How much does it cost to divide property by agreement?

If the issue is resolved peacefully by mutual consent of the spouses (former spouses) and there is no dispute, a written agreement is drawn up, which must be certified by a notary (clause 2, article 38 of the Family Code). The state duty for the division of property of spouses is paid on the basis of the Tax Code (clause 5 of clause 1 of Article 333.24) in the following amount:

- 0.5% of the amount specified in the contract;

- minimum size - 300 rubles;

- the maximum amount is 20,000 rubles.

The state duty for the division of property of spouses in the amount of 20 thousand rubles (maximum tariff) corresponds to the contract price of 4 million rubles. This is a fee for performing notarial acts (tariff). In addition to this, you must pay for legal and technical services. Their cost is set at the level of the subject of the federation, but cannot exceed the maximum amounts calculated on the basis of the Methodological Recommendations of the Federal Tax Service (approved on February 28, 2016). The fee for technical work is set annually and published on the website of the regional notary chamber.

So, for example, in Moscow, the state duty for the division of property is 8,000 rubles, increases by 500 rubles for each property specified in the contract, starting from the 4th, and is limited to a maximum value of 10,500 rubles.

Thus, the state duty for dividing property in the form of an apartment, the cadastral value of which is 12 million rubles, will ultimately amount to 28,000 rubles. Money is transferred to the notary's account by bank transfer, or paid directly at the office upon receipt of a receipt. In addition, the fare amount is indicated on the certified document.

If there were no appeals to court

Judicial feuds during divorce, especially those related to property disputes, require litigants to waste a lot of time and nerves, which the spouses could save if they turned to a notary and amicably agreed on the division of assets.

What are the advantages of a notarial agreement that formalizes the division of spouses’ assets?

- It is incomparably faster in time than resolving a dispute in court.

- It will cost the husband and wife less than paying court fees and lawyer fees.

- The procedure is much more comfortable than legal feuds, in which ex-spouses often cannot restrain accumulated negative emotions.

How is a notarial agreement concluded? Future parties to the agreement make an appointment with the notary and prepare a package of documents in advance, which includes the following:

- Passports of the parties to the agreement;

- Official papers with which you can verify the existence of ownership of property;

- Purchase and sale agreement or other title documents for real estate;

- The appraiser's conclusion regarding expensive items or items of value that can only be understood by specialists (antiques, collectible weapons);

- Certificate of divorce or marriage.

This last point is very important because there is a myth that after a divorce it is impossible to legally enter into a notarial agreement. This is wrong. Family law allows former spouses to settle property relations within 3 years from the date of annulment.

During the meeting, at which, according to legal requirements, only the notary and the parties to the agreement must be present, information about the spouses and their property, as well as the time and place of concluding the agreement, are written into the agreement.

The fees charged by notaries for certifying such agreements are shown in the table below.

| Valuation of property in the agreement, rub. | Notary fee |

| Up to 1000 000 | 0.5%, however, not less than 300 rubles. |

| From 1000001 to 10000 000 | 0.3% of the price, above 1,000,000 rubles, plus 5,000 rubles. |

| Over 10,000,000 | 0.15% of the price, above 10,000,000 rubles, plus 32,000 rubles. |

Also keep in mind that notaries additionally charge money from their clients for so-called “technical and legal services,” which on average cost about four thousand rubles.

Let's calculate the notary fee for certifying an agreement using a specific example. Let us assume that the contract price is 3,000,000 rubles. What will the tariff be? It is clear that 3,000,000 rubles. included in the range from 1000001 to 10000000 rubles. and will be taken into account 0.3% of the price above 1,000,000 rubles, i.e. We consider 0.3% of 2,000,000 (3 million minus 1 million) rubles. and we get 6000 rubles. To this number we add 5000 rubles.

As a result, the notary fee for this service will be equal to 11,000 rubles.

The amount of duty for dividing the property of spouses in court

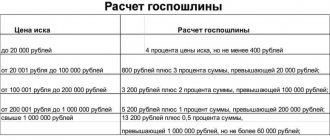

If there are disagreements between husband and wife, jointly acquired property is usually divided through the court. The state fee when filing a claim for the division of property of spouses also depends on the amount of its assessment, and is established by Art. 333.19, 333.20 of the Tax Code of the Russian Federation. If an application to the court is filed for the first time, its amount is determined depending on the cost of the claim:

- 4% (at least 400 rubles) - with an assessment of up to 20 thousand rubles;

- 800 rub. + 3% of the amount over 20 thousand rubles. (from 20,001 to 100,000 rubles);

- RUB 3,200 + 2% of the amount over 100 thousand rubles. (from 100,001 to 200,000 rubles);

- RUB 5,200 + 1% of the amount over 200 thousand rubles. (from 200,001 to 1,000,000 rubles);

- RUB 13,200 + 0.5% of the amount over 1 million rubles. (over RUB 1,000,000).

The maximum amount of the fee for dividing the property of spouses in court is limited to the amount of 60,000 rubles. In the event that a re-examination of an appeal regarding previously divided property is carried out, it is paid in the amount of 300 rubles (Article 333.20 of the Tax Code). If, during the consideration of the case by the court, the parties entered into a settlement agreement, nothing additional is paid, but the amount previously paid is not returned.

