When an inheritance comes into the possession of several heirs at the same time, so-called common property . It comes in two types: joint (when the shares are not distributed among the owners) and shared (when there is a division into specific parts with the definition of the owner, each of whom acquires the right to use his share and income from it).

Legal regulation of common property in inheritance (use, payment of taxes, sale, etc.) is carried out by Ch. 16 Civil Code (Civil Code) of the Russian Federation.

The concept of common property is especially relevant when several people own a thing that cannot be divided without loss of functional use, or cannot be divided according to agreement. In other cases, by agreement of the owners or by a court decision, the property is divided and goes into shared ownership .

The data from the issued certificate of inheritance and the actual shares of the real estate determined by the heirs in the agreement may not coincide . This should not prevent the state registration authority from officially securing the rights of successors to real estate.

From the common shared property, a part of one heir can be allocated or a division can be made between all applicants.

Grounds for the emergence of shared ownership in inheritance

If the testator has not drawn up a will, or if the document drawn up does not indicate which heir specifically receives what and in what amounts, then the property of the deceased person comes into the common (joint) possession of all persons from a certain line of inheritance, or those listed in the will document (Article 1164 of the Civil Code).

The successors by law automatically become co-owners of the property until (unless) each of them decides to allocate their share. The latter can be done by agreement or by court order.

The testator's young children and his dependents ) have the right to receive their part of the inheritance both by law and by will (even those not mentioned in the latter) . If by his will the testator bequeaths all the property to one specific person or organization, then if the deceased has such relatives, according to the law, shared ownership of the inheritance will also arise.

Also, the unborn child . The property is divided after his birth, he is entitled to his share.

Common shared ownership appears if the object of the inheritance is an indivisible thing (Article 133 of the Civil Code), and does not arise if the testator has assigned ownership of certain and divisible things to different persons.

The concept of a share in an apartment

A real estate object, unlike money, cannot be divided, and the size of the premises does not matter. A share in an apartment is the right to a certain part of the living space; it can be any percentage. It all depends on the number of property owners, as well as on the procedure for entering into inheritance.

In accordance with the Civil Code, property must have one owner, but shared ownership is also permissible if we are talking about an indivisible object, for example, a house, apartment or room. Thus, each co-owner has rights in relation to the real estate.

It is important to know! According to the law, a person who has a share in an apartment or house has the right not only to use it, that is, to live and inhabit members of his family, but also to dispose of it - to give it away, to sell it. Consent from other owners for deeds of gift or inheritance is not required.

Determination of shares of heirs

The co-owner of the property has the right to demand his part of the inheritance, which he can use in his own way, or carry out joint management on an equal basis with others (Articles 246, 252 of the Civil Code). Initially, the shares of the owners are assumed to be equal (Article 245 of the Civil Code), unless otherwise specified in the law, appointed by the court or determined by agreement between the heirs.

According to the law, all recipients of the inheritance (including unborn children and dependents of the eighth stage) can automatically count on an equal share on a par with other applicants (Articles 245, 1141, 1142-1148 of the Civil Code).

According to a will that does not stipulate shared distribution, property is divided between specified persons in equal parts (Article 1122 of the Civil Code). If for some reason the testator did not indicate in the document young children or disabled dependents who are close relatives, they still have the right to a mandatory share in the amount of at least 1/2 of what they are entitled to by law (Article 1149 of the Civil Code).

The distribution of shares can be carried out by agreement (Articles 252, 1165 of the Civil Code) and actually differ from what is required by law. The agreement should not infringe on the interests of minors and disabled persons (Articles 37, 1166, 1167 of the Civil Code).

There may be an increase in shares of the common property specified in the agreement if one of the owners effectively invested in development and improvement (Article 245 of the Civil Code).

Some of the heirs will have an advantage in acquiring the right to an indivisible thing, which can be claimed within three years after the opening of the will (Articles 1167, 1168 of the Civil Code).

Common property of heirs: current problems of theory and practice

O.E. BLINKOV, E.A. BUTOVA

Blinkov Oleg Evgenievich, editor-in-chief of the magazine “Inheritance Law”, Doctor of Law, Professor.

