In order for the children of our country to receive upbringing and education at the proper level, their rights are protected by law. The Family Code of the Russian Federation, defining the responsibility of parents in relation to children, provides for their material support in any life situations. If one of the parents leaves the family during a divorce, he is obliged to pay alimony until the children reach adulthood.

Child support can be paid on the basis of two documents:

- voluntary alimony agreement;

- court decision on compulsory collection of alimony.

Who is entitled to receive alimony and from whom?

Family relationships are determined not only by kinship, but also on a legal basis. If a man and a woman get married, then along with personal and property rights they also receive responsibilities towards each other. The same thing happens when children are born. Depending on how family life develops, family members have the right to count on care and material support from relatives. In case of loss of ability to work or for other reasons determined by the Insurance Code and the Code of Civil Procedure of the Russian Federation, the following have the right to receive alimony:

- minor children from parents;

- elderly or disabled parents with adult children;

- spouses, if they remain single and need care, from the other spouse;

- grandparents requiring outside help from their grandchildren;

- disabled or incapacitated brothers and sisters from their adult brothers and sisters, if there are no parents;

- educators, adoptive parents, stepfathers and stepmothers of adult children raised by them.

Should alimony be withheld under a civil agreement?

Of course, there are also disadvantages to this design. For example, not all employees can have a GPC agreement.

In particular, such registration is unacceptable for materially responsible employees.

In addition, there is a risk of changing such a contract into an employment contract if it is repeatedly re-signed to perform the same work. However, in some situations, it is the GPC agreement that becomes the best solution.

What it is

The parties to the agreement can be represented by government agencies, organizations, individual entrepreneurs and individuals. Depending on what is the subject of the agreement, the type of contract differs.

The GPC agreement and the employment contract have many differences, but the general condition is the mandatory written form of the document.

The difference between a civil contract can be considered the absence of formalities. To conclude an employment agreement in an organization, a special order is issued.

On its basis, personnel documents are drawn up, allowing the employee to be enrolled on the staff. The employee usually begins to perform his duties only after complete registration.

It is easier to conclude a GPC agreement. There is no need for additional documentation.

The parties verbally agree on the terms of cooperation. Then the contract is signed, and the contractor can begin work.

At the same time, there are several types of GPC agreements, each of which has its own chapter in the Civil Code.

That is, the performer, regardless of his specialty or qualifications, performs predetermined work or provides a service.

Article 779 of the Civil Code of the Russian Federation contains a definition of services. This is the completion of certain actions or any activity, subject to payment by the customer upon achieving a positive result.

For comparison, an employment contract can be drawn up for an indefinite period (Article 58 of the Labor Code of the Russian Federation).

If in order to terminate an employment contract the employer needs to comply with a number of formalities, then the GPC agreement ends after acceptance and payment for the work.

The relationships between participants in civil law relations are regulated by Part 2 of the Civil Code of the Russian Federation and the Constitution of the Russian Federation. Labor law standards are not applicable in this case.

If a man presents to the bailiff: civil contract agreements concluded between him as an individual and a legal entity or individual, which will indicate the cost of work or services (that is, the amount of earnings), receipts for payment of alimony calculated on the basis of this amount and paid on time (no later than 3 days from the date of receipt of funds), ... there can be no claims against him. It’s good if alimony payments from a contract are received frequently and in large quantities.

A very common situation is when a parent refuses to pay child support citing the lack of a regular salary. At the same time, the citizen is very actively carrying out construction or other work under construction contracts, but does not consider it necessary to classify them as permanent income.

How to pay alimony from a contract and labor contract In particular, a contractor performs certain work for a fee, just like an employee on the organization’s staff. There are significant differences between these transactions. The contractor may have irregular earnings - it all depends on the volume of orders.

USEFUL INFORMATION: Does the law allow inheritance before 6 months?

Grounds for collecting alimony

Based on the norms of the Criminal Code and the Code of Civil Procedure of the Russian Federation, alimony can be awarded to any of the participants in family relations. The main condition for collecting alimony is proof of the relationship between the plaintiff and the defendant. According to the Code of Civil Procedure of the Russian Federation, such evidence is provided by civil records, which are stored in state archives. To confirm their existence, citizens are issued certificates. They are documents by which one can trace the origin or termination of family relationships.

If the parents were married at the birth of the child, their names are recorded as the father and mother. It is from them that, according to the Code of Civil Procedure of the Russian Federation, alimony can be recovered in favor of the child. In the same way, the Investigative Committee and the Code of Civil Procedure of the Russian Federation require confirmation of relationship when it comes to paying alimony to disabled elderly parents and other family members.

Unmarried parents, in accordance with the norms of the Criminal Code and the Code of Civil Procedure of the Russian Federation, can submit a joint application in order to establish the father of the child. They must also decide together whose last name the child will bear. If it is necessary to submit an application for payment of alimony, this act record will serve as confirmation that the citizen against whom the claim is being made is indeed the father of the child. Although the norms of the Code of Civil Procedure of the Russian Federation allow paternity to be challenged in court.

