Deadline for receiving maternity capital in 2020

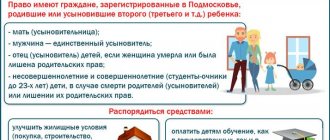

Maternity capital is a form of targeted material support . It should be noted that the right to it arises only once in a lifetime after the second child is born in the family.

Important! At the proposal of the President of the Russian Federation, starting from 2021, maternity capital will also be issued for the birth of the first child.

After the certificate is received, the citizen can no longer count on this form of state support even after the birth of descendants in the future.

As a general rule, as the name of this program suggests, maternity capital is drawn up by the mother of the child. The certificate is personal, so only its owner can dispose of it. However, in some situations, the father also has the right to receive maternity capital.

It is also useful to read: Was there indexation of maternity capital?

This is possible in cases where a woman dies or is deprived of parental rights by a court decision. In addition, the child himself, who has reached the age of majority, can dispose of the certificate, but only on the condition that he was previously left without parents (they died or do not have the opportunity to exercise the rights of their parents), who themselves did not have time to take advantage of the measure of state support.

The issuance of a network certificate occurs exclusively on an application basis . In other words, to receive it, you must contact the Russian Pension Fund. You can draw up the document immediately, but only after the birth of the child. The document is not issued automatically.

Reference! You can apply for the assignment of maternity capital not only directly to the pension fund branch, but also to the multifunctional center.

Fraud schemes

Certificate holders are trying to deceive the state through various frauds, unaware of criminal penalties. Due to improper spending of social support, the damage to the state amounts to hundreds of millions of rubles.

Fraud may consist in the fact that a citizen knowingly:

- registers someone else's child in his name;

- provides false information about himself or his children;

- hides that he was deprived of parental rights.

The list of ways to implement this manual is quite large, which has led to a large number of fraud methods.

The most common include:

- mortgage;

- its receipt by entities that do not have rights to maternity capital;

- cashing out funds;

- malfeasance.

The use of these methods of fraud is punishable by current legislation in the Russian Federation. You should not try to deceive the state, since the judicial practice on this issue is quite extensive; punishment for such a violation of the law cannot be avoided.

All kinds of schemes for obtaining money from capital are complex and confusing, designed for a high level of corruption in the state and the lack of verification of this type of transactions.

In 2007 alone, more than a dozen scammers were exposed who were trying to illegally implement this social support in various ways. So, let's look at them in more detail.

Cashing out funds

These schemes are practiced both by certificate holders themselves and by outsiders. In the case when the mother independently decides to illegally seize money, the following scheme is usually used: a contract for the sale and purchase of their home, both in full and in part, is concluded with close relatives (often with whom the young parents live). Often the price for an apartment is indicated equal to the size of the family capital.

Also read: VAT refund as a new type of fraud: how to avoid getting caught by scammers

Then all documents are transferred to the Pension Fund, which transfers money to the seller’s account. He, after receiving the funds, withdraws them and transfers them to the owner of the certificate.

In fact, after the transaction, the seller remains to live in the apartment or house purchased with social benefits. There is no improvement in the family's living conditions. This is an inappropriate use of maternal capital funds.

Currently, you can find many advertisements posted in public places or posted on the Internet offering assistance in cashing out maternity capital. These can be both legal entities (for example, real estate agencies) and individual specialists working as individual entrepreneurs.

Various methods of cashing out funds are being developed, where the role of the certificate owner is minimal. For example, he hands over a document to scammers, issues a power of attorney for them and receives a certain amount. As a rule, it is only 20-30 percent of the size of the capital.

It may also be possible to provide for the mother’s participation in submitting documents to the Pension Fund and her signing the transaction papers. In most cases, the scheme for cashing out funds is as follows: unsuitable housing is selected (dilapidated houses, apartments in an old building) or a small share in the right to real estate. After this, a purchase and sale agreement is concluded. The price is often stated equal to the cost of maternal capital. However, it turns out to be prohibitively overestimated. As an example, in fact, the real market valuation is 50,000 rubles, but according to documents, it was purchased for an amount of over 400,000 rubles.

After the Pension Fund transfers money to the seller’s account, the amount is withdrawn. It is then distributed between the intermediaries and the certificate owner. As a result, the family’s living conditions do not improve, since it is impossible to stay in the purchased houses and apartments.

Buying a house

You can obtain maternity capital by purchasing a dilapidated house, unsuitable for housing, at an inflated price.

According to documents, the building may be in satisfactory condition, although the house may be fictitious and even destroyed by fire.

Then the real price of housing is subtracted from the market value, and the capital is transferred to the parents.

