As the tax inspector’s auto-informer on the hotline says, if you received any income subject to personal income tax last year, do not forget to report and pay it. Owners of rental properties are also subject to these rules. Today we will figure out whether it is necessary to pay tax on renting out an apartment and how to save on it.

Do I need to pay tax on renting out an apartment?

In this article, the words “hiring” and “renting” an apartment are used as synonyms, although it is legally correct to say “renting an apartment”, as required by Chapter 35 of the Civil Code of the Russian Federation. Regardless of what it is called in the contract, the owner must pay tax to the budget on the lease. This is stated in the Tax Code.

When renting an apartment, only compensation for utilities is not subject to tax. The rest of the homeowner’s remuneration falls under the tax regime he has chosen. If you don’t pay the tax on renting out an apartment, the tax office will charge additional fines and penalties.

If the apartment rental agreement is for 11 months

Many people specify in the papers a lease period of 11 months or less, supposedly this will help to legally avoid tax. In fact, it does not matter for what period the contract is signed - the very fact of receiving a lease at least once already legally entails the need to report to the Federal Tax Service and pay tax to the treasury.

A contract term of less than a year affects only the need to register it with Rosreestr, but not taxes. Rentals under 1 year do not need to be registered.

How to officially rent out an apartment in the Moscow region

There are several ways to rent out an apartment in the Moscow region: enter into a rental agreement as an individual or rent out an apartment as an individual entrepreneur. Read about how to conclude an agreement and what documents are needed for this, how to pay taxes on the rental of an apartment and fill out a 3-NDFL declaration in the material of the mosreg.ru portal.

Find out how families with minor children can exchange social housing in the Moscow region>>

Lease agreement

According to the Civil Code of the Russian Federation, an agreement concluded in writing indicating the data of both parties, the amount of monthly payment and the rental period, signed by the landlord and the tenant, will be an official document.

According to Chapter 35 of the Civil Code of the Russian Federation, a rental agreement is concluded in cases where an apartment is rented to an individual.

A lease agreement is concluded if the tenant is a legal entity, and the tenant can use the residential premises only for the residence of citizens.

According to Article 683 of the Civil Code of the Russian Federation, a residential lease agreement can be concluded for a period of no more than 5 years. If the contract does not specify a period, then it is considered that the contract was concluded for such a time period.

An agreement concluded for 1 year or less is considered short-term, and the term in such an agreement must be specified.

Agreements for a period of less than a year do not need to be certified by a notary and registered with Rosreestr - the signatures of both parties will be sufficient.

The agreement can be concluded in free form, but must be in writing. The agreement should be drawn up in as much detail as possible, since it will become the basis for resolving possible controversial situations.

The contract must indicate:

- passport details (of the owner and future residents);

- the amount of monthly rent;

- payment period;

- what property in the apartment can be used;

- information about who pays utility costs;

- time and procedure for checking the apartment by the owners;

- information about the owners of the apartment;

- number of future residents;

- method of paying for the apartment (cash or card);

- procedure in case of non-payment or damage to property;

- permission or ban on pets.

Apartment insurance in the Moscow region: cost, payment amounts and insured events>>

Registration of the agreement in Rosreestr

According to Article 674 of the Civil Code of the Russian Federation, a short-term rental agreement does not need to be registered in the branches of Rosreestr, but a long-term agreement (concluded for a period of one year or more) must be registered within 1 month from the date of its conclusion.

A short-term lease agreement differs in that the tax authority can obtain information about the amount of income from the lessor or the tenant. At the end of the tax period, you must submit a declaration to the tax office at the place of registration indicating the income received, as well as calculate the tax and pay it on time. The declaration must also be accompanied by documents that confirm the receipt of income and the amount.

What you can find out about an apartment building in the Moscow region on the public services portal>>

Paying taxes

Paying tax as an individual involves a rate of 13%. The landlord must submit a declaration to the tax office at the place of residence (or stay) on income for the previous year in form 3-NDFL by April 30.

Along with the declaration, copies of the following documents are submitted: a rental agreement (or lease), an apartment acceptance certificate, documents confirming the right of ownership of the property and a passport.