A significant percentage of newborns are registered by single mothers, which does not contradict the Code of Civil Procedure of the Russian Federation. The child is given the mother's surname, and the patronymic is written down from her words. In the future, in order to file an application for the recovery of alimony from the biological father, the Code of Civil Procedure of the Russian Federation provides for the possibility of establishing paternity in court. In addition to witness testimony, which the court takes into account, an important basis for recognizing paternity are the results of a medical genetic examination. In the Russian Federation, the Code of Civil Procedure recognizes the legality of this document.

Personal income tax on income under NAP

Part 8 of Article 2 of the Federal Law of November 27, 2018 No. 422-FZ establishes that self-employed payers of personal income tax are exempt from personal income tax in relation to income subject to taxation of personal income tax. This rule applies to all self-employed people - both entrepreneurs and ordinary citizens without entrepreneurial status.

This means that counterparties of the self-employed under GP agreements, which are considered tax agents for personal income tax, do not calculate or withhold income tax on remunerations paid to the self-employed (letters of the Ministry of Finance of Russia dated 02/17/2020 No. 24-03-08/10748, dated 03/11/2019 No. 03- 11-11/15357). Accordingly, a self-employed person does not have the right to receive personal income tax deductions from his income taxed under the NAP (letter of the Ministry of Finance of Russia dated November 20, 2020 No. 03-11-11/101167, dated September 24, 2019 No. 03-11-11/73352).

Who has the right to apply to the court for alimony?

According to the norms of the Code of Civil Procedure, adult citizens who have not been declared legally incompetent have the right to request alimony by contacting the judicial authorities on their own behalf. If, for health reasons, they cannot come in person to submit an application and to court hearings, then, in accordance with the norms of the Code of Civil Procedure of the Russian Federation, authorized representatives can act on their behalf. A power of attorney to represent interests in court for the collection of alimony is certified by a notary, which is a requirement of the Code of Civil Procedure of the Russian Federation.

According to the Insurance Code and the Code of Civil Procedure of the Russian Federation, alimony for the maintenance of minor children has the right to demand:

- one of the parents;

- adoptive parents;

- educators or guardians (trustees) appointed legally;

- representatives of guardianship and trusteeship authorities.

The Code of Civil Procedure of the Russian Federation does not authorize any other relatives - grandparents, uncles, aunts, if they are not recognized as guardians or trustees of the child, to demand alimony in court or receive it. Schools and other educational institutions also do not have such rights. But if the child lives in an educational institution - an orphanage or a boarding school, then, according to the Code of Civil Procedure, alimony can be demanded from the parents by the administration of this institution.

What is the difference between a contract and an employment contract?

A work contract is a civil law agreement, under the terms of which the contractor must perform contract work on the instructions of the customer. It is concluded for a certain period and terminates after acceptance of the order and transfer of payment.

An employment contract is an agreement under which an employer hires an employee to a full-time position to perform job duties.

It is concluded for an indefinite period. A fixed-term contract is signed in cases strictly stipulated by law. Let's consider the distinctive features of a contract and employment agreement:

| Work agreement | Employment contract |

| The contractor works at a convenient time | Employee works according to schedule |

| No labor guarantees | The citizen is granted annual leave, paid sick leave, and other guarantees. |

| Withholding of alimony is carried out by a bailiff if the payer does not transfer it voluntarily | Alimony may be withheld by the accounting department of the organization in which the citizen is employed |

The disadvantage of working as a contractor is that it is difficult for the recipient of alimony payments to determine the exact amount of the payer’s income. By verbal agreement there may be one amount, but in the contract - a lower amount. Part of the payment is transferred in person and cannot be confirmed by a certificate of income.

Can a child support worker work under a contract?

In view of the above “advantages” of a free form of employment, many alimony payers often think about leaving their official place of work and even deliberately quit in favor of working under contract agreements in order to hide real earnings and minimize payments to the alimony collector. Is this legal?

The fact that every citizen of the Russian Federation has the right to freely dispose of their labor abilities, choose a profession and type of activity, as well as the fact that labor is free, and forced labor is prohibited, is stated in Art. 37 of the Constitution of the Russian Federation. Since the payer of alimony is, first of all, an individual and a citizen of the Russian Federation, his constitutional rights must be respected and inviolable. Consequently, the circumstance whether he will be employed at all or work under an official contract or a contract agreement is exclusively his civil right.

Where to apply for an award of child support?

If the opportunity to reach an agreement between the parents is not used, and mutual agreement cannot be reached, then child support can be collected through the court. According to Article 28 and Part 3 of Article 29 of the Code of Civil Procedure of the Russian Federation, the mother (most often the children remain with the mother) can appeal to the court of the region where she lives, or to the court where the child’s father lives.

