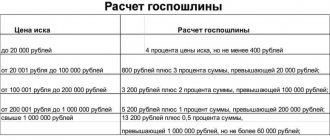

Often in practice we encounter the following question: how to divide a joint and several debt in court? Theoretically, it is possible to go to court with a statement of claim for the division of a joint and several debt. Such an application may be considered by a magistrate or district court, depending on the amount of debt.

In practice, the court refuses such claims. The very essence of joint and several debt is that the creditor has the right to collect the debt from any of the debtors. It doesn’t matter to him who fulfills the obligation. The court, guided by the law, too.

General provisions on the division of debts

From a legal point of view, the term “property” in relation to family law in a broad sense includes:

- asset – directly movable and immovable property, as well as property rights (for example, the right to demand payment for services rendered or repayment of a debt);

- liability – property obligations or debts.

Taking this into account, the basic rule for the division of debts looks quite logical: debts are distributed between the ex-husband and wife in proportion to their shares in the common property. Most often they are divided equally.

The key issue in the division of debt obligations of spouses is the determination of their shares in the common property. As a general rule, the shares of husband and wife are assumed to be equal.

Deviation from this principle is possible if:

- the spouses provided otherwise in the contract;

- the court, in the interests of spouses or children, considered it necessary to distribute the shares differently;

- one of the spouses did not have a regular income for an unjustifiable reason and through his actions contributed to the waste of common property.

Thus, if after a divorce the jointly acquired property was divided in half between the spouses, then all debts under agreements (no matter with the bank or with a neighbor) are divided 50/50. If the spouse’s share in the property after the divorce was 1/3, and the spouse’s 2/3, then the former common debt was distributed in exactly the same shares.

There are 2 ways to divide family debt obligations:

- by means of a contract;

- by filing a lawsuit.

The contractual method of dividing debts, as well as other features of the procedure for dividing obligations, are described in detail in a separate publication.

What should I do?

From the point of view of a competent lawyer, it is necessary to act in a slightly different way. A joint and several debt, as noted above, can be paid by any debtor, but this does not mean that claims from another debtor who has not fulfilled the obligation are completely removed. This is wrong.

The debtor, who has fulfilled the obligation in full, has the right of recourse against the second debtor, who considered that the bribes were “smooth” from him. For example, the total amount of debt is 1 million rubles. One of the debtors, based on a court decision, pays this amount to the creditor. After fulfilling the obligation, this debtor may file a claim against another debtor in the amount of 500,000 rubles. Thus, the division of joint and several debt is not permitted by law. But what is the right of recourse if not division of debt?! Precisely a section, but not in “one action”, but in several.

Lawsuit as a way to divide debt

If it is not possible to resolve the issue peacefully and an agreement between the spouses is not reached, the court comes to the rescue. The judicial procedure for dividing debt obligations is more complex and lengthy than a peaceful resolution of the issue.

In order for a debt division case to be considered by a judge, you need to draw up a statement of claim and submit it to the court authorized to consider it.

These include:

- court of general jurisdiction (not arbitration or military);

- with a property value of up to 50,000 rubles. – the case will be considered by a magistrate;

- if the value of the property is greater - a district or city court.

The issue of territorial jurisdiction is resolved in practice ambiguously.

A claim only for division of debt will need to be filed at the place of registration of the defendant and nowhere else. Difficulties arise if, together with the division of debt, demands are made for the division of real estate.

The fact is that the legislation refers disputes about the right to real estate to the competence of the court of the district where the object is located.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Some presidiums of regional courts in different regions indicated that a dispute about the division of property is not a dispute about law, and therefore should be considered at the place of residence of the defendant.

However, some courts still take the position of considering a claim for the division of real estate at its location, citing the fact that real estate will be recognized as joint property only during the trial, and until that moment the statement of claim is a dispute about the right.

