A terminal is a device for paying by card; it can read information from plastic cards and send it to the bank via the Internet. The bank debits the buyer's money and transfers it to the seller's account. This process is called merchant acquiring.

Order a cash register

Through the terminal you can not only accept payment, but also return money back to the buyer if there was an erroneous payment or the client wanted to return an unsuitable product. We figured out how to return money to the card through the terminal.

Returns via the terminal to the card can be made in two ways: through cancellation of the purchase and direct return.

Conditions and grounds

only the holder of a plastic card can contact the store .

Therefore, when purchasing any new product, do not immediately put it aside, but carefully consider, test and check it in action. And, if you are not satisfied with something, do not hesitate to return this product back.

When going to the store you should have with you:

- passport;

- two receipts for the purchase: a cash receipt from a fiscal device and a receipt for withdrawing money from a bank device;

- payment bank card.

What to do if the check is lost?

According to Russian law, you have the right to return the goods even without a receipt, but for this you will definitely need witnesses who can confirm the accomplished fact of the transaction (if necessary, in court).

It's best if they are not your close relatives .

sample application for a refund for a purchase on a card.

What products can be returned through online checkouts?

The consumer has the right to refuse any purchase, regardless of its quality, within a specified period. For products with properties that meet the requirements, it is 14 days, for defective items - a warranty period or 2 years, if one was not declared.

But there are exceptions included in a special list. These include things that provide personal hygiene, cosmetics and perfumes, underwear, medicines, household chemicals, plants, technically complex goods, animals and some other groups. They are not returnable under any circumstances.

Registration procedure

To return money to your card for an unsuitable product, when contacting the store you will have to perform the following operations :

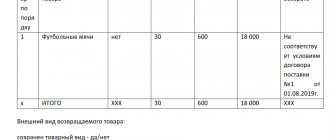

- give all receipts and goods to the store employee (in this case, the appropriate act or invoice will be issued);

- draw up a written application in which you indicate your last name, first name, patronymic, circumstances of the return and the amount of money required for transfer (the specialist will also attach a copy of your passport to this application).

Reprinting a check

In some cases, the receipt either does not come out (for example, the paper has run out) or it is damaged. After replacing the paper/ink in the terminal, it becomes necessary to reprint the receipt. To do this, you need:

- Open the terminal menu.

- Select the item “Repeat receipt”.

- Confirm the operation.

- Select “Last” (the latest receipt will be printed) or “Select from list” (if you need to print an earlier receipt).

Process from the inside

Often, plastic card holders are unhappy that the money for the returned goods is not transferred to them immediately , on the day of the request.

In fact, this is not a whim of sellers who want to torment the client longer and discourage him from returning the purchased goods.

The return process is a rather complex system , which includes several stages:

- To begin with, the store's accounting department transfers to the bank , with which the agreement for servicing customers' plastic cards is concluded, copies of customers' statements. This stage depends only on the efficiency of the accounting staff and may take several days.

- Then, within 3 working days, a bank employee registers the received application , checking its accuracy and sending it for execution.

- The next day, the relevant department of the bank returns the funds to the correspondent (general) account of the bank in which the buyer’s card was issued.

- The further period for crediting money to the cardholder’s account depends solely on the policy and efficiency of the servicing bank. Typically, commercial units quickly return funds to the card; the operating time of state banks (for example, Sberbank) often reaches the maximum allowable value - 30 working days.

Useful fact: the law sets the deadline for returning funds to the buyer at 10 days. In this case, the store bears responsibility for any violation of the deadline (Article 22 of the Law of the Russian Federation “On the Protection of Consumer Rights” dated 02/07/1992 No. 2300-1).

At the same time, the return period depends not only on the quick actions of the store, but also on the efficiency of payment systems and the bank, so the specified period is very rarely observed and ultimately amounts to up to 40 days.

If a violation of the deadlines prescribed by law is due to the slowness of the bank, the store may demand compensation for losses , and the consumer may demand payment of the penalty from the store.

Reconciliation of results in Sberbank

Every time after the end of the working day, you need to perform a reconciliation operation. She sends a report to Sberbank on all operations carried out during the day and, as it were, draws a line under today. To do this, you need:

- Go to the terminal menu.

- Select the item “Reconciliation of totals”

- Confirm the operation.

- Wait until the information is processed.

- Receive a receipt confirming the fact that the results have been reconciled.

How long should I expect to receive funds?

How many days does it take for money to be returned to my bank card? Depending on the efficiency of the work of all structures involved in the process - from the store’s accounting department to the servicing bank - the time frame for receiving money can be 3 days or 40 days .

For example, on a VTB 24 card, in most cases, returns are made within 10-12 days.

But, depending on various circumstances, here too the period may extend to the 30 days stipulated by law.

If it seems to you that the time frame for refunding funds is being delayed , you can contact the store’s accounting department or bank at any time and clarify at what stage the process is and within what time frame each operation on your issue was carried out.

An important exception: when returning an item on the date of purchase, the card payment transaction is simply canceled, and therefore the funds are returned to you as quickly as possible.

How to return erroneously transferred money (algorithm of actions)

There are several ways to return incorrectly transferred money:

- by calling the hotline;

- at a bank branch;

- via Sberbank Online;

- in the mobile application.

