An extract on the transfer of rights contains information about persons who have ever owned an apartment or land plot, as well as documents confirming the change of ownership. The history of registration of rights to real estate is stored in the Unified State Register of Real Estate (USRN).

Previously, this information was entered into the register of rights (USR), and the owners were issued paper certificates of ownership. But in 2021, the Unified State Register became part of the Unified State Register, and the certificates were replaced with extracts from the register.

Attention: Data on the transfer of rights to real estate have been entered into Rosreestr since 1998. Earlier data can be found in regional archives - BTI, city administration, and can only be obtained by the owner.

Who can act on behalf of an individual entrepreneur

A person who has received the status of an individual entrepreneur remains an individual. After state registration, he receives the right to conduct business, but at the same time the individual entrepreneur acts personally on his own behalf in the contract. This makes it fundamentally different from an LLC, which is represented in transactions by its director.

An individual entrepreneur cannot have a director acting on his behalf without a power of attorney. But an individual entrepreneur can hire an employee or choose a representative who has the right to sign business documents, but only by power of attorney.

Thus, when concluding an agreement, the individual entrepreneur signs it personally. In addition, such a right can be transferred to a trustee if this is documented.

What does certificate of equivalence mean?

Notarization of the equivalence of a document is of two types:

- certification of the equivalence of an electronic document to a document on paper;

- certification of the equivalence of a document on paper to an electronic document.

The essence of this procedure is confirmation of the identity of the content of an electronic document produced by a notary with the content of a document presented to the notary on paper.

The procedure for certifying the equivalence of a paper document to an electronic one means that the notary confirms the identity of the created digital copy of its physical version. That is, a digital copy becomes legally equivalent to a paper copy.

The certificate of equivalence in Russia appeared in 2013. The legal basis is Articles 103.8–103.9-1 “Fundamentals of the legislation of the Russian Federation on notaries.” The practice allows any citizen or organization to quickly transfer certified electronic documents anywhere in Russia.

What document confirms the authority of an individual entrepreneur?

A person receives the status of an individual entrepreneur after information about him is entered into the state register of the Unified State Register of Individual Entrepreneurs. Until 2021, this fact was confirmed by a certificate of registration of individual entrepreneurs.

But then, including in 2021, instead of a certificate, they began to issue a USRIP entry sheet, and in electronic form. If you wish, you can request from the Federal Tax Service a paper sheet with a stamp, then at any time you can show on the basis of which document the individual entrepreneur operates.

And of course, the identity of the individual entrepreneur himself is confirmed by his passport. Therefore, when concluding transactions, the original of this document must be carried with you. Or, if the counterparty requires it, attach a notarized copy of the passport to the agreement.

In addition, more and more entrepreneurs and organizations enter into contracts online using an electronic digital signature. In this case, special identification of the party is not required.

Who issues property documents?

Property documents can be issued by different authorities, depending on how it was obtained

Where to go to obtain documents confirming ownership depends on their type. Everything is clear with the contracts; their preparation and signing is the responsibility of the parties to the transaction.

In some cases, their certification requires an application to a notary. You can’t do without contacting a notary’s office if you want to assume your rights as an heir.

Which notary you should go to to open an inheritance case, you should check with the notary fee of your region.

When exercising the right to privatization, you must contact the local government authorities in charge of this issue.

The judicial body to which the owner should apply to protect his interests is determined taking into account the rules of jurisdiction and jurisdiction.

Basically, real estate disputes are resolved at its location.

To register your rights, you will need to contact the Rosreestr or multifunctional centers. You can apply for an extract from the register of rights to real estate to the registration authorities, the Cadastral Chamber or a multifunctional center. By personal contact, or via the Internet on the organization’s website.

The authority to which you need to contact to obtain documents depends entirely on their type. In some cases, applicants are given the right to choose where exactly to address their request

What to write in the contract

The usual wording in the head of the agreement looks like this: “... represented by _____________, acting on the basis of _________________...”.

Organizations here indicate the full name of the manager, and a document confirming his powers may be a charter, a decision/minutes of a general meeting, or an order to assume the powers of the sole executive officer (for the sole founder-manager).

What to write for an individual entrepreneur, on the basis of which document does the party act? After all, he has neither a charter nor a decision on the transfer of management powers. And an entrepreneur cannot appoint himself as a director either.

We have already found out above that the only official document that confirms the status of an individual entrepreneur is a registration certificate or a USRIP registration sheet. This is the answer to the question on what basis the individual entrepreneur acts in a transaction.