Butova Ekaterina Anatolyevna, lecturer at the Department of Civil Law, Southwestern State University.

The article updates the problems of theory and practice in the field of the emergence and termination of common property of heirs. The authors pay special attention to the problems of allocating a share in the common property of spouses to the surviving spouse and the procedure for determining the shares of heirs in the right of common shared ownership of the inheritance.

In inheritance by law, if the inherited property passes to two or more heirs, and in inheritance by will, if it is bequeathed to two or more heirs without indicating the specific property inherited by each of them, the inherited property comes from the date of opening of the inheritance into the common shared ownership of the heirs ( paragraph 1 of article 1164 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation)). If the will does not indicate the shares of the heirs and does not indicate what things or rights are intended for whom, then the property is considered bequeathed to the heirs in equal shares. The heirs become co-owners, co-creditors and co-debtors in accordance with the rights and obligations that passed to them in the order of hereditary succession <1>.

———————————

<1> For details, see: Bryuchko T.A. Common shared property of heirs // Notary. 2007. N 3. P. 14 - 17.

However, having received property into common shared ownership, often the heirs cannot fully realize their private personal interests (Ulpian also called common property the mother of discord), therefore the legislator provided for the possibility of them concluding an agreement on the division of inherited property. At the same time, when dividing inherited property, it is necessary to take into account that the provisions of Chapter 16 of the Civil Code of the Russian Federation on common shared property are applied to the common property of the heirs, taking into account the rules of Art. 1165 - 1170 of the Civil Code of the Russian Federation on the preferential rights of certain categories of heirs.

Features of the exercise of the right of common shared ownership of heirs are as follows.

Firstly, an agreement on the division of an inheritance, which includes real estate, including an agreement on the allocation of a share of one or more heirs from the inheritance, can be concluded by the heirs after issuing them a certificate of the right to inheritance (clause 2 of Article 1165 of the Civil Code RF). Thus, it is prohibited to conclude an agreement on the division of an inheritance, which includes real estate, until the relevant heirs receive a certificate of the right to inheritance. Consequently, the heirs have the right to enter into an agreement on the division of common ownership of real estate both before and after the state registration of their rights to it. In the first case, for state registration it is necessary to provide a certificate of inheritance and an agreement on the division of the inheritance, in the second - only an agreement on the division of the inheritance. The division of movable inheritance property is possible before receiving a certificate of the right to inheritance.

Secondly, if there is a conceived but not yet born heir, the division of the inheritance can be carried out only after the birth of such an heir (Article 1166 of the Civil Code of the Russian Federation). In this case, the legislation ensures the protection of the interests of the unborn heir. An agreement on the division of inheritance concluded before the birth of the heir is voidable in accordance with Art. 168 Civil Code of the Russian Federation.

Thirdly, if there are minors, incapacitated or partially capable citizens among the heirs, the division of the inheritance is carried out in compliance with the rules of Art. 37 of the Civil Code of the Russian Federation (in order to protect the legitimate interests of the specified heirs, the guardianship and trusteeship authority must be notified about the drawing up of an agreement on the division of the inheritance and about the consideration of the case on the division of the inheritance in court).

Fourthly, the division of the inheritance must be carried out taking into account the preemptive right to an indivisible thing (Article 1168 of the Civil Code of the Russian Federation) and the preemptive right to items of ordinary home furnishings and household items (Article 1169 of the Civil Code of the Russian Federation).

