The inclusion of a child among the co-owners of a summer cottage is similar to the participation of adults. According to Art. 245 of the Russian Civil Code, joint property of a certain number of people is called common. The legislator stipulates the volume of the share (in the form of a fraction or percentage) and recognizes the indivisibility of the object. No one has the right to take away a part without losing integrity. When planning to register a plot of land for a child, it is important to understand: this is an independent subject of civil law relations, whose interests are defended by a legal representative or guardian. A child has the right to be a co-owner of real estate or allotment , ownership is registered in his name, and the surname and name of the representative are indicated in the DCP.

Participation of a minor in real estate transactions

Until the age of 14, a person does not have the right to manage housing. Legal representatives - parents or guardians - act on his behalf. The guardianship authorities ensure that the interests of the minor are not harmed as a result of the transaction.

When a child turns 14, he must personally participate in transactions and sign documents. However, this is done only in the presence of legal representatives and with their written consent. The right to unlimited disposal of one’s property comes after the age of majority, when a person becomes fully capable. In some cases provided for by law, a citizen is recognized as legally competent before reaching this age and, accordingly, the right to sole participation in real estate transactions also occurs earlier.

The presence of a child under 14 years of age when submitting documents to register property rights is also optional. When submitting documents to the registration authorities, in addition to the standard package of documents and a passport or birth certificate of the child, you will need the identity cards of his legal representatives, their consent to the transaction, and in some cases, permission from the guardianship authorities.

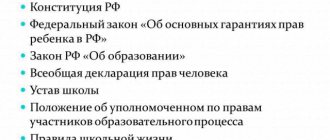

Legislation

Land resources are under the constant control of the state, this also applies to private estates.

The donation procedure is a type of disposal of one’s property. It falls under the legal regulation of the Land Code, Federal Law and other regulations.

The donor can only be a legally capable land owner. Speech

We are talking about plots that are not limited in civil circulation and have not been seized. The main condition is the voluntary decision of the donor.

If it is later proven in court that physical or psychological pressure was exerted on him, the deal will be annulled.

Land belongs to the category of real estate. Therefore, any manipulations with it are accompanied by state registration in Rosreestr. In fact, donation means a gratuitous change of ownership by the good will of the donor.

The transaction is secured by a special agreement - a deed of gift. It must be drawn up in writing, signed by the parties to the agreement and certified by a notary.

Registration of an apartment for a child during privatization

The housing privatization procedure allows you to indicate the owners who will own the living space. The apartment is divided among all persons indicated in the application in equal shares. Persons registered in the apartment, at their own request, can renounce their share in favor of another person. If all family members renounce their share, the child will become the sole owner of the apartment. Otherwise, he will own a share proportional to the number of privatization participants.

If a child is registered in an apartment and the parents have begun the privatization process, they do not have the right to exclude the minor from the list of future owners at their own request. It is also illegal to deregister children before privatization in order to deprive them of their property rights.

The legislative framework

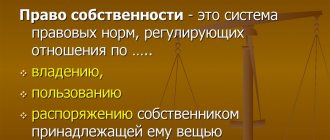

First of all, any donation procedure is gratuitous , and the donor waives any rights to the donated real estate, which is enshrined in Article 572 of the Civil Code of the Russian Federation.

Registration of donating a plot of land for a child follows the same algorithms as for an adult.

All existing restrictions can only be related to the legal status of a minor. Such restrictions are specified in Articles 572, 573, 574, 575, 576, 577, 578, 579, 580, 581, 582 of the Civil Code of the Russian Federation. These restrictions will be discussed below.

Child's participation in purchasing a home

According to the law, even a newborn can be indicated as a buyer in the purchase and sale agreement. However, as with other real estate transactions, a minor under 14 years of age does not directly participate in the transaction, and the documents are signed for him by his parents or guardians. But when registering property rights in the Unified Register, the child will be indicated as the owner of the apartment. From the age of 14, he can independently sign documents, but the presence of legal representatives when making a transaction still remains mandatory.

After purchasing an apartment, parents have the right to receive a tax deduction for that part of the property that became the property of the child. The right to deduction remains even if the parents have not become the legal owners of the home. At the same time, the child also retains the right to receive a tax deduction in the future.

After registration of ownership, any actions with real estate, including leasing, will be possible only after obtaining the consent of the guardianship and trusteeship authorities.

What is more profitable: a will or a deed of gift?

If we summarize the benefits of a deed of gift and a will solely from the financial side, it is more profitable to draw up a deed of gift for a dacha if there is a close relationship. If it is planned that the dacha will pass to distant relatives, preference is given to a will.

Although the differences between a will and a deed of gift are not only financial in nature. If you have several obligatory heirs (disabled people, children), and you want to bequeath the property to one person, it is worth choosing a deed of gift, otherwise, in court, the legal relatives can regain their due shares. The deed of gift in this case is also good because it is impossible to challenge it in court.

