All the lines of heirs according to the law What is the line of inheritance for grandchildren How do disabled dependents inherit

Inheritance by law is the most common in our country. It is carried out in an order strictly defined by law.

There are the following principles of inheritance by law :

- Inheritance is based on family and marital relationships with the testator

- The list of persons who are included in the circle of heirs by law is strictly defined by law and is exhaustive

- The inheritance is divided only between the heirs of one line called to inherit, and in equal shares

- The right of inheritance passes from one line of inheritance to the next only if there are no heirs belonging to the previous line. That is, in the absence of heirs of the first stage, heirs of the second stage are called upon to inherit, and so on. Accordingly, heirs of the fourth and subsequent orders receive the right to inheritance only in the absence of heirs of the first three orders.

Lawyer on inheritance issues in St. Petersburg. Tel.+7 (812) 989-47-47 Telephone consultation

Inheritance by law

Receiving an inheritance is not an obligation by law, but an opportunity to become the new owner. To avoid disputes and scandals, the state identified priority applicants, and for the rest it established a procedure for becoming owners. Blood relatives, spouses and third parties participate in the division, even if they have no family ties. Persons registering an inheritance according to the law apply to a notary office or court at the location of the largest share of the inherited volume.

There is a category of citizens that falls under compulsory inheritance. Laws take care of people who do not have the opportunity to work independently and ensure their own well-being. And even if the entire inheritance legally belongs to a specific person, part goes to the dependent. This could be a child under the age of majority, parents or third parties who were dependent on the testator for at least a year before his death.

Order of relatives

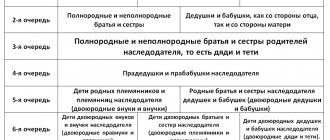

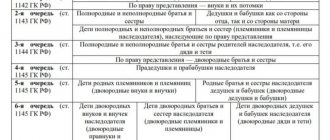

Inheritance by law minus the obligatory share assumes an equal distribution of property between applicants in the same group. There are eight such groups in total:

- First . This inheritance queue has maximum privileges. These are children, spouses, parents of the deceased. They claim to be the first priority.

- Second . The order of inheritance allows you to enter into an inheritance if there are no priority ones, they refused or ignored the right. These are grandparents, brother and sister.

- Third . The order of inheritance includes the circle of relatives, which includes the brothers and sisters of the parents of the deceased.

- Fourth . The order of succession gives the right to claim by law if the applicants are the testator's grandparents.

- Fifth . The right of inheritance passes to cousins (granddaughters (grandsons), grandmothers (grandfathers)).

- Sixth . According to the order of succession by law, persons who are great-grandchildren, nephews, great-grandparents and great-grandfathers, if they are cousins, enter into the process.

- Seventh . This line of heirs is characterized by a non-blood relationship, if the testator grew up with a stepfather or stepmother, or raised a stepson or stepdaughter.

- Eighth . Inheritance laws apply to dependents who were cared for by the now deceased for at least 12 months prior to their death. The presence of related intersections is not necessary.

The listed order of heirs when accepting an inheritance according to the law enters into the procedure in the sequence of the groups to which they belong.

Who is allocated a mandatory share in inherited property?

Article 1149 of the Civil Code of the Russian Federation states that there are persons who must receive their share of the inheritance. They cannot be deprived of it, and even if they are not indicated in the will, the state must still allocate them a part of the inheritance.

These are minor children, natural or adopted, recognized as incapacitated, for example, having a disability, as well as spouses of retirement age or also on disability without the ability to work, and, accordingly, dependents in the same situation.

This category of citizens, in any case, whether there is a will or not, will definitely receive their share in the property of the deceased, only this requires certain evidence, for example, officially confirmed papers about the incapacitating degree of disability.

Inheritance by law and right of representation

The laws of the Russian Federation do not prohibit receiving an inheritance in one’s own interests. Reluctance to join, a warm attitude towards people from another category of heirs, material reward is a sufficient reason to transfer rights, regardless of the established procedure for inheriting property. The degree of relationship in inheritance by presentation does not matter. It is not difficult to arbitrarily appoint a stranger who is not related to the family as heir.

The essence of prosecution by right of representation

The purpose of the procedure is to transfer the right of inheritance according to the law, regardless of the order and the presence of family ties. Having written the appropriate application and notarized the signature, the applicant transfers the property to the new heir for registration. The main requirements are voluntary decision-making and legal capacity. Initially, you must be a legal successor.

