How to get a mortgage without the participation of a spouse is a fairly common question among mortgage borrowers. Nowadays, many married couples take a responsible step in their lives together - take out a mortgage loan to purchase a home. As a rule, one spouse takes out a mortgage, and the second is automatically a co-borrower (). In other words, both spouses bear the same burden of mortgage debt. Many banks by default include a spouse as a co-borrower if they see that the borrower is married.

In what cases does a spouse not participate in the mortgage?

However, there are cases when one of the spouses wants to take out a mortgage only for themselves, without involving their spouse in this process. A mortgage without a spouse may have the following reasons:

- division of property of spouses, the desire to protect real estate from division in the event of a possible divorce;

- one of the spouses works unofficially and his income is not confirmed;

- one of the spouses has a bad credit history;

- the wife, for example, is a housewife and has virtually no income.

Very often, a family has to take out a mortgage only for the wife if the husband already has several loans.

It is possible and quite legal to take out a mortgage without the consent of your spouse.

Who can be a co-borrower?

Any adult who meets the requirements of the credit institution can act in this capacity. Considering that the co-borrower is a full participant in the loan agreement, the involvement of minors for these purposes is not allowed.

For example, you can take the loan program of a conditional bank. Standard requirements for potential clients are as follows:

Preferential mortgage Gazprombank, Persons. No. 354

from 5.99%

per annum

up to 3 million

up to 30 years old

Get a loan

- Age appropriate.

- Availability of permanent income and employment - the data is documented.

- Permanent registration in the region where the agreement is concluded.

- Positive credit history.

- No heavy credit load.

Whatever requirements are imposed on the borrower, the bank sets the same requirements for the co-borrower. In certain situations, a person becomes a co-borrower automatically - in accordance with legal requirements. This is possible if the mortgage is issued by a person who is officially married. The second spouse enters into the agreement as a co-borrower, regardless of whether he meets the requirements of the credit institution or not.

Methods for completing an application without taking into account a spouse

Answering the question - is it possible to take out a mortgage without the knowledge of the spouse, we give an unequivocal answer in the negative. Even though one spouse is excluded as a co-borrower, his or her participation will still be required.

To take out a mortgage without a spouse, you need to contact a notary and register your consent to the purchase of real estate by the second spouse. The document contains data on the property and the consent itself.

The notary certifies the identity of the spouse and records this consent. This document has a default term of 3 years, like most notarized documents. Such consent will be required to register the transaction, that is, when registering ownership of the apartment.

Recommended article: Mortgage loan agreement: what to look for when signing

However, the apartment will still be joint property, to which the non-participating spouse has the right to claim. And debt obligations also apply to both spouses.

Joint purchase of housing

Real estate is always in demand on the market. Since not everyone can buy an apartment with one payment, most citizens take out a housing loan. If a person is married, before concluding a mortgage agreement, you should consult with your life partner. But is it necessary to obtain his consent?

When purchasing real estate without using borrowed funds, the spouse’s permission to purchase an apartment is not required:

- if the transaction is concluded by proxy;

- if housing is transferred into ownership on the basis of shared ownership or as joint ownership, both transactions are documented;

- in case of purchasing a commercial property.

Before issuing money, bank employees will request notarized permission from the second spouse. .

Nuances of registering a marriage contract

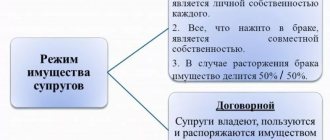

What kind of document is this? This is an agreement between husband and wife, in which they can establish ownership of certain real estate objects or redefine shares, or generally change the procedure for disposing of joint property (). The agreement is concluded in writing and certified by a notary, who acts within the framework of the rules for performing notarial acts on the basis of the laws of Russia ().

cannot contradict civil legal acts or limit the rights and legal capacity of spouses.

The database cannot be changed unilaterally, that is, on the initiative of only one spouse. The marriage contract is considered invalid after the divorce of the spouses (). When one of the spouses receives a loan, the marriage contract must be presented to the financial institution. A mortgage without a spouse as a co-borrower is formalized through such an agreement.

How to get a mortgage without your wife's consent

First you need to make sure you have the right to take out a mortgage loan without obtaining your wife’s consent. To do this, you need to take care of having a marriage contract certified by a notary, or prepare documents confirming that your wife does not have Russian citizenship. Otherwise, the registration procedure will be standard and include 7 steps:

- Choosing a suitable bank. I recommend not relying on advertising, but comparing the conditions of different credit institutions yourself and only after that making a decision on where it is more profitable to get a mortgage.

