As a result, if there is such an agreement, then the allocation of funds for the financial support of the minor is terminated if there are the following grounds for termination of alimony payments:

- after the expiration of the agreement. Such a document must state that obligations to pay alimony cease upon the teenager’s 18th birthday or upon receipt of a university diploma;

- after the occurrence of specific events. For example, a son or daughter may change their place of residence when moving to their father, or an ex-wife may enter into a new marriage;

- after the death of the alimony payer or alimony recipient, as well as in connection with the death of a child.

The agreement on payments for children is an executive document, therefore, to stop payments, simply fulfilling the requirements specified in it (expiration of the agreement date or the occurrence of circumstances) is enough.

In such a situation, you do not have to go to court. The alimony payer can obtain an alimony agreement from a court bailiff or a company accountant.

After concluding an agreement on alimony, you need to go to court only on the following grounds:

- if such an agreement has not been notarized;

- if this document does not indicate the mechanism for completing the transfer of alimony by the father or mother;

- if the alimony recipient or alimony payer disputes the points of the document.

Changing the amount of child support when one of the children reaches 18 years of age

According to the general rule of Art. 81 of the RF IC, deductions for maintenance are assigned up to 18 years of age. This provision of Art. 120 of the Family Code, which provides that one of the grounds for stopping the payment of amounts on account of material support is the acquisition of full legal capacity by the person on whose account they were paid.

When determining the amount of the obligation to financially participate in raising a child, the court relies on the amounts established by Article 81 of the IC of Russia:

- for one minor no more than a quarter of the average monthly earnings of the alimony payer;

- for two - within a third of the salary of the parent who does not live with the child;

- for three – half.

Accordingly, the amount of deductions depends on the number of children. When one of them reaches the age of majority and acquires full legal capacity, it is necessary to recalculate the amount collected.

The amount of alimony when one of the children reaches eighteen years of age is changed by a bailiff or by court decision

The assignment of amounts for maintenance is made by the court or by voluntary agreement of the former spouses, formalized by a notary. The execution of court documents is carried out by the Federal Bailiff Service, which issues a writ of execution, which is an official document - the basis for the accounting department of the enterprise where the father or mother is employed, who are obliged to make deductions for the payment of mandatory amounts to the child’s account.

Important! The procedure for changing the amount of payments is also carried out by applying to the magistrate's court and then to the bailiff, who is in charge of the proceedings for collecting payments for material support.

In order for deductions to be reduced, the parent living separately must provide a document confirming that the child has reached the age of majority to the court. Such a document in the considered option is a copy of the birth certificate or a copy of the child’s passport, on the basis of which a court decision is issued and then the bailiff issues a new writ of execution with a changed amount of deductions. This sheet is sent to the accounting department of the enterprise at the official place of work and from that moment the deduction from wages is made in accordance with the new executive document.

When a child turns 18, child support payments stop

In accordance with the norms of codification of family law, the age of majority is recognized as the basis for termination of payment of maintenance obligations.

Important! As mentioned above, turning eighteen is the acquisition of full legal capacity by a citizen, which gives him the opportunity for official employment and self-support.

It is this provision that substantiates the position of the legislator, who links the termination of alimony payments when the recipient reaches 18 years of age.

Grounds for termination of alimony obligations

Termination of alimony obligations is regulated at the legislative level. This issue is discussed in paragraph 1 of Article 120 of the RF IC. In accordance with this legislative standard, alimony relationships can be terminated under the following circumstances:

- If one of the parties to the alimony agreement suddenly died;

- If the contract has expired and the parties do not intend to renew it in the future;

- When children reach 18 years of age. In some situations, child support obligations may be extended until the child receives higher education;

As a result of the occurrence of other conditions that are provided for in accordance with the provisions of alimony agreements. For example, this could be the restoration of the alimony recipient’s ability to work, or the improvement of the recipient’s financial circumstances, as a result of which he will not need financial assistance from the payer.

Alimony agreement

Termination of alimony obligations occurs on the following grounds:

- the duration of the agreement has come to an end;

- the agreement spelled out the situations that would result in release from alimony obligations, and they occurred;

- the child/support provider has died.

