When can you file a lawsuit against a bank?

There are several common reasons for citizens filing lawsuits against banking institutions:

- Introduction of additional commissions. Any withdrawal of funds without the client’s consent is illegal.

- Incorrect drafting of the contract. The points reflected in the document must not contradict the norms of the law.

- Imposing additional loan services. Most often this concerns insurance.

Most appeals to the court are related to loan disputes and illegal retention of client funds.

Loan dispute

The reasons for loan disputes may be:

- loan not paid on time;

- incorrect definition of the interest rate in the agreement;

- imposition of additional services;

- violation of the terms of the agreement by the bank.

Reference!

The borrower has the right to go to court if the bank hid the real amount of the commission, fine, penalty, or provided the client with an unreliable debt repayment schedule. Problems may arise if the bank does not recalculate interest or even refuses to accept payment for early repayment. If the agreement provides for payment of the debt ahead of schedule, the client has the right to sue the bank.

Doesn't return money

The bank client can file a lawsuit for the return of money.

Among the grounds for appeal are:

- accrual of additional commissions, interest;

- non-payment of deposit funds, reduction of interest;

- illegal blocking, withdrawal of funds from the account;

- loss of funds transferred through the bank.

A citizen can file an application if the settlement deposit was closed unreasonably.

Sample statement of claim against a bank

To the Oktyabrsky District Court of Yekaterinburg

Sverdlovsk region

Plaintiff: full name, address

Defendant: Name of the bank and its legal address

STATEMENT OF CLAIM

on recognition of the loan agreement as fulfilled

(Note: the statement of claim is taken from the actual legal practice of our Law Office, you can ask questions to our lawyers on credit matters). 08/11/2013 between me…. (borrower) on the one hand and LLC "..." (hereinafter referred to as the Defendant) on the other hand, a loan agreement No. 435224 was concluded, under the terms of which the Defendant provided me with an installment plan in the amount of 84,150 (eighty-four thousand one hundred fifty) rubles to pay for the goods, 14 each 025 (fourteen thousand twenty-five) rubles per month. The contract period is 6 months.

Having paid the specified amount in full, I came to the bank branch for a certificate of execution of the contract. Arriving at the bank branch, it turned out that I owed the amount of 7,596 (seven thousand five hundred ninety-six) rubles and 82 kopecks. When concluding a loan agreement, issuing funds under it, as well as during the debt repayment period, bank employees did not inform me about the need to fill out a certificate for early repayment of the loan.

In the absence of information from bank employees about the need to fill out a certificate for early repayment of the loan, I formed the opinion that in order to repay the loan early, it is necessary to deposit the amount specified in the agreement into the Defendant’s account. My opinion is confirmed by a clause of the concluded agreement, which stipulates that early repayment of the debt will be without submitting an application to the Bank. My verbal request for early repayment of the loan upon depositing a sufficient amount for repayment on time was satisfied by the bank employees in the form of an answer that the loan would be repaid automatically if there were sufficient funds in the account, which did not require any additional statements to be made to the bank.

According to Art. 309 of the Civil Code of the Russian Federation, obligations are fulfilled properly. According to clause 6 of the above agreement, I was provided with a Grace period (this is the period of validity of the Preferential rate, which begins from the moment the agreement is concluded). On the end date of the grace period, full early repayment of the debt can be made without submitting an application to the Bank.

In Art. 15 of the Law of the Russian Federation “On the Protection of Consumer Rights” provides for the possibility of recovering compensation for moral damages from the bank in favor of the consumer.

Considering the nature of the violations of my rights, I assess moral damage due to the violated fulfillment of the obligation in the amount of 10,000 rubles.

I paid 1,000 rubles for drawing up the statement of claim.

Based on the above and guided by the Civil Code of the Russian Federation,

ASK:

- recognize the loan agreement No. 435224 dated August 11, 2013, concluded between the Plaintiff and the Defendant as executed;

- recover from the Defendant in my favor moral damages in the amount of 10,000 rubles, a fine in the amount of fifty percent of the amount awarded by the court in favor of the consumer, legal costs in the amount of 1,000 rubles.

Date, signature

Algorithm of actions

If a bank client is faced with a violation of his rights, he must file a lawsuit. You must first prepare a set of documents.

List of documents

Before filing a claim, you should try to resolve the conflict amicably.

