Kontur.Accounting - 14 days free!

Automated calculation of maternity benefits in a few clicks.

Save your time. Try for free

The rules for calculating maternity and child benefits are of interest to both accountants and expectant mothers. We will talk about the changes for 2021 and teach you how to use an online calculator to calculate the amounts of these payments.

- How to use a calculator to calculate maternity and child benefits

- Main changes in the calculation of benefits in 2021

- Maternity benefit in 2021. Example

- Monthly child care allowance. Example

- Example: calculating maternity benefits on video

What are maternity benefits?

Maternity pay is a one-time benefit for pregnancy and childbirth (at least 58,878 rubles in 2021). Maternity leave is issued by the Social Insurance Fund on sick leave for a period of 140 to 194 days. For the calculation, take the average earnings for two calendar years. Only the mother can receive maternity payments. Such sick leave is given immediately (and paid in one amount) for the entire period and is not divided into parts. Minimum (according to the minimum wage) - 58,878.25 (from January 1, 2021); RUB 55,830.6 (from January 1, 2021); Maximum - 340,795 (in 2021); 322,191.80 (in 2021).

Duration

- 140 days (70 days before the expected date of birth and 70 days after) for uncomplicated pregnancy;

- 156 days (70+86), if the birth was complicated or the baby was born;

- 156 days (0+156) premature birth (between 22 and 30 obstetric weeks).

- 194 days (70+124), if several children are expected to be born;

- 194 days (84 days before the birth of the child and 110 after), if several children unexpectedly appeared;

- 160 or 176 days of maternity leave in the Chernobyl zone or in another contamination zone;

Mothers entitled to maternity benefits during the period after childbirth have the right, from the day of birth of the child, to receive either a maternity benefit or a monthly child care benefit (255-FZ Article 11.1).

Deadline for maternity leave

Mothers most often go on sick leave for pregnancy and childbirth at 30 weeks. They leave at 28 weeks if the birth of several children is predicted.

Benefits are calculated based on the date of maternity leave. It is especially important if sick leave opens at the end of December or beginning of January. The exact date of maternity leave is determined solely by the doctor on the sick leave. No amount of statements can correct this date.

Calculation of maternity benefits

To calculate maternity leave, we need to calculate three numbers:

- Minimum

- Calculation of average earnings for 2 years (according to calculations)

- Maximum

Minimum > By salary > Maximum

Maternity benefits will be paid to you according to your average earnings, but not less than the minimum and not more than the maximum.

Minimum calculation

The minimum amount of maternity leave is calculated very simply. Here is an example of the minimum for standard conditions in 2021:

Minimum wage on the day of opening of sick leave (12,792) × 24 (months) ÷ 730 (calendar days for 2 years) × 140 (duration of maternity leave) × 1 (rate at work) × 0% (regional coefficient) = 58,878.25 ₽

The regional coefficient can be viewed here (all regions). To calculate the minimum, always take 730 days

| Minimum maternity leave (duration 140 days) | ||

| Sick leave opening date | Minimum maternity leave * | |

| Full rate | Part-time | |

| From 07/01/2017 to 12/31/2017 | 35901,37 ₽ | 17 950,68 ₽ |

| From 01.01.2018 to 31.04.2018 | 43675,40 ₽ | 21 837,70 ₽ |

| From 05/01/2018 to 12/31/2018 | 51380,38 ₽ | 25 690,19 ₽ |

| From 2021 | 51918,90 ₽ | 25 959,45 ₽ |

| From 2021 | 55 830,6 ₽ | 27 915,3 ₽ |

| From 2021 | 58 878,25 ₽ | 29 439,13 ₽ |

| Unemployed | 2861,32 ₽ | |

*They cannot pay less than the minimum amount. If the experience is less than 6 months, then only the minimum amount will be paid.

Calculation of average earnings

Let's give an example of calculating average earnings Uncomplicated singleton pregnancy (140 days) | Income for 2 years 480,000 rubles | 6 days of illness (725 days):

480,000 (salary for 2 years) ÷ 725 (calendar days) = 662.07 ₽ (average daily earnings) 662.07 (average daily earnings) × 140 (duration of sick leave) = 92689.8 ₽

Experience does not affect the calculation. There is only one rule - the experience must be more than 6 months, otherwise the minimum.