Since the order of a higher court is not binding on all courts in the country, in practice it is better to adhere to the rule of exclusive jurisdiction over real estate. If the claim is returned due to lack of jurisdiction, file it with a clear conscience at the defendant’s place of residence.

So, which court should the claim be submitted to?

- at the place of residence of the defendant - the spouse, if only the debt is divided;

- at the location of the real estate subject to division simultaneously with the debt.

Contents of the claim

The content of the application for the division of debt obligations must comply with the general standards for such documents. The requirements for the content of the claim are specified in Art. 131-132 of the Code of Civil Procedure of the Russian Federation and are strictly checked by judges at the stage of accepting a claim. In terms of substantiating the position and describing the evidence, it is better to consult a lawyer in advance.

The plaintiff must include in the content of the statement of claim:

- name of the court authorized to consider the case, its address;

- the full name of the plaintiff, his address, contacts, details of his representative (if the case is being conducted by a lawyer or other person by proxy);

- the full name of the defendant, his actual address, possible contact details;

- third party - creditor, as well as his address and other data;

- circumstances preceding the dispute: information about the conclusion and dissolution of the marriage, reference to the impossibility of dividing property by agreement, dates of the conclusion of the loan agreement, etc.,

- requirements for division of property/debts and their legal and factual basis;

- cost of claim;

- attachments, date, signature.

When preparing a claim for debt division, please note:

- a demand for division of debt can be submitted together with a demand for divorce;

- spouses can divide the debt at any time after the divorce;

In relation to the judicial procedure for dividing the debt, the statute of limitations applies - 3 years from the time the spouse learned of the violation of his rights. In this case, the starting date of the period will not be considered the moment of divorce, but the second spouse’s refusal of voluntary separation recorded in any way.

The responsibility to prove that the borrowed funds were spent on the needs of the family or the occurrence of debt obligations as a result of joint actions of the spouses rests solely with the spouse who seeks recognition of the debt as joint and its division (see review of the judicial practice of the Supreme Court).

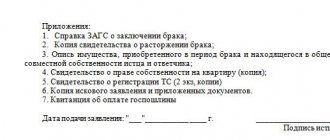

Attachments to the claim

The claim must be accompanied by:

- a copy of the claim for the defendant, third parties (if any);

- original receipt for state payment. duties;

- copies of marriage certificates, divorce certificates, and, if available, birth certificates;

- power of attorney (when filing a claim by a representative);

- documents to support the claims: the agreement on the basis of which the debt arose; certificates of debt repayment and its balance.

All documents are attached in copies, except for the receipt of payment of the fee. It is strongly recommended that the originals be provided to the court for review during the trial.

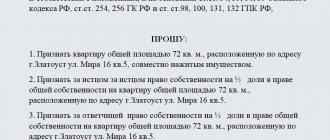

Sample statement of claim

Below is a sample claim for division of spouses' debt using the example of debt to a bank. Depending on the circumstances of the debt, the content of the statement of claim may vary significantly. We recommend that you seek advice from a lawyer before filing a statement of claim.

Below you can download the posted sample to prepare your statement of claim.

Important! When drawing up a document in violation of the requirements of Art. 131-132 of the Code of Civil Procedure of the Russian Federation, the court can either return the claim in the cases specified in the Code of Civil Procedure of the Russian Federation or give time to the applicant to eliminate the shortcomings. If the deficiencies are not eliminated within the specified time frame, the judge will return the claim to the applicant, which does not prevent the plaintiff from re-submitting the documents after bringing them into compliance.

The Supreme Court was considering whether the loan obligations of one of the former spouses could be recognized as their common debt

The Supreme Court, in its Ruling in Case No. 18-KG21-56-K4 dated August 17, decided whether it is possible, within the framework of civil law relations, to involve an ex-wife as a co-borrower on the debt of the ex-spouse.