Expenses for conducting examinations and assessments

During the trial on the division of property, one of the parties may declare its disagreement with the specified value of the disputed property. In this case, at the request of the dissenting party (and at its expense), the court appoints an independent judicial appraisal examination designed to establish the real market value of the disputed property.

It is possible to evaluate property before going to court, but it is pointless.

Firstly, it costs a lot of money. Secondly, during the trial, if the defendant disagrees, a re-examination of the value will be ordered, but no one will return the money for the first one if the results of the initial and re-evaluation differ.

Lawyers advise indicating for any property either the purchase price or the approximate market price, determined based on advertisements in newspapers or the Internet. If the defendant does not agree, he can apply for an appraisal examination.

Expenses incurred during the court hearing for expert examinations are subject to distribution between the parties in proportion to the property awarded to them.

Approximate prices for property valuation:

- Household appliances, furniture – from 2000 rubles/item;

- Vehicles – from 4000 rubles/unit;

- Apartment, residential building, commercial real estate - from 5,000 rubles.

The above figures are purely approximate and directly depend on the region, the complexity of the task and a host of other factors. Check the cost of appraising a particular property directly with organizations that carry out appraisal activities in your region.

In addition to the assessment at the court hearing, a number of examinations may also be required. Most often, this need arises in relation to real estate that needs to be divided in kind.

In relation to real estate objects the following may be assigned:

- Construction and technical expertise;

- Land management examination;

- Expertise to determine the readiness of the facility (for unfinished construction).

All legal costs incurred are subject to proportional distribution between the parties based on the value of the awarded property.

IMPORTANT: not all expenses will be subject to recovery from the other side or taken into account in their total distribution, but only those that turn out to be objectively necessary. If the plaintiff filed a claim, to which an assessment of the apartment was attached, and the defendant insisted on a re-assessment, as a result of which the cost of the apartment did not change, then his expenses will not be attributed to the plaintiff.

Calculation of state duty when dividing property of spouses

The plaintiff must calculate the amount of the state duty for the division of property independently on the basis of available assessment documents, and pay it before filing an application with the court. The supporting receipt is included in the list of required attachments to the claim.

Calculation example.

The spouses dissolve the marriage in court, and at the same time one of them (the wife) applies to divide the apartment (6,000,000 rubles) and the owned dacha plot (1,800,000 rubles). If she claims half, the calculation of the state duty when dividing the property of the spouses will look like this.

Claim amount:

- 6,000,000 × 1/2 = 3,000,000 rubles;

- 1,800,000 × 1/2 = 900,000 rubles.

Then:

- 13,200 + ((3,000,000 - 1,000,001) × 0.005) = 13,200 + 9,999.99 = 23,199.99 rub.

- 5,200 + ((900,000 – 200,001) × 0.01) = 5,200 + 6,999.99 = RUB 12,199.99

In total, the total amount of payment of the state duty when filing a claim for the division of property of the spouses in this case will be 29,599.99 rubles.

The procedure for paying state fees when filing a claim for division of property of spouses

An application to the court can be filed at any time: during the period of cohabitation, during divorce proceedings, after the dissolution of the marriage (no later than 3 years). As a general rule, it is filed at the defendant’s place of residence. However, if it is filed simultaneously with an application for divorce, or a claim for alimony, you can contact the district court at your registered address. Issues regarding the division of real estate are resolved only in court at its location.

The law provides for a deferment of payment of the state duty on the division of jointly acquired property of spouses during a divorce at the request of the plaintiff, or its payment in installments (installment payment). To do this, you need to provide a justification supported by documents. For example, a certificate from the employment center about registration as unemployed, a pension certificate. Based on the results of consideration of the appeal, the court makes a ruling:

- satisfy the request indicating the terms and date of final payment;

- refuse and set a deadline for depositing funds into the account.

Another basis for obtaining a deferment is the fact that the objects are registered in the name of the defendant. For example, the plaintiff may not have information about the value of real estate, since all the documents are in the possession of the spouse. In this case, petitions can be attached to the claim to request evidence and to defer payment of the state duty for the division of property until responses to requests to identify its value are received.

State duty for division: cadastral, and other types of property value

Since the amount of the fee for dividing the property of spouses in court depends on the value of the claim, the question arises: how to evaluate the existing property? This is especially important when it comes to real estate: apartments, houses, land plots. They make up a significant part of the joint property, and their value is high.

The law does not establish strict rules defining the rules of assessment for such cases; it is important that the specified amount is supported by documents. There are three well-known methods for determining the value of real estate.

- Inventory cost. It is confirmed by a BTI certificate, and most often does not reflect the real price of the object. You can often find advice to the plaintiff to represent her specifically in order to reduce the state duty when dividing the jointly acquired property of the spouses during a divorce. However, this is disadvantageous if he expects to receive monetary compensation for his share.

- Cadastral value. You can find it out in Rosreestr by requesting an extract from the State Property Committee. This is a government assessment and is carried out solely for tax purposes. Of course, you can use the cadastral value to calculate the state duty for the purpose of dividing property, but it may differ from the real one, either down or up.

