Inheritance by minors

Children can legally inherit any property, including debts and obligations. In inheritance matters, they have a special status, because even when drawing up a will, the testator does not have the right to ignore their interests. According to Article 1149 of the Civil Code of the Russian Federation, children are included in the category of “obligatory heirs”.

This means that minors, in any case, will inherit the property due to them, despite the will of the testator . The testator may not want to include them in the inheritance under the will, but nevertheless the heirs will have to take them into account. The main conditions for such inheritance are:

- children must be related to the testator, who can be their parent, guardian, or trustee.

- Minors, even if they are not biological children of the deceased, must be financially dependent on the testator, that is, they are his dependents. In this case, he acts as the main breadwinner.

Children of other relatives (nephews) who are not dependent on the testator and are not his children are not considered obligatory heirs.

When deadlines are missed

Due to their age, young children cannot know the laws that regulate the timing of inheritance. Minors cannot declare themselves; this must be done by guardians and employees of the Public Education Department within 6 months from the date of death of the testator.

In other words, one of the adults should be concerned that the child has rights to the inheritance and should help him formalize everything legally correctly. Otherwise, within the next three months, the successors of the following orders will enter into the inheritance.

You can restore the missed deadline through the court. This is done in the same way as a regular lawsuit, but instead of the child, his representative will present significant evidence. In practice, if the interests of a child are affected, the court almost always takes his side.

Features of the transfer of a mandatory share

If the testator makes a will for other persons, then the children, in accordance with Art. 1149 of the Civil Code of the Russian Federation, a mandatory share of inherited property is due. There are no exceptions here, since the law protects the interests of children, so the will of the testator does not play a role here. He may prohibit them from inheriting in his will, but such a decision will be considered invalid.

This means that minors receive their part of the inheritance under a will at the rate of at least ½ share of the property if they inherited by law in accordance with Article 1149 of the Civil Code of the Russian Federation. In other words, in order to calculate the obligatory share of the inheritance, you must first select all the heirs of the 1st stage, including the child, and calculate their share of the inheritance according to the law, but the “legal share” of a minor must simply be divided in half according to Article 1149 of the Civil Code of the Russian Federation.

IMPORTANT! If the testator ignored his minor children or other obligatory heirs in the will, then the document is declared invalid. The inherited shares will be distributed according to the rules of Article 1149 of the Civil Code of the Russian Federation, and the main heirs will receive much less property than they were owed according to the document.

Let's say testator N bequeathed an apartment to his mother (father died), but he has a young child from a previous marriage who inherits an obligatory share of the property.

The mother of the deceased and the child are heirs of the 1st stage. If there had been no will, then by law they would have received 1/2 of the apartment, but in reality the child receives 1/4 of the obligatory share, that is, exactly half of his 1/2 legal share. Read more about the inheritance queue here.

The testator's mother will receive 3/4 of the property. If the testator had two young children, then each of them would receive 1/6 of the apartment, and the mother would be left with 1/2 of the property according to the will. The more compulsory heirs, the smaller the share of the inheritance under the will.

As for inheritance without a will, minors receive their part in equal shares along with other heirs, so no difficulties should arise here.

The obligatory share of the inheritance is determined based on the total number of all legal, obligatory heirs and the size of the inheritance, taking into account bequeathed and untested property.

The court may individually reduce the share of the inheritance depending on the circumstances of the case and the specifics of the property. The legal heir must prove that the child has other real estate and has not previously lived in this apartment, so this will not violate his legal interests in any way.

What share of the inheritance is due to a minor child?

The children's share of the inheritance is determined by law and will. In this case, the testator can transfer to his heirs not only property, but also debts and other obligations. Article 1149 of the Civil Code of the Russian Federation defines the children of the testator (including adopted children) as obligatory heirs. If the deceased ignored the children in the will, then they can easily declare this document invalid through the court and demand distribution of the inheritance in accordance with the law.

In order for children to receive their obligatory share, the following conditions must be met:

- It is necessary to have a family connection with the deceased, or officially registered adoption or guardianship.

- There must be financial dependence, that is, the deceased must participate in the maintenance of the children and be their breadwinner.

If other minors who are not his relatives or who are supported by other persons live in the house of the deceased, then they will not be obligatory heirs.

The size of the obligatory share is equal to ½ of that which would be due to the heir by law. For example, a child is the only heir of the deceased. According to the law, he is entitled to everything. But the testator bequeathed his property to a charitable foundation. In this case, even if there is such a will, the child has the right to claim ½ of the inheritance.

Another example. By law, a minor has the right to half of the testator's property, but there is a will in which only 1/10 of the share is transferred to him. In this case, you can challenge the will through the court and obtain the right to half of the legal share, that is, in this case, ¼.

Independent acceptance of property by children

Children cannot fully accept the inheritance on their own. Only legally capable persons can enter into inheritance relations, but minors have a completely different status. The legislator identifies several age categories of incapacitated persons:

- from 0-14 years (completely incapacitated);

- from 14-18 years old (limited capacity).