For this purpose, a letter of claim is issued. The document must be submitted in person, online via the Internet or by mail to the bank. The claim reflects the basis for its filing and the requirements. If it was not possible to resolve the issue peacefully or the bank did not respond to the appeal, a lawsuit is filed in court.

The following documents must be submitted along with it (depending on the basis for the application):

- a receipt confirming that the loan has been repaid;

- personal account statement reflecting the transfer of funds;

- loan agreement;

- additional agreement to the loan agreement describing the services;

- evidence of violation of client rights;

- written response to the complaint.

If a citizen demands to terminate the relationship with the bank due to early repayment of the loan, no special evidence is required. If additional fines and penalties are assessed, you will have to prepare statements in which the bank requires you to repay the additional amount.

If insurance is imposed on a client, witnesses can be brought in. By law, the insurance contract is terminated within 15 days, provided that it was concluded together with the loan.

Along with the statement of claim, it is necessary to send a response from the credit institution to the filed legal claim. The document will help confirm that the client applied for a peaceful resolution of the issue. If there is no response, you can provide paper with the date of sending.

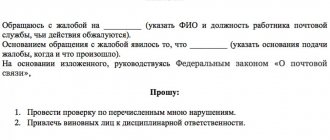

Sample claim

When going to court, you will need to draw up a statement of claim.

It is drawn up in accordance with the norms of the Code of Civil Procedure of the Russian Federation. When filling out, you can use this sample: Download a sample claim to court against a bank

The document must reflect the following information:

- The header of the application contains the details of the judicial authority, last name, first name, patronymic, residential address and contact information of the plaintiff and defendant.

- Cost of claim. The amount of damage caused or the price of the claim is indicated.

- The fact of concluding a deal. The date, time, place, and terms of the agreement are noted.

- Violations committed by the bank. The situation is described in detail. It should be noted that attempts were made to reach a pre-trial settlement and provide the bank’s response.

- Rules of law that were violated by bank representatives.

- Claimant's claims.

- Attachments to the application. A list of documents that will be transferred is provided.

- Date of document preparation, signature.

It is necessary to prepare three versions of the application. Each party is given a copy of the document.

Attention! When describing violations, it is necessary to refer to evidence. They must be documented.

Additionally, in addition to compensation for damage, you can demand compensation for moral and material damage.

Referral to court

The lending agreement usually specifies the jurisdiction of the cases being considered between the parties.

And banks often insist that the plaintiff must submit an application at the location of the institution. But in accordance with the Law “On the Protection of Consumer Rights,” a citizen can file a claim at his place of residence. The package of documents is sent to the magistrate’s court in one of the possible ways:

- personally;

- through a representative;

- by mail.

Counterclaim to the bank

In certain cases, you can file a counterclaim against the bank.

When is it possible to file a counterclaim against the bank? A counterclaim may be brought by the defendant until the court makes a decision on the case, for the purpose of joint consideration with the original claim.

A counterclaim will be accepted by the court if the following conditions are met:

- if the counterclaim is directed to set off the first claim

- in the event that satisfaction of the counterclaim leads to refusal to satisfy in whole or in part the original

- when there is a relationship between the first and counterclaim, taking this into account, joint consideration of applications will help to resolve the case more effectively and correctly

You can file a counterclaim in advance using one of the methods that are used when filing a claim (see above), or a counterclaim can be filed directly at a court hearing, then the court will decide whether to accept a counterclaim. When filing a counterclaim at a meeting, do not forget to hand over a copy of the claim to the plaintiff (the defendant in your claim), as well as other persons, if they are participants in the process.

Arbitrage practice

Practice shows that courts satisfy plaintiffs’ demands within the law, but not always in full.

Thus, the Kuibyshevsky District Court of St. Petersburg made a positive decision on the claim of citizen Ya. against a banking institution. She demanded that the bank’s actions be declared unlawful, as well as to recover money, penalties, compensation for moral damages and a fine and legal costs. The basis for the appeal was the illegal blocking and forced closure of the client’s accounts. The court determined that the bank's actions were unlawful. According to the decision, the defendant is obliged not only to return the money to the plaintiff, but also to compensate for moral damages, legal costs, and pay a fine. Part of the penalty was denied.

