Does the person at fault need to do anything after an accident?

Yes. The legislation on compulsory motor liability insurance in 2021 stipulates that it is mandatory to inform the insurance company about the insured event that has occurred. However, the official interpretation obliges this to be very contradictory. Let's explain what's going on here!

- Paragraph 2 of Article 11 of the Law on Compulsory Motor Liability Insurance indicates that the policyholder is obliged to report an accident as an insured event that could potentially entail insurance compensation to the insurance company.

- At the same time, please note that it is the insured who bears this responsibility - it is not necessarily the culprit of the incident. This is the one who purchased the policy - he is indicated in the corresponding column at the top of the policy. It is also noteworthy that the policyholder is not necessarily the person whose civil liability accrues; it accrues to the driver.

- As for the deadline for contacting the insurer with notification, the same provision states that it is specified in the contract. The policy itself is such a contract. However, you will not find this information there.

- You will find it in the Insurance Rules, clause 3.8, which states that if an accident is registered using a European protocol, you must inform the insurer about it within 5 working days.

Thus, the culprit is obliged to notify the insurer about the insured event within 5 working days after the accident. However, we are talking specifically about the European protocol. It turns out that there is some contradiction - the law obliges in any case to inform the insurance company about the accident, but regarding the timing it refers to the Insurance Rules. The rules oblige you to take a copy of the European protocol of the culprit within 5 days to the insurance company. Therefore, we recommend that in any case you notify the company about the incident.

Although, exactly how you notify does not matter, since in 2021 failure to fulfill this obligation does not carry any consequences. That is, we are talking about obtaining evidence of such a notice. Although, under the European protocol, paragraph 1 of clause 3.8 directly states that the notification forms themselves must be sent to the insurer in any of the ways that ensure confirmation of receipt by the latter.

Let's talk separately about the consequences of failure to notify the culprit to your insurance company. Until recently, this was subject to recourse. That is, if you did not inform the insurer about the accident or did not meet the 5-day deadline for this, then the company could recover from you the entire amount of damages compensated to the victim.

However, this right of insurance companies was abolished in May 2021, when a new law abolishing the corresponding subclause “g” (now declared invalid) in Article 14 of the Federal Law on Compulsory Motor Liability Insurance came into force. Thus, there will be no consequences if you miss the deadline for notifying the insurer if your MTPL policy was issued after May 1, 2019.

Can I contact my insurance company?

You can not only contact your insurance company, but, more often than not, you even need to contact them exclusively. Based on the number and nature of accidents that occur in our country, most often they meet the requirements for direct compensation for losses.

The victim makes a claim for compensation for damage caused to his property to the insurer who insured the civil liability of the victim, if the following circumstances exist simultaneously:

- a) as a result of a traffic accident, damage was caused only to the vehicles specified in subparagraph “b” of this paragraph;

- b) a traffic accident occurred as a result of the interaction (collision) of two or more vehicles (including vehicles with trailers), the civil liability of the owners of which is insured in accordance with this Federal Law.

In other cases, you should contact the culprit's insurer. And in some cases, victims have to apply to the RSA for compensation.

When should I report an accident to my insurance company?

As for the victim, the period for applying for insurance compensation also directly depends on the method of registration of the accident.

At the same time, the same contradiction is at work here, when the basic law obliges you to apply for compensation under compulsory motor liability insurance within a specified period, but the Rules to which this law refers provide for a deadline only if a European protocol is drawn up.

Thus, we receive the following responsibilities:

- if the accident is registered using a European protocol, then you must submit a claim to the insurance company within 5 working days (same clause 3.8, paragraph one),

- if traffic police officers arrived, then paragraph 3 of Article 11 of the Federal Law on Compulsory Motor Liability Insurance obliges you to contact the insurer as soon as possible with notification of the accident, and send an application with reference to the same paragraph 3.8.

As a conclusion: if the accident was registered by inspectors, then you have the right to apply at any time, and not 5 days. Why relatively? Below you will find out that there is also a statute of limitations that must be taken into account.

How are the deadlines for applying under compulsory motor liability insurance regulated?

So, there are 3 legislative acts regulating the timing of contacting the insurance company after an accident:

- Civil Code of the Russian Federation and the general limitation period,

- The Federal Law on Compulsory Motor Liability Insurance, which prescribes other deadlines for applying for payment or repairs,

- Insurance rules of the Central Bank, which largely duplicate the above Federal Law.

It should be borne in mind that we have listed these 3 regulations in order of priority of their application: codes have priority over the Federal Law, and the Federal Law over even more local legal acts - the Regulations on the Insurance Rules of the Central Bank.

