One of the advantages of working as a teacher is the right to early retirement. Since 1959, there has been a long-service pension for teaching staff. Teachers, kindergarten teachers, university professors and other educational workers with more than twenty-five years of experience could count on her.

In 2001, new rules for calculating pension benefits appeared. Long service pensions were abolished. Instead, preferential pensions appeared. For teachers, this change was rather formal. The accrual of long-service pensions for teaching staff has, in fact, been preserved, but acquired a new name. Although the rules for calculating and calculating pensions have changed, teachers still retain the right to retire earlier than the age norm established in the country for men and women.

After 2001, preferential pensions were introduced

Let's consider what conditions a teaching worker must fulfill in order for him to have a preferential pension (length of service, pay), as well as innovations for 2021.

The concept of teaching experience

The provisions of Federal Law No. 400 reflect the list of citizens who are entitled to use preferential retirement . This list also includes citizens engaged in teaching activities. In addition, benefits are provided to those who work in harsh climates.

Currently, current legislation does not provide for a precise concept of teaching experience. An independent concept can be derived based on an analysis of the provisions of the above law.

Teaching experience is understood as the time during which a citizen worked as a teacher. He must work in an educational institution for children.

Generalization

Pedagogical work experience is the most important aspect in the field of social security of the population. It affects the amount of wages and early retirement, and also covers all areas of pedagogy that are directly related to the educational process.

The article presents most of the factors for obtaining seniority: for whom, when and under what conditions it is possible.

There is also a detailed description of how to calculate and arrange pension payments yourself based on your teaching experience, so all that remains for you is to take our advice and ensure a decent old age for yourself right now.

Teaching positions according to list 781

Government Decree No. 781 of 2002 reflects the full list of positions, filling which a citizen has the right to early registration of pension status.

In order to earn such experience, a citizen can work:

- all schools, and it does not matter what name is assigned to the organization and what type it is classified as, including correctional organizations;

- military-oriented educational institutions, for example, Nakhimov schools, cadet corps;

- educational centers intended for minors;

- boarding schools;

- institutions intended for children with orphan status or for those who have lost parental care;

- correctional schools and organizations intended for people with mental disabilities and other health difficulties;

- medical and health-improving institutions, for example, sanatorium schools, summer camps;

- organizations providing preschool education services.

In addition, institutions of secondary vocational education can be included in this list. This includes colleges and schools, technical schools, and orphanages. Organizations that provide vocational guidance for children and additional education are also included in the list.

Important! It is important to note that simply working in the specified institution is not enough. This rule is formulated by the said resolution. A citizen also needs to hold a certain position.

Eg:

- be a manager or his assistants, including regime assistants;

- teach a specific specialty;

- educators;

- a citizen who is responsible for organizing extracurricular activities;

- teachers, in particular, speech pathologists and speech therapists;

- production masters;

- employees responsible for training conscripts;

- nurses working in nurseries.

This also includes the parent-educator.

Common Mistakes

The most common category of disputes today is the refusal to grant an early pension. Due to incorrect accounting of individual periods of work, a “lack of work experience” may occur.

Often, employers are to blame for the fact that Pension Fund employees did not take into account one or another period of work (this can happen with controversial periods). This is due to the fact that the names indicated do not correspond to the official ones.

Attention! A teacher who continues to work in an educational organization may not use the right to receive pension payments early. However, the right to use them remains mandatory.

Thus, it is possible to trace a number of some changes in the pension reform applicable to teaching staff since 2017. The effectiveness of such changes remains in question...

What is not included in the teaching experience

In certain situations, production will not be counted towards the total amount of experience. This includes situations where a citizen held a position not listed above or was employed in an organization that did not allow early retirement.

Then the accrual of experience does not occur. However, it is worth saying that there are some exceptions to this rule. This is due to the fact that it is necessary to take into account not only the positions enshrined in the above government act.

These could also be teaching positions that have already been abolished . For example, those that took place in the Soviet Union. In addition, these are the positions that were in organizations before 2002. For example, a pioneer leader.

Also, this period will not include the time during which the person studied at an educational institution. This rule does not apply when, prior to this training, the person has already started working in the field of education. Then it is also taken into account that after training the citizen must work in the specified field.

Attention! When a person begins to study immediately after school, this time will not be included in the development. There is also another limitation associated with this production. It cannot include periods during which a person cared for a child. Similar rules apply to situations where a citizen worked part-time. This applies when the second job is not related to the teaching field.

Then only those intervals described in the resolution are taken into account.

Normative base

To take into account all the nuances of pension reform, it is necessary to understand what legislation regulates this activity.

To apply for a preferential teacher pension for 2021, the following legislative acts are relevant:

- Federal Law “On Insurance Pensions” (Article 30−31);

- Decree of the Government of the Russian Federation No. 665 of July 16, 2014;

- Decree of the Government of the Russian Federation No. 781 of October 29, 2002.