Tax must be paid no later than July 15 of the year following the one in which the income was received. This can be done on the Federal Tax Service website (in the “Type of payment” column, select “Individual Income Tax” and mark 1 option “Form 3-NDFL”).

The tax return form can be found on the official website of the Federal Tax Service of Russia. Residents of the Moscow region can find contacts of the Federal Tax Service (IFTS) inspectorates for the Moscow region on the Federal Tax Service website in the “contacts and requests” section.

Failure to pay taxes is subject to a fine (Article 119 of the Tax Code of the Russian Federation) or criminal liability (Article 198 of the Criminal Code of the Russian Federation).

Payment of property tax for individuals in the Moscow region: calculation procedure and benefits>>

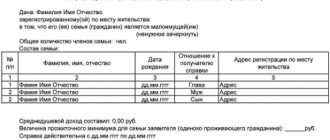

How to file a 3-NDFL declaration

Form 3-NDFL is a tax return for personal income tax. The declaration in form 3-NDFL consists of a large number of pages and therefore is a rather complex document. The declaration can be filled out by hand, the form can be downloaded from the website of the Federal Tax Service of Russia, there are also instructions for filling it out.

You can also use the “Declaration” program, which will automatically generate a tax return in Form 3-NDFL, ready for submission to the tax authority.

When filling out the title page of the tax return, indicate:

- correction code (at the first feed, “0” is indicated, when feeding after correction – “1”, after the second correction – “2”, etc.);

- general information about the taxpayer;

- TIN;

- in the paragraph “Tax period (code)” the code of the tax period is indicated, then the reporting tax period (year) is indicated;

- in the field “Submitted to the tax authority (code)” the number of the tax authority is entered;

- in the “country code” field the code of the country of which the person is a citizen is indicated;

- the field “Taxpayer Category Code” is filled out on the basis of the Directory given in Appendix No. 1 to the Procedure for filling out the tax return form for personal income tax;

- Full name, date of birth;

- Place of Birth;

- identity document details;

- in the paragraph “Taxpayer Status” the status of an individual taxpayer is indicated (if there is the status of a tax resident of the Russian Federation, 1 is entered in the corresponding field, if there is no such status - 2);

- place of residence of the taxpayer;

- contact phone number.

Sheet A contains information about the income received by the landlord from the tenant for the rented apartment.

Next, line 030 indicates the full name of the individual from whom the lessor received income. An apartment can be rented out on the basis of an agreement that defines the procedure for paying rent, then line 040 indicates the amount of rental income actually received for the year.

Section 2 calculates the tax base and the total amount of tax that is payable on income taxed at a rate of 13% (for an individual entrepreneur - 6%). Indicate: on line 010 the total amount of income, on line 030 - the total amount of income subject to taxation.

The preparation of the tax return is completed by filling out Section 1 “Information on the amounts of tax subject to payment (surcharge) to the budget/refund from the budget.” The lessor indicates in Section 1 the amount of tax to be paid additionally to the budget, according to the budget classification code and the OKTMO code (All-Russian Classifier of Municipal Territories). You can find out OKTMO for the Moscow region here. Line 020 of this section indicates the BCC (budget classification code) of the personal income tax.

See the infographic on how to calculate the social tax deduction in the Moscow region>>

Renting an apartment as an individual entrepreneur There is also the option of renting out an apartment and paying taxes as an individual entrepreneur working under a simplified taxation system (tax rate is 6%). To do this, the landlord must register as an individual entrepreneur, pay insurance premiums every year and submit an income statement to the tax authority. An individual entrepreneur must regularly submit documents to the tax authority and maintain accounting records. Individual entrepreneurship is usually registered by someone who rents out several residential premises.

How to obtain ownership of leased municipal property in the Moscow region>>

Simplified taxation system for individual entrepreneurs

The simplified taxation system (STS) is one of the tax regimes in which a special procedure for paying taxes is aimed at representatives of small and medium-sized businesses. The transition to using this taxation system occurs on a voluntary basis, but in the future you can abandon it by switching to using the regular tax regime. When registering an individual entrepreneur, the amount of rental tax is not 13%, but 6% plus a fixed annual contribution to the Pension Fund. After registering an individual entrepreneur, a declaration according to the simplified tax system is filled out, in which the fee is calculated.

