What else would you like to do besides accounting?

Is it possible to do without deductions?

You can avoid deductions by signing a debt forgiveness agreement. Forgiving an employee’s debt means not raising the issue of the existence of a debt and not demanding its repayment.

In everyday life, settling a debt between individuals through forgiveness does not entail any consequences for both parties to the transaction. In a situation where one of the parties is a legal entity, debt forgiveness entails additional paperwork and also requires adjustment of tax obligations.

At the beginning of the procedure for forgiveness of vacation debt, you will need to draw up a document that reflects the will of the parties to repay the debt. Such a document may be an agreement on debt forgiveness for vacation overpayment.

The preparation of such a document is similar to similar agreements drawn up in the normal course of business. After the title of the document, the date and place of its preparation are indicated, followed by the parties to the agreement and its main text. It may contain the following content:

“...The employer exempts the employee from repaying the debt for 14 unworked vacation days in the amount of 10,025 (ten thousand twenty-five) rubles, which arose in connection with his dismissal under clause 3, part 1, art. 77 of the Labor Code of the Russian Federation until the end of the working year, towards which he used annual paid leave...”

The final elements of the agreement are the details and signatures of the parties.

Read about the next steps of debt forgiveness for unearned vacation pay in the next section.

Other payments

As you know, an individual can rely not only on wages. This, for example, could be travel allowances, benefits and other types of income. So, payment for extra vacation days cannot be withheld from everything. For example, this is prohibited from the following payments :

- to compensate the employee for harm;

- in connection with a business trip, transfer or assignment to another location;

- as compensation for wear and tear of the employee’s own tools that he or she uses at work;

- in connection with the registration of marriage, the birth of a child or the death of a loved one.

Tax nuances of vacation advance forgiveness

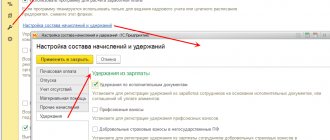

The debt forgiveness agreement signed by the parties automatically triggers the tax adjustments associated with this event.

For the employee, recalculation of tax obligations does not lead to material losses - the tax on his income in the form of a forgiven debt has already been withheld when he was paid vacation pay. Changing the status of the amount received from vacation pay to a bonus from the employer (debt forgiveness) does not have an impact on personal income tax obligations.

What to do with personal income tax if an employee voluntarily repays the debt on advance vacation pay, see the material “Personal income tax on unearned vacation pay is subject to return .

The employer's situation is different. In connection with the “act of goodwill” in relation to the employee, the income tax will have to be recalculated. In this case, it becomes necessary to exclude from expenses the amount of unearned vacation pay (clause 1 of Article 252, clause 49 of Article 270 of the Tax Code of the Russian Federation). Tax officials consider such expenses to be economically unjustified (letter from the Federal Tax Service for the city of Moscow dated June 30, 2008 No. 20-12/061148).

With regard to the amount of unearned vacation insurance premiums accrued, it should be noted that there are no grounds for their recalculation - they were accrued within the framework of the labor relationship. The legality of their inclusion in tax expenses is not disputed by officials of the Ministry of Finance (letter dated April 23, 2010 No. 03-03-05/85).

How to reflect compensation in accounting?

In accounting, compensation must be reflected among labor costs by postings:

- Debit 20 Credit 70 - compensation accrued (what);

- Debit 70 Credit 68 subaccount “Settlements for personal income tax” - personal income tax is withheld;

- Debit 70 Credit 50(51) - compensation issued (what kind).

If the institution is not a small business entity, a reserve for vacation pay must be created in the accounting records. In this case, compensation is recognized not as a current expense, but as the fulfillment of a previously provided obligation. After payment, it is written off to reduce the reserve for vacation pay.

Methodology for calculating advance vacation pay

If the employer is not inclined to be generous and forgive the employee unearned amounts, the accounting department will have to work hard. The algorithm for their calculation includes the following steps:

- determining the number of unworked vacation days;

- clarification of information about average daily earnings;

- calculation of the amount of advance vacation pay.

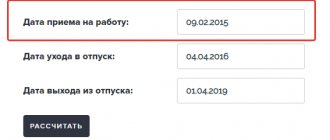

Determine the number of days of unworked vacation. For calculation we use the formula:

KDno = KDio – [KD o / 12 months. × KM],

Where:

KDno and KDio - the number of vacation days, unworked and used, respectively;

KD o - duration of the next vacation;

KM - the number of months of work at this enterprise.

For example, during his work, an employee of the company did not use part of his vacations in full, but in the working year before his dismissal, his vacation was in full accordance with the vacation schedule. As a result, at the time of his dismissal, he had “two-way” vacation pay: not paid off for the previous period (15 days) and advance pay for the unfinished current year (10 days). In this situation, the employer, instead of deducting for unworked vacation days, is obliged to give the employee compensation for unused days.

If the employee had not had incompletely used vacations in previous periods, then, based on the results of this calculation stage, the number of unworked vacation days would be 10, and to calculate advance vacation pay, the accountant would have to proceed to the next step of the calculation algorithm.

We clarify information about earnings and calculate unearned vacation pay.

This stage is associated not only with calculations, but also with clarifying the available information. The accountant will have to provide information about the average daily earnings, based on which the employee was paid for vacation days. This indicator has already been calculated earlier (before the employee went on vacation).

