How are they installed?

The amount of payments in the event of a divorce is determined on the basis of family law. In this case, the amount of different alimony for different children will be determined according to the same principle without restrictions. This issue is regulated by Art. 81 IC RF.

According to this norm, the calculation is carried out as a percentage, taking into account the earnings of the parent obligated to pay child support:

- 25% for one child;

- 1/3 of earnings for two children;

- 50% for three or more children.

It does not matter whether these children have different mothers or are from the same woman (man). The payer of alimony can be either a spouse or a spouse. The same rules apply.

Note! These percentages may be changed up or down at the discretion of the court.

There is also the concept of fixed charges. Here the court sets a specific monthly payment amount. This happens when the obligated parent does not have an official or stable job, if his income is not fixed or changes every month. The material and social components are taken into account.

In addition, the law does not oblige you to adhere to established rules if the parties are ready to negotiate. Often, spouses themselves determine the amount of payments, regardless of whether there is one minor, two or several from different marriages.

Alimony for minor children

Article 80 of the Family Code of the Russian Federation (FC RF) establishes the responsibility of parents to provide financial support for their minor children. Moreover, parents usually agree among themselves about who, to what extent and in what way makes a material contribution to the development and upbringing of children.

1.1. Origin and termination of alimony obligations

The question of establishing official alimony, as a rule, is raised when one of the parents believes that the other provides insufficient financial support to the children or even avoids fulfilling this parental responsibility.

The main condition for child support obligations in this case is the fact that the child is natural or adopted.

Alimony obligations are terminated in the following cases:

a) the child reaches 18 years of age;

b) the child acquires full legal capacity through emancipation;

c) the child acquires full legal capacity by entering into legal marriage;

d) the child is adopted by other people.

Remember that the child support debt is not canceled when the child reaches the age of eighteen and unpaid child support will still have to be paid.

As for the official adoption of a child by a court decision, it is important to keep in mind that if the judge, by his decision, retained property and personal non-property rights and obligations in relation to the child for the natural parent, then alimony obligations are automatically preserved (clause 37 Resolution of the Plenum of the Supreme Court of the Russian Federation No. 56).

The following have the right to collect alimony:

a) a parent living with the children and actually caring for them;

b) the guardianship and trusteeship authority in the event of non-payment of alimony and if the parent, on his own initiative, for some reason does not collect it.

1.2. Forms of collection and amount of alimony

National family legislation provides a choice of one of the following forms of alimony collection:

a) as a percentage of the total income (earnings) of the parent;

b) in a fixed amount of money;

c) in mixed form.

Question: what is the amount of child support for 3 children?

Answer: Article 81 of the RF IC does not establish a strictly fixed amount of payments, but only an approximate value from which to base when determining the final amount of alimony:

a) 1/4 of the total income of the alimony payer (25%) - for 1 common child;

b) 1/3 of the total income of the alimony payer (33.3%) - for 2 common children;

c) 1/2 of the total income of the alimony payer (50%) - for 3 or more common children.

If a family dispute regarding the collection of alimony is considered in court, the judge may change this average amount of payments either up or down, taking into account the following features of the life of each parent:

a) when it comes to the distribution of not only wages and other income of each of the parents, but also the division and distribution of property belonging to each of them;

b) the number of financially supported (dependent) parents;

c) the state of health of the alimony payer (presence of temporary or permanent disability), etc.

A list of various types of earnings and income, the totality of which is taken as the basis for calculating the amount of alimony, is compiled by the Government of the Russian Federation and is enshrined in Resolution No. 841 of July 18, 1996.

Remember that alimony is collected from all types of earnings and income only after paying the appropriate income taxes.

Alimony in a fixed amount is usually approved if:

a) the alimony payer has inconsistent income or earnings vary greatly from month to month;

b) the alimony payer receives at least part of the income in kind;

c) the alimony payer receives at least part of the income in foreign currency;

d) the alimony payer receives at least part of the income unofficially (has a “gray” or “black” salary);

e) there are reasonable suspicions that at least part of the income is hidden by the alimony payer.

In theory, the amount of a fixed sum of money should be approved by the court in such a way as to maximally preserve the children’s previous standard of living, that is, as a rule, the standard of living that they had before their parents’ divorce. However, in practice, however, the judge most often takes as a basis the cost of living for a specific region of our country.

