Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/09/2016

Reading time: 8 min

2

7778

One of the categories of citizens who are entitled to receive a long-service pension are federal government employees.

All citizens who belong to this category can, upon the occurrence of certain conditions, apply for its receipt. The conditions and procedure for assigning pensions to civil servants, as well as the procedure for this procedure, will be discussed further.

- Requirements for applicants

- Calculation procedure Average salary for the last 12 months before retirement

- The amount of experience an employee has as a civil servant

Who are municipal employees

This is what local government employees are called. They are not civil servants who work in federal authorities and authorities at the level of constituent entities of the Russian Federation, but have their own status. Their legal status, features of service and conditions for receiving a municipal pension in 2021 are regulated by Law No. 25-FZ of 03/02/2007. A person is a municipal employee if:

- he has an employment contract with a local authority;

- his position is included in the staffing table of the body;

- his remuneration is paid from the municipal budget.

Changes in 2021

As for changes, they never cease to overtake the pension sector.

Before people have time to recover from one statement, something new comes into force. The first thing that has changed is the retirement age. If earlier there were rumors that they would make an exception for civil servants and would not raise them, now they have been officially refuted. But there is also good news, which is that pension payments will be indexed. And these positive trends will continue for several years.

What is required to assign pension payments for length of service?

A citizen is entitled to a long-service pension under the following conditions:

- presence of experience in local service - the length of service itself. Its duration is determined according to the rules from Appendix No. 2 to 166-FZ and depends on the moment of release: the length of service of municipal employees in 2021 will be 17 years;

- the presence of certain grounds for dismissal: agreement of the parties, employee initiative, liquidation of a local government body, or the citizen reaching the age limit for service of 65 years;

- in some cases, for example, if a citizen resigns at his own request or by agreement of the parties, in order to receive payment for length of service he must meet the requirements for receiving an insurance pension: reach retirement age and have the required number of pension coefficients, for 2021 this number is 16.2.

Clause 1.1 of Article 7 166-FZ establishes the conditions under which a citizen receives a long-service pension before grounds for assigning old-age insurance appear, that is, ahead of schedule:

- he has at least 25 years of local service experience;

- he spent at least the last seven of them in local service before his dismissal;

- the citizen resigned on his own initiative.

Changes are planned: the latest news about the municipal pension in 2021 promises that the minimum length of service will increase, by 2026 it will be 20 years and will not increase any further. No other changes are expected, including the indexation of pensions for municipal employees in 2021, but given that government employees at all levels are the first to test upcoming legislative changes, the requirements for receiving payments change periodically.

Additional terms

The assignment of a regular payment for government work is permissible if, before dismissal, the continuous period of work lasted at least 12 months. This rule applies only to employees of federal structures.

The long-service pension is retained if the reason for dismissal was a change in the terms of the contract, an agreement between the parties, the expiration of the civil service deadline, the liquidation of a legal entity or a reduction in staff. In the last two cases, a mandatory 12-month period of service is not required.

Types of payments to municipal employees

Municipal employees have the right to receive simultaneously:

- payment for length of service: this opportunity is provided to them by Art. 7 of the Federal Law of December 15, 2001 No. 166-FZ as a civil servant (Article 24 25-FZ states that the pension rights of local and civil servants are the same);

- old age insurance payment - according to Art. 19 Federal Law dated December 28, 2013 No. 400-FZ;

- savings according to Federal Law No. 424-FZ dated December 28, 2013, if the citizen has special pension savings.

Such employees have the right to receive a disability pension if, for medical reasons, they are assigned to one or another group. To obtain it, it is not necessary to have the status of a municipal employee; it is available to any citizen who has insurance experience. The minimum duration of the required insurance period is not established.

How to independently find out the amount of pensioners’ supplies?

Let's turn to the pension calculator for those who want to know how much money the treasury is ready to allocate to them. Federal legislation establishes a formula for calculations, which consists of several steps:

- first, the amount of allowances, insurance payments and assistance due to disability is deducted from 45% of the average monthly income;

- then 3% of average earnings are multiplied by the number of years of service exceeding the minimum;

- The subtraction and product obtained in the previous paragraphs are summed up.

The value generated by the civil servant pension calculator is called the amount of benefits in connection with production. If the required output is sufficient, then the pension is calculated on the basis of average annual earnings (meaning the last year of service).

Employees of government agencies have preferences over other employees. Municipal authorities have the right to introduce some privileges at their own discretion. Therefore, it is better to visit the relevant branches to clarify the details.

As for the part of the insurance benefit, it is provided to a person when applying for a pension related to the accumulated experience.

More than 4 years ago, a decree was issued requiring that the insurance share be considered as the ratio of the available capital and the term of accrual of funds (calculated in months).

Assignment of old-age insurance benefits

In addition to payment for length of service, employees of local authorities have the right to count on a share of the insurance payment, the amount of which is determined according to the rules of Art. 19 400-FZ. The same norm establishes the conditions for obtaining it.

