Home / Disputes with the bank / We file a complaint with the Central Bank about the actions of the bank (sample attached)

Before suing a bank regarding its unlawful actions, it is recommended to file a complaint with regulatory authorities and organizations. This approach allows you to solve tactical problems in a dispute with a financial institution.

Competent actions increase the chances of resolving the dispute in favor of the client out of court. One of the organizations where you can send a complaint is the Central Bank or the Bank of Russia.

Why does the Bank of Russia accept complaints?

The Bank of Russia, also known as the Central Bank or the Central Bank of the Russian Federation, is the main regulator of the state’s financial and banking system. All other banks and other credit organizations are subordinate to him. In addition, it is entrusted with supervisory and regulatory functions, issuing and revoking licenses.

The list of responsibilities of the financial regulator includes resolving controversial and conflict situations between market participants. In this case, between clients, servicing banks and other credit institutions. The Central Bank of the Russian Federation reports directly to the State Duma.

What is the Central Bank of Russia and what functions does it perform?

So, the Central Bank of the Russian Federation (Bank of Russia, Central Bank, Central Bank of the Russian Federation) is the main regulatory body of the country’s credit system. Simply put, this is the main Russian bank, which is responsible for the security and stability of the ruble in relation to other currencies of the world, the development and strengthening of the banking system, supervision of the activities of other banks, issuance and revocation of licenses.

Let us note the specific differences and features of this organization:

The Central Bank of Russia is a legal entity, but its goal is not to make a profit;

In carrying out its functions, the Central Bank is obliged to develop and implement policies to prevent, identify and manage conflicts of interest;

The Chairman of the Bank bears full responsibility for the activities of the Bank of Russia (since June 24, 2013, this position has been held by Elvira Sakhipzadovna Nabiullina);

The regulatory, control and supervisory functions of the Bank of Russia in the field of financial markets are carried out through a permanent body - the Financial Supervision Committee;

The Central Bank has the right to file claims in the courts in the manner prescribed by the legislation of the Russian Federation;

At the same time, regulatory acts of the Central Bank of the Russian Federation can be appealed to the court in the manner established for challenging regulatory legal acts of federal government bodies.

In what situations should you contact the Central Bank?

The reasons for filing a complaint with the Central Bank of the Russian Federation from individuals and companies may be:

- blocking a card or account;

- high interest rate for withdrawing funds from a card or account;

- high interest rates on the loan or large fines and penalties for violating the terms of the agreement;

- changing the interest rate under lending agreements unilaterally without notifying the borrower;

- illegal accrual of penalties and fines;

- problems related to the operation of the Internet bank or personal account that the servicing bank refuses to solve;

- placing a personal telephone number in a database for auto-dialing and SMS advertising without the client’s consent;

- forcing paid additional services without the need for them;

- violation of the deadlines for issuing a card or crediting funds to it;

- non-receipt or illegal debiting of money from a card or account at an ATM or payment terminal;

- inaccurate information provided by the bank to the Credit History Bureau, which affected the credit rating;

- prohibition or restriction on contacting another insurer and forcing one to work with only one insurance company;

- transfer of debt to collectors, if this is expressly prohibited in the loan agreement;

- refusal to return the paid insurance benefit during the “cooling off period”;

- illegal issuance of a loan, for example, on the basis of a lost or fake passport or to an incapacitated person;

- illegal actions of debt collectors when working with a debtor;

- refusal to issue a deposit, interest on it;

- questionable quality of banking services;

- refusal to issue documents related to the loan;

- dissemination of the client’s personal data or their insufficient protection, resulting in a data leak;

- refusal to open an account or deposit, to carry out transactions, to open or close a bank account;

- writing off money to repay a loan without notifying the client;

- violation of the law when registering collateral;

- disclosure of information related to banking secrecy.

In addition, other violations of legislation, including antimonopoly legislation, may be the reason.

Unlawful actions of financial organizations

Most often, clients encounter such violations:

- Suspension of payment;

- Introduction of a commission unilaterally under a deposit agreement, unlawful withholding of it;

- Change in interest rate under a loan agreement, etc.;

- Introducing a ban or deliberately restricting clients’ right to repay their debt early;

- Transfer of data to third parties without the consent and notification of debtors, depositors, etc.;

- Other violations of current legislation, including antitrust, consumer protection, etc.

