When the collection of alimony in proportion to earnings is impossible or it is difficult for the interested party to file a claim for alimony in a fixed sum of money. We offer a sample statement of claim for the collection of alimony for minor children in a fixed amount, taking into account the latest changes in legislation.

Read in this article:

|

Is it possible to apply for alimony in a fixed amount?

Material support for close and nominal relatives, voluntarily or compulsorily, is called alimony. The law provides for the obligation of citizens to provide for their disabled parents, adult children, grandparents, spouses during marriage and after its dissolution, stepmother and stepfather, de facto educators, minor children and grandchildren.

Other relatives cannot demand mandatory security in court.

The Family Code establishes the following payment options:

- percentage of the income of the alimony obligee;

- fixed amount;

- receiving maintenance in kind;

- combined option.

The percentage represents the withholding of funds calculated based on the citizen’s total income. The amount of payment depends on the number of children:

- 25% when supporting one child;

- 33% when providing for two children;

- 50% for financial payments for three or more minors.

The method is used exclusively when collecting financial support from minor children.

A fixed (firm) amount is paid when financial support is assigned to all other relatives. The legal representative of a minor child also has the right to request payment in a fixed amount or to combine several options.

The parties can independently determine the replacement of monthly payments by re-registration of the payer’s valuable property to the recipient of the funds. Thus, you can transfer the apartment into the child’s ownership once and no longer have to pay child support.

Important! It must be drawn up in the form of a notarial agreement, where the legal representative of the child agrees to replace the monthly payment with the right of ownership in the real estate or other property of the alimony payer.

A mixed payment means the application of different types of payments to one payer in relation to one minor child. For example, material support as a percentage of the main type of earnings and a fixed amount from earnings under civil contracts.

The amount of alimony in a fixed amount

Let's look at how to calculate the amount to file a claim for alimony, sample in a fixed amount. The Family Code provides for the assignment of financial security for all possible recipients of alimony payments in the form of a fixed amount. However, the exact amount of payment is not provided by law.

The Family Code establishes the amount of payment that is a multiple of the minimum wage. The amount is set for regions and for Russia as a whole. If an entity sets the minimum wage for a certain category of citizens, the court must be guided by this amount. The minimum wage is set:

- for the working population;

- for minor citizens;

- for pensioners.

Thus, to calculate alimony payments, the amount for the category of citizens to which the claimant of financial support belongs can be used.

The amount of material support is subject to annual indexation in accordance with the increase in the minimum wage. In addition, the assigned amount must be a multiple of the minimum wage. For example, make up 1/3 of the minimum wage, or ½ part.

Due to the fact that the full amount is significant for most regions, courts rarely use it. If a citizen does not have a sufficient level of income, has dependent minor children or disabled relatives, then the amount can be established adequate to the expenses of the alimony payer. But in case of malicious evasion, the court has the right to review the decision and raise the payment to the minimum wage.

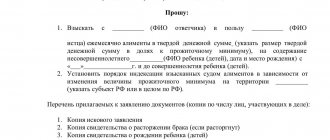

A sample statement of claim for the collection of alimony in a fixed amount can be downloaded here

Minimum size

The law does not establish the exact amount of financial support payments for minors or disabled relatives. The parties can determine the amount independently and secure it in a notarial agreement.

An agreement is a document concluded between:

- parents of a minor;

- alimony payer and a disabled relative or his guardian.

A prerequisite is that the document must be certified by a notary. The terms of the document cannot include additional terms. For example, the procedure for communicating with a minor. The agreement regulates exclusively the financial side of the relationship between the alimony obligee and the recipient of funds.

The amount of payment for the child cannot be less than the payment that the court would assign as a percentage. The restriction was established to protect the property interests of children.

Important! The minimum amount for other categories of relatives is not established and is considered individually. The person wishing to receive the payment and the payer independently determine the amount.

In court, a citizen must prove that he needs the amount to meet his needs. Despite the fact that you either don’t have your own income or they don’t cover the necessary expenses. The court will not take into account the need to purchase luxury goods and other items that are not vital. This quality takes into account payment for utilities, clothing, shoes, food, medicine, rehabilitation equipment, treatment and other vital items.

The court calculates the amount of payment based on the total amount of expenses minus his personal income. A large amount can be established solely at the initiative of the payer.

If a citizen does not have an official place of employment without a good reason, the court sets the amount of payment in the amount of the minimum wage. Lack of work is not a reason to cancel the payment. Moreover, the court accepts reluctance to obtain official employment as a sign of malicious evasion.

Maximum size

The law does not limit the payer in establishing the amount for the maintenance of a minor or disabled relative. Establishing the amount of the crown minimum wage is the only limitation. In this case, the amount can be either 3 or 5 minimum wages, at the discretion of the alimony payer.

In the case of measuring the financial situation of the payer, the citizen has the right to go to court to adjust the amount of payment.