The amount of vacation pay for the unworked vacation period (∑Ond) is calculated based on the number of days of unworked vacation (KDno) and average daily earnings (AS) according to the formula:

∑Ond = KDno× SZ.

Additional adjustments will be needed if, during the employee’s rest period, all employees of the company received a salary increase. The date of this event is of particular importance - the vacation period is calculated from it, the payment for which will have to be adjusted by an increasing factor.

The sequence of actions in this situation is as follows: unworked days are counted from the end date of the vacation, and it is determined how many days fall in the time period after the salary increase (and how many before this event). The average daily earnings for these periods will be different due to the application of the adjustment factor.

The amount of unearned vacation pay will be calculated using a complicated formula:

∑Ond = KD0× SZ0 + KD1× SZ1,

Where:

KD0 and KD1 - unworked vacation days before and after the salary increase;

SZ0 and SZ1 are the average daily earnings, calculated for vacation pay and increased by a factor, respectively.

What to do if an employee decides to resign of his own free will during his next vacation? How to make a payment upon dismissal? Is it possible to withhold paid vacation pay? The answers to these and other questions are considered in detail by ConsultantPlus experts. Get trial access to the system and study the ready-made solution for free.

Example of calculating advance holiday pay

The manager of Breeze LLC, R. N. Gavrilov, is resigning, having used the standard vacation duration (28 days) this year. At the time of the severance of the employment relationship with the employee, the accountant of Breeze LLC had the following information:

- number of vacation days received in advance from the employer - 12;

- Average daily earnings for calculating vacation pay are 1,120 rubles.

Additional terms:

- while the employee was on vacation, the company increased salaries - the increase occurred on May 20 and affected the entire work team;

- R.N. Gavrilov’s vacation ended on May 30;

- the employee’s salary before and after the increase was 25,000 and 28,000 rubles. respectively.

The accounting specialist began the calculation by determining the unworked vacation days falling during the period after the salary increase. Of the 12 advanced vacation days, the period after the increase accounted for 11 days (from May 20 to 30); unworked rest days, paid without taking into account the increasing factor, accounted for 1 day (12 - 11).

The accountant made the following calculation using the formula from the previous section:

∑Ond = 1 day × 1,120 rub. + 11 days × [RUB 1,120 × (28,000 rub. / 25,000 rub.)] = 14,918.40 rub.

At the time of R.N. Gavrilov’s dismissal, this amount amounted to his debt to the employer as received, but not worked out.

We will tell you in the next section how much of this debt will be returned to the employer.

For information about how leave policies may change, see here.

Deduction for used vacation upon dismissal

The amount of vacation pay not worked by the employee and the amount that can be withheld from his income obtained as a result of the calculation do not always coincide.

IMPORTANT! The amount of deductions is limited by law (Article 138 of the Labor Code of the Russian Federation) and amounts to 20% of the income received by the employee. In some cases, it is allowed to exceed the established limit to an amount not exceeding half of the income received.

It should be taken into account that in addition to advance vacation pay, the employee may have other obligations (under writs of execution, in connection with compensation for damage, etc.). Then they, together with advance vacation pay, should not exceed the specified limit on the amount of deduction.

The accountant needs to find out what part of the calculated amount of unearned vacation pay can be deducted from the employee’s income. If he has no other deductions, and the amount of vacation pay received in advance is less than 1/5 of the amount received upon dismissal, no problems arise - the advanced vacation pay can be withheld in full.

If established by Art. 138 of the Labor Code of the Russian Federation, the restriction does not allow the employer to reimburse the full specified amount, you can try to do the following:

- ask the employee to voluntarily repay the remaining balance of the debt;

- apply to the judicial authorities to resolve the issue of collection (Articles 382-383 of the Labor Code of the Russian Federation);

- forgive the balance of the debt.

Each of these methods has its own nuances. For example, voluntary repayment of debt entails recalculation of personal income tax, and forgiveness of debt leads to adjustment of income tax obligations.

The judicial way of resolving the issue, as practice shows, is not always in favor of the employer. For example, in the appeal ruling of the Supreme Court of the Republic of Karelia dated January 11, 2013 No. 33-111/2013, the court defended the interests of the employer, and in the ruling of the Presidium of the Rostov Regional Court dated September 15, 2011 No. 44g-109 on a similar issue, the opposite point of view was expressed.

Find out what the Labor Code of the Russian Federation establishes regarding deductions from wages from this article.

If the employee does not return the money used in advance

The judicial practice of collecting overpaid vacation pay is very ambiguous. Cases when employers turn to former employees with relevant claims are quite rare. There are several reasons for this:

- usually the amounts of overpayments turn out to be too insignificant to waste time and effort on claiming them;

- the former employee does not always have income that can be recovered;

- a positive court decision is possible if it can be proven that the employee’s unlawful actions led to damage to the entrepreneur (Articles 248, 391 of the Labor Code of the Russian Federation).

At the same time, the argument that there are insufficient funds to recover overpayments of vacation pay usually satisfies tax inspectors and does not entail negative consequences for the company.

Results

Deduction for unworked vacation upon dismissal is made from the final payment amounts received by the employee. In certain legally established cases, such deductions are not permitted or limited.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.