Attention! Now, 25 years of experience includes those years that a person spent on his own education, but if the teaching activity was carried out by him before the start of his studies and after his graduation. Also, if a person worked in a pedagogical institution corresponding to the list of preferential categories until 2021, then all work performed will be included in the length of service.

How much teaching experience is needed for preferential exit?

Currently, teachers can retire upon reaching a certain age group or due to length of service. This profession has some special categories, including school teachers and university teachers. They have special working conditions.

For a preferential pension you need to have the following amount of output:

- having at least 25 years of experience in the teaching profession;

- accumulate the minimum number of points (in 2021 this is 16.2);

- withstand the delay.

The latest rule came into force in January 2021. This period is five years. However, while the transition period lasts, that is, in 2021 and 2021, more flexible rules apply. In particular, in 2021, retirement took place after six months, next year - 1.5 years.

Registration procedure

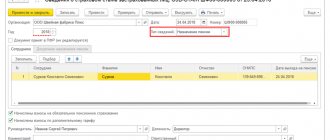

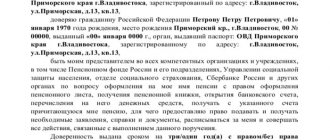

To apply for a preferential pension, a teaching worker must contact the regional office of the Pension Fund of the Russian Federation (or at the place of registration) with the following list of documents:

- passport of a citizen of the Russian Federation;

- employment history;

- military ID (for men);

- child birth registration certificate;

- SNILS;

- application for early benefits;

- income certificates for the last year;

- clarifying information.

Documents for applying for a preferential pension can be submitted in person, through a representative, or using the electronic system. The application review period is up to 10 days.

It should be noted that when granting early retirement to teaching staff, many questions arise regarding confirmation of preferential length of service. Therefore, it is better to contact the territorial office of the Pension Fund of Russia in advance.

Calculation of length of service for teaching staff

A certain order of output is provided for citizens who work as teachers and educators. In particular, for the first category, the calculation must take into account the time during which they held the above positions. When calculating total output, you need to take into account this period in calendar terms.

If a person worked at half the rate, the time actually worked should be taken into account . As an exception in this situation, people who teach in rural areas in primary schools should be considered. According to this resolution, citizens working in the village can count on being included in production all the time, regardless of the load assigned to them.

Also, special conditions apply to the management of an educational institution. In accordance with these conditions, he must hold a position related to the implementation of teaching activities. Otherwise, this person cannot receive a pension ahead of time.

Due to the fact that teaching is combined with the fact that a person resolves organizational issues, a minimum for teaching is applied. This person cannot teach more than 6 lessons per week. That is, in a year this is 240 hours and no less.

When the length of service is shorter, this period will not be included in production. A similar rule applies to directors of a medium-sized special institution. The minimum is 360 hours per year.

To calculate the teacher’s experience as a whole, the rules listed above apply. It is worth noting that special conditions are provided for citizens who work in nurseries. According to the decree of 1992, this time will not be included in production.

Thus, teachers have the right to retire earlier. To do this, certain conditions must be met.

How to calculate your pension

When calculating a teacher's insurance pension, a number of factors are taken into account. These, first of all, include insurance period , which today is calculated in the form of IPC pension points. The number of points depends on the length of work experience during which they were accrued. The size of the teacher’s salary also has an impact, since each point has its own monetary equivalent.

Additional factors influencing the amount of pension benefits include length of service , the number of years worked after retirement age.

To accurately calculate the amount of pension due to a teacher, you can use the online calculator located on the official portal of the Pension Fund.

To receive the approximate amount of your pension benefit, you will need to fill out an electronic form with the required information.

About labor law

The legal norm linking the size of the “northern” percentage increase in wages not with length of service in the Far North, but with the reason for dismissal, contradicts the Labor Code of the Russian Federation

On this basis, the Supreme Court of the Russian Federation declared invalid since December 23, 2004, subparagraph “e” of paragraph 27 of the Instructions on the procedure for providing social guarantees and compensation to persons working in the regions of the Far North and in areas equated to regions of the Far North, in accordance with current regulations , approved by Order of the Ministry of Labor of the RSFSR dated 22.

Does it matter for pension calculation?

Currently, NTS does not matter for calculating pensions. Today its size is determined as follows:

| For persons born before 1963 (working before 2002) | The number of years worked and the amount of earnings are taken into account |

| From 01/01/2002 | The amount of the pension is determined by the insurance contributions paid by employers for their employees. |

The amounts paid are accumulated in an individual account. The amount of contributions will depend on the year of birth of the future pensioner.

Employers make payments only for those employees who perform their functions on the basis of an employment agreement.