Since June 24, 2011, Sergei Fomenko and Evgenia Ragulina have been married. On November 13, 2011, Fomenko borrowed 650 thousand rubles from his wife’s parents. and provided a receipt. The return period was determined by the moment of demand. On January 20, 2012, the spouses acquired common shared ownership (1/2 share each) of a residential building and a plot of land. The price of real estate was determined in the amount of 1.1 million rubles, of which 400 thousand rubles. were paid to the seller at the expense of the buyers’ personal funds, and 700 thousand rubles. - due to a mortgage.

On November 26, 2021, the couple divorced. On June 30, 2021, the mother of Sergei Fomenko’s ex-wife, Valentina Ragulina, sent him a demand for repayment of the debt, as well as interest for using the loan in the amount of almost 330 thousand rubles.

Since Sergei Fomenko did not return the money, Valentina Ragulina appealed to the Pavlovsky District Court of the Krasnodar Territory. She asked to collect the entire amount of the debt, interest determined as of January 31, 2021 in the amount of about 350 thousand rubles; interest on the loan from February 2021 until the actual fulfillment of the obligation; interest for violation of the loan repayment period, determined as of January 31, 2021 in the amount of more than 41 thousand rubles; interest on the use of other people's funds from February 1, 2021 until the actual fulfillment of the obligation to repay the debt.

In turn, Sergei Fomenko filed a counterclaim against Evgenia and Valentina Ragulin, pointing out that the debt arose on the initiative of both former spouses. He noted that the money was spent on the needs of the family, which is confirmed by the preliminary agreement for the purchase and sale of a land plot with a house dated November 14, 2011. The man asked to apply the provisions of the Family Code to the existing legal relations and recognize the debt as the common debt of the former spouses, to divide this debt in equal shares between him and Evgenia Ragulina, recognize the loan receipt as invalid to the extent that the borrower is Sergei Fomenko alone, and also apply Art. 333 of the Civil Code - taking into account his financial situation and the unreasonably inflated, in his opinion, calculations of Valentina Ragulina.

The court partially satisfied Valentina Ragulina's claims. He collected 325 thousand rubles from Sergei Fomenko to reimburse the principal debt on the receipt; interest under the loan agreement in the amount of about 175 thousand rubles; interest on the loan from February 1, 2021 until the day of actual fulfillment of the obligation; interest for violation of the loan repayment period in the amount of 20 thousand rubles. and interest for the use of other people's money from February 1, 2021 until the actual fulfillment of the obligation. At the same time, the court declared the receipt invalid insofar as the debt was assigned exclusively to Sergei Fomenko, recognizing it as the common debt of the former spouses in equal shares. Fomenko's statement on the application of Art. 333 of the Civil Code the court left without satisfaction. The appeal and cassation left the judicial act unchanged.

Valentina Ragulina filed a cassation appeal to the Supreme Court. The Supreme Court, having studied the materials, noted that the court considered the significant circumstance for the case to be the purposes for which the defendant borrowed money from the plaintiff and for what it was subsequently spent. Since, according to the court, this money was spent on the family needs of Sergei Fomenko and his wife, then, according to the logic of ordinary family relations between parents and children, the plaintiff transferred the money under the loan agreement to the defendant, acting primarily in the interests of her own daughter. Meanwhile, the Supreme Court noted, the legal relations that arose between Valentina Ragulina and Sergei Fomenko are civil law and are not regulated by family law.

From the case materials it follows that Valentina Ragulina’s claim is motivated by reference to Art. 809, 810, 395 Civil Code. She asked to recover from the defendant the amount of the debt, interest on it, as well as interest for violating the loan repayment deadline due to Sergei Fomenko’s improper performance of his civil obligations. The Supreme Court referred to paragraph 1 of Art. 807, paragraph 2 of Art. 808 and paragraph 1 of Art. 810 of the Civil Code and noted that, taking into account the above rules of law, a legally significant circumstance was the clarification by the court of the issue related to the conditions for receiving and returning money under the loan agreement concluded between the lenders - the parents of the ex-wife - and the borrower - Sergei Fomenko.

