“In 2021, women born in the first half of 1965 and men born in the first half of 1960 have the right to an insurance pension,” the Pension Fund noted.

At the same time, the number of pension coefficients depends on the amount of insurance contributions transferred for the employee by the employer: the higher the official salary, the more the employer transfers contributions to the future pension. So, last year, to grant a pension, it was necessary to have at least 11 years of experience and 18.6 pension coefficient. In 2021, the requirements have increased - at least 12 years of experience and 21 pension coefficients.

“Every year, the number of length of service and pension coefficients will increase until they reach 15 and 30, respectively,” the Pension Fund added.

If the pension coefficients and length of service are not enough, the assignment of the pension will be postponed until the required amount is “earned”. If this cannot be achieved five years after reaching retirement age, then a social pension will be assigned instead of an insurance pension.

General provisions on pensions

Every citizen has the right to receive a state pension if certain conditions are met.

The main legal act that regulates the conditions for assigning a pension is No. 400-FZ dated December 28, 2013, as amended on December 27, 2018. Thus, the right to pension payments arises for Russians not only upon reaching a certain age. Legislators also identified a number of requirements that must be met in order to calculate payments.

Key requirements for elderly citizens to receive a pension:

- This is reaching the required age. From 2021, men can apply for a pension only from the age of 65, and women from 60. However, officials have consolidated transitional provisions. The age will be increased gradually.

- Having a minimum insurance period. The concept of minimum length of service was first introduced back in 2015; the minimum for a pension was 6 years. The indicator is gradually increased to 15 years by 2024. In 2021 it is equal to 10 years.

- Accumulated points for pensions, or IPC, will not be lower than 16.2 points by 2020. Please note that the indicator will increase to 30 points by 2024.

Only when all three conditions are met, citizens are assigned an insurance pension. If the conditions for length of service or IPC are not met, then the citizen will have to work until the specified conditions are met or until the right to a social pension arises.

Let us remind you that social pension provision is provided for citizens who do not have the minimum insurance period and have not accumulated pension points (the minimum IPC requirement has not been reached). Such a pension should be assigned at 65 l. for women, and at 70 for men.

How are they paid?

Pensioners receive monthly payments from the state in three ways:

- At Russian Post. Payments can be delivered to your home or issued at the post office. Depending on the method of receiving money, a payment schedule is assigned. Taking into account delivery times may be extended. If a citizen has been assigned a pension, he has chosen to receive it at the department at his place of residence and has not come to collect it for more than 6 months, payments are suspended. To resume accrual, you need to contact the Pension Fund and write an application. This precaution is taken to ensure that in the event of the death of the pensioner or under other circumstances, there is no abuse of government payments.

- Through a pension delivery organization. A list of organizations that officially provide such services can be found at the Pension Fund branch.

- Through the bank. At a banking institution, you can receive your pension at a branch or on a card. The money will be credited to the account on the same day that the Pension Fund transfers the funds to the bank. You can withdraw money from your card at any time. Or you can use them for non-cash payments or for card payments. On our service you can choose a favorable offer from banks with interest accrued on the balance. If you often leave funds in your account, the bank will charge you a set percentage. You can also choose a card with a large cashback, free service and online banking where you can pay for utilities.

Choose a suitable card for a pensioner →

When choosing a pension delivery method or changing it, submit a corresponding application to the Pension Fund. For example, you have been receiving money at Russian Post offices for a long time, and now you want it to be transferred to a Sberbank card or any other bank of your choice.

In 2021, the amount of the fixed payment of the insurance pension is 5686.25 rubles.

