Article updated: July 30, 2021.

Author: Lawyer Sergey Vladimirovich.

In simple terms, with this calculation method you will receive the exact amount of alimony, for example, 7,000 rubles per month, and not a percentage of income. The exact amount is determined by the court, depending on the financial situation of the parents.

Appointment procedure

Most often, this size depends on the cost of living throughout the country. At the beginning of 2021, the cost of living is 11,280 rubles.

In order to start receiving alimony in a fixed amount, you need to file a claim with the district court. The application will need to describe all the circumstances, as well as data on the child.

We provide more details on how to download and fill out the application below.

The following documents must be attached to the statement of claim:

- birth certificate of each child;

- a copy of your passport with registration information;

- a copy of the marriage or divorce certificate;

- receipts confirming your expenses;

- a statement stating that the child lives with you;

The following categories of persons have the right to receive alimony in a fixed amount:

- children under 18 years of age;

- adult disabled children;

- a spouse who is raising a child under three years of age;

- wife is pregnant;

- the former spouse needs to receive alimony by law;

- the ex-spouse has been raising a disabled child or a disabled person of the first group since childhood.

Example 1: Vladimir does not work anywhere, so his ex-wife decided to establish child support in a fixed amount. She wrote a statement of claim and went to court. The court ordered alimony in the amount of 7,500 rubles, taking into account the average salary in the region.

How to file and collect child support payments

An application for the collection of alimony in a fixed amount must be submitted to the magistrate's court. In this case, the law gives the plaintiff the opportunity to decide for himself which court to choose - in the place where he lives or where the defendant lives. When filing claims for alimony, no state fee is charged.

The claim must state the essence of the demands, indicate their amount, and justify it. You also need to make a calculation, which can be included in the text, or can be presented as an appendix. It is desirable to provide a detailed description of the circumstances surrounding the filing of the application and information about the defendant’s earnings. Significant facts may include:

- having children together;

- their place of residence;

- disability of any family member;

- financial situation of the plaintiff and defendant;

- information about the place of work and earnings of the person obligated to make alimony payments.

If the plaintiff does not have the opportunity to obtain information about the defendant’s earnings himself, he can indicate in the application a request for their requisition by the court.

Documents that must be attached to the statement of claim include:

- Passport.

- Birth certificates of children.

- Certificate of marriage or divorce.

- Certificates from the place of residence of the plaintiff and defendant about family composition.

The documentation specified in the first three paragraphs is submitted in the form of copies. Based on the results of the meeting, the judge makes a decision on the amount of alimony, which is the basis for issuing a writ of execution. He is sent to the FSSP, where enforcement proceedings are initiated.

Applications for the collection of alimony in a fixed amount.

Flat sum alimony calculator

The most important thing when using the calculator is to indicate the cost of living per child in your region. In 2021 in Russia it is 11,303 rubles , this is the amount we wrote in the calculator. But you can change it and enter your own.

| Alimony calculator in a fixed amount | |

| How many children do you have under 18 years of age? | |

| Living wage in your region: | rubles Error |

| Amount of additional expenses per child: | rubles Error |

| Alimony will range from 400 rubles to 13,000 rubles for each child. The judge will determine the exact size! If the alimony payer does not officially work, then alimony is calculated on his unemployment benefit. If he is not registered with the employment center, then you need to file a claim and set alimony in a fixed amount. |

Here are the main living wages in different regions in 2021:

- Moscow: 15582 rubles

- St. Petersburg: 11607 rubles

- Sevastopol: 12276 rubles

- Sverdlovsk region: 11850 rubles

- Tatarstan: 9905 rubles

You also need to choose how many minor children you have; the final calculation will also depend on this.

If you do not know the size in your region, you can ask a lawyer in the chat or in the comments.

Be sure to include all additional expenses that are spent on children each month. For example, if you pay for school or kindergarten, or attend a music section.

What's the result?