If parents live in different areas or different cities, experts advise women to apply for child support at their place of residence. The judicial review of a case on awarding alimony in accordance with the Code of Civil Procedure of the Russian Federation can last for a month; more than one hearing and court hearing will be held. To get a satisfactory result, you must arrive at court on time. It’s not easy to do this while in another city. If the defendant does not appear at the hearing on the award of alimony, the issue may be considered in his absence. This fact will not serve in his favor, since it will emphasize an indifferent attitude towards the fate of the child who will have to pay child support.

Like any court proceeding, the case for the collection of alimony is subject to state fees. But according to the Tax Code, the plaintiff is exempt from paying the duty. It is recovered from the defendant along with other legal costs and transferred to the state budget on the basis of Part 1 of Article 103 of the Code of Civil Procedure of the Russian Federation.

If the child’s father does not appear in court on a subpoena to consider the case for the collection of alimony, and it is impossible to find him to serve copies of the claim documents, a court decision or a writ of execution, the judge is obliged to announce a search for him on the basis of Part 1 of Article 120 of the Code of Civil Procedure of the Russian Federation.

Features of work under a GPC agreement

A civil contract can be drawn up with both individuals and legal entities.

Its parties are represented by the customer and the contractor (for an employment contract, the employer and the employee). When concluding a GPC agreement, an individual should know about its main features.

First of all, you should not count on the appearance of a new entry in the work book, since such, in principle, is not used in civil law relations.

But at the same time, the insurance period is taken into account, and work under GPC contracts gives the right to apply for a labor pension.

The customer transfers contributions to the Pension Fund, as under an employment contract. Relations between the parties are regulated by the Civil Code. The performer's rights are less protected.

You cannot refer to the norms of the Labor Code of the Russian Federation. The terms of cooperation are determined exclusively by the concluded agreement. The GPC agreement does not provide for the definition of working hours.

The contractor is only required to complete the work within a specific time frame, even if this means working for days.

In civil law relations, the performer is independently responsible for his own safety. An injury sustained while performing work is not compensated by the employer in any way.

There is also no provision for payment for temporary disability of any nature. The employee receives payment only for results.

If the result of the work does not meet the customer’s requirements, then there may be no payment. The reason for refusing payment may be failure to comply with clearly stated deadlines.

In order to protect its interests, the contractor should remember the basic recommendations for concluding a civil contract:

Attention! When concluding a GPC agreement, the customer does not have the right to indicate to the contractor how, where and when to perform the work. How to correctly calculate your monthly salary based on an accountant’s salary, read here

How to correctly calculate your monthly salary based on an accountant's salary, read here.

The whole process comes down to issuing a task and receiving the finished result. All additional conditions are valid only if they are indicated in the main agreement.

Correct filling of the form

The GPC agreement is concluded in one copy for each of the parties. There is no unified form of the document.

You can take a standard template as a basis and make the necessary additions to it. The civil contract stipulates the following points:

- identification data of the customer and contractor (details of the organization, full name and passport data of the individual);

- date and place of compilation;

- subject of the contract (the essence of the work or services for which the contractor will receive payment);

- amount of payment under the contract (exact amount, date of payment, attached payment schedule for partial payment);

- responsibilities of the parties (use of materials and tools, who pays for what during the execution process, the possibility of intermediate checks of completion, etc.);

- presence/absence of notarization of the contract;

- personal issues (non-disclosure of information, confidentiality, etc.);

- force majeure circumstances under which the contract becomes invalid;

- deadline for completing work or providing services;

- procedure for receiving the result (attachment of a sample acceptance certificate);

- additional conditions (negotiated individually);

- signatures of the parties with transcripts.

Nuances when concluding a deal

When concluding a civil contract, it is important to draw it up correctly. Otherwise, the GPC agreement can be replaced with a labor agreement

This is especially disadvantageous for the employer, since it threatens with serious consequences.

In particular, this is the obligation to pay for unused vacation, payment of insurance premiums and accrued penalties, the need to prepare personnel documentation, the imposition of a fine under the Code of Administrative Offenses of the Russian Federation, etc.

Before signing, the drawn up GPC agreement must be checked for compliance with the following requirements:

What documents must be submitted to the court to collect child support?

In addition to the application for the recovery of alimony from the father for the maintenance of the child and a copy for delivery to the defendant, the following must be submitted to the court:

- Information about the plaintiff

- Copy of the passport.

- The address to which information about hearings and court hearings should be sent.

- Certificate of employment.

- Information about wages and other income.

- Certificate of health (if necessary).

- Information about the defendant

- The address at which his place of residence and place of stay is registered.

- The address where he can actually be found.

- Place of work.

- Salary information.

- Information about property (housing, transport, land).

