- home

- Reference

- Old age pension

The current pension legislation establishes that in the event of the death of a citizen who received the appropriate funds, his relatives may qualify for various payments.

First of all, this concerns the pension accrued but not issued to the deceased. At the same time, certain requirements are imposed on relatives who expect to receive cash payments. How to receive a pension, as well as where and in what time frame you need to apply, will be discussed later in this article.

What does the pension consist of?

Let us remind readers that the pension in the Russian Federation consists of two parts: insurance and funded.

The insurance part of the pension is a monthly and lifetime cash payment that represents compensation for lost income. Today, all insurance contributions transferred by the employer (22% of the employee’s salary) go towards the formation of an insurance pension.

To date, all contributions go only to the formation of the insurance part of the pension.

Let us dwell in more detail on the savings part, since this is what the heirs can claim.

Holders of pension savings can be divided into 2 categories:

1. Citizens who were born in 1966 and earlier. For such citizens, pension savings were formed only from 2002 to 2004 inclusive, at the expense of contributions to the Pension Fund paid by the employer. Thus, the funded part of the pension of this category of citizens took only 2 years to form, and the amount of such pension savings is unlikely to represent an impressive amount.

2. Citizens born in 1967 and younger. Their default funded pension was formed from 2002 to 2014 also at the expense of contributions paid by employers to the Pension Fund. Since 2014, a moratorium on the formation of the funded part of the pension until 2023 was introduced.

What type of pension can you get?

Pensioners usually mean people who receive payments upon reaching old age or an old-age pension. However, the circle of persons belonging to this category of citizens is much wider. And here it should be noted that relatives cannot count on all types of pensions. Let's take a closer look.

Relatives can receive the following types of pension payments:

- Due to old age. Third parties can count on receiving, first of all, an insurance pension assigned to citizens who have sufficient experience and the required number of insurance points. In addition, social benefits are paid to persons who do not meet the criteria for an insurance payment. In addition, if the deceased pensioner received a preferential pension, including early retirement, then relatives can count on it.

- According to length of service. Certain categories of citizens receive payment based on length of service. First of all, these are former military personnel, as well as employees of law enforcement agencies equivalent to the army. Relatives of deceased military pensioners can also receive payments accrued but not paid to them.

- Funded pension. The procedure for paying the funded pension of the deceased is somewhat different from the generally accepted one. The corresponding procedure will be discussed below.

Is it possible to inherit the insurance portion of a pension?

Payment of the insurance part of the pension ceases after the death of the pensioner, starting from the first day of the month following the month in which the death of the pensioner occurred.

If the pensioner did not manage to receive the payment due to him in connection with his death, disabled members of the family of the deceased who lived with the pensioner at the time of his death are entitled to receive it. The list of such persons is indicated in Part 2 of Art. 10 Federal Law “On Insurance Pensions”.

The period for applying for an unpaid pension is 6 months from the date of death of the pensioner. In a situation where there are several applicants for the pension payment due to the deceased, the amount of such payment will be divided between them in equal parts.

If disabled family members are absent or simply have not made a claim, the unpaid part of the pension is inherited on a general basis.

If the deceased pensioner is the breadwinner, is it possible to switch to the deceased’s dependent pension?

A relevant case is when the deceased pensioner actually supported the rest of the family. Relatives of the deceased who were dependent on him have the right to request a pension “in connection with the loss of a breadwinner”: disabled parents and spouses can also do this, even if they were not entirely supported (this is possible in the case when they have lost their sources income).

In this case, unlike withdrawing the remainder of the pension, the time interval from the date of death is not important. To transfer to the deceased’s pension, a person who is in a registered marriage with the deceased should contact the Pension Fund, presenting:

- passport

- marriage certificate, as well as death certificate of the pensioner)

- SNILS of the deceased

- information about his earnings for an arbitrary 5 years, as well as his work experience

- documents certifying the applicant's dependent status or loss of sources of income

In some circumstances, additional documents may be required - this question must be asked to the Pension Fund, and they are required to answer.

