The key difference between guardianship and a foster family is that an agreement is concluded with the foster parent, which reflects the procedure for placing the child in foster care, including the conditions for calculating wages. Guardianship is appointed by order of the local administration. There is no salary for guardianship; guardians are paid child benefits.

IMPORTANT!

Foster care and adoption are completely different concepts. Upon adoption, parents receive a full range of rights and responsibilities, equal to those of blood. A foster family (hereinafter referred to as FS) is one of the types of guardianship; the rights and obligations are determined by the terms of the agreement on the transfer of a child to a foster family.

Legal concept of foster family

Foster parents are not the same as adoptive parents.

Adoption of a child implies that the orphan becomes a full member of the family and is equal to the spouses’ own child. An agreement is concluded between the adoptive parents and the guardianship authorities, according to which the former take responsibility for the upbringing and maintenance of the orphan until he reaches adulthood.

Signs that distinguish a foster parent from an adoptive parent are:

- Concluding an agreement with the guardianship and trusteeship authorities for a certain period.

- Subject to compliance with all legal requirements, both a married couple and a single person can become foster parents.

- The child is sent back to a social institution or to his natural parents as soon as the agreement with the foster parents ends, or when the foster parents refuse to renew the agreement.

- The foster family agreement is terminated if conflicts arise with the pupil, disagreements or violations of the terms of the agreement.

- Adoptive parents receive remuneration under the contract, various social support measures, allowances and benefits (adoptive parents will receive only child benefits, as if the child were their own).

- Children in their care can continue to communicate with their biological parents.

- Due to the signing of the agreement by the adoptive parents, the child under guardianship does not have the right to inherit their property or receive alimony.

Cancellation of the contract

Revoking a foster care agreement is a rare legal process. However, this practice still exists. Such situations are discussed in Article 153.2 of the RF IC.

The agreement on maintaining a child in a foster family may be terminated in the following cases.

- Upon expiration.

- If the foster family no longer has the opportunity or desire to raise a child (illness, inability to provide financial support).

- The guardianship authorities changed their decision and do not give their consent to guardianship. This decision may be due to the fact that the family does not have favorable conditions for raising a child.

- If one of the parties to the agreement violated its terms.

Sometimes the foster family agreement is broken

Attention! A foster family taking care of a sick child with developmental disabilities or an existing disability must understand that his place of residence must correspond to his illness.

Guardianship must make decisions based only on the interests of adopted children. Therefore, if the child is already 10 years old, then his opinion will be taken into account when signing the contract. The interests of children under 10 years of age are represented by guardianship authorities.

The interests of children over 10 years old must be taken into account

Tax benefits for adoptive parents

A significant type of assistance for officially employed foster parents is the opportunity to receive a monthly tax deduction. Not only foster families, but also guardians and trustees of children can count on this preference. A tax deduction involves reducing the tax base for personal income tax by a certain amount, depending on the number of children taken into care:

- 1,400 rubles for raising the first and second child;

- 3,000 rubles for the third and each subsequent child;

- 6,000 rubles for agreeing to take on the upbringing of a disabled child.

To apply for a tax deduction, you must contact the employer directly, providing the accounting department with an application for the assignment of benefits and a photocopy of the agreement with the guardianship and trusteeship authorities.

Examples of using family capital for an adopted child

If a family takes custody of a child from an orphanage or baby home, the guardian can apply to purchase a family capital certificate. This is possible if there are at least two children in the family along with the adopted child. It will not have any differences from the usual one, but to complete it you will have to collect more documents. The application will be reviewed within 5 working days.

Cash benefits can only be used for the purposes specified in the legislation.

- For the purchase of living space.

- To improve living conditions.

- To obtain education for a child.

- For the formation of the mother’s pension and so on.

Important ! In addition, guardians have the right to receive money in the form of monthly payments. But at the same time, the money will need to be recorded and reports on expenses submitted to social authorities.

A foster family can apply for maternity capital when adopting a child from an orphanage for upbringing, provided that this is the second child in the family

It is also possible to save transfers to the child’s account. So, this money will help the child purchase housing or receive additional education in the future. In addition, the certificate does not have a validity period. But it should be taken into account that the family capital program itself is valid only until 2021, but one is likely to be extended.

In the current economic situation, the state does not always have the opportunity to allocate additional funds for foster families. Despite this, payments for such families, as a rule, are never delayed. The government strives to do everything so that such citizens do not need anything, and motivates other families to decide to raise a child from an orphanage.

An example of calculating a tax deduction for adoptive parents

The couple Marina and Sergei took in an orphan who is visually impaired. Sergei works in a factory and receives 25,000 rubles a month, and Marina is a housewife and looks after her adopted child (he is the only one in the family).