- Preparation of the necessary package of documents. Usually collecting them is not a problem, but sometimes you have to wait a little until all the necessary certificates are prepared by the employer.

- Filing an application. It is issued on the website or in the office. All previously prepared documents in the form of originals or scanned copies must be attached to the application.

- Receiving a positive decision from the bank. It is usually accepted within 2-7 days, but sometimes financial institution specialists take a little longer to verify the borrower.

- Selecting an object to purchase. It must also usually be assessed by an independent company and then agreed upon with the bank.

- Signing documents and conducting a transaction. At this stage, it is important not to forget about the need to insure the property, which will act as collateral. Insurance is paid by the borrower.

- State registration of the transaction. To do this, you will have to contact Rosreestr directly or through the MFC. Many banks also offer electronic registration of transactions.

What documents will be needed

You must approach the collection of documents necessary to obtain a mortgage loan responsibly. It largely depends on him whether the bank can approve the application. When applying for a mortgage without the participation of his wife, the borrower must, in addition to the marriage contract, prepare his own passport, as well as documents on employment and income. Usually for these purposes it is enough to provide a salary certificate and a copy of the work record book.

The following documents also allow you to confirm your income:

- tax returns (for individual entrepreneurs, business owners);

- lease agreement (to confirm additional income);

- a certificate from the Pension Fund (to confirm the amount of pension payments if the borrower is already receiving them).

Important. The bank has the right to request other additional documents, taking into account the situation of a particular client and the information contained in the application.

After selecting a property for purchase, the seller must provide an extract from the Unified State Register of Real Estate, as well as a document providing the basis for the emergence of ownership rights (for example, a purchase and sale agreement). For a new building, another package of documents is provided: an extract of land ownership, an investment agreement, and the developer’s constituent documents.

Requirements for borrowers

The requirements for the borrower to obtain a mortgage without the participation of the wife will not change in any way. This category of loans is available to citizens of the Russian Federation and in some banks to foreigners. The potential client must also meet the following parameters:

- adult age and full legal capacity;

- presence of registration on the territory of the Russian Federation (sometimes in the region where there are offices of the selected bank);

- constant income, which is enough to make payments on time.

The decision on each application is made individually. It is largely influenced by the following points:

- client's credit history;

- borrower's solvency;

- current credit load;

- the presence or absence of debts collected through the court.

Important. The bank has the right to refuse any loan application. He is not obliged to explain the reasons for making a negative decision. It may also be caused by the credit policy of a particular organization.

A mortgage without the consent of the wife is possible in strictly prescribed cases by law. Usually, to do this, you need to have a marriage contract with a separate regime for the use of property, including real estate. In other cases, the husband will have to agree on the deal with his other half.

What does a marriage contract contain?

The husband and wife agreement for a mortgage without the consent of one of the spouses must contain the following:

- information about the person taking out the loan (full name, passport details, place of residence);

- information about who will own the property;

- information about the amount of the down payment and its payer;

- information about who will make monthly payments;

- those responsible for violations of the marriage agreement are identified.

Recommended article: Rural mortgage at 1-3 percent

Let's look at each point in more detail.

The first clauses of the agreement clearly and clearly define which of the spouses is the borrower and who will be the future owner of the home.

About mortgage payments

An important point in a prenuptial agreement when it is drawn up to take out a mortgage without the participation of a spouse is the down payment. After all, unless otherwise stated, all money in the family is considered joint. Therefore, it is important to indicate the source of the down payment.

The point about monthly payments is also very important. It must be indicated that such payments are part of the income of the future owner, and not joint family income.

About the norms of civil contract

A BD is an ordinary civil contract, in this case it decides the question of whether it is possible to take out a mortgage without the consent of the spouse. Therefore, in a situation where the clauses of the agreement of one of the parties are not fulfilled, the norms of the Civil Code of the Russian Federation apply. That is, the second party has the right to make demands for elimination of violations and even compensation for losses, as under any civil contract.

Termination of a marriage contract occurs in connection with the divorce of the spouses, unless other conditions are specified in the agreement

In each specific case, the agreement may contain information about the bank that issued the mortgage, the terms of this mortgage, or additional information about the property itself.

What is the difference between a co-borrower and a guarantor?

A co-borrower is a person who has equal rights and obligations with the title borrower. It is involved in order to increase the chances of receiving a loan. The income of the title (main) borrower and co-borrower are added up, so the likelihood of a positive decision on the part of the bank increases. Co-borrowers are subject to the same requirements as the main borrowers.