On increasing the retirement age

As we noted above, the retirement period has been significantly increased. Now men and women will have to work for an additional five years to get their well-deserved retirement. The innovations came into force on 01/01/2019. However, the new provisions provide for a special transition period.

| Year of birth | Year of retirement | ||

| Men | Women | How it was before the innovations | As is, according to the new provisions of Law No. 400-FZ |

| 1959 | 1964 | 2020 | 2020 |

| 1960 | 1965 | 2020 | 2022 |

| 1961 | 1966 | 2021 | 2024 |

| 1962 | 1967 | 2022 | 2026 |

| 1963 | 1968 | 2023 | 2028 |

But that's not all. Those who were due to receive a well-deserved old-age pension in 2021 have had their period halved. They will only have to work for six months instead of an additional 12 months.

Benefits are also provided for citizens who have extensive experience. For example, a 60-year-old man with at least 42 years of work experience. or a woman 55 years old who has worked for at least 37 years.

How to increase your pension

To understand, you need to understand what pension payments consist of.

Let's divide the payments into three parts and see what they consist of and how to increase them.

From January 1, 2019, the amount of the fixed payment to the insurance pension is indexed by 7.05% and amounts to RUB 5,334.19. Such an increase is provided for in Part 8 of Art. 10 of Law No. 350-FZ of October 3, 2018, which came into force on January 1, 2019.

| Pension payments | Explanations | Size | Pension increase |

| Basic part | Paid from the budget. Paid to citizens if they have length of service. | As of 01/01/2019, the amount is 5334.19 rubles. per month. | The persons listed in Article 17 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” are entitled to an increase. |

| Insurance part | Determined from the amount of insurance premiums. These payments are made by the employer based on the official salary. | It is set individually depending on the value of the coefficients. Affects: age and experience. |

|

| Cumulative part | It is accumulated in the same way as the insurance part, but is increased by the income received when placing funds on the securities market. Citizens have the right to independently manage the funded portion. | Savings of citizens born in 1967 and subsequent years. |

|

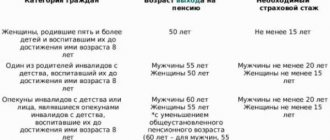

Early assignment of pension

For employees of certain categories, additional benefits were provided in the form of the right to early retirement. These privileges were retained even after the age limit was increased. However, the deadlines for applying for pension payments were also adjusted by officials.

So, early state pensions are awarded:

- If you have experience in special climatic conditions. For example, for work in the Far North, or in territories equivalent to the RKS.

- For working in dangerous, hazardous industries or in difficult working conditions.

- For years of service in certain professions and positions (for example, medical or teaching workers).

- In the presence of exceptional factors defined in Article 32 of Law No. 400-FZ. For example, those who gave birth and raised three or more children.

Special provisions on the procedure and rules for assigning an early pension are disclosed in Chapter 6 of Law No. 400-FZ.

Other types of old age pensions

Federal Law No. 166-FZ “On State Pension Security in the Russian Federation” lists all types of pension contributions that are paid to citizens in Russia:

- long service pension;

- insurance pension upon reaching old age;

- social Security contributions;

- state pension pension.

The last two types of contributions are paid from the federal budget.

State pension

Not everyone receives a state pension. Citizens have the right to:

- Victims during military service,

- Victims of a radiation or man-made disaster.

Evgeniy Baidalin

Practicing lawyer in civil and arbitration cases. More than 8 years of experience

Ask a Question

In addition, state pensions are paid to people to compensate for income that is lost due to termination of government service due to long service or old age.

Set of documents for the state. pensions

The list of documents is established by Resolution of the Ministry of Labor of the Russian Federation and the Pension Fund of the Russian Federation No. 16/19пб dated February 27, 2002. In addition to the application for the calculation of security, attach:

- Passport of a citizen of the Russian Federation.

- Military ID.

- Papers about work experience: work book, extract from the personal data sheet or other document issued in the prescribed manner.

- Documents confirming the reason for receiving the pension. They are attached to the kit if necessary.

Social

Social pension is paid to citizens who are recognized as disabled, but cannot receive an insurance pension. Social pensions can be received by people who have reached the age of incapacity without confirmed work experience. In addition, social pension is paid:

- disabled people;

- children due to the loss of a breadwinner;

- children who do not know their parents;

- pensioners who did not have enough service for a labor pension.