Child support for less than a month

How to calculate alimony if we are talking about less than a month? When calculating the amount of alimony, the court is guided by the type and form of payments. This means that the payment of alimony in shares is tied directly to the periods of salary payment, while the fixed amounts of alimony paid directly depend on fluctuations in the cost of living. At the same time, a new level of living wage is established every quarter, that is, once a season. In this situation, it is quite reasonable to ask how to calculate alimony payments if the payer does not fulfill his obligations in good faith.

The law takes the fixed date specified in the writ of execution as the start date for withholding payments. Since the accounting department can calculate alimony payments for less than a full month, any date can be set. At the same time, the choice of calculation option is not fixed by law, so calculations can be performed both on calendar and on working days. In practice, the first option is more often used, in which payments are withheld from wages, vacation pay, as well as sick leave and other payments.

This is also important to know:

Certificate of alimony from your place of work

The calculation is made as follows: the actual salary is divided by the total number of calendar days of the month and multiplied by the number of days starting from the date specified in the writ of execution.

Example

An employee of one of the organizations, Nikolai, must pay the assigned amount of alimony in favor of his minor daughter by a maximum of July 16. Let's make a calculation for this partial month:

- Nikolai’s net income is 45 thousand rubles. After deducting personal income tax (13%) - 39.15 thousand rubles;

- for 1 calendar day Nikolai receives 1305 rubles (with a calendar month equal to 30 days);

- the number of days in an incomplete month is 16 (from July 16 to July 31);

- calculation of income for this period is 1305 × 16 = 20880 rubles.

- calculation of the amount of alimony in the amount of 25% of the amount of 20880 for one child is 5220 rubles.

When considering the assignment of alimony in a fixed amount of money, their calculation is even simpler. To do this, you just need to divide the amount of the cost of living in a particular region by the number of days in the current month, and multiply the resulting value by the number of calendar days calculated from the specified date.

How is alimony calculated in a fixed amount?

If the parties cannot reach an amicable agreement, the amount of payment will be determined by the court. To do this, you must submit an application for alimony in a fixed amount, a sample of which is presented below.

The court calculates the amount of payment based on the specific situation. The following circumstances are taken into account:

- the income level of the parent with whom the minor lives, or the income level of the relative who requires payment;

- the level of income of the citizen from whom funds are collected;

- the minimum wage established in the region for a certain category of citizens;

- whether the recipient of funds requires additional support for medications, rehabilitation and other expenses above the minimum amount.

Important! In this case, the established amount is subject to annual indexation depending on the increase in the minimum wage.

What amount of fixed alimony payments should be indicated in the claim?

How to file a claim for alimony and what amount to indicate there? Since the amount of alimony payments in a fixed value directly depends on the level of the subsistence minimum, any amount can be indicated in the claim, but it must necessarily be related to this value, that is:

- 1 subsistence level or 9,000 rubles;

- 0.5 times the cost of living or 4,500 rubles;

- 1.5 times the cost of living or 13,500 rubles.

This is also important to know:

Average Russian wages and calculation of alimony: how it affects, features of calculation, examples

All indicated values are given as an example, since the cost of living changes quarterly, and can be set both for the country as a whole and for each individual region.

Most lawyers believe that the claim must indicate an amount slightly higher than that which can be satisfied by the court. At the same time, experts are guided by the idea that the court may slightly reduce the requested amount.

How to apply for alimony in a fixed amount?

Let's look at how to write a sample application for alimony in a fixed amount. You must first decide on the procedure for collecting financial support.

The claimant of financial security must act as follows:

- calculate the amount he needs to meet his needs;

- collect documents that confirm the recoverer’s expenses;

- prepare information that explains the additional costs of the citizen’s needs;

- draw up an application for a fixed amount of alimony (sample below);

- submit documents to court;

- get a solution;

- send it for enforcement to the FSSP.

What to do if the writ of execution is lost

The writ of execution is issued in a single copy. How to obtain alimony if such a document is lost? It is necessary to apply to the court with a request to issue a duplicate of it. The application must be accompanied by a document confirming the loss of the writ of execution: for example, a certificate from a bailiff or from the debtor’s place of work. The issue of issuing a duplicate is resolved in a court hearing, in which both the recipient of alimony and the payer must be present. If the demands are found to be justified, the court makes a ruling and issues a duplicate of the writ of execution to the claimant.

Documentation

A sample statement of claim for alimony in a fixed sum of money is drawn up on the basis of a certain list of documents. After which, each document must be copied, certified with the applicant’s signature, transcript and the inscription: “Copy is correct.”

The application must include the following information:

- copies of statements for all parties to the process (when applying to a magistrate’s court - 2 copies, when applying to a city or district court - 3 copies);

- personal document of the applicant;

- information about the birth of a minor (if funds are collected by the child’s legal representative);

- information about family ties between the parties (if funds are collected for the maintenance of a disabled relative);

- information that the defendant was actually raised by the claimant;

- divorce document;

- information about the health status of the disabled claimant;

- information about the pregnancy of the spouse/ex-wife;

- information about being on leave to care for a minor under 3 years of age;

- data on the income of the recipient and the alimony obligee;

- data on the income of the second parent (if funds are collected for the maintenance of a minor child);

- other information that will confirm the applicant’s position.

Important! During the trial, the court has the right to request additional information.