The final amount of alimony in a fixed amount is also approved taking into account the financial and marital status of each of the parents and other important features of a particular family dispute.

Please note that in those rare cases when, after separation (divorce), not all children remain to live with one of the parents, but at least one of them remains to live with the other parent, alimony is paid to the parent with less income and is paid in a fixed amount. every month. The amount of such alimony is determined by the court taking into account all the specific circumstances of the case.

Question: how is child support divided for three children from different marriages?

Answer: National family law establishes the equality of all natural children of a parent, regardless of whether they were born in marriage or not, whether they were born in the same marriage or in different ones.

Consequently, to the question “what percentage of the income of a parent with many children will each of the three children receive?” we can answer that everyone will receive an equal amount of alimony, that is, approximately 16.7% of all earnings (for each child, if there are three children), if alimony is collected as a percentage of income (clause 19 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated 12/26/2017 No. 56).

As a rule, in Russia children remain to live with their mother if their parents divorce. And if all three children were born from the same woman, in 2021 the amount of alimony on average will be 50% of all income of the father of the children and all this alimony will be transferred to the mother.

If children were born from different women, then alimony will be established several times. For example, the first ex-wife receives alimony for one common child in the amount of 25% of the ex-husband’s income. And then the second ex-wife files a lawsuit to recover alimony for the man’s second and third children.

In this case, the court must involve the first wife in the family dispute in order to redistribute alimony in such a way that all three children receive an equal amount of alimony from the father and the total percentage of income collected from the man does not exceed 50% (subject to the absence of any or important circumstances that would motivate the judge to deviate from the standard amount of alimony).

Payments to children from different fathers

In practice, situations arise when a woman raises two or more children alone and all or some of them have different fathers. In this case, the general procedure for calculating alimony will be applied and the issue will be resolved based on an agreement with each of the fathers. All men should also be sued, and the amount of payments will be determined taking into account their income. The alimony providers are not related to each other in any way.

It is better to consider the situation when different fathers pay alimony to different children using an example. Let's say a woman has three children. Two are from her first husband, and the third is from her second, from whom she is also divorced. Both men are ordered to pay by court order. However, the amount of these alimony payments will vary.

A man who has two children will pay them half of his earnings, which is, for example, 40 thousand rubles. That is, for two children a woman will receive 20 thousand rubles. The second husband is the father of only one and receives a salary of 20,000 rubles. Consequently, he is obliged to pay 25%, namely 5 thousand rubles. And in total, the woman will receive 25 thousand monthly alimony for different children and from different men.

Note! It is impossible to sum up alimony if there are different husbands with obligations for different children. Everyone is responsible for their responsibilities to their own children.

Responsibility for non-payment of alimony

If the alimony payer dishonestly fulfills his obligations to pay alimony, then in this case he will be held liable for ignoring the law.

Current legislation provides for the following types of liability:

- civil law;

- administrative;

- criminal.

Civil liability arises when the delay in alimony payments established by the court occurs through the fault of the payer (Article 115 of the RF IC). a penalty in favor of the alimony recipient in the amount of 0.5% of the debt amount for each overdue day. However, if alimony was not paid due to the inaction of other persons, then the payer is released from liability.

The alimony recipient has the right to demand that the defendant compensate for losses that, in the end, were not covered by the penalty.

Administrative punishment for non-payment of alimony involves the imposition of a fine (Article 17.14 of the Code of Administrative Offenses of the Russian Federation) in the amount of one to two and a half thousand rubles (in case of concealment of place of residence, employment or income).

The Criminal Code provides punishment for gross evasion of the payer’s obligations to provide financial support for his children, including those recognized as disabled upon reaching adulthood (Article 157 of the Criminal Code of the Russian Federation).

Malicious (gross) evasion of alimony payments is characterized by systematic and deliberate disregard of the requirements of family law.

The following may be considered malicious evasion:

- concealment by the payer of his earnings;

- random and frequent change of place of residence;

- intentional refusal of employment;

- large alimony debt;

- a long period of no contributions for children;

- ignoring obligations after repeated warnings about the possibility of criminal prosecution, etc.

The penalties provided for by the Criminal Code for gross disregard of alimony obligations include:

- correctional labor for up to twelve months;

- forced labor for up to twelve months;

- arrest (up to three months);

- imprisonment for up to one year.

In addition, the court, at the request of the plaintiff or the competent authorities (for example, the social security service), may deprive the payer of parental rights , as well as prohibit him from holding public office for a certain period.

