To build a house, you can use the mortgage lending program. Most large banks in the country have such offers.

Under what conditions can I get a mortgage for building a house? Which banks should I contact? And in what case is a potential borrower most likely to be refused? Real estate investment expert, head of the real estate agency Andrei Mozol these questions to the FAN .

From the personal archive of Andrei Mozol /

Preparing for a mortgage to build a house

Before contacting the bank, it is important to resolve several “formal” questions about where construction is planned and in what form. Banking organizations do not support any type of construction: as a rule, loan funds are provided for individual housing, that is, for the construction of a private house or cottage. Some programs are designed for the construction of “seasonal” housing, that is, country houses, summer houses.

One of the main requirements for compliance with these programs is the selection of a land plot with a similar purpose. That is, if a potential borrower applies to a bank for a mortgage to build a private house, he will have to submit documents for a plot of land with a designated purpose “for individual housing construction.” If he plans to lend under a program for the construction of suburban housing, the intended purpose of the land may be different: for private plots or gardening.

There are categories of sites on which the construction of residential buildings is prohibited. And asking for money from a bank if construction is planned on such land does not make sense. Such areas include lands:

- industry;

- water and forest resources;

- specially protected areas;

- stock.

It is also prohibited to build residential buildings in agricultural areas, but with a caveat: it is possible to build a seasonal house here if the land is used for personal farming.

Therefore, when choosing a site, it is important to choose it taking into account its intended purpose. You can clarify the category of land, as well as restrictions on the site, in Rosreestr by submitting an application at the nearest one or online on the website.

Does the Security Council of the Russian Federation provide such a mortgage loan?

The bank is ready to provide loans for the purchase of houses with or without land. You can buy ready-made objects or borrow money from the bank for individual housing construction.

Types of properties you can buy:

- country house with or without land;

- plot for individual housing construction;

- cottages or garden houses.

You can get up to 60-85% of the contractual value of the property on credit. For borrowers who intend to buy houses, a number of loan programs are available:

- "Construction of a residential building."

- "Country estate".

- “Non-targeted loan secured by real estate.”

You can buy a house, not an apartment, within the framework of preferential programs:

- "Mortgage with maternity capital."

- "Military Mortgage"

Important! Sberbank is ready to lend for the purchase of suburban real estate: from ordinary houses to dachas and plots for individual housing construction. Interest rates on these loans average from 8.6 to 12% per annum.

Obtaining a building permit

The list of permits is determined by the form of ownership of the site. If it can be used for individual housing construction and is the property of a potential borrower, before contacting the bank, you need to notify the local administration of your intention to build.

To do this, it is necessary to prepare a notification in the approved form, in which you indicate the address, area, and approximate location of the future house on the site. You should also complete a schematic plan and note the number of floors. It is important that within the framework of individual housing construction and on lands of such purpose, the construction of buildings only up to three floors is allowed. If the owner of the land plans high-rise construction, the administration will refuse him.

You must attach copies of your passport and an extract from the Unified State Register to your application, send a package of documents and wait for a response. After receiving approval, you can begin searching for a bank that will provide a mortgage for the construction of a residential building.

If construction is planned on leased land, it is important to obtain the consent of the owner of the site and provide for this in the contract. The document will be required by the bank when considering the application.

Which banks provide mortgages for construction?

“In almost all regions there are large banks that issue mortgage loans for these purposes,” explains real estate investment expert, head of a real estate agency Andrei Mozol. ― Among the largest are Sberbank, RosBank, VTB, Dom.RF. Conditions vary from bank to bank; they need to be clarified with the financial institution. But there are also general ones: the rate is from 4.6% per annum, the down payment is from 0%, the term is up to 30 years.”

According to the expert, the most favorable conditions offered by banking organizations may turn out to be a marketing ploy. For example, subject to lending at 5%, the bank can limit the period of use of loan funds to five years, and if the term increases, it can increase both the rate and the amount of the down payment.

