Is it possible to sell a car, how long after taking ownership?

To obtain the right to dispose of inherited property, it is necessary to issue a certificate at a notary's office. On the basis of such a document, a person has the right to register movable and immovable property, which he accepted as an heir.

The standard period for entering into inheritance is 6 months. After the specified time, the heirs receive official documents giving them the right to dispose of the property of the deceased.

According to Art. 1163 of the Civil Code, registration of inheritance can be carried out in a shorter period of time. To obtain a certificate, you must provide irrefutable facts about the absence of other claimants to the property.

Read more about re-registration of a car after inheritance here.

Is notarization required?

Without a notary, it is impossible to obtain documents confirming the right to inherit and use property. For proper legal registration, you need to bring with you to the notary office:

- personal passport;

- documents for the vehicle that will confirm that the deceased was its owner;

- STS;

- death certificate.

Without papers confirming the family ties between the heir and the testator or justifying the legality of inheritance, it is impossible to register a car in your name.

Features and stages of receiving an inheritance

The car is inherited in the standard manner. The specifics of the deal depend on the specifics of the machine. No later than six months after the death of the former owner of the vehicle, it is required to draw up an application and apply to a notary in order to open an inheritance case.

Papers for receiving inheritance:

- Death certificate of the owner of the car.

- Papers confirming relationship.

- Heir's passport.

- Vehicle registration certificate.

- Ownership of a vehicle.

First, the cost of the car is assessed. The procedure is carried out to calculate government taxes. The assessment is carried out by specially trained people. The price of a car is affected by its age, mileage, wear and tear, and the presence of damaged elements.

Six months after the vehicle is assessed, papers are issued on the legal entry into inheritance rights . After this, you are allowed to start registering the car in your name or sell it immediately.

How to sell the resulting car?

According to Art. 1110 of the Civil Code, the heir has the right to dispose of the property inherited to him at his own discretion. All procedures are carried out only after the official entry into inheritance and receipt of a certificate of inheritance rights from a notary. Next, we will consider in detail how to sell a car after inheriting.

Registered to yourself

After the procedures for re-registration and registration of the car in the name of the heir, he has the right to dispose of it at his own discretion. A citizen must remember that if he owns a car for less than 3 years, he will have to pay the state a tax amounting to 13% of the cost of the vehicle.

No self-registration

The heir is given a period of 10 days to register the car after receiving documents from the notary. During this period, he has the right to sell it without registering it in his name. To register a vehicle for the new owner, you need to visit the traffic police department and present the following documents:

- personal passport;

- certificate of inheritance;

- original papers for the car.

If a buyer could not be found within ten days, then the car must be registered in the name of the heir. For the procedure you will have to pay a fee of 500 rubles.

By proxy

The use of the services of a trustee is possible only after the heir has registered ownership of the car. If the vehicle has not been registered (the 10-day period has not expired), then sale by power of attorney is impossible.

The nuances of the transaction if the vehicle was inherited by two or three people

10 days after entering into inheritance rights, the car must be registered - there is only one owner - the decision is made by general agreement or by way of a court decision. Selling vehicles has its own nuances:

- the general consent of all interested parties is separately stated in the purchase and sale agreement;

- Attached separately is a document confirming the agreement of all heirs among themselves - with signatures.

The absence of certified papers on consent to the sale of a shared vehicle may be challenged in court.

Is it possible to sell the share of the transferred car?

The sale of a shared inheritance begins with an offer to buy part of the car to the second heir. A car is an indivisible property and it is unlikely that any stranger will want to buy half or part of it. In practice, the owners of the vehicle jointly sell it, and the money received is divided in accordance with the shares received under the will.

Art. 246 of the Civil Code of the Russian Federation states that the disposal of property in shared ownership can only be carried out by agreement of all owners.

List of documents

Preliminary preparation for selling a car involves collecting the following documentation:

- purchase and sale agreement between the heir and the person interested in purchasing the vehicle;

- document on the right of inheritance;

- receipt of paid state duty;

- buyer’s passport – it will be required to re-register the car;

- OSAGO policy;

- PTS;

- car registration certificate;

- Certificate of vehicle maintenance.

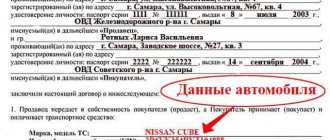

Registration of the contract

The agreement has a standard form, which includes the following points:

- passport details of the buying and selling person;

- place and time of drawing up the contract;

- information about the item of sale and purchase, its technical characteristics;

- vehicle registration certificate;

- car cost;

- signatures of citizens making a transaction.

The contract must indicate that the car is not under arrest, pledged or has already been sold.

How to draw up a DCT if there are several heirs?