Distribution of shares

If there is no will, then the estate must be divided between relatives who are closest in line of kinship. So, if there are several parents, children and other persons who belong to the 1st group of kinship, this means that the inheritance is divided into equal shares .

However, if a will is made, then you can receive an inheritance in the share that is due to you. If it is impossible to calculate the share that should go to each of the heirs in the absence of a will, then it is necessary to evaluate the property in monetary terms, and then divide it among the heirs.

The procedure for entering into inheritance according to law

The laws regulate the procedure for acquiring an inheritance. In accordance with the inheritance scheme, property values are indicated in the inheritance case initiated by the notary. The main law is the Civil Code. The articles contain regulations according to which the order of inheritance by law is transferred according to the scheme “from the first stage to the eighth”.

The procedure established by the laws of the Russian Federation involves obtaining a certificate giving the right to register the property, becoming its full owner. There are several ways of re-registration that fit into the inheritance scheme by law. But in any case, the process is initiated by submitting an application to the competent authorities. After checking the information, searching for applicants, and assessing the degree of relationship, a decision is made on the distribution of the inherited wealth.

Methods of accepting property

Emerging rights to inheritance are legally implemented in accordance with several principles stipulated in the Civil Code of the Russian Federation:

- By degrees of inheritance . In accordance with the previous scheme, heirs are classified into groups. The right to inheritance by law is transferred to the next line, if there is no one in the previous line, they do not want to register the property or have signed a refusal.

- Upon ownership . Co-owners, even not official ones, are a special category of heirs under the law, since they have sufficient rights to re-register property in the inheritance procedure. Reasons: joint expenses for maintenance and servicing, repayment of debts, ensuring the safety of property.

People often ask, if a second cousin lived in the apartment, the heir of which order takes ownership of the property by inheritance. The law says that if she proves that she paid utility bills, made repairs, maintained cleanliness and order for a long time, then even if there are heirs of the fourth stage, entry is allowed based on the fact of use.

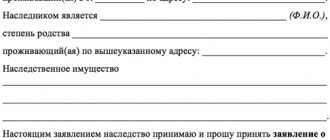

Submitting an application to a notary

The text indicates what degree of relationship is taken into account when inheriting without a will. To contact a notary's office, you must prepare a package of documents confirming your relationship with the testator. How many lines of inheritance according to the law remain afterward does not matter. It is important that no one stands in front. Then the right to inheritance is undeniable, and the rules will allow you to easily become the owner.

The notary is presented with a passport, as well as a death certificate of the testator. Copies are also made of all documents indicating family ties. This is a marriage or birth certificate, even if the applicant is a first-degree heir. Entering into an inheritance is a paid service. You will have to pay a fee and attach the receipt to the application. And this must be done no later than six months after the opening of the inheritance case.

Actual acceptance of property

The need to enter into inheritance in this way allows you to do without a notary. It is enough to submit an application to the executive bodies of local government. The text of the appeal contains references and evidence of joint ownership. If there are no applicants from the first priority according to the law, who are entitled to a mandatory share, there will be no problems with inheritance. The main thing is to do everything on time and complete the re-registration.

First of all

If the deceased did not leave a will, then inheritance by law comes into force, the order of inheritance in which is observed very strictly.

According to Art. 1142 of the Civil Code of the Russian Federation, the heirs of the first priority include the husband or wife, children and parents of the deceased.

Property acquired by spouses during marriage is considered their joint property. The share of the deceased spouse is determined by Art. 256 of the Civil Code of the Russian Federation and is part of the inheritance.

The surviving spouse enters into inheritance rights, even if he remarried after the death of his husband/wife.

If the marriage was declared invalid, then the spouses cannot be each other's heirs.

Upon divorce, the mutual inheritance rights of parents (former spouses) and their children do not change.

Grandchildren can present their inheritance rights only if their parents (first-degree heirs) died along with the testator or before the opening of the inheritance. This is called the “right of representation”, which determines the order of further inheritance.

If the deceased has made a will, but the first priority heirs are not included in it, they can still claim a share of the inheritance in cases determined by law.

For example, they can claim their inheritance rights if at the time of the testator’s death they are disabled:

-by age (minors or pensioners),

- due to health reasons (disabled people).

In this case, their interests are protected by Art. 1149 of the Civil Code of the Russian Federation. Disabled heirs of the first priority have the right to 50% or more of the share of the inheritance that they would have received by law in the absence of a will.

Terms of inheritance

Inheritance law says that no more than 6 months are allotted for receiving an inheritance. During this time, the employees of the notary office carry out the necessary checks, look for heirs, and clarify the presence of the transferred values. It does not matter whether the inheritance is received by will or by law; in case of delay, additional steps will have to be taken.

