○ The concept of shared ownership. Causes of occurrence.

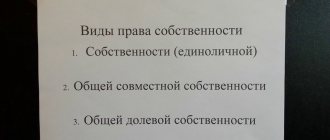

Shared property is the property of two or more persons, owned by them by right of ownership, with the share of each person determined by agreement or law. Clause 1 of Article 244 of the Civil Code of the Russian Federation. Property owned by two or more persons belongs to them under the right of common ownership. In practice, there are three reasons for the emergence of shared ownership:

1. Division by former spouses of jointly acquired property during marriage. A young family bought an apartment as their property, and after a couple of years the spouses divorced, then each of the former spouses owns a share in the apartment. 2. By way of inheritance. After the death of the owner, he may be left with a surviving spouse, parents, children, incl. children from the first marriage, who will also be heirs, are the first-priority heirs to receive the share of the deceased. 3. Acquisition of a share in an apartment. Obtaining a share in an apartment on the basis of a gift agreement, rent, pledge or by purchasing a share.

○ Sale of a share in an apartment.

To exercise their right to sell a share in an apartment, the owner must follow the following algorithm:

STAGE 1. We notify you about the sale of your share in the apartment. The seller must inform the other owners in writing of his desire to sell the share, since they have a pre-emptive right. The notice indicates at what price and under what conditions the sale will take place. In case of failure to notify, owners can go to court. If within a month none of the owners indicated their desire to buy the offered share, the Seller has the right to sell it to an outsider, but on the terms contained in the notice. When the owners agree to sell a share to an outsider, then to speed up the transaction process they can write a refusal before the end of the month and send it to the seller (Clause 2 of Article 250 of the Civil Code of the Russian Federation).

STAGE 2. Making a deal. The Seller and the Buyer turn to a notary to draw up and certify an agreement for the purchase of a share; for this, the notary is provided with a number of documents, which are determined separately for each transaction, but the general list includes the following:

• Information about the parties (full name, passport, place of registration). • The document on the basis of which the Seller acquired ownership rights. • Certificate of ownership (if available). • Notarized consent of the spouse for the sale/purchase of a share. • A certificate confirming the presence or absence of debt on utility bills. • An extract from the house register about the residents registered in the apartment. • If the transaction affects the interests of a minor, then a certificate from the guardianship and trusteeship authorities.

Important! Do not believe the information on websites on the Internet that say that you can buy or sell a share in an apartment without involving a notary; it is obvious that this information is outdated. As of June 2, 2021, amendments were made to Federal Law No. 122 “On state registration of rights to real estate and transactions with it,” which states that transactions for the alienation of real estate on the basis of shared ownership are subject to notarization.

STAGE 3. We submit documents to the registration authority. To register the transfer of ownership (according to Articles 131 and 551 of the Civil Code of the Russian Federation), it is necessary to submit documents to Rosreestr or the MFC. I recommend communicating with the MFC, although receiving documents on registration of property rights will take two days, but you will save personal time and nerves. The list of documents must be found out in advance. But there is a general package of documents that is provided in any case:

• Application for registration – the form is filled out at the registration authority. • Passports of the parties, birth certificates, if minors are present in the transaction. • Document confirming marital status. • Agreement and deed evidencing the transfer of the share. • A document confirming the basis of the Seller’s ownership of the share. • Documents from the guardianship authorities - if necessary. • Document confirming payment of the state fee.

STAGE 4. We pay tax. Once all registration actions have been completed, the seller must pay tax for the sale of the share (Clause 17.1, Article 217 of the Tax Code of the Russian Federation). We remind you that you have the right to receive a tax deduction for the purchased real estate.

Stages of the procedure

The basis for the process of purchasing shared ownership of a living space is a standard purchase and sale agreement.

The process is carried out in several stages:

- achieving agreement in principle between the parties to the transaction, including all co-owners of real estate;

- collecting a package of documents necessary for registering a transaction;

- concluding a purchase and sale agreement for shared ownership;

- state registration of rights to acquired property.

The law allows for registration of property rights from 12 to 18 days, depending on the region of the country. The deadline is counted from the date of submission of the complete package of documents to the registration authorities. It will take from a month to three to complete all the step-by-step instructions. If minors are registered in the apartment, or they are the owners of certain shares, the registration process will take several weeks longer.

Ownership of part of the living space is transferred at the time of state registration. An extract from the Unified State Register confirms the fact of registration.