Even if the agreement was certified in the past by an employee of a notary agency, the law does not force you to re-apply to it - financial obligations will be terminated automatically.

Judgment

In this case, the grounds for termination of financial support will be as follows:

- the child has acquired legal capacity: reached the age of 18 or, before reaching it, entered into an official marriage union, registered himself as an individual entrepreneur, and began working under an employment contract;

- the child was adopted by his wife’s new boyfriend (this will require the consent of the biological father or a procedure for depriving him of parental rights);

- the child/support provider has died.

If funds were transferred to a child 18 years old who was deprived of the ability to work, then upon its restoration, alimony is no longer paid. Disability should be confirmed by a medical report, a certificate of income (if it is necessary to prove the fact that, due to circumstances beyond his control, the child receives less than the minimum subsistence level established in the region of his residence).

As for the full-time education of an adult child at a university, in this case, parents are no longer required to provide him with financial support by law. But most often, adults support an adult child on a voluntary basis.

Attention! If, when the child reaches 18 years of age, the child support provider has arrears in cash payments, then he will be obliged to pay all his debts. From the date the person receiving alimony filed the claim, the court takes into account the last 36 months.

If the alimony holder becomes aware that the financial situation of his ex-wife has significantly improved, he has the right to go to court to reduce the amount of alimony or cancel it completely. Thus, it is possible to cancel alimony payments in connection with the marriage of the ex-wife, as a result of which the financial condition of the spouse has significantly improved.

Another basis for canceling alimony is challenging paternity. A parent who doubts the child’s parentage can apply to the court to conduct a genetic examination. If the expert determines that the child was conceived from another person, then the applicant will no longer make any child support payments. The accuracy of genetic testing data is high - more than 99.98%.

Appeal to the bailiff

In this case, you will need to inform the FSSP employee about the death of the minor, or that the child has acquired legal capacity. After this, the employee will draw up a resolution indicating the completion of enforcement proceedings. As a result, the provision of financial support based on the court decision will be terminated.

The bailiff's decision will be submitted to the court.

Measures taken previously - for example, the seizure of the debtor's property - are cancelled.

Going to court

You will need to initiate an appeal to the magistrates' court by filing a statement. It states the reasons why, in the applicant’s opinion, the amount of alimony requires revision. You also need to provide evidence.

The application should include the following information:

- the name of the judicial authority (you should contact the same court that in the past considered the case regarding the establishment of alimony payments);

- Full name of the applicant and defendant, residential addresses of the parties;

- circumstances for establishing alimony payments;

- circumstances for termination of financial support;

- request to cancel alimony payments;

- signature of the applicant, date of preparation of the document.

We invite you to familiarize yourself with Alimony payment order payment purpose

What documents are needed:

- passport;

- statement;

- court order (you will first need to make a photocopy).

When do they stop making contributions for financial support according to the law?

If the child is 18 years old and the child support debt remains

It is the achievement of the age of full legal capacity that is the main reason for stopping making financial contributions to the child’s account from the salary of a parent who does not live with him in the same family. In order for the cancellation of alimony to be legal and to avoid the accumulation of debt, the payer parent should contact the magistrate’s court to consider the case and issue a court decision on the cancellation of the obligation and the Federal Bailiff Service to the specialist who was in charge of the collection proceedings. .

In this case, the person who is entrusted with the obligation to pay alimony payments must provide documentary evidence that the recipient has reached the age of majority. The court considers the evidence provided and a statement of a certain sample drawn up by the alimony payer, after which it issues a decision, on the basis of which the bailiff issues a writ of execution containing information about the end of the circumstances in which the son or daughter needed financial assistance from the parents.

The law connects the abolition of alimony with the child acquiring full legal capacity

Based on this writ of execution, the paperwork for the collection of alimony is closed, and a document is sent to the accounting department of the enterprise to stop making monetary deductions from the salary of the parent living separately.

Important! Even if there is a writ of execution for release from the obligation to pay alimony, the alimony payer is not released from the obligation to repay the debt for the last three years, if any.

Do I need to tell the judge that alimony will stop when I turn 18?

The body that makes the decision to cancel alimony can be represented by the court or the FSSP, depending on the information contained in the writ of execution on the assignment of the submitted deductions.

