The work book is issued on the day of dismissal without the employee’s application

The obligation to issue a work book is established by Part 4 of Art.

84.1 of the Labor Code of the Russian Federation: “On the day of termination of the employment contract, the employer is obliged to issue the employee a work book and make payments to him in accordance with Article 140 of this Code. Upon written application by the employee, the employer is also obliged to provide him with duly certified copies of documents related to work.” As you can see, the code does not contain a specific list of work-related documents issued upon dismissal. It only says that they are issued upon a written application from the employee. Based on the mentioned norm, we can conclude that all issued documents are divided into:

- for mandatory ones, issued without any statements from the employee (work book);

- to optional ones, issued at the request of the employee.

Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ Part 4 art. 84.1

Dismissal due to presentation of false documents

One of the grounds for termination of an employment contract is the submission by the employee of false documents when concluding this contract. Dismissal is possible only if the following documents are found to be fraudulent:

- Presented upon employment.

- Served as the basis for concluding an employment contract.

- Mandatory to submit when concluding an employment contract.

In this case, it is necessary to establish that the forged document was submitted by the employee and no one else. This, in particular, can be evidenced by a questionnaire filled out by a person applying for a job, his autobiography and other materials.

IMPORTANT

The fact of document falsification must be established by competent authorities (for example, the educational organization that issued the diploma, law enforcement agencies, court).

The dismissal of an employee who submitted false documents when applying for a job is carried out in accordance with the general procedure. Since at the time of submitting false documents the person is not yet in an employment relationship with the employer, the indicated guilty actions do not constitute a disciplinary offense. Accordingly, there is no need to initiate disciplinary proceedings and demand explanations from the employee.

Please note: despite the fact that there is no disciplinary offense in the employee’s actions, they are still guilty. And if an employment contract is terminated for guilty actions, the provision of leave with subsequent dismissal is prohibited.

IMPORTANT

It is not permitted to dismiss an employee due to the submission of false documents during a period of temporary incapacity for work or while on vacation.

Dismissal of a pregnant woman (even if false documents are submitted) is also unlawful. Calculate all payments for a dismissed employee in the web service Calculate for free

Special situations considered by Rostrud specialists

| Question | Answer |

| The employee resigned of his own free will. In his work book they wrote: “Dismissed at his own request, Article 77, part three, paragraph 3 of the Labor Code of the Russian Federation.” Is the part specified correctly? | Yes, right. An entry in the work book about voluntary dismissal is made in accordance with the wording provided for in paragraph 3 of part 1 of the article of the Labor Code of the Russian Federation, with reference to this norm. |

| Is the employer liable if he hired a visa-free foreigner with fake documents (patent)? Is an employer required to check the authenticity of documents upon employment? | Submission of forged documents when concluding an employment contract may be grounds for termination of employment relations (under clause 11, part 1, article 81 of the Labor Code of the Russian Federation), provided that the documents that the employee was required to present are forged, or the absence of which could serve as grounds for refusal in concluding an employment contract with him. Labor legislation does not oblige the employer to verify the authenticity of documents. |

| The dismissal of the employee was formalized only by making an entry in the work book. The employer refused the employee’s offer to familiarize him with the dismissal order. Is this legal? | No, it's illegal. Issuing an order to dismiss an employee and familiarizing him with it is mandatory. |

Work-related documents must be issued within three days

Copies of work-related documents and the deadline for their provision are stated in Art.

62 of the Labor Code of the Russian Federation: “Upon a written application from an employee, the employer is obliged, no later than three working days from the date of filing this application, to issue the employee a work book for the purpose of his compulsory social insurance (security), copies of documents related to work (copies of employment orders, orders on transfers to another job, orders of dismissal from work; extracts from the work book; certificates of wages, accrued and actually paid insurance contributions for compulsory pension insurance, the period of work with a given employer, etc.). Copies of work-related documents must be properly certified and provided to the employee free of charge.” Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ Article 62

Editor's note:

Thus, the legislator allocated three days for the employer to prepare documents. If, after three working days from the date of filing the application, the employer does not issue the necessary certificate, the employee may file a complaint with the State Labor Inspectorate or the court.