○ Preemptive right of co-owner.

If the owner of a share in an apartment decides to sell it, he must first offer to purchase it to other co-owners. The co-owners have a month to decide not to purchase the share or to buy it back. And only then the owner who wants to sell shares in the apartment has the right to look for a buyer from outside (Clause 2 of Article 250 of the Civil Code of the Russian Federation). That is, other owners have an advantage in acquiring a sellable share in the apartment over unauthorized persons (Clause 1 of Article 250 of the Civil Code of the Russian Federation).

✔ When does the pre-emptive right not work?

• If the transaction is gratuitous (donation, rent). • If several shareholders expressed a desire to purchase a share. • If the share is sold at public auction, to pay off the debt of the owner of the share in enforcement proceedings or in bankruptcy.

How to force a share to be sold?

The question is answered

with respect, Victoria Suvorova, leading lawyer of a family law firm (Pyatigorsk) Once

upon a time there lived people in three rubles, Sasha used one room. Well, how I used it - I stored furniture there, my unnecessary things, in short, a warehouse. His ex-wife Sveta and their daughter lived in the other two rooms. Sveta really wanted to buy this room from Sasha and never see him or his things again.

Sasha lived separately, but did not want to sell his room to her. He doesn’t need money, and let him have 1/3 share in the apartment. As they say, the owner is a gentleman, he wants to keep the furniture, but he wants to settle a camp there.

Sveta thought and thought and decided to go to court. The claim was to recognize Sasha’s share as insignificant and to buy it out.

But she lost the first trial, and the appeal too. The case was appealed and the Supreme Court (this is the main one in our country) sided with her.⠀

○ What to do if one of the owners is against the sale of the apartment?

No one can prohibit the owner from selling his share in the apartment, not even other owners. If a co-owner is against the share in the apartment being sold to an outsider, then he has the right to give his consent to its purchase within a month from the receipt of notification of the sale. In practice, there are cases when co-owners sent objections to the seller for the sale of a share, but did not take any action to acquire it, then in this case the seller should wait until 30 days have passed from the date of notification of the sale and sell the share to unauthorized persons.

Possible problems during the transaction process

During the transaction, some difficulties may arise.

Co-owners

The main risk when repurchasing shared ownership relates to the reaction of its co-owners. Often the relationship between them is tense, and this tension is transferred to the buyer. Despite the fact that they are being offered a priority buyout, some of them, as an act of revenge, may protest the deal by filing a corresponding lawsuit.

Important! It is necessary to obtain from them notarized consent to complete the transaction and wait a month from the date of notification of the sale.

Minors

A significant risk is the presence of minors registered in the apartment or owning other shares. The guardianship authorities monitor the observance of their interests; they may not consent to the ransom if they consider that the interests of the children are being harmed.

Mortgage

Problems may also arise when applying for a mortgage. Banks are wary of lending to buyers of shares. The fact is that the share, from the point of view of banks, serves as unreliable collateral for the loan. If payments are stopped, it cannot be physically reclaimed to pay off the debt.

An exception is made for citizens who buy out the last share and combine the apartment into a single property. In this case, the object can be alienated from the sole owner and serves as reliable collateral for the loan.

Expert opinion

Klimov Yaroslav

More than 12 years in real estate, higher legal education (Russian Academy of Justice)

Ask a Question

Due to the prevalence of fraudulent schemes involving the imaginary transfer of property rights between relatives for the purpose of cashing out loan funds, the likelihood of approval of a loan for the purchase of shares by members of the same family from each other is low. They are also subject to high mortgage lending rates, which should compensate the banking institution for the increased risk.

○ What if one of the owners refuses to receive notice of the sale?

If a co-owner refuses to receive notification of the sale of a share in the apartment, then there are two ways to solve this problem:

1. Send the notice yourself by mail. The seller sends a letter about the alienation of the share by registered mail with notification. Better yet, a letter with a declared value, as opposed to a registered letter, is accompanied by a list of documents contained in the envelope, which is certified by a postal employee. Then the person to whom the notice is addressed will not be able to subsequently claim that the Seller sent him a blank sheet of paper and not a notice of sale. If the co-owner does not pick up the letter from the post office, then it will be returned to the Seller with the appropriate mark, in which case the envelope will be considered proof of sending the specified notice. 2. Notify through a notary. The seller, through a notary, issues a notice of sale of a share in the apartment. The notary, in his own name and address, sends a registered letter with acknowledgment of receipt. If the co-owner does not contact the notary within 30 days from the date of delivery of the notice, the latter will issue the Seller a certificate confirming that the co-owner was notified of the sale of the share. If the co-owner did not receive the letter and it was returned to the notary, then the notary issues a certificate stating that the seller took all possible actions to notify this participant in shared ownership.

