Home / Disputes with the bank / Finding out how and where to complain about the bank?

The rudeness and incompetence of employees of banking institutions can cause not only financial losses for citizens, but also damage to health. And the loss of money from the card account, and the groundless introduction of restrictions into the loan agreement, and the obstacle to the withdrawal of money - all this must be appealed.

Higher and supervisory authorities may consider violations of legislation in the actions of bank employees, including on the protection of consumer rights, which will allow the institution to recover a penalty.

In what cases can you complain to the Central Bank of the Russian Federation?

The Central Bank of the Russian Federation exercises control over the implementation of legislation by credit institutions and the normal functioning of the financial system as a whole. In addition to commercial banks, the Central Bank controls the following organizations:

- microfinance organizations;

- Insurance companies;

- pawnshops;

- non-state pension funds;

- credit cooperatives and other financial communities.

The Central Bank of the Russian Federation is authorized to consider all complaints about violations of legislation by banks and other dishonest actions of credit institutions. However, the most common cases of contacting the Central Bank of the Russian Federation are:

- an increase in the loan rate not provided for in the agreement and other attempts to change the terms of the loan agreement unilaterally;

- unlawful accrual of fines and penalties;

- writing off money from the client's account without his consent;

- disclosure of customer information to third parties;

- ignoring customer requests;

- imposition of services;

- incorrect work of bank employees;

- assignment of the right to claim a debt without the written consent of the borrower.

Complaints that do not fall within the competence of the Central Bank of the Russian Federation will not be considered.

What is the Central Bank of Russia and what functions does it perform?

So, the Central Bank of the Russian Federation (Bank of Russia, Central Bank, Central Bank of the Russian Federation) is the main regulatory body of the country’s credit system. Simply put, this is the main Russian bank, which is responsible for the security and stability of the ruble in relation to other currencies of the world, the development and strengthening of the banking system, supervision of the activities of other banks, issuance and revocation of licenses.

Let us note the specific differences and features of this organization:

The Central Bank of Russia is a legal entity, but its goal is not to make a profit;

The Bank of Russia is accountable to the State Duma of the Russian Federation;

In carrying out its functions, the Central Bank is obliged to develop and implement policies to prevent, identify and manage conflicts of interest;

The Chairman of the Bank bears full responsibility for the activities of the Bank of Russia (since June 24, 2013, this position has been held by Elvira Sakhipzadovna Nabiullina);

The regulatory, control and supervisory functions of the Bank of Russia in the field of financial markets are carried out through a permanent body - the Financial Supervision Committee;

The Central Bank has the right to file claims in the courts in the manner prescribed by the legislation of the Russian Federation;

At the same time, regulatory acts of the Central Bank of the Russian Federation can be appealed to the court in the manner established for challenging regulatory legal acts of federal government bodies.

Powers of the Central Bank when considering appeals

The Central Bank of the Russian Federation issues licenses for banking activities and monitors compliance by credit institutions with banking legislation. At the request of citizens, the Central Bank has the right to initiate an inspection and, if violations are detected, take preventive measures. Thus, the Bank of Russia can block an account from which funds are unlawfully debited, issue a warning to the bank, deprive it of its license, and influence services if an error occurs in recording banking system data.

However, if a bank client needs to return money that was unlawfully withheld, the Central Bank is unlikely to help with this:

he does not have the appropriate powers. In this case, you need to contact the prosecutor's office or court.

The practice of considering citizens' appeals by the Central Bank shows that this organization most effectively solves the problems of inadequate banking services. In case of legal problems, the appeal is usually redirected to other, more competent structures: FAS, Rospotrebnadzor or the prosecutor's office.

How to write and submit a complaint or claim against Russian Post?

Where and how to write a complaint against Sber?

When to file a complaint?

If you cannot agree on a discount with the debt collector, you should file a complaint even for the first and single violation. If a collection company commits many minor or two serious violations, it may be excluded from the FSSP register, deprived of its certificate and prohibited from working in the debt collection market. The same consequences occur with systematic violations committed during the year.

If you ignore a minor violation of the law, debt collectors may feel impunity and move on to more serious actions. For example, insults in a conversation can turn to threats, real violent methods. Not only the debtor himself, but also his family members and close people can suffer.

Sample complaint to the prosecutor's office against debt collectors (18.7 KB)

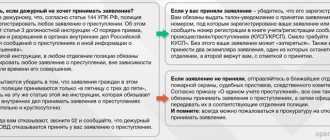

The procedure for sending and considering appeals

Although the Central Bank of the Russian Federation is not a government body, it is obliged to consider citizens’ appeals in accordance with Federal Law No. 59-FZ of May 2, 2006 “On the procedure for considering appeals from citizens of the Russian Federation.” Therefore, the period for consideration of a complaint by the Central Bank of the Russian Federation is 30 days from the date of receipt, and if additional verification of the information specified in the appeal is required - 60 days.

There are several ways to file a complaint with the Central Bank of Russia.

Important! No matter how a complaint is submitted to the Bank of Russia against the actions of a commercial bank, the result of its consideration largely depends on how exactly it is compiled: the reason for the appeal is formulated, evidence is provided, and references to regulations are provided. Otherwise, you can receive a formal reply from the Central Bank, which will not help in solving the problem.