The preemptive right to receive, on account of their inheritance share, the indivisible property included in the inheritance, including residential premises, the division of which in kind is impossible, have:

1) heirs who, together with the testator, had the right of common ownership of an indivisible thing, including residential premises that are not subject to division in kind, who can exercise this right preferentially over all other heirs who were not participants in the common ownership of the indivisible thing during the life of the testator , including heirs who constantly used it, and heirs who lived in residential premises that were not subject to division in kind;

2) heirs who were not participants in the common ownership of an indivisible thing during the life of the testator, but who constantly used it by the day the inheritance was opened (except for cases of unlawful use of someone else’s thing, carried out without the knowledge of the owner or against his will), who can use this right preferentially over others heirs only in the absence of heirs who, together with the testator, had the right of common ownership of an indivisible thing, and when inheriting residential premises that are not subject to division in kind, also in the absence of heirs who lived in it on the day the inheritance was opened and do not have other residential premises;

3) heirs who, by the day of opening of the inheritance, lived in a residential property being inherited, not subject to division in kind, and who do not have any other residential premises owned by right of ownership or provided under a social tenancy agreement, who can exercise this right preferentially over other heirs only in the absence of heirs who, together with the testator, had the right of common ownership of the inherited residential premises.

These persons have a preemptive right, but not an obligation, therefore they can refuse to exercise the preemptive right when dividing the inheritance to receive, on account of their inheritance share, an indivisible thing included in the inheritance, a living space, the division of which in kind is impossible. In this case, the division of the inheritance is carried out according to the general rules. According to the general rules, division is also carried out if the application for division was made after three years from the date of opening of the inheritance.

If the property to which the heir declares a preferential right is disproportionate to his share in the inheritance, the remaining heirs receive other property from the inheritance or are provided with other compensation, including the payment of an appropriate sum of money. It should be borne in mind, unless otherwise established by agreement between all the heirs, the exercise by any of them of the preemptive right is possible only after the provision of appropriate compensation to the other heirs. It should also be taken into account that when exercising the preemptive right to an indivisible thing, including residential premises, the specified compensation is provided by transferring other property or paying the corresponding sum of money with the consent of the heir who has the right to receive it (clause 4 of Article 252 of the Civil Code of the Russian Federation), then as in the exercise of the preemptive right to items of ordinary household furnishings and household items, the payment of monetary compensation does not require the consent of such an heir.

Thus, from the day the inheritance is opened, common shared ownership of the inherited property arises, which is terminated by the heirs concluding an agreement on the division of the inheritance (Article 1164 of the Civil Code of the Russian Federation). Furthermore, in accordance with Art. 1165 of the Civil Code of the Russian Federation, it is also possible for one of the participants in the right of common shared ownership to allocate their share. The legal consequences of the division of an inheritance and the allocation of an inherited share are different: the result of the division of an inheritance is the termination of common shared ownership, and when a share is allocated, the legal relations of the common shared property are terminated only for the separated heir.

Particular attention should be paid to the emergence of the right of common shared ownership of heirs to property that belonged to the spouses. As is known, in the event of the death of one of the spouses - a participant in joint property - the inheritance is opened in accordance with the general procedure. If there is a will, the persons specified in it are called upon to inherit, and if the deceased spouse did not leave a will, then his property is inherited by law. It is important to take into account that the right of inheritance belonging to the surviving spouse of the testator by virtue of a will or law does not detract from his right to part of the property acquired during the marriage with the testator and which is their joint property. The deceased spouse's share in this property is included in the inheritance and passes to the heirs (Article 1150 of the Civil Code of the Russian Federation).

Thus, we can conclude that the death of one of the spouses who had the right of common joint ownership of property acquired during marriage is the basis for the emergence of the right of common shared ownership of the share of the surviving spouse and heirs that belonged to him. It is unlawful to include a share in the common property rights of the surviving spouse in the inheritance estate. An exception to this rule may be the refusal of the surviving spouse to allocate the marital share, then the property that was the common joint property of the spouses will be fully included in the estate of the deceased. However, the legislator clearly does not provide for such a method, which gives rise to certain difficulties in practice <2>.

———————————

<2> See: Garin I., Tavolzhanskaya A. Allocation of the marital share from the inheritance mass: right or obligation? // Russian justice. 2003. N 9. P. 25 - 27.