Salary and income

The salary is taken in full (including personal income tax). Income also includes: vacation pay, official bonuses, business trips (minus sick leave).

Amounts of sick leave, maternity and child benefits are never included in maternity calculations.

There are maximum income limits for each year. Income cannot be higher than this amount (you will not be able to enter), because... he does not pay contributions to the Social Insurance Fund. For example, for 2021, such income cannot exceed 912,000 rubles.

Years to calculate

They take the two years preceding the year of maternity leave (in 2018, this is from January 1, 2021 to December 31, 2021). At the same time, for choosing years, the start date of sick leave is important, but when of birth is not important. You can only take a full year from January 1 to December 31. You cannot choose two identical years. It is impossible to take into account the year of maternity leave.

For example, if a woman goes on maternity leave in 2021, then she will not be able to take 2021 into account under any circumstances.

If you were on maternity leave in the reference year(s)

for a child or on maternity leave (at least one day), then, if desired, you can replace the year (one year) with the previous year (year) (see statement below) You cannot replace years for other reasons (for example, if you did not work). In this case, you can only replace it with the previous year. You cannot take any years for replacement.

For example, a woman goes on maternity leave in 2021. Before that, she was on maternity leave for 3 years, 2015-2018. Then you can take any 3 years from 2013 to 2021. For example: 2014 and 2016.

What if you're on vacation all year?

If a woman has been on maternity leave all year, then you can safely take this year, because... it does not affect the calculation (all its days are excluded). But you can’t take two such years. One must include salary and income. Otherwise - minimum.

Is it possible to take only one year?

In the case described just above, one year is actually taken, because Maternity days are excluded completely. But the calculation always takes two years.

Days for calculation

The fewer days the better. But you can’t take zero. If there are no days, the calculation is “minimum.”

Take 730 or 731 (the number of calendar days in two years). But there are exceptions...

When calculating maternity and child benefits, the number of days 731 can be reduced. When calculating, it is necessary to exclude: 1) periods of temporary incapacity for work (regular sick leave), maternity leave (maternity leave), and parental leave; 2) the period of release of the employee from work with full or partial retention of wages in accordance with the law, if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period (downtime due to the fault of the employer, etc.).

No other cases can reduce the number of days. And if, for example, a woman worked for only a year out of two calculation years (a month, a year and a half - it doesn’t matter), and the rest of the time she was simply unemployed, then they still divide by 730. And this reduces the calculation.

Maximum

The amount of the maximum depends solely on the selected two years and the duration of maternity leave. Example of calculating the maximum for the selected years 2021 + 2021. Duration 140 days:

865,000 (maximum amount for Social Insurance Fund in 2019) + 912,000 (maximum amount for Social Insurance Fund in 2020) = 1,777,000 (maximum earnings for 2 years) 1,777,000 (maximum earnings for 2 years) ÷ 730 (calendar days for two years ) = 2,434.25 ₽ (average daily earnings) 2,434.25 (average daily earnings) × 140 (duration of maternity leave) = 340,328.80 ₽

This maximum can only be applied by those who go on maternity leave in 2021, because 2019+2020 can only be chosen in 2021.

| Maximum maternity leave (duration 140 days) | |

| Selected years | Maximum |

| 2021+2020 (from 2022) | RUB 360,164 |

| 2020+2019 (from 2021) | RUB 340,328.80 |

| 2019+2018 | 322 191,80 ₽ |

| 2018+2017 | 301 095,20 ₽ |

| 2017+2016 | 282 493,40 ₽ |

| 2016+2015 | 266 191,80 ₽ |

| 2015+2014 | 248 164,00 ₽ |

| 2014+2013 | 228 603,20 ₽ |

| 2013+2012 | 207 123,00 ₽ |

| 2012+2011 | 186 986,80 ₽ |

| 2011+2010 | 167 808,20 ₽ |

| 2010+2009 and earlier | 159 178,60 ₽ |

How to use a calculator to calculate maternity and child benefits?