By phone

By phone you can find out the address and operating hours of the regional bank branch, find out the status of consideration of the application, and get advice.

Contacts:

- 300 – free short number for mobile phones;

- +7 – for residents of Moscow and the Moscow region;

- 8 – single hotline.

Through the Internet

This method is the simplest and fastest. Complaints submitted through the Internet reception of the Central Bank of the Russian Federation have the status of written appeals and are subject to mandatory consideration.

In order to submit a complaint to the Internet reception of the Bank of Russia, you need to open the official website of the Central Bank of Russia. In the form that opens, the request is filled out in 4 stages:

- Selecting the topic of the complaint. If the complaint concerns the relationship between the bank and its clients, you must select “Banking products/services”

- Description of the problem. It is necessary to fill in the fields “Product” (with which service the problem occurred), “Type of problem” and “Name of organization” (bank). Next comes the “Text of the complaint” field, where you need to state the essence of the complaint in free form. The problem should be described sequentially, in chronological order, with details of relevant documents and other evidence. Here you can attach files related to the complaint: a scan of the loan agreement, history of debits from the account, etc.

- Contacts. You can use auto-fill through government services or fill out the fields yourself. It is important to provide only reliable information about yourself, otherwise you may not receive a response to your complaint. You should definitely leave your email, which will receive a response.

- Data checking. After checking that all fields are filled in correctly, you can send a complaint to the Central Bank of the Russian Federation.

Come for a personal appointment

Personal reception of citizens at the central branch of the Bank of Russia is carried out at the address:

Moscow, Sandunovsky per., 3, building 1. Personal reception is carried out according to the schedule: Monday from 10:00 to 18:00, Tuesday-Thursday from 10:00 to 16:00, except non-working holidays.

You can also come to the regional branch of the Central Bank of the Russian Federation. A list of territorial branches of the Bank of Russia and their contacts can be found here.

At the reception, you can get advice on the legality of the banks’ actions, as well as submit a written complaint, which will be immediately registered. To do this, you need to make 2 copies of the complaint to the Central Bank, so that you can give one to a bank employee, and put a mark of delivery on the second.

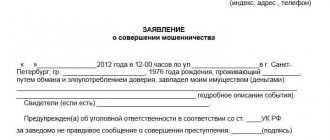

Send a request by mail

In order for a written complaint not only to be accepted, but also to be answered on its merits and action taken, it must be correctly drafted. In particular, the style of presentation in the letter should be businesslike, the circumstances should be presented concisely and without emotional overtones.

To write an appeal to the Central Bank, you must follow the following rules. The complaint begins with a header that indicates the sender's contacts and the name of the recipient: Bank of Russia. In order to receive an accurate answer, it is important to provide your correct information: full name, return address, telephone number and email address.

Next, you need to describe the essence of the complaint, indicating the following data:

- all relevant events in chronological order: date of application to the bank, name of the bank and address of the branch;

- Full name of the bank employees who performed the service;

- what rights, in the opinion of the applicant, were violated;

- links to regulations;

- requirement to conduct an investigation into the fact of violation and restore rights, provide explanations, etc.;

- attach all documents related to the complaint: account servicing agreement, payment documents, correspondence with the bank, etc.;

- date and signature.

Important! It is necessary to indicate exactly how the response to the appeal should be sent: by registered mail via mail to your home address or by e-mail.

Copies of all relevant documents are attached to the complaint.

Sample complaint

The letter should be sent by registered mail with return receipt requested to the address: 107016, Moscow, st. Neglinnaya, 12, Bank of Russia. Next, you need to wait for the return receipt, which will indicate the date of receipt of the complaint. It is from this date that the deadline for the Central Bank’s response to the appeal is considered.

We stop illegal actions

A real case that happened to clients of one of the leading banks in the Russian Federation. He purchased an apartment in the capital worth 10 million rubles. Since the buyer came from another city, he did not take risks and deposited the entire amount into an account at this institution. After that, I immediately called the bank branch in the capital and ordered money for the day of purchase. The institution’s employees promised that they would prepare an agreement, the transaction would be completed without problems, and the client would receive the money on time.

At the agreed time, the client applied for the required amount at the capital branch of the bank. In response to legal demands, he was told that the money would not be given until he presented documentary evidence that it had been received legally. Otherwise, he will have to pay a commission of 10%. After waiting all day at the branch of the financial institution, by 18.00 the client agreed to pay a commission of 5% (500 rubles) and took the money.

In the case considered, the bank client was in a hurry, did not want to miss out on a profitable deal, so he agreed to some financial losses. Thus, he encouraged bank employees to further abuse the rights granted to them.

are the most common violations of the rights of bank clients :

- Wrongful deduction of commission;

- Introducing restrictions and a ban on early repayment of loan debt without notification and consent of the borrower;

- Refusal to provide required information;

- Being forced to use a specific insurance or appraisal company;

- Other violations of current legislation, including the Law on Banks and Banking Activities.