The contract form has a standard form, with minor differences:

- the information indicates the passport details of all owners;

- the share of ownership of each participant in the purchase and sale process is included;

- the amount of money that each of the sellers will receive must be specified;

- The papers are signed by each of the heirs.

Is it allowed to sell inherited property?

After a car is inherited from a husband or other close relative, the person is allowed to freely dispose of the received property. A car can have several owners if this nuance is specified in the will or provided for by law.

If the deceased left a document on the disposal of his property, then the notary quickly re-registers the vehicle as the right of ownership of the person indicated in the act of unilateral will. If the deceased did not leave a will, then the notary appoints heirs independently, based on the legal order.

Denis Lvovich

Inheritance lawyer. More than 10 years of experience

Ask a Question

If a person bought a vehicle on credit and did not have time to pay it off, then the obligation to repay the loan falls on the heir.

Until the receiver buys the car, he will not be able to sell it, since for the period of lending the car acts as collateral from the financial institution. If there are several heirs, then all of them are required to make payments.

If there is no will, then the spouses and children have priority.

Having a power of attorney or living together allows you to get the car in full, regardless of the total number of heirs.

If there are several heirs, then the order of disposal of the car is determined by mutual agreement. You can buy out someone else's share. You can also donate your part to other heirs or a third party. Decisions for a minor successor are made by parents or guardians who are responsible for the child.

It is impossible to sell the car in parts. Only after the consent of all heirs is it allowed to sell the car. Only one owner is listed on the registration certificate . And in the contract when selling the car, all successors are indicated.

Transaction procedure

The sale of a car received into ownership is carried out according to the following algorithm:

- Search for a client. Information about the sale of vehicles is posted in newspapers and on car enthusiast websites. Exporting vehicles to a special market before registration of ownership documents is prohibited - before this procedure, you must go through the re-registration procedure.

- Drawing up a policy statement. The document is drawn up independently by the parties to the transaction; notarization of the sale and purchase form is not required. The final re-registration of vehicle rights takes place at the traffic police department.

- Handing over keys and documents, receiving money. The new owner is initially given papers: a photocopy of a certificate of inheritance or a car registration certificate, a written document.

In some cases, you may need a copy of the death certificate of the previous owner. After the transfer of documentation, the keys are handed over, the buyer at this moment pays the heir - in cash or by bank transfer of money to the seller’s account. - Registration in MREO by the buyer. Re-registration falls on the shoulders of the new owner.

He provides papers to the traffic police department, PTS, a purchase and sale agreement, a personal passport, an application for registration of the established form - it can be obtained on the spot, a receipt for payment of the state fee, and a maintenance document. The transaction is considered completed after receiving the car registration certificate, 2 copies of license plates and papers from the traffic police.

The sequence of selling a machine without registering a successor

There are several ways to sell a car. It is allowed to complete the transaction without registering it in the name of an heir. The contract states that the seller owns the vehicle. Then the buyer, having a signed contract and papers confirming the heir’s ownership, immediately registers the car in his name.

The sale is carried out according to the standard procedure if the heir has previously received registration in his name. The transaction is registered in writing (with the signatures of both parties to the contract). The law does not regulate the preparation of the DCT, but if there is no contract or the form is filled out incorrectly, the transaction may be declared invalid.

Procedure for selling an inherited car:

- Preparation of contract.

- Deregistration of the car and registration to the buyer.

- Carrying out a technical inspection if the vehicle is over 3 years old.

- Renewal of insurance.

- Payment of taxes.

When buying an inherited car, there is always a risk of other successors appearing. It is possible that the heir missed receiving ownership rights within the allotted period for compelling reasons. It is allowed to restore your rights in court if 3 years have not passed. When the new successor receives his share, he can seek annulment of the deal.

How can a buyer protect himself from unexpected heirs:

- verify the authenticity of ownership of the car;

- check the number of heirs in the state register;

- request information about possible theft of a vehicle.

If the sale transaction is invalidated due to the appearance of new heirs, then the full amount of the cost of the car is returned to the buyer. You can also obtain compensation for repair work and car tuning.

Machine evaluation

The car is inspected by specially trained people - appraisers . The procedure allows you to determine the heir’s share, the price of the car and the amount of taxes. The price of a car usually corresponds to average market prices in the Udmurt Republic.

Vehicle evaluation criteria:

- car age;

- Availability of repairs, painting, replacement of components;

- mileage;

- condition of individual machine elements.

A visual inspection is mandatory when providing documents for the car. In the report, the appraiser indicates the purpose of the procedure performed, personal data of the successor, describes the technical condition of the vehicle, indicates methods of analysis, lists the documents provided and sets the date of the inspection.