The Supreme Court indicated that from the contents of the receipt signed by Sergei Fomenko dated November 13, 2011, it follows that it was he who borrowed the money, obliging to return it at the first request of the lender. There are no references in the receipt to the fact that the money was taken for the common needs of the spouses, nor to any indication that Evgenia Ragulina accepted the obligation to return it.

The Supreme Court noted that the provisions of paragraph 1 of Art. 39 of the Family Code that when dividing the common property of spouses, common debts and rights of claim for obligations arising in the interests of the family are taken into account, does not indicate the existence of legal grounds for collecting from the other spouse in favor of the lender the unpaid debt under such an agreement, as well as reducing the borrower's liability to the lender by the amount of the marital debt.

“Obligations arising during the marriage under loan agreements, the fulfillment of which after the termination of the marriage lies with one of the former spouses, can be compensated to the spouse by transferring to him the ownership of the corresponding part of the property in excess of the share in the jointly acquired property due by law. In the absence of such property, the borrower spouse has the right to demand compensation from the second spouse for the corresponding share of the payments actually made by him under the agreement,” the Supreme Court indicated.

Otherwise, the Court considered, it would contradict the provisions of paragraph 3 of Art. 39 of the Family Code and entailed obviously unfavorable consequences for the other spouse in terms of the deadline for fulfilling the monetary obligation to the lender, as well as would entail adverse consequences for the lender, counting on the fulfillment of the obligation to repay the received loan amount on time and in the manner provided for by the loan agreement (Clause 1 of Article 810 of the Civil Code).

By declaring the receipt half invalid, that is, in essence, making a decision to recognize the loan agreement as partially invalid, the court, in violation of the requirements of Art. 198 of the Civil Code did not indicate in the decision the legal norms with which the said transaction contradicts and on the basis of which, in the opinion of the court, it can be declared invalid. Moreover, the court’s decision to exempt the defendant from repaying half the amount of the debt and interest on it actually means transferring part of the debt to another person without the consent of the creditor, which directly contradicts paragraph 2 of Art. 391 of the Civil Code, noted the Supreme Court.

In addition, the court did not indicate in the decision whether the disputed receipt is invalid from the date of its signing (as void) or from the date of its recognition as such by the court (as voidable). In this regard, the courts left Valentina Ragulina’s arguments about missing the statute of limitations on Sergei Fomenko’s request to invalidate the loan agreement he disputed, the application of which she declared during the consideration of the case, without investigation and legal assessment, although the correct resolution depended on clarification of this circumstance the dispute that arose, the Supreme Court emphasized. He overturned the decisions of appeal and cassation and sent the case for a new appeal hearing to the Krasnodar Regional Court.

Lawyer, managing partner of the Moscow law firm Lebedeva-Romanova and Partners Elena Lebedeva-Romanova pointed out that Sergei Fomenko, defending his rights, did not need to take the path of declaring the civil law loan agreement invalid, especially since there were no grounds for such a requirement was not presented. To protect his right as a borrower spouse, he could involve his ex-wife as a co-defendant in the initial claim, justifying his position with relevant evidence. Or Sergei Fomenko should have turned to his ex-wife with an independent claim to recover property or funds as compensation under a loan agreement concluded during the marriage in the interests of the family.

The Supreme Court's determination in no way contradicts the imperative norms of civil and family law on the fulfillment of assumed obligations and on the return of borrowed funds (clause 1 of Article 807 of the Civil Code) and on the legal regime of joint property of spouses (clause 1 of Article 33 of the Civil Code), oh,” noted Elena Lebedeva-Romanova.