The writ of execution must contain information about the date of birth of the payee and the validity period. As a rule, when issuing such a document, the bailiff indicates the period for payment of alimony “until reaching the age of majority.” In the presented situation, the procedure for canceling mandatory contributions to the child’s account is much easier, since the parent paying the alimony only needs to contact the FSSP for the issuance of a new writ of execution based on the data of the previous one, and in the future there is no need to notify the judge.

If for some reason the writ of execution does not contain information about the validity period, in order to cancel alimony it is necessary to file a claim in the magistrate’s court, which, based on the evidence provided, makes a decision to cancel the deductions for minors.

Grounds for dismissal of a claim

How to cancel child support? The court does not always side with the applicant. He may reject the claim for cancellation of alimony if the grounds for termination provided by law are not met.

- If financial support was intended for a disabled child, cancellation due to adulthood is not always possible. In accordance with the law, disabled people of groups 1 and 2 are entitled to lifelong maintenance.

- If the payer's income has decreased significantly or he has lost his job, it is impossible to stop collection. If financial support is collected in a fixed amount, the amount may be reduced. With a percentage deduction, a reduction in the share is possible.

- If the alimony payer has become disabled, it is impossible to cancel the enforcement proceedings. Alimony payments will be deducted from the disability pension.

A mandatory condition for termination of collection is a court decision. If a citizen independently stops paying financial support, sanctions provided by law will be applied to him.

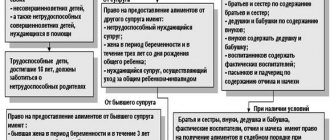

In what cases is it necessary to take part in financial support after 18 years of age?

Disabled children and students have the right to receive child support after reaching 18

Payment of alimony

The legislator provides for a number of situations in which parents are obliged to continue to support their children after they have acquired full legal capacity:

- when a son or daughter receives higher education on a full-time basis;

- when the heir of the alimony payer is employed, but his income for objective reasons is less than the minimum subsistence level established by the state;

- if the child has a medical certificate confirming the assignment of a disability group.

How to register the fact of termination of alimony

The establishment of financial payments can occur on the basis of an alimony agreement and a court order. The list of grounds in both cases differs slightly. Termination of alimony obligations occurs on the following grounds:

- the duration of the agreement has come to an end;

- the agreement spelled out the situations that would result in release from alimony obligations, and they occurred;

- the child/support provider has died.

In this case, the grounds for termination of financial support will be as follows:

- the child has acquired legal capacity: reached the age of 18 or, before reaching it, entered into an official marriage union, registered himself as an individual entrepreneur, and began working under an employment contract;

- the child was adopted by his wife’s new boyfriend (this will require the consent of the biological father or a procedure for depriving him of parental rights);

- the child/support provider has died.

If funds were transferred to a child 18 years old who was deprived of the ability to work, then upon its restoration, alimony is no longer paid. Disability should be confirmed by a medical report, a certificate of income (if it is necessary to prove the fact that, due to circumstances beyond his control, the child receives less than the minimum subsistence level established in the region of his residence).

As for the full-time education of an adult child at a university, in this case, parents are no longer required to provide him with financial support by law. But most often, adults support an adult child on a voluntary basis.

If the alimony holder becomes aware that the financial situation of his ex-wife has significantly improved, he has the right to go to court to reduce the amount of alimony or cancel it completely. Thus, it is possible to cancel alimony payments in connection with the marriage of the ex-wife, as a result of which the financial condition of the spouse has significantly improved.

Sometimes, even after the dissolution of a marital relationship, a man is obliged to financially support his ex-wife. So, if the marriage was dissolved during the woman’s pregnancy (by law this is only possible at the request of the wife - the husband does not have the right to file for divorce in such a situation), then the man will need to support her until the child is born.

After the child is born, his mother is on maternity leave until he reaches 3 years of age. A woman has the right to receive payments both for the child until he comes of age, and for himself within 3 years after giving birth. This is explained by the inability of a woman to go to work and independently provide for herself and her child.

When the spouse lost her ability to work within 5 years after the divorce (and the marriage was quite long), she also has the right to initiate a judicial review of the case in order to establish alimony for herself.