When alimony is collected in a fixed amount based on the official salary of the payer, this is a convenient option for the recipient, since the latter can calmly plan expenses for the child without worrying that in the coming month the amount will not be enough to cover all needs. But to receive such payments, you need to thoroughly prepare, collect the necessary documents, and then go through a long judicial procedure.

If there are any difficulties or ambiguities in the case, it is better to seek legal advice from the very beginning. This will help avoid mistakes in the future.

Minimum size

The minimum amount of alimony in a fixed amount greatly depends on the region where the child lives. For example, in Moscow the cost of living is 15,582 rubles, and alimony will be calculated using the formula: 15,582 / 2 = 7,791 for one child.

Thus, in Moscow and the Moscow region, the minimum fixed amount of alimony will be 7,791 rubles per child.

If you have two children, then this amount needs to be multiplied by 2, you get the amount (15582 / 2) * 2 = 15582 rubles for 2 children.

But the lowest value is in the Voronezh region. There, the cost of living for a child is only 9,248 rubles, and accordingly, alimony there will be 4,624 rubles.

In Russia, the cost of living per child in 2021 is 11,303 rubles, so courts often rely on this amount and assign alimony in a fixed amount: for 1 child - 5,651 rubles, for 2 children - 11,303 rubles, for 3 children - 16,954 rubles.

But remember that the court can even reduce this amount if the defendant provides evidence. For example, if he is disabled or has high medical expenses.

How to calculate a fixed amount of alimony

Child support is calculated taking into account the financial status of both parents and the child’s previous standard of living.

The procedure for calculating alimony in a fixed amount:

- calculate monthly expenses for a child;

- compare your salary and child expenses;

- establish what and how much income the defendant has;

- find out the cost of living in the region.

Example: In a marriage, parents spent 30 thousand rubles monthly on a child from the general budget (clothing, food, education). Mother's salary is 17 thousand rubles. My father's salary is 75 thousand rubles. The father has additional income from renting out an apartment. This is 15 thousand rubles monthly. The plaintiff’s total income for the year is 204 thousand rubles. The defendant’s total income is 1,080,000 rubles (salary 900,000 rubles + rental income 180,000 rubles). The cost of living in the region is 12,300 rubles. The application indicates the collection of alimony at twice the minimum subsistence level. The financial situation of the defendant is much better than the plaintiff, so the court satisfied the claims.

In what cases is it prescribed

If you have entered into a notarial payment agreement with each other, then it can establish alimony in any amount.

There you can prescribe a fixed amount that will be paid in a certain period. If there is no such agreement, then the law provides for the following situations for assigning payments in a fixed amount of money:

- the spouse who must pay does not have a regular source of income or earnings;

- the debtor has variable earnings: for example, when working on a rotational basis or is on piece work;

- receives a salary in foreign currency;

- receives salary in goods or results of work;

- if establishing alimony as a share of the salary violates the rights and interests of the child.

These rules are established in paragraph 1 of Article 83 of the Family Code of the Russian Federation.

If any of these grounds exist, the court may set payments in a certain amount.

Grounds for filing a claim in court

The obligation of parents to financially support minor children is spelled out in the Family Code of the Russian Federation. Parents can determine the procedure and form for providing funds for child support on their own. All conditions are specified in the alimony payment agreement. The agreement must be certified by a notary.

For information on how to correctly draw up an agreement on the payment of alimony, read the article: Settlement agreement on the payment of alimony - form, sample, drafting

If the parents were unable to peacefully agree on the maintenance of their common child, the court will determine the amount and method of collecting alimony.

Child support can be recovered as a percentage of the parent’s income:

- in the amount of 25% per child;

- for two children – 33%;

- for three or more children – 50%.

If the payer does not work, is not officially employed, or receives income in kind or foreign currency, it is impossible to collect alimony in shares. The parent with whom the child remains can file a claim for alimony in a fixed amount. In this case, the amount of alimony is determined by the court.

The court takes into account the financial and family situation of the parents and the ability to provide the child with the same level of support.

Need advice on the issue of collecting alimony? Our lawyers will answer your question free of charge and in as much detail as possible. Fill out the application form below or write to the duty consultant on the website.

