Returning money to a Sberbank card is a frequently encountered topic that interests many of the organization’s clients. First of all, this comes up when the purchased product is returned to the seller for various reasons. Let's look at consumer rights in this regard, the application procedure and deadlines, as well as several other nuances.

Buyer's rights and Law No. 2300-1

With regard to the relationship between buyers and sellers, the main source of information is the Law of the Russian Federation of February 7, 1992 No. 2300-1

(last edition dated July 29, 2018) “On the protection of consumer rights.”

It states, in particular, that the buyer has the right to return the purchased product within two weeks from the date of purchase - if we are talking about non-food items. If the situation is related to food products, it is returned when a violation of the expiration date or storage rules is discovered. This is recorded in Article 25 of the Law.

Important! In Art. 25 also establishes the consumer’s right to demand the return of funds spent on purchases. Moreover, the requirement must be satisfied before the expiration of three days from the date of return of the defective product.

Note 1.

The twenty-fifth article can be viewed at this link. The entire act is available for study here.

In addition, another point is connected with the right to return your money - the warranty period

goods. Within its limits, you can send what you purchased back to the store and, again, get your money back.

Note 2.

The buyer himself must contact the seller directly for these reasons, especially if we are talking about using a bank card. If the problem is resolved normally, the money will be transferred by the store to the card account.

How much money will go to its owner depends on many factors. For example, the seller may refuse a transaction if there are grounds to believe that the item sold has become unusable due to the actions of the buyer.

If there are no complaints against the buyer, the money will be returned within ten days

, which is established by law.

What is needed to properly complete the return procedure? The client will need:

- the purchased product itself;

- a completed application (sometimes on a form provided by the store);

- passport (another document that satisfies the consumer’s identity is possible);

- receipt of payment for the item;

- card details.

Note 3.

If a customer does not have a sales receipt, this is not a legal reason for refusing a refund. However, in this case, you need to prove the act of purchase in a different way - for example, with the help of witnesses.

To avoid misunderstandings, it’s easier to take a bank statement

.

Nuances of the user agreement for bank cards

When receiving a bank card, a small part of clients become familiar with the banking service agreement and user agreement. In these documents, credit institutions prescribe one important rule: for transactions using a PIN code or SMS confirmation, the issuing bank is not responsible.

In a simpler form, this rule is explained as follows: if the client performs the transaction independently and uses the security system tools, then in the event of an error, no claims should be made to the bank. A similar rule is used without exception by all credit institutions.

Therefore, if the operation was performed personally by the card holder or a third party using a PIN code, then a refund from the Sberbank card will not be possible. The exception is when a mistake is made by the bank. Below, each case will be considered separately.

How is an application completed?

As noted, the seller usually gives the buyer an application form, which is a standard one. To receive it, you must, of course, visit the establishment where the purchase was made. If we are talking about an online trading platform, in most cases there is a link to download the document (see the title at the end of the article for details on this).

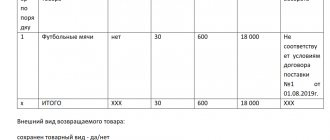

Important! The seller cannot refuse to accept the application, because from the moment of the application he has 10 days to resolve the issue. In addition to the application, the store itself draws up an act or attaches an invoice.

The main thing is to clearly understand that all actions are regulated and justified by law.

General procedure

If you are a client of Sberbank and used a card from this financial institution when paying for goods, the procedure for you will be as follows:

- contact the store with a freely written statement;

- attach a copy of the receipt to the document;

- hand over the goods along with the warranty card - in this case, you must draw up a transfer certificate

; - present your passport during the process.

The application shall indicate

Full name, name of the product (taken from the receipt), reason for the request, desired outcome (replacement of the item or refund).

After that, all you have to do is wait for the money to be returned.

Note 4.

This process is universal for all situations – using cards from any bank. The specificity lies in intrabank procedures.

Sberbank application for refund

Sberbank has its own form inside for requesting a refund. What does it contain? It contains the following provisions:

- last name, first name and patronymic of the applying client;

- the type of document provided confirming the identity of the buyer;

- series, number (for example, passports);

- telephone number - necessarily the one linked to the bank card used to make the purchase;

- list of reasons/grounds for filing an application – usually one item is selected;

- the method within which the issue of refund is resolved;

- notification option regarding the seller’s decision on the client’s request;

- location of the transaction;

- day, month, year and time of contacting the banking organization.