For raising a disabled child, Sergei is entitled to a tax deduction in the amount of 6 thousand rubles. This means that personal income tax will be charged only on the following part of the salary: 25,000 – 6,000 = 19,000 rubles.

Personal income tax is paid at a rate of 13%, which means that Sergei’s salary will be withheld to make payments to the Federal Tax Service of the Russian Federation: 19,000 x 0.13 = 2,470 rubles .

- If there were no tax deduction, personal income tax would be paid in the following amount: 25,000 x 0.13 = 3,250 rubles.

The foster family, thanks to the tax deduction, saved 3250 – 2470 = 780 rubles .

Help for adoptive parents in kind

At the regional level, foster families are entitled to social assistance measures that apply to:

- purchase of food and non-food essential goods at a discount;

- reimbursement of part of the cost of utilities;

- priority issuance of free vouchers to sanatoriums and health resorts, to children's holiday camps;

- taking into account the period of guardianship as the work experience of a non-working parent;

- free education and meals (or at a discount) for a foster child at preschool educational institutions and schools;

- free provision of rehabilitation equipment for disabled people (prostheses, special technical equipment);

- allocation of land plots for individual housing construction and private plots;

- provision of preferential mortgage loans for the purchase of housing;

- issuing a free pass for public transport.

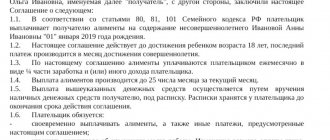

Payments to foster families

The amount of monetary remuneration, as well as a specific list of social guarantees provided to adoptive parents, will be specified in the agreement with the guardianship and trusteeship authorities, depending on the regulations adopted in a particular region and on by-laws. The amount of the benefit will depend on the following points:

- the number of children taken into the family;

- age and presence of disabilities among pupils;

- decisions of regional authorities regarding the list of benefits and monetary allowances for foster families.

The annual indexation of child benefits is carried out in February, not from the beginning of the calendar year.

In general, adoptive parents can claim a one-time benefit equal to what is paid to the families into which the child was born - 16,350 rubles 33 kopecks (initially, in 2007, the benefit was set at 8 thousand rubles, by 2017 they reached a larger amount due to annual indexation). Only residents of the Far North and equivalent areas can receive a larger amount (in this case, the amount of the benefit will be multiplied by an increasing factor - 1.8 for the Far North).

Foster parents who agree to raise a child with a disability, children over 7 years of age, or several children who are blood brothers and sisters can count on a much more impressive one-time benefit (this is how the state tries not to separate relatives). In this case, the payment will be 124,929 rubles 83 kopecks .

Foster children are also entitled to receive a monthly child care allowance, the amount of which varies depending on the region of residence of the family. From the date of transfer of the orphan to family patronage, he will also be accrued a monthly allowance, the amount of which also depends on the subject of the Russian Federation.

Conditions for employment of orphans!

Upon completion of training, upon further employment in enterprises, including commercial organizations, graduates are provided with everything necessary at the expense of the state (clothing, equipment, etc.). These standards for orphans are determined by Decree of the Government of the Russian Federation No. 409 of June 20, 1992 “On mandatory urgent measures aimed at protecting orphans.” Federal Law No. 159 Art. 9 regulates the procedure for employment of this category of the population.

According to the law, representatives of state employment services, after graduates of this category aged 14–18 years apply to them, are obliged to carry out professionally oriented work with them to check their professional suitability.

All activities must be carried out taking into account the health status of graduates and their profile specialization in which they studied at the educational institution.

Persons who first applied to the employment service in order to find a job and at the time of application are registered with the state employment service as unemployed are guaranteed payment of unemployment benefits. This benefit is paid to a citizen of the Russian Federation within 6 months from the date of application. The amount of the benefit corresponds to the level of the average salary, which is fixed in a certain region, district, city, territory, autonomous district, republic.

If a child left without parental care leaves the organization due to the liquidation of its activities due to staff reduction, his maintenance falls on the shoulders of the employer. When dismissing a person of this category, the employer must understand that, upon liquidation of his company, he is obliged, at his own expense, to conduct vocational training for the employee and subsequently ensure his employment in his or another company, regardless of the form of ownership.

In addition to government agencies, charitable organizations provide travel packages for children left without parents.

How to receive payments to a foster family

To claim their rights to payments for adoptive parents, citizens must contact the regional department of social protection of the population with all the required documents. It will be necessary to indicate which way it is more convenient for parents to receive accruals - by postal order or to a bank account. To know in advance what benefits and privileges the foster family will be entitled to, you can seek advice from the USZN in advance, since the list of preferences for preferential categories of citizens may vary significantly by region.

Expected changes

There are no important changes that would allow increasing payments and benefits to foster families where adopted children are being raised in 2018-2019. Their size will change by an average of 4% according to planned indexation.