Only citizens of the Russian Federation who permanently reside in the country and cannot work can count on monthly assistance.

Social Old age pension is paid 5 years after the onset of incapacity. In fact, women can apply for a pension after 65 years, men - after 70 years.

Contributions are indexed annually.

List of papers for social media pensions

To apply for a social pension, the following must be attached to the application:

- A document confirming permanent residence in the Russian Federation.

- A document stating that the applicant lives in the Far North or an equivalent area, in an area with severe climatic conditions that require additional material and physiological costs. If your passport contains a mark indicating registration in any of the specified areas, you do not need to collect additional certificates.

- If a person belongs to the small peoples of the North, a birth certificate is provided.

- Certificate confirming the period of residence in the Russian Federation. For foreign citizens - GNI.

Documents for applying for a pension

So, registration of a pension is ahead: where to start? An employee of a budget organization must contact the accounting department or human resources department to confirm the length of service and salary.

IMPORTANT!

The collection, preparation and submission of documentation for the pension must be carried out exclusively by the employee. In addition, the employer is not responsible for the missed deadline for applying for payments.

Please note that if you miss the deadline for applying for government payments, the overdue (missed) period will not be paid. That is, the state payment is strictly declarative in nature. This means that the state pension will be accrued only from the moment a written application is received from the pensioner. Despite the fact that all conditions regarding minimum experience, IPC and age must be met. In order not to miss time, we recommend that you come to the Pension Fund in advance.

In addition to the application for a pension, a citizen must provide documentation according to the list (Resolution of the Ministry of Labor of the Russian Federation No. 16, Pension Fund of the Russian Federation No. 19pa of February 27, 2002).

What documents to submit to apply for a pension:

- passport and SNILS (pension certificate);

- employment history;

- military ID;

- labor, civil or copyright contracts;

- certificates from the employment center;

- a certificate of average monthly earnings for 5 consecutive years until 01/01/2002;

- other documents.

Please note that representatives of the Pension Fund have the right to request additional information, documents and certificates that can confirm labor or social activities included in the calculation of the insurance period for a pension.

Note that the pensioner himself should be primarily interested in providing an exhaustive list of documents confirming the right to receive a pension. Otherwise, unconfirmed periods may not be included in the calculation of the pension payment, which will significantly reduce its size.

The procedure for calculating pension benefits

The amount of the old-age pension benefit is the amount of:

- insurance pension;

- fixed payment;

- funded pension (if it was formed).

The size of the fixed payment is regulated by law and in 2021 is 6044 rubles 48 kopecks. The size of the funded pension payment is influenced by the amount of pension contributions made by the employer or the citizen himself. To calculate it, the amount of savings is divided by the expected period of pension payment (in months), which in turn is determined by law and in 2021 is 252 months.

What amount of insurance pension a citizen will receive depends on the size of his individual pension coefficient (IPC) and its cost. The cost of the IPC is established by law, is indexed annually and from January 1, 2021 is equal to 98.86 rubles. The amount of the IPC is formed from the amount of insurance premiums transferred for the employee, the duration of the insurance period and the periods included in it.

The pensioner's insurance benefit is calculated using the formula:

SP = IPK x SPK,

Where:

SP - the amount of old-age insurance pension;

IPC - individual pension coefficient;

SPK is the cost of one coefficient on the day the pension is assigned.

If you apply for a pension later than the period when the citizen has the right to it, then when calculating the IPC, the increasing coefficients established by law are used, applied for each year of delay in registration.

The insurance pension and fixed payment, provided that their recipient does not work, are indexed annually by the state.

Employer's actions

The employer must issue a work book and salary certificates upon the employee’s request, but no later than 3 working days. Moreover, the work permit must be issued against receipt (Article 62 of the Labor Code of the Russian Federation). The employee must return the document three days after returning the labor document from the OPFR.