If the deceased pensioner was a military man, his wife should go through a similar procedure for applying for his pension.

Algorithm for applying to the Pension Fund for the unpaid part of the insurance pension

Below is an approximate procedure that is recommended to be followed when receiving the unpaid portion of the pension due to the pensioner.

1. Prepare the necessary package of documents:

- application for pension payment;

- applicant's passport;

- documents confirming the death of the pensioner;

- documents that can confirm family relationships with the deceased;

- certificate of inheritance.

2. Send the documents to the Pension Fund.

A package of documents is submitted to the territorial body of the Pension Fund. Moreover, it can be presented personally by the applicant, as well as through the MFC.

In connection with the current epidemiological situation, it is recommended to first clarify the procedure and mode of operation of a specific PFR body.

Unreceived funds must be paid to the applicant within 5 days from the date of receipt of the application by the Pension Fund. The method of receipt is previously indicated in the application.

Withdrawing money from the deceased's account for a funeral by inheritance

In Russia, support measures are provided upon the death of a relative, namely a social benefit for burial. It is paid to the Pension Fund upon the application of loved ones of the deceased. Payment is made immediately, on the day of application, based on the death certificate. It is allowed to receive money no later than 6 months after the death of the pensioner.

To apply you must provide:

- Identification.

- Appeal.

- Certificate of death.

- Confirmation of the fact that the pensioner was unemployed on the day of death.

Who is entitled to receive the deceased's pension savings?

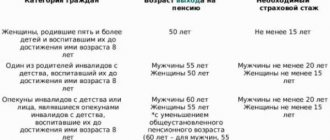

The legislator establishes 2 categories of such citizens, these include:

- 1st stage – children, spouse and parents of the deceased;

- 2nd line – brothers, sisters, grandparents and grandchildren (if there are no relatives listed in the first category).

When inheriting the funded part of a pension, the age and ability to work of the heir does not matter; only the fact of being assigned to one of the queues indicated above is important. Pension savings are divided in equal shares between relatives of the same line; accordingly, if there is only one heir, then he will receive the entire available part of the funded pension.

Separately, mention should be made of maternity capital, which was aimed at forming savings. If the specified funds, at the time of the woman’s death, had not been paid to her, then only:

- father (adoptive parent) of the child, in connection with whose birth (adoption) the right to maternity capital arose;

- minor children of the deceased woman;

- adult children of a deceased woman studying full-time until graduation, but no longer than until they reach 23 years of age.

Some nuances of receiving a pensioner's last pension

A relative of a pensioner must have information when the pension is credited to his bank account. It’s good if a senior citizen transfers his pension to a bank card account issued by a bank. To receive his last pension for the heir, this is the most convenient option. If an elderly relative entrusted him with his bank card, and the pension funds for the current month were credited to it before he died, then the relative can receive them using any ATM. He will not have to prove his right to receive it and go through the authorities.

If the pension amount is credited to the bank account from which the pensioner withdrew funds from the savings book, it is better to hurry with submitting an application to the pension fund and apply there as soon as he is buried. Then the relatives will have the opportunity to receive funds no later than the middle of next month, otherwise the pension will be credited to the bank account of the deceased and will go to the general inheritance.

In what cases can pension savings be inherited?

The specified amounts of money are not inherited a priori, but only if:

- a potential pensioner died before receiving the funded part of the pension;

- the pension recipient died after retiring, but did not have time to apply for payment of pension savings;

- a potential pension recipient died before reaching retirement age.

If a pensioner has received a payment from pension savings at least once, then the legal successors will no longer be able to claim payment of the rest of their pension savings.

Registration of inheritance for labor pension

If the person who has left the world has never received a pension, then relatives have the preference to receive the accumulated funds in a personal pension account.

To apply, applicants must contact the nearest branch of the Pension Fund of Russia, write an application indicating their desire, and attach the prescribed package of documents to it.