Legal exceptions to the rules

When submitting an application to extend the deadline, indicate the reason that led to the formation of circumstances that do not allow you to apply for the inheritance in a timely manner. Any reason must be compelling and documented. For example, if it is an illness, then a certificate from a medical institution is attached.

It happens that the inheritance is registered in the name of a cousin, but the testator’s son was in another country and learned about his father’s death only 9 months later. Even if children have priority in the order of inheritance, then in this case the deadlines have passed and they will have to be restored. A visa and passport with customs clearance marks are used as proof of stay abroad. Each reason is documented.

How a notary looks for heirs

The successors must contact the notary themselves to obtain the certificate. No one will specifically look for them. The maximum that a notary can do is contact the successors if he has their contacts. And also submit an advertisement in the media (local newspaper and radio, the official website of the notary chamber, etc.). However, as practice shows, authorized persons rarely do this, because these actions are not mandatory under the legislation of the Russian Federation.

Ways to restore deadlines

In any case, an appeal should be made to the court at the location of the property. The procedure involves paying a state fee. The receipt is attached to the claim. A court date is set, after which a court order is issued to extend the deadline for another six months so that the legal heirs can complete the necessary actions.

With the permission of other heirs

For example, a spouse who belongs to the first line of inheritance was undergoing treatment when his wife died and was physically unable to contact a notary. Cousins took advantage of the right to inheritance. After the husband returned to his hometown, by joint agreement, the relatives decided to voluntarily transfer the rights of inheritance. The lawsuit must contain a request for an extension. Number of months limited to six

By the tribunal's decision

When the inheritance process is carried out without a will, the deadlines have been missed, and relatives from the seventh line have decided to inherit and do not want to give up their intentions, go to court. Write a statement of claim. In the text, describe the inherited property in the form of a list or table, indicate prices and total cost. List and document your desire to start the inheritance process all over again. You have the right to demand monetary compensation.

Establishing family relationships with the deceased

In order to become the owner of an inheritance without a will, you need to prove to a notary or court the fact that you were related to the deceased. To do this, you must provide written evidence of this fact. Perhaps this will be a birth certificate, marriage certificate, and so on.

Also, there is a high probability that you will obtain a certificate from the civil registry office, which will also confirm the presence of your relationship.

Reference! In a situation where you are a distant relative, and at the same time cannot document in any way the fact that you are a relative, it is enough for you to obtain written consent from other family members.

Also, written testimony from other representatives of your family is suitable.

Inheritance registration procedure

In Russia, legislation clearly regulates the inheritance process. On the day of the testator's death, the notary initiates the inheritance case. The heirs by law write a statement if they wish to assume the property and obligations associated with it. It is not necessary to issue a refusal. It is enough for the heir to ignore the appearance at the notary’s office, and if after death the persons belonging to the 4th line of inheritance refused, there is no one left in the 5th and 6th stages, the seventh stage is included in the process. In order not to waste a lot of time, you need to know how inheritance occurs.

Step-by-step algorithm

Inheritance by turns is sequential. The order of heirs by law depends on the degree of relationship. The procedure is carried out according to the following scheme:

- An inheritance case is opened.

- The heirs are called by the notary.

- Those interested write applications.

- A certificate is issued.

- The owner's right is re-registered.

First priority relatives have priority.

Upon actual acceptance

Let's say a cousin lived with her cousin in the same house. He died, but while he was alive, she paid for land, electricity and water, bought firewood and coal, paid for repairs and maintenance. She has the right of inheritance, and a notary is not needed. The procedure is as follows:

- Documents, receipts, checks, bank statements are collected.

- An application is submitted to the local government body.

- If necessary, a court hearing is initiated through a lawsuit.

- A decision is made and a document is issued that has legal force.

- The inheritance received by law is transferred to the applicant.

Which court or executive committee should I contact? At the location of the property registered in the order of inheritance.

Design nuances

The last step is mandatory, especially if we are talking about inheritance, which is called actual. Knowing what the procedure is, people forget to do this, and then, when children or grandchildren formalize the entry, problems will arise, because it will not be possible to prove that you received the property according to the law. Accepting an inheritance is not the only limitation. Valuables cannot be sold, exchanged, or donated unless the ownership is officially re-registered.

What has been gained in marriage and how to share it

Joint property is discussed in detail in the Family Code, in Article 34 .