If the entrepreneur is registered before 2021, then the preamble refers to the registration certificate. Example: “IP Sergeev Oleg Vasilievich, acting on the basis of a certificate of state registration of an individual as an individual entrepreneur (series, number) dated …”.

For an individual entrepreneur registered later and who received not a certificate, but a USRIP entry sheet, the wording will be different. For example, like this: “IP Sergeev Oleg Vasilyevich, acting on the basis of the entry sheet of the Unified State Register of Individual Entrepreneurs dated …”.

Please note that you must refer to the very first sheet of the Unified State Register of Entrepreneurs, the date of issue of which corresponds to the date of registration of the entrepreneur. The fact is that the entry sheet is drawn up not only during registration, but also in the future when information in the state register changes.

Let’s assume that in 2021 an individual entrepreneur added OKVED codes, and this fact is confirmed by a recording sheet issued also in 2021. At the same time, the registration of the entrepreneur took place in 2021. If you refer to the last sheet of record, the counterparty may have a question: “Why is the document on the basis of which the individual entrepreneur acts when concluding an agreement dated 2021, if he has been working since 2021?”

Why is an extract from the Unified State Register of Rights required?

The document will be useful to: the owner, the buyer, the notary and the bailiff. Next, we will consider in what situation an extract may be needed.

To the owner

With the help of an extract from the Unified State Register of Real Estate, you can prove to the buyer that the apartment is your property and conclude a deal faster.

If you plan to receive money or apply for a mortgage from a bank, you will also need to provide information from the Unified State Register of Real Estate about the previous owners of the apartment.

To the buyer

Having received an extract on the transfer of rights before purchasing an apartment, you can make sure that:

- the seller is indeed the copyright holder;

- the contract indicates the same number of owners as in the register;

- there are no encumbrances or restrictions on the apartment;

- owners did not change too often.

This information will help you reduce the risks when buying an apartment.

To the notary

Information about copyright holders is necessary for a notary to formalize a real estate transaction, as well as for:

- division of an apartment during a divorce;

- establishing shared ownership;

- drawing up a will, etc.

To calculate the amount of inheritance tax, a notary can request information from Rosreestr about the cadastral value of the apartment.

To the bailiff

An extract from the Unified State Register can also be requested by a bailiff when it is necessary to establish what property an individual (or legal entity) owns.

How a party to a contract checks a partner

So, we figured out on the basis of what document the individual entrepreneur acts in transactions. However, you must be prepared for the fact that only a USRIP entry sheet and a copy of the entrepreneur’s passport will not be enough to conclude an agreement.

After all, a problematic counterparty can be not only a shell company, but also an individual entrepreneur. And every conscientious taxpayer should exercise caution and prudence when choosing a business partner.

Therefore, in addition, you can provide the party to the contract with a report about yourself from the free contractor verification service. The same tool can be used when analyzing the activities of a future business partner.

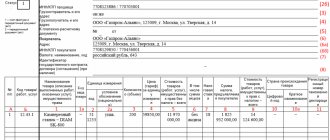

Separation of primary documents by business stages

All transactions can be divided into 3 stages:

Stage 1. You agree on the terms of the deal

The result will be:

- agreement;

- an invoice for payment.

Stage 2. Payment for the transaction occurs

Confirm payment:

- statement from the current account , if the payment was made by bank transfer, or by acquiring, or through payment systems where money is transferred from your current account;

- cash receipts, receipts for cash receipt orders, strict reporting forms - if payment was made in cash. In most cases, this payment method is used by your employees when they take money on account. Settlements between organizations are rarely in the form of cash.

Stage 3. Receipt of goods or services

It is imperative to confirm that the goods have actually been received and the service has been provided. Without this, the tax office will not allow you to reduce the tax on money spent. Confirm receipt:

- waybill - for goods;

- sales receipt - usually issued in conjunction with a cash receipt, or if the product is sold by an individual entrepreneur;

- act of completed work/services rendered.

I put in the primary, I figured it out right away

“I enter the primary data into Kontur.Accounting; the accountant handles the accounting and reporting. The service has a very convenient and intuitive interface, I figured it out right away, without any help. Very well made, made for people! And, of course, it’s convenient that you can log into the system from anywhere, from any device.”

Marat Imanov, director at Dialog LLC, St. Petersburg.

How to prove the existence of a debt for excess traffic?