For untimely issuance of a work book, the employee will have to compensate for the earnings not received by the employee.

Article 234 of the Labor Code of the Russian Federation states: “The employer is obliged to compensate the employee for the earnings not received by him in all cases of illegal deprivation of his opportunity to work. Such an obligation, in particular, arises if earnings are not received as a result of:

- illegal removal of an employee from work, his dismissal or transfer to another job;

- delay by the employer in issuing a work book to an employee, or entering into the work book an incorrect or non-compliant wording of the reason for the employee’s dismissal.”

Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ Article 234

Editor's note:

The same requirements are contained in clause 35 of the rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225 “On work books”.

The period between the day of dismissal and the actual date of issue of the work book is recognized as the time of forced absence, for which the employee must be paid the average salary (clause 62 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”).

Results

Electronic work books have been introduced since 2021.

Employees have the right to choose the document format: electronic or paper only. In the first case, make a corresponding entry in the paper work record and give it to the employee. From this time on, you are no longer responsible for its maintenance and storage. When issuing a work permit in other cases, be sure to document everything and be on the safe side. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

You need to send notification of receipt of a work book on time

The appeal ruling of the St. Petersburg City Court dated October 27, 2015 No. 33-18051/2015 is a vivid example of what the untimely issuance of a work book can result in for an employer.

The employee filed a lawsuit against her former employer for untimely issuance of a work book, the obligation to change the date of dismissal and issue a work book, to recover unpaid wages, penalties for delayed wages, as well as to recover compensation for forced absence and moral damages.

On the day of dismissal, the woman was present at the workplace, but did not receive the book. The employer did not come to his senses immediately, but almost three months after the dismissal and sent the former employee a notice about the need to receive the book or agree to have it sent by mail. The notice was sent on 02/20/2015 and received by the plaintiff on 02/26/2015. The lady received her work book only during the consideration of the case on 07/01/2015.

The woman’s last day of work was November 27, 2014. The court ordered the company to pay wages from November 28, 2014 to February 20, 2015, that is, from the next day when the employee should have been issued a work book. As a result, for the specified period of forced absence, the organization paid the former employee 36,237 rubles, while changing the date of dismissal to 02/20/2015, that is, the date the notice was sent.

Appeal ruling of the St. Petersburg City Court dated October 27, 2015 No. 33-18051/2015

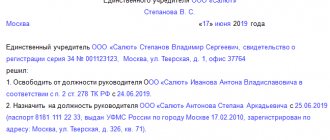

Contents and structure of the notice

Neither the Labor Code nor the rules established by Government Resolution No. 225 provide for a uniform form of notification. Write it freely on A4 sheet or official form. According to the general rules of Art. 84.1 of the Labor Code, in a letter to an employee about the need to pick up a work book, you must indicate:

- personal data of the employee - full name, residential address;

- name of the company sending the message;

- information about termination of the contract;

- a message about the employer’s readiness to provide information about work activities;

- an offer to choose a method of receipt - in person or provide permission for postal forwarding;

- signature of the director or head of the organization’s human resources department;

- outgoing number and date.

To avoid future questions about improper notification of the employee, it is advisable to provide detailed information about where to report or send a response. Please indicate the exact address, operating hours, office, and person in charge.

This is an example of such a notification about the need for an employee fired for absenteeism to pick up documents from work:

A work book must be issued even if the dismissed person did not provide it

The court ordered the issuance of a work book, although the dismissed person did not bring it.

The company manager resigned of his own free will, but did not receive a timely payment and work book. The employee went to court for the issuance of the document and compensation, including moral suffering. The first instance denied the applicant, since, according to the testimony of witnesses, the specialist did not give the work book to the former employer. However, in the appeal, the arbitrators indicated that this circumstance does not exempt the company from issuing a new work book for an employee upon hiring, as well as from inviting him to pick up the document after dismissal or sending papers by mail, as established by the Labor Code of the Russian Federation.

The employee was ordered to issue a work permit and compensate for:

- inability to find a job without a document;

- representative costs;

- moral damage in the amount of 1 thousand rubles.