Where do pension savings go after a person dies?

The fate of the pension savings of a person who has passed on to another world is determined by several factors:

- if an individual began to use pension benefits during his lifetime, then the balance of the funds stored in his account after his death will remain at the disposal of the Pension Fund or a non-state fund. That is, the heirs in this case will not receive anything and have no right to claim;

- compliance with delivery deadlines. If the application deadlines are met, the payment will be received by the legal successors. If there are no valid reasons for restoring the registration period, then the accumulative part will remain in the assets of the fund.

How is payment inherited to legal successors?

When inheriting by will, fund employees initially notify individuals of the existence of such a preference.

Further, the procedure becomes the same in both testamentary disposition and inheritance by law. Persons who have a preference for receiving financial assets apply to the authorized institution within six months after the death of the account owner. A list of documents is attached to the application.

Algorithm for legal successors to apply to the Pension Fund for the unpaid funded part of the pension

1. Collect the necessary package of documents.

As in the case of payment of the insurance part of the pension, it is necessary to collect a certain set of documents. These include:

- application for payment of pension savings;

- applicant's passport;

- documents that confirm relationship with the deceased;

- SNILS of a pensioner;

- court decision to restore the deadline for filing an application for payment of pension savings funds - for legal successors who have restored the deadline in court for filing an application for payment of pension savings funds.

The list indicates the main documents that must be submitted to the Pension Fund, however, the list itself may vary depending on each specific situation. If you have difficulty selecting the necessary documentation, our specialists are ready to assist you in resolving this issue. You can consult by phone: + or via WhatsApp.

The specified set of documents must be submitted to the territorial body of the Pension Fund of the Russian Federation or the non-state pension fund in which the deceased’s savings were located, within 6 months from the date of death of the pensioner. If the six-month period is missed, it will have to be restored in court.

2. Receive a receipt notification that the Pension Fund has accepted your application. Such a receipt is issued on the spot or sent by mail within 5 working days from the date the application is accepted for consideration. The Fund may return the application if the information specified in it does not correspond or if required documents are missing. In any case, the fund is obliged to indicate the reason for the return.

If you doubt the correctness of the application or set of attached documents, our lawyers are ready to provide you with qualified legal assistance.

3. Wait for the results of the review of your application.

The decision must be made by specialists no later than the last working day of the month following the month in which the six-month period established for the appeal of legal successors expires. For example, if 6 months expires on 03/31/2020, then the last day on which the fund can make a decision will be 04/30/2020.

The law establishes a closed list of grounds for refusal to pay pension savings to legal successors.

4. If the fund makes a decision in your favor, receive the funds due. The deadline for their payment is no later than the 20th day of the month following the month in which the decision on payment was made. For example, if the decision on payment was accepted by the fund on 04/30/2020, then the payment must be made no later than 05/20/2020.

The method of receiving funds is previously indicated in the application.

Amounts of pension savings of the deceased that are paid to legal successors are not subject to personal income tax.

Who can apply for the latest pension payments?

Close relatives of a deceased pensioner can receive their final pension. This list includes all heirs whose order of inheritance is established by law in accordance with Article 1183 of the Civil Code of the Russian Federation.

Article 1183 of the Civil Code of the Russian Federation

“Inheritance of unpaid amounts provided to a citizen as a means of subsistence” (more details)

Important! The amount of the last pension is not included in the inheritance and is not paid for funeral expenses. It is classified as an inheritance only if it is not received within six months. Then it is transferred to a bank account opened by the pensioner and included in the general inheritance, which is inherited both by law and by will.

Federal law established the priority condition for a relative receiving the last pension to be his residence with the deceased citizen.

If several members of his family want to receive the last pension of a relative, the amount of the pension will be divided equally between them, unless they agree otherwise. The possibility of receiving a citizen's last accrued pension by distant relatives is allowed if no one lived with him. These persons will receive permission only after documenting the reasons why they claim the right to receive a pension.