Determining the amount of alimony

The court determines the amount of alimony depending on the minimum subsistence level. The decision must be made in such a way as to best take into account the interests of the child. The evidence presented by the plaintiff is important in such cases. You need to try to collect as much information as possible about the sources of income of the second spouse.

Be sure to make copies and provide the court with documents that confirm the expenses for the child. It can be:

- drug receipts.

- checks for doctors, medical examinations, massages.

- receipts for visiting sports sections.

- checks for kindergarten, school.

- receipts for the purchase of clothes, toys, stationery.

You must ask for child support that will leave the child with the same standard of living. For example, if he already went to a private kindergarten, then he can continue to go there. And the expenses for the kindergarten must be recovered through alimony.

If a child visited the pool and you spent 3,000 rubles a month on it, then you need to indicate this and collect this money from the defendant through the court as alimony.

This rule is stated in paragraph 2. Article 83 of the Family Code of the Russian Federation.

In addition, you must collect certificates and receipts that will confirm expenses for children. These could be checks for the purchase of clothes, payment for kindergarten, payment for doctor's services.

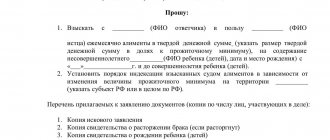

Statement of claim for the recovery of alimony in a fixed amount. Sample

We have prepared for you a sample of filling out a statement of claim to receive alimony in a fixed amount. Most importantly, do not forget to indicate the cost of living in your region, and also change the region to the one where the child lives.

For example, in Moscow now the cost of living for a child is about 16,000 rubles per month, so there you can ask for alimony in the amount of 8,000 rubles or more. But in the Saratov region, the cost of living is only 10,000 rubles. And you can ask for alimony in the amount of 5,000 rubles plus additional expenses for treatment and education.

Here is a short instruction from our lawyer:

- Download the application and fill out all the information. Be sure to include information about the child, as well as the amount you want to receive monthly. If you have several children, then make a detailed calculation for the court.

- Submit the application and copies of documents to the court. You can submit it in person through the court clerk or send a letter by mail. If you deliver the documents in person, then ask to mark one copy of the claim.

- In a few days the court will set a date for the first hearing. Be sure to take all original documents with you. If you indicated in the claim that the child requires additional treatment, then take receipts that will confirm this.

Indexation of payments

How indexing is carried out is discussed in Art. 117 RF IC. They carry it out:

- the organization in which the payer works;

- bailiff responsible for specific enforcement proceedings.

It all depends on who exactly the executive document was sent to. The basis for indexation is the increase in the cost of living in the region. If an indicator is not defined in a region, territory, or republic, then federal-level figures are taken.

How is recalculation made?

It was noted above that the amount of fixed alimony is always tied to the subsistence level. If its value has increased, then the amount of payments should also increase.

For example: the court collected alimony in the amount of 13,500 rubles, which corresponds to 1.5 times the minimum. The minimum wage has gone up. Previously it was 9,000 rubles, now it is 9,300. Accordingly, the amount of payments should also increase: 9,300 * 1.5 = 13,950 rubles.

Thus, the calculation of alimony in a fixed amount must, however, be carried out for each specific case. You can give examples from practice, generalize it, but without taking into account the circumstances of a particular case, it is difficult to predict its outcome.

If you find an error, please select a piece of text and press Ctrl+Enter.

State duty

The state fee for filing alimony in a fixed amount is 150 rubles. This rule is specified in paragraph 14 of paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation.

But you don't need to pay for it. The court will order the defendant to pay this amount after it makes a decision. Plaintiffs are exempt from paying the fee. This rule is specified in paragraph 2 of paragraph 1 of Article 333.36 of the Tax Code of the Russian Federation.

Alimony payments in 2021

Alimony is the amount that one of the parents pays for the maintenance of minor children: buying food, clothing, paying for education, etc.

