Collection of legal expenses - approach the process carefully. Not a single civil case that reaches the court is complete without legal expenses. One way or another, when turning to judicial authorities, citizens bear certain costs. In certain circumstances, it is possible to recover legal costs after a decision is made, incl. recovery of expenses for payment of representative services. This will help you not to be left at a loss after the process.

Our civil lawyer will help you in the matter of collecting legal costs from drawing up an application to full support of the procedure.

What types of legal expenses are there?

There are several types of costs that may be incurred during a lawsuit.

- State duty. For some types of claims, a mandatory payment is required - a state fee. Its size is set by the state. The established amount is paid before filing an application with the court and a document confirming payment must be attached to the statement of claim. Therefore, if the fee is not paid on time and is not included with your application, your case will not be processed.

- Costs associated with the consideration of the case. This type of cost is also divided into several categories:

- amounts for payments to persons involved in the case;

- housing costs for persons who must appear in court in this case;

- costs of searching for the defendant;

- expenses for the execution of a court decision;

- loss of time;

- other expenses – postage, etc.

This list is considered open, and, in fact, the party who incurs these costs can petition the court to recover other reasonable costs that arose in the provision of services by the lawyer in your civil case or as a result of independently handling the case.

USEFUL: watch a video with tips on claiming legal costs, the deadline for this, as well as challenging the amount of collected costs, write your question in the comments of the video to receive a FREE answer

Representative services. In civil proceedings today, this can be not only a lawyer, but also any citizen.

The participation of such a person in the process is, of course, not mandatory. Typically, the judge decides on the amount of the penalty based on experience and knowledge of the cost of such services in his region.

Calculation and payment of state duty: postings

In the records of payment of state duties in the postings, invoice correspondence is used. 51 and 68:

- Dt 68 / state duty Kt 51

However, in practice there are often situations when the state duty is paid not from the company’s current account, but in cash through its representative. Are such actions legal? The answer to this question is given to us by the letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated 06/01/2012 No. 03-05-04-03/43, in which officials confirmed the competence of such actions. At the same time, when paying the state duty, you must attach documents to the payment receipt confirming that the funds paid belong to the company performing the action for which the state duty is charged . This may be a power of attorney for the representative, copies of constituent documents, an expenditure order for the issuance of cash to the representative to pay the state duty.

Accounting entries for payment of state duty in this case will have the following form:

- Dt 71 Kt 50 - cash was issued for reporting to the representative;

- Dt 20 (23, 25, 26, 44, 91.2) Kt 71 - reflects the amount of state duty paid.

Procedure for collecting legal expenses

When collecting legal costs, the main condition is their justification. Accordingly, the party seeking reimbursement must prove that the costs were strictly necessary. Also, the declared amount, of course, must be adequate; when challenging the declared amounts, a certificate of the cost of legal services can often be provided as evidence.

An application for recovery of legal costs is submitted either along with the filing of a claim or during the consideration of the case in court. When announcing the decision in the case, the court also determines the issue of reimbursement of the claimed expenses. All costs that are officially confirmed can be divided between the parties to the case. It is also worth noting that a petition for recovery of legal costs must be drawn up and submitted in writing.

As for the period for collecting legal costs, filing an application is possible within six months from the date of the court’s decision on a particular case.

Results

Posting state duties in accounting has numerous features. The state duty can be attributed to expenses for core activities, other expenses or to an increase in the value of the asset.

When writing off state duty, postings are made using expense accounts in correspondence with the account. 68, to which the corresponding sub-account is opened. The fee for carrying out legally significant actions charged by private notaries is not a state duty, therefore, when carrying out such business transactions in accounting, invoice. 68 is not used.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Objection to an application for recovery of legal costs

A party to a case, if the outcome of the case is not decided in his favor, is faced with the question: how to reduce legal costs for a representative in civil proceedings? Which were stated by opponents in the trial.

In this case, it is necessary to pay attention to a number of circumstances that may affect the amount of legal costs recovered:

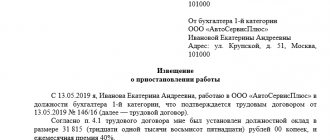

- Documents confirming the expenses of the winning party in the case must be properly executed, that is, there must be an agreement for the provision of legal services, and documents confirming payment under this agreement. At the same time, you should carefully consider the date of payment and conclusion of the contract; these legal relations could not arise after the trial, if legal costs are collected after the decision in the case;

- The documentation submitted by the winning party must relate to the dispute under consideration , that is, you must pay attention so that the costs of another case of your procedural opponent do not fall on your shoulders.