For example, in 2010, institutions such as Uniastrum Bank, SKB Bank and Investtorgbank prevented clients from replenishing deposits at interest rates in accordance with previously concluded agreements. These financial structures made a marketing move by signing agreements with investors at the most favorable interest rates for them, and then unilaterally changed the conditions. Their actions were recognized as illegal and a manifestation of unfair competition.

Another case is allowing clients to replenish a time deposit for free when concluding an agreement with Transportny Bank, and then deducting a 5% commission . Similar violations were observed in other financial institutions, including the nationally known bank Tinkoff. In these cases, it was possible to eliminate the violations pre-trial, saving clients from lengthy and expensive legal proceedings.

The most pressing issue has become the suspension of financial transactions with signs of legalization of illegally obtained money. Based on the regulation of the Central Bank No. 375-P of 2012, banks are required to take measures to identify dubious transactions in the activities of clients. The result is that during the period from January to October 2021, 480 thousand transfers were suspended for a total amount of about 200 billion rubles.

Reasons for this situation:

- Formal approach of bank employees when checking monetary transactions;

- Making a decision based on one or two signs;

- Ignoring the provisions of civil legislation prohibiting such actions (clause 3 of Article 845 of the Civil Code).

As a result, the courts satisfy the claims in three out of five cases. This means that it is possible and necessary to defend violated rights before banks, thereby preventing their further illegal actions. And the process needs to begin with a pre-trial settlement of the conflict, including an appeal to the Central Bank.

General information about where to complain about a bank is described in a special material. Recommended reading.

What to consider when filing a complaint

To file a complaint with the Central Bank of the Russian Federation, adhere to certain rules of correspondence:

- The text style is formal business. Minimum emotions and maximum facts. This will help not only understand the current situation, but also give an objective answer that will help find a way out.

- The text is succinct but concise. Verbosity and deviation from the essence may harm the content, and the appeal will not be considered.

- The complaint is made by the applicant. The Central Bank does not provide answers without indicating the details of the person who is applying.

Before sending complaints to the Bank of Russia, try to find out the situation with the servicing financial institution. At the same time, it is important not only to listen to what the specialist answers, but also to request references to the legal or internal documents that he is guided by. All specified documents, points and excerpts can then be used in the text of the complaint drawn up and sent to the Bank of Russia.

If there is any doubt that a personal meeting or telephone call to the hotline will provide complete information, it is better to submit your request in writing. Typically, a lawyer will work on drafting the written response. Therefore, the text will include all necessary references to clauses of the agreement, legislative acts, decisions of the Code of Administrative Offenses, internal regulations and other grounds.

How to write an appeal to the Bank of Russia?

Before drawing up a complaint, it is necessary to “translate” the client’s requirements into financial and legal language. This means writing a letter correctly using:

- Special terms that are used in banking;

- Rules of law that have been violated (articles and paragraphs of laws).

Therefore, at the preliminary stage, you need to try to resolve the dispute with the manager and head of the bank branch. You need to understand the meaning of what is happening, carefully understand (write down) all the rules of law that guide the institution in its actions towards the client.

After this, you need to contact the bank's hotline , and also consult with a practicing lawyer. The purpose of these actions is to obtain accurate data:

- What exactly happened: an increase in the interest rate, suspension of the operation, etc.

- On what basis: clauses and articles of laws, decrees, regulations, instructions, contracts, etc.

- Actions required by the bank: make a deposit under new conditions, confirm the legality of the origin of funds, etc.

Based on the materials received (written answers, consultation results), you can move on to the next stage - filing a complaint against the bank’s actions with regulatory authorities and organizations, in particular with the Bank of Russia.

Sample

There is no special form for drawing up an application to the Central Bank. The complaint is drawn up in accordance with the requirements of the law regarding the appeal of citizens. The letter must contain :

- Name of the territorial body of the Bank of Russia where the application is submitted.

- Passport details of the applicant, including place of permanent or temporary registration (registration).

- Document title: complaint or statement about unlawful actions of a specific institution.

- A brief summary of the situation and what the problem was.