- Information about securities, deposits.

- Information about the child

- A copy of the birth certificate, which indicates the paternity of the defendant.

- A certificate from the place of residence, which confirms the fact of living with the mother.

- Certificate of health if the child needs special care and treatment.

From the moment the court receives the full package of documents until it considers and makes a decision on the collection of alimony at the request of the Code of Civil Procedure of the Russian Federation, no more than a month should pass, since funds for the maintenance of the child are regularly needed. An appeal may be filed to challenge the decision. But according to Articles 211 and 212 of the Code of Civil Procedure, alimony can be collected immediately.

How to change the method of collecting alimony payments?

It happens that alimony payments are assigned as a share of income. Then, in order to evade alimony obligations, the payer hides his income. In this case, you can change the method of collecting alimony from a share to a fixed sum of money.

A lawsuit is filed in court to change the method of collection. It states:

- information about the parties;

- information about children;

- information about the original court decision;

- circumstances in connection with which it is necessary to change the payment method;

- references to legal norms;

- requirement to change the order of retention of content;

- list of applications;

- date and signature.

Documents confirming the need to change the procedure for paying maintenance are attached to the claim.

Within a month, the court makes a new decision and issues a writ of execution. It is transferred to the bailiff, who conducts proceedings against the payer.

Firm form of payment

The fixed form of alimony directly depends on the minimum subsistence level for a minor, which is established in the region. However, the minimum itself changes every three months, or even more often. This is due to constant inflationary processes. To ensure that alimony does not change in value, the bailiffs or the payer himself are engaged in their indexation. This is a computational procedure that involves revising the existing payment amount. It is implemented quite simply.

- the amount of the subsistence minimum (LM) is determined at the place of residence of the recipient of financial assistance;

- the multiplicity of the amount of alimony in a fixed amount is calculated according to the total number of PM values;

- the resulting multiple is multiplied by the identified PM volume at the time of calculation.

All calculations can be represented as a formula:

IAl = NPPM / SPPM * D.

Here IAL is the volume of already indexed alimony. It is obtained by dividing the new PM indicator by the old one. The resulting amount is multiplied by the monthly amount of alimony payments, which was established before indexation.

Indexation is carried out quarterly, that is, once every three months.

What types of income are alimony collected from, and in what amount?

Child support can be awarded in a fixed amount or in a certain portion of all income. A fixed sum of money is most often assigned by the parents themselves when drawing up a voluntary alimony agreement. In this case, they are guided by their property status, care for the child and the degree of participation of each of them in material support. The main condition is that the alimony that will be paid should not be less than the minimum consumption budget for a given age category.

The collection of alimony in court is often based on a percentage of the payer’s total income. For one child you will have to pay one fourth, for two – a third, for three or more children – half of all types of income.

A special Government Resolution determines the types of income from which alimony must be paid. The main ones:

- wages with allowances, bonuses and other regular payments;

- old age pension;

- scholarships received in educational institutions of various types of accreditation;

- business income;

- dividends, deposits, profits from securities;

- income from the rental of property - real estate, vehicles;

- other.

This list also includes alimony from a civil contract. However, the court always meets the wishes of the plaintiff and orders the payment of civil alimony in a fixed amount.

Withholding alimony from wages (memo to an accountant)

/ condition / The accounting department has three writs of execution per employee. According to two of them, it is necessary to withhold alimony for two children in the amount of 10,000 rubles each. for each, and for the third - compensation for damage caused to health as a result of an accident in the amount of 20,000 rubles.

The employee’s income for May 2014, minus personal income tax, amounted to 30,000 rubles.

/ solution / First, calculate the maximum amount to be withheld. It will be 21,000 rubles. (RUB 30,000 x 70%). Since the amount of claims is 40,000 rubles. (RUB 10,000 + RUB 10,000 + RUB 20,000) more than the amount that can be withheld (RUB 21,000), do this in May 2014:

- according to two writs of execution, withhold alimony of 5,250 rubles. for each child (21,000 rubles x 10,000 rubles / 40,000 rubles);

- according to the third document, withhold 10,500 rubles. for compensation for damage to health (21,000 rubles x 20,000 rubles / 40,000 rubles).

SITUATION 3. Only alimony is collected upon application for its voluntary payment. You can withhold any amount indicated by the employee in such a statement. Up to 100% of his earnings.

SITUATION 4. Alimony is collected upon application for its voluntary payment and any other payments under writs of execution. You must comply with the following order of deductions:

1) first, alimony and other payments of the first priority are collected according to the writ of execution;

2) then - other deductions according to executive documents;

3) lastly - voluntary alimony at the written request of the employee.

You can maintain a separate register for each debtor. From it, when checking, you and the bailiff will see the amounts withheld from the employee, the remaining arrears on his alimony obligations as of any date and the amounts transferred to the alimony recipient.