Grounds and requirements in the statement of claim against the bank

It is certainly unlawful to change the payment schedule, write off excess amounts, commissions, etc. is a violation of your rights and must be restored. At the same time, when you receive a loan, you automatically become a consumer of lending services, and, therefore, from the moment you receive funds from the bank, the consumer protection law begins to apply. If you decide to file a claim for termination of a loan agreement, or for violation of other rights, in addition to the main one, you can make the following demands:

- Compensation for moral damage . As the law states, if consumer rights are violated, in any case the latter experiences moral suffering. Courts, as a rule, when satisfying the main claim, depending on the essence of the bank’s violation of its obligations, seek compensation for moral damage. However, the amount of such compensation is not limited in any way and in each specific case its amount is proven by the consumer.

- Penalty . If the main requirement is material, that is, it arises from the return of funds illegally withheld by the bank, a legal penalty is charged for the period of delay in the return of money.

- Fine . So, if the court finds your rights violated, then the bank will also be subject to a fine in the amount of 50% of the amount awarded by the court.

Questions from our readers

We receive many questions from clients who have disputes with banks. We answer the most common ones below.

Can you sue a bank for imposing insurance?

Insurance of the client's life, as well as in the event of situations related to dismissal, financial risks, is voluntary. A bank client, even one who has taken out insurance, can return the money back within 15 days.

If the bank interferes or does not respond to the application within 10 days, you can go to court. Along with the claim, you must present an insurance policy, a loan agreement and the bank’s refusal to return the insurance. It is also important to confirm that the service was imposed.

The bank does not return money on the deposit. Where to complain?

Due to the difficult financial and economic situation, many banks are trying to keep deposits in their accounts for as long as possible. To do this, the bank: STRONGLY recommends that the depositor extend the deposit term and renew the agreement. He reports that he will not give out the money because... the amount had to be ordered 5 working days in advance. Offers to withdraw the deposit in a couple of months because... There is currently no cash in the bank. And sometimes things get even worse; when a depositor comes to a bank office to get a refund on a deposit, he simply sees a closed door. If you are not satisfied with the work of the bank, they do not return your deposit money, they delay the time frame for returning the deposit, you need to file a complaint against the bank’s actions by calling the hotline of the Consumer Rights Protection Society.

Below we present a fragment of an interview with a lawyer for financial institutions.

— Mikhail, tell me what procedure must be followed by a depositor to return his money on a deposit if the bank refused to issue funds?

— First of all, you shouldn’t panic, swear at bank employees, etc., they are forced people, they told you not to give out money, and they won’t give it out. Whatever reason the bank gives you as a basis for refusing to issue money, or the bank may tell you that it does not refuse to issue money on a deposit, you must submit a written application to make a debit transaction on the deposit or otherwise record that you have made a request for a refund money on the deposit, but the bank did not fulfill your legal requirement. If bank employees do not mark your acceptance of the application, then it must be sent by mail to the nearest post office, and the bank’s refusal to issue money on the deposit must be recorded in an act.

— Okay, but what to do if even after this the bank did not return the deposit to the consumer?

- In this case, the only option left is to go to court to protect your rights. But in this case, it is better to immediately contact a qualified lawyer for help. A lawsuit against a bank to recover funds from a deposit. Almost all court cases regarding the collection of deposit money from banks are resolved in favor of the depositors, this is due to the fact that there is only a legal dispute supported by documents. There is nothing complicated in such cases for experienced trial lawyers. If you have any questions about returning money from the bank, call the hotline of the Society for the Protection of Consumer Rights and get a free consultation.

Currently, in relation to disputes regarding the return of deposits, the Federal Law of the Russian Federation on the Protection of Consumer Rights is also subject to application. This provides investors with a large number of advantages. A statement of claim in court against a bank can be filed with the court at the place of residence of the plaintiff, or his place of stay, at the location of the bank branch, at the conclusion or execution of the agreement. This provision significantly simplifies a depositor’s access to justice, because it is much easier to file a lawsuit against a bank that does not issue a deposit in its region than at a legal address in Moscow. The depositor as a consumer is exempt from paying state duty if the value of the claim is up to 1,000,000 rubles. And if the Society for the Protection of Consumer Rights comes forward to protect the rights of the consumer with a claim against the bank to recover the amount of the deposit, then the depositor is completely exempt from paying the state duty. The bank is also subject to a fine of 50% of the total amount collected in favor of the consumer for failure to comply with the voluntary procedure for satisfying the requirement. Previously, this fine was collected in favor of the state, but subsequently the practice of applying this norm was changed and the fine began to be collected in favor of the consumer to whom the bank did not return the deposit within the period established by the agreement. Return of deposit from the bank upon revocation of the license. If you have information that the bank’s license has been revoked, then it is necessary to take decisive and urgent action, because this clearly means that in the near future all investors will rush to get their money and there is a possibility that there will not be enough money for everyone.

