The essence and types of civil contracts

Civil contracts are agreements that are drawn up according to the rules of the Civil Code of the Russian Federation.

The main of these rules (Article 421 of the Civil Code of the Russian Federation) determines the possibility of concluding an agreement on any conditions that suit its parties (unless otherwise established by law for a certain type of agreement). The parties to such agreements can be, in different combinations, both legal entities and individuals (including those acting as individual entrepreneurs), i.e. the agreement can be concluded between:

- legal entities;

- individuals;

- legal entity(ies) and individual(s).

By type, civil law contracts are divided into those drawn up:

- on transactions with property (purchase and sale, exchange, donation, lease);

- performance of work, provision of services.

Despite the fact that the Civil Code of the Russian Federation separates contracts for work and services (their outcome is different - obtaining a result in the first case and carrying out certain actions in the second), the principles for drawing up the contracts concluded under them are very similar. And it is these contracts, in situations where the executor under them is an ordinary individual (not acting as an individual entrepreneur), that attract the closest attention of inspectors. This is due to the fact that taxation of income paid under such agreements is carried out according to special rules.

Below we will look at the features of registration and taxation of a civil contract with an individual performing work for the employer (i.e., who has entered into a contract agreement).

Orders and claims from regulatory authorities

Dissatisfied employees can contact the State Labor Inspectorate (SIT) with a complaint against the employer. The GIT can learn about violations of the organization not only from employees. Government agencies can report this: the prosecutor’s office, the police, the Federal Tax Service, and so on. If the State Tax Inspectorate finds out that the employer is hiding behind a civil process agreement instead of a labor agreement, it will issue him an order to eliminate the violation. The employer can either comply with it or try to appeal it in court.

There is no point in going to court if there really is a violation. If there is doubt about the nature of the relationship, the court interprets it as a labor relationship (Part 3 of Article 19.1 of the Labor Code of the Russian Federation).

Until January 1, 2014, the State Labor Inspectorate could not independently go to court with a demand to recognize the relationship as an employment relationship. Now the State Tax Inspectorate can conduct an inspection, prepare materials based on its results and take them to court with a claim to re-qualify the contract. In this case, the opinion of the employee himself is not taken into account. In this case, the court will study all the information and make a decision.

GIT does not often go to court to re-qualify contracts with individual entrepreneurs. The status of an entrepreneur implies greater security when working with customers and the possibility of not complying with internal regulations.

Distinctive features of a contract

Who can become an employer under a civil contract - GPA - with an individual concluded in connection with the performance of work? Any person - legal or natural, and the latter may be an individual entrepreneur or one without this status. In turn, the executor can be either an ordinary individual or an individual entrepreneur.

What distinguishes relations under such an agreement? First of all, the presence of specific work of a certain volume that must be done within a specified time frame. It is allowed for the contractor to carry it out both on his own and by persons attracted by him, using for this purpose both his own materials and equipment, and the customer’s materials and equipment.

In the process of performing work under the GPA, its performer is not subject to the work regime in force at his employer, but is responsible for:

- for the quality of what he or the persons involved did;

- compliance with contract deadlines;

- safety of property and materials transferred to him by the customer.

The specifics of the terms of such an agreement also depend on what type of contract work performed by an individual belongs to (Chapters 37, 38 of the Civil Code of the Russian Federation).

Turnaround time

To ensure that the repair work does not drag on for an indefinite period of time, the Parties determine the deadline for its completion. The deadlines are determined by the Contractors and depend on the quantity and complexity of the work performed. So, in the text of the document this section is written as follows:

The Contractor undertakes to fulfill the points specified in the document within the period: from October 23, 2023 to November 10, 2023. The work is accepted by the Customer on November 11, 2023, after which an acceptance certificate is drawn up.

GPA for work between individuals - what are its consequences?