Of course, the second option is more attractive, but in fact some notaries refuse to issue a certificate if the notice of sale is not served, so before contacting a notary you should clarify whether he will issue a certificate, so as not to waste time and money, but contact another notary .

○ Purchase and sale agreement.

To draw up a purchase and sale agreement, you should contact a notary’s office; it will be drawn up by a notary’s assistant. The notary does not certify independently executed purchase and sale agreements regarding real estate. The contract must contain the following:

- Information about the parties (full name, passport, place of registration).

- Information about the share in the apartment (what address it is located at, the size of the share, the area of the apartment).

- Price, payment terms, payment procedure.

- Information about the presence or absence of restrictions and rights of third parties.

- Rights and obligations of the parties.

- Based on what documents the share is being sold.

- Information about the transaction for the alienation of real estate on the right of shared ownership to the persons who will reside.

- Information that the premises are suitable for habitation.

- The procedure for paying transaction costs, in what order and by whom they are paid.

- Information that other owners have been notified of the sale of the share.

As well as other information that the parties to the agreement would like to indicate in it. Obviously, the contract is a fairly voluminous document and it is better to entrust its drafting to a professional. The contract is drawn up in three copies: 1 – to the Seller; 2 – Buyer; 3- to Rosreestr. An act must be drawn up with the agreement, which indicates the transfer of the share to the new owner (Clause 1, Article 556 of the Civil Code of the Russian Federation).

In crowded but not mad…

Yes, of course, you can be guided by this principle and tolerate unwanted proximity. But still, if you are ready to fight for your rights and circumstances allow you to do so, go into battle!

If you have become a victim of unscrupulous plaintiffs, do not lose heart either. There is no pre-established truth in such disputes. It all depends on how the line of defense is built. We are always ready to give an objective assessment of your situation and help achieve justice.

The article was prepared taking into account the edition of regulatory legal acts in force as of October 21, 2018. Author of the article: Maya Sablina, Director of the Law Laboratory

Estimated cost of services to support cases of forced buyout of shares in the Maya Sablina Law Laboratory:

| № | Name of service | Cost, rub.) |

| 1. | Consultation on forced buyout of shares | 5 000 – 10 000 |

| 2. | Drawing up a claim for forced redemption of a share | 20 000 – 30 000 |

| 3. | Forced redemption of a share through the court | 90 000 – 120 000 |

| 4. | Representation on forced purchase of shares at the appeal stage | 40 000 – 50 000 |

Don't be afraid to defend your rights and do it with us!

○ Risks when purchasing a share in an apartment.

Risks when purchasing a share in an apartment cannot be avoided, here are the most common:

1. Replacement of the purchase and sale agreement with a gift agreement. One of the most common risks for the Buyer is the Seller’s proposal to formalize the alienation of the share through a gift agreement, and transfer the money in accordance with the general procedure. The risk is that the Seller turns out to be dishonest and the share “gifted” to you does not live up to expectations for a number of reasons (for example: antisocial neighbors, in fact the condition of the premises turned out to be worse, etc.) Go to court to terminate the gift agreement and return your hard-earned money from the Seller useless, because the gift agreement is gratuitous. 2. “Share” is not “room”. In most cases, the Buyer is not aware of the difference between the concepts of “share” and “room”. A share is not always a separate, isolated room. A share in an apartment can only be seen in documents in the form of a fraction (for example: ½, ¼, etc.). If you have acquired a share in an apartment and want to allocate a room in this share, then this can be done in agreement with other owners or through the court, provided that it is technically possible to separate by making a separate entrance, kitchen, bathroom, etc. without damage to property. In practice, it is almost impossible to distinguish. 3. Problems with selling shares. The cost of a share in an apartment is always lower than the cost of a separate room. If you want to sell the acquired share within the time frame and at the price at which you originally expected, it may not be possible. 4. Moral aspect. When purchasing a share, you should take into account that strangers will live in the same apartment with you and conflicts cannot be avoided.