This method can be dangerous because it is carried out by dummies. The money is transferred to their account by non-cash means, after which the scammers simply disappear.

Defrauded citizens usually avoid contacting the police, as they themselves may be charged for fraudulent activities.

Fictitious transactions and fraud when buying a house with maternity capital are a violation of the law, for which criminal penalties are established.

Not all creditor banks agree to work with maternity capital due to economic instability. Only a few dozen organizations agree to issue a loan against a certificate or pay a mortgage on an apartment.

The Pension Fund also does not always accommodate young parents, especially for the reconstruction or construction of a house.

A transaction involving the purchase of housing is considered legal if the building is given the status of a full-fledged residential building, and the house itself:

- not dilapidated or in disrepair;

- suitable for permanent residence (equipped with all amenities and communications);

- has an individual address;

- has documents of residential construction;

- you can register there.

The Pension Fund considers the basic requirements for housing that parents want to buy with maternity capital:

- the house must have housing construction status;

- located on the territory of the Russian Federation;

- availability of water supply, sewerage, heating and electricity systems;

- wear no more than 50%.

The law prohibits the purchase of a house in disrepair with family capital. Also a necessary condition for obtaining permission to purchase is the land plot where the residential building is located. Land must be purchased or leased.

Buying an apartment from relatives

The safest way is to commit fraud when buying an apartment with maternity capital with the involvement of your own relatives. In this case, the contract itself is drawn up as expected, but the previous owner continues to live in his apartment.

The pension fund transfers the money to the account of a fictitious seller, who cashes it out and transfers it to the person who registered the maternity capital. In most cases, such schemes are not disclosed by law enforcement agencies.

The law does not prohibit buying apartments from relatives, but imaginary transactions are prohibited.

They can be identified by the following characteristics:

- the seller has not checked out of his home;

- the parties to the transaction are spouses;

- the buyer registered the property as joint ownership of all family members, including the seller.

Obtaining a certificate by persons who do not have the right to do so

As a rule, two situations serve as examples of these cases. In the first case, a woman who has not given birth to a second child applies to the Pension Fund to receive a payment. At the same time, all necessary certificates and certificates are presented.

The second case is the receipt of a certificate by persons whom the court has deprived of their parental rights or limited in them. According to the law, they are not entitled to social benefits. But these citizens hide this fact from the Pension Fund, illegally receiving maternity capital.

Subsequently, an illegally obtained certificate can be cashed. It is also possible that the payment funds will be used strictly in the areas listed in the law. But despite this, actions to illegally issue a document are a crime.

Schemes involving officials

Officials of government agencies do not often take part in illegal schemes, but such situations do exist. These could be Pension Fund employees who “turn a blind eye” to obvious falsifications of submitted documents for a certain fee. Sometimes bank employees whose powers include approving loans take part.

There are cases of illegal activities of doctors (gynecologists and pediatricians). These persons issue fictitious certificates about pregnancy and the birth of a child. Based on them, the registry office subsequently issues certificates for non-existent children.

No matter what schemes are used, if maternity capital is illegally cashed out, the perpetrators will be prosecuted. Any use of the payment for purposes not listed in the regulation is a crime.

Mortgages and home loans

The scheme for cashing out family capital through mortgage or loan agreements is also widespread. There are possible ways for certificate holders to receive money independently or with the involvement of relevant organizations. When implementing this scheme independently, the recipient of the payment negotiates with relatives or close persons who own suitable housing. After this, an agreement is concluded on obtaining a loan and purchase and sale using maternal capital funds. Documents are provided to the Pension Fund.

After transferring the money to the seller’s account, he transfers it to the owner of the certificate, who repays the loan taken out ahead of schedule, and keeps the amount of maternity capital for himself. There are only interest costs for the mortgage during the registration period. In fact, there is no improvement in the family's living conditions.

This scheme is also being implemented by many organizations specially opened for this purpose, including microfinance ones. They offer to conclude housing loan agreements, also with installments, using funds using a certificate. As a result, unsuitable properties for living are purchased, or small shares in the right to them.

Also read: Responsibility for fraud using electronic means of payment

The funds received from the Pension Fund are divided between the organization and the owner of the certificate. Sometimes the latter can receive a very small amount.

Workers at such agencies deliberately seek out families from disadvantaged backgrounds. These are people with alcohol and drug addiction, or those in difficult financial situations. Such people are ready to give up their certificate for real money and sign all the necessary documents for a very small remuneration, ten times less than the payment required by law.