The need for this arises when using fixed payments in calculations, as, for example, happened in the case considered in the Resolution of the AS SZO dated January 16, 2017 No. F07-12700/2016.

The subject of the agreement concluded between the operators was interconnection. The Contractor agreed to provide the customer with services for connecting networks, as well as for transmitting traffic. The parties agreed that invoices for the service of connecting the parties’ networks and other one-time payments are issued by the contractor before the start of the provision of services. Invoices for the monthly traffic fee (and all other periodic payments) are issued by the contractor prior to the start of the period in which the services will be provided.

Payment for excess traffic volume or additionally paid traffic is made monthly after the provision of services and the signing of the acceptance certificate for the services provided. The Contractor issues a separate invoice to the customer for excess traffic or includes the price of excess traffic as a separate line in the next invoice.

In support of the demand for debt collection, the contractor presented the following evidence: an extract from the automated system about the excess traffic volume, copies of invoices and acceptance certificates for services provided, lists of postal items, electronic correspondence between the parties. At first, the judges did not accept this correspondence, since the parties did not agree on the possibility of sending documents by e-mail.

Meanwhile, the electronic correspondence is presented by the operator not as evidence of sending documents to the subscriber (acts and invoices were sent by mail), but as confirmation of receipt of the said documents. Moreover, the subscriber did not dispute the existence of email correspondence between the parties, as well as the authority of the person conducting this correspondence. The authority of the chief accountant, who signed and thereby certified the extract from the automated system, was also questioned. We believe that this does not deprive the document of legitimacy.

The case has been sent for new consideration, and there is every reason to believe that the documents presented by the operator will be sufficient to confirm the debt for services provided that exceed the established traffic “quota”.

Payment documents

Confirms payment for goods or services. This can be a payment order, payment request or cashier's check.

A cash receipt is issued using an online cash register. It is required to be used by everyone who accepts payments in cash and by bank cards. Exceptions are listed in paragraph 2 of Article 2 of Law 54-FZ. All checks are submitted to the tax office through the fiscal data operator (FDO). Kontur.OFD instantly sends data to the Federal Tax Service, and all information about receipts and cash registers is available in the service’s personal account.

There are no longer any deferments for the use of online cash registers, but there are exceptions for some types of activities, and only some entrepreneurs should use a patent cash register - see the article for a full list of exceptions.

Article about online cash registers

The payment order remains with the entrepreneur when he transfers money via Internet banking. This document confirms the transfer of funds using certain details.

A sales receipt is an optional document that is issued at the buyer’s request. The buyer needs a document to confirm that he not only spent a certain amount of money, but also bought certain goods - for example, on behalf of his manager. The form of the sales receipt has not been established, so you can develop your own with the required details: name of the document, number, date, name of the LLC or full name of the individual entrepreneur, INN, goods and services, amount of payment and signature with transcript and position.

Results

Thus, to confirm the fact of service provision, an act of services rendered, a report from the contractor and correspondence with the customer will help.

To confirm payment for services, you will need an act of services rendered, receipts, cash receipts, cash order, cash book, bank documents, expense report, and accounting documents. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Main stages of the procedure

- The client contacts the notary. Bring documents with you (the list will be below).

- The specialist creates a digital copy and signs it with his CEP.

- The certified version is recorded on a verified removable media or transferred online (via email, cloud services).

If you additionally need to convert a document from electronic to paper, then the following happens:

- The certified copy is transferred to another notary.

- The specialist converts the document from electronic to paper and certifies their equivalence.

- The certified document is transferred to the second party.

Documents for a transaction with a client:

- The contract is the beginning of the transaction. In it, you and the client determine the terms of cooperation: what, for what price and in what time frame you do. If the client is a regular one, you can draw up one agreement for several transactions.

- The invoice contains the amount to be paid, a list of goods and services and the bank details of the seller. This is an optional document, but is usually used for convenience.

- A cash receipt, sales receipt or strict reporting form confirms payment. Give them to the client who pays in cash or by card. When paying by bank transfer, payment is confirmed by the payment order.

- Invoice is a document that the supplier issues to the buyer when shipping goods.

- An act of provision of services or completed work is a document that the customer and the contractor sign based on the results of the provision of services or completion of work.

- Invoice - usually issued by individual entrepreneurs and LLCs using the general taxation system, because they work with VAT. In rare cases, invoices are issued using the simplified tax system, UTII and patent - read more about this in the article.

- UPD replaces the act/invoice + invoice.