Lawyer of the Leningrad Region Administration Stanislav Izosimov considered that the Supreme Court eliminated the obvious mistake of the lower courts. “It consisted of a complete lack of understanding of the difference between the creditor-debtor relationship, let’s call it “external,” and the relationship between spouses regarding the common debt, let’s call it “internal.” The courts were unable to understand that the spouse in civil proceedings acts as an independent subject of law. If he enters into a loan agreement and receives money under it, then he becomes an obligated person for the lender. Even if the lender knows that he is providing money for the common needs of the spouses, this does not make the borrower’s spouse a co-borrower if he is not named as such in the agreement, as stated in the ruling of the RF Armed Forces,” the lawyer pointed out.

The relationship between the spouses regarding the common debt does not concern the “external” obligation. If the borrower spouse pays the total debt to the creditor, then he can distribute it as part of the division of marital property or recover compensation from the former spouse in the amount of half of the money paid. “The conclusion of the lower courts about the partial invalidity of the loan agreement is completely absurd. As can be seen from the ruling of the Supreme Court, they were unable to cite the rules of law on the basis of which the contract was declared invalid,” summarized Stanislav Izosimov.

Olga Istomina, a lawyer at the SanctaLex legal group, also considered that the Supreme Court rightfully assessed the legal nature of the loan agreement between two individuals, indicating that it is governed exclusively by civil law, without mixing civil and family disputes.

“There was no reference to the spouse’s obligations or mention of joint responsibility in the receipt. The fact that the money was borrowed to purchase property in the joint shared ownership of the spouses (which does not follow from the receipt) would be of significant importance in the division of jointly acquired property by the spouses. And, as the Supreme Court of the Russian Federation rightly pointed out, this does not deprive the borrower spouse of the right to apply to the ex-spouse for the transfer of part of the property or compensation of part of the funds after the execution of the court decision,” noted Olga Istomina.

She added that when considering disputes about the division of property between spouses during or after the dissolution of a marriage, the courts take into account and clarify in detail the purposes of loans and credits of one of the spouses and the circumstances of their use, and only if it is established that the borrowed funds were spent specifically on the acquisition of a joint property. property or for other joint family needs, the courts proportionately divide the debt between the spouses.

Documents attached to the claim

The application must have documentary evidence, so you need to attach:

- Copies of the claim for all participants in the process.

- Original receipt for payment of state duty.

- A copy of the plaintiff's passport.

- A copy of the marriage certificate, divorce certificate. You must have the originals of these documents with you.

- If there are children, then copies of their birth certificates.

- Copies of loan agreements, statements, and other documents that confirm debt obligations.

- Copies of documents confirming that the loan money is spent on the needs of the family or one of the spouses.

- The written consent of the plaintiff for the defendant to take out this loan.

- If the process is managed by a representative, then the power of attorney and his passport are only the originals of these documents.

How to draw up a claim correctly?

First you need to decide in which court to file a claim:

- If the price of the statement of claim does not exceed 50,000 rubles, then it is submitted to the magistrate’s court.

- If the value of the claim is more than 50,000 rubles, then it is filed in the district court.

The application must be submitted at the defendant’s place of residence.

The statement of claim must include the following information:

- Name and address of the court. For example: Leninsky District Court of the city of Krasnodar.

- Full name, residential address and contact details of the plaintiff. Similar information about the defendant.

- Information about third parties involved in the trial: name, full name, contact information and address.

- Document title: “Statement of Claim for Division of Marital Debt Obligations.”

- A complete, chronological, concise description of the essence of the matter: when the marriage was registered, in connection with which the debt obligations arose, the amount, the procedure for repayment, where the loan was spent (in whole or in part), the balance of the debt at the time of filing the claim. This must be documented, otherwise the court will not take it into account.

- Argumentation of the claims: in what order should the debts be divided between the spouses. This point must be confirmed by references to legislative acts.

- The heading “Please” continue to list the claims for the division of debts between spouses.

- List of documents that are attached to the claim.

- Date and signature.

If the statement of claim does not comply with the procedural rules in accordance with Articles 131-132 of the Civil Code of the Russian Federation, then the court office will not accept it.