From 0 to 14 years of age, a child is completely incapacitated, and therefore cannot independently write an application to a notary. Parents/guardians as legal representatives are fully responsible for it, therefore they are entrusted with the task of accepting the inheritance in accordance with Art. 28 Civil Code of the Russian Federation.

From 14 to 18 years of age, a person is partially incapacitated and therefore has the right to independently accept an inheritance with the written consent of the parents in accordance with Article 26 of the Civil Code of the Russian Federation.

This means that he can personally write a statement to a notary in the presence of his parents, who sign the document and also express their consent to inheritance on a separate sheet. Children over 16 years of age may be considered fully capable if they:

- have their own earnings or income.

- They work under an employment contract.

- Doing business.

In this case, the court or guardianship authorities recognize the children as emancipated and therefore they can do everything on their own.

REFERENCE : When a minor enters into an inheritance relationship, the participation of guardianship and trusteeship authorities is not required; therefore, their final word is not required.

The procedure for a minor to inherit an inheritance

Many people are afraid of the question of how to do everything correctly so as not to deprive the child of the property they are owed. A similar principle of Art. 1152-1154 of the Civil Code of the Russian Federation, but with special conditions. A minor child can actually accept an inheritance in only one way, based on Art. 1153 of the Civil Code of the Russian Federation, that is, contact a notary and write an application. Depending on age, this can be done either by the legal representatives themselves, or by the teenager himself and his parents.

Where to contact?

To enter into an inheritance relationship, you must visit any notary office. It is advisable to do this at the address where the property is located or at the place of residence of the deceased testator. In the law, this is called the “place of opening of the inheritance.” Before applying, you need to collect all the documents justifying the right of inheritance.

The list of documents can be read on the official website of the notary office. Directly at the notary, parents/guardians or the teenager himself fills out an application.

Documentation

You cannot come to the notary empty-handed, as you must present documentary evidence of the right to inherit. Otherwise, the notary will not accept clients. If the heir is a child under 18 years of age, then the list of documents presented is similar to adults, with the exception of some nuances. If a minor appears in the case, the notary will require the following documents:

- death certificate of the testator (copy and original);

- passport, as well as the child’s birth certificate, where the testator is indicated as the father or mother;

- an extract from the house register, which contains all the information about all discharged and registered persons in the apartment;

- information confirming the relationship with the deceased;

- single housing document;

- an open will in which a minor citizen is indicated as an heir;

- passport of legal representatives;

- power of attorney for the child's representative (lawyer);

- other information.

The list of documents is not complete, since the inheritance situation of each applicant is individual.

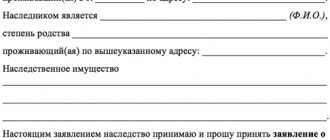

Drawing up an application

To accept an inheritance from a notary, you must write an application. If the child is under 14 years old, then the document is entirely drawn up by the parents/guardians. For this, the will of one legal representative is sufficient.

If the heir is a teenager (from 14 to 18 years old), then he draws up and signs the application independently in the presence of his parents/guardians, who provide their details (full name, passport details, address) as legal representatives. On a separate sheet they write their consent to the fact that the minor child will accept the inheritance.

A signature must be affixed at the end of the application. The notary, as a rule, gives the legal representatives a ready-made form where they need to enter all the necessary information.

This makes the situation quite easy, since you don’t need to create anything on your own. The document must indicate the following details:

- Full name of the testator.

- Full name, passport details, address of parent/guardian

- Full name, passport details of the minor heir.

- Grounds for receiving an inheritance (will, law, family relationship).

- Date and signature of legal representatives and heir.

In our materials you will learn about such heirs: by right of representation, unworthy, disabled, commorients. It also talks about what to do if the heir has not entered into the inheritance within 6 months and about who the heir of the deceased heir is.

Illegitimate and adopted children: problems of inheritance

Most often, problems arise with illegitimate children. Adopted children have official proof of their relationship. Of course, the relationship will not be blood, but for the civil code the legal side of the issue is more important than the moral aspects of how truly related the testator and heir are.

Often children are raised in families that hide the moment of adoption until the last minute, and some learn this fact after the opening of the inheritance not at all from their parents, who were the direct guardians and adoptive parents.

Illegitimate children are a more complex issue. As a rule, their availability is revealed only after the opening of the inheritance. Of course, relatives intervene, challenging the moral and ethical right to claim the inheritance of children born in another marriage or out of wedlock. However, challenging such a relationship, they argue with the civil code, according to which if the birth certificate contains information about a given parent, if a minor bears the father’s patronymic, in a word, if the father legally recognized the child in any way, he is also entitled to a mandatory share of the inheritance, even if, according to he was deprived of it by the will.