Underwater rocks

Litigation with banks can have some difficulties:

- It is necessary to prove that the bank committed illegal actions, which is not always easy. For example, if the client was forced to take out insurance, you can attach audio and video recordings. In the absence of evidence, it will be difficult to prove your case.

- Banking institutions create favorable conditions for themselves. They reflect them in the contract. It is necessary to carefully study the agreement before signing.

- If the issue cannot be resolved peacefully, it will take a lot of effort and time to go to court. Not all clients have sufficient legal knowledge to defend their interests.

Claim to the bank for the release of property from seizure

These disputes arise from transactions between persons in relation to property that is under an encumbrance to fulfill obligations to pay a debt. The second case of detection of an arrest may be the failure of government agencies to fulfill their duties in a timely manner.

Well, for example, you purchased an apartment from a debtor, which was subsequently seized due to late entry into the state property register about its alienation.

What to do if your property is seized:

- Determine who made the arrest. As a rule, these are employees of the bailiff service;

- Find out information about the person, to secure obligations, whose property has been seized;

- Prepare a statement of claim. Attention: such an application is submitted to the court at the location of the seized property;

- Trial. As part of this process, you will need to prove the integrity of your behavior at the time of acquisition of the seized property;

- Obtaining a court decision and excluding property from seizure.

How to submit a claim to the bank?

After preparing and checking the text of the claim, it must be sent to the bank.

You can do this in the following ways:

- Personal reception at a bank branch. Contact the nearest bank branch to the customer service department and submit the claim to the head of the bank branch.

- Contact the bank's legal address. Go to the head office to the complaints department

- Mail. Send a claim using the postal service or other correspondence delivery service with mandatory receipt of receipt

- Electronic appeal. Send the prepared document using email

- Bank website. Send a claim using the feedback forms on the official website of the banking organization.

When choosing any method of transmitting a document, it is necessary to record the fact of direction or delivery. Namely: put a mark on the shipment indicating the date of sending at the post office or other organization that carried out the shipment; receive a note that the claim has been delivered to a bank representative, save the sent email; receive a mark on the direction of the electronic form.

This is necessary to calculate the time frame for consideration of the claim.

Disputes with a credit institution

If a bank violates the rights of its client, who is a consumer, then the conflict can be resolved in several ways. If it is impossible to resolve the dispute peacefully, the borrower or investor of the company has the right to go to court. In practice, consumer claims may be related to loans, returns of deposits or collateral, or bank errors.

Challenging the terms of the contract

One of the reasons for filing a lawsuit against a bank is disagreement with the terms of a previously executed loan agreement. Despite the fact that the lending procedure is determined by the Federal Law “On Banks and Banking Activities,” organizations often violate the requirements by deceiving or misleading the consumer.

So why can a loan agreement be challenged in court?:

- The bank unilaterally changed the terms of an already executed loan agreement;

- The terms of the contract are enslaving and violate the law;

- The fact of deception on the part of the bank and its employees when completing the transaction and concealment of some important information was revealed.

General information on how to sue a bank is described in this article.

As a rule, these are the reasons for filing a lawsuit in order to hold the bank accountable and restore acceptable lending conditions. You can challenge additional fees, for example, for making a payment, imposed insurance services, unjustified charges of fines and penalties.

Litigation under a loan agreement makes it possible to determine the most favorable loan repayment terms for the borrower, especially if the company’s demands are disproportionate to the amount of the loan issued. But remember: it is impossible to refuse to repay the debt through the court.

Through the court, the borrower can achieve not only changes in the terms of the current loan agreement, but also its termination . Of course, with the return of the previously received amount from the bank. What exact percentage will be for using the money will be determined by the court based on the law. Most often, the enslaving conditions for payday microloans are disputed, since their rate can reach up to 1000 percent per year.

Judicial practice of debt collection on personal loans

The issue of debt collection on personal loans - securing statements of claim - does not lose its relevance. We propose to consider the possibility of securing court orders by analyzing conflict of law issues and an analogy with securing claims.

Problems of debt collection on personal loans are becoming increasingly relevant.