Therefore, it is necessary to evaluate the terms of a mortgage for building a house taking into account weighted factors: you should initially decide on a “comfortable” monthly payment amount, the possibility of paying a down payment, and only then select programs that meet your expectations and financial capabilities.

pexels.com/

How to get a mortgage loan - step-by-step instructions

To obtain a loan you need to obtain bank approval . The package of documents submitted by the borrower is carefully studied by the bank. If a decision is made on lending, the borrower will be required to evaluate the property being purchased. To do this, you will have to find an independent appraiser and order a report from him (the cost on average is from 5 to 10 thousand rubles).

Step-by-step instructions on how to buy a house with a loan:

- Provide a package of documents for consideration of the loan application.

- Get a positive decision.

- Provide a package of documents regarding the property.

- Sign the loan documentation.

- Register your rights to the house in Rosreestr.

The purchased house will need to be insured by one of the companies accredited by Sberbank. Simultaneously with the loan agreement, a mortgage agreement is also drawn up for the purchased or other real estate. The mortgage is registered in Rosreestr. Until the loan is repaid, the borrower will not be able to sell or exchange his vacation home.

Important! Mortgage loans for the purchase of a residential building require a loan interest rate that is 2-3 percentage points higher than similar products for the purchase of apartments.

You will also need a decent down payment - at least 15-25% of the cost of the property.

Read more about how to take out a mortgage for a private house and what documents are needed here, and from this article you will learn about the procedure for applying for a loan for a dacha and a plot of land.

How to draw up a contract for a building with land?

The Sberbank loan agreement regulates the relationship between the bank and the borrower. It must indicate the loan amount, rate, payment schedule, loan term, as well as the rights and obligations of the parties. The structure of the contract is typical. The text traditionally contains 4-5 sections describing the entire system of relationships between the parties.

The contract also states:

- subject and purpose of the agreement;

- description of the property;

- repayment terms, scheme and terms;

- method of securing the loan (collateral);

- rights and obligations of the bank and the borrower;

- liability for failure to fulfill obligations;

- procedure for resolving disputes.

If a house with a plot is purchased on credit, it is important that this is also reflected in the contract. When drawing up a loan agreement with a bank, you need to pay attention to the lender’s right to increase the rate, the amount of sanctions in case of failure to pay the debt on time, as well as the bank’s procedure in the event of a long delay.

The bank should not impose restrictions on early repayment and introduce additional fees.

If the client cannot cope with the loan, then the contract must describe a civilized way to solve the problem, for example, the sale of collateral in agreement with the creditor or debt restructuring.

Mortgage conditions for construction in 2021

The borrowing limit is determined by the bank's program. If a financial organization offers its own “product,” the limit can reach up to 120 million rubles. If the borrower expects to receive a mortgage for construction with government support, the limits will be more modest.

This year there are three state programs under which you can request funds for the construction of a private house at a small percentage:

- Family mortgage . The rate on it is 6%, the size of the down payment is at least 15%, you can borrow money for a period of up to 30 years and in an amount of up to 12 million rubles.

- Rural mortgage . Under this program, you can get a loan at a very favorable rate of up to 3%, but you can only build on land in rural areas. The contribution under the program is from 10%, and the amount is up to 5 million rubles.

- Far Eastern mortgage . The program is designed for young families in the Far East regions who want to improve their living conditions, and for young Russians who are ready to move to the region to live and work here. The conditions are more than loyal: lending at 2.5% and with a down payment of 15%. You can expect to receive up to 5 million rubles.

Banks’ own programs differ from targeted programs with state support. Thus, VTB is ready to provide a mortgage for the construction of a house from 9.3%, but only on the condition that the land plot is located in a cottage village.

Sber has two lending options: regular and preferential. In the first case, the rate is from 9.2%, while the down payment is at least 25%, and the loan is secured by a residential premises or land plot. At the same time, the bank is ready to provide no more than 75% of the funds required for construction. A preferential mortgage for the construction of a country house provides a lower rate - from 6%, but it is provided only if the borrower is ready to enter into an agreement with a developer from a list approved by the bank.

RosBank will not approve the application if the site is not registered as the property, but is rented. Dom.RF does not provide such a loan in some republics of the North Caucasus.