- Market valuation. Conducted upon request and for a fee by an independent expert. This is a licensed specialist, he is responsible for his report before the law. The courts trust this assessment more. It is almost impossible to challenge it, however, if it differs from the cadastral one by more than 30%, a justification must be provided.

Thus, you can use any of the options, and remember that the defendant has the right to file a counterclaim to reduce (increase) the assessment amount, and petition for the appointment of an examination. According to Art. 8 of the Law on Valuation Activities, it is carried out without fail during division at the request of one of the parties.

Collection and refund of state fees when filing a claim for division of property of spouses

The party that wins the court dispute has the right to recover from the other the legal costs, including the state fee paid when dividing the property of the spouses. This issue can be considered within one case if the petition was filed during its consideration. Then the question of distribution of costs is reflected in the court decision.

If the claim is partially satisfied, they will be distributed in proportion to the satisfied claims. However, you can contact the judge after the decision is made, before it enters into legal force. In this case, a ruling will be issued indicating the defendant’s obligation to reimburse the costs of paying the state duty for the division of the spouses’ jointly acquired property during a divorce.

In addition, in some cases, you can return the amount paid in full or in part (Article 333.40 of the Tax Code of the Russian Federation). This is permitted in the following cases:

- the plaintiff refused the appeal and withdrew the application;

- the claim was returned or the proceedings were terminated;

- the application was left without consideration;

- the amount was paid in excess.

The latter situation may arise due to the fact that the state duty for the division of property of the spouses was calculated incorrectly, or the price of the property was reduced during the contestation process.

To receive money, you need to submit an application to the same court where the claim in connection with which the payment was made was heard. Upon receipt of the determination, it is submitted to the tax office at the location of the court. A return application is filled out and payment documents are attached to it. Originals - if the amount is returned in full, copies - if partially.

Application for divorce - how to file correctly.

Any proceeding begins with the preparation of documents. What you will need:

- TIN;

- identification document;

- marriage certificate;

- a document confirming the presence of common young children.

Now let's look at the options for resolving the issue:

- There are no young children, there is no need to divide the property, we mutually came to an agreement.

Upon arrival at the registry office, you will be given an application form (form No. 8), which will be available below for download. All columns, except nationality (filled in optionally), must be completed. Also, the form is accompanied by a passport of each spouse, confirmation of payment of the state fee and a marriage certificate. The termination of the marriage occurs after thirty days. During this month, either party can change their mind and withdraw the application, refusing the divorce;

- One party decided to divorce, there are young children, the other party is disabled or missing (by a court decision), or is in prison for a term of 3 years or more.

In such a case, the application is filled out according to Form No. 9. The procedure is the same as described above, but in addition to the main documents, you must attach confirmation of the person’s incapacity, his disappearance, or a verdict from the court. An example of the form will be attached below and is available for download.

- Divorce is initiated by only one party, the other party avoids it.

Also, divorce on the initiative of one spouse is possible if it has already been decided who and where minor children will be raised, and issues of property and alimony have been resolved voluntarily. The case can be heard in the magistrate’s court if the value of the property is no more than 20 thousand rubles.

The application must contain:

- Full name and place of residence of the spouses;

- where and when they got married;

- the defendant’s consent to the divorce (if the party does not avoid the registry office);

- information about common minor children and the place where they will continue to live;

- a request for divorce with a detailed description of all aspects (reason, alimony, joint property.)

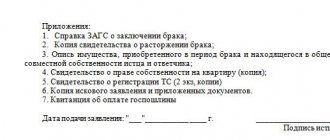

The above application is accompanied by an annex which must contain:

- a document confirming the validity of the union;

- a document confirming the birth of common young children;

- income certificates;

- list of jointly acquired property;

- a copy of the statement of claim and confirmation of payment of the state fee.

Such cases are considered within a month.

Applications of the same type are considered by district and city courts if the spouses have not reached an agreement on the residence of minor children, alimony and/or distribution of property whose value is more than 20 thousand rubles.

The application itself is no different from a claim in the magistrate’s court; it is filled out and drawn up in exactly the same way as above. It will be considered no more than 2 months from the date of submission. Sometimes the period can be extended to 3 months.

According to the law, a husband cannot divorce his wife during pregnancy and in the next 12 months.

Differences between an agreement and a prenuptial agreement

At first glance, both the property division agreement and the prenuptial agreement serve the same purpose - to change the general marital property regime. Both documents must be certified by a notary and can be drawn up at any time. However, there are significant differences between them, outlined below.

| Marriage contract | Property division agreement |

| The legal regime of property ownership can regulate the relations of future, not yet existing property. | Division of specific property that exists in kind. |

| Cannot be unfavorable for one of the parties. | May be disproportionate, shares are determined by agreement. |

| Concluded between persons entering into marriage and spouses. | Occurs between actual and former spouses. |

| Fixed notary fee. | A percentage of the value of the property. |

| Creditors must be notified | There is no obligation to notify creditors |

| Compensation, provision of maintenance, participation in each other's expenses, taxes, grounds and terms of challenge are possible general provisions. | |