Penalty for non-payment of alimony

The law provides for various penalties applicable to a persistent non-payer of alimony.

In this article we will consider the procedure for applying such a civil law measure as a penalty for non-payment of alimony.

From this article you will learn the following :

- The procedure for collecting penalties for alimony

- How to collect a penalty for alimony

- How to correctly calculate the penalty for alimony

- Formula for calculating alimony penalties

- Who calculates the penalty for alimony?

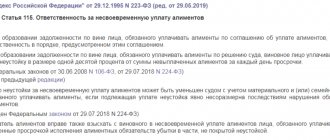

Article 115 of the Family Code of the Russian Federation stipulates that in the event of arrears in alimony paid by court decision , the debtor is obliged to pay the alimony recipient a penalty in the amount of 0.1% of the amount of unpaid alimony for each day of delay .

Until August 09, 2021, the penalty amount was 0.5% for each day of delay. This circumstance must be taken into account when calculating the penalty.

An important point is that this measure of material impact is applied if the alimony debt arose precisely through the fault of the person obligated to pay alimony , i.e. in case of malicious evasion of this obligation by the debtor.

If in court the debtor presents irrefutable evidence that the debt arose due to circumstances beyond his control (for example, due to late payment of wages, incorrect transfer of alimony amounts by the bank, temporary disability caused by a long-term illness, etc.), he will be released from paying the penalty.

In court, it is advisable for the plaintiff to file a petition to request the materials of enforcement proceedings from the FSSP, since it may contain documents confirming the defendant’s guilt in creating a child support debt.

If the debt arose in connection with the debtor’s failure to fulfill an agreement to pay alimony , then the liability provided for by this agreement (the agreement may also provide for more serious measures of liability, for example, a larger penalty or a fixed one-time penalty).

If in the agreement on the payment of alimony the parties did not provide for the liability of the alimony payer for non-payment, it is possible to apply a legal penalty provided for in Article 115 of the Family Code of the Russian Federation.

Thus, the penalty collected for late payment of alimony in the form of a fixed amount of interest for each day of delay in payment of alimony is a serious measure of family legal responsibility that guarantees the exercise of the rights of needy family members (in particular, minor children) to receive maintenance.

, a very significant penalty can accrue .

Before filing a claim in court, you need to understand how to correctly calculate the penalty for alimony.

To calculate the penalty, you must know the exact amount of alimony debt and have a calculation of the debt by month.

To do this, you must contact the bailiff in charge of enforcement proceedings against the defaulter with a corresponding statement.

Circumstances of the dispute

So, a resident of Kuban divorced her husband.

The child remained with her, and the court decided to collect alimony from the father as a percentage of income and 10 times the minimum wage. But he didn’t pay the money, and his son was fully supported by his mother. Some time later, the woman filed a lawsuit against her ex-husband. She demanded to collect from the defaulter the debt, a penalty due to late payment, and at the same time to deprive him of parental rights in relation to their common son (the ex-husband does not participate in the child’s life at all and does not care about his health and development) and to reimburse legal costs.

How is alimony arrears calculated?

The procedure for determining alimony debt is regulated by Article 113 of the Family Code of the Russian Federation. The amount of debt is determined by the bailiff , who conducts enforcement proceedings against the debtor, based on the amount of alimony established by the court or the agreement of the parties on the payment of alimony.

To calculate arrears of alimony paid for the maintenance of a minor child in proportion to the debtor’s earnings, the bailiff takes as a basis the earnings and (or) other income of the debtor for the entire period when alimony was not paid.

If during the period of alimony debt formation the debtor did not work anywhere, or did not provide documents confirming the amount of his earnings, the calculation is made by the bailiff based on the average monthly salary in Russia at the time of debt collection (according to GOSKOMSTAT).

If alimony payments were not received in full and irregularly, the bailiff indicates the amount of debt for each month, taking into account the payments made.

If you disagree with how the bailiff determined the debt, either party has the right to challenge the actions of the bailiff.

Let's make a brief conclusion : the amount of alimony debt is determined by:

- Based on the amount of alimony established by the court or by agreement of the parties (collected in a fixed amount of money)

- Based on the earnings and (or) other income of the debtor for the entire period of debt formation (if alimony was collected for the maintenance of a minor child as part of the debtor’s earnings)

- Based on the average monthly salary in the Russian Federation (if the debtor did not work during this period or did not provide information about his earnings)

The bailiff shall indicate the following information in his calculation:

- Total debt period

- Number of months and days of delay

- The amount of debt separately for each month

- The total amount of alimony debt as of the day of calculation

Based on this calculation, the bailiff issues a resolution establishing the amount of alimony debt.