A legal way to cash out maternity capital through a loan

The only real option for cashing out family capital within the framework of applying for a loan, loan or loan is indicated above. It provides for the conclusion of an agreement with a bank or microfinance organization with the fulfillment of the requirement for the targeted expenditure of funds. They can also be issued in cash, but in any case the borrower must document that the money was spent on one of the following areas:

- improving the child’s living conditions (buying an apartment, room, house);

- children's education;

- mortgage payment;

- formation of mother’s pension savings;

- purchasing goods or paying for services for a disabled child.

Payments to a card or account, available to low-income families, become a separate area of spending maternity capital. We are talking about an amount not exceeding one and a half subsistence minimum established for a particular region. It is this option of receiving government assistance that can be called almost full-fledged cashing out. But it is even theoretically impossible within the framework of a loan, loan or bank credit.

What is the punishment?

The scope of liability for theft when receiving various social benefits, including maternity capital, is provided for in Art.

159.2 of the Criminal Code of the Russian Federation and depends on many factors: the commission of an unlawful act by one person or a group of persons, the use of official position, the amount of money received. Depending on the presence of these factors, punishment may vary from a fine of 120,000 rubles to imprisonment for a period of 10 years and a fine of one million rubles. Criminal liability arises only if the person initially had the intent to steal funds and it was proven that the defendant violated the requirements of the Law on Additional Measures of State Support for Families with Children in terms of the intended use of maternity capital funds.

At the same time, by virtue of Art. 104.1 of the Criminal Code of the Russian Federation, funds received as a result of committing a crime under Art. 159.2 of the Criminal Code of the Russian Federation are not subject to confiscation, but are returned as part of a civil claim in a criminal case or in the manner of filing a claim in civil proceedings.

This is explained by the fact that these funds are provided in the interests of the entire family, including minor children who cannot be deprived of this right due to the illegal actions of their parents.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

How to correctly exchange cryptocurrency for rubles. Step-by-step instruction

There are several ways to legally and safely withdraw digital assets such as Bitcoin. We explain the whole process in detail

There are many options for withdrawing cryptocurrency and exchanging it for fiat money. This can be done using exchangers, directly from exchanges, for cash in person and in other ways. We tell you in detail about each of them, about possible risks and commissions and explain whether you need to pay taxes and how to do it.

Exchangers

The most popular way to withdraw cryptocurrency is through exchangers. Special services allow you to sell cryptocurrency and then send money to a bank card, payment system like PayPal and others.

Step by step it looks like this:

- an exchanger is selected;

- the cryptocurrency and the volume to be withdrawn are indicated;

- in response, the exchanger determines the amount received, for example, in rubles, and also indicates the address to which the coins should be sent;

- the user transfers coins to the specified address. In some cases, after this, on the exchanger’s website you need to click the “paid” button. If this is not done, the money will not be transferred;

- when the cryptocurrency arrives at the exchanger’s address, its employees will process the transaction and transfer funds to the user’s account.

Important! When using an exchanger, you need to transfer exactly the number of coins that was agreed upon in the transaction. Otherwise, you may lose funds because the service does not recognize the transfer

The process usually takes about 10-15 minutes, sometimes faster. If more time has passed, you should contact the service’s technical support and find out what the reason for the delay is. There are different reasons. For example:

- The delay may occur due to the congestion of the cryptocurrency network, in such cases transactions are confirmed slowly;

- If there is an error in the data when filling out the application, the cryptocurrency will most likely be irretrievably lost.

The average commission ranges from 1% to 10%, in rare cases it significantly exceeds this value. The fees depend on:

- from the cryptocurrency that the user withdraws;

- from its reserves at the service;

- on withdrawal methods and other factors.

In addition to the commissions of the exchanger itself, part of the fees will be incurred by external payment systems, for example, such as Yandex.money. A fee will then be charged for withdrawing funds to your bank card. This must be taken into account.

There are special aggregators that help users select exchangers. On such services you can filter services by withdrawal methods, prices, customer reviews and other parameters.

It is important to remember that there is always a risk of running into scammers. This could be a phishing site that copies the interface of a real site, or an exchanger that was originally created for the purpose of deception. Therefore, when using an unfamiliar service, you need to be careful; it is advisable to try with a small amount. However, it is also worth considering the fact that attackers can miss a small transaction and freeze a large one.

Exchanges

Another popular way to buy and sell cryptocurrency is through exchanges. Many trading platforms now have the function of direct withdrawal of funds to a bank card. This is convenient and most often safe, but commissions may be higher than those of exchangers.