/ condition / From employee A.S. Barabanov needs to withhold alimony for two children in the amount of 10,000 rubles each. for each and the amount of compensation for damage to health in the amount of 20,000 rubles.

Barabanov's income is paid twice a month.

/ decision / Registers for alimony writs of execution are filled out in the same way. We present one of them, as well as a register of amounts withheld for compensation for injury to health.

In accordance with the norms of current legislation, alimony obligations can be fulfilled both voluntarily and forcibly.

If in the first case the parties can enter into an alimony agreement between themselves, where they independently determine all the essential conditions for the fulfillment of alimony obligations, then forced collection involves going to court.

If the court decision is not executed voluntarily, the case will be transferred to the Bailiff Service.

Thus, the collection of alimony is a procedure for the fulfillment of assigned alimony obligations. Find out in more detail how alimony is collected.

When deducting alimony obligations from the salary of the enterprise administration, it is important to understand how to calculate the percentage of funds to be paid.

In this case, there are legally established indicators that determine what part of the alimony worker’s earnings can be withheld.

The amount of payments will be determined by the court based on the specific circumstances of the case, including the amount of income of the payer, the needs of children, etc.

Alimony payments are exempt from income tax, so deduction is made from net salary.

In accordance with the norms of labor legislation, employers have the opportunity to provide their employees with financial assistance, including assistance for health improvement, going on vacation, compensation for harm caused, and so on. In this regard, both payers of alimony and representatives of the administration have questions about whether alimony is collected from financial assistance for leave for recovery and other payments.

It all depends on whether such payments are regular (for example, payment for annual leave) or are one-time in nature (for example, financial assistance in the event of a work injury).

If payments are not provided to resolve a specific critical situation, alimony may be collected from such funds.

Thus, the answer to the question of whether alimony is paid from vacation pay will be positive.

If you have any doubts whether alimony is collected from a pension, or, for example, scholarships, then to resolve this issue we turn to the resolution of the Government of the Russian Federation of July 18, 1996.

No. 841 “On the list of types of wages and other income from which alimony for minor children is withheld.” It directly states that alimony can be collected from any type of income, including salary, pension and scholarship.

To find out more about how this happens, read how alimony is collected from a pension.

In addition to official employment, a citizen can work under civil contracts, for example, under a contract. According to the terms of the latter, the customer and the contractor stipulate the subject, timing and procedure for the execution of the agreement.

Although civil employment contracts are often fixed-term (temporary), this does not exempt the person working under such a contract from paying alimony, since the remuneration received in this case is considered income.

In other words, work on civil transactions does not in any way impede the ability to collect alimony from a citizen.

When filing a claim for alimony payments in court, the judge issues an order in accordance with the decision made on this issue.

Based on the court decision to assign monthly payments, a writ of execution is drawn up, which clearly defines the procedure for withholding funds for the needs of the child or indicates a specific amount of deductions.

The document is sent:

- at the place of work of the alimony obligee;

- to the Federal Bailiff Service (FSSP).

The writ of execution contains all the information necessary for alimony payments.

Article 101 of Federal Law No. 229-FZ of October 2, 2007 lists payments received by the alimony provider, from which he is not obliged to deduct child benefits.

These amounts do not relate to income, since they represent subsidies for the payer himself, allocated from the state budget or from enterprise funds for production needs.

This includes:

- Compensation for treatment, care for disabled people, travel and others.

- Additional payments to pensions from the state budget.

- One-time payments to the poor.

- Maternity capital (amounts for the second and subsequent children from the Pension Fund).

- Insurance coverage.

- Pensions for children upon loss of a breadwinner.

Compensation from the employer:

- for the purchase of tools;

- business trips;

- related to events in the family.

It is important to decide how financial assistance will be collected. Typically, collection occurs on a shared basis. That is, a percentage is calculated from the income received by the second parent who does not live with the child. But there are situations when parents can pay a fixed amount, which is determined by the court. Sometimes a mixed method of collection is used.

In order for a flat payment to be applied or a mixed option to be used, the following circumstances apply:

- the father, from whom a fixed payment will be collected, has an unstable and changing income, therefore it is difficult to calculate the period for receiving the money;

- the alimony payer receives a solid income in kind or dollars/euro/other currency;

- the payer has no official income at all;

- if the assigned share funds violate the interests of the child, or it will be difficult to carry out such collection.

Alimony, which is paid in a fixed amount, is usually not used for minors or is used in extreme cases. This format of cash assistance is more intended for adult citizens who are supported by their relatives. This is stated in the law of the Russian Federation.

Shared recovery is carried out as a percentage. If there is one child, he is entitled to 25%, for two children this percentage increases to 33.33%, and for three children it is more than 50%. The choice of method for assigning alimony depends on what income the alimony payer has and what responsibility he bears.

Why is it better to collect alimony from a civil document in a fixed amount?