If the spouses entered into an agreement on alimony, then the document contains conditions for the collection of financial resources and the termination of their payments. If the life circumstances of the alimony recipient have changed for the worse, then he can file a claim with the court to have the amount of alimony revised or canceled altogether.

When a woman enters into a new marriage, the court has the right to cancel the payment of alimony to her ex-wife.

Finally, if one of the participants in the alimony case dies, then payments stop automatically.

The law reflects that the last day of payment of alimony upon reaching 18 years of age is considered to be the eve of the child’s birthday. However, after this, collection does not automatically stop. In order for funds to stop being written off, you will need to take a calculation of payments from the company’s accounting department and submit the documents to the bailiff handling the case.

If a child has been declared legally incompetent under the age of 18, he or she will need to file a claim in court. The termination of payments is carried out in accordance with newly discovered circumstances. The application will need to be supported by documents. So, you can attach a marriage certificate or a certificate from the child’s place of work.

At the time of completion of the alimony case, the debt obligations of the payer are considered. If not all the funds have been provided, the child himself, who has reached the age of 18, has the right to file an application with the court demanding recovery of the remaining amount. It is recommended that you first obtain a certificate containing information about the amount of debt, penalties and fines.

The document is provided by the bailiff service. Having received an appeal from a citizen, the court orders repayment of the debt. Additionally, the procedure for fulfilling obligations is fixed. The law allows you to appeal a court decision. To do this, the defendant must apply within the prescribed time frame. The application is submitted to a higher authority.

Registration of alimony for a disabled person after reaching 18 years of age

The procedure for obtaining alimony for a disabled child after he/she comes of age is identical to the general procedure. If the former spouses have mutual understanding, they can enter into a voluntary agreement with a notary. Otherwise, you should go to court.

How to apply for disability for a child

In this case, the court must provide evidence of:

- the child has a disability of group I-III;

- need for further maintenance by parents.

Important! The receipt by a disabled child of a state disability benefit is not a reason for refusing alimony.

Is it permissible to refuse child support?

From a legal point of view, refusal of child support is the reluctance of one of the parents to maintain or enter into a child support relationship with the other party. There can be many reasons, but the most popular is the termination of relations between parents after a divorce and a fundamental reluctance to accept help.

Legally, refusal of alimony is illegal, because such an action directly violates the rights and interests of a minor. The parent is obliged to take part in the maintenance of the child, regardless of the wishes of the second parent and the relationship between them.

It is impossible to formalize the refusal, but gaps in the legislation lead to the fact that spouses can easily circumvent the requirement to pay funds for the maintenance of a minor.

Of course, it will not be possible to directly ignore the fulfillment of parental responsibilities, but government authorities cannot be interested in the extent to which the parent participates in the maintenance of the child.

Thus, legally, an ex-wife or husband cannot issue a written refusal to accept alimony, but they can take a number of absolutely legal actions to terminate alimony payments.

The procedure depends on the basis on which funds were previously received in favor of the child - under a settlement agreement, a court order or a writ of execution.

As practice shows, the simplest and most effective way to refuse alimony is not to seek to collect it in the first place.

Judicial practice in Russia

Important! As a rule, the court makes a positive decision on imposing maintenance obligations. However, the problem is the irresponsibility of parents who avoid fulfilling prescribed obligations, which contributes to the accumulation of debt.

As for the maintenance of adult children, judicial practice has an equal number of refusals and satisfactions of the plaintiff’s demands. Thus, the only sure way to guarantee receipt of amounts for child support can be achieved by drawing up a notarial agreement between the parents.

The maintenance of their heirs is the responsibility of each parent equally, regardless of marital status or separation. The deadlines established by the legislator for when they stop paying child support according to the law should not be a priority for parents, since the upbringing of a child does not end after the child reaches the age of eighteen.

If we can agree...

Fathers do not always refuse to support their children. If a parent left the family, but wants to help his son or daughter while studying at a university, an agreement can be reached. For example, agree on a monthly amount to pay for the student’s current expenses: living in a dormitory, buying groceries, paying for travel. There is no longer any need to transfer money to the mother - an adult can receive it directly from the father and use it for his own needs.