When cashing out cryptocurrency, the trading platform transfers funds to a third-party service, which then transfers the money to the user. In this case, he immediately pays a double commission, the total amount of which can reach 4-5%. You should always check the withdrawal conditions before taking any action.

When withdrawing cryptocurrency, you should take into account the risk that its rate may rapidly fall. For example, on June 22, the price of Bitcoin fell below $29 thousand for the first time since January of this year. It is safer to withdraw funds in stablecoins - these are cryptocurrencies whose exchange rate is pegged, for example, to the dollar. The most famous of these is the Tether USDT token.

To prevent losses due to a sharp drop in the exchange rate, there is a function to freeze it. Some services, when concluding a transaction, allow you to temporarily fix the price at which the cryptocurrency will be sold. Typically for 15 minutes. However, this option may incur additional fees.

other methods

You can also cash out cryptocurrency using cryptomats - this is an analogue of ATMs. Each of them has its own digital address. The user can transfer funds to it and thus cash out Bitcoin and several other popular coins.

However, crypto ATMs have their drawbacks:

- High commissions, often exceeding 5%;

- Low prevalence. According to cryptocoinmap.ru, there are only 7 of them in Moscow;

- Risk of using a fraudulent device.

Another risky way to exchange cryptocurrency is through cash transactions. For example, during a meeting, transfer digital assets and receive money. It is important that such operations can only be carried out with people you know well and trust. Otherwise, there is a risk of not only losing money, but also putting your life in danger.

There are many ways to cheat. A partner can pay at the wrong rate, lose money when receiving cryptocurrency, appropriate it for himself, citing a technical error, or simply rob it.

A safe way to make a deal with another person without intermediaries is through p2p platforms. The most popular of them is LocalBitcoins. The service guarantees that its clients will not deceive each other.

The main disadvantages of withdrawing funds through LocalBitcoins:

- The price is indicated without the commission that the bank or system will charge for the transfer;

- Due to the low popularity of p2p services, there are fewer offers for sale or purchase on them.

Another non-standard way to exchange cryptocurrency for fiat is through Telegram bots. They allow you to buy and sell Bitcoin and other coins, as well as store them in a wallet linked to your Telegram account.

This option is extremely risky. The user entrusts his money to a complete stranger, with whom he almost certainly will not be able to contact if something goes wrong.

Taxes

Transactions with cryptocurrency are not always, but can generate income. In this regard, the user must pay tax on transactions performed. Its value is 13%, said Yuri Brisov, a member of the Commission on Legal Support of the Digital Economy of the Moscow Branch of the Russian Bar Association.

“Individuals pay income tax. The tax on the sale of property in Russia is 13%. The citizen must deduct from the amount in rubles received as a result of “cashing out” the cryptocurrency, the amount in rubles that he spent on purchasing the cryptocurrency. You should pay 13% of the difference received,” the expert said.

He added that printouts from wallets confirming the generation of income should be attached to the personal income tax form-3 submitted to the tax office. However, there is no such requirement, and the declaration can be submitted simply by indicating the amount of income. Income of individuals from the sale of cryptocurrency minus the costs of its purchase is subject to personal income tax at a rate of 13%.

“To pay tax, you need to submit a tax return in form 3-NDFL to the tax authority at your place of registration in person, by mail, through the MFC or in your personal account on the website of the Federal Tax Service of Russia, and pay personal income tax. Tax authorities may conduct a desk audit of the declaration and request additional documents and explanations. The income tax return for 2021 had to be submitted by April 30; when filing it now, a fine will be charged, and it will increase with each month of delay. But you can still pay the tax on such a declaration painlessly if you do it before July 15,” explained Dmitry Kirillov, senior lawyer in the tax practice of Bryan Cave Leighton Paisner (Russia) LLP, teacher at Moscow Digital School.

Cashing out cryptocurrency in parts and blocking bank cards

Brisov explained that when cashing out cryptocurrency, you should not divide it into small amounts. This will not prevent the bank from checking the transaction if it considers it suspicious. Moreover, dividing one payment into several small ones in international practice is perceived as unfair practice and always raises questions from the monitoring service. Therefore, any “cunning” schemes can bring the wrath of not only the bank, but also law enforcement agencies, upon their perpetrator.

“Experienced participants in crypto-circulation know that banks have “flags” set for certain amounts, so they are often advised to “split” payments into amounts of up to 50 or 30 thousand rubles. The law does not provide for such restrictions on amounts and banks can check any suspicious transaction even for 1 ruble... It is not recommended to engage in “fragmentation”, you just need to indicate the legal basis for the transfer, save transaction confirmations and pay the tax on time. Thus, under the current legislation, cryptocurrency activities should not cause problems,” Brisov shared.