- Links to legal norms and attached documents.

- Requirements that must be met to restore the violated rights of the applicant.

- List of attached documents.

- Date and signature.

If careful work has been done at the preliminary stage, filing a complaint will not be difficult. Otherwise, it is recommended to seek help from a legal specialist.

The document is available for download here

How to complain about a servicing bank

You can take the completed claim to the public reception of the Central Bank. It is located in Moscow, per. Sandunovsky 3 building 1. Schedule:

- from 10:00 to 18:00 - on Monday;

- from 10:00 to 16:00 - Tuesday, Wednesday and Thursday;

- Friday, Saturday and Sunday are days off.

The public reception is closed on weekday holidays and public holidays.

During the coronavirus quarantine period, the reception office also does not receive citizens in person. The resumption of the work schedule will be announced additionally on the Central Bank website. During this time, you can use other options for filing a complaint.

Other serving options

In addition to the public reception, they file a complaint with the Central Bank of the Russian Federation:

- through the Internet reception;

- by fax;

- by registered mail;

- by calling the Central Bank of the Russian Federation hotline.

The latter option is used when a conflict of interest arises on the part of Central Bank employees.

Online reception

Filing a complaint through the online reception is the most common way for most Russians to file a complaint. This option is suitable for anyone who cannot attend a public reception in person, but still wants to receive a detailed written answer.

To register a complaint in the system:

- Go to the website of the Central Bank of the Russian Federation.

- Go to the "Complaint" section.

- Write the subject of the letter. For example, failure to meet the deadline for card production or imposition of paid services.

- Select whether the complaint relates to banking products, banking activities, insurance companies or other services.

- If the complaint relates to insurance, please go to the section below.

- Describe the problem, leave cantata data and indicate which method of obtaining an answer is most suitable.

- Check the data and wait for a response.

All requests that fall within the competence of the Bank of Russia are considered and responded to.

Fax

A claim to the Central Bank can be sent by fax to the following numbers in Moscow:

- 621-64-65;

- 621-62-88.

The extension code for calls from other cities and regions is +7 (495) before the phone number.

By calling 771-48-30 you can check whether your request has been received or not. If you plan to go to court, it is better to use other methods of appeal - registered mail or online reception. Fax requests may not be taken into account in court.

Ordered letter

Written requests by registered delivery to the Bank of Russia are sent to the address: 107016, Moscow, st. Neglinnaya, 12.

You can send the envelope via mail or courier. When sending by courier, it is advisable to ask to put the date of receipt of the request on the second copy, but if the question does not fall within the jurisdiction of the Central Bank of the Russian Federation, then it is not obliged to provide an answer.

Helpline

The “Helpline” of the Central Bank of the Russian Federation can be reached at 8 800 250 48 83 . Calls are accepted 24 hours a day, 7 days a week. Individuals and companies can contact this service with information:

- on the identification or suspicion of corruption in the actions of bank employees of the Central Bank of the Russian Federation;

- if a conflict of interest arises in the work of employees of the Central Bank of the Russian Federation;

- non-compliance by employees of the Central Bank of the Russian Federation with prohibitions, restrictions, obligations, and legislation of the Russian Federation.

It is not recommended to use the service for other purposes. They will not respond to calls or requests that do not relate to the listed facts.

How to submit a complaint to the Central Bank via the Internet? Step-by-step instruction

Another way to contact the Central Bank is to file a complaint using the online reception on the official website of the Central Bank of the Russian Federation. To do this, you will need to fill out a simple application form:

Step one: select the topic of the complaint (for example: Imposition of additional services when concluding a contract);

Step two: indicate the name of the organization with which your appeal is related;

Step three: fill out the “text of complaint” field;

Step four: fill out information about yourself;

Step five: indicate the desired method of receiving a response.

Ready! The complaint has been sent to the Central Bank. If your appeal falls within the competence of the Central Bank of the Russian Federation, then it will certainly be considered along with other written appeals.

