From this material you will learn:

- What is employee depreciation?

- When is the procedure for disabling an employee legal and when is it not?

- Grounds for deprivation of bonuses to employees

- The procedure for depreciation of employees according to the Labor Code of the Russian Federation

- How an employee can challenge an employer’s illegal deprivation of bonuses

- How to implement and apply a system of depreciation of employees

- Pros and cons of the employee bonus system

One of the options for punishment for certain violations is deprivation of bonuses to employees. Of course, disciplinary sanctions are also actively applied, but enterprise management often rightly believes that sometimes material forms of punishment have a much greater effect.

But there are some nuances here. If a company practices deprivation of bonuses to employees, then this point must be specified in internal documentation, otherwise it will run counter to legal norms. And even in this case, subtleties remain, knowledge of which is mandatory when using this form of punishment.

What is employee depreciation?

In addition to the mandatory salary, an employee can also receive bonus payments, which can be either systematic or accrued on a case-by-case basis. The answer to the question of whether to give or not to give a bonus depends on whether the planned indicators have been achieved in the work.

Additional payments are not obligatory (unlike salary), and the employer independently decides whether to pay them to his employees or not.

Deprivation of bonuses to employees is a punishment provided for by the Labor Code of the Russian Federation for a disciplinary offense. In this case, the person may be completely deprived of the bonus or have it cut. It should be emphasized that this form of punishment acts as a fine, is applied specifically to violators of internal regulations and is not a disciplinary sanction.

Management may decide to terminate or suspend the payment of bonuses, necessarily indicating the reasons in the company’s internal documentation or in a special provision.

Simply put, depreciation of employees is a way to deprive a person of additional material rewards (in full or partial) if he has done something wrong.

It should be remembered that not a single law, regulatory legal act or the same Labor Code includes such a concept as depreciation. This means that this method of punishment cannot be legally approved at the level of the company’s local documentation.

We recommend

“Bonus payments to employees of the organization and its documentation” Read more

Therefore, from the point of view of practical application, depreciation of employees means that the employee receives a bonus only if he fulfills the agreed list of conditions. They might be something like this:

- the employee completed the planned amount of work;

- he did not violate discipline;

- the planned plan was exceeded, etc.

If it turns out that these conditions are not met, the employer has the right to reduce the amount of the bonus payment.

The bonus must be reflected in the company's documentation as an additional method of monetary incentives and cannot be part of the basic salary. At the same time, it is allowed to deprive employees who already have a disciplinary sanction - for example, in the form of a reprimand. Many enterprises practice issuing bonuses in an envelope, without any official registration. In this case, the employer can easily decide for himself who to encourage and who not, determine the amount of remuneration at his own discretion, etc. If at an enterprise the bonus procedure is stipulated in special acts, then it should be observed, and the deprivation of an employee of material remuneration should have has a legal basis.

Pros and cons of bonus stimulation

The bonus reduction system is imperfect, however, the relative success of its functioning proves the effectiveness of such enforcement measures. Naturally, subject to compliance with labor laws.

Contradictions in depreciation:

- Having made mistakes, the employee cannot correct them in order to avoid deprivation of bonuses;

- in the case of non-specific wording in the documentation, the manager’s hands are too free (for example, the award of a bonus “for high performance” can easily be revised);

- indicators must correspond to the current level of development of the enterprise and are periodically reviewed and updated.

Positive aspects of depreciation:

- the responsibility of both parties increases: both employees and management;

- labor discipline receives an additional incentive to comply;

- the possibility of a differentiated approach to financial motivation.

Negative aspects of depreciation:

- possible mistrust of management;

- the pain of financial deprivation;

- work for results at the expense of the personal factor;

- additional ground for conflict situations.

Question: Does the employer have the right not to charge (reduce) a bonus depending on the type of disciplinary sanction applied to the employee (remark, reprimand)? How can this be done? View answer

When is the procedure for disabling an employee legal and when is it not?