Appeal ruling of the Moscow City Court dated December 18, 2018 No. 33-56184/2018

Editor's note: It must be said that this position occurs quite often, however, there have also been precedents when the court came to the conclusion that it is necessary to draw up a work book only at the request of the employee. Without one, there is no need to impose a form on employees (Appeal ruling of the Orenburg Regional Court dated 02/07/2018 No. 33-998/2018). To avoid conflict situations, we recommend asking the employee to write a corresponding statement before completing it.

An employer does not always have to pay for the delay in issuing a work book to an employee

The Supreme Court of the Republic of Mari El, in the Appeal Determination No. 33-1207/2018 dated July 24, 2018, came to the following conclusion: for an employee to recover compensation, the fact that the employer did not issue him a work book on time is not enough.

The court noted that the legally significant circumstances to be proven in the case of recovery from the employer of earnings not received by the employee on the above basis are:

- the fact that the plaintiff, after termination of employment relations with the previous employer, applied to other employers for the purpose of employment;

- the fact of refusal of employment due to the employee’s lack of a work book.

In this case, the burden of proving these circumstances rests with the former employee (plaintiff).

It should be noted that in general, judicial practice on this issue is ambiguous.

Appeal ruling of the Supreme Court of the Republic of Sakha (Yakutia) dated 04/02/2018 No. 33-1207/2018

How to free yourself from liability for failure to issue a work book on the day of dismissal

The Ministry of Labor reminded: Art.

84.1 of the Labor Code of the Russian Federation provides that if an employee is absent on the day of termination of the employment contract or refuses to receive a work book, the employer is obliged to send the employee a notice of the need to receive a work book or give consent to receive it by mail. From the date of sending this notification, the employer is released from liability for the delay in issuing the work book. The Ministry of Labor expressed the opinion that the employer can send this notification not only by mail with a notification to the employee’s address specified in the employment contract, but also in any other way that allows proving the fact of its sending.

After receiving consent from the employee to send the work book by mail, the employer should send the work book to the address specified by the employee.

The employee must express his consent in writing - only she can prove the fact of giving consent.

In addition, the provisions of this article provide for the possibility of issuing a work book upon a written request from an employee within three days from the date of application. In this case, the work book is not sent by mail, but is issued to the employee.

LETTER of the Ministry of Labor dated April 10, 2014 No. 14-2/OOG-1347

How and when to submit an application

An employee has the right to receive documents about his work activity at any time: on vacation, on sick leave, but most often upon dismissal. If it is not possible to submit an application to request documents from the employer in person, he has the right to send it by registered mail with notification. In any case, when submitting to the name of the manager, it is necessary to register the application in the order of office work. To do this, the HR officer indicates the number on the request and records it in the incoming documentation log. It is necessary to write the application in two copies so that one remains with the company and the other (with registration number) with the employee. All documents upon dismissal are issued on the employee’s last working day.

Upon dismissal, an employee must be issued a 2-NDFL certificate.

To issue this certificate, an application will be required from the employee.

This is directly stated in paragraph 3 of Art. 230 of the Tax Code of the Russian Federation: “Tax agents issue to individuals, upon their applications, certificates of income received by individuals and amounts of tax withheld in the form approved by the federal executive body authorized for control and supervision in the field of taxes and fees.” The certificate form was approved by Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected] Note that the certificate form and its name itself have recently changed. Starting from 2021, a new certificate form must be issued. Instead of the previous name 2-NDFL, it received a new one: “Certificate of income and tax amounts of an individual.”

Issue a certificate in accordance with Part 1 of Art. 62, part 4 art. 84.1 of the Labor Code of the Russian Federation, a resigning employee must do so on the last day of his work.

Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 12/25/2018) (with amendments and additions, entered into force on 01/25/2019)

Editor's note:

The Tax Code of the Russian Federation does not provide for liability for violation of the deadlines for issuing a certificate of income and tax amounts for an individual and a 2-NDFL certificate for an individual. However, violation of deadlines or refusal to issue a certificate may result in an administrative fine (Articles 5.27, 5.39 of the Code of Administrative Offenses of the Russian Federation):

- for officials and individual entrepreneurs - in the amount of 1 to 5 thousand rubles;

- for legal entities – from 30 to 50 thousand rubles.