These payments cannot be waived . These are mandatory payments, and their payers are divided into two groups: the first pay voluntarily, the second only through the court. But sometimes you have to go to court even if there is good will. For example, a party agrees to pay alimony, but the claimant is not satisfied with its amount. Then the court will determine the amount of child support for the minor child.

Alimony payments are assigned in a flat amount or as a share of the payer’s income . In practice, a share of income is assigned if the party has a permanent official income. For example, a white salary. Then the amount of alimony for one child will be equal to ¼ of the income, for two - ⅓, for three or more - half of the income.

A fixed payment is assigned to those who do not have an official or permanent income. Also, a fixed amount is often prescribed for individual entrepreneurs. The court does not take fixed alimony payments out of the blue; it focuses on the subsistence level.

Jurisdiction for alimony

As we have already said, in cases of alimony in a fixed amount, only a statement of claim can be filed. Because of this, you cannot go to the magistrates' courts as before. Currently, such cases can only be heard by city or district courts.

This rule came into effect on October 1, 2021.

Also remember that you can choose a court either at the place of residence of the defendant or at your location. This is convenient if the plaintiff and defendant live in different cities.

For example, you and your child live in Moscow, and the child’s father lives in St. Petersburg. To avoid having to travel to another city with your child, you can file a claim for alimony with the Moscow district court. And the defendant will have to come to you for court hearings.

Calculation of alimony according to the form of collection

Salary is the main source of income for withholding payments.

If the alimony obligee is not officially employed, but receives benefits or a pension, alimony will be calculated from them. The exception is compensation for moral damage, damage for causing harm to health, payments to victims of accidents or natural disasters - they are not subject to alimony.

As a percentage of income

Alimony as a share of salary is calculated from the amount remaining after payment of personal income tax, pension and medical contributions. The amount of payments depends on the number of children:

- one – 25%;

- two – 33%;

- three or more – 50%.

Important! If alimony obligee pays 25% of the salary for one child, but he has a second child who needs alimony, 25% is also assigned to him. To reduce the amount of payments to the required 33%, the alimony provider must file a corresponding claim in court.

Example 1. Alimony as a share of income O. N. Gorkov earns 70,000 rubles. “clean”, he has one child.

22% is transferred by the accountant to the insurance part of the pension, 5.1% to health insurance, 2.9% to social insurance. 13% personal income tax is also paid. The calculation of alimony is made from the remaining “dirty” amount.

70,000 x 22% = 15,400 rub. insurance part of the pension.

70,000 x 5.1% = 3,570 rub. – MHIF.

70,000 x 2.9% = 2,030 rubles. – FSS monthly.

70,000 x 13% = 9,100 rubles. – Personal income tax.

70,000 – 15,400 – 3,570 – 2,030 – 9,100 = 39,900 rubles. – remains in the hands of the payer. Child support is calculated from this amount.

39,900 x 25% = 9,975 rub. - for a child.

39,900 – 9,975 = 29,925 rubles. - total after all deductions.

In a fixed amount of money

Alimony in a fixed amount is assigned if the payer is not officially employed, receives a salary in foreign currency, or the exact amount of his income cannot be determined. This is most relevant for individual entrepreneurs.

When calculating payments in a fixed amount, the following are taken into account:

- living wage in the region;

- the average salary in the country;

- financial situation of the parties;

- child's need.

Having decided to collect alimony in this way, it is recommended to keep all receipts and receipts for expenses for a young child for 2-3 months. In the future, they will be needed to file claims regarding the amount of payments, since you cannot come up with amounts yourself - you need documentary justification.

Example 2. Alimony in a fixed amount Makarova O.L. divorced her husband in 2021, her daughter remained with her. The cost of living is 9,000 rubles. The ex-husband works unofficially; earnings cannot be proven. For two months, the woman collected all the receipts for spending money on the child, a total of 23,000 rubles came out in a month.

Makarova O.L. went to court with the claim and receipts, indicating as a claim the payment of alimony in the amount of 11,500 rubles. monthly - half the amount she spent.

Having studied the case materials, the court granted the claim, since lack of work is not grounds for release from alimony obligations.

How does collection occur?