Read about the grounds and procedure for reducing the amount of alimony debt or exemption from it here.

We will prepare a claim for the recovery of alimony penalties. Tel.+7 (812) 989-47-47 Telephone consultation

How to calculate penalties in a fixed monetary amount

The simplicity of calculating the penalty when collecting alimony in TDS lies in the fact that every month the debt increases by the same amount.

Suppose the father must pay 7,000 rubles per month for the child and has not transferred funds for 5 months. You can calculate the penalty as follows:

| № | Month | Number of days | Amount of debt, rub. | Percent | Penalty, rub. |

| 1 | March | 31 | 7000 | 0,1% | 217 |

| 2 | April | 30 | 14000 | 0,1% | 420 |

| 3 | May | 31 | 21000 | 0,1% | 651 |

| 4 | June | 30 | 28000 | 0,1% | 840 |

| 5 | July | 31 | 35000 | 0,1% | 1085 |

| Total: | 3213 | ||||

For example, in this case, to find out the amount of debt in April, you need to multiply 7,000 by 2, since April is the second month of debt, and in May, you need to multiply 7,000 by 3, and so on.

Calculation of penalties for alimony

In order to file a claim for the recovery of alimony penalties, it is necessary to calculate this penalty, otherwise the statement of claim will not be accepted by the court.

Who calculates the penalty for alimony?

The calculation of the penalty is made by the plaintiff on the basis of a certificate from the bailiff about the amount of the debt, which is issued by the bailiff along with the resolution establishing the amount of alimony debt.

These documents are sufficient to correctly calculate the penalty for alimony and go to court.

Formula for calculating alimony penalties

The penalty for alimony is calculated separately for each period of delay , which is equal to a whole or non-whole month , and then everything is summed up.

In other words, the amount of debt for each month is multiplied by the number of days overdue in that month and multiplied by 0.1%.

The formula is: amount of debt for the period × number of days of delay in the month × 0.1%

Then all the figures received for each month are summed up, and the total amount of the penalty to be collected from the alimony payer is obtained.

Here's an example:

Initial data according to the bailiff's certificate:

- The debt period is from September 15, 2018 to November 1, 2018, i.e. a month and a half

- Alimony is set at ¼ of the debtor’s earnings of 15,000, which is 3,750 rubles. monthly

- Debt for September – 1875 rubles; debt for October - 3,750 rubles, total debt - 5,625 rubles.

Based on the specified initial data, the calculation of the penalty will be as follows:

September: 1,875 (debt amount) × 15 (calendar days of delay) × 0.1% = 28.12 rubles.

October: 5,625 (debt amount) × 31 (calendar days of delay) × 0.1% = 174.37 rubles.

In total, the penalty for non-payment of alimony for the period from September 15, 2018 to November 1, 2018 will be: 28.12 + 174.37 = 202.49 rubles.

If payments were made, but not regularly and not in full, for example, out of 3,750 rubles the debtor paid 1,000 rubles, and not every month, then the bailiff will calculate the debt taking into account the minor payments made.

The above calculation formula applies regardless of the form in which the payment of alimony is established, in a fixed sum of money or in the amount of part of earnings, or the debt is determined based on the information of GOSKOMSTAS on the average monthly salary in Russia.

The complexity of the calculation mainly depends on the length of the total debt period, and requires extreme care and accuracy.

Convenient table

Bailiffs can independently calculate the penalty. They present it in table form. To do this, the recipient of alimony only needs to submit an application to the bailiff who is responsible for collecting these funds.

It is noteworthy that the calculation by the bailiffs is presented in the form of a table. This approach is also recommended when drafting a document yourself. It takes on a visual form, making it easier to convince the court to satisfy the claims, as well as to resolve the issue pre-trial.

The table has the following columns at the top:

- Beginning of period.

- End of period.

- Debt at the beginning of the period.

- Accrued.

- Received.

- Debt at the end of the period.

- Number of days for calculation.

- Penalty per day.

- Total penalties accrued.