If you discover these circumstances, you can count not only on a reduction in legal costs, but also on a complete refusal to collect these costs.

Nuances of accounting for state duties in 2020-2021

State duty, according to Art. 13 of the Tax Code of the Russian Federation, is recognized as a collection at the federal level. Recently, no adjustments have been made to this area, therefore in 2020-2021, as before, an account is used to reflect accounts for its accrual and payment. 68 (subaccount “State duty”).

At the same time, the type of corresponding account when calculating state duty depends on its type. State duty may be paid in connection with:

- with the acquisition of certain property assets;

- carrying out business operations related to the main activities of the company;

- carrying out operations that are not related to its main activities;

- participation of the company in legal proceedings.

Let's look at how state duties are recorded and what transactions are necessary to record the operation to accrue the corresponding amounts in the listed situations.

How to reduce legal costs for the losing party?

If these circumstances are not available, then the party to the trial should think about how to reduce the legal costs of the losing party, in this case, that civil procedural legislation, that arbitration rules tell us that these costs are recovered from the losing party within reasonable limits, in this case by This reasonable limit is influenced by the following factors:

- complexity of the dispute , in this case, depending on the legal regulation, the price of the claims, and the stated requirements, the category of the dispute in a particular case is determined, and on the basis of which the amount of expenses for a representative is determined, which is why, for example, a trial for the protection of consumer rights is not a complex dispute in view of which, on this basis, it is quite reasonable to demand a reduction in legal costs;

- the number of procedural documents prepared and their value , in this case during the trial, the court evaluates how the representative prepared for this or that process, what documents he prepared, whether these documents were relevant to the case, therefore, if the representative made mistakes on this basis also it is possible to reduce the amount of recovered legal costs;

- number of court hearings , in this case, objections regarding the amount of costs recovered should reflect how many court hearings there were, for what reason and whose fault were the postponements and postponements of court hearings. This basis is also significant when determining the amount of expenses.

- whether there was an appeal against the judicial act, in which instances the representative participated, what was the result of the appeal against the judicial act. It should be noted that the trial does not end with a decision in the court of first instance, and in this case the work of the representative is assessed in the appeal and, if there is a cassation and supervisory appeal procedure.

It is simply necessary to take these circumstances into account when preparing a reasoned objection to the application for recovery of legal costs of the winning party. Our Law Office will analyze the documents submitted by the Principal and prepare a reasoned objection, taking into account not only the arguments presented above, but also existing judicial practice to achieve the most positive result for the Principal.

How is state duty reflected in tax accounting?

All types of state duties in tax accounting are included in the category of other expenses. Moreover, it should be reflected at the time of accrual (subclause 1, clause 1, article 264 of the NKRF). For different circumstances, this moment may fall either on the date of payment, or on the date of registration documents, etc.

Thus, when registering any actions, the state duty is paid in advance, but it should be included in expenses only after the registration documents are accepted by the authorized body. But when paying the state fee for licensing, it is taken into account at the time of accrual (letter of the Federal Tax Service of Russia dated December 28, 2011 No. ED-4-3/22400). If the state duty is due to the purchase of non-current assets, then the amount of the state duty will be included in the initial cost of the objects, provided that it is paid before their acquisition. If after, then in the category of other expenses.

The cost of legal services plays a role

The cost of legal services is another factor that negatively affects the practice of considering claims for the collection of expenses. This is due to the fact that the more expensive a lawyer is, the less likely there is to fully compensate for his cost.

If the amount of costs does not exceed one hundred thousand rubles, then the statement of claim will be approved in full; if the amount is higher, then a good evidence base will be required.

Situations where expenses are high are much more common when it comes to businessmen. The assistance of legal experts becomes more expensive every year. Even the preparation of one document can reach up to ten thousand, and if during the process it is necessary to send several appeals, including the representation itself in court , then the sums are impressive.

We recommend reading: The impact of the pandemic on business in Russia. What happened to the business and how to save it?

Courts, when assessing these circumstances, do not pay attention to the fact that different firms and private lawyers can set different prices for the same services. To evaluate this objectively, it is enough to study the market.

However, the judicial community does not waste time and effort on this, relying solely on its own opinion. It is this fact that has a negative impact on the practice of collecting expenses.

The Supreme Court of the Russian Federation does not offer significant clarifications in this regard. An important clarification that only confirms the problem is that you cannot recover the entire amount of costs based on the fame and experience of a lawyer with a high price tag.

That is, the level of professionalism of the representative is not important for the court. The only option when the full amount can be received is through the opponent’s dishonest behavior and deliberate delay of the process on his part.