Efim Kazantsev, Ph.D., expert at Moscow Digital School, added that the bank can block funds if a cryptocurrency cash-out operation seems suspicious to it. This is provided for by Federal Law 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.”

Briefly

There are at least six ways to withdraw cryptocurrency. The most popular way is through exchangers. Aggregators will help you choose a service with the most favorable rate and provide the opportunity to work with a huge number of payment systems. But there is a risk of using the services of scammers and losing money.

The most convenient way to withdraw funds is through exchanges. However, not all trading platforms have this option. Plus, an additional fee may be charged for withdrawing cryptocurrency if the transaction occurs through third-party services.

According to the law, a citizen of the Russian Federation must pay tax when cashing out cryptocurrency. Gray schemes, for example, evading this by splitting the withdrawal amount into parts, can lead to blocking of the card. Such transactions are recognized by banks as suspicious.

— How to buy cryptocurrency profitably and safely. Instructions for a beginner

— How to start trading cryptocurrency. Instructions for a beginner

— How to choose an exchange for trading cryptocurrency. Instructions for a beginner

You will find more news about cryptocurrencies in our telegram channel RBC-Crypto.

How to recognize scammers and not lose capital?

According to the law, Russians can legally use capital only to improve their living conditions, educate a child or several children, form a funded part of a mother’s pension, or buy goods and services for the social adaptation of disabled children.

In addition, you can also live for several years, receiving capital in the form of small monthly payments: this option is available only to families whose average income over the last 12 months does not exceed two regional subsistence levels per person.

To whom do they want to pay additional maternity capital?

Read more…

At the same time, not everyone is ready to follow legal requirements—another scheme was discovered the day before in St. Petersburg. Residents of 11 regions of the Russian Federation were involved in it, the press center of the Ministry of Internal Affairs reported.

note

Members of a criminal group who fraudulently cashed out the maternity capital of women from 11 regions of Russia were detained in St. Petersburg. The scammers kept 45% of the amount allocated by the state at their disposal. According to the Russian women themselves, until the last moment they did not understand that they had fallen for the trick of criminals and became part of their scheme.

According to operatives, the criminals searched for their victims via the Internet, after which they offered them to use the mother capital certificate to build houses in the regions. Subsequently, a fictitious agreement was concluded, which the attackers transferred to the Pension Fund to receive payment. For their services, the organizers of the scheme demanded 45% of the capital amount.

Can Matcapital be allowed to invest in securities?

Read more…

The Ministry of Internal Affairs clarified:

Thus, in 2021 and 2021, cooperatives attracted more than 100 clients in several Russian regions. In St. Petersburg and the Leningrad Region alone, the damage caused to the federal budget amounted to about 20 million rubles.

Putin is not against using maternity capital for an “expensive thing”

Read more…

Families who find themselves involved in a criminal scheme do not always realize that they are dealing with scammers. Thus, in December 2020, a preliminary investigation was completed against six residents of the Kurgan region who deceived legally illiterate women in order to receive capital instead of them. The total amount of the stolen goods exceeded 28 million rubles, the press service of the Russian Ministry of Internal Affairs for the region reported.

Who was allowed to reuse maternity capital?

Read more…

As investigators were able to establish, from 2013 to 2021, the head of the center for the provision of legal services, with the help of accomplices, convinced clients to enter into a targeted loan agreement for the purchase of housing. The owners of the certificates issued a power of attorney to the director of the center to carry out transactions, after which the scammers bought illiquid plots with dilapidated houses unsuitable for living at an inflated price. The property was transferred to the families themselves, while the accomplices received payments from the Pension Fund and divided them among themselves. Thanks to this scheme, they managed to deceive 66 women, the Ministry of Internal Affairs specified.

note

Seven people were detained in connection with a scam involving cashing out money under the maternity capital program, official representative of the Russian Ministry of Internal Affairs Irina Volk said on Thursday. Five residents of the Volgograd region and two St. Petersburg residents were detained, the official website of the Russian Ministry of Internal Affairs reports. The alleged organizer is a resident of the Volgograd region previously convicted of fraud. According to Irina Volk, during the searches, three premium cars, cash in the amount of 1.3 million rubles, hard drives, stamps and documents that may be important for the investigation were seized from the defendants. A private plane was found in the possession of the alleged leader, and the issue of its seizure is being decided. The representative of the department added that the Kuibyshevsky District Court of St. Petersburg has already chosen preventive measures against the suspects. Five were taken into custody, one person was placed under house arrest, and another was under recognizance not to leave the place.

