The company often has employees who travel on official assignments. This category includes engineers performing repair functions in client offices, sales representatives traveling to negotiate the sale of goods, drivers, and couriers. According to the Labor Code of the Russian Federation, the movements of workers are divided into business trips and traveling work.

How to establish the traveling nature of an employee’s work ?

Criteria for traveling work activity

The permanent activity of an employee related to his constant official movements is divided into labor (Article 168 of the Labor Code of the Russian Federation):

- on an expedition;

- in the field;

- on my way;

- traveling work.

How to take into account compensation for the traveling nature of work ?

Clear definitions of the nature of the work in question are not established by law, so the enterprise itself establishes them, taking into account a number of defining characteristics, when:

- The worker spends a significant proportion of his working time outside the company's premises, performing his actual duties at this time.

- The employee's primary responsibilities include travel.

- Other criteria are determined by the employer individually in relation to a specific position.

By internal regulatory document, the organization defines positions with the type of work that involves moving (Article 168, Part 2 of the Labor Code of the Russian Federation) and fixes the service territory for production movements.

The limit for a territory is indicated by an individual subject of the Federation or its region, a number of subjects or the entire territory of the Russian Federation.

How to draw up an employment contract with a condition regarding the traveling nature of the work ?

TYPES OF EMPLOYMENT CONTRACT ACCORDING TO THE NATURE OF THE WORK PERFORMED

When recruiting is organized, the conclusion of the TD in writing is mandatory. Organized recruitment refers to the recruitment of personnel through specialized bodies that carry out labor mediation between citizens who want to get a new job and enterprises that need personnel. Such bodies are employment authorities.

Employment contracts differ from each other according to various criteria. It should be noted that employment contracts may simultaneously differ from each other in form, duration, content and subjects (for example, a contract). It should be taken into account that labor legislation does not apply to relations relating to service in the bodies of the Ministry of Internal Affairs of Ukraine and service by military personnel.

Differences between travel and business trips

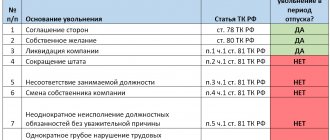

The traveling nature of work is incompatible with the concept of a business trip, which is an employee’s trip for a limited period of time on a production assignment and by order of the employer from the place of permanent employment (Article 166 of the Labor Code of the Russian Federation).

Question: How to record compensation for expenses of an employee with a traveling nature of work? In accordance with the collective agreement and the regulations on the traveling nature of work, an employee whose work is traveling in nature is compensated for the actual costs incurred for travel, renting accommodation and daily allowances. The provision regarding the traveling nature of the work is included in the employment contract with the specified employee. In accordance with the procedure established by the collective agreement and the regulations on the traveling nature of work, funds (advance) for expenses associated with business trips are transferred to the employee’s bank account. The amount of compensation is determined on the basis of the advance report submitted by the employee. Advance payment for these expenses in the amount of 20,000 rubles. transferred to the employee's bank account. According to the advance report submitted by the employee and the supporting documents attached to it (drawn up on strict reporting forms with VAT amounts highlighted as a separate line), the employee’s actual travel costs amounted to 6,105 rubles. (including VAT 54 rubles), for renting residential premises - 10,620 rubles. (including VAT 1,770 rubles), daily allowance - 5,000 rubles. After approval of the advance report, the overexpenditure is reimbursed to the employee by transferring funds to his bank account. For profit tax purposes, income and expenses are accounted for using the accrual method. View answer

A specialist sent on a business trip retains his place (position) and average salary with compensation:

- travel expenses;

- costs of paying for accommodation;

- other expenses when not in the place of permanent residence (daily allowance);

- costs approved by the management of the enterprise (mobile communications).

To arrange a business trip, an order is issued at the enterprise, the employee is issued a work assignment and a certificate (travel permit). The business traveler receives money in advance for expenses (travel, accommodation, daily allowance). Upon returning from a business trip, the employee submits a report on the work done, the amounts spent and attaches documents on all types of expenses.

In contrast to the periodic nature of business trips (as needed), traveling activities are an integral element of the employee’s work function and are permanent in nature. The conditions that determine the specified nature of work are necessarily reflected in the labor agreement of the parties (Article 57 of the Labor Code of the Russian Federation).

Attention! All trips within the framework of the performance of official duties are paid at the salary agreed upon when drawing up the employment contract. Payment based on average earnings applies only to business trips (Article 167 of the Labor Code of the Russian Federation).

If an employee registered for work with a mobile nature within one locality is sent on business to another city, the movement must be formalized in the form of a business trip.

Movable

Here the workplace, or rather its “mobility,” comes to the fore. It sounds somewhat strange and incomprehensible. But for some professions, moving the workplace around is commonplace. Classic examples are construction workers, as well as workers employed in logging .

When the object is built, the workplace essentially disappears . The builder goes to a new site and works on a new building. Regular movement of the workplace is a hallmark of flexible work.