Stepchildren can receive an inheritance, occupying the last line of inheritance. Here, proximity can be proven, for example, by witnesses who testify that the teenager lived with the testator, but was not officially recognized as a relative. Judicial practice knows cases when inheritance went to such children when there are no other heirs.

Is a power of attorney needed on behalf of a child?

Representatives of the child can be not only parents/guardians, but also outsiders, including lawyers in accordance with Article 1, Article 1153 of the Civil Code of the Russian Federation. The power of attorney must indicate the powers of the representative, which include:

- right to submit documents;

- the right to draw up an application;

- government payment duties;

- right to sign;

- obtaining a certificate.

In this case, the power of attorney must be drawn up in writing and notarized. The document itself is drawn up by parents or a teenager (from 14 to 18 years old), but only within the limits of their rights.

A minor must be present when submitting documents to a notary, but if this is not possible, then his signature on the power of attorney must be notarized.

Establishment of fact and recognition of property rights

To carry out this procedure, it is necessary to prepare a claim to establish the fact of acceptance of the inheritance and recognition of property rights. It should contain evidence of the actual acceptance of the property specified in paragraph 2 of Art. 1153 of the Civil Code of the Russian Federation.

It is advisable to state the following circumstances in the claim:

- all actions were performed within 6 months after the opening of the inheritance case;

- measures were taken to preserve real estate;

- All utility and tax payments were paid.

Then pay the state fee, which will depend on the estimated value of the property. Next, the claim is submitted to the court in person through the office, or sent by mail.

When the court decision comes into force, it is necessary to obtain a court decision and apply to Rosreestr, where to register the property right with payment of a fee, which is equal to 2000 rubles.

State duty and other financial expenses

According to clause 5 of Article 333.38 of the Tax Code of the Russian Federation, minor heirs do not pay the state fee when contacting a notary regarding acceptance of an inheritance. The main condition: they must not be older than 18 years at the time of the death of the testator.

Other financial expenses occur if parents want to use the help of a professional representative. In various notary offices it is also possible to receive legal and technical assistance (production of documents), for which a fee is charged according to tariffs established individually in each notary firm.

Situations are different, so clients often need advice. It is quite possible to avoid unnecessary expenses if the case is simple or the applicants know the legislation in detail.

Voluntary refusal

Theoretically, a child can refuse an inheritance, but for this it is necessary to obtain permission from the guardianship and trusteeship authorities in accordance with Part 4 of Article 1157 of the Civil Code of the Russian Federation. Emancipated teenagers can freely refuse their inheritance, but all other children do not have this opportunity. The notary will not consider such applications without prior permission from special authorities.

REFERENCE: You should not confuse missing deadlines for accepting an inheritance with a real refusal of it, since these legal phenomena are not equivalent. The child becomes the owner of the obligatory share of property from the moment of the death of the testator.

Reasons

In order to refuse an inheritance, you must first contact the territorial guardianship and trusteeship authority. Employees of the institution must be convinced that the inherited property violates the interests of the child. As a rule, such grounds include cases of inheritance:

- Property responsibilities.

- Contractual or credit obligations.

- Collateral property.

- Huge debt to pay for utilities.

- Liabilities under promissory notes.

- Damaged property (apartment, house in disrepair).

The grounds for refusal may also include the presence of a minor child of similar property or the actual impossibility of living in the inherited apartment. In other words, the reasons for the refusal must be carefully argued so that such an inheritance is unprofitable for the child in a legal and factual sense.

How does this happen?

First, you need to contact the guardianship and trusteeship authorities with an application, which is submitted by the legal representative or the child, if he is 14 years old. The document must contain a request for permission to refuse inheritance. If the young heir is 10 years old (Article 57 of the RF IC), then he and his parent/guardian also write a statement expressing his consent to the refusal.

In addition, parents/guardians must provide a package of documents that is similar to when submitting an application to a notary. The guardianship authorities consider everything and make a decision within 15 days in accordance with Article 21 of Federal Law No. 48. They may refuse or allow the applicant to refuse the inheritance.

If permission is granted, the child and parents must contact a notary and write a corresponding application. If the guardianship and trusteeship authorities refuse the request, then the child can only enter into inheritance relations.

In conclusion, it must be said that inheritance of property by a minor is fraught with many nuances, although it is subject to the general rules of law. The testator's minor child is a compulsory heir, so he cannot be left without property.

In such cases, the exact age of the child, as well as all the circumstances of the case, are very important. It is necessary to take into account the number of all heirs, as well as the specifics of the inherited property, in order to know for sure how to act and not make mistakes.

Actual acceptance of inheritance

The actual acceptance of an inheritance, in other words, can be characterized as inheritance by law. This procedure shows that each first-degree relative, including children, is entitled to a certain mandatory share. This share is calculated in proportion to various circumstances: the number of assets, the presence of other heirs. Legal inheritance will require less effort to confirm your rights. All heirs, including minors, only need to present the required package of documents together with an application for receiving property and consent to the processing of the heir’s personal data.