Typically, such agreements are concluded orally: an amount is agreed upon, and then the father transfers the money to the account or gives the child in cash. You can also enter into a written agreement, where you need to indicate the form of payment: a percentage of the father’s income or a certain amount that he is willing to pay monthly, the regularity of payments, their terms. Both parents and an adult can enter into an agreement with their father or mother.

The peculiarity of such an agreement is its voluntariness. It is impossible to force a parent to pay, even if he signed the paper. The only way to achieve guaranteed payments is to collect alimony after the age of 18 for a student at a university or college through the court.

pixabay.com/qimono

How to keep child support during a long business trip abroad

For a staff employee sent on a business trip, the organization is obliged to reimburse:

— travel expenses; - expenses for renting residential premises;

- daily allowance; - other expenses incurred with the permission or knowledge of the organization’s administration.

In addition, the employee retains his average earnings while on a business trip.

Alimony is not deducted from the amount of compensation payments. However, not all of these payments are considered compensation. In this case, deductions can be made from average earnings. Confirmation of this is the rules of subparagraph “k” of paragraph 1 of the List, approved. Decree of the Government of the Russian Federation dated July 18, 1996. No. 841 (hereinafter referred to as Resolution No. 841), according to which alimony is withheld from the amount of average earnings retained by the employee in all cases provided for by labor legislation, including during vacation.

Let us note that in practice a situation may arise when an employee on a business trip abroad will be forced to work on a day that is considered a non-working day (holiday) in Russia. As a general rule, during a business trip, an employee retains the average earnings for all days of work according to the schedule established by the sending organization. Moreover, if an employee is involved in work on holidays, then remuneration for work on a business trip is made according to the norms of the Labor Code of the Russian Federation (clauses 5, 9 of the Regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

The rules for remuneration on holidays are established by Article 153 of the Labor Code of the Russian Federation. Work on a weekend or a non-working holiday is paid at least double the amount:

- piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out on within the limits of the monthly working time standard, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

Alimony is withheld from these compensations (sub-clause “e” of clause 1 of the List, approved by Resolution No. 841).

In cases where the employer reimburses an employee for expenses incurred for production purposes with his consent and knowledge, these payments do not increase the basis for calculating alimony. In this case, compensation for non-production expenses can be equated to payment for work and services made by the employer in the interests of the employee, from the amounts of which alimony is withheld.

It is explained this way. The list of payments from which alimony must be withheld is open (paragraph 1, clause 1 of the List, approved by Resolution No. 841). At the same time, in the list of payments from which alimony is not deducted, the cost of work (services) paid for the employee is not listed (Article 101 of Law No. 229-FZ).

Example 1

| Programmer of the organization A.A. Ivanov was sent on a business trip to New Zealand from January 1 to October 1, 2011. The organization's accounting department has a writ of execution to withhold alimony for a minor child in the amount of 1/4 of Ivanov's earnings. For March, the employee was accrued: - payment based on average earnings - 50,000 rubles; — Birthday bonus — 10,000 rubles; — payment for work on the holiday March 8 — 5,000 rubles; — daily allowance — 70,525 rubles; — payment for telephone conversations from the hotel in connection with the need to communicate with the employer during non-working hours — 9,000 rubles; — payment for using a minibar in the hotel — 3,000 rubles. Alimony is collected from the employee’s earnings after personal income tax is withheld (Part 1, Article 99 of Law No. 229-FZ, Clause 1, Article 210 of the Tax Code of the Russian Federation). Ivanov’s income since the beginning of the year has exceeded 280,000 rubles; he is not provided with standard deductions. As of the beginning of March, the employee is a tax resident of the Russian Federation (during the previous 12 months, the citizen stayed in Russia for more than 180 days). Therefore, the tax must be calculated at a rate of 13%. The amount of personal income tax that is withheld from an employee’s income is equal to: (50,000 rub. + 10,000 rub. + 5,000 rub. + 3,000 rub.) x 13% = 8,840 rub. The amount of alimony that must be withheld from the employee’s income is equal to: (50,000 rub. + 10,000 rub. + 5,000 rub. + 3,000 rub. - 8,840 rub.) / 4 = 14,790 rub. Per diem allowance for each day of stay on a business trip and compensation for telephone expenses incurred with the consent and knowledge of the employer do not increase the composition of income from which alimony is subject to deduction. |