Fulfillment of obligations can be ensured by a penalty - this is a way of simplified compensation for losses associated with violation of obligations. The use of a penalty is preferable in relation to obligations arising from supply contracts, work contracts and others, since the interests of the creditor are related to the achievement of certain results and are not related to receiving a sum of money from the debtor.

Quite often, when concluding a business agreement, the parties provide for the payment of a penalty. The legal regulation of penalties is provided by § 2 of Chapter 23 of the Civil Code of the Russian Federation “Ensuring the fulfillment of obligations.”

A penalty (fine, penalty) is a sum of money determined by law or contract, which the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in the case of delay in fulfillment (clause 1 of Article 330 of the Civil Code of the Russian Federation).

It follows from the text of Article 330 of the Civil Code of the Russian Federation that a penalty can be legal and contractual. The contractual penalty is established by agreement of the parties, while the parties independently determine its amount, as well as the procedure for calculation. A legal penalty is a penalty established by law.

An example of such a penalty is a penalty for violation of the contractual terms of a contract in public procurement, as indicated by paragraph 5 of Article 34 of the Federal Law of 04/05/2013 No. 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” . The creditor has the right to demand payment of a legal penalty, regardless of whether it is provided for in the contract or not. It should be borne in mind that the amount of the legal penalty can be increased with the consent of the partners, but only if this is not prohibited by law (Article 332 of the Civil Code of the Russian Federation).

Article 330 of the Civil Code of the Russian Federation defines two types of penalties - fines and penalties.

A penalty in the form of a fine is, as a rule, a fixed amount fixed in the agreement, and a penalty is an amount that depends on the period of time during which the rights of the creditor are violated. Please note that upon a request to pay a penalty, the creditor is not required to prove that losses have been caused to him; this is expressly stated in paragraph 1 of Article 330 of the Civil Code of the Russian Federation. The same opinion is shared by the judicial authorities, as evidenced, for example, by the decisions of the Federal Antimonopoly Service of the East Siberian District dated January 20, 2014 in case No. A33-12334/2013, dated December 27, 2013 in case No. A33-2754/2013, dated November 26, 2012 in case No. A58-1504/2012, FAS Far Eastern District dated November 26, 2013 No. F03-5487/2013 in case No. A37-4143/2012 and others.

In accordance with paragraph 2 of Article 330 of the Civil Code of the Russian Federation, the creditor has no right to demand payment of a penalty only if the debtor is not responsible for non-fulfillment or improper fulfillment of the obligation. Let us note that the grounds for liability for violation of obligations are established by Article 401 of the Civil Code of the Russian Federation. In all other cases, if there is evidence that the rights of the creditor have been violated, he has the right to impose penalties on the guilty party.

According to Article 331 of the Civil Code of the Russian Federation, an agreement on a penalty must be made in writing, regardless of the form of the main obligation. Failure to comply with the written form entails the invalidity of the agreement on a penalty (Resolution of the Federal Antimonopoly Service of the North-Western District dated September 24, 2013 in case No. A56-67023/2012).

Typically, provisions for the payment of penalties are written directly into the contract itself. However, they can also be reflected in an additional agreement, which is an integral part of the main contract. At the same time, we can recommend that the parties still write down the condition of the penalty, as well as its amount, in the main agreement, since this will greatly simplify the “claims procedure” of the injured party.

Let us note that the payment of fines and penalties provided for in the agreement does not prove anything. After all, the debtor may consider that he has fully fulfilled all his obligations and does not have to pay fines. Moreover, disagreements may arise between the parties regarding the amount of fines and so on. Thus, in order to confirm his consent to pay fines and penalties, the debtor must send a letter to the counterparty indicating the amount of sanctions and the deadline for their payment.

When establishing the amount of the penalty, you should remember the rules of Article 333 of the Civil Code of the Russian Federation, which establishes the court’s right to reduce the penalty if its size is clearly incommensurate with the consequences of violating the obligation.

A reduction of the penalty determined by the contract and payable by the person carrying out business activities is allowed in exceptional cases if it is proven that the collection of the penalty in the amount stipulated by the contract may lead to the creditor receiving an unjustified benefit. Please note that the rules of Article 333 of the Civil Code of the Russian Federation do not affect the debtor’s right to reduce the amount of his liability on the basis of Article 404 of the Civil Code of the Russian Federation and the creditor’s right to compensation for losses in cases provided for in Article 394 of the Civil Code of the Russian Federation.

It should be borne in mind that a penalty, as a method of securing an obligation, can in fact be applied to any of the obligations arising from the parties to a business contract. That is, the penalty can be applied both to the supplier, for example, who did not deliver goods or was late, and to the buyer who is late in payment.

Next, we will consider the procedure for reflecting in the debtor’s accounting the penalties (fines, penalties) paid by him for violation of contractual obligations.

Legal and contractual penalties under the Civil Code of the Russian Federation

In order to ensure the obligations of the transaction by the parties, the legislator in Art.