How to obtain a certificate of participation or non-participation in the privatization of municipal housing in the Moscow region>>

How to prepare an apartment for rent

The cost of renting an apartment consists of many factors. If the apartment has not been renovated for a long time, the furniture in it is old, then you need to make cosmetic repairs, update the furniture, and refresh the wallpaper. It is also necessary to check the plumbing, sewerage, hot and cold water pipes, electrical wiring, sockets - everything must be in order.

Before submitting an ad, you must take several high-quality photographs of the apartment so that there are no foreign objects in the background. Also, the advertisement itself should describe the residential premises and area as informatively as possible (indicating the advantages).

Find out what a resident of the Moscow region should do if his apartment is flooded>>

How to write an ad correctly

In an advertisement for renting an apartment you must indicate:

- city, street;

- number of rooms and their sizes;

- kitchen footage;

- information about the bathroom (separate or combined, shower or bath installed);

- engineering communications: gas in the kitchen or electric stove, is there Internet, telephone and television;

- terms of housing delivery (long-term or short-term rental);

- information about transport accessibility.

You can post information about renting an apartment on bulletin boards, in newspapers, and on specialized Internet sites.

How to get in line for housing in the Moscow region>>

Tax on apartment rental for an individual – personal income tax 13%

“By default,” if the homeowner is not registered as an individual entrepreneur or self-employed, you need to pay 13% of the apartment rental amount - this is income tax or personal income tax.

Of all the options available, this is the most expensive option in terms of tax.

How much do you need to pay

The calculation is very simple, and it is done once a year. For the year you need to add up all rental payments and multiply the amount by 13%. The resulting number will be the tax payable to the budget.

Utility tax for rent

The rent does not include compensation for metered utilities (electricity, water), if the tenants transfer it to the owner. For the rest of the communal services (ODN, housing and communal services from the management company or HOA, payment for resources according to the standard), if the residents compensate the owner for it, the tax must be paid.

Calculation examples:

Option 1. The apartment is rented for 20,000 rubles per month. Additionally, residents pay utility bills according to meters (electricity and water) in the amount of 1,500 rubles. The owner pays the remaining utility bills (heating, services for maintaining the common property of the apartment building). In this case, to calculate the tax, you need to take only the rent, which for the year will be 20,000 * 12 = 240,000 rubles, and the tax for the year, respectively, is 240,000 * 0.13 = 31,200 rubles.

Option 2. The apartment is rented for 20,000 rubles per month. Additionally, residents pay utility bills according to meters (light and water) in the amount of 1,500 rubles, plus other utility bills (heating, services for maintaining the common property of the apartment building) in the amount of 3,500 rubles monthly. In this case, to calculate the tax, you need to take the rent plus utilities, which are not metered. The income will then be 20,000 * 12 = 240,000 rubles (rent) plus 3,500 * 12 = 42,000 (income from compensation for utilities not according to meters), a total of 282,000 rubles. Personal income tax for the year will be 282,000 * 0.13 = 36,660 rubles.

Personal income tax and insurance contributions

When providing housing to an employee, you need to take into account the specifics regarding personal income tax and insurance contributions.

According to officials, payments by employers for rental housing for their employees, as well as compensation for expenses incurred by them in renting housing, are subject to personal income tax and insurance contributions (Letters of the Ministry of Finance dated 02/12/2019 No. 03-04-06/8405, dated 03/19/2021 No. 03-15-06/19723, Letter of the Federal Tax Service dated January 10, 2017 No. BS-4-11/ [email protected] ).

But in such a situation one can argue, since payment of housing to employees is directly related to the performance of their job duties and is of a compensatory nature. Thus, lease payments do not need to be included in the tax base for personal income tax.