In recent years, the number of loans issued has sharply increased, and as a result, the question arises about the need to repay them, including through judicial proceedings. Judicial debt collection for a credit institution is relevant primarily from the standpoint of its actual execution. However, the practice of Russian legal proceedings is currently such that actual recovery without first securing the claimant’s claims is practically impossible. In accordance with Art. 139 of the Code of Civil Procedure of the Russian Federation, upon the application of persons participating in the case, the judge may take measures to secure the claim. Securing a claim is allowed in any situation in the case if failure to take measures to secure the claim may complicate or make it impossible to enforce the court decision.

According to paragraphs 1 and 2 of Part 1 of Art. 140 of the Code of Civil Procedure of the Russian Federation, an interim measure may be the seizure of property belonging to the defendant and located by him or other persons, as well as a ban on the performance of certain actions by the defendant.

But even when securing claims by seizing the debtor’s property, there are many practical problems.

Seizure of debtors' property

The most common and widely applicable method of securing claims is the seizure of the debtors' property.

As practice shows, applications for securing a claim are filed and satisfied in the majority of cases if the applicant (or plaintiff, recoverer) is aware of the availability of the corresponding property from the debtor. Moreover, the courts satisfy applications for securing claims when the applicant (plaintiff, claimant) can confirm the fact that the debtor has the relevant property. However, in practice, a credit institution does not have such an opportunity. In this regard, the courts refuse to seize property from a credit organization due to the lack of documents confirming the availability of the relevant property from the debtor. There are several ways to eliminate this situation.

One of these methods is when concluding a loan agreement, receiving from the borrower information about the availability of the relevant property, confirmed by documents, including notarized copies of certificates of ownership of real estate, vehicles, etc. This method is quite labor-intensive and time-consuming. Moreover, the collection of such information may lead to an outflow of borrowers from the credit institution.

Filing an application for seizure

When collecting a debt on a personal loan, the credit institution submits an application to seize property located at the defendant’s place of residence.

The credit institution assumes that at the place of residence (actual registration) of the borrower there are household items, household appliances and other property that can be seized to ensure the fulfillment of the borrower’s obligations. This position is confirmed in judicial practice. Thus, in paragraph 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 55 “On the application of interim measures by arbitration courts” the following is stated: “The court has the right to take interim measures in the form of seizure of the defendant’s property, establishing the total amount of the value of the property subject to arrest, while the specific composition of the property subject to seizure may be determined by the bailiff in accordance with the requirements of the Federal Law “On Enforcement Proceedings in the Russian Federation.”

Thus, it is quite legitimate to file a claim to seize property without individualizing this property. Moreover, developing the idea set out in the above-mentioned Resolution of the Supreme Arbitration Court of the Russian Federation, it is possible, in our opinion, to ask the court to seize the property of the defendant, “no matter what it is expressed in and no matter where it is located, with the exception of that property that is not arrest may be made by law."

However, this position is not shared by all courts and judges. The main reason why courts do not grant this type of application for interim measures is the risk of infringing on the interests of the defendant and third parties. Let's consider the practical situation on this issue.

By a court ruling, the property of debtor B., which is located at his place of residence, was seized. The bailiff seized the property. The defendant's father filed an application with the court to exclude the property from the inventory, where the defendant was both the bailiff and the credit institution. The court satisfied the demands to exclude the property from the inventory1.

In this article we will not dwell on the controversial issue, which concerns the involvement of a credit organization in such a case as a defendant and charging it with the costs of paying the state duty. We would only like to note that in order to exclude the filing of applications for the exclusion of property from the inventory, many judges do not satisfy the demands of the credit organization to seize the place of residence of the defendants.

Seizure of vehicles belonging to debtors

When deciding whether to secure a claim, credit institutions seek to seize liquid property.

At the same time, vehicles owned by borrowers are, of course, such liquid property. Let's consider the problem associated with the seizure of this property. Judicial practice on this issue is far from clear. Thus, some courts refuse to seize the vehicle if the credit institution does not confirm the fact that the vehicle belongs to the defendant. Other courts independently, at the request of the plaintiff, make a corresponding request to the traffic police authorities.

As the practice of credit institutions in the Central Black Earth region shows, the traffic police authorities in most cases refuse to provide official information confirming the fact that the property belongs to the debtor, which is due to technical reasons.