12 and paragraph 1 of Art. 329 of the Civil Code of the Russian Federation provides for the possibility of collecting a penalty. For all types of transactions, a penalty can be assigned on the basis of an agreement, i.e., the text specifies the possibility of collecting a penalty and the procedure for calculating it. For some types of transactions, a penalty may be collected based on legal requirements.

The penalty under the supply contract is recovered:

- for non-payment or untimely payment of goods received or advance obligation, if advance payment is provided;

- delivery of goods specified in the contract in incomplete quantities;

- Missing the established deadline for transferring the subject of the transaction to the buyer.

At the same time, the last two grounds for collecting a penalty under a supply contract of the Civil Code of the Russian Federation are additionally regulated by a special norm - Art. 521. The penalty can be collected only until the delivery of the missing goods under the contract. Once the delivery is completed, no penalty will be charged.

Legal penalties under a supply agreement are established only for certain types of supplies, for example, supplies for government needs, supplies of electricity. Accordingly, if the supply is not related to government procurement or its subject is not electricity, the possibility of collecting a penalty is specified separately in the contract.

Violation of the supplier's terms of delivery of goods under the contract

Significant violations of the terms of the contract may include cases prescribed in paragraph 2 of Article 523:

- If the delivered product was not of adequate quality and all its defects were not corrected within the required time frame;

- If the supplier has repeatedly deviated from the terms of the contract. If the supplier deviates from the deadlines, then the other party may simply lose interest in fulfilling this contract. This action may be specified in the contract or follow from its information.

These are not all the violations that may exist; their number is more significant.

The following consequences may follow from these violations:

- one party may refuse to fulfill the terms of the agreement either in full or in part;

- a penalty may be charged on the party that violated the terms of the contract;

- when interest is accrued on the basis of the established requirements of Article 395 of the Civil Code of Russia.

Calculation and accrual of penalties

The advantage of a penalty is its unconditional nature, i.e. the injured party is not obliged to prove whether it suffered losses or not and what their size is. Accordingly, the accrual of a penalty under a supply agreement is not related to the presence of losses and is made upon the fact of a violation on the part of the counterparty.

Penalty, according to clause 1 of Art. 330 GK, can be used in two forms:

- Fine.

- Peni.

Calculation of the penalty under a supply contract is required only when it is applied in the form of a penalty, since the penalty is of a fixed nature.

This position is not clearly established in the legislation, but this follows from the practice of civil circulation and judicial practice, which considers penalties as a monetary sanction, measured as a percentage, depending on the overdue obligation. In particular, this opinion was voiced back in the resolution of the Presidium of the Supreme Arbitration Court dated February 20, 1996 No. 8244/95.

The sanction is accrued from the moment when the counterparty should have fulfilled its obligation. Moreover, in the case of delivery of goods in batches, a penalty may be provided for late delivery or payment for both an individual batch and the entire volume. This opinion is confirmed by judicial practice (for example, the decision of the 13th Arbitration Court of Appeal dated April 17, 2018 No. 13AP-3540/2018 in case No. A21-8999/2017).

2.3. Possibility of simultaneously collecting fines and penalties from the supplier

If the supplier does not deliver the goods at all or does not start work, the customer has the right to recover from the supplier not only a fine for violating obligations under the contract, but also a late fee. Such conclusions were made by the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation in the Determination of 03/09/2017 No. 302-ES16-14360, A33-28174/2015. The Ruling of the RF Armed Forces dated 03/09/2017 N 302-ES16-14360 (Clause 36 of the Review of the RF Armed Forces dated 06/28/2017) also states: “...Fine for late fulfillment of obligations under a state (municipal) contract is subject to accrual until the termination of the contract as a result of unilateral refusal of the customer to fulfill it. At the same time, for the fact of non-fulfillment of a state (municipal) contract, which served as the basis for unilateral refusal of the contract, a fine in the form of a fixed amount may be collected...”

Penalty amount: how to calculate, formula

The amount of the penalty under the supply contract is fixed if it is determined in the form of a fine. Accordingly, no calculation is required.

How to calculate a penalty under a supply contract, defined as a penalty? This procedure is not established by law. If there is no special indication in the contract regarding the calculation procedure, the formula for calculating the penalty under the supply contract is as follows:

P = C × % × V,

Where:

- P - the amount of penalties to be satisfied;

- C - the amount of the overdue obligation (the amount of the overdue payment, the cost of undelivered goods);

- % - the amount of interest established by the parties for improper performance of the obligation;

- B - the period for which the sanction is accrued (days, weeks, months, etc.).

So, for example, if there is a delay in delivery of goods worth 10,000 rubles. within 1 month and a penalty of 10%, the amount of sanctions to be paid will be: 10,000 × 1 × 10% = 1000 rubles.

The procedure for collecting penalties from the supplier

The customer can recover a penalty from the supplier in 4 ways:

- Withhold from contract performance security if the corresponding security is transferred in cash.

- Withhold from the amount due to the supplier for payment under the contract.