You need to clarify the conditions at a bank branch, on the website of a financial institution, or using online portals that provide selections of loan products and their comparisons.

pexels.com/

What you need when applying for a mortgage

To apply for a housing loan, the borrower must meet the bank's requirements and collect an impressive package of documents. The conditions for issuing differ depending on the selected bank. For example, some issue funds only if you have Russian citizenship, while in others foreign citizens can also take out a mortgage.

In general, the list of requirements for the borrower comes down to the following characteristics:

- The client's age is from 21 to 75 years at the time of repayment. Some banks may lower the lower limit to 18 years.

- Availability of permanent registration on the territory of the Russian Federation. In this case, the purchased object may be located in another region.

- Solvency. It is necessary to have a sufficient official income to repay the client’s mortgage and other obligations. Solvency is confirmed by a certificate in form 2-NDFL or an account statement if you receive wages on the card of the bank where the mortgage is issued. The total amount of monthly payments should not exceed 40% of income. If it is necessary to increase the level of solvency, you can attract co-borrowers.

- Seniority. As a rule, in order to receive a housing loan, the borrower must work in his current place for at least 6 months and have a total work experience of at least 1 year over the last 5 years. The duration of employment is confirmed by a copy of the work record book certified by the employer. If the client receives wages on the card of the creditor bank, then in this case 3 deposits are enough, that is, you need to work only 3 full months (supporting documents are not required).

- Credit history. Clients with a positive reputation can count on approval of their application at reduced interest rates. If your credit history is damaged, then you will have to face a bank refusal. In this case, assistance in obtaining a mortgage can be provided by mortgage brokers who will select a lender with the most favorable conditions.

- Availability of a down payment. Taking into account the chosen mortgage program, it can range from 10 to 50% of the cost of housing.

If co-borrowers are involved in the transaction, then similar requirements are imposed on each of them. Spouses are required to act as co-borrowers even in the absence of income and permanent place of work.

To obtain a mortgage, certain requirements apply to the property being purchased. Housing is assessed from the point of view of the materials used to construct it, the availability of infrastructure, communications, access roads, and territorial location. Based on all these factors, the degree of liquidity of the property and the possibility of pledging it are determined. Also, applying for a mortgage loan will require the provision of documents for the purchased property, namely:

- draft purchase and sale agreement;

- cadastral passport;

- documents confirming ownership of finished housing;

- assessment report.

If you purchase real estate during the construction phase, you must collect a package of permits from the developer.

Do they provide a mortgage for construction without a down payment?

“The main disadvantage of such programs is the high lending rate,” notes real estate investment expert Andrei Mozol, “as well as the low chance of getting approval for a loan.”

As a rule, the contribution amount is 15–25% of the requested amount. The borrower’s ability to deposit this amount serves as a signal for the bank of the client’s solvency and allows them to offer more favorable lending conditions due to the low risk of refusal to return funds.

The down payment on a mortgage for building a house can usually be made using maternity capital. At the same time, the use of maternity capital is allowed only in case of lending for the construction of a residential building, while it is impossible to build a garden or summer house with these funds.

Stages of applying for a home loan

Sber processes a mortgage loan in several stages:

- Submitting a loan application online or at a bank branch;

- Preliminary decision. The citizen receives a notification via SMS to the phone number specified by the borrower;

- Submitting papers for consideration;

- Decision on approval or refusal of lending;

- Search for a residential property for purchase;

- Providing documents for the selected property to the bank;

- Signing a loan agreement with the bank;

- Providing an initial loan payment;

- Registration of ownership rights to the object;

- Signing a mortgage at a credit institution;

- Transfer of funds to the seller.

After passing all stages, the borrower becomes the owner of his own home or land for its construction.

Is it possible to take out a mortgage for construction without proof of income?

It is possible, but the conditions will not be very favorable. The presence of a stable source of income for the borrower is another important signal for the bank, allowing it to reduce the rate and offer more favorable conditions.