Legitimacy is determined by the type of bonus system adopted by the company. There are special documents that stipulate the conditions for accruing additional material rewards. Documents can be like this:

1. Regulations on remuneration and bonuses (these may be two different documents)

It is desirable that large enterprises have it. The same applies to companies where most of the employees or even all of them receive bonuses. Then the documents stipulate a list of conditions under which these additional payments are made. The list could be as follows:

- grounds for calculating material remuneration (planned indicators that must be met are indicated);

- a list of employees who will receive additional payments;

- specific bonus amounts;

- reasons why the premium may be reduced or not paid, other information.

2. An employment contract concluded with a specific employee

This is an option for companies where only some employees receive additional material rewards, so separate documentation is not developed for this. The contract contains a clause that sets out the conditions for the accrual and payment of premiums that are binding on the signatories.

Deduction of bonuses to employees is considered legal only if consent to all conditions is confirmed by the employee, that is, he read these conditions and signed them (in the employment contract or in a special provision on bonuses and remuneration).

In addition, according to the law, the documents must clearly state that we are talking about additional payments that are periodic in nature and accrued only if a number of pre-agreed conditions are met.

Recommended articles on this topic:

- Competitive advantages of a company: how to form and develop

- How to make a business successful and not become a “firefighter” for your company

- Company marketing strategy: from development to analysis

Deprivation of bonuses to employees will be contrary to the law if the adopted remuneration system (or contract) requires mandatory payment of bonuses. We can name a number of other actions of the employer that fall into the category of illegal:

- You cannot deduct from your salary the amount of bonus that was previously paid to the employee. There is no law according to which this could be done. The employer has the right to cancel payment of money that has not yet been issued to the employee, but here, too, a number of conditions must be met.

- You cannot deprive a bonus if you indicate reasons that are not specified in the company’s local documentation. This refers to minor violations or long-term absence due to illness, child care, vacation, etc.

The provision on bonuses or the employment contract must include a list of reasons (grounds) for depriving employees of bonuses.

If the employer commits violations in this area, the employee can appeal his actions through the labor inspectorate or court.

Here's what this could mean for an employer:

- imposition of an administrative penalty in the form of a fine;

- an order to pay the employee a bonus that should have been accrued by law;

- There may be cases when it is also ordered to pay moral damages along with the costs of legal proceedings.

When bonuses or deductions for employees are provided specifically for work results, the manager must organize everything so that these results are open and visible to everyone. Then employees will be able to understand in time that they need to push harder so as not to lose their bonus payment.

PS: Recommended materials for managers from Evgeny Sevastyanov

- Book “System management in practice: 50 stories from the experience of managers for the development of management skills”: https://50stories.ru/

- Online courses and trainings for managers: https://regular-management.ru/

- Management consulting services:

Now you can Go to all articles or View the catalog

Those who read this article also read

How to implement regular management in your company (part 3). Standard implementation plan. Risk assessment. Consolidation of results

Untimely dismissal of employees: Why it is dangerous to work with a person who should have been fired long ago

Grounds for deprivation of bonuses to employees

Many employers believe that even for a minor offense or several minor violations, employees can be deprived of the required material remuneration. Meanwhile, the reduction of bonuses to employees must be seriously justified.

The most correct approach is to list specific reasons directly in the contract or regulations on wages and bonuses:

- failure to comply with internal labor regulations, namely: absence from work (without good reason), negligence, causing damage (unintentional), showing up at work while drunk;

- non-compliance with safety regulations regarding labor protection, use of electrical equipment, personal protective equipment, etc.;

- failure to fulfill planned plans and standards or untimely implementation, which negatively affects the overall results of the enterprise;

- causing material damage in the form of property damage, for example;

- presence of complaints from clients or partners;

- failure to fulfill one's direct duties or orders from superiors;

- other reasons specified in the internal documentation of the enterprise, such as, for example, an unpaid fine, disorder in the workplace, violation of basic dress code rules, etc.

If an employee is often sick, or, for example, lacks initiative, he cannot be deprived of material remuneration for this. Here you can only take into account the personal contribution or share of labor participation and, based on this, determine the coefficient for calculating payments.