Types of ransom

Depending on the family or legal relationships in which the shareholders are, there are several types of redemption.

Deal between relatives

Often relatives who receive an inheritance do not want to live together. Then one of them sells his part of the apartment to the others. Relatives who own shares receive priority when redeeming them.

If the owner plans to sell his part of the home, he is obliged to notify the co-owners in writing about the planned purchase. The notification indicates the price and additional conditions for the sale of the property. Within 30 days from receipt of the notification, co-owners of the living space have the right to declare their intention to buy out the share.

Important! Only after the expiration of a month and after receiving their written refusal, the owner can offer his shared property for sale to third parties.

Through the court

When selling shared ownership, a situation often arises in which the co-owners do not want to buy out the share offered to them. More often this happens with small shares.

Three conditions must be met:

- shared ownership is considered insignificant;

- the owner is not interested in ownership;

- impossibility of allocating part of the property in kind.

The person who wants to buy it goes to court with a claim. The statement contains a requirement to recognize the specified share as insignificant. According to the court decision, the previous owner receives the equivalent of the value in money, and the plaintiff’s share increases.

If one of the co-owners wants to buy out the other's share, but he refuses to sell, a lawsuit is also sold.

To satisfy the claim, the following conditions are required:

- the owner of a small share is not related to other owners;

- shows no interest in the property, does not live in the apartment;

- does not participate in paying for housing and communal services.

These facts will need to be confirmed by documents and testimonies from residents.

For a mortgage

If the available funds are not enough, those wishing to buy out the share can apply to the bank for a mortgage loan.

To do this, you will have to prepare a number of documents:

- mortgage loan agreement indicating the property;

- mortgage on the loaned property;

- agreement for the sale and purchase of shared ownership.

Attention! If the last share is purchased, and the remaining part of the property already belongs to the buyer, then the apartment as a single object can act as collateral under the loan agreement.

For maternity capital

Maternity capital can be used to improve the child’s living conditions. The certificate amount is not enough to purchase an apartment. The solution is to acquire shared ownership. This is convenient if the ransom is carried out from relatives, and the family already lives in this apartment.

The use of maternity capital is monitored by Pension Fund employees. They strive to prevent fraudulent transactions.

To approve a related buyout, the following conditions will need to be met:

- suitability of living space for living, full compliance with sanitary standards;

- as a result of the buyout, the family receives a separate premises or apartment or house for use;

- the facility is located on Russian territory;

- the redemption is carried out after a three-year period from the birth of the child for whom the maternity capital was received.

Maternity capital funds can be supplemented with mortgage lending.

In addition, additional restrictions are introduced:

- Redemption transactions between spouses are not allowed, since legally the second spouse is an equal co-owner of maternity capital intended for the entire family;

- the possibility of cashing out the ransom amount should be excluded.

For this purpose, an encumbrance may be placed on the property, preventing the property from being sold for a certain time.

The purpose of all these checks and restrictions is to ensure that the transaction results in a real and permanent improvement in the child's living conditions.

○ Advice from a lawyer:

✔ Ways to bypass the pre-emptive right to purchase a share and the risks associated with these methods.

There are two options when the application of a preemptive right can be avoided:

1. Conclusion of a gift agreement. 2. Conclusion of a loan agreement.

Donation agreement. When drawing up a gift agreement, no one can prohibit the owner from donating his share. Guided by paragraph 1 of Article 250 of the Civil Code of the Russian Federation, the preemptive right applies only to sales contracts. Risks of registering a gift agreement:

- For the Buyer: the co-owner can go to court to have the transaction declared invalid or sham. In this case, the court will oblige the acquirer of the share to return it.

- For the Seller: the gift agreement, on the basis of clause 1 of Article 572 of the Civil Code of the Russian Federation, is gratuitous and for this reason the Buyer may not pay the Seller, and it will not be possible to recover funds from the dishonest Buyer in the future.

Loan agreement. The seller and buyer enter into a loan agreement for the amount of the cost of the share, and at the same time an agreement is signed to secure this loan with a pledge of the share in the right to the apartment. After which the person who is the borrower misses the loan repayment deadline and the parties draw up a compensation agreement, the subject of which is a share in the apartment.

Risks:

- For the Buyer: other owners can go to court to declare the transaction a sham, and the court will oblige the buyer to return the share.

- For the Seller: In case of a sham transaction, the Seller will be obliged to return the amount of money to the Buyer.