The maternity and child benefits calculator from the Kontur.Accounting service will help you easily calculate the amount of payments. The calculator is available for free and without registration. The calculation is very simple:

- On the “Initial Data” tab, select the desired benefit, enter data from the sick leave or information about the child and the duration of the vacation.

- On the “Pivot Table” tab, enter information about the employee’s earnings for the last 2 years (or previous years when replacing years). If a regional coefficient is applied, check the required box. If the employee works part-time, indicate this.

- On the “Results” tab you will find out the amount of sick leave.

The calculations take a couple of minutes. If you are an employee, add our calculator to your Bookmarks to calculate benefits if necessary. If you are an accountant, you will appreciate the ease of working with the calculator. Kontur.Accounting has many other convenient tools for accounting and payroll.

Free calculators for sick leave, maternity leave, and vacation pay are our open access widgets. If you want to quickly calculate salaries, easily keep records and send reports via the Internet, register in the online service Kontur.Accounting. The first 14 days of operation are free for all new users.

Conclusion: you can calculate benefits in a couple of minutes using the free calculator from Kontur.Accounting. This is done in three steps. You will need sick leave, vacation dates and information about average earnings for the last 2 years.

All payments to pregnant women and mothers (list)

| Type of assistance | Sum |

| Coronavirus | |

| Monthly payments from April 2021 for a child under 3 years old. Due to coronavirus. From April for 3 months. For those who have the right to maternity capital. | 5 000 ₽ |

| Monthly payments from April 2021 for each minor child. Due to coronavirus. From April for 3 months. Condition: parents are unemployed. | 3 000 ₽ |

| One-time | |

| One-time benefit for pregnancy and childbirth (maternity leave) (+ calculator) | from 58,878.25 RUR to 340,795 RUR |

| Birth certificate for medical care | 11 000 ₽ |

| One-time benefit for the birth of a child | 18 004,12 ₽ |

| One-time benefit for women registered in medical institutions in the early stages of pregnancy | 675.15 ₽ + 600 ₽ in Moscow |

| Request for financial assistance from the employer (voluntary) | up to 50,000 ₽ is not subject to personal income tax |

| Providing free land to large families (from 3 children) | Plot |

| Sick leave to care for a sick child under 15 years of age (+ calculator) | from 150 ₽ per day |

| Monthly | |

| Monthly benefit for a child up to one and a half years old (+ calculator) | from RUB 5,116.8 to RUB 29,600.48 |

| Monthly payments from January 2021(!) for a child from 3 to 7 years old. Will start in June 2021 | from 4,000 ₽ to 9,000 ₽ (depending on the region) |

| Monthly payments from 2021 per child from the state | from 10,532 ₽ |

| Monthly payments from 2021 for a child from one and a half to three years old from the state | from 10,532 ₽ |

| Benefit for the third child from 2021 (list of regions) | about 10,500 ₽ |

| Monthly allowance for a child from one and a half to three years old | 50 ₽ and retention of seniority |

| Alimony: how to collect and amount | from 2,750 ₽ per month |

| For some categories | |

| One-time benefit for the pregnant wife of a military serviceman undergoing military service. | 25 892,45 ₽ |

| Monthly allowance for the child of a soldier undergoing military service upon conscription | 11,096.77 ₽ per month. |

| One-time benefit when placing a child in a family | 18 004,12 ₽ |

Who pays maternity benefits: the employer or the state?

Every woman, when going on maternity leave, cares about whether her family will be financially secure at a sufficient level, because stability and a high level of income are very important for the healthy and full growth of the child.

Who pays maternity benefits, its amounts, payment terms, documents necessary for its registration, the procedure for calculating benefits and other aspects of receiving it will be discussed further.

Documents for appointment

To assign and pay maternity benefits (maternity benefits), the following documents are needed:

- certificate of incapacity for work (sick leave);

- if the calculation of the B&R benefit will be made for one of the last places of work of the woman’s choice, a certificate from another policyholder stating that the appointment and payment of this benefit is not carried out by this policyholder;

- if you want to replace the accounting years (or one year) with an earlier one, then you also need an Application for Year Replacement;

- A salary certificate from a previous job (excluded periods must also be indicated there) (if the woman worked for other employers during the billing period). This certificate is not mandatory. You should first make a calculation and understand whether you need to provide it. After all, if you worked a little during the billing period and/or you had a small salary, then the calculation (for example, 20,000 rubles) will come out less than the minimum (35,901.37 rubles for full time) and then there is no point in wasting time on a certificate;

- Sometimes they ask for an application: Sample application for maternity leave for benefits. Although sick leave is usually enough.