Are there categories of employees who under no circumstances should be deprived of a bonus (or part thereof)? According to the Labor Code of the Russian Federation - no. The situation with dismissals is somewhat different (for example, the law prohibits dismissing a pregnant woman). Nevertheless, the reduction of bonuses for employees must be strongly justified; the following points should be taken into account:

- the penalty must be reasonable - a person cannot be deprived of his annual bonus for being late for work once;

- to determine the amount of penalties, it is necessary to define a clear system and set it out in a special provision or use the same approach for all employees;

- the amount to be withheld should be set reasonably, based on available documentary evidence of the violation (reports and explanatory notes from persons related to the episodes in question);

- personal motives cannot be the reason for depriving an employee of material remuneration, and if the case goes to court, such an approach will be regarded as a deliberate violation of human rights.

Important point! According to the law, two penalties cannot be imposed at once for the same violation. That is, if a fine has already been imposed for an offense, then the employee cannot be deprived of bonuses at the same time.

Results

The provisions of the Labor Code of the Russian Federation oblige the employer to independently develop rules for bonuses for employees, enshrining them in an internal regulatory act.

These rules usually include a section devoted to situations in which an employee is deprived of the right to receive bonuses. Most often, the loss of a bonus is tied to the commission of disciplinary offenses or the presence of penalties for them, which requires special care when drawing up all procedures related to violations of a disciplinary nature. For a number of situations, it is necessary to issue an order to forfeit the bonus, and the absence of such an order in these cases makes non-payment of the bonus illegal. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for depreciation of employees according to the Labor Code of the Russian Federation

To avoid conflict situations related to additional payments or their cancellation, the following documents should be drawn up and used in your work:

- Regulations on the assignment of bonuses, which precisely states when the employee is entitled to payment of material remuneration and in what cases he cannot count on it. In this case, there is no need to use the wording “deprivation of bonuses to the employee” in the document.

- A single template of an employment contract, which should specifically indicate that the salary includes salary and additional payments due by law. But bonus payments are not constant and not mandatory (in general, this point may not be discussed separately).

Each employee should be given the opportunity to review internal documentation. This must be stated in a special order, according to which the employee is required to read the regulation. Or this moment is specified in a personal contract.

If the employer complies with these requirements, he will not have to subsequently assign or cancel bonus payments (or part of them) using special orders (which must be provided to employees for review).

Important nuance! You can immediately spell out everything related to additional payments in the collective agreement. However, if these points are covered in a special provision, then it will be easier to quickly adjust something later, because changing the terms of a collective agreement is a more complex procedure.

How to officially document the dismissal of an employee? You will have to issue a special order if there are no other ways. It should be understood that in labor legislation there is no such term as depreciation, and there are no special forms for its execution. Management, at its discretion, issues an order, which must be drawn up competently and in no way associated with the imposition of disciplinary punishment (in case of an audit).

Such an order must contain information about the conditions for calculating material remuneration and its cancellation (or reduction of the amount). The regulations that serve as the basis for accepting the specified conditions must be indicated.

The document could be formatted something like this:

- At the top there is a header containing information about the company (enterprise or firm), OKPO code, order number and date of its preparation.

- Next is the title, for example “Order to impose a disciplinary sanction.”

- The person's full name, position held and the department in which he works are indicated. Then the reason why the employee is being disciplined and the specific type of punishment is described (for example, a bonus is not paid at the end of the current month due to regular lateness). You should indicate in words the amount that the employee will receive if the amount of payments for him was reduced.

- Then the grounds for recovery should be mentioned again. If there is internal documentation that management relied on when making a decision, indicate which one.

- The document must be signed by the manager, as well as the violator himself.

Download material:

Sample order on dismissal of an employee

If you want to see an exact example of a provision on the deprivation of bonuses for employees, then there is none. Why? Because the law, in principle, does not provide for this penalty. Thus, the employer’s task is to competently work out the content of the provision on bonuses for his subordinates. This is not a mandatory requirement, you don’t have to draw up such a document, but practice shows that it is used quite often.

If an employer decides to dismiss an employee, his actions must be as follows:

- First of all, the head of the department where the offender works draws up a memorandum or act and transmits it to management. The document must indicate on what grounds the employee may not be accrued the required allowances.

- The criteria by which additional payments are calculated should initially be clearly stated in local documentation, for example, in the collective agreement that the employee signs upon joining the job.

- The offender is asked to provide an explanation for his actions. He draws up a note in which he sets out the situation and confirms that he really did not fulfill the terms of the contract.