It is noteworthy that in their refusals, the traffic police authorities refer to paragraph 56 of the Order of the Ministry of Internal Affairs of Russia dated January 27, 20032, which states that information on the availability of vehicles in citizens’ possession is issued on the basis of a written request only to the government bodies specified in this paragraph of the Order, including the credit organization does not apply. However, the named by-law contradicts the legislation (clause 4 of article 29 of the Constitution of the Russian Federation; clause 2 of article 3 and clause 5 of article 8 of the Federal Law of July 27, 2006 No. 149-FZ “On information, information technologies and information protection” ).

In addition to the specified Order, the powers of the State Traffic Safety Inspectorate of the Main Internal Affairs Directorate for the registration of motor vehicles are established:

• Federal Law of December 10, 1995 No. 196-FZ “On Road Safety” (clause 3 of Article 15);

• Decree of the President of the Russian Federation dated June 15, 1998 No. 711 “On additional measures to ensure road safety” (subparagraph “c”, paragraph 11);

• Decree of the Government of the Russian Federation dated August 12, 1994 No. 938 “On state registration of motor vehicles and other types of self-propelled equipment on the territory of the Russian Federation” (clause 2).

None of these acts contains provisions on restricting access to information about registered vehicles.

Thus, the refusal of the State Traffic Safety Inspectorate to provide information about registered vehicles is illegal, since it does not comply with clause 4 of Art. 29 of the Constitution of the Russian Federation, paragraph 2 of Art. 3 and paragraph 3 of Art. 8 of the Federal Law “On Information, Information Technologies and Information Protection”.

Regional judicial practice on securing claims

In some regions, the following opinion of judges regarding securing claims has developed: if the property of one of the defendants (the borrower himself) is seized, then it is inappropriate to secure the claim by also seizing the property of other defendants (guarantors).

Moreover, it is believed that by seizing the property of guarantors to secure a claim, their rights are thereby limited. Thus, the Bank filed a claim for debt collection under the loan agreement with S. (borrower), Ts. and T. (guarantors). In order to secure the claim, the Bank filed a motion to seize the property of S., Ts., T., located at their place of residence, as well as the VAZ 2106 car registered in Ts., and the accounts available in the bank, as well as the GAZ car 31029, registered on T.

Having examined the plaintiff’s application, the court considered it to be satisfied only partially, citing the fact that measures to secure the claim must be directly related to the subject of the dispute, proportionate to the stated requirements, in support of which they are taken, necessary and sufficient for the execution of the judicial act.

As a result, the court seized only S.’s property located at the place of his registration. At the same time, the court recognized that the measure to secure the claim - the seizure of the property of S., who is a party to the loan agreement, is proportionate to the claim stated by the plaintiff. In this case, the court considered it unnecessary to seize the property of the guarantors, since the property of the borrower himself had already been seized.

As can be seen from this case and other similar cases, of which there are many, the court primarily proceeds from the need to satisfy the claims of the creditor at the expense of the borrower’s own property, and only in the absence of such property to collect the debt from the guarantors.

This position also affects the possibility of securing claims at the expense of the property of the guarantors. At the same time, this position does not find support in the current legislation and infringes on the interests of the creditor.

Seizure of funds on deposit

Of particular interest is the problem of seizure of funds on deposit.

The problem of writing off funds from the debtor's deposit when there is a delay under the loan agreement has a certain theoretical and at the same time practical interest. The theoretical interest is determined by resolving the question of whether a credit institution has the right to write off funds held on the debtor’s deposit if the depositor is at the same time a debtor of the same credit institution under a loan agreement. In this issue, there is a contradiction between the norm of the Civil Code of the Russian Federation and local acts of credit institutions, which provide for the procedure for the direct debiting of funds from deposits.

So, according to Art. 410 of the Civil Code of the Russian Federation, the obligation is terminated in whole or in part by offsetting a counterclaim of the same type, the due date of which has come or the due date of which is not specified or determined by the moment of demand. For offset, a statement from one party is sufficient. From the standpoint of this article, a credit institution has the right, upon application unilaterally, even in the absence of the depositor’s consent, to offset his funds against the repayment of debt under the loan agreement.

However, the specifics of banking activities require clear regulation at the level of local acts of the operating procedure of a credit institution (in instructions, regulations, etc.). Taking into account this circumstance, in the absence of an appropriate regulation on the procedure for the bank to write off funds from a deposit in order to repay loan debt, a credit institution cannot apply this norm of the Civil Code of the Russian Federation. In this regard, credit institutions are forced, when going to court, to file petitions to secure claims/court orders to seize borrowers’ funds on their deposits.