This is property that was purchased during marriage from the moment of its registration. And it doesn’t matter who is indicated as the owner and whose material assets were used during the purchase.

Real estate is divided - apartments, dachas, land plots, garages, outbuildings, and so on, movable - cars, motorcycles, as well as securities, shares, precious jewelry, pensions, benefits, income from business.

If one of the spouses received an inheritance or received something as a gift for free, then these things will not be considered jointly acquired property, even if these facts occurred during the years of marriage.

Also, personal items for personal use are not divided between spouses: clothing, shoes, personal hygiene items. But the jewelry, even if it was purchased and was the wife’s jewelry, will be divided among the heirs, with the obligatory marital share being allocated.

While both spouses are alive, they have equal rights to all their property. For example, during marriage, a family purchased housing - an apartment, and registered it in the name of the wife, however, after her death, marital shares are determined.

That is, this living space will be divided as follows: ½ share is part of the spouse’s apartment , since it was purchased during the period of legal marriage, and ½ is the wife’s share , which will already be divided between the relatives of the first line of heirs.

The first priority includes the spouse, children or their legal successors.

And accordingly, the living space will have to be divided as follows:

- 1/2 - part of the spouse , as joint property, it is indivisible among the heirs.

- 1/2 is the second part of the deceased , it will be divided between the husband and all children.

- If there are two children 1/3 from this half ,

- Each child will also receive 1/3 .

- In the end, the husband's property will be 4/6 of the total area of the apartment, and each child will have 1/6, respectively

Everything acquired during a joint marriage will be shared in the same way. And even if the husband and wife have not lived with each other for a long time and do not communicate, but the marriage is not dissolved, then one of the spouses still has the full right to the marital share of property after the death of one of them.

By the way, if the marriage was not officially registered with the registry office, the spouses lived in a so-called civil marriage, then anything acquired during this marriage will not be considered jointly acquired. Since a common-law marriage is not legal, cohabitants have no rights to inherit property after the death of their partner.

Frequently asked questions when registering an inheritance

We invite you to read the answers to questions that people ask lawyers:

- Is inheritance transmitted through representatives? Yes, a lawyer can arrange the transfer on the basis of a notarized power of attorney.

- How to refuse inheritance in favor of a person who does not belong to any queue? Indicate a successor, who may be a relative, an outsider, an enterprise, an organization, or a government agency.

- Who is the heir if a person has no one left in his family? In the absence of direct heirs, inheritance is impossible; the property passes to the benefit of state bodies of local self-government.

- Are taxes paid upon inheritance by law? State duty is paid. Taxation is relevant when reselling inheritance according to the law.

- Is it possible for an unofficial wife to join? The child has the right of inheritance. The law gives children a mandatory share. It is legally impossible for a common-law spouse to receive inheritance if there is no marriage certificate.

The list can be continued endlessly. Each case is different and has its own characteristics. Therefore, it is better to contact professional lawyers for a free consultation by phone or online. They will help you figure out who will inherit first, make a list of applicants according to the law, and tell you about the rules of inheritance without a will.

Peculiarities

There are some features of the section that you should carefully study.

Otherwise, you risk jeopardizing the entire procedure, as well as delaying it to the most incredible deadlines. Therefore, pay attention to this relatively small point. Direct heirs (first priority) divide the inheritance exactly in those shares specified in the will. In the absence of a will, the inheritance is divided in half.

Further, if the heir has children, then they are entitled to larger shares than the spouses or parents.

general information

During his life, a citizen becomes the owner of a significant number of objects and things. In the event of his death, property objects are transferred to other persons by inheritance.

The Civil Code establishes the following options for transferring ownership of property of a deceased citizen:

- at the will of the owner (will);

- in accordance with legal regulations.

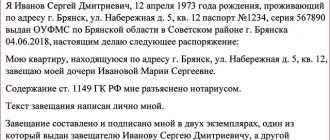

A will is a document in which a citizen disposes of property in the event of death at his own discretion. The law allows the owner to transfer property to any individuals and legal entities.

There are no restrictions for individuals. The heir does not have to be a relative, spouse or just an acquaintance.

The legal entity may be a municipal authority, a charity, a shelter or any other organization.

Important! The testator should not report to anyone, including a notary, why he made such a decision.

The will must be in writing and certified by a notary. After proper certification, the notary enters information about the document into the unified system of the federal notary service.

Inheritance in accordance with the law is possible in the following cases:

- there is no will;

- the document does not cover the full scope of property;

- the will is declared invalid or challenged in court;

- the heirs under the will refused to accept the property of the deceased.