- Thus, the manager has two documents in his hands (a statement of violation and an explanatory note), which are transferred to the personnel department or accounting department (depending on whose responsibilities include the calculation and accrual of bonus payments). The available data is analyzed, and the measure (and amount) of punishment is determined.

- The next step is to draw up a special order (based on the clauses of the bonus regulations), which will be a document confirming the recovery.

- The violator reads the order and signs it. The terms for deprivation of bonus payments must be clearly stated.

It will not be possible to see illegal actions in depriving employees if the manager begins to act in the manner described above.

There are difficult situations when an employee is injured, for example. In this case, the precedent is examined by a commission specially created for this purpose and an examination is carried out. Special acts are drawn up, which describe in detail all the circumstances of the incident.

It happens that an employee does not consider himself guilty and takes certain actions so that he is not deprived of the additional payments due.

Internal regulations

Employers, with the exception of individuals not officially engaged in business, can create their own internal documents.

When forming them, the current Labor Code of the Russian Federation is taken into account, and they must also be mutually agreed upon with the social body that represents the interests of workers, for example, a trade union organization, if there is one.

Independent acts, according to which the situation of employees will worsen, if compared with the norms of the Labor Code of the Russian Federation, are not taken into consideration. In such a situation, labor legislation, collective agreements, and existing agreements apply.

How an employee can challenge an employer’s illegal deprivation of bonuses

If an employee considers the measures applied to him to be illegal, then within three months after he was familiarized with the order, he can go to court or complain to the state labor inspectorate.

In fact, if there is no desire to participate in litigation, a claim can be filed with the labor inspectorate, which will initiate an inspection of the enterprise and establish the legality or illegality of the actions taken against the employee. The employer will be fined if he did not act in accordance with the law, and the employee will be given compensation (prescribed by the same check).

When going to court, evidence is required that the employee's deprivation of bonuses was illegal.

These may be documents (copies thereof) according to which the enterprise calculates additional payments:

- individual employment contract;

- regulations on the calculation of bonuses;

- payroll regulations;

- collective agreement;

- act (memo) on deprivation of material reward;

- order on the accrual and cancellation of the award (or part thereof);

- an order to apply punishment in the form of a disciplinary sanction;

- explanatory note from an employee.

The employee can obtain all necessary copies of work-related documents from the employer (by writing an application). They must be provided within three working days.

During the proceedings, it is imperative to find out whether the employee intentionally committed a violation or whether he became a victim of circumstances (either version must be proven). The employee may, for example, present a doctor’s certificate or other documents.

The employer also justifies his actions and provides documented grounds for depriving the subordinate of a bonus. The reasons for this may include disciplinary sanctions that have taken place, actions that contradict the organization’s charter, etc. An important point: disabling an employee should not act as a disciplinary sanction; this goes against the law.

In cases where the unlawfulness of the employer’s actions is proven, Article 5.27 of the Code of Administrative Offenses of the Russian Federation comes into force, according to which a warning is issued as a punishment. The court may also decide to impose a fine.

For 2021, the following fines are provided:

- for enterprises - from 30 to 50 thousand rubles;

- for private entrepreneurs and employees guilty of violations - from 1,000 to 5,000 rubles.

These are the amounts applied as punishment for one violation, but if it is repeated, the fines will be greater:

- for enterprises - from 50 to 70 thousand rubles;

- for private entrepreneurs and employees guilty of violations - from 10 to 20 thousand rubles.

Moreover, an employee may be disqualified (for a period of 1 to 3 years) if a repeated violation is detected.

Circumstances vary, and the court may find either party guilty.

The situation with employee deprivation of bonuses will look clearer if you give a specific example. A certain Petrov N.P. works as an engineer. In May 2021, all employees of his department received the due bonus, and Petrov was paid only a net salary. The engineer filed a statement of claim in court, in which he asked to recognize the actions of his employer as unlawful, since he believed that he also deserved a bonus. The court considered it necessary to refuse the applicant, since during the proceedings the following circumstances were revealed: the enterprise has internal rules that clearly stipulate the conditions for the calculation and issuance of additional payments (bonuses). The conditions were:

- Work without violations of labor discipline during the reporting period.

- Performing one's duties competently and fully, achieving planned goals.