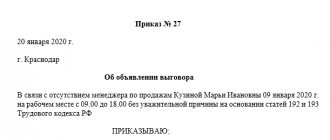

The lie about 15 days to notify the insurer

Meanwhile, in some sources you may find incorrect information about how long it takes to contact someone after an accident. The fact is that a number of notice forms contain at the very end of their reverse side an indication that it must be transferred to the insurer within 15 days. This is what the form looks like:

But this is actually incorrect information. The official form of the European protocol is a form approved by the Bank of Russia, although not for strict reporting. You can see a sample of it on the Garant resource, as well as the Russian Union of Auto Insurers. There you will see that there is no talk of any 15-day deadline - you simply will not find the corresponding line on the approved notification form.

Thus, when registering an accident using a European protocol, the only legal period is 5 days - they are prescribed by the Insurance Rules.

If you do not believe us, but rather trust the notification form, because it was given to you by the insurance company, and you read this information on some regular website, then we have more compelling evidence for you. The courts in Russia hold a similar opinion. Here, for example, is the decision of one of the acts of judicial practice:

The accident notification form contains conflicting and incomplete information for the policyholder (the note at the bottom “to be completed and submitted to the insurer within 15 (fifteen) working days”). At the same time, the 15-day period is not specified either in the insurance rules or in the Federal Law “On Compulsory Motor Liability Insurance”. It is also not specified which insurer this notice should be given to.

What to do in case of an accident?

Traffic rules dictate the necessary actions of drivers in the event of an accident: stop, turn on the hazard lights and put up an emergency stop sign, and also make sure whether there are victims, and if necessary, call an ambulance and the traffic police.

It is necessary to discuss the circumstances of the incident with the other participant in the accident: this will help to find out whether he is in adequate condition, and whether there are disagreements regarding who is at fault. According to paragraph 1 of Art. 11.1 Federal Law “On compulsory civil liability insurance of vehicle owners” No. 40-FZ, it is possible to file an accident under the Euro Protocol if:

- only two vehicles were involved in the incident;

- no casualties;

- none of the drivers is under the influence of alcohol, drugs or toxic substances;

- there is no disagreement regarding the circumstances of the incident;

- damage does not exceed 100 thousand rubles;

- both drivers have valid MTPL policies (read what will happen if the person at fault for the accident does not have MTPL, read here, and what to do if the victim does not have the policy, we told here).

If these conditions are met, then a simplified accident registration scheme can be used without involving employees of authorized bodies. Necessary:

- Take detailed photographs of the scene:

- the location of vehicles on the road and relative to each other;

- close-up - places of damage and fragments of parts, registration numbers.

- Clear the roadway.

- Fill out the accident notification form. Each driver must keep their own copy of the document.

If using the Europrotocol is not possible, you will need to take detailed photographs of the incident and go to the traffic police department yourself, or call employees to the scene of the accident.

We talked about how participants in an accident should behave competently in order to receive compensation under compulsory motor liability insurance in this material, and you will learn about the nuances of receiving payments if a Europrotocol was issued for an accident here.

How long can I apply for payment?

From the above, two important summary conclusions can be drawn:

- the culprit needs to notify the insurer about the accident only if a European protocol is issued,

- the victim under the European protocol must submit an application and send this notice along with it within 5 working days,

- if the accident was registered by the traffic police, then the victim is obliged to notify the insurance company about this event as soon as possible, but can apply for payment at any time.

So, the last point is only partly true. In fact, the time limit for applying to the insurance company for compensation for damage has limits. After all, if you applied with an application 10 years later, it would be logical to refuse you?!

Applying for insurance compensation is possible within 3 years after the occurrence of an event - an accident. This rule is no longer regulated by the law on compulsory motor liability insurance, but by a more general norm - part 2 of article 966 of the Civil Code of the Russian Federation.

But as for the European protocol, the 5-day period prescribed in the Rules is unbreakable. This means that even if you missed this deadline, did not submit a notice to the insurer, and generally did not notify at the first opportunity about the accident, then nothing actually changes for you. You can still apply within 3 years after the accident. And refusal, underestimation of payments and other measures will not be legal only on the grounds that you did not submit the European protocol on time.

Thus, we get that, regardless of the method of registering the incident, you can apply to the insurer for compensation under compulsory motor liability insurance after an accident within 3 years. However, remember the main disadvantage of procrastinating. After a long period of time, the damage may rust and otherwise change. This provides additional grounds for examination. And any examination is almost always a lottery with very real chances of receiving a conclusion like “the expert was unable to establish the correspondence of the nature of the damage to the declared insured event.”