What to do if the employer ignores the application

If the company ignored the request or violated the deadline for issuing documents, the employee has the right to file a complaint with the Labor Inspectorate or the prosecutor's office. For such violations, the organization and the head of the company face penalties (under Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

The organization will have to pay a fine of 30,000 to 50,000 rubles (for a repeated violation, the amount will increase to 70,000 rubles). The inspection authorities have the right to impose on the manager from 1000 to 5000 rubles, and in case of repeated violations from 10,000 to 20,000 rubles or a ban on conducting activities for a period of 1 to 3 years.

Information on forms SZV-STAZH, SZV-M: what the law says

The obligation to issue information about length of service is specified in clause 4 of Art.

11 of Law No. 27-FZ: “On the day of dismissal of the insured person or on the day of termination of a civil contract for compensation in accordance with the legislation of the Russian Federation on taxes and fees or Federal Law of December 15, 2001 No. 167-FZ “ “On compulsory pension insurance in the Russian Federation”, insurance premiums are calculated, the policyholder is obliged to transfer information about the insurance period to the insured person.” The period for which the policyholder is obliged to transfer information to the insured person in the SZV-M form is not established by law (clause 4 of article 11 of Law No. 27-FZ).

Federal Law No. 27-FZ dated 04/01/1996

(as amended on 07/29/2018) “On individual (personalized) accounting in the compulsory pension insurance system”

(as amended and supplemented, entered into force on 01/01/2019) P. 4 tbsp. eleven

SZV-M and SZV-STAZH: for what period to provide

In the letter, representatives of the Pension Fund of the Russian Federation expressed the opinion that “the policyholder has the obligation to issue to the insured person extracts from information in the forms SZV-M and SZV-STAZH, containing information only on this employee, submitted by the policyholder to the Pension Fund of Russia (SZV-M - for reporting month; SZV-STAZH - for the reporting (including the current) year).

In addition, officials explained why personalized information forms might be needed at all. The fact is that this information can be used by the insured person to confirm his work experience if the specified information is not reflected in his individual personal account.

Letter from the GU - OPFR for the city.

?

Moscow and Moscow Region dated 04/03/2018 No. B-4510-08/7361

“On the procedure for insured persons to receive forms SZV-M, SZV-STAZH”

Editor's note:

Thus, on the day of dismissal, it is necessary to issue SZV-STAZH for the current year and SZV-M for the current month against signature. Information in both forms is entered exclusively about the resigning employee. It is the extract that needs to be issued, and not the forms as a whole, since individual (personalized) accounting information belongs to the category of confidential information (Clause 8, Article 6 of the Law on Personalized Accounting).

Such an extract is issued in person.

It is not regulated by law what an employer should do if the employee was absent on the day of dismissal. We recommend that you send a notice to the employee so that he comes to receive this document or agrees to have it sent by mail. And in order not to prepare several notifications, we believe that this information can be included in the notification of the need to appear for a work book or agree to have it sent by mail. Thus, you will be able to prove that you used all available means to fulfill the obligation to provide information from the personalized information forms to the dismissed employee. Currently, there is no provision in the pension legislation by which an employer can be held liable if he/she fails to issue the employee documents containing the information provided for in clauses 2–2.3 of Art. 11 of Federal Law No. 27-FZ. In this case, the already mentioned sanctions under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Mandatory list

Regardless of the reason for dismissal (at one’s own request, by agreement of the parties, due to circumstances beyond one’s control, due to a reduction in numbers or staff, at the initiative of the employer for certain misconduct, etc.), each dismissed employee must be given the following set of documents:

Draw up personnel documents for free according to ready-made templates

1. Pay slip.

This document is issued upon final settlement with the employee. It contains information about all accruals and deductions made in this case (Articles 136 and 140 of the Labor Code of the Russian Federation). Each employer independently develops and approves the form of the payslip.