- Achieving individual planned indicators that are set for each employee.

It turned out that Petrov N.P. fulfilled the first and second points from this list, but the intended results according to the individual work plan were not achieved. And the employer confirmed this with documents. Thus, the employee did not receive the bonus on completely legal grounds.

Another example of depriving an employee of bonuses. The person worked for the company and left in early November 2021 without receiving his annual bonus (which was calculated in December). He filed a complaint with the court, and the employer was ordered to pay the employee the financial remuneration due.

Such an attitude on the part of the employer was regarded as discrimination. That is, worse conditions for calculating payments were applied to a quitting employee than to those who were still working. The fact that the employment contract has been terminated cannot, by law, be the reason for non-payment to a person in full of the amounts due for the work done (including bonuses for the time when the employee was still performing his duties in his position).

Important nuance

When signing an employment contract with an employee, the wording on the components of the salary is of great importance (see table).

| Formulations | Interpretation |

| Salary includes salary, allowances and bonuses | The payments in question are part of remuneration, not incentives. Therefore, the employer does not have the right to take them away from the employee, otherwise he will be held accountable. The legal grounds for withholding wages are listed in Art. 137 and 138 of the Labor Code of the Russian Federation. |

| The contract states that the salary consists of a constant (salary + allowances) and variable (bonuses) parts | Payments have the status of incentive bonuses. If the conditions of the internal regulations are not met, the employee is simply not awarded a bonus. To do this, if necessary, they provide a link to an internal document, which the employee must familiarize himself with under signature. |

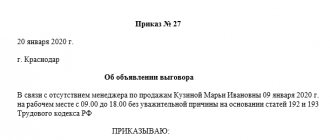

EXAMPLE Ponomarev, holding the position of driver, committed a disciplinary offense - he repeatedly violated the schedule for the start and end of work on the route. The director of the organization reprimanded the employee and refused to award the bonus.

How to implement and apply a system of depreciation of employees

The system of deprivation of bonuses for employees cannot be implemented in one day. There is a step-by-step work ahead. Both management and the entire team will need time to get used to the new order. In addition, newly arriving employees will also need to be explained the conditions for calculating additional payments and taught how to work according to this scheme (if newcomers are not yet familiar with it). What procedure should I use for this?

Stage No. 1: determine the amount of possible deduction of bonuses for employees

It is necessary to determine two main amounts, namely, the amount of general and one-time bonuses. The total most often amounts to 10% of the salary and is awarded to employees who worked the entire month without violations. And this is the maximum amount that an employer can withhold as punishment for misconduct. A one-time deduction is equal to 1/10 of the premium amount.

It turns out that if an employee’s salary is 50,000 rubles, then he is awarded a 5,000 ruble bonus for impeccable work. And for each offense the employer can withhold 500 rubles. Someone will ask: what to do if an employee already has 10 violations, but he continues to make mistakes? From what money should collections be withheld? In general, practice shows that employees do not have more than five violations per month. If you do come across a person who incorrigibly screws up over and over again, then think about whether you need him or whether it’s better to part with him as soon as possible.

Employees should understand that they will receive a bonus (and not a net salary) only if they perform impeccably, and this is not a mandatory payment at all. That was the original agreement. Although it often happens that this point is forgotten and employees take the accrual of bonuses as a matter of course.

Stage No. 2: apply a grading system

This stage of implementing the employee bonus reduction system cannot be skipped: it ensures reliable operation of the entire scheme. A grade refers to the level of professional skill and development of a specialist’s personal abilities. When a person cares about acquiring new knowledge and skills, his level increases and he moves to the next level of the grade. And along with this, the size of bonus payments also increases.

Stage No. 3: increase your salary

What is the significance of the grade system in the process of depreciation of employees? An important condition of this system is that the employee ultimately does not lose money. Possible losses are compensated to him in an amount equal to five deductions for the alleged violations.

But from what means can the employer pay these expenses? The employee receives compensation as an advance - in the expectation that in the near future he will improve his skills and move to the next level of the grade. If an employee doesn’t do this (he can’t do it or simply doesn’t want to), then maybe there’s no point in continuing to cooperate with him?

Such compensation gives confidence that even if a person commits 5 violations, a person will still not lose money. Thus, he has an incentive to work better and get more.