According to some researchers, such a refusal cannot be carried out in hereditary succession. The subject of inheritance is not a share in the right of common ownership of property, as it should be, but all property, which violates the rights and interests of the surviving spouse, since a certificate of inheritance is issued for a share in the right of ownership of property of a living subject < 3>. In addition, some scientists believe that “this can be regarded as a donation and should be formalized in the manner prescribed by Chapter 32 of the Civil Code of the Russian Federation” <4>. To certify the agreement of donation of a share in the right of common ownership, this share must be determined, and in cases established by law, the corresponding right must also be registered.

———————————

<3> See: Zaitseva T.I., Krasheninnikov P.V. Inheritance law in notarial practice. Comments (Civil Code of the Russian Federation, Part 3, Section V), method. recommendations, samples of documents, standards. acts, courts practice: Prac. allowance. 5th ed., revised. and additional M.: Wolters Kluwer, 2007. P. 196.

<4> Kazantseva A.E. The property right of the surviving spouse and its accounting by the rules of inheritance law // Family and housing law. 2007. N 4. P. 21 - 26.

Others, on the contrary, believe that “the refusal of the surviving spouse to allocate a marital share in jointly acquired property still has the right to exist” <5>.

———————————

<5> See: Nisht T.A. Some problems of notarization of the surviving spouse’s ownership of a share in the common property of the spouses // Notary. 2008. N 6. P. 20 - 22.

We believe that the point of view of the first group of researchers is more consistent with established notarial practice. In order for the property of the deceased spouse to pass to the heirs, it is necessary to allocate the marital share and determine the estate of the deceased spouse. The imperfection of the current legislation is manifested in the fact that it does not clearly regulate the procedure for determining the share, and therefore there is no clear opinion on this matter.

In practice, one may encounter a position according to which, after the death of one of the spouses, the common housing automatically becomes the sole property of the surviving spouse <6>. It should be noted that previously the registration of the property rights of the surviving spouse was carried out in this way, by analogy with Art. 560 of the Civil Code of the RSFSR, which was related to the inheritance of property in the collective farm yard. But according to the current legislation, there are no legal grounds for this. This contradicts Art. 1110, 1112, 1150 Civil Code of the Russian Federation. In addition, Art. 75 of the Fundamentals of the legislation of the Russian Federation on notaries provides for the obligation of a notary to issue a certificate of ownership of a share in the common property of spouses after the death of one of them to the surviving spouse. This article directly emphasizes that such a certificate can be issued to the surviving spouse for half of the common property acquired during the marriage.

———————————

<6> See: Gros A. Inheritance of residential premises in common joint ownership // Russian justice. 2002. N 11. S. 27 - 29.

A number of scientists believe that it is necessary to conclude an agreement on determining the share between the surviving spouse and other heirs of the deceased participant in the common joint property. Based on the agreement reached, the heir is issued a certificate of right to inheritance. If the issue of shares is controversial, the share of the deceased is determined by the court upon the claim of any interested person <7>. Notaries, having received the application of the surviving spouse, notify the heirs about this, who are asked to enter into an agreement to determine the shares of the surviving and deceased spouse. Based on the agreement reached, the heir is issued a certificate of ownership of the share. If any of the heirs disagree, this issue is resolved in court.

———————————

<7> See: Zalyubovskaya N. Common ownership of residential premises: features of inheritance // Domestic notes. 2005. N 1. S. 234 - 238.

In our opinion, such actions do not comply with the law for the following reasons. In 2002, Art. 3.1, which states that in the event of the death of one of the participants in joint ownership of a residential premises privatized before May 31, 2001, the shares of the participants in the common ownership of this residential premises are determined, including the shares of the deceased. In this case, the specified shares in the right of common ownership are recognized as equal. But this applies only to residential premises privatized before May 31, 2001.

The third part of the Civil Code of the Russian Federation, which came into force, seems to have clarified this issue. In Art. 1150 of the Civil Code of the Russian Federation states that the share of the deceased spouse is determined in accordance with Art. 256 of the Civil Code of the Russian Federation, which, in turn, refers to family law. Within the meaning of Art. 38 of the Family Code of the Russian Federation (hereinafter referred to as the RF IC), the share of spouses in common property can be determined by dividing it, which again is carried out by agreement between them or in court. But it is impossible to apply this rule to inheritance legal relations. One of the spouses has died, and the heirs, except the surviving spouse, are not participants in the common joint property, so it is impossible to conclude an agreement in this case. They also cannot go to court, which could determine the share, since the defendant in such a claim will be the deceased spouse and other heirs. There is no subject of law, therefore there is no one to file a claim against. Although in the practice of courts of general jurisdiction one can find examples where the court determines the share of the deceased spouse <8>, which, in our opinion, is contrary to the law.