2. Work record book.

If the employer kept a paper work book for the dismissed employee, then it should be issued on the last day of work, even if the employee was granted leave before the dismissal (Part 4 of Article 84.1 of the Labor Code of the Russian Federation, ruling of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 131-O -Oh, letter from Rostrud dated December 24, 2007 No. 5277-6-1). For information about what entries to make in the work book when dismissing an employee, see the article “Filling out a work book in 2021: rules and sample.”

If the employee has switched to an electronic work book, then on the last day of work information is issued in the STD-R form (Article 84.1 of the Labor Code of the Russian Federation; see “How to fill out the STD-R form and issue it to the employee”). You can draw up a document either on paper or electronically, certifying the file with an enhanced qualified electronic signature. Please note that the choice of the method of receiving STD-R upon dismissal is the prerogative of the employee. And he must indicate his choice in the appropriate statement (Part 5 of Article 66.1 of the Labor Code of the Russian Federation).

Important

It is not necessary to issue STD-R upon dismissal to those who decided to keep the traditional paper work book (letter of the Ministry of Labor dated June 16, 2020 No. 14-2 / OOG-8465; see “An employee refused an electronic work record: is the employer obliged to give him information on form STD-R?”).

3. Extract from the SZV-M form.

This statement is issued for the month of dismissal. It contains information about the employer, as well as data about the dismissed employee. The extract must be certified. This is done as follows. The extract indicates the name and position of the person authorized to certify the document, followed by his signature and the date the extract was prepared. If the organization has a seal, then the extract must also be certified with a seal.

4. Extract from the DAM.

This statement is compiled for the period from the beginning of the quarter to the date of dismissal. Information about the employer from the title page is transferred to it, as well as data from section 3 “Personalized information about insured persons” concerning the dismissed employee. An extract from the DAM must be certified in the same manner as an extract from the SZV-M.

5. Extract from the SVZ-STAZH form.

Such an extract must be generated for the reporting year (up to the date of dismissal of the employee). Information about the employer and information about the dismissed employee are transferred to it (letter from the Pension Fund of Russia branch in Moscow and the Moscow region dated 04/03/18 No. B-4510-08/7361). The extract from the SZV-STAZH form must be certified according to the rules described above (i.e., the signature, full name and position of the authorized person, and the seal of the organization, if any, are required; the date the extract was compiled).

Fill out, check and submit SZV-M, SZV-STAZH and RSV via the Internet for free

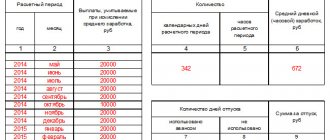

6. Certificate of salary amount (certificate 182n).

This document is drawn up in the form approved by Order of the Ministry of Labor dated April 30, 2013 No. 182n (for information on how to fill out the certificate, see the article “Certificate 182n on the amount of wages”). We recommend giving the employee 2-3 copies of such a certificate - this will simplify his communication with subsequent employers.

Advice

Include in the set of documents that must be given upon dismissal of employees several copies of income certificates for the current and previous years (see below for more details).

In some cases, it is necessary to provide additional documents to the dismissed employee.

So, if the organization transferred insurance contributions to the funded part of the employee’s pension, then upon his dismissal he must draw up an extract from the DSV-3 form for the quarter of dismissal. And if during the time of work a medical record was issued for an employee (including at the expense of the employer), then it must also be included in the mandatory set of documents issued upon separation from employees (letter of Rospotrebnadzor dated November 10, 2015 No. 01/13734- 15-32).

Fill out and submit DSV-3 online for free

It is also necessary to return to the employee the originals of all documents that he brought during work. These can be diplomas, certificates, medical reports and other official papers.

Attention

The documents listed above (with the exception of income certificates) are issued at the initiative of the employer. No statements from the employee are required.

Section 3 of the calculation of insurance premiums is issued from the beginning of the quarter to the date of dismissal

The need to provide the specified document is established in clause 2.3 of Art.