If the child’s father does not have a permanent job or is not employed as an individual entrepreneur, it is difficult to say what means should be considered his income. Most likely, such a citizen works seasonally or under a civil agreement. His income will be unstable, because the work by agreement is episodic.

It is even more difficult to determine the percentage that should be paid as alimony. During months when wages are very low or non-existent, deductions to pay may be lower than the cost of living. The situation is significantly aggravated if the defendant tries to hide his income in order to reduce the amount intended for alimony payments.

To avoid such manipulations, and not to leave the child without a means of subsistence, alimony from a civil agreement can be demanded in a fixed amount of money. This form of calculation should suit all participants in alimony relations and representatives of government bodies called upon to regulate and exercise control over the process.

- In the interests of the child, the court makes a decision to pay alimony in an amount that cannot be lower than the subsistence level.

- For the mother, as the recipient of alimony, there is a guarantee of regular receipt of money throughout the entire period until the child turns eighteen years old.

- The defendant will be spared the need to visit a bailiff for seasonal or periodic recalculation of alimony.

- The executive service will be able to exercise effective supervision over the implementation of the court decision without unnecessary confusion in calculating or changing the amount of alimony.

Retention based on writs of execution: complex cases

Is it possible to withhold alimony based on a voluntary application by an employee?

Having considered the issue, we came to the following conclusion: The employer does not have the right to withhold alimony based on the employee’s application.

Rationale for the conclusion: According to Art. 137 of the Labor Code of the Russian Federation, deductions from an employee’s salary are made only in cases provided for by the Labor Code of the Russian Federation and other federal laws.

So, in accordance with Art. 109 of the Family Code of the Russian Federation, the administration of the organization at the place of work of the person obliged to pay alimony must withhold monthly alimony from wages and (or) other income on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution.

Thus, the administration of the institution is obliged to withhold alimony only on the basis of the above documents.

Therefore, we believe that the employee's statement in itself does not allow deduction. It can be the basis for deductions only when such a procedure is established by a specific norm of federal law.

Since neither the Labor Code of the Russian Federation nor other federal laws contain a corresponding norm, we believe that the employer does not have the right, at the request of the employee, to carry out the deduction specified in the question (see also letter of the Federal Service for Labor and Employment dated July 18, 2012 N PG/5089-6-1 ).

Meanwhile, we draw your attention to the fact that the provisions of Art. 137 of the Labor Code of the Russian Federation are also consistent with the provisions of Art. 8 of the International Labor Organization Convention No. 95 of July 1, 1949 “Regarding the protection of wages.” According to paragraph 1 of Art. 8 of the Convention, deductions from wages are permitted only under the conditions and within the limits prescribed by national legislation or determined in a collective agreement or in a decision of an arbitration body.

In accordance with part five of Art. 136 of the Labor Code of the Russian Federation, wages are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract. The fact that the legislator allows exceptions to the rule on payment of wages directly to the employee does not mean that, with the consent of the employee, his wages can be transferred to any person. The Constitutional Court of the Russian Federation, in its ruling dated April 21, 2005 N 143-O, indicated that the norms of parts three and five of Art. 136 of the Labor Code of the Russian Federation are aimed at ensuring the coordination of the interests of the parties to an employment contract when determining the rules for paying wages, at creating conditions for the unhindered receipt of wages by the employee personally in a way convenient for him and cannot be considered as violating the constitutional rights and freedoms of citizens.

Thus, in our opinion, in the situation under consideration, the employer must pay (transfer) to the employee the entire amount of wages due to him. The employee, having received the entire amount of wages due to him, can use the money at his own discretion, in particular, transfer part of the wages as a voluntary payment of alimony.

For your information: Various specialists from the Legal Department of Rostrud express opposing opinions on the issue under consideration. If the already mentioned letter dated July 18, 2012 No. PG/5089-6-1 indicates the inadmissibility of deductions from wages, except in cases provided for by the Labor Code of the Russian Federation and other federal laws, then the letter dated September 26, 2012 No. PG/7156-6 -1 indirectly confirms the legality of additional deductions made on the basis of the employee’s application. Answer prepared by: Expert of the Legal Consulting Service GARANT Gabbasov Ruslan

The answer has passed quality control

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

And it is within the framework of these relations that the legislator has taken measures to protect wages from various deductions. Meanwhile, we draw your attention to the fact that the provisions of Art. 137 of the Labor Code of the Russian Federation are also consistent with the provisions of Art. 8

International Labor Organization Convention No. 95 of July 1, 1949 “Regarding the protection of wages.” According to paragraph 1 of Art. 8 of the Convention, deductions from wages are permitted only under the conditions and within the limits prescribed by national legislation or determined in a collective agreement or in a decision of an arbitration body.

In accordance with part five of Art. 136 of the Labor Code of the Russian Federation, wages are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract.