Civil and local employees were the first group of citizens of the Russian Federation who were affected by the pension reform; the age for reaching an insurance pension for them began to increase in 2021. The retirement age of a municipal employee from 2021 will be 57 for women and 62 for men. The gradual increase will continue until 2026, when it will be 65 for men and 63 for women. The scheme for increasing the retirement age is given in Appendix No. 5 to 400-FZ:

| The moment when a citizen is assigned an old-age insurance payment, in accordance with Part 1 of Article 8 and Articles 30-33 of the 400-FZ (as of December 31, 2016) | The age at which old-age insurance benefits are awarded during the period of filling local positions | |

| Men | Women | |

| 2017 | V + 6 months | V + 6 months |

| 2018 | V+12 | V+12 |

| 2020 | V+18 | V+18 |

| 2020 | V+24 | V+24 |

| 2021 | V+36 | V+36 |

| 2022 | V+48 | V+48 |

| 2023 | V+60 | V+60 |

| 2024 | V+60 | V+72 |

| 2025 | V+60 | V+84 |

| 2026 and beyond | V+60 | V+96 |

V: 55 for women and 60 for men.

IMPORTANT!

The required insurance period and pension coefficient are currently gradually increasing. In 2021 they are 10 years and 16.2 coefficients. In 2021, the required experience will be 11 years, and the coefficient will be 18.6.

What is included in the length of service in the state civil service?

First, let's look at what the term experience means. It represents the full period of time during which a citizen held a certain position and performed his job duties.

Length of service plays the most important role when retiring, since it can affect its size and also when exactly a person can achieve the right to retire. Experience is divided into two types and can be general and special. But for most organizations, including government ones, it is calculated a little differently.

As for the special, in this case only that period of work activity is taken into account during which the person performed work exclusively in his professional field.

Now let's look at what is included in the length of service for civil servants upon retirement. This includes the following:

- Work experience, the duration of which must be at least 15 years;

- Well-deserved leave granted annually to recuperate;

- The period of time spent on sick leave.

Good to know! It should also be noted that these requirements are valid only for those organizations that require employees to have special professional experience upon retirement. As for the general thing, there are more lenient requirements for it.

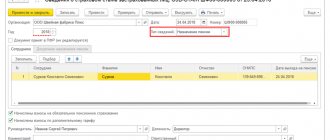

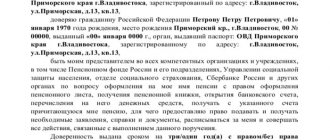

Registration procedure

To apply for a pension supplement for municipal employees in 2020, you should contact the regional division of the Pension Fund of the Russian Federation at the place of residence of the pensioner. The documents you will need are:

- statement;

- passport.

If there are grounds, for the correct calculation of the insurance pension you will need:

- children's birth certificate;

- Marriage certificate;

- documents confirming the presence of dependents of the applicant.

A citizen has the right to submit documents personally to the Pension Fund of the Russian Federation, send them by mail, through the MFC, or using the citizen’s personal account on the website of the Pension Fund of the Russian Federation.

Cases of cancellation of allowance accounting during calculations

Note that operations to establish benefits in old age exclude the period of incapacity during:

- vacation days without saving the rate;

- pregnancy;

- the process of childbirth;

- maternity leave.

Financial assistance for these cases of absence from work does not appear in the calculations of pensions for civil servants. From January 1, 2020, as part of the calculations, subsidies that were provided to subordinates due to certificates of incapacity for work will no longer be valid.

How to calculate what payment is due to local employees

How the municipal pension is calculated in 2021 is determined by Art. 14 166-FZ, which states that the basic amount is 45% of the average salary that a citizen had. For each additional year of service beyond what is required, the pensioner is entitled to an increase of 3% of the salary. Regardless of the length of service, such an additional payment to the municipal pension from 2020 will not exceed 75% of the salary.

The amount of the accrued pension is increased through indexation or the appointment of certain allowances. Payments are indexed in the manner established by the regulations of a particular local entity and represent the application of a certain increasing factor to the pension amount.

Age benefits for retirement

Each region of the Russian Federation has the right to independently establish a list of benefits when assigning pensions to civil servants. These include:

- supplement to pension payments to civil servants;

- preservation of state guarantees;

- free medical care;

- providing vouchers to a health facility or monetizing those vouchers that were not used.

For example, the legislative act of Nizhny Novgorod dated June 24, 2003 number 48 defines a pension supplement for complete loss of ability to work. Samara Legislative Act No. 19 of March 13, 2001 established a monthly supplement equal to 45-75 percent of the pension.

Starting this year, the service life for obtaining a preferential exit

will be 16.5 years, whereas previously it was 16 years.

Amount of pension paid to civil servants: supplement

The size of the pension of civil servants is directly dependent on their salary and monthly payments that they received at their place of work. The size of the pension is calculated as a percentage of the income of civil servants.

Expert opinion

Semenov Vyacheslav Denisovich

Practitioner lawyer with 8 years of experience. Specialization: criminal law. Member of the Bar Association.

Its minimum amount is 45% of average monthly earnings. For each subsequent twelve months of civil service experience in excess of the minimum amount, an additional allowance is calculated in the amount of 3% of average monthly earnings.

The law sets a limit (max.) for civil servants' pensions: it cannot exceed 75% of the average monthly income of a civil servant. The table details the percentage increase:

| Amount of pension, calculated as a percentage of average monthly earnings | EXPERIENCE | |

| 2019 | 2020 | |

| 45 % | 17 l | 17.5 l |

| 48 % | 18 l | 18.5 l |

| 51 % | 19 l | 19.5 l |

| 54 % | 20 l | 20.5 l |

| 57 % | 21 l | 21.5 l |

| 60 % | 22 l | 22.5 l |

| 63 % | 23 l | 23.5 l |

| 66 % | 24 l | 24.5 l |

| 69 % | 25 l | 25.5 l |

| 72 % | 26 l | 26.5 l |

| 75 % | 27 l | 27.5 l |