Based on what has been written, it turns out that when asked whether a will or a deed of gift is more beneficial, one can safely give the privileges of a deed of gift. Although in reality it all depends on the situation. Even with relatives, the profitability of the gift remains in doubt.

We should not forget that immediately after signing this document, the donor completely loses the rights to this property and, under bad circumstances, the new owner of the dacha with the plot can easily kick the donor out the door. It will be pointless to go to court, because the deed of gift is not disputed. The picture is completely different with a will, which comes into force only after the death of the previous owner.

Did you find this article helpful? Please share it on social networks: Don't forget to bookmark the Nedvio website. We talk about construction, renovation, and country real estate in an interesting, useful and understandable way.

Donating an apartment to a minor

A minor can receive real estate as a gift either from family members or from third parties. But he has no right to act as a donor until he turns 14 years old.

If the apartment was received as a gift from a close relative - parents, grandparents, sisters or brothers - it will not be subject to tax. For real estate donated by other relatives or third parties, a tax of 13% of the value of the gift must be paid. However, since minors usually do not have their own funds for this, the tax burden falls on their parents.

If for any reason the parents are against the child becoming the owner of the donated apartment, the consent of the guardianship authorities will be required to refuse the gift. In this case, they will need to be convinced that the gift is detrimental to the interests of the minor.

Structure and content of the agreement

The agreement is drawn up in writing and includes the following clauses established by law:

- personal data of the parties (including guardians and representatives);

- detailed description of the subject of the agreement (area of the plot, address, cadastral number, category of land, purpose);

- list of objects located on the site (buildings);

- a list of documents confirming ownership rights (sale and purchase agreement, certificate of inheritance, decision of the authorities on the allocation of land);

- an extract confirming the absence of an encumbrance, arrest or pledge on the given plot;

- basic conditions;

- additional and desired conditions;

- signatures of the parties.

To draw up a contract you will need a package of documents:

- identification;

- expert assessment of the land plot;

- confirmation of family ties with the recipient;

- documents certifying ownership;

- certificates from guardianship authorities (for minor children);

- check for payment of state duty.

This list varies in each specific case, so it is better to consult a lawyer for advice.

A deed of gift for a land plot does not require a mandatory notary seal. Then the data is entered into the Rosreestr database.

If the recipient is a minor, both parents must be present when signing the agreement. If one of them cannot do this, he must give the second certified consent on his behalf. An exception is the case of deprivation of parental rights.

Inheriting an apartment

The right to inheritance arises in two cases:

- as a result of inheritance according to the order determined by law (Chapter 63 of the Civil Code of the Russian Federation);

- by will.

For a will to be valid, the document must be certified by a notary. However, in extreme cases, when this is impossible for objective reasons, the law allows certification by third parties:

- the head of the institution where the testator is located - the head physician, director of a nursing home, etc.;

- commander of a military unit;

- two disinterested witnesses.

It is worth considering that the law not only ensures a person’s right to transfer his apartment after death to a chosen person, but also protects the interests of disabled and minor heirs. Therefore, even if a person bequeaths an entire apartment, but after his death there will be a disabled spouse, a minor child or another dependent heir, they will receive at least half of the share that would have passed to them in the event of inheritance by law (Article 1149 of the Civil Code of the Russian Federation).

For example, the testator left an apartment to his adult daughter, but he also has a minor son. If, in the absence of a will, the son could claim half of the apartment, then after the will is executed he is entitled to a ¼ share. Moreover, in the opposite situation, when a will is drawn up in favor of a minor, infringing on the rights of other capable heirs, they will no longer be able to count on their share of the inheritance.

To refuse an inheritance, the decision of the child’s representatives alone is not enough. As in any case concerning real estate owned by minors, consent to this must be given by the guardianship authorities. As in the case of a donation, it is extremely difficult to obtain it, since it will be necessary to prove that receiving an apartment will harm the interests of the child.

If the will is made in favor of a child who is about to be born, ownership passes to him after birth.

Since a minor does not have the right to dispose of an apartment, when drawing up a will, a person can appoint trustees who guarantee the execution of the will. Often such concern for the interests of the child is unnecessary, since after the minor takes ownership rights, the legality of real estate transactions will be monitored by the guardianship authorities. Therefore, the situation when a minor heir loses the apartment left by the testator due to dishonesty or malicious intent is minimized.

Plot with house

Land and house are different objects.

Each of them can have a separate owner. It also happens, for example, that real estate is registered as shared ownership of different heirs. The law adheres to the principle of indivisibility of land and buildings on its territory: Separate sale of a land plot and buildings erected on it, if they are owned by one owner, is prohibited.

This condition applies regardless of the number of land owners.

If we are talking about donating a share of an allotment, then in this case it is impossible without donating a similar share of the house. Rosreestr will not allow such an “operation”.