The Civil Code of the Russian Federation does not prevent the conclusion of a civil contract between individuals. However, a number of questions arise here regarding who is responsible for paying taxes on the income received by the executor. Let us recall that each of the parties to such an agreement may be an individual entrepreneur, and due to this, the following options for the parties to the agreement are possible:

- both of them (the employer and the contractor) are individual entrepreneurs;

- the employer is an individual entrepreneur, and the performer is an ordinary individual;

- the employer is an ordinary individual, and the contractor is an individual entrepreneur;

- both of them are ordinary individuals.

In the first option, the relationship is the same as between legal entities or between a legal entity and an individual entrepreneur, i.e., everyone pays the taxes required for him, and the amount of payment under the GPA is a regular settlement between counterparties.

In the second option, the individual entrepreneur, in relation to income paid to an individual, is the payer of insurance premiums and the tax agent for personal income tax withheld from this income.

In the third option, the individual employer does not impose any taxes on the income paid to the individual entrepreneur. The latter makes all the necessary payments from his own income.

And with the fourth option, both parties have a need to make tax payments and prepare reports:

- for the contractor - in relation to the tax on income received, since the individual employer is not included in the number of tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation);

- from the employer - in relation to insurance premiums from this income (subclause 1, clause 1, article 419, clause 2, article 420 of the Tax Code of the Russian Federation).

The latter requires, accordingly, registration with the Federal Tax Service as a payer of contributions. Thus, both parties with this version of the GPA have consequences that are not desirable in contracts of this kind that are concluded infrequently.

Item

Information about the subject of the contract is the main component of any contract. The subject in our case is the types of work that the General Contractor undertakes to perform, and the Customer undertakes to pay for. In the section about the subject, it is important to indicate the volume and content of the work. It looks like this:

The general contractor, on the instructions of the Customer, within the period established by the contract, undertakes to carry out the following work: Carry out the construction of the Orleans residential complex, which includes the construction of three ten-story residential buildings of a panel series at the address: Kurgan region, Kurgan city, Lenin Street 97. Number of entrances - 9 (Nine), the total number of apartments is 342. Additional structures that the General Contractor undertakes to erect on the territory of the residential complex are:

- underground parking with 250 parking spaces;

- street parking for 25 parking spaces;

- playground;

- playground;

- simulators.

The characteristics of these structures are contained in the appendices to the contract. The work is carried out in accordance with technical documentation. The general contractor carries out work on the basis of a license, which gives the right to carry out construction, reconstruction, and major repairs. The license was issued by the Ministry of Construction of the Russian Federation on April 12, 2021.

Taxes for parties to a civil contract with an individual

What taxes will arise in a civil contract with an individual? Here, again, everything depends on the capacity in which (an ordinary individual or individual entrepreneur) the performer acts.

An ordinary individual (including an individual entrepreneur who enters into such an agreement as an ordinary individual) will be regarded as an employee registered with the employer under the GPA. And from his income the employer will accrue and pay:

- Personal income tax (except for the situation when the employer is also an ordinary individual), withholding it from the employee’s income (clause 1 of Article 226 of the Tax Code of the Russian Federation);

If you have access to ConsultantPlus, see recommendations from K+ experts on how to calculate and pay personal income tax on payments under service and contract agreements with resident individuals. If you don’t have access, sign up for a free trial access to K+ and learn the procedure.

- insurance premiums for compulsory health insurance and compulsory health insurance (such income is exempt from accrual of contributions to compulsory health insurance in terms of disability and maternity - subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation);

- insurance premiums for injuries, if such a condition is provided for in the GPA (Clause 1, Article 20.1 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

How to calculate insurance premiums when accepting work under a contract with an individual who is not an individual entrepreneur, experts from the K+ system explained in the Contract Guide. Get free trial access to ConsultantPlus.

An ordinary individual who has entered into a GPA on his own will only have to pay personal income tax in a situation where his employer also becomes an ordinary individual.