The FSSP is in charge of initiating a criminal case, if there are compelling reasons. However, criminal prosecution of a citizen in a case of payment of alimony is possible only in cases where a court decision on the assignment of payments is violated. Thus, bringing the debtor to criminal liability within the framework of the concluded alimony agreement is not possible. The debtor under the agreement bears responsibility within the limits of the obligations fixed in the agreement signed by him.

To initiate criminal prosecution, the interested party submits an application to the court for the payment of alimony. By decision of the court, a writ of execution , which is subject to transfer to FSPP employees to initiate proceedings (given ten days) in the case and take urgent measures. If the measures taken by the employees are unsuccessful, the defaulter may be held accountable (including criminal liability).

The recipient of alimony has the right to challenge the actions of the FSSP in court if he considers that the measures taken by the bailiffs as part of the execution of the punishment (for example, to collect a penalty) are ineffective.

Is it necessary to pay for all children?

Payment of child support to three or more children from different marriages is the responsibility of the parent, which remains with him until the child reaches adulthood, and in some cases, until graduation. However, many fathers seek to avoid such financial losses, and while some simply avoid transferring money, others may claim it legally.

The grounds for termination of alimony obligations are provided. These include the following situations:

- adoption of a minor by the woman’s new spouse;

- it has been established that the man is not the biological father;

- residence of a minor with his father, as determined by a court decision;

- death of one of the parties;

- the child reaches the age of eighteen.

Note! There are no grounds for refusing to pay alimony. The law regulates only the termination of obligations, which in most cases depends little on the will of the parties.

Also, in addition to the complete termination of alimony obligations, the possibility of relief is provided. This is also possible in certain circumstances: concluding an agreement between former spouses, transferring expensive property (housing, car, etc.) towards alimony, determining a fixed amount of payments, the dependent’s coming of age, transferring a large amount to the child’s account.

In this case, the fact of an agreement between the former spouses must always be present. If an agreement cannot be reached, then the only way out is to go to the courts.

Brief educational program

Alimony is a mandatory payment for a child. Moreover, citizens who allocate a certain amount for a minor are usually divided into two categories:

- conscientious and voluntary payers;

- payers-debtors from whom certain amounts have to be collected literally every month.

Usually, during the divorce process, the parties agree on the required amount that will be allocated monthly for the needs of the child. However, if the couple could not agree, then the judicial authorities are already involved in this case.

Federal News Agency (FAN)

Amount of payments to children from different marriages

Situations are identified in which the procedure for obtaining alimony for 2 or more different children, including those from different marriages, will differ. Here we need to take into account how many husbands a woman has had, different fathers or mothers of children, and so on. From here the method of calculating payments will be determined.

- First situation. A woman has two children from two different men. Each of them must fulfill his obligations to the minor. Consequently, the mother files a lawsuit against one husband and the second. These will be two different productions. At the same time, the mother will be able to receive the legally established 25% of earnings from each man.

- Second situation. The man has two children from two different women, and each of them filed for child support. In this case, each mother can also claim 1/4 of the former spouse's income, which will ultimately lead to the loss of half of the man's earnings.

Practice allows the defendant to file a motion to reduce the amount of payments, for example, to ask for the total amount of payments to be set at 1/3, that is, 1/6 for each. However, such situations are considered individually. A man must have grounds for reducing the amount of deductions.

Note! The total amount of alimony withheld from a man cannot exceed 70% of his earnings. In this case, the amount of income is determined from salary and additional funds.

Arbitrage practice

Child support for four children is collected through the court in the same way as for three, five or more minors. The same standards apply everywhere, the only difference is the amount of payments: it directly depends on the number of children.

Let's look at a few examples:

- At the request of the prosecutor, alimony was recovered from the mother of the children; her parental rights are limited (Decision No. 2-273/2012 2-273/2012~M-261/2012 M-261/2012 dated December 20, 2012).

- The district court considered demands for alimony and divorce (Decision No. 2-2841/2019 2-584/2020 2-584/2020(2-2841/2019;)~M-2754/2019 M-2754/2019 dated February 21 2020 in case No. 2-2841/2019).

- The woman tried to collect alimony for three children and compensation for legal expenses from the defendant. By decision No. 2-60/2020 2-60/2020~M-32/2020 M-32/2020 dated January 22, 2021, in case No. 2-60/2020, the claims were denied.