Beginning of the limitation period under the insurance contract: payment cannot be delayed

In legal literature and judicial practice, disputes about the beginning of the limitation period in insurance have long roots. This is due primarily to the special specifics of the insurance legal relationship to provide protection from the adverse consequences of the reality around us. Insureds, by purchasing an insurance service, thus buy their peace of mind and confidence in the future, shifting possible adverse risks to a professional manager of these same risks. It is the possibility of the occurrence or non-occurrence of an insured event that is the cornerstone of the beginning of the limitation period.

Some time ago, the prevailing approach in court practice was to begin calculating the limitation period from the date of occurrence of the insured event. This approach was actively criticized in the literature[1] and, obviously, did not meet the interests of consumers of insurance services. This approach also had supporters, o[2]. Yu.B. Fogelson proposes to calculate the limitation period “for the insurer’s obligation to “pay for an insured event” not from the moment the insured event occurred, but from the moment when the policyholder (beneficiary) learned of its occurrence. Only with such a definition of the beginning of the limitation period will this legal structure in insurance ensure the achievement of the goals for which it is introduced.”[3] An example will be given below that shows that this approach also does not always meet the interests of a separate category of consumers of insurance services.

One of the last insurance cases considered by the now defunct Presidium of the Supreme Arbitration Court of the Russian Federation dealt with precisely this issue [4]. The rapporteur on this case was S.V., who needs no introduction. Sarbash and if the author of this note is not mistaken, then it was this case that Sergei Vasilyevich spoke about in his interview, answering questions from M.A. Erokhova and V.V. Batsieva[5]. In this judicial act, the Presidium of the Supreme Arbitration Court of the Russian Federation supported the approach of the start of the limitation period under an insurance contract, not from the moment of the occurrence of the insured event, but from the moment of refusal to pay insurance compensation, as well as from the moment of payment not in full or the expiration of the grace period for payment provided by law or contract. The same practice was consolidated in the courts of general jurisdiction[6], and then in the joint supreme court[7].

Currently, courts do not have any difficulty in determining the beginning of the limitation period if policyholders (beneficiaries) timely submit a statement about the occurrence of an insured event. Problems begin to arise when a strict event claim is made after a sufficiently long period of time, such as three years from the occurrence of the insured event. The reasons for this may be various, such as the low legal literacy of consumers of insurance services, and, on the contrary, the uncertainty of the beginning of the limitation period if they do not apply for payment. And indeed, according to the same paragraph 4 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 N 58 “On the application by courts of legislation on compulsory insurance of civil liability of vehicle owners”, the limitation period for disputes arising from contracts of compulsory insurance of civil liability risk, in in accordance with paragraph 2 of Article 966 of the Civil Code of the Russian Federation is three years and is calculated from the day when the victim (beneficiary) learned or should have learned:

on the insurer’s refusal to provide insurance compensation or direct compensation for losses by organizing and paying for the restoration of the damaged vehicle at a service station or issuing the amount of the insurance payment, or

about the implementation of insurance compensation or direct compensation for losses not in full.

The limitation period is also calculated from the day following the day of expiration of the period for the insurer to make a decision on the implementation of insurance compensation or on direct compensation for losses by organizing and paying for the restoration of the damaged vehicle at a service station or on issuing the amount of insurance payment (clause 21 of Article 12 of the Law about OSAGO).

Having read this clarification of the Supreme Court of the Russian Federation, it seems that the statute of limitations does not begin to run until an application for the occurrence of an insured event is filed and the insurance company does not violate the rights of consumers of insurance services in any way. After all, this is exactly what is written in the above explanation. However, having analyzed the judicial practice, primarily on mass types of insurance (CASCO, OSAGO), it becomes clear that if the insurance company fails to apply for payment for a long time, the courts are ready to interpret differently the established approach to the beginning of the limitation period.

This can be seen from the recent Determination of the SKGD of the Armed Forces of the Russian Federation dated June 16, 2020 in case 7-KG20-1, in which the following legal position is formed - “if the voluntary insurance contract establishes a deadline for making an insurance payment, then the limitation period will run if the victim does not apply for insurance payment begins from the moment of expiration of the period established by the insurance contract for making the insurance payment.” In this judicial act, the trio of judges proposes to calculate the limitation period under a voluntary insurance contract from the date of occurrence of the insured event, adding to it the period for filing a claim provided for in the contract and the grace period for making payments. What is this if not a return to the old approach of calculating the statute of limitations from the date of occurrence of the insured event?