An individual entrepreneur who has entered into a relationship under a GPA agreement as an individual entrepreneur will have to accrue and pay all payments required for an individual entrepreneur:

- due to the applied taxation system;

- insurance premiums for compulsory medical insurance and compulsory medical insurance;

- taxes, the accrual of which is required by the presence of an object of taxation.

Find a comparative description of special modes, the use of which is preferred by individual entrepreneurs, here.

Remuneration: regular or one-time

Employees on staff regularly receive salaries in the agreed amounts . According to the rules of the Labor Code of the Russian Federation, salaries must be transferred at least twice a month - an advance payment and the main part. For failure to comply with payment deadlines, the employer issues compensation to the employee. It is charged for each overdue day as 1/300 of the refinancing rate.

If an employee works properly and fully performs his functions, he cannot be paid a salary below the minimum wage. In 2020, the minimum wage increases to 12,130 rubles.

Employees under a GPC contract will receive remuneration when they provide the customer with the result of the work performed . So the contractor can receive payment even once every six months, if such a period was required to complete the order.

The GPA can include the delivery of work in stages or the payment of advances. Then the customer will pay regularly, after accepting part of the work performed.

Form and content of a civil contract with an individual - sample

How is the GPA completed? Since it contains quite a lot of conditions that require special reservations, it is always drawn up in writing. It should reflect:

- names and details of the contracting parties;

- subject of the task entrusted to the performer;

- conditions for its implementation (volumes, quality, timing, ownership of raw materials and necessary equipment);

- cost of work, terms of payment for them;

- rights and obligations of the parties (including the condition on the accrual or non-accrual of contributions for injuries);

- procedure for accepting completed work;

- liability of the parties for violations of the terms of the agreement.

To learn about which points in the GAP you should pay special attention to, read the article “Contract agreement and insurance premiums: nuances of taxation.”

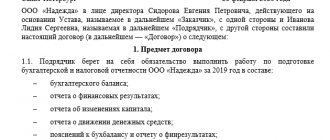

A sample civil legal agreement with an individual, executed by a legal entity, can be viewed on our website:

We do not provide a sample of a civil law agreement between individuals, since there are no special rules for its execution. Only the tax consequences will be special for him.

Mutual responsibility of the parties: employer and employee, customer and contractor

The employer is obliged to make the following payments in favor of the employee:

- average earnings for the period during which he was illegally deprived of the opportunity to work;

- compensation for damage to health and property;

- compensation for moral damage

- interest for late wages.

The employee, in turn, bears financial responsibility to the organization within the framework of his monthly earnings. For violation of discipline, he may be subject to a reprimand, reprimand or dismissal.

The customer of work or services is obliged to compensate the contractor for losses caused by improper performance of duties. The performer is responsible to the customer in the same way.

The contractor cannot be brought to disciplinary liability.

Results

A civil contract is distinguished by freedom in establishing its terms. The parties to such an agreement can be any person. By type, these agreements are divided into those concluded:

- on property transactions;

- in connection with the performance of work and services.

The greatest number of questions are raised by situations where the contractor under a contract for the performance of work (rendering services) is an ordinary individual. It becomes an employee for its customer, but is not subject to the rules of labor legislation, and its income is subject to taxation in a special manner.

Sources:

- Civil Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Internal labor regulations

Each full-time employee works at a time agreed with the operating hours of the organization itself . Therefore, he is obliged to work according to the company's rules. Come and leave work at the appointed time, have lunch and rest, and take technical breaks. Absence from work without a good reason is permitted only on non-working days: holidays and weekends established by the staffing schedule.

The full-time employee remains under the control of the employer throughout the working day.

Persons working under GPC agreements are not required to obey the customer’s internal rules . They do not obey the officials of the organization and its regulations.

The contractor can work at night, when the entire staff of the organization is resting, and sleep well during working hours. Weekends also do not affect the work process in any way. The main thing is to submit the result of the work on time.