Based on the results of the investigation, the defendants were charged under the articles “Fraud in receiving payments” and “Legalization of funds obtained as a result of committing a crime.” During the investigation, expensive cars and apartments worth a total of 10 million rubles, as well as 11 million rubles in cash, were confiscated from them.

The scope of application of maternity capital will be expanded - now for repairs

Read more…

Here is the story of one of the victims, albeit from a different region: they gave the phone number of a female realtor and said that she would help her buy a home using her maternity capital. The realtor filled out the paperwork and said she had found the house. After some time, the realtor called her client and asked her to transfer money through the bank, having previously withdrawn it from her account. We went to the bank and withdrew money. The realtor said that the client should give the amount to her. The client, not knowing the procedure, gave it away.

note

Earlier it was reported that the St. Petersburg police identified fraudsters who, according to operational information, cashed out maternity capital through controlled credit consumer cooperatives: they entered into fictitious housing construction agreements with certificate holders and transferred them to the Pension Fund. The money received was distributed between the client and the cooperative workers. More than a hundred people allegedly took advantage of the defendants’ offer. Preliminarily, the damage from illegal activities is estimated at 20 million rubles.

The realtor promised that she would transfer the money to the company’s account and, if the company approved the deal, the funds would be transferred to the sellers of the house... Nothing has happened since then. On the phone, the realtor answered that the deal would take place tomorrow or the day after tomorrow, this dragged on for about six months. Soon the sellers of the house, without receiving funds, filed a lawsuit against her. Left without property and money, the woman filed a statement with the police, but the case was not opened due to lack of evidence. And when checking, the “realtor” said that she simply borrowed money.

Most scammers adhere to the same schemes for cashing out maternity capital: they offer certificate holders to buy housing at a greatly inflated price or in an illiquid condition. After this, most of the money is simply cashed out, leaving the victim with her new property. Some companies also offer to withdraw maternity capital for the construction of a new house, constantly reselling the same plots.

Matkapital may be allowed to be used to purchase devices

Read more…

Chairman of the Board of the credit consumer cooperative “Sodeistvie” Alexey Lashko explained to 66.RU:

The state has little control over this area. Construction is a rather expensive undertaking; maternity capital alone will most likely not be enough for it. However, the absence of the need to return money to the budget if the house is not built has given rise to an entire industry for scammers. God-forsaken lands without any networks or landscaping are bought by swindlers for pennies, divided into small plots and sold to “cash-outs” for several months - while they receive maternity capital. Then the deal is terminated and the victim - at best - receives at least some part of the money.

note

A source told Interfax that four men and three women aged from 33 to 45 were detained as suspects in this case. Law enforcement officers conducted 40 searches at their places of residence in St. Petersburg, Volgograd and Pskov regions.

In this regard, the Pension Fund of the Russian Federation regularly reminds: absolutely all advertisements promising legitimate “cash out” are fraud in receiving payments. Maternity capital cannot be cashed out, exchanged or sold. At the same time, both the organizers of illegal actions and the owners of certificates are held accountable for violation of the law when cashing out maternity capital. If violations are detected, the victim may, at a minimum, lose capital, and at maximum, receive a fine or imprisonment for fraud.

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition

Maternity capital hotline phone number

There is a preliminary entry in which the organization is introduced, with a message that by connecting with the operator, you consent to the processing of personal data. Next you are offered:

- click on number 1 to get advice on pension and social security issues;

- Click on number 2 if you want to report facts of corruption in the Pension Fund system;

- If you want to send an appeal to the Pension Fund, you should press number 3 on your phone.

And just before the connection, a standard message will sound stating that all conversations with employees are being recorded.

How to cash out maternity capital in the Russian Federation. Spoiler: the number of crimes is growing

Some scammers immediately ask you to send photos of SNILS and the first pages of your passport. Allegedly for verification by the Pension Fund. In order to gain trust, they forward messages from other users who have already sent them photographs of their documents, and also promise to withdraw a third of their capital on the very first day. Despite the lack of an organization as such, the scammers assure that it makes no sense for them to deceive anyone: “Our reputation is important to us.”

After studying the advertisement on the Internet, we turned to the Pension Fund with a request to check for fraud randomly selected sites that promise to legally cash out maternity capital.

Some of them are designed in such a way that they can inspire confidence in an ignorant person. For example, the following site seems to emphasize its officiality: “Do you want to cash out maternity capital? This is correctly called “implementation”. We will help you realize your maternity capital.”

This site also contains a list of “official partners”: Pension Fund, Sberbank, Federal State Registration Service. The Pension Fund assured us that they in no way cooperate with any real estate agency.