Please note that performing work tasks in field and mobile modes are different things, since in mobile:

- a well-equipped resting place/work process has been organized;

- located on the territory of a populated area or located next to it.

What documents will need to be completed?

The presence in the company of employees with a traveling option of work raises before the administration the issues of documenting this type of activity and compensation for expenses incurred by the employee in accordance with the law.

Options for assigning a category of work associated with constant movement (Article 168 of the Labor Code of the Russian Federation):

- contract of employment;

- agreement with the team;

- local (separate) normative act (LNA).

To properly keep track of expenses for mobile work, you must:

- introduce a condition on the type of employment in the employment contract (Article 57 of the Labor Code of the Russian Federation);

- approve the list of relevant positions and works in the contract with the team or LNA;

- provide for the conditions for documentary evidence of travel (in the contract, LNA);

- determine the amount and terms of payment of allowances (Article 168 of the Labor Code of the Russian Federation).

The establishment of allowances is the right, but not the obligation, of the enterprise administration, except in situations stipulated in legislation or industry agreements.

For whom is this work suitable and for whom is it not?

It must be said that almost all citizens can work without a permanent workplace if they agree to this and have signed an employment contract. After all, the functions that they can perform not at the location of the organization can be anything: for example, a courier can deliver goods, and a sales representative can enter into cooperation agreements. Therefore, even teenagers and women can work under such conditions. There are no special conditions in this regard in the legislation.

Registration procedure

The provision on the type of employment can be in the form of a separate document or be an addition to the company’s Rules of Procedure. In any form, the document must be approved by order of management. Employees of the organization for whom the type of employment in question is established must familiarize themselves with the document and sign with their own hands (Article 68 of the Labor Code of the Russian Federation).

If a traveling option of employment is established for a worker when he registers with a company, then this requirement is fixed in a clause of the employment contract. If such a need arose during the employee’s activities, then the condition is formalized in an additional agreement to the contract. In case of disagreement of the employee and with full legislative compliance with the procedure, the administration of the enterprise has the right to use the norms of the Labor Code of the Russian Federation (Article 74) up to the termination of the labor relations of the parties.

The type of employment should also be reflected in the employment order (for the admission of a new employee) and the order in free form (for an existing employee).

An order establishing the type of activity is necessary to notify certain officials of the corresponding status. The text of the employment contract does not relate to public information, therefore, for example, an accountant learns about the need to accrue a bonus to an employee directly from the order.

Orders in connection with traveling activities

In an organization, the list of positions assigned to a traveling type of work may be subject to adjustments. In order not to change the entire Regulation, it is possible to determine such a list by a special order of management.

The procedure for recording trips and document flow is established by the enterprise independently (as opposed to a business trip). Forms of official assignment or traveler’s certificate (for developing a route sheet) can be used as a sample.

In any document executed, the signature of the management and the signature of the employee are required.

Attention! An order to send an employee with a traveling nature of work on a business trip is not issued.

If travel on duty is carried out using company vehicles, then it is mandatory to issue a waybill (in one copy) issued to the driver (against signature).

Mandatory points of travel documents (Order of the Ministry of Transport of the Russian Federation No. 152):

- document number, its name;

- validity period of the document;

- information about the owner of the car;

- vehicle driver data;

- vehicle data.

It is mandatory to affix the day of issue, seal and stamp of the organization that owns the vehicle.

The waybill is registered in a special journal, the shelf life of which in the organization must be at least 5 years. It is also advisable to register service assignments with notes about the destination, purpose, and time of arrival at the sites.

A documented mobile type of employment affects the reduction of the company’s administrative costs, and in a number of situations, the reduction of expenses for travel and wages for employees.

Example of an order approving a list of positions

Limited Liability Company "AAA" (LLC "AAA")

December 25, 2015

Moscow

Order No. 1001-P on approval of positions for employees whose permanent work is traveling in nature

Guided by Art. 168.1 Labor Code of the Russian Federation,

I order:

Establish the traveling nature of work for employees hired and rehired for the following positions: - courier; - driver; - insurance agent; - legal assistant.

General Director _________/Ivanov A.A./

Travel reimbursement

For permanent, traveling work, there are two options for compensation.

- Expenses for movements confirmed by documents are refunded, excluding daily allowances (Article 168 of the Labor Code of the Russian Federation). Otherwise, these amounts will not be included as expenses.

- Cost compensation does not involve payment to the employee of expenses confirmed by him, but the payment of a fixed bonus for the traveling nature of the work, the amount of which is provided for by the LNA.

When choosing one of the options, a company must take into account not only the associated costs of taxation and insurance premiums, but also additional paperwork that increases the company’s costs indirectly through the payment of workers’ time.

Reimbursement of expenses for the traveling nature of work on official documents is more often in demand during long-term business trips of employees to other areas or outside the country.

- Transport expenses are confirmed by tickets for the type of transport used, and when traveling by personal or company car - by waybills and receipts.

- Accommodation is confirmed by a cash receipt or a strict accounting document.

Management independently decides which documents to consider to confirm that an employee is on a business trip, and whether approval is needed from management for such trips.