What to include in a complaint: document samples

There is no universal form for a complaint to the Central Bank that is suitable in all cases. But the text of the claim submitted to the Bank of Russia must contain:

- The full name of the applicant, even if the company is applying, the personal information of the director or manager on whose behalf the complaint is made must be indicated;

- TIN and OGRN for legal entities;

- telephone for communication;

- address for sending the response - email or postal;

- the name of the company against which the claim is being made, bank, microfinance organization or other reporting organization;

- a description of the situation that served as the reason for contacting the Central Bank of the Russian Federation;

- the essence of the claim, as well as demands or proposals that will satisfy the applicant;

- a list of supporting documents that certify the claim;

- links to legislative acts;

- date of filing the complaint and signature of the applicant.

You can submit an appeal yourself if you have done thorough preparatory work. But if the applicant plans to go to court, and the complaint becomes a stage of pre-trial or judicial settlement, then it is better to contact a lawyer or advocate. He will competently compose the text of the appeal and will be able to point out all violations from the point of view of the legislation of the Russian Federation.

The sample complaint to the Bank of Russia is different for an individual and a legal entity. To give you a general idea of what this document looks like, download links have been provided.

→

→

For a specific appeal, you will need to refer to those federal laws and violations that apply to your case.

How to submit a document?

The prepared appeal can be sent:

- By mail;

- Via fax;

- In person, by visiting the collection point for applications and correspondence at the territorial office of the Central Bank.

Of the above, the first option is recommended. It must be sent by the recommended letter with a description of the attachment and a notification of receipt. There are several advantages, namely:

- There is no need to listen to the opinion of the bank employee receiving the complaint;

- The risk of refusal of admission is reduced;

- The complaint will be taken seriously and a response will be given within the time limits specified by law;

- For regulatory authorities and the court, the sender will have evidence of the appeal in his hands.

A fax message is not always accepted by the court as evidence of a timely filed complaint. An alternative to postal communication is through an application collection point. In this case, it is necessary for the person in charge to sign the date of receipt of the complaint.

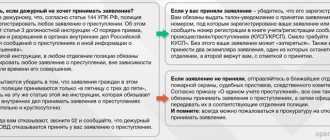

You may encounter veiled actions by a bank employee who is guided by unspoken instructions to limit the acceptance of such requests. For example, the applicant will not sign the second copy; they will convince him that he needs to contact other institutions, for example, the court.

Through the Internet reception of the Central Bank of the Russian Federation (online)

The fastest way to file a complaint with the Bank of Russia is via the Internet. In addition, this method also saves money on postage. To use this method of contact, you must :

- Go to the official website of the Central Bank.

- Find the “Internet reception” section and enter it.

- Select the “file a complaint” option.

- From the proposed application topics, click on the appropriate one.

- Following the system prompts, enter information in the appropriate lines/windows.

The preparation carried out at the preliminary stage will allow you to enter the necessary information, write it down briefly and to the point. Difficulties may arise if you follow emotions, without any prior contact with bank employees or lawyers, and immediately send a complaint to the Central Bank. There is a high probability that it will not be possible to compose it correctly, and the answer will come only formally.

Terms of consideration

Regardless of whether the complaint is submitted by mail or through the official website, it is considered within the period prescribed by law. Somehow such requests are not highlighted separately, so such requests will receive a response within 30 days , taking into account postal delivery of letters. Therefore, an electronic complaint will receive a response faster.

Who else can you complain to the Central Bank about?

Complaints are written to the Central Bank about the work and specific actions of not only banks, but also other organizations:

- credit cooperatives;

- housing savings cooperatives;

- pawnshops;

- insurance companies;

- microfinance organizations;

- non-state pension funds;

- investment fund managers.

In addition, the Bank of Russia is approached to resolve disputes with statistical authorities, the foreign exchange market, and between participants in the commodity market and the securities market. A complete list of reasons and organizations is posted on the Internet reception page of the Central Bank of the Pension Fund.

How long does it take to process an application?

A regular complaint that does not require the involvement of other supervisory authorities and inspections will be considered within 7-30 business days. If a credit institution has committed serious violations, the investigation period can last up to 2 months. But most often, a response or an interim letter about additional verification is received by the applicant within 30 days.

After completing the verification, the Central Bank sends a response to the communication channel that was indicated as preferred. If the request is sent through the online reception, then the response will be sent electronically to the specified e-mail. In other cases, a registered letter is often sent to the sender's specified postal address.