If desired, the employee can voluntarily file an application to withhold alimony. The administration of the company where the payer works will withhold alimony every month upon application or court order from the employee’s salary and/or other income and transfer it to the benefit of the recipient.

If such an employee resigns, the employer must notify the recipient of contributions and/or the bailiff. If the writ of execution is received by the company after the payer has resigned, the organization is obliged to return this document to the sender.

Payments begin to be made from the date indicated in the executive document. If, for example, the 15th date is indicated there, then the first time the accountant should count out the amount of money for half a month. In the future, this is done within 1 month. Funds are transferred to the account of the alimony recipient within three days after the salary is accrued. Even if the writ of execution is received late by the accounting department, there should be no delay in payment.

Accountants transfer to the recipient's account all amounts provided for in the document. If alimony payments should have started a month ago, then in the current month an amount equivalent to two months of alimony is deducted from wages.

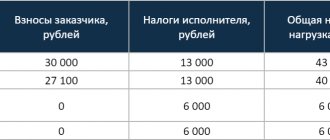

In this case, the accountant first deducts personal income tax, and from the remaining amount - alimony payments. For example, if an employee receives 30,000 rubles, then minus personal income tax he will have 26,100 rubles left. It is from this amount that the money to provide for the child is calculated.

[2]

The application from the alimony payer is not a fundamental document for the accounting department withholding alimony payments. In other words, without a writ of execution in the form of a sheet, a court order or an agreement concluded voluntarily, the money will not be transferred in favor of the recipient.

It is easier for the payer to entrust the obligation to an accountant than to deal with the transfer of money himself. In addition, this way it is easier to avoid debt. If you transfer alimony accrued in a fixed amount yourself, you will have to do the indexation yourself. Therefore, in most cases, if there is official employment, the transfer of alimony is handled by the accounting department of the organization where the alimony payer works.

For example, Tatyana and Oleg, after a divorce, entered into an agreement to pay alimony in the amount of 8,000 rubles. every month. Along with the application, Oleg gave this agreement to his employer (accounting department). This relieved him of the responsibility to monitor the receipt and correctness of payments.

For this purpose, the payer, on his own initiative, contacts the accounting department, having previously collected the necessary package, which includes the following documents.

- Application for deduction of alimony from wages (can be drawn up according to the sample).

- Agreement.

- Document confirming the birth of the child (optional).

- Account details.

- List of income from which deductions are and are not allowed.

Not all income is subject to alimony withholding. The following list contains types of earnings for which deduction is possible.

- At work:

- salary;

- money to provide for employees of state and municipal enterprises;

- fees for creative objects and media activities;

- bonuses for certain achievements;

- bonuses;

- allowances for staying in special conditions;

- salary while on sick leave or vacation;

- overtime;

- additional regional payments.

- Other sources:

- money from the government social fund insurance for the unemployed or temporarily disabled;

- pension + allowances;

- student scholarship;

- money allocated for food;

- payments to dismissed employees due to the liquidation of an enterprise or reduction in staff numbers;

- income from shares;

- compensation paid in connection with damage to the health of the payer;

- providing financial support;

- income from property sales transactions;

- income for services under the contract;

- dividends from business activities.

There are also incomes that cannot be sources for withholding alimony. These include the following:

- benefits for pregnant women;

- business trips;

- alimony received from another person;

- compensation for food in medical institutions;

- state support provided:

- when a baby is born;

- for organizing a wedding;

- funeral;

- allocated in connection with a natural disaster;

- survivor's pension benefits;

- compensation for transfer to another division of the organization;

- compensation for damage to tools belonging to the employee.

Do child support payers have to contribute to additional expenses for the child?

It is believed that by paying alimony from a contract or other types of income in a fixed sum of money or in a certain part, the parent who does not live with the child fulfills his responsibilities for his financial support. However, life shows that the funds received may not be enough. And this depends not only on the prudence of the mother, who manages alimony, on her ability to spend money economically and for its intended purpose.

Situations may arise in a child’s life that require additional costs. Most often this concerns health. Expensive treatment and special care cannot be provided without appropriate payment. The alimony received from the father is not enough for these purposes. If he does not voluntarily agree to provide financial assistance to the child, the legislator reserves the right of the mother to claim it in court.

In order for the court to decide to satisfy the claim, serious grounds and compelling arguments are needed. In addition to the child’s poor health, there may be other reasons for the father’s participation in additional expenses: creative success in literature, music, fine arts, achievement of good results in sports, manifestation of other talents, the development of which must be supported in every possible way, including financially.

What to do if the alimony provider hides income

Practice shows that many individuals who provide services under a contract do not formalize these agreements and evade alimony payments. As a result, they remove the income they receive from the control of all regulatory authorities.

