Last modified: February 2021

A homeowners' association is organized to resolve issues related to managing the house and maintaining it in technically sound condition. When the activities of the HOA do not bring the desired effect, or there are serious complaints about the work of its employees, there is a need to close the organization and transfer management to another company. The liquidation of an HOA can be initiated by the residents themselves, or there is a court decision, and the termination of work is related to the identified violations.

The procedure for closing an HOA voluntarily or forcibly is regulated by federal law. Legal regulations must be followed to ensure the liquidation is carried out properly.

Grounds for termination of activity

The partnership is liquidated voluntarily or forcibly. Grounds for liquidation of HOAs and TSNs:

- making a collective decision by residential property owners

- submitting an application from the housing inspection

- bankruptcy of the owners' organization

- judicial decision

- expiration of the period for which the association was created

- the emergence of information about the illegality of creation

Homeowners' associations (TSN) are forcibly closed by a court decision if:

- the company carries out activities that are subject to licensing, but does not have the right to do so

- a lawsuit was filed regarding the need for liquidation due to the inability to achieve the goals for which the HOA (TSN) was created

- the number of residents of an apartment building who are not members of the owners association exceeds the number of members of the society

- a gross violation of Russian legislation has occurred and/or continues to occur systematically (if the situation cannot be corrected)

- the organization does not carry out any activities (does not function)

- a complaint was received from an interested organization (for example, from a water supplier) about the partnership having a large outstanding debt (the reason may be ineffective, illiterate management of the partnership or systematic failure to make utility payments by residents)

The liquidation of a partnership of real estate owners is carried out voluntarily, when the corresponding verdict is passed by the owners at a general meeting of residents. The reason for the voluntary liquidation of a partnership may be:

- achieving all the goals that the HOA (TSN) had when it was created, and solving all the tasks for which the legal entity was formed

- failure by the partnership to fulfill its initial tasks

- formation of large debts to utility providers

- the end of the organization’s term of action (if the partnership was opened for a certain period)

Differences in procedure

If you have debts

Before liquidation, additional checks will be carried out to detect fraud. The property of the debtor partnership is put up for sale. Debts to creditors are paid in the order of priority established by clause 1 of Art. 64 Civil Code of the Russian Federation.

If you did not carry out activities

The closure of such a partnership is only formal and can also be liquidated by a meeting of residents if the following conditions are met:

- There are no debts to third parties.

- There are no complaints from the tax authorities regarding the zero balance.

Normative base

The liquidation of a partnership of residential real estate owners occurs according to the standards described in Article No. 61 of the Civil Code, and is declared insolvent under Art. No. 65. At the same time, Art. No. 62 describes the responsibilities of persons responsible for the initiative to close an organization, and Art. No. 63 – the procedure for carrying out this procedure. If a legal entity has creditors, their claims must be satisfied in the order specified in Article 64 of the same legal act. When the reason for the dissolution of the partnership is bankruptcy, liquidation is carried out in accordance with the bankruptcy procedure under Articles No. 130, 131 of the Civil Law Code.

In a situation where members of the HOA (TSN) leave its membership, and the remaining part of the disintegrating partnership does not have even half (fifty percent) of the votes of all residents of the apartment building, the owners of the premises included in the HOA (TSN) must liquidate the specified legal entity according to Art. No. 141 Housing Code.

The liquidation procedure of the HOA (TSN) is underway by decision of the general meeting of owners. In order for a valid verdict to be made, such a meeting must be attended by 50% or more of the partnership members. The decision to close an organization is made by a simple majority (half of the participants, plus at least one vote, must be “for” the liquidation of the organization).

Creation of an audit commission

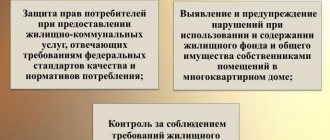

Provisions of Art. 150 of the RF Housing Code indicate that the commission acts as a control body, which is elected by the members of the partnership.

The validity period is 2 years. The commission must have a chairman who is selected from among its members.

The auditor has obligations:

- implementation of an audit of the partnership’s activities. The procedure is performed at least once a year. The responsible person undertakes to provide the meeting of homeowners with the results of the measures taken;

- generating a report on the estimate of income and expenses of the partnership;

- preparing reports on your activities.

The commission may include a citizen who is trusted by the members of the HOA. However, members of the board of the partnership cannot conduct an audit.

Liquidation of a homeowners association by court decision

The procedure for liquidating an owners' association is compulsory if representatives of:

- tax authority

- state housing supervision (if gross violations are detected)

- prosecutor's office (in case of violation of the rights, freedoms, interests of individuals, legal entities, the state)

- local government bodies (if violations were identified at the stage of creating the partnership)

Apart from the indicated persons, no one can close the organization through the court, therefore, if a complaint or claim is filed by a person who does not belong to one of the specified categories, the petition will not be granted.

Step-by-step instruction

How to close a homeowners association (TSN), below is a sequential algorithm of actions:

- creation of an initiative group of board members

- formation of a register of partnership participants and preparation of a draft application

- consideration and signing of the application

- provision of the document to the head of the liquidated organization

- convening a general meeting with the issue of liquidation on the agenda

- voting with recording of results in the protocol

- creation of a liquidation commission

- message in the State Registration Bulletin about the upcoming procedure for closing a HOA (TSN)

- notification of the tax authority about closure

- sending letters to creditors (if any), notifications to employees

- Carrying out settlements with employees/creditors

- preparation and approval of the liquidation balance sheet

- sending the necessary documentation to the supervising state tax service to exclude the organization from the Unified State Register of Legal Entities (occurs within five working days)

Liquidation commission

The liquidation commission deals with the closure within 60 days from the moment the decision on liquidation is made (this period is allocated by law for the closure of an HOA or TSN). In this case, expenses that go beyond the budget of a legal entity are covered by those responsible for the bankruptcy of the organization (for example, the head of the organization).