How to properly file a complaint

In order for the problem put forward by the applicant to be resolved, it is necessary to correctly compose the text of the appeal. When drawing up a document online, the client enters only the essence of the claim. If the document is submitted by other methods, it is imperative to follow the accepted form for submitting documents: to whom the complaint is addressed, full name. the applicant, indicating the registration address, contact phone number or email address.

Rules for drawing up the text of a complaint:

- The writing style is businesslike, emotional expressions are not allowed, the norms of literary language must be observed.

- Events should be described in chronological order.

- Describe only essential details of the event.

- The document must contain specific dates, names, and links to documents.

- Copies of documents must be attached to the complaint.

- If the applicant has already addressed this complaint to the management of the bank, but has not received a response or the bank’s response has not satisfied the client, a link should be made to this, attaching the complaint itself and the response received from the management of the credit institution.

- If there are video materials, you can also make a reference in the complaint and attach them as evidence.

- When filing a complaint against the actions of employees, it is good to have written testimony of witnesses , which are also attached to the list of documents.

The conclusion should write what the applicant wants to receive when considering the complaint , for example, “Please look into the situation”, “I ask you to be held accountable”, etc. How the applicant should be notified of the measures taken: by email, by registered mail to specified address.

The complaint must contain references to specific provisions of the documents regulating the activities of banks that were violated. Information should only be taken from official sources.

At the end of the message, a list of documents attached to it is compiled. Documents are attached in copies; in some cases, notarization is required.

The complaint can be written by hand or typed on a computer and signed by the applicant himself, indicating the transcript of the signature and the date the document was compiled.

Where else can you file a complaint?

If it was not possible to solve the problem through the Bank of Russia, then you can contact other authorities:

- Rospotrebnadzor - in case of violation of the rights of the client as a consumer of a service or banking product. And also in the case when the client did not have enough information to make a decision or it was unreliable.

- The prosecutor's office - in case of violation of the civil rights of clients.

- Federal Antimonopoly Service (FAS) - in case of a unilateral change in conditions, for example, an increase in the interest rate on a loan or a decrease in the deposit. The content of the complaint should indicate, not the conditions, but the fact that in this way the bank obtained a competitive advantage in an illegal way. Here you can also complain about SMS spam, which endlessly rains down on the client.

- Association of Russian Banks , which not only protects the interests of banks, but also strives to improve their work. This organization's website also accepts complaints from customers.

- Financial Ombudsman's office . This impartial institution for resolving disputes appeared in the Russian Federation 12 years ago. The Financial Ombudsman does not look for someone to blame. It helps to find a compromise between the bank and the client on mutually beneficial terms.

You can write an appeal to any of the above organizations if the violations are related to:

- dissemination of personal information;

- carrying out transactions on client accounts without his order and consent;

- transfer of securities owned by the client to third parties;

- changing the terms of the contract, which led to a violation of consumer rights and civil rights.

Complaints can be submitted to all these authorities simultaneously. It is especially important to do this if a lawsuit is brewing between the client and the credit institution. In this case, it is better to enlist the support of an experienced lawyer. He will help you correctly draw up all documents with reference to current legislation and in compliance with established procedures.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Case practice

The Central Bank often holds commercial banks accountable for violating anti-money laundering requirements. This is precisely what is associated with the facts of reinsurance of financial institutions and suspension of transactions with money, requirements from clients to confirm the legal method of receiving funds.

Banks that are subject to sanctions are filing lawsuits against the Central Bank . Thus, the Arbitration Court of the Primorsky Territory considered the application of a credit organization that was subject to a fine. The reason is that when registering a transaction, the passport data of individuals was indicated, and not the name of the legal entity that took part in the transaction.

According to employees of the territorial division of the Central Bank of Russia, such actions are a violation of the legislation on combating money laundering and the financing of terrorism. The unlawful acts committed are recorded in a protocol on administrative violation.

The management of the credit institution considered the resolution and presentation illegal and appealed to the arbitration court demanding their cancellation. During the meeting, the fact of entering false data about the persons who made the transaction was confirmed.

Therefore, the conclusion drawn and the punishment in accordance with the specified legislation, as well as the regulations of the Central Bank, were considered fair. The claims were rejected, appeal and cassation left the decision of the first instance unchanged.