- The supplier may voluntarily transfer the penalty to the customer's account.

- Collect in court.

It should be noted that the withholding of a penalty from the amount of contract security or the amount of payment under the contract should be qualified as one of the methods of terminating obligations - offsetting counter-similar claims (in accordance with Article 410 of the Civil Code of the Russian Federation). Set-off in the cases under consideration will undoubtedly be legal if the counterparty recognizes such a debt or if the possibility of appropriate deduction is provided for in the contract between the customer and the supplier.

These findings are consistent with the position of regulatory and control authorities. The Ministry of Finance of Russia and the Federal Treasury in a joint letter dated December 25, 2014 N 02-02-04/67438, 42-7.4-05/5.1-805 indicate that partial or full withholding of the security amount is carried out in accordance with the terms of the contract. This position is supported by the FAS Russia in a letter dated December 10, 2015 N ATs/70978/15: “...In the opinion of the FAS Russia, the inclusion in the draft contract of a condition that in the event of non-fulfillment or improper fulfillment of the obligation provided for in the contract, the customer has the right to make payment according to contract minus the appropriate amount of the penalty (fine, penalty), does not contradict the requirements of the Law on the Contract System.” Also, the Ministry of Finance of Russia, in letter dated November 2, 2020 N 24-03-08/95446, indicates: “... the customer has the right to make payment under the contract minus the appropriate amount of the penalty (fine, penalty) or has the right to return the contract security, reduced by the amount of accrued fines, pennies..."

Penalties cannot be withheld from a bank guarantee. Letters from the Ministry of Finance of Russia dated 09/14/2020 N 24-05-08/80942, dated 10/02/2020 N 24-03-08/86257 indicate: “Thus, based on the above, the penalty cannot be paid using bank guarantee funds, so as a minor obligation under a contract, the performance of which is secured by a bank guarantee...”

Collection procedure. Statement of claim for recovery

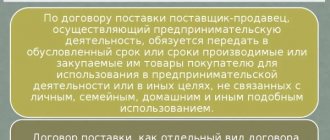

Features of the supply contract based on Art. 506 of the Civil Code - its parties, which can only be business entities. This means that all disputes arising from such legal relations are subject to consideration by arbitration courts.

Collection of funds under civil law transactions is carried out through arbitration courts only after compliance with the pre-trial procedure for resolving the dispute. Part 5 art. 4 of the Arbitration Procedure Code allots 30 calendar days to resolve the issue in the claim procedure (the period begins to run from the day the claim is sent).

According to paragraph 1 of Art. 196 of the Civil Code, a general three-year statute of limitations applies to claims for payment of penalties under work contracts, since the law does not establish other deadlines.

During this period, a party can at any time send a claim to the other party according to the rules defined by the terms of the transaction. If these are not identified, then the request must be sent by registered mail with notification and a list of the attachments.

In general, the collection procedure is as follows:

- Drawing up and sending a claim.

- Waiting for a month to respond.

- Preparation and submission of a statement of claim to the arbitration court.

- Making a decision by the court.

- Entry of the decision into legal force.

- Receipt of the writ of execution by the claimant.

- Collection of the amount of the penalty (including through the bailiff service).

A statement of claim for the recovery of a penalty under a supply contract is drawn up and sent in accordance with the general rules of claim proceedings established by Section II of the APC.

Violations and liability of the customer

Buyers usually violate the payment terms. But there are other situations:

- did not prepare the site for unloading (when the contract provides for delivery);

- late collection or refusal to receive;

- did not issue a power of attorney for the representative, which excludes the possibility of actual transfer of the goods.

The first example involves vehicle downtime, which allows you to recover damages in the amount of expenses incurred, based on the hourly payment for the work of the vehicle.

Failure to pay will result in the accrual of a contractual penalty (if provided for in the terms and conditions). Untimely sampling or lack of proper registration of the representative’s powers may result in the accrual of a penalty, but it is possible to additionally provide for a fee for storage over a certain number of days.

Results

Thus, speaking about supply, the most relevant is a contractual penalty, since the law provides only a penalty for violation of government supply contracts, as well as contracts for the supply of electricity. The amount of the penalty depends not only on the terms of the contract, but also on the amount of the transaction and the period of delay.

To collect a penalty through the court, the pre-trial procedure for resolving the dispute must be followed.

The issue is resolved in arbitration court if the claim is not satisfied during the claim settlement of the dispute. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to recover losses?

Losses are the costs of restoring a violated right (the difference in price between products when the buyer was forced to refuse the item due to delay and buy a more expensive product in another store).

Losses are compensated along with satisfaction of claims arising due to violation of the terms of the contract by the seller. At the same time, they are compensated both voluntarily and in court.

Article 22 of the POPL states that the buyer’s claims for damages are satisfied within 10 days from the date of filing the claim.

If the delivery time is not met, the buyer has the right to demand full compensation.

IMPORTANT: the condition for damages must be included in the content of the claim and justified.