The court agrees with this position, citing Art. 169 of the Labor Code of the Russian Federation (Resolution of the Federal Antimonopoly Service of the East Siberian District dated September 11, 2013 No. A19-2330/2013). The article states that the employer must reimburse the employee for the costs of settling into a new place of residence when moving to work in another area. The judicial authorities recognized that payment for the employee’s accommodation is the arrangement in a new place, and at the same time took into account that this procedure was determined precisely in the employment contract. At that time, clause 3 of Art. 217 of the Tax Code of the Russian Federation, which exempted compensation payments from personal income tax. Therefore, the court agreed with the taxpayer’s opinion.

There is another court decision - Resolution of the Federal Antimonopoly Service of the Ural District dated 06/08/2012 No. F09-3304/12. In this situation, the court considered that the rental payments were paid for the non-resident employee to perform his job duties. Without this, the employee simply would not be able to do his job, since he would live in another place. In this regard, the housing rental was made primarily in the interests of the company, and therefore the employee did not have any income.

Important! If a company is ready to resolve conflicts with the Federal Tax Service in court, it may well not charge personal income tax and insurance contributions on rent for housing for a non-resident employee.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Alternatives and taxpayer status

Personal income tax can be replaced with another tax at the choice of the home owner. You need to calculate your prospects, decide which option will be more profitable, and notify the tax office of your decision.

There are several options:

- become self-employed and pay 4-6% of rent;

- register an individual entrepreneur, switch to a simplified tax system (USN) and pay 6% of rent;

- register an individual entrepreneur and buy a patent for 6% of average annual income.

You need to remember about additional payments and reporting, which differ for each tax. RENOVAR.RU recommends that it is more profitable for an ordinary individual who simply rents out one or two apartments as an additional income to become self-employed.

Purchasing a service apartment

Sometimes companies purchase office apartments to provide housing for out-of-town employees. This approach has two significant drawbacks:

- An organization, becoming the owner of an apartment, must take this object into account as a fixed asset and, accordingly, pay property tax on it. In this situation, the employer’s tax burden arises;

- the company will not be able to take into account the cost of purchased housing when determining income tax without tax risks. According to the Ministry of Finance, a service apartment is a non-depreciable property that is used to generate income. Accordingly, depreciation deductions are not taken into account for tax purposes (Letters of the Ministry of Finance dated November 24, 2014 No. 03-03-06/2/59534, dated January 24, 2019 No. 03-03-06/1/3843). It turns out that in this situation the employer incurs significant costs in the amount of the cost of the purchased property, which he does not have the right to take into account when calculating income tax.

Because of these disadvantages, the option of renting a residential premises is preferable. Moreover, the employer can rent the apartment himself or compensate the employee for the corresponding rental payments.

Self-employment

A relatively new way to legalize your activities, provided for by the special Law on Professional Income Tax (PIT). Introduced by regional authorities. From July 2021, you can become self-employed in almost all regions of Russia.

Renting an apartment for the self-employed is a convenient tax status: easy reporting, low tax rates and full legalization of activities. Being self-employed, you don’t need to worry that the tax office will track the income on your card and impose a fine or penalty.

Both a registered individual entrepreneur and a citizen unregistered as an individual entrepreneur can become self-employed. This mode can be combined with work under an employment contract.

How much do you need to pay

Self-employed people pay:

- 4% of the apartment rental, if the contract is with an individual;

- 6% of the apartment rental if the agreement is with a company.

For the first time, the state gives the self-employed a tax deduction of 10,000 rubles, which helps reduce taxes. For example, if an apartment is rented for 30,000 rubles, then for the first month the tax must be paid not on the full amount, but on 20 thousand, taking into account the deduction.

The self-employed do not have any additional payments other than tax.

Advantages

Unlike individual entrepreneurs in other modes, self-employed:

- do not pay insurance premiums (compulsory medical insurance and Pension Fund) - in 2021, more than 40,000 rubles;

- do not submit tax returns;

- must not use the cash register;

- They don’t calculate the tax themselves - they receive a receipt for payment from the Federal Tax Service once a month;

- Interaction with the tax office is carried out through an application or online portal.