The introduction of an allowance for a mobile activity is applicable if the employee travels primarily within one locality (one locality). He has no costs for travel and housing in other regions or abroad of the Russian Federation, and transport costs are relatively small, their size is known (if, for example, he is in demand only for travel on public transport). The bonus is paid to an employee who performs work while simultaneously traveling during all or most of his working time.

Another option for reimbursement of expenses is allowed - combined. With this method, reimbursement of expenses for transport, rental housing and other expenses incurred by workers with the knowledge of management is carried out according to supporting documents, and daily expenses are reimbursed through an allowance (Article 168.1 of the Labor Code of the Russian Federation).

Compensation amount

The size of the bonus is not regulated by law; employers have the right to independently determine the size of the bonus, taking into account economic feasibility and recording it in the LNA.

In some industries related to river transport, road transport and roads, an additional 20% of the salary is paid; in construction, the compensation amount is 15%-20% depending on the number of days of travel.

It is assumed that the additional amount should compensate for transport, daily allowance and other possible expenses. Therefore, with such payments, those receiving them are not required to provide documents confirming expenses. This payment option facilitates document flow and does not require additional time spent on paperwork.

Taxation of travel expenses

Documented expenses for business trips are not subject to personal income tax in the form of personal income tax and insurance contributions (Letter of the Ministry of Finance of the Russian Federation No. 03-04-06/1626, 01/22/2015). There is no mandatory payment for these amounts, because the payment is of a compensatory nature and is related to the worker’s performance of duties according to his job description (Article 217 of the Tax Code of the Russian Federation).

In this case, a note about the nature of employment and payment (compensation) in the agreement, collective agreement, and internal regulations is required. Payment is not subject to personal income tax in amounts limited by internal company documents or contracts (Article 217 of the Tax Code of the Russian Federation).

Payments are exempt from insurance premiums within the limits determined by collective or labor agreements, regulatory acts of the organization (Letter of the Federal Insurance Service of the Russian Federation No. 14-03-11/08-13985 dated November 17, 2011, Federal Law No. 212 dated July 24, 2009).

Attention! The daily allowance paid for traveling employment may exceed the amount established for business trips. They are not subject to full income tax, since business trips are not recognized as business trips and are not subject to the established limit.

An enterprise is not required to have a separate structure, create it specifically and register with the tax authority in the area where its specialist with a traveling nature of employment performs the duties stipulated by the contract (Letters of the Ministry of Finance of the Russian Federation No. 03-02-07/1-50 dated 01/03/2012, No. 03- 02-07/1/18634 dated 05/24/2013). An employee’s workplace is considered equipped if the conditions necessary for the normal performance of job duties are available.

The importance of correct documentation

The company's management must pay attention to the correct execution of documents, since this determines the payments or bonuses due depending on the specific nature of the work.

In a situation where the type of activity is not noted in the employment contract, but its documentary evidence is provided, a court decision may recognize it as such.

Example

Ivan Fedorov, who worked at Stroy CJSC as a driver, filed a claim with the court for payment of debt on wages and daily allowances for the time spent on business trips.

The court found that Fedorov worked under a contract, which, in addition to work at his main place of employment, provided for the performance of labor duties in separate structures of the closed joint-stock company.

The applicant was denied reimbursement of daily allowance (Decision of the Moscow Court in case No. 33-24126, October 25, 2011).

Despite the fact that the contract does not indicate the special nature of Fedorov’s work, in fact his employment was of a traveling nature. In confirmation, waybills were accepted, according to which the employee moved daily between different points, being constantly on the move.

Constant movements between points specified in the contract, or traveling activities are not recognized as business trips (Article 166 of the Labor Code of the Russian Federation). The work of a driver of official transport does not apply to business trips; in the employment contract, Fedorov’s obligation to carry out official trips to the divisions of the company was clearly indicated.

The panel of judges did not change the decision of the regional court.

On my way

If in the previous paragraph the employee has the opportunity to return home at the end of the working day, then such an opportunity is not provided .

Suitable professions include working as a conductor, flight attendant or freight forwarder.

Train conductors often literally spend the night at their workplace.

Comfortable home or office rest is impossible in such conditions.

Freight forwarders are one of the typical professions for this category.

One of the most important documents is Government Decree N554. A forwarder is an employee who performs or organizes the performance of transport services .

Of course, this implies a long stay on the road. Forwarding work is distinguished from field work by its focus on providing transport services.

Benefits of traveling employment

The traveling nature of an employee’s work has certain advantages for the company, expressed in the following points:

- Reducing document flow for business trips reduces their administration.

- It makes it easier to record working hours and calculate payments, since there is no need to maintain advance reports. This results in a more accurate assessment of the overall future labor costs.

- Labor costs are reduced. Instead of the average earnings accrued during business trips, the worker is paid his official salary. If there are additional payments to the salary, its value will be lower than the average earnings.

The company receives tax advantages due to the absence of the need to create a separate division in the locality (territory) where the company employee is employed.