Application for change of year

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones (255-FZ Article 14). Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind that real payments are taken into account and are not indexed in any way.

Download free Application for replacement of the year sample 31 kb. Word (doc)

Billing period in 2021

The number of days in the calculation period is the number of calendar days for two years, i.e. 730 days for non-leap years (365 days + 365 days). And for leap years, respectively - 366 days in a leap year plus 365 days. That is, 731 days.

There are situations where calendar years can be replaced . This is often done to calculate maternity benefits if a woman goes from maternity leave to maternity leave . That is:

EXAMPLE

Over the past 2 years, the woman has been on labor and employment leave or maternity leave. She had no salary, and the amount of the new B&R benefit is minimal. In such a situation, it is allowed to take other, earlier years to calculate the new benefit - when the woman worked and received income.

If the expectant mother wants to change calendar years, she must write an application . In this case, the amount of maternity payments may increase.

For example, an employee is going on maternity leave again in 2021 and wants to take other periods so that she can have maternity pay calculated for them. She can write a statement like this:

Payment

Who pays?

Vacation for all these days, including weekends and holidays, is paid at the expense of the Social Insurance Fund. Moreover, it does not matter what taxation regime the company is in. Payments are made by the employer, and then the FSS (social insurance) reimburses him.

In those regions where the Social Insurance Fund pilot project operates (there are now more than 20), benefits will be reimbursed directly to employees from the Social Insurance Fund. In this case, the employer helps the employee collect all documents.

When I get?

Maternity benefits must be calculated and accrued no later than 10 calendar days from the moment the employee applied for it. The basis is the original sick leave certificate. The benefit is paid on the next day when the company pays wages, and in full. That is, there is no need to “split” it by month.

What is the payout amount?

Sick leave for pregnancy and childbirth will be paid in the minimum amount in two cases:

- a woman has worked for less than six months in her entire life (only official work experience is taken into account);

- The average daily earnings are less than the established minimum.

Next, the average daily earnings for the previous two years must be multiplied by the number of days indicated on the sick leave. In pregnancy and childbirth sheets, three main options can be prescribed, based on the course of labor:

- in standard cases, 140 days of incapacity for work are issued;

- if there were complications during childbirth, the maternity hospital extends sick leave to 156 days;

- 194 days - such a decree is required if a woman is expecting several children.

So, minimum maternity benefits in 2021 should be calculated based on average daily earnings equal to 370.85 rubles. The total amount of payment below which benefits cannot be assigned in favor of an officially employed pregnant woman is:

Deadlines

Application deadlines

Maternity benefits are assigned if the application for it is made no later than six months from the date of the end of maternity leave (255-FZ Article 12, paragraph 2).

Recalculation for increase

If you have new documents or decide to calculate in a different way (replace years, reduce calculation days, provide certificates), you have the right to apply for recalculation of benefits within three years in order to increase the amount of maternity benefits.

The application is written in free form.

| STATEMENT I ask you to recalculate my maternity benefits in accordance with clause 2.1. Article 15 of the Federal Law of the Russian Federation No. 255-FZ dated December 29, 2006. I am attaching the following documents: …. Date Signature. |

Can I choose a date or reschedule?

The issuance of certificates of incapacity for work during pregnancy and childbirth is carried out at 30 weeks of pregnancy (clause 46 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

If a woman, when contacting a medical organization within the prescribed period, refuses to receive a certificate of incapacity for work under the BiR for the period of maternity leave, her refusal is recorded in the medical documentation. When a woman before childbirth repeatedly applies for a certificate of incapacity for work for maternity leave, the certificate of incapacity for work is issued for all 140 (156 or 194) calendar days from the date of the initial application for the specified document, but not earlier than the period established by the first paragraphs or the second of this paragraph.