After submitting the papers to the PF department, the employee sends another application in any form to the organization where he worked. This time to generate individual information about the employee. The employer must provide personal data about the employee to the territorial office of the Fund and to the employee himself no later than 10 days. The employer provides (clause 36 of the Instructions approved by Order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n):

- Information about the citizen’s insurance experience in the SPV-2 form.

- Inventory of data provided according to form ADV-6-1.

When accepting the application, make sure that the employee indicates the expected date of assignment of pension payments. This is necessary for the formation of SPV-2. In some cases, the form will have to include length of service that the employee has not yet completed.

IMPORTANT!

The employer is obliged to provide assistance in obtaining pensions to contractual employees.

Why is this necessary?

The main goal of such a social partnership is to make the process of assigning a pension for citizens as comfortable as possible.

The employer, within the framework of an agreement concluded with the Pension Fund on electronic interaction for assigning pensions to its employees, undertakes to generate an electronic package of documents on the pension rights of employees and transfer them to the Pension Fund authorities.

Thanks to such care, working time is saved. Future pensioners are not distracted from work, are spared from independently preparing documents and from visiting the Pension Fund of the Russian Federation, which not only makes it easier for them to receive government benefits, but makes it better and more accessible.

For example, in the Khabarovsk Territory, more than 3.5 thousand socially responsible employers who entered into an agreement with the Pension Fund of Russia actually helped about 6 thousand workers in assigning pensions, saving them from unnecessary visits to the Pension Fund of Russia.

By the way, this process became more dynamic after the Government of the region adopted Order No. 15r dated January 28, 2016 “On additional measures to create conditions to ensure accessibility, increase the efficiency and quality of providing state residents of the region with public services for establishing pensions,” regulating the interaction of executive and municipal authorities with PFR bodies on all socially sensitive issues, including the involvement of employers in the social project of the PFR Branch.

How to calculate insurance experience

The length of service includes not only periods of work for which the employer made pension contributions, but also periods of social activity or activity significant to society. We wrote in detail about which periods are included in the total length of service and which are not in the article “We calculate the length of service for a pension, taking into account the latest changes.”

IMPORTANT!

Let us clarify about parental leave from 1.5 to 3 years. Disputes on this issue do not subside. Some Constitutional Courts recognize that the period must be included in the insurance period, since the employment contract for this period is not interrupted. The same explanation was given by representatives of the FSS (Letter of the FSS dated 09.08.2007 No. 02-13/07-7424). But Pension Fund employees continue to exclude the period of child care from one and a half to three years.

Problem: proof of experience

This problem is relevant for citizens whose working activity fell during the Soviet era, namely in the 90s. Thus, during the “hard” years, most workers worked unofficially.

Orders and other personnel documentation were practically not kept. At that time, wages were not paid for months, let alone compliance with personnel discipline. It is precisely these circumstances that cause the problems of Russians when applying for pension payments.

Most companies collapsed. Those who survived were reorganized or merged into larger organizations. Company names changed everywhere. As a result, if an employee has lost documents or there is no entry in the work book for the period of work during Soviet times, then it is incredibly difficult to restore such an entry.

To confirm the fact of labor activity during the Soviet period, a full-fledged investigation will have to be conducted to find out who received the rights and powers of the organization in which the pensioner once worked.

We'll have to be patient. Prepare numerous requests, comply with proformas and deadlines for requests. Wait for official responses from authorities and other entities. However, such efforts will be rewarded. Soviet experience is calculated separately.

Registration by power of attorney

If the future pensioner does not have the opportunity to deal with issues of registration of pension payments personally, then he can delegate these powers to a third party. However, this fact must be certified in the manner prescribed by law, that is, a notarized power of attorney must be issued.

Important! A power of attorney can be drawn up for absolutely any person. The main condition is his full legal capacity.