Is it possible to restore the deadline for filing an application for payment of the funded part of the pension?

Yes, this period can be restored in court. The distinctive point here is that the courts, when considering this category of cases, are not as strict as in the case of restoring the deadline for filing an application for acceptance of an inheritance.

The courts, realizing that knowledge about the pension system and its capabilities is rather narrow, and that an ordinary citizen may not always know about the opportunities that he has, quite often restore the terms.

An application for restoration of deadlines is submitted to a court of general jurisdiction, the amount of the state fee for its consideration is 300 rubles.

Frequently asked questions

Does the fact of employment of the deceased affect the receipt of the last payment by relatives?

No. The legislation does not establish any restrictions regarding whether a pensioner worked or not. Consequently, relatives have the opportunity to spend the last income on his burial.

What papers need to be collected if the deceased did not work?

To use the money not received by the deceased, it is necessary to substantiate the legality of their claims. Namely, confirm:

- presence of family ties;

- fact of cohabitation;

- being dependent.

Can a wife apply for a pension benefit for her deceased spouse?

In general, this is not allowed. However, there are conditions under which a woman has the opportunity to slightly increase her insurance content. They are:

- the spouse has the right to receive accruals for the insured event;

- refuses his own in favor of a pension for the loss of a breadwinner;

- confirms its right with the following documents:

- marriage certificate;

- certificate of disability;

- official information that he is raising young (under 14 years old) children, grandchildren, sisters or brothers of the deceased.

Attention: survivor benefits are provided for in Article 10 of Law No. 400-FZ.

How to bequeath your pension savings

The ability to bequeath your pension savings is enshrined in law, and any citizen who possesses them has the right to dispose of them in the event of death, without resorting to the services of a notary.

You can take care of the distribution of your pension savings now

To do this, you need to contact the territorial office of the Pension Fund or the non-state pension fund in which your pension savings are accumulated.

When applying, you must have your passport with you, as well as a completed application for the distribution of pension savings between legal successors. In addition to other data, this application must indicate the legal successors themselves, as well as the size of their shares.

In the event of the death of the insured person, the fund will be obliged to notify the legal successors of the opportunity to receive the pension savings of the deceased.

The Russian pension system appears to be quite complex, and the payment of pension funds to legal successors can be affected by the smallest nuances. Our lawyers with many years of experience in the field of inheritance law will help you resolve any issues of inheritance law. Call the number: + or write to WhatsApp.

Options for receiving a pension

Let's first consider how pensioners can receive their pension in general. The delivery of pensions is carried out by two bodies: a post office located near the pensioner’s residence and a banking institution.

Pensioners can receive these payments in several ways:

- directly at the post office;

- by delivering the pension by post office to the address where the citizen lives;

- receipt from a pension account opened with a savings bank or other credit institutions;

- by receipt from a bank card opened in the bank for the recipient.

Delivery of pensions to your home is free of charge; this service is paid for by the Pension Fund. The pension is credited to a bank account or bank card account in accordance with the established schedule for the receipt of pension funds at the regional bank branch.

Expert commentary

Shadrin Alexey

Lawyer

Receiving a pension using a plastic bank card is very convenient, because... You can withdraw funds at a convenient time, or use your bank card directly.

Where to get it

To apply for a funeral subsidy, you should contact one of the authorized organizations, depending on the current situation. Such institutions include:

- the PFR branch at the place of registration of the deceased citizen, if he received a pension;

- organization - the employer of the deceased, if he was officially employed, or the Social Insurance Fund (hereinafter referred to as the Social Insurance Fund);

- military registration and enlistment office - the institution responsible for calculating funeral subsidies:

- veterans of the Great Patriotic War, military operations;

- police officers;

- military personnel;

- employees of law enforcement agencies;

- firefighters;

- former military personnel;

- customs officers;

- tax service employees;

- the regional social security authority to which the deceased was attached during his lifetime at the place of permanent registration, provided that he was unemployed and was not a pensioner or former military personnel.