Stage No. 4: preparing the team for the new rules

The procedure for introducing a system of depreciation of employees should be gradual. New working conditions require some adaptation. State the essence of the upcoming changes in an accessible form, and have employees write down any questions they have. For each specialist, it is necessary to determine the first grade that he must achieve. At the same time, the amount by which the salary will increase after the intended goal is achieved is also announced. Practice shows that the process of getting used to new conditions occurs in stages and each stage takes about a month. It’s good if the manager finds the opportunity to talk about this topic personally with each employee.

Stage No. 5: application of the so-called conditional deduction of bonuses to employees

It is necessary to make it easier to understand the operation of the entire circuit. That is, to begin with, the manager only conditionally assigns punishments for errors, which are recorded electronically (in the employee’s personal file). And it also indicates what kind of penalty would be applied if it were not a conditional, but a real deduction for the employee.

There is no increase in salary for moving to the next grade level. This advance will then be used to pay off real deductions for real violations, but at the initial stage everyone seems to be just learning how to work according to the new scheme and material punishments are not applied to anyone.

Stage No. 6: half reduction in bonuses for employees

Now money is actually deducted from employees’ salaries for violations, but the amount is only half of the assigned bonus deduction. In the personal file, everything is recorded again. The amount of compensation payments is also reduced by 50%.

Stage No. 7: full implementation of new working conditions

Everyone has figured out the new system, one-time penalties are deducted in full, and the corresponding compensation is also paid in full.

Now all violations are recorded, and for each employee there is a financial penalty. For the system to be truly effective, this should be taken seriously and not turn a blind eye to the mistakes of subordinates from time to time, otherwise it will turn out that all the efforts made before were in vain.

Stage No. 8: checking the system operation

Some time after introducing new conditions, check how effective they are. If a reduction in bonuses has never been applied to employees, this is an alarm bell. The reason may be precisely that the rules are ignored, employees do not suffer any punishment for their violations, and the new work scheme that you so diligently developed and implemented is only formal.

Or the subordinates are so involved that they automatically perform their duties perfectly. This is not as good as you might think. In essence, it turns out that the company has no development, no movement forward, you are standing still.

Step #9: Tracking the Development Process

It is impossible to do without depreciation of employees if the bar for them is regularly raised. To develop successfully, it is necessary to constantly change conditions, each time making the level of requirements higher and higher. Employees manage to cope with the new regulations to a large extent thanks to the system of penalties for mistakes. The requirements are raised again once they are reached. This is the process of development of the company, as well as each specialist working in it.

To implement the reduction of bonuses to employees, there is a special algorithm, when applying it, it is important that the employee fully understands his mistake and practically assigns his own punishment.

- As soon as a violation occurs, you should immediately thoroughly understand what exactly happened and why.

- If during the proceedings the employee admits his guilt, ask him directly: “Do you agree to assign yourself a deduction?”

- If the answer is positive, you need to invite the subordinate to say out loud something like the following: “I believe that the situation was analyzed completely correctly, the conclusions drawn were also correct, so I am depressing myself, this is fair.” It is desirable that the phrase be constructed in this manner. The point is that a person who does not agree with the punishment and is simply waiting for the end of an unpleasant conversation will utter such words with great difficulty or even refuse to utter them. This approach will show the employee that part of his money is not taken away for nothing, it is his fault.

- In case of refusal, it is necessary to find out the reason: it is possible that the boss does not know everything. Then the situation should be considered taking into account new discovered circumstances.

- Document the fact of depreciation of the employee.

Why can't oral conversations replace lost money?

Many managers have seen in practice that verbal calls and appeals to comply with the rules are extremely ineffective. The situation is not much better with debriefing or tete-a-tete.

The problem is that most employees have developed a kind of immunity . There is also the optionality of fulfilling one’s own promises in the style: “I’ll fix it, this won’t happen again.”

Alas, the average employee perceives an oral conversation or a “call on the carpet” as an unpleasant conversation with the general meaning: “again the boss has composted his brains.” “Brain composting” is just part of the work process and a routine thing that does not in any way affect the future behavior of the individual. And, as a result, the same “shoals” are repeated again and again.

Go to contents