In this case, the recipient of alimony will have to turn to FSSP employees for help, expressing in the application a requirement to take all necessary measures to identify the hidden income of the alimony recipient.

What types of alimony payments are made to the recipient?

When concluding a voluntary agreement on the payment of alimony, parents can specify in a separate paragraph how the process of transferring funds for the maintenance of the child from the father to the mother will take place. When making a court decision, this issue is resolved by the bailiff who conducts enforcement proceedings, in agreement with the payer and recipient. The following payment methods are possible:

- transfer from hand to hand during a personal meeting between the plaintiff and the defendant;

- sending alimony payments by mail;

- bank money transfer.

Each method has its own advantages and disadvantages, which should be taken into account when giving preference to one of them. To exclude the possibility of accusing the payer of failure to fulfill his obligations, any method of paying money must be recorded. If a check or receipt is issued for bank and postal transfers, then when transferring money in person, you can request a receipt. This is important, since non-payment under a writ of execution (including a voluntary agreement) is regarded at the legislative level as an offense for which various types of punishment are provided.

Any delay in paying alimony leads to the accumulation of debt. The recipient has the right through the court not only to demand its payment, but also to charge a penalty for the entire amount. Once the child turns eighteen years old and child support stops being paid. But the debt recognized by the court must be repaid in full. Only after this will the case of enforcement proceedings be closed.

For the entire period of existence of the debt, the payer is subject to a ban on traveling to foreign countries, which can be lifted after paying the debt in full.

To work or not

According to Art. 37 of the Constitution of the Russian Federation, every citizen is free to choose the type of work, the form of relations with the employer and the method of payment. It is impossible, even in court, to force him to get a job with a “white” salary and transparent deductions for alimony.

Another thing is to oblige the parent, regardless of the form of employment, to fulfill the obligations under the writ of execution.

Even a FSSP employee will not check where the alimony worker works and what form of relationship exists with the employer if payments to children are received on time and in full. His powers will begin when alimony debt accumulates. The bailiff has the right to apply administrative and criminal measures to the debtor.

General alimony provisions

Alimony if under a civil contract For example, if the child’s father works as a bricklayer and in the contract he has concluded there is a condition that the payment is made after the completion of the project, and the construction period is 3-4 months, then alimony will be paid not once a month, but once per quarter.

- the performer is officially considered unemployed, registration for the position is not provided;

- seasonal work, for a certain period or at a convenient time (the main result);

- lack of guarantees provided for by the Labor Code of the Russian Federation (social package);

- The conclusion procedure is simple, the contract is automatically canceled after the work is completed and payment is made.

How to transfer alimony

How to Pay Alimony If You Work Under a Contract In this case, the amount of payment will not depend on the amount of earnings. The calculation is made based on the cost of living in the region where the minor lives. In the event of a conflict between spouses, maintenance for a minor is assigned through the court. The claim is filed in the district or city court at the payer’s residential address.

How alimony will be paid depends on the relationship between the parties. Of course, a conflict-free option is always preferable. More often, voluntary payment is present where the parties were able to overcome internal differences in the name of the child and come to a joint compromise.

Mkou "Vyazovskaya Primary School"

Agreement for the supply of food waste to a private person 2.1.3. Ensure the removal from the Customer of production and consumption waste specified in Appendix 1, followed by the execution of a bilateral Waste Delivery and Acceptance Certificate and the issuance of a certificate to the Customer for submission to the environmental authorities regarding the actual delivery and acceptance of waste. In case of late payments, the “Contractor” has the right, in accordance with Art. 366 of the Civil Code of the Republic of Belarus to collect interest from the “Customer” for the use of the “Contractor’s” funds in accordance with the discount rate of the National Bank of the Republic of Belarus. Interest is accrued from the date of receipt of the payment request by the Customer’s bank.

Sample contract for disposal of food waste – Personnel management (read more...)

6.1. All changes and additions to this agreement are made by signing additional agreements by the parties.

3.5. The Customer, within 10 (ten) calendar days, signs the work completion certificate and sends a signed copy to the Contractor; if he receives an additional invoice, he pays for it.

§ Alimony from a Worker under a Civil Law Agreement Duration of the agreement, extension

How can alimony be withheld?

How alimony is collected from a contract. Funds are withheld from all of a person’s profits, but if a citizen’s income is not reflected in tax reports, it is difficult to determine the real amount of profit associated with civil transactions. There is a way out of this situation, but the process has certain differences. The basis for collecting funds to provide for children may be an agreement of the parties or a judicial act. These methods of resolving the issue vary in terms of time and complexity. The first option takes the least time and gives the parties more freedom.

If the ex-spouse has a stable income and works officially, then you should file an application for a court order. This type of case is considered by the judge alone without the participation of the parties. An order is issued in the case, which indicates the amount of the monthly penalty. This document can be immediately sent to the organization in which the person works, or it can be handed over to the bailiffs for collection.