Or, for example, another recent example arising from the MTPL agreement. A close relative of a passenger killed in an accident applies for compensation in the event of injury to life after more than 3.5 years have passed from the date of the accident. The insurance company, of course, refuses to pay, citing the expiration of the statute of limitations. The courts refuse to collect insurance compensation, citing the following, in my opinion, erroneous arguments [8]: “the occurrence of an insured event only means the emergence of the right of the insured (beneficiary) to apply to the insurer for an insurance payment, while the exercise of the right to insurance payment itself is carried out in accordance with the procedure provided for by the insurance contract or law. If the insured (beneficiary) contacted the insurer within the period established by law or contract, then the limitation period begins from the moment when the insured learned or should have learned about the refusal to pay insurance compensation or about payment not in full, and in the event of failure to do so actions (that is, if you fail to contact the insurer within the period established by law or contract) - from the moment of expiration of the period established for the insurance payment, taking into account the proper behavior of the insured (beneficiary).”

From this reasoning of the court it is clear that they use the same approach as the Supreme Court of the Russian Federation in the Ruling of June 16, 2020 in case 7-KG20-1, however, the Law on Compulsory Motor Liability Insurance does not have a specific deadline for the victim to apply for payment of insurance compensation. In addition, judicial practice is based on the postulate that an untimely application by the insured (beneficiary) for payment is not an absolute basis for refusal to pay insurance compensation. In the case under consideration, the court compensated for the absence of a statutory deadline for applying for payment by using an analogy of the law and used the period for the driver to send a notice of an accident in conjunction with the period for accepting the inheritance, calculating the beginning of the limitation period, again from the date of the accident. However, the court did not give any arguments regarding the term for accepting the inheritance, which has nothing to do with the right to receive insurance compensation in connection with causing harm to life.

Another argument that the court pointed out boils down to the following thesis: the beginning of the limitation period cannot be postponed for an indefinite period (any, calculated in years and decades) and depend solely on the will of the victim (beneficiary) regarding the date when he should contact to the insurer. This statement also seems extremely unconvincing, since the judicial panel obviously confuses the concepts of objective and subjective statute of limitations. The subjective statute of limitations under compulsory motor liability insurance is three years (Article 966 of the Civil Code) and begins to run according to the currently prevailing approach no earlier than the insurer violates the subjective right of the plaintiff (by refusal, payment not in full), which presupposes at least contacting the insurance company. Of course, the time frame for contacting the insurance company for payment, that is, the exercise of one’s subjective right, depends only on the victim. If the victim applied for payment of insurance compensation after, for example, 2 years and 10 months and did not receive compensation, then the 3-year statute of limitations will run precisely from the expiration of the 20-day period for payment established by the law on compulsory motor liability insurance. That is, it is obvious that the subjective statute of limitations of 2 years and 10 months before contacting the insurance company simply did not begin to run. So why should it flow if the application for payment followed after the expiration of the three-year period from the date of the accident? This seems to be an absolutely illogical position of the court.

To be fair, it should be noted that the approach proposed in the above-mentioned judicial acts is not decisive. In judicial practice, there are also decisions in which, in the opinion of the author, the courts separate the moment of emergence of the right to appeal to the insurance company from the moment of violation of a subjective right by the debtor, from which the subjective statute of limitations should begin to be calculated[9].

According to the author, the problem is solved by establishing in Art. 966 of the Civil Code of the Russian Federation has an objective limitation period, which will be calculated from the moment the obligation arises, that is, from the moment the insured event occurs. The establishment of this period will contribute to the stability of civil turnover and the certainty of legal norms governing insurance. The need to establish an objective limitation period is also mentioned in the Development Concept of Ch. 48 of the Civil Code of the Russian Federation[10]. However, the term of 10 years proposed in the Concept, taken apparently by analogy with the general objective period established by Art. 200 of the Civil Code of the Russian Federation, clearly does not meet the needs of the development of insurance legislation. Considering that, for example, the storage period for the same MTPL contracts with payment cases by the insurance company is 5 years, and also taking into account the storage period for information about the same accidents in the competent authorities, it seems that the objective limitation period of 5 years from the date of the accident is sufficient for consumers of insurance services exercise their rights, taking into account the balance of interests of all participants in insurance legal relations.

Telegram channel “Insurance litigation” - https://t.me/Insurancecaselaw

[1] A.P. Sergeev The beginning of the limitation period in insurance obligations \\Collection of scientific articles in honor of the 60th anniversary of E.A. Krasheninnikov: collection. scientific Art. / answer ed. P. A. Varul; Yarosl. state University named after P. G. Demidova. – Yaroslavl: YarSU, 2011.