11 of the law on persuescheta: “On the day of dismissal of the insured person or on the day of termination of the GPC agreement, the remuneration for which is in accordance with the legislation of the Russian Federation on taxes and fees or the Federal Law of December 15, 2001 No. 167-FZ “On compulsory pension insurance in Russian Federation" insurance premiums are calculated, the policyholder is obliged to transfer information to the insured person." Such information is the information reflected in section 3 of the DAM. The form for calculating insurance premiums was approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] In section 3 you need to indicate information about the employee for the reporting period in which he quit, that is, from the beginning of the current quarter to the date dismissals.

If, according to personalized accounting information, it is necessary to provide extracts, that is, only parts of the SZV-M and SZV-STAZH documents relating to a specific resigning employee, then section 3 of the DAM is issued to the employee in the form of a copy of the document. The reason is that this section is compiled separately for each insured person. Therefore, upon dismissal (termination of the GPA), Section 3 with data on payments and contributions accrued in the quarter of dismissal must be printed for the insured and certified by the manager.

Federal Law No. 27-FZ dated 04/01/1996

(as amended on 07/29/2018) “On individual (personalized) accounting in the compulsory pension insurance system”

(as amended and supplemented, entered into force on 01/01/2019) P. 2.3 art. eleven

Editor's note:

Sanctions for late provision or refusal to issue documents - in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Certificate of average earnings to determine unemployment benefits

The reference to the certificate of average earnings is contained in clause 2 of Art.

3 of the employment law: “The decision to recognize a citizen registered for the purpose of searching for a suitable job as unemployed is made by the employment service authorities at the citizen’s place of residence no later than 11 days from the date of presentation to the employment service authorities of a passport, work book or documents replacing them, documents certifying his qualifications, certificates of average earnings for the last three months at the last place of work (service), and for first-time job seekers (who have not previously worked) who do not have qualifications - a passport and a document on education and (or) qualifications.” This certificate will help the former employee register with the employment service and receive benefits. The form of such a certificate is not approved by regulation, but there is a recommended form of a certificate of average earnings, which is given in the letter of the Ministry of Labor of the Russian Federation dated August 15, 2016 No. 16-5/B-421.

The certificate must be issued within three working days from the date of receipt of a written application from the employee (Clause 2, Article 3 of Law No. 1032-1, Article 62 of the Labor Code of the Russian Federation).

Law of the Russian Federation dated April 19, 1991 No. 1032-1

(as amended on December 11, 2018) “On employment in the Russian Federation”

Clause 2, Art. 3

Editor's note:

If the employer does not issue a certificate within three working days from the date the employee submits the relevant application, he faces liability in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The employer is not required to issue copies of local regulations

The plaintiff applied to her former employer for the issuance of work-related documents. The management's response indicated that the requested documents were prepared for issue and could be picked up at the HR department. Having come to pick them up, the woman found out that there were no documents to be issued. The requested documents were never issued. This was the reason for going to court. The plaintiff believed that the actions of the defendant violated her rights, causing her moral harm. The fact is that the woman had significant overtime for overtime work. Moreover, the defendant did not provide working conditions that met regulatory labor safety requirements; there were bedbugs and cockroaches directly at the workplace. The employer violated the deadline for communicating the shift schedule to the employee. That is why the employee insisted on giving her copies of the following documents:

- collective agreement with all amendments and additions;

- internal labor regulations with all amendments and additions.

At the same time, it follows from the agreement on termination of the employment contract that the employee had no claims regarding the termination of the employment contract and labor relations against the officials of the institution and the employer.

However, after her dismissal, she turned to her former employer with an application for the issuance of these documents. As the court indicated, the employment relationship between the parties had already been terminated. In addition, to the documents referred to in Art. 62 of the Labor Code of the Russian Federation, refers to documents relating to the employee and related to his work with the employer. The documents requested by the plaintiff relate to local regulations of the defendant, and not to individual acts relating to the plaintiff himself. Therefore, there are no grounds for imposing on the defendant the obligation to provide the plaintiff with the requested documents.

Appeal ruling of the St. Petersburg City Court dated April 4, 2018 No. 33-6491/2018