Those. theoretically, the deadline can be postponed to a later date (for example, to January, so that the current year is included in the calculation). It is not possible to go to an earlier date.

Maximum and minimum average earnings in 2021

To calculate the amount of maternity benefits, you need to know that the maximum amount cannot be more than a certain amount. For 2021, this amount is calculated as follows: it is necessary to take the maximum amount for insurance premiums for 2021 and 2021 and divide it by 730 days.

Let's calculate this maximum amount of average daily earnings:

(912,000 + 865,000.00) / 730 days = 2434.25 rubles.

When calculating the amount of maternity benefits, in addition to the maximum amount, you need to remember the minimum amount of average earnings. This amount is determined in accordance with the Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” dated December 29, 2006 No. 255-FZ (hereinafter referred to as Law No. 255-FZ). This amount is equal to the 24th minimum wage .

The minimum wage for 2021 is set at 12,792 rubles . This means that the minimum maternity benefit per day will be:

12 792 × 24/730 = 420.56 rubles

So in 2021 the benefit amount will be:

| Days to pay benefits under BiR | MAXIMUM BENEFITS | MINIMUM BENEFITS |

| 140 | 340 795 | 58 878,40 |

| 156 | 379 743 | 65 607,36 |

| 194 | 472 244,50 | 81 588,64 |

How to calculate maternity money? For this:

- The calculated average daily earnings are multiplied by the number of days of sick leave according to the BiR.

- The resulting value is then compared with the minimum and maximum possible benefits.

If:

- the resulting allowance fits into the “fork” - they pay it;

- the calculated benefit is less than necessary - they pay the minimum - according to the minimum wage;

- the calculated amount has exceeded the maximum benefit according to the contribution limit - the maternity leaver only needs to pay the maximum possible limit.

Rights

Annual vacation due!

According to Art. 260 TK. “Before or immediately after maternity leave, or at the end of parental leave, a woman, at her request, is granted annual paid leave (28 days), regardless of her length of service with a given employer.” You can calculate your vacation here.

Moreover, if a woman has less than 28 days of vacation time, vacation pay is given to her in advance. These vacation pay are either included in the vacation period or returned upon dismissal.

See also: Sample application for adding another leave to maternity leave.

Where to go if maternity benefits were accrued incorrectly?

First try to resolve this issue with an accountant. If it doesn’t work out, then contact the labor inspectorate or the Social Insurance Fund. Recalculation can be requested within 3 years.

Absenteeism and dismissal

It is impossible to dismiss a pregnant woman from an existing organization (and individual entrepreneur) (Article 261 of the Labor Code of the Russian Federation) at the initiative of the employer. Also, it is impossible for such a woman to be given absenteeism, because Pregnancy is always a valid reason for not showing up for work.

If a maternity leaver was fired during the liquidation of the organization

You need to take certificates and go to the social security authorities (RUSZN) - they will continue to pay benefits in full, as before dismissal.

Employees of organizations in which bankruptcy proceedings have begun can apply directly to the Social Insurance Fund to receive sick leave or maternity benefits (Federal Law of March 9, 2016 No. 55-FZ).

Is it possible to go back to work early?

An employee has the right to go to work before the end of maternity leave. However, you cannot receive benefits and wages at the same time (there may be claims from the Social Insurance Fund). Therefore, you can only leave unofficially.

Fixed-term employment agreement (contract)

If the employee finds herself in a situation and a fixed-term employment contract was concluded with her, then its validity is extended until the employee returns from sick leave for pregnancy and childbirth (maternity leave). They cannot fire such an employee earlier.

If a student is on maternity leave

Women studying full-time in educational institutions of primary vocational, secondary vocational and higher vocational education (HEIs), and in institutions of postgraduate vocational education have the right to maternity benefits. This benefit is paid to student mothers in the amount of the scholarship established by the educational institution (Resolution of the Government of the Russian Federation No. 865 of December 30, 2006).

Child care allowance up to 1.5 years old

Child care benefits up to 1.5 years are often also called maternity benefits. Therefore, they ask the question of how to calculate monthly maternity payments.