For the case discussed above, the table looks like this:

| Beginning of period | End of period | Debt at the beginning of the period | Accrued | Received | Debt at the end of the period | Number of days for calculation | Penalty per day | Total penalties accrued |

| 01.06.17 | 30.06.17 | 12 t.r. | 0 | 12 t.r. | 30 | 60 rub. | 1.8 t.r. | |

| 01.07.17 | 31.07.17 | 13.8 tr. | 14 t.r. | 0 | 27.8 tr. | 61 | 130 rub. | 4.03 t.r. |

| 01.08.17 | 31.08.17 | 31.83 tr. | 14 t.r. | 0 | 45.83 tr. | 92 | 200 rub. | 6.2 tr. |

The total debt as of September 1, 2021 is 52.03 tr.

At the beginning of the document, in the middle, the name is written - calculation of the penalty. Next, on the line below, the plaintiff is written down, and even lower, the debtor. If the settlement is filed as part of a legal proceeding rather than as part of a claim, the case number is recorded. Even lower is the period, in this case from 1.06. until September 1, 2017.

Having received a clear table with clearly verified calculations that do not raise doubts, the court makes a decision in favor of the plaintiff, despite the participation (or without it) of the defendant.

Often, payers take measures to hide income or lose their jobs. In this case, they are registered with the employment center. Bailiffs send the table to this institution. From the moment it is received, it is the chief accountant who is responsible for calculating alimony in a timely manner.

Another case is when payments were not made or not transferred on time, but the payer transferred the money to the child as a gift. Such funds are not taken into account as repayment of the resulting debt.

Collection of penalties for alimony

So, let's figure out how to collect alimony penalties, what is the procedure for going to court , what needs to be attached to the claim, and to which court it should be filed.

To recover a penalty, it is necessary to draw up a statement of claim in accordance with the requirements of procedural law.

According to Articles 131-132 of the Code of Civil Procedure of the Russian Federation, a claim for the recovery of alimony penalties must contain the following information:

- Name of the court in which the claim is filed

- Information about the plaintiff and defendant - full name, addresses, telephone numbers

- Information about the cost of the claim (amount of penalty collected)

- Subject and grounds of claim (circumstances that were the basis for filing the claim)

- Clearly stated requirements

- Justification of requirements

- List of documents that are attached to the claim

The following documents must be attached to the claim for the recovery of alimony penalties :

- Calculation of penalties

- A copy of the child(ren)'s birth certificate

- Copies of marriage/divorce certificates

- A copy of the bailiff's resolution on determining alimony arrears

- A copy of the bailiff's certificate regarding the calculation of alimony arrears

- Documents confirming the filing of the claim with an attachment to the defendant

- Other documents

When filing a claim for recovery of a penalty for late payment of alimony, the plaintiff is exempt from paying state duty (clause 15, clause 1, article 333.36 of the Tax Code of the Russian Federation).

We will make the correct calculation of the penalty for alimony. Tel.+7 (812) 989-47-47 Telephone consultation

What to do if indexation is denied

In my practice, I have only encountered two cases where the creditor was denied indexation. Both times it was a question of the low qualifications of the FSSP employees, who sent the claimant to the court for recalculation. However, through the court you can only demand a penalty and recalculation of the debt. The court will not index alimony payments.

Complaint about the inaction of bailiffs

If bailiffs evade indexation and do not respond to oral and written requests, you can file a complaint against their inaction. A sample complaint can be downloaded in the appendix to the article. Be sure to include a link to the normative act that approved the new cost of living coefficient. This will simplify the appeal procedure. The complaint is filed in the order of subordination (i.e. to a superior official) or to the court. The review period is no more than 10 days, after which the bailiff will be obliged to re-read the amount of alimony.

If the indexation was not carried out by the employer, his inaction can also be appealed through the bailiffs or in court. Since the interests of the child are being violated, you can file a complaint with the prosecutor’s office at your place of residence. Based on the results of the appeal, the employer will be sent an indication of the need for indexation.

What to do if indexed incorrectly

There are also cases when an incorrect indexation coefficient is applied, or an arithmetic error is made. Typically, such issues are corrected as they are identified, or at the request of the claimant. If it was not possible to achieve justice in this way, you can demand a recalculation by appealing. The procedure for filing a complaint is standard - in the order of subordination, or through the court.

In this article, I talked about the main points related to the indexation of child support. If you have any questions or have a dispute with bailiffs or your employer, please contact our lawyers for a consultation. We will help even in the most difficult situation!