The appraiser works under a contract. The cost of its services depends on the locality and ranges from 1000 to 5000 rubles.

Required documents

To avoid mistakes in drawing up a contract, it is recommended to use legal assistance in Izhevsk. The cost of a lawyer's services will cost approximately 2% of the price of the car.

If you draw up a written statement yourself, you will need to first study samples and examples of filling out the document. Information about the car is taken from the title and registration certificate. If some data is missing, then a dash is placed where it is written. It is forbidden to leave lines blank.

For the contract to be valid, a number of documents are attached to it:

- copies of passports of both parties to the transaction;

- Title, insurance and registration certificate;

- papers confirming ownership of inherited property.

Information about the change of owner is entered into the contract form. If a person sells a car without first registering it in his name, then he adds the death certificate of the testator to the list of required papers.

Subtleties of drawing up a purchase and sale agreement

The contract is concluded for both parties to the transaction. There should be 3 copies in total, since one of the options is submitted to the traffic police. Based on the DCT, the heir will fill out a declaration next year. In this case, it does not matter how long the successor owned the car, and whether he paid personal income tax for it upon sale.

When drawing up a contract, it is required to rely on the Civil Code. There is no need to use complex legal terms to fill out the form correctly; the text should be simple and understandable. The agreement can be drawn up either on a computer or filled out manually using a ready-made form. If a representative (lawyer, relative) acts for one of the parties, then this must be indicated in the document.

What information is included in the DCP:

- Passport details of both parties to the transaction.

- Information about the place and time of the contract.

- Information about the condition of the car, an indication of its characteristics.

- Vehicle registration number.

- Papers confirming the seller's ownership.

- Purchase amount.

The contract states that the vehicle is transferred from the seller to the buyer. Both parties to the transaction put their signatures. All expenses for paperwork, technical inspection and registration are borne by the buyer.

Example of PrEP by inheritance

Contract for the sale and purchase of a vehicle by inheritance

“__” ______________ 20__ _______________

(date of)

We,

gr.__________________________________________, living at the address _____________________________________________________________________,

registered at the address _____________________________________________________________________,

Identity card: passport series ________ No. ________________, issued “_____” _____________ _______,

____________________________________________________________________,

hereinafter referred to as the “Seller”, and

gr.________________________________________________________________________________, residing at the address _____________________________________________________________________,

registered at the address _____________________________________________________________________,

Identity card: passport series ________ No. ________________, issued “_____” _____________ _______,

____________________________________________________________________,

hereinafter referred to as the “Buyer”,

have entered into this Agreement as follows:

1. The Seller transfers ownership to the Buyer (sells), and the Buyer accepts (buys) and pays for the vehicle:

Vehicle make, model: _____________________________________________________________________

Identification number (VIN): _____________________________________________________________________

Year of issue: _____________________________________________________________

Engine No.: ______________________________________________________________

Chassis (frame) No.: ________________________________________________________________________________

Body No.: ______________________________________________________________

Color: __________________________________________________________________

2. The vehicle specified in clause 1 belongs to the Seller on the basis of a Certificate of Inheritance under the law of _______________ (form number), according to register No.____________________, issued by “___” __________ _____.

and Agreement on the division of property (if there are several heirs) _______________ (form number), according to register No.____________________, issued by “___” __________ _____.

3. According to the Seller, at the time of concluding this Agreement, the alienated vehicle has not been sold to anyone, has not been pledged, is not in dispute or under prohibition (arrest), and is not the subject of claims by third parties.

4. The cost of the vehicle specified in clause 1 is agreed upon by the Buyer and the Seller and is: _____________________________________________________ rub. ____ kop.

5. The Buyer transferred to the Seller as payment for the purchased vehicle, and the Seller received funds in the amount of _______________________________ rubles. ____ kop.

5. The ownership of the vehicle specified in clause 1 of the agreement passes to the Buyer from the moment of signing this agreement.

6. This agreement is drawn up in three copies, each having equal legal force. One copy of this Agreement for transfer to the registration department of the State Traffic Safety Inspectorate, and one copy of the Agreement each was received by the Seller and the Buyer.

___________________ ____________________

(signature, full name of the seller) (signature, full name of the buyer)

Machine registration algorithm

First, the vehicle is inspected to obtain a diagnostic card, on the basis of which insurance is issued. Then the papers for registration are collected and the owner drives his car to the traffic police in the UR.

The main difficulties when registering a car include outstanding fines from the previous owner. If such a problem arises, it is important to pay attention to the date of issue of penalties.

Denis Lvovich

Lawyer for inheritance matters.

Ask a Question

If more than 2 years have passed, the fine is invalid. In other cases you will have to pay.