In this case, the following problem arises: does the credit institution have the right to inform the court (indicate in the application for security) account numbers and cash balances on them.

In accordance with the Law “On Banks and Banking Activities”, a credit institution guarantees the secrecy of the deposits of its clients. At the same time, in accordance with paragraph 4 of Art. 25 of this Law, certificates of deposits of individuals are issued by credit organizations, including to the courts. At the same time, as practice shows, courts independently make inquiries about the availability of deposits and the balance of funds on them.

For the disclosure of bank secrets, credit organizations, as well as their officials and their employees, bear responsibility, including compensation for damage caused, in the manner established by federal law.

Based on the above, the question arises whether the indication of account numbers and cash balances in the application for seizure of the deposit of the borrower and his guarantors is a disclosure of bank secrecy.

In our opinion - only partially. On the one hand, given that clause 4 of Art. 25 of the Law “On Banks and Banking Activities” allows such information to be provided to the courts, then indicating the account number will not constitute a violation of bank secrecy. At the same time, it is not always advisable to indicate the balance of funds in the account, since it may change.

In this case, when filing a petition for securing claims/court orders with the credit institution, it is advisable to inform the court about the seizure of funds on deposit, within the limits of the applicant’s requirements.

Securing court orders

Securing court orders deserves special attention.

This practice is in its infancy and therefore requires further development. The situation regarding the need to secure claims is similar to the situation regarding securing a claim. In accordance with Art. 126 of the Code of Civil Procedure of the Russian Federation, a court order is issued within 5 days from the date of receipt of the application to the court. Then the court sends a copy of the court order to the debtor, who has the right to submit objections to its execution within 10 days (Article 128 of the Code of Civil Procedure of the Russian Federation). If the debtor does not appear at the post office for a court order, then according to the current postal rules, the postal item is stored at the post office for 1 month and then returned to the sender.

This is a sufficient period for the debtor to sell or otherwise conceal his property. In addition, this period does not include other circumstances that lengthen the order procedure (vacation, illness of the judge, etc.).

Due to the fact that the purpose of applying interim measures in claim proceedings is to execute the court decision in full (Article 139 of the Code of Civil Procedure of the Russian Federation), the general period of writ proceedings established by law may be the same 2 months that are provided for the consideration of the claim by the court.

Disadvantages of securing statements of claim for debt collection on personal loans

Securing statements of claim and court orders also has a downside, which is often not taken into account by law enforcers.

Let's consider an example when, during the consideration of a case on debt collection on a loan from an individual, the debtor's deposit was seized. In accordance with Art. 144 of the Code of Civil Procedure of the Russian Federation, security for a claim can be canceled by the same judge or court at the request of the defendant or at the initiative of the judge or court. If the claim is satisfied, the measures taken to ensure it remain in effect until the court decision is executed. After a decision has been made to collect the debt on the loan, the credit institution can write off funds only if the seizure is lifted from the account. The issue of canceling security for a claim is resolved at a court hearing.

Thus, after a court decision is made, in order to write off funds from the deposit, the credit institution is forced to spend time filing a petition with the court to remove the seizure from the account. At the same time, to ensure that funds are not written off from the account by the depositor during the period from the removal of the arrest from the account until the credit institution writes off the money to repay the debt on the loan, the bank must go to court to seize the account through enforcement proceedings.

Agree, such a cumbersome scheme is very inconvenient in practice. Moreover, delaying the actual execution of the decision leads to an increase in the amount of the penalty and interest on the loan, which the debtor is obliged to return to the credit institution.

The considered legislative conflict also occurs in the case when, during the consideration of the case, the property of the debtor was seized, which the bailiff must sell. In this case, the bailiffs raise the question of having the claimant initiate the removal of the seizure imposed by the court from the property.

In our opinion, clause 3 of Art. 144 of the Code of Civil Procedure of the Russian Federation requires clarification and amendments and additions. It is advisable to provide that measures to secure the claim remain in force, however, after the court decision enters into legal force, they do not prevent its actual execution by the claimant.

Collection of debt on loans in the event of the death of the borrower

An analysis of judicial practice shows that there are certain features of debt collection on personal loans in the event of the death of the borrower.

The absence of an indication in the guarantee agreement that it remains in force in the event of the death of the borrower may lead to the termination of the guarantee. Note that the guarantee agreements concluded by Sberbank of Russia contain a necessary condition.