Adventurer Profile

It is precisely because of the demand for cashing the certificate among mothers themselves that such scammers appear. Daily Storm tried to find out the reasons that push women to commit a criminal offense. Most of those convicted under Article 159.2 of the Criminal Code are reluctant to talk about their criminal records, but one woman who received a suspended sentence for maternity capital fraud agreed to talk to the Daily Storm on condition of anonymity.

Oksana (name changed) is a 26-year-old resident of the Volga Federal District. In 2021, she gave birth to her second child, and in the spring of 2018 she applied to the Pension Fund with a request to issue her a certificate for maternity capital in the amount of just over 450 thousand rubles.

At the age of 15, Oksana received the prize for the best player at a backyard football tournament, managed to graduate from music school and planned to become a professional musician. Now, according to her, she works at the local House of Culture at a quarter rate, and also unofficially works part-time at night - so as not to be deducted from her salary.

“In this case, I will at least somehow be able to pay for meals at school for my eldest daughter, for kindergarten for my youngest, and also to dress and feed them,” says Oksana. — And reimburse the maternity capital, of course. They take 50% of the official salary per month. At the cultural center my salary is 2500 rubles. Soloists are not satisfied with more than a quarter of the rate. I could, of course, go to work at a network company (MTS, Beeline, etc.) or at a factory, but who would take care of the children then?!”

After the verdict, the local press wrote about Oksana only as a “cunning fraudster.” What exactly made her commit a scam with maternity capital? In a dialogue with a Daily Storm correspondent, she said that at that time she had a difficult life situation:

“I didn’t work, I was on maternity leave with my child. At that time, my husband had a conflict with his superiors - he was asked of his own free will. For a long time he could not find a job. It was necessary to pay for a rented apartment, a garden, and something to eat, again. That’s why I decided to take this step.”

Oksana claims that the state did not provide any subsidies. At that time, my daughter was more than one and a half years old, and child care benefits are paid exactly up to this age. According to her, this is about four to five thousand rubles.

“For comparison: a receipt for a kindergarten is issued for no less than two thousand rubles,” complains Oksana. She learned that low-income families were entitled to payments of up to 20 thousand rubles during the investigation.

“The most interesting thing,” Oksana continues, “is that I was awarded compensation for the entire maternity capital, although I received only 270 thousand in my hands (out of 450 thousand - Note: Daily Storm). I contacted a company that helps cash the certificate. An option was proposed to withdraw money through the purchase of land for construction. Accordingly, this company bought the land. As a result, according to the loan agreement, they officially take their percentage - 50-something thousand rubles, plus I gave 120 thousand rubles to the person who handled the documentation. The director of the company warned me that the deal was illegal.”

Oksana did not immediately spend the cashed money: “First, I paid off all my utility debts and paid for kindergarten. I bought autumn clothes for the children and got my eldest daughter ready for first grade. And a little later we rented a car so that my unemployed husband could drive taxi.”

A few months ago, the court sentenced Oksana to one year of probation and decided to recover the entire 450 thousand rubles from her.

The convicted mother admits that there is no one to shift the blame to:

“Actually, I found myself in this situation myself. It's my fault - now I'm making up for it. The only thing that’s offensive,” Oksana notes, “I didn’t spend this money somewhere in clubs or boutiques, I invested it all in my family.” I still wonder why I didn’t immediately consult with my husband (he found out about the “cash out” after all the documents were completed). Perhaps we could take out a microloan...

When asked if she regrets her action, Oksana replied that she certainly does. “But everything happened as it happened,” she resigns herself.

Payment procedure

There are several legal ways to receive money from the government. If you need to use them for current needs, you can get 25 thousand rubles.

To do this, you will need to contact your local Pension Fund office and write an application for the issuance of money. After checking the documents, you will receive a one-time payment of 25 thousand rubles .

Interestingly, you can receive payment more than once. The main condition is cashing out once a year. The money should be spent on the current needs of the family and children.

You can also cash out during the construction or reconstruction of a residential building.

Here, Federal Law No. 256 provides for the payment of money directly to the account of the owner of the capital. Initially, when all documents are verified, you will receive half of the maternity capital funds, and after six months the rest will be paid.

However, you will need to provide payment documents that the money was used properly.

Another opportunity to legally cash out public funds is to obtain a mortgage or take out a loan against capital. In the latter case, there are several important nuances.

You will need to prove that the money was used specifically to improve living conditions or to another item required by law. You will also need to prove the absence of collusion in the use of this cash-out scheme.