The owner of the house has a priority right to acquire this land (purchase or lease). If there are several owners, the plot becomes shared ownership.

The procedure for donating land and house must be formalized jointly.

Any transaction involving joint ownership must obtain the approval of all other owners. Without it, the transaction will not have legal force and will be annulled by the court.

Is it possible to return a donated plot?

You can return your valuable gift, but only through the court within three years of the date of signing the deed of gift.

For a successful outcome of the case, legal and compelling reasons will be required:

- the transaction was concluded in violation of the law;

- violation of the rights of a minor when making a transaction;

- significant deterioration in the material and living conditions of the donor;

- negligence of the new owner towards the donated property, which may lead to its damage or loss in the future;

- the recipient committed a crime against the donor or his family;

- the recipient died before the donor (if the condition is provided for in the contract).

Each of these points will require evidence.

A mutual decision by both parties to annul the deal or the voluntary renunciation of the land by the offspring should not be ruled out. At the same time, a corresponding application and agreement on termination of the transaction are also submitted to Rosreestr. If the “small” owner managed to receive the ownership paper, he will have to go to court to terminate the already concluded contract.

Concluding an apartment purchase and sale agreement using a mortgage may be the best solution for those who cannot afford to buy an apartment outright with their own funds. What are the benefits of leasing land for 49 years? Find out about this from our article. Interested in the price of renting land from the municipality? There is very detailed information on this issue here.

Sale of a minor's share.

Mignonette

We sell the child’s share, allocate the father’s apartment, the cost is twice as much and there are also more square meters. But the guardianship department refused, saying that the rights of the child are being violated, and you cannot replace a paid transaction with a gratuitous one. A parent cannot sell to a child, but only give it as a gift. Exodus, you sell the apartment, put the share into the account, and be sure to allocate the share. It’s kind of a vicious circle, we’re selling because we need money, two expensive apartments, one has a child in the share we’re moving into, the owner is the father. What to do? We want to sue, but we think it’s useless.

Verified by CIAN

Participant of the program “? I work honestly”

Good evening. The OOP has the following position: if the parents have any real estate, it will still go to the child by inheritance. You cannot take something and give in return what the child is entitled to in the long run. Therefore, if his share is sold, then in return the child needs to buy something equal in both cost and quality, maybe more, but not less. You can’t sell something without buying something in return, otherwise it’s an infringement of rights. Or, the guardianship will give permission for the sale, but with the condition that you put the money into the child’s account, as you wrote in your question. Money from the account can be spent in the same way with the permission of the PLO. Either a simultaneous purchase with the allocation of a share, or money into an account, the court will not help you and changing the child’s registration will not help either.

Colleagues, tell me, why does changing the place of registration of the child give nothing? Do all wards now operate strictly uniformly? About 10-15 years ago, re-registration sometimes helped a lot. It’s been a long time since I’ve come across apartments for sale with problematic children’s property, so I can, of course, operate with outdated concepts.

pros

There are a number of advantages in designing living space for a child, such as:

- Reducing the cost of paying property tax for individuals if legal representatives (parents, guardians) have real estate of the same type.

- Providing children with their own housing in advance, providing both a solid financial foundation and social independence.

- The impossibility of dividing or allocating part of the housing from the child’s share in the event of divorce between the parents, as well as the inability to dispose of it to unauthorized persons.

- The child is not responsible for the parents’ loan obligations with his property.

Is it possible to register a plot of land for a minor child?

Rarely does anyone have to register an apartment for a minor child, but such transactions exist on the market. Experts told us how to register an apartment for a minor child, what rights and responsibilities remain with the parents, and how this is secured legally.

Federal Law of the Russian Federation No. 26 contains not only a list of provisions on the basis of which the privatization of municipal property is carried out, but also information about who has the right to enter into the right and under what circumstances municipal employees can refuse.

First of all, no fiscal breaks are provided for minors in Russia by law, with one single exception. The tax benefit for individuals applies only if the child has a disability.

Privatization of real estate by children

According to Federal Law No. 26 of 1994 “On Privatization,” minors are given the right to privatize real estate at their place of registration. Registration is free, even when children turn 18 years old. In other words, a child has the right to privatize a share of his parents’ property, and after reaching adulthood, he can privatize other real estate for a second time on an equal basis with other citizens. A child has the right to refuse privatization only with the consent of the guardianship in exceptional cases. Privatized property can be sold if another property is purchased with the proceeds or with a share of the proceeds from the sale.

The rights to privatization in the event of a parental divorce remain with the child.

In this case, it will be possible to privatize housing only after 6 months, but during this time the child must be permanently registered in another place. You cannot remove a child from registration in order to conduct a transaction without his participation. Otherwise, it will be cancelled. From the documents attached to the standard list:

- privatization agreement,

- social contract rental (instead of a certificate of ownership),

- documents confirming the absence of similar transactions previously,

- consent from adults who decide to waive the right to privatization (must be notarized).