The guarantor is also a third party in the loan agreement, who acts as a guarantor of the borrower’s fulfillment of obligations to the lender. Unlike a co-borrower, a guarantor does not bear joint and several (equal) liability under the loan agreement. His liability arises if the main client does not fulfill his obligations to the bank. The diagram looks something like this:

Loan “State support for families with children” SberBank, Individuals. No. 1481

from 0.1%

per annum

up to 12 million

up to 30 years old

Get a loan

- The borrower stops paying on the loan.

- The bank issues demands for debt repayment.

- The borrower is unable to fulfill his obligations.

- The bank issues demands to the guarantor.

Consequently, the co-borrower fulfills the obligations under the agreement together with the title borrower, and the guarantor - instead of him. In this case, the first one has the right to dispose of funds, as well as to a share of ownership in the real estate purchased with a mortgage. The guarantor does not have these preferences, since he does not bear joint liability on an equal basis with the main client of the bank.

Where to draw up a marriage contract

Although this agreement is registered by a notary, its drafting can be entrusted to a competent lawyer. After submitting the documents, the specialist will quickly and accurately formulate the main points and conditions of the marriage contract relating to a mortgage without the consent of one of the spouses. Documents you will need:

- passports of husband and wife;

- marriage document;

- ownership documents and mortgage agreement.

Only after a competent drafting of the agreement, if there are no contradictions with existing legislation, will the notary register the marriage contract. It will come into force, and there will be a chance to take out a mortgage without the participation of a spouse.

Advice for borrowers

It is very difficult to get approval for a mortgage without official income. Therefore, check out the recommendations that will help you get a positive answer:

- try to make as much of a down payment as possible. The higher it is, the stronger the bank’s loyalty. The easiest way to get approval is with an PV of more than 50%;

- close all existing loans and debts, especially credit cards;

- initially consider the offer of the bank through which you receive your salary, or in which you have ever held a deposit or taken out a loan;

- Don’t lie about your place of work and salary, everything will be checked. The declared income must be objective.

If you have a negative credit history, it is unlikely that you will be able to get a mortgage without official employment. Even borrowers with certificates are denied in such circumstances.

How to increase your chances of getting a mortgage approved without the participation of your spouse?

This will happen if:

- the borrower's income is greater than average (at least twice);

- continuous work experience of more than 3 years;

- a co-borrower with a good stable income, preferably related to the borrower by family ties;

- the borrower will make a large down payment.

If there are two or three such points, there is a possibility of getting a mortgage without a spouse.

It should be noted that at any time the database may be:

- terminated by agreement of both parties;

- renegotiated on different terms.

That is, during the term of the mortgage loan, the spouse not participating in the loan can, for example:

- receive a pre-agreed share in housing;

- make monthly payments under any conditions.

Influence the bank's decision to get a mortgage

To increase your chances of getting a mortgage for a one-person household, collect all statements and income certificates. Try to confirm your additional income with bank and card statements. If you have a deposit, be sure to include this information in your application. Banks are loyal to customers who keep money in banks.

Get a statement from the BKI in advance and make sure that you have a positive credit rating. If you have other credit obligations, try to pay off all debts in advance. Managers will check your credit load, but it is best when you have no other debts to banks. If the bank requires a down payment of 20%, try to put down 30% or even 40% of the property price. Thanks to this, you will reduce the total loan amount and overpay less on interest.

Stay with us - subscribe to the newsletter. We will notify you about new articles by mail or messenger.

Which bank can approve a mortgage without a spouse as a co-borrower?

First of all, it must be a large bank. According to statistics, VTB often approves mortgages in such situations. In any case, when you first contact the bank, you should immediately ask the employees the question - is it possible to get a mortgage without the consent of the spouse. Bank specialists can advise the most effective method.

List of banks in which the mandatory participation of the spouse as a co-borrower is not required and only the notarial consent of the spouse is sufficient:

- Sberbank

- House of the Russian Federation

- Gazprombank (even without consent)

- Promsvyazbank

- Sovcombank

- Uralsib Bank

- Absolut Bank

- Bank "Saint-Petersburg

- BJF (Housing Finance Bank)

- Moscow Industrial Bank

- ICD

- Primsotsbank

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateMarch 27, 2020May 11, 2021

Conditions for refinancing a mortgage

The ability to change the terms of the mortgage is, first of all, convenient for the debtor. As a rule, the agreement involves revising the terms of loan repayment. Refinancing is used to:

- reduce monthly payments;

- change the validity period of the agreement;

- reduce the interest rate.

To determine whether you need your spouse's consent to refinance your mortgage, you should consider the status of the property. For example, if the property is shared, the mortgage in most cases is repaid from the funds of the joint budget. In this situation, the spouse must choose one of three options:

- Conclude a surety agreement.