“Question-answer” section

How to receive a pension for a deceased relative from Sberbank?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

When an application is submitted to the Pension Fund, details are provided to which the paying organization will transfer the money. A current account can be opened at Sberbank or another bank.

How to receive a pension for a deceased relative at the post office?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

If it is more convenient for a relative to receive the transfer not to a bank account/card, but by mail, the appropriate method should be indicated in the application. However, first they fill out an application according to the above scheme, so that the relative can be given this money after the death of the relative while living together with him.

What payments do a group 1 disabled pensioner receive after the death?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

Relatives should count on several different benefits from the state. First, you can apply for a lump sum payment after the death of a disabled person. In addition, they receive a funeral benefit. If the deceased received a pension, then relatives can start preparing documents and certificates in order to be able to claim these funds. But this is only possible if the deceased became disabled relatively recently, previously worked, and has experience.

What payments are due upon the death of a military pensioner?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

A military serviceman has privileges over civilians: after death, his relatives can receive a pension, but not double, but even triple the amount, compensation for expenses incurred for burial and installation of a tombstone, and a one-time payment from the state. There is another option - to have a funeral free of charge. At the same time, the expenses are written off by the state. However, relatives need to choose what may be more beneficial for them: receiving compensation for funeral expenses or having the burial carried out at the expense of the state.

How to receive a pension for a deceased relative from Sberbank from a card?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

The relatives with whom the deceased lived in recent years contact the Pension Fund to leave a statement. At the same time, the documents indicate the details, including the Sberbank card number, which will then allow funds to be transferred to it. Moreover, the person who received them must take into account that it is impossible to provide details of credit and deposit accounts.

Payments after the death of a pensioner disabled group 2

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

A relative who lived with the deceased before the death of the latter can count on various types of assistance: one-time assistance, as well as pension funds accrued for disability, and other monthly payments.

If a pensioner dies the day before retirement, what payments are due?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

It does not matter when the pensioner’s death occurred (a day, two or more before receiving pension funds). The Pension Fund of the Russian Federation stops accruing money on the 1st day of the month following the death of a person. In the current one, it is still possible to withdraw money that was paid earlier.

How to receive a pension for a deceased pensioner by proxy?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

A pension by proxy is received during a person’s lifetime when he transfers these rights to a third party. Moreover, the duration of validity of such a document is limited. After death, it will no longer be possible to issue a power of attorney. Moreover, this does not make sense, given that relatives can receive pension funds and other assistance from the state if they submit the appropriate application.

What part of the payments can be withdrawn from the pension: insurance or funded?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

The difference between the savings and insurance options lies in the methods of deductions for their formation. Insurance pension funds are paid to relatives after the death of a loved one. Savings payments can be received, but on the condition that the person is ready to enter into an inheritance.

Can I count on payments if people did not live together?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

If in the past people lived together, later separated, and an older relative died, you can count on receiving money - the last pension payment. But this happens under one condition - a family member contacts a notary to enter into an inheritance.

Can bailiffs seize a pension?

Expert opinion

Yesentsev Vladimir Nikolaevich

Lawyer, funeral service specialist

When the money received is withdrawn from the card, if there are debts, payments may be blocked by bailiffs. However, circumstances are completely different when a person receives transfers by mail. Regardless of the city (Moscow or the regions), it is impossible to impose an arrest.

Termination of accrual of pension benefits to a deceased person

The legislation provides that old-age benefits are not accrued to a deceased person from the first day of the month following the date of the sad event. This applies to all types of subsidies for old age, disability and others .

However, reconciliations between government agencies that accrue funds and the registry office are not carried out every month. This leads to the fact that money can be transferred to a person who has gone to another world. Relatives have the opportunity to receive them for the deceased.

Important: misappropriation of illegal payments is fraught with punishment. The fact of the death of the pensioner will sooner or later be revealed, and the money will have to be returned. If the amount turns out to be large (over several months), then a criminal case will be opened for fraud.