———————————

<8> See: Garin I., Tavolzhanskaya A. Allocation of the marital share from the inheritance mass: right or obligation? pp. 25 - 27.

The next point of view is that agreement of the heirs on determining the size of shares is not required if the surviving spouse is issued a certificate of the right to a share in the jointly acquired property. In accordance with Art. 75 of the Fundamentals of Legislation on Notaries, upon his application, the surviving spouse may be issued a certificate of ownership of a share in the common property of the spouses, but with mandatory notification of the heirs who accepted the inheritance.

The application of the surviving spouse with a request to issue him a certificate of ownership is drawn up in the same way as the application of both spouses wishing to determine their share in the common property. It also indicates the type of property to which the surviving spouse claims a share of ownership, and the grounds for acquiring this property. It is necessary to establish the absence of a marriage contract concluded by the spouses during their lifetime, which changed the legal regime of the property. A certificate of ownership of the surviving spouse can be issued only for 1/2 of the share in the common property of the spouses. The notary has no right to increase or decrease the size of this share <9>. But it should be noted that the heirs can appeal the actions of the notary, the size of the shares of the spouses and invalidate the issued certificate. In addition, Art. 39 of the RF IC allows for the possibility of derogating from equality of shares based on the interests of minor children or for other noteworthy reasons, in particular if one of the spouses did not receive income for unjustified reasons or spent common property to the detriment of the interests of the family. And if the rights and interests of the testator’s minor children are protected by law (in accordance with paragraph 1 of Article 1149 of the Civil Code of the Russian Federation, they have a mandatory share in the inheritance and, regardless of the contents of the will, inherit at least half of the share that was due to them when inheriting by law), then in In the second case, no one except the spouses can say with certainty that one of the spouses did not work according to their mutual desire and that in this way they determined the contribution of each of them to the family. As a result of the conflict that has arisen, the dispute between the surviving spouse and other heirs may drag on for a long time.

———————————

<9> For details, see: Zaitseva T.I. Protection of family rights in notarial practice // Bulletin of notarial practice. 2003. N 4. P. 10 - 19.

The fundamentals of legislation on notaries provide that, upon the written application of the heirs who accepted the inheritance, and with the consent of the surviving spouse, the share of the deceased spouse in the common property can be determined in the certificate of ownership (Article 75). It is worth agreeing with the proposal of the Plenum of the Supreme Court of the Russian Federation in its Resolution No. 9 of May 29, 2012 “On judicial practice in inheritance cases”, that the property of the testator is fully included in the inheritance if the surviving spouse files an application for the absence of his share in property acquired by the deceased spouse in his own name during marriage (clause 33).

Literature

1. Bryuchko T.A. Common shared property of heirs // Notary. 2007. N 3. P. 14 - 17.

2. Garin I., Tavolzhanskaya A. Isolation of the marital share from the inheritance mass: right or obligation? // Russian justice. 2003. N 9. P. 25 - 27.

3. Gros A. Inheritance of residential premises in common joint ownership // Russian justice. 2002. N 11. S. 27 - 29.

4. Zaitseva T.I. Protection of family rights in notarial practice // Bulletin of notarial practice. 2003. N 4. P. 10 - 19.

5. Zaitseva T.I., Krasheninnikov P.V. Inheritance law in notarial practice. Comments (Civil Code of the Russian Federation, Part 3, Section V), method. recommendations, samples of documents, standards. acts, courts practice: Prac. allowance. 5th ed., revised. and additional M.: Wolters Kluwer, 2007. 800 p.