Arbitrage practice

As for judicial practice in cases of alimony in a fixed amount, as a rule, the court takes into account the interests of both parties to the dispute. Indicative in this regard is case No. 2-2634/15-33-2556/15, considered by the Novgorod District Court, and the appeal decision 33-2094/2017 adopted by the Novgorod Regional Court.

The essence of the issue and the initial consideration of the case

T.A wrote a statement to the magistrate’s court demanding a change in the amount of alimony payments collected for two children under 18 years of age, in shares of their father’s income. She asked to establish obligations in a fixed amount, to award the defendant O.R. payment for moral damages and debts for past periods.

As grounds T.A. indicated the following.

- Since May 2013, the defendant has been awarded alimony in the form of 1/3 of the income once a month.

- O.R, working as the head of the enterprise, deliberately understates the amount of real income. He periodically changes his place of residence, is engaged in home improvement and goes on vacation abroad.

- The plaintiff does not have the opportunity to adequately support her children and take care of their proper development. Her only income is an income of 7,000 rubles.

Based on the facts presented, T.A. asked for maintenance for the children in the amount of 15,210 rubles, which was equal to two subsistence minimums per child in the third quarter. 2014 in the Novgorod region, to collect debt and moral damages of 100,000 rubles.

The magistrate referred the case to the district court. A bailiff was involved in the proceedings. The court satisfied only part of the demands. The amount of alimony was changed to a fixed amount of 10,000 rubles, which amounted to 1.06 of the subsistence level for the first quarter. 2015, with its subsequent indexing. The remaining demands were not satisfied. A state duty of 150 rubles was collected from the defendant.

applications to the magistrate's court with a request to change the amount of alimony payments.

Defendant's appeal

The appeal was filed by the defendant. He did not agree with the appointment of alimony in a fixed amount due to the fact that the court, in his opinion, did not fully study his financial situation. O.R. focused on the fact that he has a stable income, from which he is required to pay alimony in shares.

The Court of Appeal, having reviewed the case, came to the following conclusions. Evidence that O.R. has an unstable income, earnings in kind or in foreign currency are not available on file. But at the same time, during the hearing, from the explanations given by T.A., it was established that before filing the application for alimony, the defendant paid money for the children every month - 10,000 rubles. From the information provided by the bailiff, it became known that O.R. paid funds for the maintenance of his son and daughter, which are calculated in amounts from 5,000 to 21,000 rubles.

The ex-husband did not refute this information. At the same time, O.R. no proof of earnings or other income was provided. Consequently, the court made a lawful decision based on the fact that the father receives additional amounts that cannot be determined, and also on the fact that as a result of the assignment of alimony in the amount of 10,000 rubles. the standard of living of children remained the same.

Drawing up an application for the collection of alimony

A sample statement of claim for the collection of alimony in a fixed amount is based on the norms of the Civil Law Code. The general view of the document includes:

- full name of the court to which the application is being filed (magistrate or district);

- complete information about the applicant (full name, registration and temporary registration address, telephone number);

- similar data on the alimony payer;

- Title of the document;

- information about the grounds for assigning payments (family ties, actual upbringing);

- the amount of the desired payment;

- justification for the specified amount;

- reference to legislation;

- claim;

- list of attached information;

- date and signature of the applicant.

The claimant does not necessarily have to draw up the document himself; if necessary, a lawyer can be involved.

Grounds for returning or refusing to accept an application

Having submitted an application for alimony in a fixed amount (sample above), it is possible to get it back without consideration. The law provides reasons for returning a document:

- the applicant did not sign the document;

- the application was signed by a citizen who did not have the right to sign;

- the document is submitted to the court by a person who has no legal grounds;

- the matter is being considered in another court;

- the applicant independently revokes the document;

- the applicant is legally incompetent;

- the person has no right to receive money from the defendant.

If a person does not have the right to collect financial security due to incapacity or cannot actually send a document to the court, it is necessary to involve a trustee or legal representative.

A citizen who submits a document not on his own behalf must have a power of attorney certified by a notary. The legal representative provides a passport and documents that confirm his authority:

- birth certificate of the minor (parent);

- document establishing paternity (father);

- information about adoption (adoptive parents);

- order appointing a guardian;

- foster parent's certificate.

Submission and consideration of an application

Having drawn up an application based on a sample claim for alimony in a fixed amount, the citizen submits it to the court. The document is accepted for consideration within 5 days from the date of registration of the claim.

The Magistrate's Court will consider the application within 1 month, without inviting the parties to the trial. The district or city court will consider the issue of alimony for as long as it takes for the trial. A decision on the award of payment will not be made until a decision has been made on all claims in the statement of claim. The process can last a year or more.

The court decision comes into force only 1 month after its adoption. This time is given to the defendant to appeal the decision.

Collection of financial support in the form of a fixed amount is a popular option when assigning payments to disabled relatives. However, when withholding funds for minor children, funds are more often assigned based on a percentage of the income of the alimony payer. The law does not specify the exact amount of payment. The only limitation is that it is tied to the minimum wage. At the same time, the payment does not have to be equal to the minimum wage.