This is not entirely correct. care benefits are not sick leave payments under the BiR. The main difference : care allowance is received by citizens caring for a child under 1.5 years of age, regardless of gender and employment status, and sick leave for pregnancy can only be issued by the mother . That is, both the father and the grandmother and grandfather can receive care benefits. A working relative caring for a child can receive a benefit in the amount of 40% of the average monthly salary for the last 2 years.

Situations

What if you have two jobs?

I. 1 employer for more than two years and 2 employers for more than two years. If an employee worked in several places at the time the maternity leave was issued, and in the previous two years she worked all the time in the same place, then maternity payments are made for all places of work. Monthly maternity benefit is paid only to one place of work of the employee’s choice and is calculated from the employee’s average earnings.

II. 1 employer for less than two years and 2 employers for less than two years. If an employee at the time of issuance of maternity leave worked for several insurers, and in the previous two worked for other insurers, then all payments are assigned to her by the employer at one of the last places of work of the maternity leaver’s choice.

III. 1 employer for more than two years, and 2 employers for less than two years If the employee at the time of issuing maternity leave worked for several insurers (employers), and in the two previous years she worked for both those and other insurers, then maternity payments can be made both for one place of work, from the average earnings for all employers, and for all current employers, from the average earnings at the current place.

Although, according to the judges of the Moscow District, the resolution of May 11, 2021 No. F05-5284/2016 states that a maternity leaver should in any case receive two benefits (clause 2 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ ).

If your lifetime experience is less than six months

If your total insurance period is less than 6 months, then you will receive maternity leave - 1 minimum wage rubles per month. Also, if during the calculations the amount turned out to be less than the calculation according to the minimum wage, then the calculation according to the minimum wage is taken (see above in the table).

The minimum wage in all regions is the federal one. No surcharges. The minimum wage from January 1, 2021 is 12,792 rubles.

What if I work part time?

If an employee works part-time, the minimum wage for minimum maternity leave must be recalculated. Let's say, for a part-time employee, the minimum wage will be 6,396 rubles. (RUB 12,792: 2).

If a maternity leaver is unemployed?

Unemployed women should contact the local branch of RUSZN (district department of social protection of the population, also known as RUSZN, also known as Paradise SOBES). The payment is made by the territorial body of the Social Insurance Fund that assigned the benefit. You can also register with the employment center and receive unemployment benefits.

If twins were unexpectedly born or adopted

If a maternity leave was initially issued with sick leave for 140 days, but she unexpectedly gave birth to twins, the sick leave (maternity leave time) should be extended by 54 days. Not only pregnant women can count on maternity benefits. This right is also given to women who decide to adopt a baby under three months of age. They are paid benefits for the period from the date of adoption until the expiration of 70 days from the date of birth of the child. If a family takes two or more children, then the following period is paid: from adoption to 110 days from the date of birth of the children.

If I go on vacation before my maternity leave, will this affect my maternity benefits?

It will have an effect, but only slightly - vacation pay is included in the calculation, but usually they are almost equal to the salary.

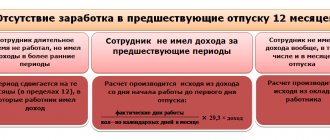

If the maternity leaver had no income during the billing period

The calculation includes all payments for all places of work for the last two calendar years for which contributions to the Social Insurance Fund of the Russian Federation were accrued. But in practice, it is quite possible that the employee had no income during the estimated two years. In this case, the benefit must be calculated based on the minimum wage.

If the employee was on maternity or child leave during the two years included in the calculation

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones (255-FZ Article 14). Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind: real payments are taken into account and are not indexed in any way.

If you recently got a job and had no earnings in the previous two years, you cannot replace the years on this basis alone.

In this case, you can only replace it with the previous year. You cannot take any years for replacement.

Procedure for paying maternity benefits from 01/01/2021

From January 1, 2021, all regions of Russia switched to direct payments of benefits from the Social Insurance Fund. The corresponding law has been adopted - this is Federal Law No. 478-FZ dated December 29, 2020.

Read more about this in the article “What happened to the FSS pilot project “Direct Payments” in 2021: regions.”

Law No. 478-FZ abolished the obligations of insurers (employers, educational institutions, etc.) to calculate and pay benefits, as well as a number of regulations regulating this process.