- Issue a notarial consent.

- Become a co-borrower.

By setting such conditions for the client, the bank thus minimizes its risks.

Is it possible to get a mortgage without an official job?

Issuing a loan by a bank involves returning the amount with accrued interest for the use of borrowed funds. Consequently, the requirements put forward by credit institutions to borrowers, such as:

- having a stable, well-paid job;

- possession of valuable movable and immovable property;

- the provision of sureties and collateral are completely justified.

But the realities of life are such that earnings can be unofficial:

- from freelancing, that is, without being employed;

- from renting out property;

- from investing.

To expand the client base of this category of borrowers, banks are developing flexible conditions for the possibility of obtaining a mortgage without the need for documentary evidence of official earnings.

How to draw up such a document correctly?

Although there is no clear template or requirement for a spouse's notarial consent to a mortgage, a certain standard form has been established among notary offices. A document executed in this form does not cause comments either from the creditor bank or from Rosreestr when re-registering rights to real estate; it consists of the following sections:

- Indication of the locality in which the document is being drawn up.

- Detailed passport information of the second spouse (the one who gives his consent).

- Line: “in accordance with Article 35 of the Family Code of the Russian Federation, I give consent to my spouse *full name of the spouse* to purchase real estate”; further - indicate the exact address of the property.

- Personal signature of the person giving consent.

- Certification by the notary who draws up the document. There must be a paragraph: “The consent is signed by the citizen *full name of the person issuing the consent* with his own hand in my presence. The identity of the person who signed the document has been established. The legal capacity and fact of marriage registration have been verified.”

- Registration number in the register, as well as the penalty for the provision of services at a certain tariff.

The couple needs to ensure that the document bears the notary’s signature and the institution’s seal. Only in this case does the document acquire full legal force.

To apply for a mortgage, you will also need other documents, which you can learn about from the following articles:

- What is a certificate of income in the form of a bank and 2-NDFL and how to get them?

- What is a bank mortgage and how to apply for it?

- The procedure for registering a mortgage agreement and the features of its termination.

How to confirm solvency without official employment?

In order to confirm solvency, it is not necessary to provide proof of income. There are enough documents confirming the level of expenses: contracts for the purchase of movable or immovable property, payment for commercial training, account statements with active receipts, the presence of a deposit in this bank.

Documents such as a civil passport, SNILS and TIN certificates, an agreement on voluntary health insurance and other types of insurance will serve as evidence of trustworthiness.

What rights to property do spouses have upon divorce?

During a divorce, the division of property is a serious issue. This problem is becoming very annoying and not easy to solve. The division does not always occur fairly, as a result of which the spouses submit an application to the judicial authority. To get your part of the property, you should go to court. Responsible persons will be able to distribute property between spouses fairly, taking into account legal provisions.

In the Family Code of the Russian Federation in Art. 34 states that each spouse has an equal right to property acquired during marriage. Valuable property objects include:

- movable property (car);

- real estate (housing, commercial buildings);

- cash;

- other valuables (jewelry, things, art, even pets).

Property acquired during the marriage is subject to division. This situation is justified by the fact that money was paid for the valuables from the general (family) budget. This means that each spouse has a relationship with property, regardless of the amount of earnings. It does not matter who earns more and invests in the family budget.

How can a non-working student or pensioner get a mortgage?

If special programs have not been developed for officially unemployed persons, then for students and pensioners who want to purchase or improve housing conditions, they have been developed.

For students

— citizens of the Russian Federation who have reached the age of 21 have access to a mortgage with a deferred payment for the duration of their studies. Parents are often guarantors when drawing up a contract.

For pensioners

Those under the age of 75 who receive a monthly pension that is sufficient to meet necessary needs and repay the loan also have the opportunity to participate in a special mortgage program. In this case, adult children of an older borrower can provide a guarantee of loan repayment.

In this case, one cannot count on the most favorable lending conditions; the bank is forced to insure its own financial risks through a high interest rate and a short lending period.

Do I need to contact a notary?

The only possible option for drawing up this document with legal force is an opinion from a notary. This institution, firstly, immediately certifies the document, and secondly, certifies that both spouses are fully aware of the actions being taken.

The validity period of the consent is not specified in the legislation of the Russian Federation; thus, the receiving party (government structures, creditor bank, and so on) themselves decide for how long the document can be considered relevant.

As a rule, the notary indicates at the bottom of the document the validity period for one year from the date of its conclusion. Most banks also establish the need to provide consent with a validity period not exceeding one calendar year at the time of submitting documents to the bank.