It would be a good idea to keep this document in mind in order to avoid delays on the part of the banking institution and if any difficulties arise. Actually, a Sberbank form will be needed if the store sent money, but it did not arrive

– in this case the problem is on the bank’s side.

Note 5. Link to an individual’s Application for a refund.

If you transferred money to scammers

Unfortunately, if it happens that you transferred money to scammers, then chargeback will not help you. It works as standard only in the case of legal online stores that make sales. That is, the disputed transaction is payment for a product or service.

When making a standard transfer to a third-party card or e-wallet, a person does this voluntarily. He confirms the operation with a code sent to his mobile phone linked to the card. This is the initiative of the cardholder himself, so it is simply impossible to take advantage of the chargeback opportunities.

In the standard procedure, the acquiring bank simply withdraws money from the online store’s account and transfers it to the affected buyer. Theoretically, a bank can accept a complaint against an individual, but there will be no action.

If suddenly an individual receives an unexpected request from the acquiring bank, he will simply answer that you voluntarily transferred the money. How to prove the opposite? Moreover, if the account is really fraudulent, then there has been nothing on it for a long time, so it is impossible to write off anything.

Terms of receipt of money

How many days does it take for funds to purchase goods to be returned to the customer? If he returns the item on the day of purchase, the transaction is canceled immediately. What’s important is that it doesn’t go to the bank

. In such circumstances, the money will be returned within a few hours.

When returning goods one day or later, the seller has a period of 10 days. This is the period during which the store must make a decision on the customer’s request. It is established by the Law “On Protection of Consumer Rights”.

At the same time, up to 30 days are allotted for internal processes – separately. What does this mean? We are talking about canceling the transaction. This delay is determined by the policy of Sberbank, whose card was used to pay for the purchase.

Of course, banks - especially large ones like Sber - value their status and prestige. Therefore, they try to return money to clients as quickly as possible. This often takes 10-12 days. However, there are nuances related to internal regulations, which we will discuss below.

Contents of the refund process

Many buyers are rightfully indignant at the long time it takes to return their money. The average user thinks simply: replenishing a card account is instantaneous, so why do you have to wait from 10 to 30 days?

In fact, everything is explained not by the simplest design and stages of the procedure:

- First, the applicant’s application is sent to the store’s accounting department. It is processed and transferred to the bank, which services the POS terminal. Here the delay on the part of the accounting department may be 2-4 days.

- Next, the bank specialist (after checking the document and processing it) transfers the money to the correspondent account of the bank that is the card issuer and submits the accompanying documentation.

- At the third stage, the application is processed by an employee of the issuing bank and funds are transferred to the client’s personal account.

Note 6.

If we are talking about a Sberbank card, the process may take much less time. This happens for the reason that sometimes Sber services both acquiring and the plastic itself. This means that all processes will take place only within this institution. Documents do not circulate between organizations, and deadlines are greatly reduced.

How to check a transaction? The consumer has the opportunity to track the movement of funds. To do this, you need to call the store, and then the bank (the issuer of the plastic).

How to protect yourself from making erroneous money transfers?

And finally, some advice for those who are tired of double-checking the numbers of bank accounts or cards during financial transactions. Firstly, to optimize money transfers, you can create special templates in mobile banking. In addition, you can use a text editor, saving the numbers of frequently used accounts in it, and then copying and pasting them in the desired column during the translation. And of course, you can easily and securely transfer funds using the contact list in your mobile phone.

How to return in cash?

Of course, customers who have returned goods often express a desire to get their money back in cash. Simply because it looks like a much faster procedure. However, this cannot be done: it is contrary to Russian law

.

What is the reason? All sellers undergo an audit in Russia by the tax office. This service monitors what transactions were made by a store (or other supplier of goods and services) in a certain period of time.

Important! Returning money to a client in cash means conducting an illegal cash withdrawal, which is punishable by large fines.

All sellers are required to return money in the form in which it was originally received when the customer purchased any product. Moreover, the funds are transferred exactly to the card from which the payment was made

.