The document itself should indicate the powers that the principal grants to the authorized person. For example, this is submitting documents to a pension fund. You can also specify the possibility of collecting various papers for the Pension Fund if the existing package of documents is incomplete.

Sample power of attorney:

And finally, there are cases when it is possible to establish this or that fact that is important for calculating a future pension only through the court. In this case, the power of attorney must provide powers related to the conduct of affairs by the authorized person in the interests of the principal in the courts.

Registration of a pension by proxy does not imply the transfer of the right to dispose of the funds received to the authorized person directly involved in this issue.

Forgery of documents

Providing fictitious and forged documents to the Pension Fund of the Russian Federation is far from new. Often citizens bring fakes out of ignorance that almost all information will be subject to total control.

Please note that such violations are subject to not only administrative liability, but also criminal liability. You should not assume that we are talking only about work records. They can also be punished for falsifying certificates, extracts and orders that have minimum values for the assignment of state pensions.

Thus, for providing a false document, citizens will face punishment in the form of administrative and criminal liability, which are enshrined in Article 19.23 of the Code of Administrative Offenses and Article 327 of the Criminal Code of the Russian Federation. The maximum penalty is imprisonment for up to two years.

Important information about pension amounts

Pension payments are calculated in accordance with the general procedure, which is enshrined in Law No. 400-FZ. So, the size of the payment directly depends on:

- on the number of accumulated pension points (IPC size);

- the cost of one point approved for the corresponding billing period;

- the amount of the fixed surcharge;

- availability of increasing coefficients (determined individually).

The size of the IPC cannot be lower than 30 points by 2024. To receive a government payment in 2021, it is enough to earn 16.2 points. The cost of one pension point for 2021 is 27 rubles 24 kopecks.

The fixed payment for the current period is 5334.19 rubles.

Increasing coefficients are determined on an individual basis. For example, an increased pension may be established for employees working in the Far North. Also, increasing additional payments are provided for pensioners who applied for payment after the due date. For example, those who delayed their retirement for a year or more.

Where is it issued?

You can apply for a pension at any time convenient for the citizen after he has acquired this right. But you can submit documents for accrual of payments no earlier than a month before your official retirement.

Submit documents in the most convenient way for you:

- When contacting the Pension Fund office in person. The day of application is considered to be the day the application is received by Pension Fund employees.

- Sending documents by mail. In this case, the day of application is the date indicated on the mail when sent.

- Contact the MFC. The day of application is also considered the day the application is received by employees.

- Online in your personal account on the Pension Fund website or on the State Services portal. The date of applying for a pension corresponds to the day of submitting the application with documents through the system.

If a Russian has left for another country for permanent residence, then upon reaching age and fulfilling the conditions of the Pension Fund, he can apply to the Pension Fund in Moscow. You can also fill out documents for accrual of payments online in your personal account on the Pension Fund website.

A pensioner or his representative can apply for pension payments personally. In addition, documents can be sent through the employer.

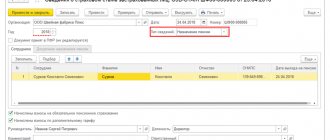

Registration of a pension using examples

Employee of the State Budgetary Educational Establishment of Children's and Youth Children's Institution "ALLUR" Sidorova S.S. I contacted the HR department for documents to apply for a pension. The secretary of the institution issued a work book against signature, the accountant compiled a salary certificate for 60 months before 2002.

Later, the territorial branch of the Pension Fund sent a notification about the provision of information in the SPV-2 form. The personnel officer prepared personalized information.

Additionally, the branch of the Pension Fund of the Russian Federation sent a notification to provide information on citizen S.S. Sergeev. according to the SZV-K form (read more in the article on filling out the sample) to confirm the insurance period when assigning a pension before 01/01/2002 in terms of military service and confirming the right to early receipt of pension payments. The HR specialist prepared the information.

When are the accruals made?