Comments: 19

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Evgeniya

10/08/2021 at 09:14 Hello, I took out a micro loan from Squirrel Cash, they approved 13,000 rubles, they transferred 5,000, but that’s still nothing, they began to write off money from the card, I reissued it, but they didn’t accept money from another card, the next day they started threatening me and my relatives tell me what to do although I can’t get through to them

Reply ↓ Anna Popovich

09.10.2021 at 17:57Dear Evgeniya, in your Belka Credit personal account, enter your login (phone number) and password, click “Login”. Next, open the “Settings” section, delete personal data, linked bank card information, and disable the subscription. Your personal account will be deleted within 5 days, additional services will not be debited. If the threats continue, contact the Central Bank of the Russian Federation and the prosecutor's office.

Reply ↓

08/30/2021 at 09:44

Hello, my daughter took out a loan secured by property, more than a million rubles. 30 thousand were subtracted from this money; consumables without payment name are available. They deducted 70 thousand rubles for insurance, as they say, but there is no insurance itself. These amounts are included in the loan balance; upon oral appeal they explained that 30 are bank services, 70 tr. This is insurance and they printed out insurance under the same name, but for a different person. They responded to a written request to return these amounts with a refusal, 14 days have passed, the period within which 70 thousand rubles can be returned. for insurance, but no insurance was provided. The question is whether the bank acted legally in withdrawing these amounts from the loan and whether it is lawful to demand the return of these amounts. The loan was taken out in April 21, and since then negotiations have been going on, where I act on behalf of the borrower, on the basis of a power of attorney.

Reply ↓

- Anna Popovich

08/31/2021 at 01:22

Dear Alexey Alekseevich, carefully study the contract, what insurance conditions are stated there. The second point is ignoring your demands within the 14 days provided for the return of insurance - this is an objective violation of your rights; you must contact the bank with a corresponding complaint in writing. After receiving an answer, we can talk about further tactics.

Reply ↓

08/30/2021 at 00:07

Hello! I need help filing a complaint online with the Central Bank about illegal actions of the bank. Please help!

Reply ↓

- Anna Popovich

08/31/2021 at 00:06

Dear Olga, you can contact the Central Bank through the Internet reception (cbr.ru/Reception).

Reply ↓

08/14/2021 at 10:53

Hello! They called me from a Moscow phone number and introduced themselves as a credit institution, someone named Boyko, who said that someone named Kravtsov, by my power of attorney, wants to get a loan. I replied that I didn’t know this person. Apparently this organization did not give him a loan, but with this fake power of attorney he can go to another one that will not check the power of attorney and will give a loan in my name. What should I do? I am 60 years old and a pensioner living in the Samara region.

Reply ↓

- Anna Popovich

08/16/2021 at 19:19

Dear Larisa, contact the police; further, such a power of attorney must be revoked by a notary.

Reply ↓

08/06/2021 at 16:16

In 2021, Investtorgbank verbally, without written confirmation, denied me a credit holiday or restructuring of a secured loan. Can I now sue the bank?

Reply ↓

- Anna Popovich

08/06/2021 at 23:06

Dear Evgeniy, unfortunately not. Firstly, because a written response from the bank would be required as evidence, and secondly, the statute of limitations on your question has already passed.

Reply ↓

04/05/2021 at 21:57

Hello. After my mother died, I took over the inheritance. The notary submitted a request to the bank about the accounts that belonged to the mother. Sberbank did not find closed accounts for which compensation was due for “real services”; they were opened on June 20, 1991. I know for sure that they were because at that time I I myself worked at Sberbank and I paid compensation. What should I do? Who should I contact? Help

Reply ↓

- Anna Popovich

04/05/2021 at 22:13

Dear Elena, if you have facts in favor of the fact that Sberbank provided false information on the deceased’s accounts, you can file a complaint with the Central Bank through the online reception on the department’s website.

Reply ↓

03/22/2021 at 09:49

Hello, scammers took money from my Tinkoff credit card, now the bank is forcing me to return this money with interest. They persuaded me to agree that I would pay a certain amount. By now I figured it out, I decided to refuse the agreement, I called the bank and they said that I would have to pay everything. I wrote to the Bank of Russia and Rospotrebnadzor. I just don’t know if I wrote it correctly. I am a disabled person of 3 yrs, I kindly ask you to consider my request.