When collecting debt on loans from deceased borrowers, the following aspects must be taken into account.

1. Before the heirs enter into the rights to inherit property, within 6 months from the date of death of the borrower, a statement of claim may be filed in accordance with clause 3 of Art. 1175 ch. 64 Civil Code of the Russian Federation. According to this norm, “the testator’s creditors have the right to present their claims to the heirs who accepted the inheritance within the limitation periods established for the relevant claims. Before accepting the inheritance, creditors’ claims may be brought against the executor of the will or against the estate.” In the latter case, the court suspends consideration of the case until the heirs accept the inheritance or transfer the escheated property through inheritance to the state.

2. The legal department made a request to the notary chamber of the Voronezh region about whether information about the opening of an inheritance, about the circle of heirs called to inherit or who accepted the inheritance, and whether notaries are required to give answers to requests for the opening of an inheritance in relation to debtors of the Central Chernozem Bank of Sberbank of Russia. We received the following response. According to the Voronezh Notary Chamber, Art. 63 Fundamentals of Legislation on Notaries4, according to which claims of creditors are accepted by notaries, contradicts Part 3 of the Civil Code of the Russian Federation.

In this regard, as we were told, measures to search for debtors should be taken by the creditor, and not by the notary, and the provisions of Art. 61 Fundamentals of legislation on notaries on the possibility of public notification by a notary of an opened inheritance are irrelevant.

At the same time, the notary chamber of the Voronezh region agreed that the lack of information about the heirs of the debtors deprives the bank of the opportunity to apply to the court to collect the debt. Despite the absence in law of a notary’s obligation to provide information at the request of banks, the Chamber of Notaries believes that in this case one should proceed from the principle of reasonableness and fairness.

Indeed, the bank can obtain reliable information about the heirs who accepted the inheritance only from the notary who is handling the inheritance matter. At the same time, the notary chamber considers it possible, at the request of the bank, to provide the amount of information that is necessary and sufficient to file a claim in court for debt collection. However, the notary can provide information about the full circle of heirs who accepted the inheritance only after the specified period.

Thus, if a six-month period has expired from the date of death of the borrower, having received the relevant information from a notary, the bank can go to court to the heirs of the borrower.

3. As an analysis of the reports and work practices of the divisions of the Security Council of the Russian Federation in collecting debts on personal loans shows, in some cases the bank files claims against deceased borrowers, since it cannot officially obtain documents confirming the fact of their death5.

During the consideration of the debt collection case, the fact of the death of the borrower is revealed, the court requests the relevant official information about the death of the borrower, as well as about the circle of his heirs, and in the course of court proceedings the defendant is replaced with the proper one.

1 Decision of the Federal Court of the Leninsky District of Voronezh dated July 16, 2007. A similar decision dated September 11, 2007 was made by the magistrate of the Kominternovsky district of Voronezh. An interesting fact is that in practice there are cases of consideration of these cases by both magistrates’ courts and federal courts, which, in our opinion, contradicts Ch. 3 Code of Civil Procedure of the Russian Federation. 2 Order of the Ministry of Internal Affairs of Russia dated January 27, 2003 No. 59 “On the procedure for registering vehicles” (registered with the Ministry of Justice of Russia on March 7, 2003 No. 4251). 3 Archive of the Federal Court of the Leninsky District of Voronezh for 2007. 4 Fundamentals of the legislation of the Russian Federation on notaries dated 02/11/1993 No. 4462-I. 5 In accordance with the norms of the Federal Law of November 15, 1997 No. 143-FZ “On Acts of Civil Status”.

Author - Central Chernozemny Bank of Sberbank of Russia, Legal Department, Claims Department, Leading Legal Advisor, Ph.D.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Claim to the bank

Claims are demands for the fulfillment of obligations: payment of a debt, compensation for losses, payment of a fine, elimination of problems, malfunctions or defects of a product or work.

As for the claims against the bank, these are unfounded write-offs, seizure of accounts, charging of illegal commissions, or the imposition and lack of a voluntary concept of returning the bank's insurance.

Claims and complaints are important tools for resolving conflict situations, including when problems arise with the bank. By submitting such a request, a client of a banking institution has the opportunity to resolve the problem out of court and save money. In addition, filing a claim allows the client to find out the position of the financial organization on an issue of interest to him. The presence of a submitted claim for some requirements is a mandatory condition for consideration of the case in court or a guarantee of victory.