[2] Krasheninnikov E. A . Prescription of claims // Essays on trade law. Yaroslavl, 2003. Issue. 10. P. 7. Note. 5

[3] Insurance law: theoretical foundations and practice of application: monograph / Yu. B. Fogelson. - M.: Norma: INFRA M, 2012. Pp. 339.

[4] Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 21, 2014 No. 11750/13

[5] https://www.youtube.com/watch?v=I3KvWI4Kjbw&ab_channel=%D0%9F%D1%80%D0%BE%D0%B5%D0%BA%D1%82%D0%9F%D0% BE%D0%B4%D0%B4%D0%B5%D1%80%D0%B6%D0%BA%D0%B0

[6] Clause 9 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 27, 2013 No. 20 “On the application of legislation on voluntary insurance of citizens’ property”

[7] Clause 4 Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 N 58 “On the application by courts of legislation on compulsory insurance of civil liability of vehicle owners”

[8] Appeal ruling of the Supreme Court of the Republic of Tatarstan dated 06/08/2020 N 33-6159/2020 (left unchanged by the Sixth Court of Cassation of General Jurisdiction, however, since the judicial act of the final court has extremely scanty arguments, I will cite the arguments of the three judges from the appeal).

[9] Ruling of the Ninth Court of Cassation of General Jurisdiction dated 01/14/2020 N 88-220/2020, Ruling of the Third Court of Cassation of General Jurisdiction dated 15/06/2020 in case No. 88-6647/2020

[10] https://privlaw.ru/sovet-po-kodifikacii/conceptions/ page 195

What is the validity period of a road accident certificate?

Please note that there are no statutes of limitations at all. And the documents themselves are not kefir to have an expiration date. They are suitable for presentation as long as:

- relevant according to legal norms and specific events,

- it is possible to read their contents (for example, if the ink has become discolored due to time when the documents have been lying in the sun, or have been damaged).

Neither the documents from the traffic police, nor the notification of an accident, nor the policy, nor any other papers regarding the insured event have any expiration dates.

But speaking of the relevance of the certificate itself. Traffic police officers may not issue it at all in case of accidents, since the corresponding obligation was abolished with the introduction of the new Administrative Regulations and Order No. 664.

What is the time frame after applying?

If the above deadlines are met and there are no other grounds for refusal, you are required to compensate for the damage in full. But this may take some time, including:

- within 20 days, the insurance company reviews your application with the attached documents (counting starts from the date of submission of all documents) and within this period is obliged to issue a referral for repairs or pay in money,

- if a referral for repair is issued, then within 30 days you are required to repair the car (the countdown starts from the date you provide the car to the service station and is not delayed by various types of approvals, lack of spare parts or other opportunities to begin repairs).

What documents are needed to contact the insurance company?

Their list is not very large, but very important, since the absence of at least one of the mandatory ones entails an increase in the legal period for compensation. In addition, please note that the owner of the car must apply for payment (maybe an authorized person under a power of attorney, but if there is a payment, it will be to the account of the exclusive beneficiary - the owner).

Their exhaustive list is given in clause 3.10 of the Insurance Rules.

- Civil passport of the car owner.

- Power of attorney if it is not the owner of the car who is applying.

- If you agree to receive payment to your account, you must provide the details of this account (it must belong to the owner of the car). If you want to receive cash at the insurer's cash desk, then you do not need any details. At the same time, the choice of payment method remains yours.

- Notification of an accident. This is the European protocol. It does not need to be filled out again if you filled it out at the scene of the accident. If you were registered by traffic police officers, you will need to fill it out (it’s better to do this at home in advance by downloading and printing its official form).

- All documents that were issued to you by the traffic police (if issued by the crew). In particular, there must be either a resolution or a ruling with the name of the culprit appearing in them.

If there were injuries and/or deaths in the accident, additional documents from clauses 4.1-4.12 of the Insurance Rules will be required to receive compensation.

Please note that in 2021, the insurance company does not have the right to demand documents that are not provided for by law.

Important note!

- This article describes the basic principles of how legislation works. Meanwhile, in judicial practice everything depends on specific circumstances.

- In 96% of all cases there are subtleties that can affect the outcome of the entire case.

- Therefore, we recommend entrusting the matter to professionals who will study your business and select the right winning strategy.

The TonkostiDTP website employs professional road accident lawyers with experience in all major types of disputes (MTPL, guilt, administrative penalties).