The fact is that the Pension Fund is reluctant to issue federal money if it is used to repay a consumer loan or a loan taken out at work.

To process the issuance of funds, you must provide a complete package of documents to the Pension Fund . The verification process takes 30 minutes. It will take the same number of days to issue funds. You can read about how to cash out MK quickly and legally here, and this article talks about illegal ways to withdraw funds.

In the next section we will talk about what documents are needed to cash out a mat. capital.

Malfeasance

To date, fraudulent transactions involving officials continue to be carried out. In most cases, officials and pension fund employees participate in falsifying documents for a fairly large percentage.

Such scams are possible because the mother capital certificate represents a depositary receipt, and if you have certain contacts, you can easily cash out money through officials. But for this, several officials at once must be corrupt.

The most frequently used scheme is the registration of maternity capital for the construction of a house. The Pension Fund usually already has concluded agreements with construction companies, and the money is transferred to their account.

Next, fake cash and sales receipts are generated for the purchase of materials and construction work. The funds are then cashed out in various ways.

Even if the bribe was transferred through an intermediary, the recipient of the certificate will also be punished, and it is quite serious for this crime, since there is a preliminary conspiracy and intent here.

What can you spend your maternity capital on?

According to paragraph 3 of Art. 7 of this law, maternity capital funds can be used for:

— improvement of housing conditions (purchase, construction of residential premises, payment of a down payment, repayment of the principal debt when receiving a loan, including a mortgage, for the purchase or construction of housing);

— education of children in any educational institution on the territory of the Russian Federation that has the right to provide paid educational services;

— formation of the funded part of the labor pension of the mother who is the owner of the certificate;

- social adaptation of children. Funds from maternal capital can be used to offset the costs of certain goods and services for the social adaptation and integration of disabled children into society. At the same time, maternity capital funds cannot be spent on medical services, as well as on rehabilitation measures, technical means of rehabilitation and services;

— receiving a monthly payment from the maternity capital fund (this change was introduced by federal law dated December 28, 2017 N 432-FZ).

What is maternity capital

Maternity capital is a state social program that has been operating in Russia since 2007 and was introduced to support Russian families. It provides for the payment of money for the second, third or subsequent children born or adopted.

The right to maternal capital is confirmed by a personal certificate. You can receive it if a person meets certain conditions, and the funds can only be spent on specific purposes. The certificate itself can be either in paper form or electronic, and from April 15, 2021 it is issued without applications. According to the Ministry of Labor, more than 10 million certificates were issued during the state program.

Illegal schemes for cashing out maternity capital

Today, there are many schemes according to which holders of maternity capital are offered to cash out money in order to use it at their own discretion, and not for the purposes provided for by law.

Such schemes, with all their diversity, are always fraudulent and not only create the risk of non-receipt of funds or part of the funds by the owner of maternity capital, but are also the basis for bringing him to criminal (Article 159.2 of the Criminal Code of the Russian Federation) and civil liability in the form of an obligation to return funds received to the Pension Fund of the Russian Federation (see, for example, the Appeal ruling of the Supreme Court of the Republic of Tyva dated July 21, 2015 in case No. 33-1051/2015).

The most common mechanism for cashing out maternity capital is through the execution of imaginary transactions and fictitious agreements, as a rule, between close relatives.

For example, a person who has legal grounds for receiving maternal capital alienates the real estate where he lives with his family under a gift agreement, and then, ostensibly in order to improve living conditions, submits an application to the Pension Fund of the Russian Federation for the disposal of funds indicating the recipient’s account, your relative.

After this, under a fictitious purchase and sale agreement, real estate that was previously alienated under a gift agreement is acquired, and the person who received funds from the Pension Fund returns them to the recipient of maternity capital (see the Determination of the Supreme Court of the Karachay-Cherkess Republic dated December 24, 2012 in case No. 33-776/12).

We recently talked about a case in the Belgorod region, where, trying to cash out MSC funds, a woman entered into a fictitious loan agreement with a dubious organization to purchase a house. The organization fraudulently appropriated the funds transferred by the Pension Fund to repay this loan, which became the reason for the certificate owner to contact law enforcement agencies. But a criminal case was opened not only against the organization, but also against the woman as an accomplice in the scheme for cashing out maternity capital.

There are also cases of registration of fictitious mortgages, certificates of ownership, contracts for repair work in residential premises and assessment of the value of purchased real estate.

Imaginary and feigned transactions are distinguished in accordance with the instructions contained in paragraphs. 86-88 Resolution of the Plenum of the Armed Forces of the Russian Federation of June 23, 2015 No. 25.