6. Zalyubovskaya N. Common ownership of residential premises: features of inheritance // Domestic notes. 2005. N 1. S. 234 - 238.

7. Kazantseva A.E. The property right of the surviving spouse and its accounting by the rules of inheritance law // Family and housing law. 2007. N 4. P. 21 - 26.

8. Nisht T.A. Some problems of notarization of the surviving spouse’s ownership of a share in the common property of the spouses // Notary. 2008. N 6. P. 20 - 22.

Source: INHERITANCE LAW magazine

Obtaining previously unprivatized housing

If the testator died before completing the privatization procedure, then his property will become the property of the state or a certain organization.

The transfer of this property by inheritance remains possible. To inherit a non-privatized apartment, you will have to include this apartment in the inheritance estate by filing a corresponding claim with the court.

Who can get it?

The right to inherit a non-privatized apartment is received by the heirs of the deceased by law or by will. However, for this it is necessary that the heir reside in this apartment until the death of the testator.

Inheriting a share of real estate has its own characteristics and difficulties, but once you understand this issue, you can easily go through all the stages of this procedure and receive your part of the property. The main thing is that you must be the legal heir of the testator, not deprived of such a right in court.

What is not the common property of the heirs

Joint property does not include items belonging to one of the spouses:

- property acquired before marriage. These are not only tangible things, but rights and responsibilities acquired by a person before marriage;

- items that were given to one of the spouses during the period from the date of marriage. This provision applies when acquiring property as a result of gratuitous transactions and through inheritance;

- things for individual use, excluding items of high material value.

Upon receipt of joint inherited property, each owner has the right to use and dispose of it at his own discretion, taking into account the agreements between the co-owners. If, after receiving the inheritance, the owners do not agree on the specifics of the disposal of the property, this problem can be resolved in court.

Author of the article

Composition of common property of heirs

Common property includes a full range of property, including divisible and indivisible property, as well as inheritance that is not subject to legal division.

Article 1112 of the Civil Code of the Russian Federation indicates that common property includes things, property rights and duties that the testator possessed at the time of opening of the inheritance. The heirs receive not only the right to own movable and immovable property, but also assume responsibilities for paying off loans and debts, based on the documented fact of their existence.

Article 321 of the Civil Code of the Russian Federation indicates that if there is more than one creditor, each of them has the right to demand immediate fulfillment of obligations. The responsibility of each heir is to repay loans or debts in equal parts with other participants in the property. Exceptions to this rule occur unless otherwise stated in the terms of inherited obligations. Not only loan obligations can be inherited, but also the right to receive repaid debt. In this case, each participant in the property is entitled to an equal share of the total debt repayment amount.

Increasing share size

In some cases, the size of the share can be increased if there is evidence that, at the expense of one of the legal successors, actions were taken to increase the value of the property.

For example, citizen K had a house before marriage; after the wedding, some construction work was done at his wife’s expense, which doubled the market value of the home. By inheritance, she received a third of the house, since her late husband had two more children from another marriage. As part of the trial, it was revealed that it was the work performed that contributed to the increase in the cost of housing, and the woman was assigned a 50% share of the house, and the rest was divided among the children.

Refusal of share

According to Russian law, refusal of inheritance is acceptable . This can be done due to various circumstances:

- the share is insignificant and has no value;

- there is a desire to transfer the share to another heir;

- In addition to part of the property, debts are also inherited.

Refusal of inheritance can be issued only once; the position cannot be changed. To do this, submit a corresponding application to the notary before receiving the certificate of inheritance.

Attention! You cannot accept only part of the inheritance, for example, refuse debts, but take a share in the apartment. Either the successor inherits everything or renounces everything.

Taking over the rights of an heir is a complex and time-consuming process, especially when a person is not the only legal successor. An apartment is an indivisible property, therefore, when there are several heirs, it is divided into shares. Their size is determined by the following circumstances: who else is a co-owner, how many heirs, what rights they have to the property. Receiving an inheritance is not subject to tax, but to obtain a certificate of ownership you must pay a state fee.