The state placed greater responsibility for patronage support for this category of citizens on the regions, instructing them to provide all possible interaction locally, without depriving them of federal payments and social benefits.

Adoptive families have the right to both federal and regional payments

What documents are needed to process payments to adoptive parents?

In order for an application for benefits to be accepted by social security employees, it is necessary to prepare in advance a complete set of documents, including:

| Document | Where to get it |

| Application for granting benefits to adoptive parents | The form will be issued at the place of submission of documents |

| Russian Federation passports of adoptive parents (single parent) | Main Department of Migration Affairs of the Ministry of Internal Affairs of the Russian Federation |

| Certificate of family composition | Housing department, passport office |

| Child's birth certificate | Civil registry offices |

| The act of transferring a child to be raised in a family | Guardianship and trusteeship authorities |

| Agreement with the guardianship and trusteeship authorities on the adoption of a child into a family (original and photocopy) | Guardianship and trusteeship authorities |

| Certificate of income of working family members in form 2-NDFL | Federal Tax Service of the Russian Federation |

| Photocopy of bank account details | – |

| Any documents that could confirm the biological or social orphanhood of adopted children: death certificate of both natural parents or only parent; acts of abandonment of children by parents; a court decision declaring parents unable to raise and support their children; a certificate from the police department declaring the parents missing; certificate of parents' stay in custody or in prison. | Civil registry offices, guardianship and trusteeship authorities, department of internal affairs |

Procedure

To receive payments for an adopted child, you need to submit the necessary documentation to local authorized bodies. It is necessary to do this within 6 months from the entry into force of the court decision on adoption.

If you did not meet the deadlines, but there is a good reason, then when submitting documents you will need to reapply to the court.

If financial benefits were denied, you should file a claim with the court, which will most likely make a decision in favor of the guardians.

If all the necessary documents have been collected and the rules have been followed, then within a 10-day period from the date of submitting the documents, the money will be transferred to the adoptive parents’ account.

Payments to foster families in Moscow

In Moscow, foster families can count on the following support measures:

- Doubling the amount of remuneration if the foster family has the status of a large family.

- Monthly payment for raising an orphan under the age of 12 in the amount of 16.5 thousand rubles ( 19.8 thousand rubles for a large family).

- Monthly payment for supervised children aged 12 to 18 years in the amount of 22 thousand rubles ( 25.3 thousand rubles for parents with many children).

- Monthly allowance for a foster child with a disability in the amount of 27.5 thousand rubles.

- Remuneration to the adoptive parent in the amount of 16.7 thousand rubles for each child under care (28,390 rubles for a child with a disability).

In the regions of Russia, payments, rewards and benefits are provided in a smaller volume. For comparison, in Samara the amount of remuneration for a foster parent is 3,359 rubles , and the allowance for maintaining a child with a disability is 500 rubles .

Legislative acts on the topic

| part 4 clause 1 art. 218 Tax Code of the Russian Federation | On providing a tax deduction to adoptive parents for raising children |

| Part 2 Art. 153.1 RF IC | About payments to foster families in 2021 |

| Art. 12.2 of the Federal Law of May 19, 1995 No. 81-FZ | On increased one-time benefits for foster families who have agreed to raise a disabled child, a child over 7 years old and blood brothers and sisters |

| Moscow Government Decree No. 376-PP | Amounts of payments to foster families |

Common mistakes

Error: Foster parents apply to take the ninth child into the family.

Comment: The maximum number of children who can be taken into foster care is 8 people.

Error: Each of the foster parents claims to receive a reward for accepting an orphan into the family.

Comment: A one-time benefit, as well as monthly bonuses, can be received by only one teacher.

Extension of benefits for admission to universities for orphans

On January 5, 2019, Federal Law No. 497 of December 25, 2018, which amended Part 14 of Art. 108 Federal Law No. 273 dated December 29, 2012.

The specified Federal Law extended the benefits for orphans to enroll in a university on a budget place in a non-competitive manner (within the established quota) until January 1, 2021. Before the adoption of the Federal Law, the benefit was valid until January 1, 2019.

Therefore, as before, all an orphan needs to do to get admitted is to pass the Unified State Exam “at least with a C.”

Answers to common questions about payments to foster families

Question No. 1: Are the minimum and maximum values of remuneration for adoptive parents established under an agreement with the guardianship and trusteeship authorities?

Answer: Yes, a monetary reward is provided in the amount of about 40% of the average monthly income of the adoptive parent for the previous year. The minimum amount of remuneration cannot be less than 3 times the regional minimum wage, and the maximum amount of the benefit depends on the region of residence of the family.

Question No. 2: Is it possible to refuse to fulfill an obligation under an agreement with the guardianship and trusteeship authorities in relation to a ward child?

Answer: Yes, if there are grounds for this - conflicts in the family, inability to establish contact with the child, violations by the guardianship and trusteeship authorities.