To do this you need to take a few very simple steps:

- After the decision is made, you will need to write an application for a writ of execution. You can obtain this document from the court office.

- Then you need to draw up an application to initiate enforcement proceedings. Along with this application and sheet, you need to contact the bailiff service.

- The bailiffs will open enforcement proceedings and begin to collect funds from the debtor in your favor.

Bailiffs can make collections from any income of the defendant. Here are some of them:

- funds in bank accounts;

- wage;

- income from individual entrepreneurs;

- from fees and other payments.

Indexation of alimony

If the court has set alimony at a fixed amount, then it must be indexed every quarter. This requirement is specified in Article 117 of the Family Code of the Russian Federation. The indexation must be carried out by bailiffs or the organization where the payer works.

But in order for the bailiffs not to forget about this obligation, we advise you to write an application for indexation every year. The application must be submitted to the bailiff who is handling your case. Below you can fill it out yourself.

To make it easier to index alimony, they are almost always assigned as multiples of the subsistence level. This rule is specified in paragraph 2 of Art. 117 of the Family Code of the Russian Federation.

See an example of filling. Do not forget to indicate the amount that the court has assigned you and the case number.

If the bailiffs do not respond to your demands, then you need to write a complaint addressed to the head of the Federal Bailiff Service and the prosecutor's office.

A court order for alimony in a fixed amount

In order for the court to issue a court order, all evidence of costs must be attached to the application. For example, checks from sports sections, clubs, and so on.

But the amount that the plaintiff asks for often greatly differs from the minimum subsistence level at which alimony is prescribed. For this reason, courts practically do not issue court orders for alimony in a fixed amount.

Also, paragraph 11 of the resolution of the Supreme Court of the Russian Federation dated May 26, 2017, states that courts should not issue court orders in such cases. Assigning a fixed amount is always an individual decision made by the judge; the exact amounts are not specified anywhere.

Because of this, the defendant must have the opportunity to come to court and prove his case. For example, if he does not agree with some expenses or has minimal income and cannot pay the requested amount.

| Calculator of penalties and alimony debt: | |

| Amount of debt today: | rubles |

| Start date of delay: | |

| Until what date are penalties calculated? | |

Penalties at the rate of 0.1% per day for 0 days: 0 rubles

Amount of penalties for all debts: 0 rubles

Total amount of debt (penalty + principal): 0 rubles

If the parent does not have a regular income or is unemployed, then the court will: award alimony in a fixed amount

clause 1 Article 83 of the Family Code of the Russian Federation

The amount of alimony in a fixed amount is determined by the court: in order to maintain the child’s previous standard of living

clause 2 Article 83 of the Family Code of the Russian Federation

The court establishes child support for children after 18 years of age: in a fixed amount that the parent pays monthly

clause 2 Article 85 of the Family Code of the Russian Federation

If the child requires treatment, outside help or housing, then the court may order: additional alimony in a fixed amount

clause 1 Article 86 of the Family Code of the Russian Federation

The ex-wife can collect alimony for herself: in a fixed amount

Article 91 of the Family Code of the Russian Federation

How to file a claim for alimony in a fixed amount

When drawing up a claim for alimony in a fixed amount of money, you should be guided by the general conditions for drawing up claims for the collection of alimony and the rules for determining their jurisdiction.

Please note: Statement of claim for collection of child support

In the text of the statement of claim for the collection of alimony in a fixed amount, it is necessary to justify why alimony must be collected in a fixed amount, and not in shares.

Attached to the statement of claim are the children's birth certificates, a certificate confirming the child's registration with the plaintiff, documents on the income of the plaintiff and the defendant (for the defendant - if possible), documents on the presence (absence) of a marriage between the parties.

The most difficult part will be to justify the conditions for receiving alimony and determine the amount of the amount to be recovered. To justify the amount, indicate the maximum possible preservation of the child’s previous level of support, taking into account the financial and marital status of the parties and other noteworthy circumstances. It would be correct to make an arithmetic calculation of the amount, attaching it to the statement of claim.