Division of common property of heirs

According to statistics, about 80% of heirs receive joint property. When property comes into common shared ownership, the shares of all heirs are conditionally recognized as equal. Deviation from this norm is possible if there is an heir who has the obligatory right to receive a certain part of the share due to him during the division of property. If the testator indicated several persons who have the right to receive ownership of an indivisible object, the object passes into the possession of each owner in equal shares of the appraised value. In the presence of common shared ownership, each owner not only enjoys its fruits, income or exploits the item, but is also responsible for maintenance costs.

The law provides for the right of each heir to dispose of his share of property at his own discretion.

When deciding to use his part of the property, he is not obliged to ask the consent of the other owners. When making a decision on the alienation of a share, the law provides for compliance with Art. 250 of the Civil Code, which provides for the right of pre-emption to purchase a share by co-owners of the object. The provisions of this article apply in the event of alienation of a part of the shared ownership for compensation. Each co-owner has the right to make a share that is his property the subject of a pledge, bequeath or donate, while he is not required to obtain the consent of the other owners.

All owners have the opportunity to exercise the right of first refusal to purchase the alienated share. If several co-owners want to purchase it, the seller can choose the buyer. It is possible to purchase a share by several owners. In this case, an equal right to use part of the property is formed, since according to the law the transaction will be made using common material resources.

If several heirs-entrepreneurs declare a preemptive right to receive a share of the company's shares, the request is granted for each participant in the transaction. The object becomes the joint property of all persons who submitted it.

As part of the process of entering into joint ownership, additions and encumbrances are used. Participants receive them in proportion to their share of the total composition. Increment - the fruits of mental and physical labor, products and income. Encumbrance - taxes, debts and planning fees, forced expenses and costs of maintaining joint property.

Participants in joint ownership can use the full list of rights available to co-owners if there is no encumbrance placed on the property object and the object is not the subject of a pledge or legal proceedings. If they exist, each owner has the opportunity to use the limited right to operate the facilities. In some cases, owners must share property rights with other individuals or legal entities before repaying the debt.

Preemptive right to purchase a share

A person who owns a share in an apartment or house has the right to dispose of it and, in particular, to sell it. In general, anyone can be a buyer, but first of all, this opportunity is offered to those who have a preemptive right:

- co-owners of real estate permanently residing in the apartment;

- persons living indoors and having no other place to live.

For them, the share is offered at the market price; if they refuse, then the owner of the share has the right to sell it to any person.

Read also: How to enter into an inheritance in another city?

Healthy! The procedure for inheriting a house and an apartment has few differences. However, in the first case, as a rule, the land plot with buildings is also inherited, which complicates the division into shares.

Features of common property of heirs

Difficulties arise when jointly inheriting securities and authorized capital. In case of inheritance of shares, all owners have the right to dispose of them at their own discretion. If the heirs do not reach an agreement, the issues are resolved in court. All heirs have equal voting rights at the shareholders' meeting. Each of them has the opportunity to speak through one of the owners of common shared property or a common representative. If the profit received is not divided in equal shares, an agreement is drawn up indicating the percentage of the total profit or the amount of dividends.

When indivisible items come into common ownership, the specifics of inheritance are determined by the rules on the preemptive right to transfer into ownership of household furnishings, compensation for unevenness in the determination of shares, which is relevant for 3 years from the date of opening of the inheritance. If the heir accepted the inheritance after this period, the priority right can be used at will.

Requirements ch. 16 parts of the third Civil Code of the Russian Federation are used selectively. When dividing the inheritance, important features of the agreement between the heirs, the provision on protecting the interests of minors, as well as citizens whose legal capacity is limited, are taken into account.

Inheriting a share in a house

In the case where the inheritance is a share in a house, it is necessary to take into account that there is a category of citizens who have an advantage over an inherited share in a house. Such citizens include:

- persons who lived in the household (the share of which is inherited) at the time of the death of the citizen who left this inheritance, and also owned the household together with the testator. But only if the person does not have any other place to live;

- persons using home ownership who have no other place to live. Only when there are no other heirs living in the given household or owning it by right of joint ownership together with the deceased citizen.