Note 7.

There is only one way to receive money in cash. This is a situation when the payment card is lost or its validity period has expired. Then the buyer submits an explanatory note along with the application.

The money hasn’t arrived or is taking a long time to come back – what should I do?

Although the return process is lengthy, it is worked out and regulated by law. However, sometimes circumstances still arise in which money does not arrive on time. As a rule, this is a consequence of some systemic failure in the bank.

There is no need to rush to file complaints. You can first try to solve the problem by communicating with employees of the financial institution itself. Before this, it is advisable to check with the store whether the application for transferring money to the bank has been submitted.

The further procedure is as follows:

- prepare your passport and card (you may need it when communicating with a specialist);

- call the support service at 900;

- Check with the operator the status of your request/application.

If a clear answer has not been received, go to the bank branch. This is where an internal bank document for a refund, a sample of which is given above, may come in handy.

If these steps do not lead to anything, do not hesitate to contact Rospotrebnadzor and/or the court. For investigations, you will need an act of return of goods.

.

Is it possible to return money that was spent via Sberbank Online: the position of the Armed Forces

Unjust enrichment means acquisition not based on law or transaction. As a general rule, this money can be returned (Article 1102 of the Civil Code). But is it possible to sue transfers through the Sberbank Online application as unjust enrichment if there were a lot of them? The courts answered this question in a recent case.

Phishers, skimmers, hackers: how to protect money on a card

Elena Evskina went to court and demanded that Vladimir Ivankov return 1.3 million rubles to her. unjust enrichment and 143,201 rubles. interest for using other people's money. Evskina sent this money to Ivankov through Sberbank Online in seven transfers ranging from 140,000 to 225,000 rubles. from January to March 2017. She explained that she had made a mistake in the transfer details and in fact wanted to repay the Sberbank loan under the agreement dated January 2017. The plaintiff, according to her statements, did not know Ivankova.

This explanation satisfied the Prikubansky District Court of Krasnodar, which satisfied the demands. The decision was not published on the court’s website, but, as follows from the acts of higher authorities, he agreed that there was a mistake, and Ivankov could not justify that he received the money as part of any agreements.

There was no error

But, as it turned out later, there was such evidence. This was found out by the Krasnodar Regional Court, which carefully studied the defendant’s position. As Ivankov claimed, Evskina knew him very well. He worked as an intermediary in concluding assignment agreements for the redemption of cases under compulsory motor liability insurance. According to the defendant, the money was not transferred by mistake, but to account for the conclusion of relevant transactions. He also drew attention to the fact that in January - March 2021, not only Evskina transferred money to him, but also vice versa - all this excludes the possibility of an error, Ivankov pointed out.

One of these transfers was taken into account by Evskina, who, by the time the case was considered in the appeal, clarified the claims. She subtracted 250,000 rubles from the amount, which Ivankov returned to her. She also changed her explanations. According to the new version, she wanted to send money to her mother. And the receipt is 250,000 rubles. Evskina allegedly did not attach any importance to it because she decided that it was a technical glitch.

- VS told how to return an erroneous payment

October 24, 7:41 - The Sun explained when debt becomes enrichment

November 19, 9:50

All these circumstances were analyzed by the Krasnodar Regional Court and decided that there were too many inconsistencies in the case. He listened to Ivankov’s arguments, but found Evskina’s version unconvincing, including because transactions through Sberbank Online exclude the possibility of transferring money to an unfamiliar person. The person making the transfer uses a card or mobile phone number and confirms the transfer with a password, the appeal noted. Evskina sent money to the same recipient many times, but never contacted the bank about the erroneous transfer. The version with loan repayment also does not stand up to criticism, because it is repaid once a month. In addition, the regional court noted, the plaintiff indicated in her application the correct address of the defendant, although she allegedly does not know him.

With this justification, the appeal overturned the lower court's decision and rejected Evskina's claims.

The Supreme Court agreed with this outcome in the case. The Civil Collegium of the Supreme Court agreed that a relationship of obligation had developed between the parties. Considering that there were seven transfers over three months, and Evskina sent money to the defendant, she did not provide evidence that the transfers were erroneous and that there was no relationship between the parties, says the Supreme Court ruling (No. 18-КГ19-186). Thus, the denial of the claims remained in effect.