The Russian Pension Fund office takes 10 days to review the application and documents. After this, the citizen is assigned pension payments. If a citizen does not provide all the certificates, then the pension is accrued within 10 days from the moment the pensioner brought the missing document. However, it must be presented no later than 3 months later.

There are situations when some documents cannot be handed over to a pensioner. Then the Pension Fund independently requests the necessary documents from organizations, and the pension is accrued within 10 days from the date of receipt of the document.

In any case, the pension is accrued no earlier than the day you apply for payments. Only in one case can it be accrued earlier: if a citizen quits his job and applies for a pension within 30 days.

Controversial issues when applying for a pension

You cannot apply for a pension in one day; you will need to collect a large package of documents, correct any errors and clerical errors found, confirm your length of service, etc. Organizational involvement is required at many stages. Please note the following situations:

- The employer is not responsible for the timely assignment of pensions. Therefore, if an employee missed the deadline, there is no point in filing a claim with the employer. Registration may take more than one month, so it makes sense for an employee to start collecting documentation in advance - three months before retirement age.

- An employee working under a civil contract (deductions of insurance premiums have been made) also has the right to demand that the manager provide self-employment forms for him. The norm is established by paragraph 82 of Instruction No. 987n.

- At the request of the Pension Fund of Russia, the employer is obliged to provide information in the SZV-K form. The reporting form contains personal information about the employee’s length of service until 01/01/2002. Based on individual information, PF representatives will calculate the total length of service, as well as the length of service that gives the right to early assignment of a pension.

- The employer is obliged to issue the employee a certificate confirming the length of service if there is an error in the work record or the entry is impossible to read. Also, a certificate must be issued if the employer did not make an entry in the employment record or if the employee worked part-time.

- An employer does not have the right to fire a citizen who has reached retirement age. Exception: the employee’s own desire. In this case, the employee writes a letter of resignation, and the employer issues an order. An entry is made in the employment record under Part 3 of Article 80 of the Labor Code of the Russian Federation: dismissal due to retirement.

- Former employees have the right to contact the employer with a request to provide documents. The former employer does not have the right to refuse such an employee; this would be a direct violation of Article 62 of the Labor Code of the Russian Federation.

- If the organization has been renamed, the HR specialist is required to make a corresponding entry in the work book. If a resigned employee requires a certificate of experience with the old name of the company, the certificate must indicate the old name, then list all subsequent renames and indicate the last current one.

You can find out where to apply for an old-age pension in Moscow on the official website of the Pension Fund of the Russian Federation. Determine your territorial department according to your place of registration. You can also get advice by phone.

Why is it good for everyone

The formation of an electronic package of documents on the employee’s pension rights and sending them to the Pension Fund of Russia bodies according to the TKS does not require any additional material investments from the insured-employer, since it is already used when submitting individual (personalized) accounting information.

The preparation of documents itself: scanning them and sending them to the Pension Fund does not take a lot of time and does not place any financial burden on the shoulders of the HR employee, the Pension Fund is confident.

As practice shows, the time spent scanning and transmitting electronic documents to the Pension Fund of Russia on average per employee is about 15 minutes. The personnel employee spends the same time on photocopying documents and certifying them page by page in order to issue them to his employee for personal presentation to them at the Pension Fund.

If on average in an organization of more than 100 people about 5-6 people retire during the year, then in general the employer spends about one hour of work on the entire work of scanning and sending documents at the rate of 6 people per year. It's not that much. In addition, it is worth considering that in the absence of electronic interaction with the Pension Fund, in addition to the consumption of paper, time for copying documents, and their page-by-page certification, the employee is distracted from his direct duties by visiting the Pension Fund with documents.

Previously, the future pensioner had to independently submit all the necessary documents for the assignment of a pension to the Pension Fund of Russia. Today, socially responsible employers take care of this.

Such active participation of the employer in arranging pensions for its employees is an additional element of the “social package”, which, of course, has a beneficial effect on the quality of staff, ensuring financial stability and strengthening reputation capital.