This means that benefits for labor and child care are paid by the FSS directly to the recipient of the benefit, and not through the employer. However, a working citizen must still submit the documents necessary to receive benefits to the employer.

submits the received information or its electronic register for consideration to the Social Insurance Fund within 5 days He, in turn, checks the correctness of the documents and, if everything is correct, after 10 days he transfers the funds to the bank account of the benefit recipient.

From July 1, 2021, you can receive child benefits only on MIR payment system cards. An alternative way to receive due payments is by postal transfer.

However, the policyholder’s representative still needs . Since, according to the new Law No. 478-FZ, if the FSS incorrectly calculates the benefit according to the policyholder’s data and in connection with this the Fund incurs expenses (for example, it overpays the benefit or underpays and the underpayment will be collected with interest), the policyholder is obliged to reimburse such expenses.

Accountant (Reporting)

Show/hide section

Taxes on maternity leave

Income tax (personal income tax 13%) is not withheld from maternity leave. Contributions to the Pension Fund and the Social Insurance Fund from these payments are also not made (In accordance with paragraph 1, paragraph 1, article 9 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds").

Reporting

Maternity benefits are reflected in the 4-FSS report for the quarter in which they were received.

Starting from 2021, the Unified Social Insurance Fee (USSS) will be submitted.

The company receives funds for maternity leave within 10 calendar days after it submits all the necessary documents. You need to submit a written application to the Federal Insurance Fund of the Russian Federation, a calculation in Form 4-FSS of the Russian Federation for the period confirming the accrual of expenses for the payment of insurance coverage; they may also require a calculation of benefits. Individual entrepreneurs (unlike organizations) can receive these funds to any account (even personal) or savings book.

First, the organization (IP) pays this benefit (or part of it), then the Social Insurance Fund reimburses it. If the FSS refused to reimburse this benefit, then it must either be returned, or additional insurance premiums must be charged and personal income tax withheld, because then this amount is essentially a regular premium. Or you can use it as financial assistance.

If the FSS reimbursed, then the reporting is as follows:

In the 4-FSS report, Section 1, Table 1 and Table 2 are filled out.

Starting from 2021, the Unified Social Insurance Fee (USSS) will be submitted.

Amounts not subject to insurance contributions (maternity benefits, child care benefits, and other benefits) are displayed in the DAM-1 calculation, section 2 on lines 210, 211, 212.

In those regions where the Social Insurance Fund pilot project operates, there is no need to reflect maternity leave in reporting. After all, the FSS pays them directly.

Financial responsibility from maternity leave

The employer does not have the right to deduct anything from maternity benefits, as well as child care benefits. Even if a liability agreement is signed and you cause damage to property, benefits are always paid in full.

Reimbursement of benefits and expenses 2017

Starting from 2021, all benefits and expenses must be reimbursed from the Federal Tax Service. To do this, for periods before 2021, you must provide 4-FSS, and after 2021, a calculation certificate (its Form has not yet been approved).

In those regions where the Social Insurance Fund pilot project operates (there are now more than 20), benefits will be reimbursed directly to employees from the Social Insurance Fund. In 2021, all regions will join this project.

And yet, who pays for maternity leave - the state or the employer?

Despite the fact that in fact the money comes from the employer, he still does not spend a penny in the process of paying maternity benefits.

Since a woman’s social security for pregnancy, childbirth, and child care is an insured event, maternity leave is paid directly by the Social Insurance Fund.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Even if the woman herself collected the relevant documents and submitted them to the territorial branch of the Social Insurance Fund, the money still goes first to the employer’s account, and then to the woman herself.

Any employed woman receives maternity benefits.

In the process of working for her, the accounting department makes contributions to the Social Insurance Fund, through which this financial assistance is paid to the pregnant woman.

Woman entrepreneur (IP)

Show/hide section

Benefit amount

If the individual entrepreneur voluntarily paid

contributions to the Social Insurance Fund, then the benefit will be minimal. From January 1, 2021 - 58878.25 rubles.

Total 2 options: either the minimum wage from the Social Insurance Fund or nothing.

Required condition!