Attached documents

After paying for the car, the new owner must come to the traffic police to register the car. It is important to complete the procedure no later than 10 days after the transaction, otherwise you will have to pay a fine.

Papers for registration:

- Contract of sale.

- Application to register the car.

- Original and photocopy of passport.

- Vehicle registration and insurance.

- Registration certificate.

- Receipt confirming payment for the service.

To register a car faster, it is recommended to queue through the State Services portal. When the set day arrives, the process will take about 2 hours.

State duties and fees

After receiving a certificate of inheritance from a notary's office, a citizen must pay a state fee. A tariff of 0.3% of the total cost of the car applies to the following applicants:

- child of the deceased;

- spouse;

- one of the parents;

- brother or sister - only to relatives and full-blooded ones.

All other heirs pay 0.6% of the total value of the inherited property. For the first applicants, the total payment amount cannot exceed 100 thousand rubles, for the rest - 1 million rubles.

State sizes fees for notarial acts are specified in Art. 333.24 Tax Code of the Russian Federation.

Buying an inherited apartment: step-by-step instructions

Transaction algorithm:

- Collection of documentation.

- Registration of the contract.

- Notarization (if necessary).

- State registration.

Required documents

To conclude a purchase and sale agreement for an apartment you will need:

- passports of the parties to the agreement;

- certificate of inheritance rights to the alienated object;

- extract from the Unified State Register of Real Estate;

- technical documentation for real estate;

- property assessment report;

- certificate of family composition of the seller.

Important! If the apartment is an inherited property, then the consent of the spouse for the sale is not required. The object is the personal property of the heir.

Contract of sale

When concluding a purchase and sale agreement, the parties must adhere to the basic requirements for such transactions.

The agreement specifies the following information:

- Title of the document;

- date, place of its compilation;

- subject of the agreement;

- property value and payment procedure;

- rights and obligations of the parties to the contract;

- seller/buyer liability;

- final provisions;

- addresses, signatures of parties to the transaction.

The agreement is drawn up according to the number of parties:

- one for each party (seller, buyer);

- if the contract is subject to notarization, then an additional copy is issued for the notary.

Sample purchase and sale agreement

Transaction costs

Main expenses when drawing up an apartment purchase and sale agreement

| No. | expenditures | A comment | Sum |

| 1 | Registration of the contract | If the purchase and sale agreement is in simple written form, then the parties only bear the costs of drawing up the contract with a lawyer | The cost of services varies depending on the law firm |

| 2 | Real estate agency services | If the parties involved a realtor, then he must assist in collecting documentation and preparing a purchase and sale agreement | The rate is set by the real estate agency. On average it is 5% of the transaction amount |

| 3 | Notarial services | If the transaction takes place before a notary, then the parties to the agreement will have to pay a state fee and notary services | The duty rate is 0.5% of the agreement amount. However, the amount of the state duty should not be less than 300 rubles. and more than 20,000 rub. (Article 333.24 of the Tax Code of the Russian Federation). |

Notarized registration of a purchase and sale agreement is required in the following cases:

- one of the parties is a minor or incompetent citizen;

- the transaction takes place regarding the share in the apartment.

In other cases, contacting a notary is possible at the discretion of the parties. Payment of the fee is borne by the party that requires such registration. If the transaction is executed in relation to a share, then the duty can be divided between the parties, by agreement.

The amount of the notary's fee is withheld one-time, regardless of the number of co-owners of the property (FNP Letter No. 2173/03-16-3 dated June 22, 2016). As for the cost of notary services, much depends on the region. You can find out more about the rate on the website of the Federal Notary Chamber.

Registration of ownership

The purchase and sale agreement for an apartment is subject to mandatory state registration. Ownership rights are transferred to the buyer only after the relevant data is entered into Rosreestr.

To re-register ownership you will need:

- apartment buyer's passport;

- contract of sale;

- technical documentation for the apartment;

- receipt of payment of duty.

For registration of property rights, a state fee is withheld from the new owner. Its size is 2000 rubles. (Article 333.33 of the Tax Code of the Russian Federation).

Sales taxes

If a citizen decides to sell a car within the first 3 years from the date of inheritance or its value exceeds 250 thousand rubles, then he must pay tax. Art. 212 of the Tax Code of the Russian Federation states:

- heirs with Russian citizenship pay 13% tax;

- persons who are nationals of another state pay 30% of taxes.

The tax amount may be reduced if you provide documentation of expensive car repairs. The tax is not paid when the vehicle was acquired as a property more than 3 years ago. Receivers have the right to take advantage of a tax deduction: if the difference between the initial price of the car and the sale amount does not exceed 250 thousand rubles, personal income tax is not paid.

In this article, we examined the sale of a car after its inheritance. Read also about how the car valuation procedure for a notary goes.