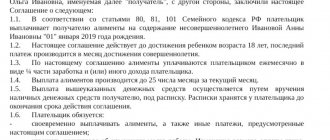

Payments under alimony agreement

Reaching an agreement on the calculation of alimony is the best option for solving the problem. Having an agreement establishing the procedure for calculating and paying child support for 3 or more children from different marriages will avoid disputes and even appeals to the courts. However, to do this, the parties must come to a compromise and determine the exact amount of payments.

An alimony agreement is a written agreement that is agreed upon by the parties (former spouses) and certified by a notary. In this case, the document must include the following information:

- information about the parties (full names, passport details, dates of birth), which are referred to as the payer and the recipient;

- subject – alimony payments in fixed form or as a percentage, taking into account the payer’s earnings;

- information about children indicating names, dates of birth;

- determining the duration of the agreement (in most cases until adulthood);

- rights and obligations of the parties;

- methods of payment of funds (cash on receipt, non-cash transfer);

- signatures of the parties;

- date of the agreement.

Important! A notary's mark is required. This type of agreement requires certification by a lawyer, otherwise the agreement is invalid.

The advantage of the agreement is that it is not necessary to follow the requirements of the law on the amount of alimony. You can determine any amount to be paid, the main thing is that the parties come to an agreement among themselves. It is important to clarify that unilateral refusal of the agreement is not acceptable. If there are special situations, alimony obligations will cease by law, and on issues of further termination and amendment of the contract, the parties must also come to a compromise.

Payments under several writs of execution

This issue is regulated by the Federal Law “On Enforcement Proceedings” and involves the forcible deduction of alimony by the employer from the salary of the obligated person. The meaning of the provisions of the law is that the monthly amount of payment established by the writ of execution is collected from the employee of the organization and transferred to the account of the recipient of the funds. All this is controlled by the employer's accounting department.

In situations where it is necessary to pay alimony for three children from two marriages at once, the rule of writs of execution also applies. The point is that even if two different women sue the same man to receive alimony, as a result of which two writs of execution are formed, the recovery will be carried out for each document without exception.

It should be noted that a man can have many children. When their number exceeds three, the question arises with the amount of accruals. How the payments will be distributed will be determined by the court; however, it must be taken into account that the total amount of monetary withholding should not exceed 70% of the salary of the obligated person.

On what income is alimony calculated?

It is generally believed that payments to children should be calculated on all types of income, but this is not entirely true.

Precise information about from which funds alimony should be withheld and from which not is set out in the list approved by the Government of the Russian Federation in its Resolution No. 841 of July 18, 1996.

For the use of the bailiff service, the Federal Law “On Enforcement Proceedings” , which explains all the intricacies of this issue.

In general, it can be stated that deductions will be made from salary, pension, stipend, benefits, stock dividends, business income, etc. Only one-time amounts, such as bonuses or other types of income, are not taken into account.

Is it possible to change the amount of alimony?

The main reason for recalculating the amount of alimony, whether up or down, is a change in the financial and social situation of the obligated person.

For example, if a man loses his job, then alimony can be converted into a solid form, since he has no official income. Or vice versa, the father’s salary increases, and accordingly, the percentage deduction of alimony from it also increases.

If there is an alimony agreement, the amount of payments can also be changed by agreement.

Calculation example

To understand the principle of calculating alimony, you should consider examples of their calculation in two possible options: percentage and fixed amount.

Example 1. A man has two children from different women. He is obliged to pay each of them 1/4 of his official earnings, which was established by the court. Therefore, having a salary of 45,000 rubles, he is obliged to pay each of his children 11,250 rubles monthly at the rate of: 45,000 * 25% = 11,250, while the total amount of deduction by the employer will be: 11,250 + 11,250 = 22,500 rubles - half of all earnings.

Example 2. The father does not work, but is obliged to pay alimony to his children, of which there are two. A man does not receive unemployment benefits, which means that the minimum subsistence level of 16,260 rubles (Moscow) is taken as the basis. The calculation may be as follows: 16,260 * 0.1 = 1,626 rubles for one minor, therefore, for two children, alimony will be 3,252 rubles.

Thus, even if there are several children from different marriages or from one woman, the man will be required to pay the amount of alimony established by law.

Termination of obligations is possible only in exceptional cases. Order a free legal consultation