Ask a lawyer

or get a free consultation by calling the hotline: 8.

Algorithm of actions of the culprit of the accident

In the event of a traffic accident, the person responsible for the accident needs to pull himself together and make contact with the traffic police. To simplify and speed up the process of compensation for harm to the victim, the following procedure must be followed.

- Do not change the location of vehicles or their parts. Turn on the hazard lights on cars and display emergency signs. In populated areas, signs should be placed at a distance of 15 meters from the accident site, outside the city - 30 meters.

- Call an ambulance (if there are victims) and traffic police officers.

- Record in a photo or video the location of the vehicles after the collision. Filming should be done in the presence of the victim. The photographs/recordings must show all damage to the vehicles. To avoid further disagreements, special attention should be paid to the victim’s vehicle.

- Record the data of participants in the accident and eyewitnesses of the incident. Exchange contacts.

- Tell the victim the details of your MTPL policy (document number, name of the insurer) and obtain similar information from him.

- Fill out an accident notification for the company. It must be signed by all participants in the accident. The forms are usually issued by insurers when taking out a policy.

- Check the correctness and completeness of filling out the documents about the accident and obtain them from the traffic police inspector.

- Notify the insurer about the incident.

Paragraph 2.6.1 of the Traffic Regulations states that if the vehicles involved in the accident impede traffic on the road, then the drivers of the affected vehicles must clear the roadway. But before this, it is necessary to record the location of the vehicles and their parts immediately after the collision. The person responsible for the accident should not refuse to undergo a medical examination.

Traffic police officers who arrive at the scene must prepare and issue the necessary documents to the parties. If only cars were damaged as a result of the incident, they are:

- road accident diagram;

- certificate of accident;

- administrative violation protocol.

If there are victims, this kit is supplemented with a medical certificate.

The driver who caused the accident must not leave the scene of the accident. His identity will still be established and he will be additionally brought to administrative responsibility under Art. 12.27 part 2 of the Code of Administrative Offenses of the Russian Federation.

The punishment for this violation is deprivation of a driver's license for a period of 1-1.5 years or arrest for 15 days. Also, if the initiator of an accident flees the scene of the accident, the insurance company has the right to make a recourse claim against the insured after making compensation payments to the victim.

Documents for payment under compulsory motor liability insurance

Let's look at the list of documents required to receive compensation under MTPL:

- application for insurance compensation or direct compensation for losses;

- certified copy of passport;

- power of attorney to represent the interests of the beneficiary (if necessary);

- bank details if you plan to receive a non-cash payment;

- consent of the guardianship and trusteeship authorities, if the payment of insurance compensation will be made to the representative of the person (victim (beneficiary)) under the age of 18 years;

- notification of an accident (only if a paper notification was issued);

- copies of the protocol on an administrative offense, a resolution on a case of an administrative offense or a ruling on the refusal to initiate a case on an administrative offense, if the preparation of documents on a road traffic accident was carried out with the participation of authorized police officers, and the preparation of such documents is provided for by the legislation of the Russian Federation.

- other documents provided for in Chapter 4 of the MTPL rules, if they are necessary to determine the amount of damage.

Let's take a closer look at the required documents:

1. Application for insurance compensation or direct compensation for losses . You can write this document yourself in free form. You can also write an application on the standard form of the insurance company when submitting documents.

If your car is severely damaged as a result of an accident and cannot participate in road traffic, you should make a note about this in the application.

2. A certified copy of your passport is the third required document to receive payment under compulsory motor liability insurance. All other documents are provided depending on the situation.

3. Notification of an accident . An accident notification form is issued to the driver along with the MTPL policy. This document (its front part) must be filled out by drivers together. The reverse side is filled out by each driver separately. This document must be completed by drivers only in the event of an independent registration of an accident. If the documents are prepared by traffic police officers, then the notice is not required to be filled out.

Note. From November 10, 2019, it is possible to fill out the notice electronically (via the application).

4. Bank details are provided to the insurance company only if non-cash payment is planned.

5. A power of attorney will be required only if a representative of the injured driver contacts the insurance company.

6. The consent of the guardianship and trusteeship authorities is needed only when the victim is under 18 years old.

7. Copies of police documents are required if the accident was registered in the presence of a traffic police officer.

8. Other documents are provided to confirm the amount of damage caused to the victim (for example, the cost of evacuating a vehicle from the scene of an accident).

What to do if the driver is not satisfied with the insurance payment?

If the driver is not satisfied with the amount of the insurance payment, he can first receive a payment, the amount of which is determined by the insurance company, and then try to get the rest of the money.