When faced with any illegal, illegal action of the personnel of a financial institution, it is necessary to draw up and send complaints to higher and supervisory organizations. You need to act decisively, not just demonstrating intention, but rather strive to hold bank employees accountable.

Competent actions allow you to document the fact of illegal actions , which will allow you to avoid unjustified financial losses and receive a penalty from the bank with compensation for moral damage.

Features of the work of banking organizations

In the context of working with clients, the financial institutions in question have an important feature. It lies in the fact that banks are authorized to perform government functions to control certain activities of clients. This distinguishes them from other commercial organizations that only pursue profit.

In particular, we are talking about performing the following functions :

- Checking the cash discipline of organizations;

- Acting as a tax agent and currency control agent;

- Anti-laundering of funds obtained illegally.

For example, the provisions of Art. 22 of the Federal Law “On Currency Regulation and Currency Control” indicate that on the territory of the Russian Federation, currency control is carried out not only by the government and the relevant authorities, but also by currency control agents. The latter include banking institutions that operate legally (the appropriate licenses have been issued).

The bank carries out control functions on the basis and limits established by the legislation of the Russian Federation. He has no right to go beyond their limits.

In 2001, a law was adopted aimed at combating the laundering of illegally obtained funds (115-FZ). For more than 10 years, he did not have much influence on business activities. However, in March 2012, the leadership of the Central Bank of the Russian Federation adopted regulation No. 375-P, according to which financial institutions are required to take measures to identify questionable transactions in the activities of clients.

As a result, the number of blocking of monetary transactions between business entities has increased sharply and the trend continues.

But in its activities the bank is guided, among other things, by the provisions of the Civil Code of the Russian Federation (CC) . Therefore, he has no right:

- Determine and control customer transactions (clause 3 of Article 845 of the Civil Code).

- All letters of the Central Bank that interpret the norms of 115-FZ should be taken as recommendations; they are not binding.

- Require clients to present agreements and other documents related to commercial transactions.

The rules of law in the context under consideration (which relate to the activities of the bank), including the specified 115-FZ, only Rosfinmonitoring has the right to interpret. Therefore, despite all the letters of recommendation from the Central Bank, financial institutions have the right to delay the execution of orders to transfer money for 1-2 days.

In the example above, the client had to pay half a million rubles for such a short wait.

Bank employees can use methods of influence on the client that relate to minor dirty tricks, namely:

- Psychological influence, including repeated methodical negotiations with security personnel of the institution;

- Threats against the client that information about him will be transferred to law enforcement agencies;

- Regular and intentional slowdown of transactions;

- Forcing to close an account;

- Adoption of personal barrier tariffs.

Such actions must be responded to by drawing up and filing a complaint. Otherwise, the pressure will increase, which will lead to financial, time and reputational losses.

Where else to turn if the Central Bank did not help with the problem?

Rospotrebnadzor

Rospotrebnadzor is authorized to consider issues related to violation of consumer rights.

He checks the circumstances set out in the complaint, and if violations are detected, within his competence, he issues an order to the bank to eliminate the violations. Contacts: The complaint will be processed faster if you contact the branch of your region, but you can also contact the main branch directly.

- Call: unified consultation center - 8 (800) 555-49-43.

- Write to the Virtual Reception.

- Send a claim by mail or come to an appointment at the address: 127994, Moscow, Vadkovsky Lane, building 18, buildings 5 and 7.

The telephone number and address of the regional office of Rospotrebnadzor can be found on the website ХХ.rospotrebnadzor.ru, where ХХ is the region number, for example, 22.rospotrebnadzor.ru. You can call the department, come to a personal appointment, or send a complaint by mail.

FAS

Regarding credit organizations, the Federal Antimonopoly Service monitors the implementation of legislation on advertising and competition. Accordingly, you can complain to the FAS:

- for the presence of information in advertising of banking services that does not correspond to reality;

- to advertising spam;

- other violations related to bank advertising.

Contacts:

- Send a request electronically.

- Telephone.

- Personal reception: Moscow, st. Sadovaya-Kudrinskaya, house 11.

- Personal reception at the regional office.

- Postal address: Central office of the Federal Antimonopoly Service of Russia: 125993, Moscow, st. Sadovaya-Kudrinskaya, 11, D-242, GSP-3.

Financial Ombudsman

In what cases should I contact

The financial ombudsman (ombudsman) carries out pre-trial settlement of disputes between financial organizations and consumers of their services. In other words, if the bank does not respond to requests, you can write to the financial ombudsman, who will give qualified advice on issues of interest in the field of banking services, and also offer terms for resolving the dispute.

Contacts:

- Leave an email request.

- Call the Contact Center.

- Send an appeal by mail or come in person: 119017, Moscow, Staromonetny lane, building 3.

Prosecutor's office

In what cases should I contact

If a client suspects signs of fraud or other crimes (for example, disclosure of personal data) in the actions of the bank or its employees, it makes sense to contact the prosecutor’s office.

Contacts: You should write a written appeal to the prosecutor's office and send it by mail or take it personally to the prosecutor at your place of residence. You can find the nearest prosecutor's office using the Prosecutor General's Office website.

If the offense is not criminal in nature, you can write to the online reception of the prosecutor's office.