“Some banks do not request proof of income, and also issue loans to individual entrepreneurs and self-employed people, allowing up to four co-borrowers,” continues Andrei Mozol. — Moreover, if a mortgage is requested to build a house on a plot that is already owned, then the property under construction serves as collateral. And if a loan is taken out to purchase a plot of land and build on it, then a lien encumbrance is placed on the house and often on the plot of land too.”

Many lenders require life, health and property insurance. Without insurance, lending conditions worsen or a loan is denied.

pexels.com/

Bank requirements for the building and land plot

The house being purchased must be located in Russia. Ideally, it will remain in the possession of the former owner for at least three years. Housing must meet all the requirements of sanitary standards that ensure the health and safety of residents. The real estate seller should not have children under 18 years of age or will have to obtain permission to sell the home from the guardianship and trusteeship authorities.

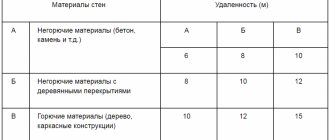

Requirements for collateral real estate:

- deterioration of the building is not higher than 70% of the service life specified in the technical passport;

- absence from the lists for major repairs, demolition, renovation;

- the presence of steam, gas or electric heating;

- concrete, reinforced concrete or stone foundation;

- The house is no older than 1970.

Which houses are suitable for buying on credit?:

- new, modern with all communications;

- buildings with reliable walls and foundations;

- with convenient transport interchanges and communications nearby;

- liquid objects, that is, located near the city, in a prestigious village;

- located near the city where there is a Sberbank branch;

- houses without debts to pay for housing and communal services;

- without encumbrances, litigation, illegal redevelopment.

Wooden houses, as well as those in dilapidated condition, are usually not considered as collateral at all. The bank requests not only an appraiser's report on the market value of the property, but also a BTI technical passport, which indicates what material the house was built from, when and whether major repairs were recently carried out.

If houses with wooden floors are accepted as collateral, it is only at a reduced price, which naturally reduces the lending limit.

All real estate must be insured . If the insurer, after inspecting the house, refuses insurance, then most likely they will not take it as collateral.

Requirements for borrowers

According to the expert, banks treat their borrowers individually. It is not uncommon for a person to receive refusals from four financial institutions and approval from a fifth. General rules for refusing approval:

- current loan debt;

- low credit rating;

- bankruptcy of the borrower in the last five years;

- high debt burden;

- debts from enforcement proceedings (fines, alimony);

- low liquidity of the facility under construction;

- age above the “threshold”.

At the same time, attitudes towards the age of borrowers are becoming more and more loyal. Some financial institutions limit it to 65 years, as there is a noticeable tendency among Russians to strive to meet their retirement with dignity in a private home.

“Houses built for personal use and especially according to their own design have low liquidity,” explains real estate investment expert Andrei Mozol. “This means that when trying to sell such a house, the seller will face low demand. Homes typically take three to five years to sell. The exception is the last year and a half, when increased demand was stimulated by the pandemic.”

According to the expert, this is the main reason why banks refuse to issue mortgages or increase the interest rate, thereby reducing the demand for these loan products. Banking organizations see such lending as a risk, since if the debtor stops paying the mortgage, the property will have to be put up for auction and there is a high probability that it will not be sold at a price close to the market price.

How to get a mortgage to build a house - an expert's guide

To get money, you need to follow the general algorithm of actions:

- Select a plot of land. Make sure that its intended purpose meets the main goal - the construction of a private house (plot for individual housing construction). It is important that communication systems pass nearby, and that the site is free from restrictions and easements.

- Agree on the project and notify the administration. Collect permits and begin choosing a bank.

- Check with the bank for the required package of documents. Usually this is an application form (filled out at the office of a financial organization or on the website), a passport, a certificate of income, permits and an extract from the Unified State Register of Real Estate. It is necessary to collect documents and submit them to the bank.

- Wait for a decision. It is taken from one to seven days.

- Sign the mortgage agreement.

If one of the bank's requirements is the existence of a contract agreement between the borrower and the developer, the funds will be transferred to the developer's account. In other cases, the funds are transferred to the borrower - to a special account or through a safe deposit box.