In practice, it happens that the payment to the insurance company is several times less than the amount required to repair the damaged vehicle. In this case, I recommend contacting a competent lawyer who deals with traffic accidents. If the case is won, the costs of the lawyer will subsequently be reimbursed by the insurance company, so you will not lose anything.

In conclusion, I would like to note that the receipt of payments under compulsory motor liability insurance is regulated by Chapter 3 and Chapter 4 of the rules of compulsory insurance of civil liability of vehicle owners. So if you still have any questions, please refer to this document.

Good luck on the roads!

and notifications and applications for payment for an insured event

As already written above, the notification form for an accident is in the established form, and the application form for compensation for damage in the form of repairs or payment of money is written in free form.

- (DOCX format),

- (PDF format for filling out by hand),

- (DOCX format, two pages need to be printed on one sheet on both sides),

- (PDF format, two pages must be printed on one sheet on both sides).

- from the official website of the Russian Union of Auto Insurers.

Submitting documents to the culprit's Investigative Committee

If your insured event does not meet the conditions under which direct compensation for harm is possible, then you will have to write an application for compensation to the insurance company of the person responsible for the accident.

Most often this situation occurs when:

- There are people injured in an accident.

- More than two cars were damaged in the accident.

In principle, the process of contacting the culprit’s investigative committee is similar to the process of contacting your own investigative committee. The list of required documents, as well as the activities carried out in this case, are absolutely the same. In the event that the license of the culprit’s insurance company was revoked or the culprit of the accident is missing (has not been found), then you should contact RSA for payment of compensation (we told you what to do if the culprit fled the scene of the accident here). In this case, RSA will be obliged to fully compensate your damages.

In the event that the insurance company of the guilty party does not fulfill its obligations or refuses to pay you without explanation, you will need the help of a competent lawyer. You may have to first file a pre-trial claim with the Investigative Committee, and if you do not receive any response from the company, you will have to file a statement with the court.

IMPORTANT! You have the right to file an application with the court within 3 years from the date of the insured event.

What to do if your payment was refused or you paid little?

It is possible to sound the alarm already 21 days after the day of submitting the full set of documents to the insurer, but it is not entirely correct. The insurer has every right to send you a referral for repairs in a simple letter, via mail, and doing this on the 19th day of the term will not violate anything. Therefore, it is best to wait at least 7 days, in case a letter was sent to you, and only then start a dispute with the insurer.

Before calling, writing or going to the insurer, we strongly recommend that you carefully read and study the following materials: Article 16.1 of the Law on Compulsory Motor Liability Insurance and our article about the financial ombudsman.

Do not forget that compulsory motor liability insurance currently represents “partial insurance”, that is, even if the insurer calculates and evaluates everything correctly, the payment made to you or the service station may not be enough for repairs. In this case, the remaining damage must be recovered from the culprit of the accident.

What are the consequences in 2021?

In almost all cases, absolutely none. But it’s not for nothing that we divided the method of registering an accident above - it is in this case that the consequences may differ. But let's consider in order whether there can be anything in the form of responsibility!

Refusal to pay?

Almost all legal options for refusing payment to a victim are listed in section 12 of the law. So, the reasons could be:

- failure to provide the victim's car for inspection to the insurance company,

- failure to provide a complete set of documents to receive compensation,

- if you contacted the wrong insurance company (for example, you went to file a claim with yours when there were victims in an accident and you had to go to the culprit’s insurer)

- and a small number of other cases.

However, none of the above reporting obligations is a legal reason to deny benefits in 2021. You simply will not find such reasons in the current legislation. Therefore it will be illegal.

Thus, if you are the injured party in an accident and did not have time to send the European report to the insurance company within 5 working days, then there cannot be a refusal on this basis alone. In fact, you can apply for payment within the general limitation period of 3 years.

Traffic fine?

And administrative penalties also do not threaten drivers who fail to fulfill the obligation to report an accident to the insurer.

All such sanctions are regulated by the relevant Code of Administrative Offences. Chapter 12 contains the rules of liability in the field of road traffic. And it contains only one article regarding compulsory motor liability insurance - 12.37, which provides for a fine for the absence of compulsory motor liability insurance or if the driver is not included in the current policy. But you won’t find penalties anywhere for failing to notify the insurance company after an accident.

Recourse claim from the insurance company

But this consequence can quite realistically occur. Recourse is the insurer’s requirement that you, if you are the culprit of the accident, pay him the entire amount that was compensated to the victim. That is, the insurer does not refuse compensation (it does not have such a right), but pays everything. But then he has the right to claim the full amount from the culprit.