Contributions must be paid for the previous calendar year (Article 4.5, clause 6 of 255-FZ).

Those. if you open maternity sick leave in 18, then contributions must be paid for the entire 17 year.

Amount of contributions

All women pay (voluntarily) a fixed amount to the Social Insurance Fund based on the same minimum wage. An entrepreneur cannot pay more or less than the minimum wage.

Contribution amount: 12792*2.9% = 370.97 rubles/month or 4451.64 rubles. for the whole of 2021.

Payment by individual entrepreneur to the Pension Fund of Russia

A woman individual entrepreneur on maternity leave may not pay contributions to the Pension Fund (letter of the Ministry of Health and Social Development of Russia dated March 22, 2011 No. 19-5/10/2-2767). This issue is controversial, but the courts are on the side of the individual entrepreneur. Since 2013, changes have been made to 212-FZ Part 6-7 Article 14: it is possible not to pay fixed contributions during the period of care of one of the parents for each child until he reaches the age of one and a half years, but no more than three years in total if presented documents confirming the absence of activity during the specified periods.

Documentation

A business woman must provide the following documents to the Social Insurance Fund:

- Application of an individual entrepreneur to the Federal Social Insurance Fund of Russia for the assignment of maternity benefits; (Word, 37 kb.)

- sick leave;

Reporting

In the 4a-FSS report (for individual entrepreneurs) it is indicated in Table 2

Employment

If the individual entrepreneur also works under an employment contract

There may be various options for receiving maternity benefits:

- at the time of the insured event, the individual entrepreneur had not changed his job under an employment contract in the two previous calendar years and at the same time operated as an individual entrepreneur. At the same time, the entrepreneur voluntarily entered into legal relations under compulsory social insurance and paid contributions to the Social Insurance Fund of Russia for the two previous calendar years. In this case, he receives benefits in two places: at the territorial branch of the Federal Social Insurance Fund of Russia at his place of residence and at the employer with whom the employment contract is concluded;

- at the time of the insured event, the individual entrepreneur had worked for other employers in the two previous calendar years and was not registered as an entrepreneur (voluntary policyholder). Then benefits are paid to him in one place - at the last employer with whom the employment contract was concluded;

- at the time of the insured event, the individual entrepreneur had worked both for the current employer and for other employers in the two previous calendar years, and at the same time operated as an entrepreneur. At the same time, the entrepreneur voluntarily entered into legal relations under compulsory social insurance and paid contributions to the Social Insurance Fund of Russia for the two previous calendar years. In this case, he has the right to choose where to receive benefits - for all places of work (both at the territorial branch of the FSS of Russia and at the last employer) or at one of them (only at the territorial branch of the FSS of Russia or only at the last employer).

If the woman worked as an individual entrepreneur or got a job later, then she cannot provide any salary certificates from her individual entrepreneur. After all, the income of an individual entrepreneur is not a salary. The income of an individual entrepreneur for the Social Insurance Fund is always zero (even if the individual entrepreneur is a member there voluntarily), because the individual entrepreneur does not pay his own salary.

When the FSS refuses payments

The same Federal Law No. 255 states in what cases the Social Insurance Fund can officially refuse an employer to return funds spent on a pregnant employee. As a rule, this is due to the employer’s dishonesty and financial fraud in order to gain their own benefit from such a “deal.”

A refusal may occur if:

- the employer and the pregnant employee are related;

- if a woman does not have documents on education, which gives her the right to occupy the corresponding position in the enterprise;

- the staffing table changed “to suit the employee”, who soon decided to go on maternity leave;

- a contract worker was not hired to replace the woman during maternity leave or his salary turned out to be significantly lower;

- the salary of the expectant mother is unreasonably inflated;

- bonuses and incentives are higher than those of other employees;

- a pregnant woman suddenly got a salary increase;

- The fact was revealed that there were no documents that would confirm the employee’s performance of her official duties.

That is, there should be no “artificial positions”, high salaries on paper in the actual absence of the employee at the workplace.

The employer has the right to file a lawsuit and prove the legality of accruing maternity benefits. But, according to judicial practice, positive decisions occur more often in relation to the Social Insurance Fund.