By phone

To return money sent by mistake, you need to:

- Call Sberbank number 8(800)-555-5550.

- Wait for the operator’s response and leave a request for an erroneous transfer of funds.

- Give a code word to identify yourself.

- Inform about which specific operation needs to be cancelled.

- Confirm transaction cancellation.

- Contact the bank branch and write a statement to the management, attaching a check or transfer receipt.

A conversation with an operator can take a long time, since it is difficult to identify a person over the phone. To successfully cancel a transaction, you must answer all security questions correctly.

At a bank branch

If more than an hour has passed since the transaction was completed, you can go to a Sberbank branch and take with you:

- passport of a citizen of the Russian Federation;

- check or transfer receipt;

- application, a sample of which can be obtained from the bank.

To return erroneously transferred funds at a branch, you need to:

- Contact the operator.

- Show your passport for identification.

- Write a request for a refund indicating the reason.

- Provide a receipt confirming the transfer.

The application is reviewed within 10 working days. During this time, Sberbank turns to the person to whom the funds were transferred with a request to return them. If the answer is negative, the operator notifies the client. According to the Bank Secrecy Law, he has no right to transfer the recipient’s contact information. Then the client needs to go to the police with a statement.

The video explains what to do if the details were entered incorrectly. Created by the Prostobank TV channel.

Through Sberbank Online

It is possible to cancel a payment to Sberbank Online if it was made through the website and the transfer status is “Executed by the bank.”

In this case it is necessary:

- Go to the main page in your Personal Account.

- Select the card from which the money was transferred.

- In the menu that appears, click “Recent transactions”.

- Follow the link “Made through Sberbank Online”.

- Click “Operations” and “Cancel” in the menu.

Transactions such as topping up a mobile phone account, transfers between two cards are instant payments. Their status automatically becomes “Completed”. It is impossible to cancel such payments in Sberbank Online. The bank can send other transfers within an hour, and on weekends – several days. Therefore, there is a high probability of payment cancellation.

Personal account and card selection

Card transactions

Viewing transactions made in Sberbank Online

Payment “Executed by the bank”

Using a mobile application

You can cancel a financial transaction in the Sberbank Online mobile application; to do this you need:

- Open it on your smartphone.

- Go to the “History” tab and find the desired translation.

- Make sure that the transaction status is “Executed by the bank.”

- Click on it and click “Cancel”.

- Select “Confirm review” to cancel the funds transfer.

If the transaction is successfully cancelled, the status will change to 'Canceled'.

In the Sberbank mobile application, you can only recall those transactions that were performed there.

Why not cash?

It would seem that returning the buyer’s money in cash for the paid product would be the simplest and most painless solution for both sides of the interaction. But, unfortunately, Russian legislation does not allow .

Tax authorities define such cashing transactions as illegal and punish them very strictly. And, of course, no organization needs serious fines

Therefore, sellers are simply forced to return the payment exactly in the form in which it was made , that is, by bank transfer.

That is, if you purchased an item using a plastic bank card, the money for returning it can only be returned to you on the same card.

You can learn how to write a claim for a refund for a product of inadequate quality from our article.

When to return goods via online checkouts

There are different situations possible in which, in principle, one has to resort to the procedure, but basically this happens for two objective reasons. The first is related to the client's refusal to purchase. What caused such a desire, inadequate quality or one’s own preferences, is completely unimportant. When everything complies with the law, the seller is obliged to return the goods to the buyer via the online checkout.

The second reason for canceling a purchase is a typo during the initial checkout. The problem may be an incorrectly entered amount, unit of product or its name. In this case, it is impossible to do without correction, since this will lead to the transfer of incorrect information to the tax service, and at the same time to other troubles. As a result of the procedure, the buyer receives a new receipt, and the seller has to prepare other documents, which we will talk about later.

What to do if money does not arrive within the time allotted by law

The time frame for returning funds to the card to the buyer when purchasing with a card, if he does not apply on the day of purchase, may take up to 40 calendar days. But there are cases when, even after this time, the money still does not reach the rightful owner.

We are talking about translation errors when bank employees make inaccuracies when preparing payment receipts. In this case, the return of money may take several months.

In order to be informed about what stage the money return process is currently at, the buyer can contact both the seller of the goods and directly the bank. If we are talking about a significant amount, you can immediately go to court with the support of an experienced lawyer, this guarantees a faster procedure and a final positive result.

To avoid the unpleasant procedure of waiting for your own money, we recommend that you carefully inspect the product and purchase it using a card, being completely confident that it is needed. Or do not delay contacting the store to return it; it is advisable to do this directly on the day of purchase.

Sample application for refund in PDF format

An individual’s application for a refund can be downloaded from this link.

The form includes the required fields:

- Full name of the applicant;

- identification document;

- series and number of the document provided;

- phone number linked to the card;

- a list of possible reasons for contacting, from which you need to select one;

- way to resolve the issue of return;

- option to receive a response;

- the location where the transaction took place;

- date and time of contacting the bank.

Appendix No. 1 contains details of the operation, clarifying:

- what exactly was paid;

- for what reason the money was written off and/or not returned;

- whether the transaction was carried out by the cardholder or another person;

- where the card was at the time the money was written off.