However, such responsibility is becoming less and less common in practice every day. Let's explain what's going on here.

There is also Article 14 of the Federal Law on Compulsory Motor Liability Insurance, paragraph 1 of which contains all the circumstances in the presence of which an insurance organization has the right of recourse. These include, for example, hiding from the scene of an accident or if the culprit was drunk. But where did the failure to inform the insurer about the accident come from?

The fact is that for a long time this norm contained a subparagraph “g”, which in 2021 lost its legal force. This happened on the basis of the Law on Amendments No. 88. It was paragraph “g” that gave insurance companies the right to recover the entire amount paid to the victim from the culprit if he did not correctly notify his company about the accident and provided that the incident itself was documented using a European protocol.

Specifically, the loss of force of this paragraph occurred on May 1, 2019. But MTPL agreements concluded before this date were also subject to the law before the amendments were made. Therefore, for culprits with policies before the specified date, subparagraph “g” is relevant. But today there are no more of them left (despite the fact that the insured event under such insurance could have been until a maximum of April 30, 2021).

Therefore, in 2021, for failure to comply with the requirement of the culprit of an accident to inform the insurance company about the event, there is no fine or recourse, nor does the insurer have the right to refuse compensation to the victim in such circumstances.

Expert opinion

Dmitry Tikovenko

Automotive law expert. 7 years of experience. Areas of specialization: civil law, disputes over compulsory motor liability insurance and road accidents

Those who may be affected by regression under paragraphs. "g" clause 1 art. 14 of the Law on Compulsory Motor Liability Insurance for failure to submit a European protocol by the culprit of an accident, less and less every day. After all, the clause was removed on May 1, 2021, and the policies that were valid at that time have already expired for everyone.

But insurers, not wanting to miss the opportunity to make money, still file claims against the culprits within the statute of limitations both one year and 2 years after the accident. It is important to remember that the insurer has a right of recourse for policies that were concluded before May 1, 2021. The date of the accident does not play a role here.

If you receive such a claim, do not pay immediately, try to get the insurer to deny the claims.

Ask a Question

How to properly notify about an insured event under compulsory motor liability insurance?

When registering an accident with police officers, paragraph 2 of Article 11 of the law does not establish in any way the form of notification to the insurer, nor the procedure, nor even specific deadlines, indicating only that this must be done as soon as possible.

Thus, formally, you can report an accident by phone, email, and even by SMS or WhatsApp or using other instant messengers.

But the main thing here is to remember the most important thing: in order to avoid consequences (which, as we found out above, in practice in 2021 there will almost never be) you must have evidence of this action.

The following methods are suitable for this:

- make a phone call only to the official number of the insurer (its branch), so that you can then get call details from your operator,

- a written notification of an accident, which you will hand over in person to the office, either in 2 copies, where one will be given back to you with a stamp confirming the acceptance of the second copy, or with a video recording,

- written notification, but sent by mail with a list of attachments and notification of delivery.

But in the case of drawing up a European protocol, the MTPL Rules clearly indicate how to notify the insurance company about an accident. This must be done by giving the original copy of your notice (European protocol) to the insurer. Here you should also remember to prove that you handed over the document.

If the European protocol is drawn up electronically?

In this case, information about the accident, as well as the electronic notification form, is submitted electronically automatically (paragraph 2 of clause 3.8 of the MTPL Rules) when you complete the registration of the accident in the application.

However, you still won’t have confirmation of sending the European protocol, so we recommend at least taking screenshots of the application while registering the accident.

Actions in case of an accident

If the deadline for contacting the insurance company can be postponed, then it is better not to delay notification of the occurrence of an insured event. This requirement is specified in the legislation “On OSAGO” clause. 2, art. 11. In addition, the driver must:

- stop the vehicle;

- turn on the alarm;

- install a warning triangle;

- call an ambulance for the injured;

- remove the vehicle from the roadway if the car is blocking the passage;

- before moving vehicles involved in an accident, it is necessary to record their position and the location of objects that depict the situation in the presence of witnesses;

- notify the traffic police of the accident;

- record the data of all parties to the accident and witnesses, including vehicle numbers;

- wait for the traffic police;

- check and sign the protocol drawn up by road service employees.

If no one was injured in the accident, and there are no controversial issues between the parties, then the situation can be resolved without involving the traffic police. In this case, a “Europrotocol” is drawn up. If more than two cars were involved in the accident, you will still have to call the road service. After filling out the protocol, each party to the accident must contact the insurance service within the specified deadlines for applying for compulsory motor liability insurance.