Reply ↓

- Olga Pikhotskaya

03/22/2021 at 14:11

Vladimir, good afternoon. You can contact the Central Bank through the Internet reception (cbr.ru/Reception). You can chat in the mobile application, call the contact center, or send a message electronically.

Reply ↓

02/16/2021 at 07:14

On January 29, PJSC Sberbank dofl 8615-0140 Kemerovo was written off from the social card; alimony funds for two minor children failed more than once and on February 9 they wrote a claim for a refund today; February 16 no money; the children have been sitting without money for almost 3 weeks. Did the bank have the right to write off alimony?

Reply ↓

- Anna Popovich

02/16/2021 at 20:20

Dear Vyacheslav, alimony payments have a designated purpose and are collected from the debtor in enforcement proceedings for the maintenance of children. It is on this basis that the bank does not have the right to write off them to pay off debt under loan obligations. You have the right to write a complaint to the Central Bank, as described in the article.

Reply ↓

09.17.2020 at 15:54

I, Sikorskaya I.V. a pensioner since 2010, on 01/28/2020 she contacted the Yuzhny branch of Uralsib Bank PJSC in the Adler district of Sochi for re-registration of the deposit. The bank employee immediately began to persuade me to apply for the purchase of investment shares in the same bank. I repeatedly asked (3 times) whether my money (principal amount) would be saved in any case on the market, to which the bank operator (signature on application No. 238701-U602 dated 01/28/2020 - Amelina Kristina Vladimirovna) categorically stated, that of course it will be preserved, and I can’t even doubt it! The most important thing is that after filling out the application and agreement, the bank employee did not let me read it, but immediately gave it to me to sign. On February 5 or 6, 2020, I came to the bank again to pick up my money, because... I read the terms of the contract and realized that my money was not insured, to which the same bank operator again assured me that I would trust her and that I would receive my principal amount at any time and in any case!!! When I finally found out that I was simply deceived at the Adler Uralsib Bank, I wrote a complaint dated March 26, 2020 to the manager against the bank’s actions, to which I received an “answer-unsubscribe” on April 15, 2020, signed by the General Director of Uralsib Management Company JSC A. F. Galimnurov that they allegedly conducted an investigation, which consisted in the fact that the Criminal Code did not investigate on its own (for example: after hearing an audio recording, etc.), but sent a request to the same bank that I am complaining about!!!! Will the bank really not cover up its employee and why was the most powerful argument, the audio recording of our conversation with the bank employee, not listened to!!! After all, this is an obvious, blatant fraud, and for this, this employee and her manager should at least be held accountable. I ask the Central Bank of Russia to look into my complaint (finally listen to the audio recordings of January 28, 2021 and 5.02 or 06 February 2021 of our negotiations) and return my initial amount in the amount of 209,772 rubles, and also hold accountable the employees of the Adler Uralsib Bank who are involved in in my opinion illegal actions. In accordance with Russian legislation, I ask you to provide an answer within a month. If the answer is unsatisfactory, I reserve the right to appeal to the prosecutor's office of the Adler district, the prosecutor's office of Sochi, the Prosecutor General's Office, and finally to the courts of higher instances.

Reply ↓

05/11/2020 at 10:55

Hello, my name is Zina, I found myself in a tezholm situation, I left for Kyrgyzstan on March 13, return tickets, I have to stay at home on March 20 and the borders were closed due to the carnavirus and I am in a foreign country these two months that I am in Kyrgyzstan. I hope the lady will return soon, please ask for preferential or reduced interest

Reply ↓

- Klavdiya Treskova

05/11/2020 at 12:03 Post author

Dear Zina, you should contact the bank where you received the loan. When communicating with a bank representative, explain your current situation and listen to the proposal of the bank employees. Perhaps you will be approved for a credit holiday or offered restructuring. Read what is needed to approve a credit holiday in this article. Don’t delay contacting the bank and then it will be easier for you to find a compromise and not increase the overdue period.

Reply ↓