Information

Inheriting a share in a house is similar to inheriting a share in an apartment. Often, along with a share in the home ownership, the right to the land plot on which the house is located is transferred to the heirs.

On the right to inheritance

The process of inheritance itself is not much different from other cases. Unless the heir will have to provide several additional documents to the notary and go through the procedure of registering the property in the registry. It is necessary to enter into a share no later than six months from the moment the testator is declared dead.

Otherwise, the issue will have to be resolved in court. There, a decision will be made on the division of property, as a result of which the bequeathed share may decrease. This is not advisable and therefore it is highly recommended that you complete the following steps within the time limit.

This instruction is applicable to receiving an inheritance both in the form of a share of an apartment and in the form of a share of a private house.

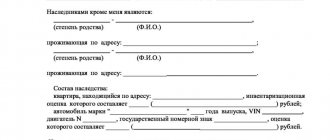

So, first of all, the heir must go to the notary who keeps the will and write an application for entry into the inheritance. But an authorized employee will not accept you without the following package of documents:

- Death certificate of the testator.

- Proof of your identity.

- A paper confirming the last place of registration of the deceased.

- Papers confirming relationship with the deceased (only if you are relatives).

- Documents for the apartment (ownership, housing plan, certificate of its value).

- An extract from the house register or personal account of the testator.

After this, you need to write a corresponding application to the notary (he will provide a sample) and after some time receive your certificate of inheritance. But this is not all.

You will not be considered the owner of your share in the apartment unless you go through the procedure for re-registration of the property.

To do this, contact your local Rosreestr office with a package of the following documentation:

- Proof of your identity.

- Received certificate of inheritance.

- Cadastral plan and real estate passport.

- Receipt for payment of state duty.

There, you must write a statement according to the sample provided by the employee. After this, within 10 days you will receive a document confirming re-registration and will become the legal owner of the share.

Our website contains interesting materials about the intricacies of inheriting a share in an LLC after the death of one of the participants and receiving part of the authorized capital, as well as how to formalize the refusal of part of the inheritance.

Filing a claim

If six months have already passed since the opening of the inheritance, then a redistribution of shares in the inheritance will be necessary. The corresponding claim can be filed only within three years from the date of recognition of the testator as deceased. In this case, there are two options:

- Go to court.

- Resolve the issue peacefully.

Pre-trial settlement

To resolve the issue without trial, the full consent of all heirs will be required. You will have to draw up a settlement agreement on the division of property. This is stipulated in Article 1165 of the Civil Code.

Thus, the heirs themselves can divide the heir’s apartment among themselves. If an agreement between the heirs has not been reached, the only way out is to demand a resolution of the dispute in court.

Where should I contact?

The claim is filed in the district court at the place of residence of the testator. If he lived abroad, and the apartment is located in Russia, then it is worth contacting the court at the location of the property. It is the district court that resolves disputes of this kind.

Documents for the case

Before going to court, you will need to collect the following documents:

- Identification.

- Receipt for payment of state duty.

- Death certificate of the testator.

- Papers that confirm your right to inheritance.

- The deceased's ownership of the apartment.

- Certificate about the cost of housing.

- Statement of claim for division of inheritance.

- Proof.

In this case, any document confirming your right to a share in the apartment can serve as evidence:

- witness statements;

- papers stating your incapacity;

- confirmation of your degree of relationship with the deceased;

- And so on.

How to make an application?

The statement of claim must clearly indicate in what form you wish to divide the property. You can either divide the apartment equally between all the heirs, or leave it to one of the heirs, demanding payment of compensation to all those remaining. When compiling, you should adhere to the following structure:

- Location of the court.

- Personal information about the plaintiff.

- Information about the defendant.

- Cost of claim and state fees.

- The name of the document (in this case, a statement of claim for the division of inherited property).

- Circumstances (death of the testator, indicating the date, and the reason for which the claim is filed).

- List and order of heirs.

- Information about shared property.

- Grounds for division of inheritance.

- Your requirement.

- List of applications.

- Compiler's signature and full name.