How to get exemption

In the latest clarifications, the tax service said that if the individual entrepreneur does not submit an application for a benefit, then the inspectorate can provide it without an application, based on the information it has - clause 6 of Art. 407 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated May 11, 2021 No. BS-4-21/ [email protected]

But what if the tax office does not receive information from the register or doubts that the property is used in business? We advise you to play it safe and do as before: send an application with supporting documents to the inspectorate. These could be documents in which the premises appear as a place of acceptance and release of goods or employment contracts in which the employee’s place of work is indicated - Letter of the Ministry of Finance of Russia dated April 26, 2018 N 03-05-06-01/28324.

At the request of the individual entrepreneur, the inspectorate can recalculate the tax for previous periods. Recalculation can be made no more than 3 years preceding the year of application and no earlier than the date when the individual entrepreneur became entitled to the benefit - Letter of the Federal Tax Service of Russia dated 01.06.2020 No. BS-4-21 / [email protected] That is, in 2021 An individual entrepreneur may request a tax refund for 2021, 2021 and 2021.

IP in simplified form

Registration of an individual entrepreneur on the simplified tax system “Income” will also help you save on tax. An entrepreneur in this mode pays 6% from the rent of an apartment. But there are also additional expenses that need to be taken into account.

By the way, we do not recommend using the simplified tax system “Income minus expenses”, since the rate there is higher, and there are practically no expenses associated with rent.

How much do you need to pay

You can use the simplified form only after registering an individual entrepreneur or LLC. To rent out an apartment, individual entrepreneur status is sufficient. When renting out an apartment, such an entrepreneur will pay:

- 6% from rental;

- fixed pension contributions – 32,448 rubles for 2021;

- compulsory medical insurance contribution – 8,426 rubles for 2021;

- If you receive more than 300,000 rubles from renting out an apartment in a year, you will have to pay an additional 1% on the excess.

Contributions to the Pension Fund and compulsory medical insurance must be paid in any case, regardless of whether there was income in the year or not. Therefore, you need to calculate in advance whether the simplified tax system, taking into account contributions, will be more profitable than, for example, simply paying 13% personal income tax.

The simplified tax rate is cheaper than paying 13% of the income from renting out an apartment as an ordinary citizen, but due to contributions it can ultimately become more expensive.

Reporting and payment

Entrepreneurs on the simplified tax system pay several times a year:

- every quarter - an advance payment of tax (for the rental income that has already been received in the quarter);

- until December 31 – fixed contributions;

- until July 1 of the following year - contributions of 1% above income from delivery of 300,000 rubles.

Additionally, the individual entrepreneur generates and submits to the tax office a declaration of income from the rental of the apartment by April 25 of the next year. The individual entrepreneur controls all contributions, taxes and declarations independently; the tax office does not remind him of this.

By the way, in simplified form you need to keep KUDiR - a book of income and expenses. This is an internal document of the individual entrepreneur, which the tax office could potentially request for verification.

Patent

The amount of the patent is the same 6%, but only on the expected, and not already received, income from renting out the apartment. Only a registered individual entrepreneur can use a patent; this opportunity is not available to self-employed and ordinary citizens. You can buy a patent from the tax office for a period of up to 12 months.

How much do you need to pay

Depending on the location of the apartment, the term of the patent and the area of housing, the potential income of the entrepreneur is calculated, and the tax percentage is calculated from it. Each region has its own rules, and in some places the rate may even be reduced to 0 in the first couple of years of renting out an apartment.

If the individual entrepreneur does not temporarily use the premises in business

Individual entrepreneurs have periods when property is not used in business. For example, the old lease has expired, but a new one has not yet been concluded, or the premises are being renovated.

The property tax exemption will still apply. Because entrepreneurial activity includes not only generating income, but also the entire preparatory process: repairs, hiring new employees and searching for contractors. Although it is advisable to save documents for repair work, in case the tax office becomes interested in the reasons for the downtime and reduction in the taxable base of your business - Letter of the Ministry of Finance of the Russian Federation dated May 12, 2014 No. 03-11-11/22083.