Required documents

To properly and quickly close a partnership, you will need the following documents:

- statement from persons initiating liquidation

- certificate of the status of the liquidation account (this is a bank account that is opened during the liquidation of a legal entity for final settlements with creditors)

- document confirming payment of the liquidation state duty

- certificate from PF

- copies of passports of members of the liquidation commission and the charter

- liquidation protocol (minutes of a meeting of premises owners documenting the adoption of a decision to close the partnership by a simple majority of voters) or a court decision.

Voting on liquidation is carried out in absentia or in person. In this case, two or more representatives of the board make the rounds of all voters, providing each owner with a voting form.

Price

The amount of money that must be paid to the state treasury to liquidate the partnership is 800 rubles. Payment details should be obtained from the government agency located at the place of registration of the partnership.

Duration of the procedure

The period allotted for settlements with creditors and closure of the partnership is sixty days from the date of publication of the intention to close the HOA (TSN) (usually such information is published in the State Registration Bulletin). If a company that has debts is liquidated, the court appoints an arbitration receiver for a period of up to six months.

What documents will be needed?

Liquidating a legal entity is much easier than creating it. If the HOA terminates its activities based on a decision of the meeting, then the following papers will be needed:

- application (necessarily certified by a notary);

- minutes of the meeting at which the decision was made;

- liquidation balance sheet;

- a certificate confirming payment of the state duty;

- documentary evidence that the data of officially employed HOA employees was transferred to the Pension Fund (what personnel are required on the HOA staff, and which employees can be recruited at will, is described in a separate material).

Note: if an organization is liquidated through court, then the initiative group needs to draw up a statement of claim and collect relevant evidence.

Closing with debts

According to the law, before the liquidation of a homeowners association (TSN) with debts, the partnership must pay off all debts. If this is not possible, it is necessary to initiate bankruptcy proceedings and close the organization through the court. An external manager appointed by the court is responsible for minimizing expenses, drawing up a settlement plan with creditors, and collecting debts from tenants. If it is impossible to pay debts, a corresponding application is submitted to the tax service, and the organization is excluded from the Unified State Register of Legal Entities.

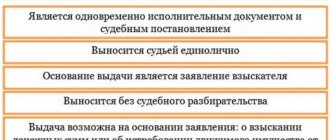

Typically, the reason for the liquidation of a partnership is the systematic non-payment of utilities by the residents of the house (owners of residential real estate) and the fault for the occurrence of bankruptcy lies with them. The resource supplying organization sues the HOA for delinquent payments. The resulting debts during liquidation are distributed in proportion to the debtors included in the association and are collected through a system of court orders. Therefore, you will have to pay for the resources consumed in any case.

The situation is worse when residents paid all issued receipts directly to the HOA, and the funds were spent by the chairman for other purposes or stolen. The law, unfortunately, is not in favor of owners. Homeowners are required to verify where the money was spent. Article 312 of the Civil Code of the Russian Federation - the lack of information about where the funds were sent by management does not relieve the payer of responsibility. Residents will have to re-pay the services of resource supply companies if the latter do not receive funds from TSN.

Bankruptcy

This is the financial position of an organization in which it is impossible to repay debt obligations. The partnership may be declared bankrupt on the basis of Art. 65 Civil Code of the Russian Federation.

The main difference from liquidation is the presence of signs of insolvency on obligations and the closure of an organization with particularly large debts.

In accordance with paragraph 2 of Art. 33 of Federal Law No. 127-FZ of October 26, 2002, the bankruptcy procedure is applied if claims for debts of a legal entity amount to at least 300,000 rubles.

Causes

- Late payment and accumulation of debts on utility bills. As a result, penalties are imposed and penalties are assessed. Since the HOA is a non-profit organization, there are no financial resources to pay fines.

- Misappropriation of funds paid by residents of the house for utilities.

Stages and sequence

- The company itself can apply to the arbitration court in order to declare its bankruptcy. Also, the initiators of bankruptcy of a partnership may be creditor organizations that have not received funds for services rendered.

- After considering the statements and accompanying evidence, the court may allow the organization to pay off its debt obligations. Thus, the bankruptcy procedure is postponed.

- Observation:

- an analysis of the real situation of the partnership is carried out;

- creditors are identified;

- rehabilitation (tenants pay their utility debts).

- If repayment of debts is impossible, then the HOA is declared bankrupt and closed under a standard liquidation plan.

Additionally, we suggest that you familiarize yourself with materials that describe in detail what the structure of an HOA is, what pros and cons it has, how it differs from TSN, and what is included in the financial and economic activities of this organization. Also read about whether a management company can manage a house together with a HOA, for what reasons disputes arise, how and where to complain in these cases, and what an association of HOA and housing cooperative is.

The liquidation process may drag on indefinitely . If significant disagreements arise between members of the HOA, as well as in the absence of free time and special knowledge on this issue, the best solution would be to contact a highly qualified lawyer in order to find a quick way out of the current situation.