Abuses and burden of proof

The defendant behaved competently, but the position of the Prikubansky District Court is strange, because in the case it is obvious that there were legal relations between the parties, comments the managing partner of the Westside Westside Federal Rating law firm. group Foreign trade/Customs law and currency regulation group Compliance group Dispute resolution in courts of general jurisdiction group Labor and migration law (including disputes) group Private capital management group Arbitration proceedings (medium and small disputes - mid market) Sergey Vodolagin. It is for this reason that the appeal court shifted the burden of proof, and the Supreme Court agreed with it, says the head of the banking and financial practice of AB KIAP KIAP Federal Rating. group Arbitration proceedings (medium and small disputes - mid market) group Compliance group Family and inheritance law group Intellectual property group (including disputes) group Dispute resolution in courts of general jurisdiction group Labor and migration law (including disputes) group Criminal law group Antimonopoly law (including disputes) group Foreign trade/Customs law and currency regulation group Land law/Commercial real estate/Construction group Corporate law/Mergers and acquisitions group International arbitration group TMT (telecommunications, media and technology) group Financial/Banking law group Bankruptcy (including disputes) group Tax consulting and disputes (Tax consulting) Company profile Roman Suslov: “In normal circumstances, the sender of funds proves that they were written off, and the recipient must prove the grounds for their crediting. But if the actions of the plaintiff show signs of abuse of rights, then it is he who must prove that he made a mistake in the translation.”

The Evskina case shows that signs of abuse may include:

- acquaintance of the plaintiff with the defendant;

- repeated translations;

- counter transfers;

- no calls to the bank due to an error.

In addition, abuse may be indicated by past contractual obligations with the recipient of funds, significant delay in filing a claim, or the purpose of payment, which corresponds to the type of activity of the recipient of funds, Suslov lists.

But even if there was no obligatory relationship between the parties, this does not mean that unjust enrichment can always be returned. It will not work if the plaintiff knew about the absence of obligations, but wanted to give a gift to the recipient or acted for the purpose of charity (clause 4 of Article 1109 of the Civil Code). Modern transfers require confirmation of the operation and the entry of codes, so in such conditions, with due diligence, there should be no mistakes, argues Ekaterina Nazarova from SSP-Consult SSP-Consult Regional Rating. group Labor and migration law (including disputes) group Arbitration proceedings group Bankruptcy (including disputes) group Dispute resolution in courts of general jurisdiction Company profile. At the same time, according to her, errors are possible if money is transferred using a card number to a client of another bank, because the recipient’s personal data is not visible in the system.

Lawyers gave advice on how to protect yourself in case of a lawsuit from the sender of money if he claims that he does not know you and made the transfer by mistake. “It’s best to formalize the agreement, then maybe there wouldn’t be a dispute,” says Vodolagin. – If it is not there, then you need to stock up on evidence of the grounds for transferring money. An example is correspondence, including electronic correspondence, which confirms the provision of a service or the transfer of an item.” You can audio record conversations discussing the circumstances and conditions of the upcoming transfer, adds Yuri Telegin from the European Legal Service.

- Evgenia Efimenko

- Supreme Court of the Russian Federation

Refund when purchasing goods in an online store

It is very difficult to get a refund when purchasing goods on online platforms. The process is simply drawn out and involves even greater time delays.

Important! If a client purchased a product in an online store, a refund may take 45–90 days.

What the buyer must do:

- at his own expense

(he will deduct delivery fees from the order amount); - expect results.

The customer only has a week to return the item after purchasing it. Sellers are reluctant to return money and often offer to replace the item with one that costs about the same.

Some online stores simply transfer money directly to the buyer’s card without any problems. Others are dragging their feet, taking advantage of the legal deadlines. So not everything here will depend on Sberbank.

Video

The video explains in detail how to return an erroneously transferred payment from a card. Created by the Legal Aid Blog channel.

Was this article helpful?

Thank you for your opinion!

The article was useful. Please share the information with your friends.

Yes (100.00%)

No

X

Please write what is wrong and leave recommendations on the article

Cancel reply

Rate the benefit of the article: Rate the author ( 1 vote(s), average: 5.00 out of 5)

Discuss the article: