Is it possible to sell a car, how long after taking ownership?

To obtain the right to dispose of inherited property, it is necessary to issue a certificate at a notary's office. On the basis of such a document, a person has the right to register movable and immovable property, which he accepted as an heir.

The standard period for entering into inheritance is 6 months. After the specified time, the heirs receive official documents giving them the right to dispose of the property of the deceased.

According to Art. 1163 of the Civil Code, registration of inheritance can be carried out in a shorter period of time. To obtain a certificate, you must provide irrefutable facts about the absence of other claimants to the property.

Read more about re-registration of a car after inheritance here.

Is notarization required?

Without a notary, it is impossible to obtain documents confirming the right to inherit and use property. For proper legal registration, you need to bring with you to the notary office:

- personal passport;

- documents for the vehicle that will confirm that the deceased was its owner;

- STS;

- death certificate.

Without papers confirming the family ties between the heir and the testator or justifying the legality of inheritance, it is impossible to register a car in your name.

Inheriting a car

The opening of the inheritance occurs on the day of the citizen’s death. Starting from this date, the car belonging to the deceased cannot be used, because previously issued powers of attorney lose legal force. Thus, after the death of the owner, the car is actually forced to remain parked for 6 months. It can be used again only after registration to a new owner.

Note. Registration of a car with the traffic police is terminated immediately after employees receive information about the death of the car owner. The license plates and documents of the car are considered invalid and are entered into the search records (clause 61 of the Registration Rules).

To receive a car you must accept an inheritance . To do this, within 6 months after the death of the previous owner, you need to submit an application from the heir for a certificate of inheritance.

A certificate of the right to inheritance is issued after 6 months from the date of opening of the inheritance. Article 1163 of the Civil Code of the Russian Federation:

Article 1163. Time limits for issuing a certificate of the right to inheritance

1. A certificate of the right to inheritance is issued to the heirs at any time after six months from the date of opening of the inheritance, except for the cases provided for by this Code.

2. When inheriting both by law and by will, a certificate of the right to inheritance may be issued before the expiration of six months from the date of opening of the inheritance, if there is reliable data that, in addition to the persons who applied for the issuance of the certificate, other heirs who have the right for the inheritance or its corresponding part, is not available.

3. The issuance of a certificate of the right to inheritance is suspended by a court decision, as well as in the presence of a conceived but not yet born heir.

Once again I would like to draw your attention to the fact that the heir will be able to use the car no earlier than 6 months after the death of the previous owner.

6 months is quite a long time for a car. On average, cars in Russia are used by their owners for 5-6 years. Six months of downtime is 10 percent of the vehicle's lifespan. Over the course of six months, a car loses several percent of its value.

There is a way to avoid this downtime, but you should prepare for it in advance. If you have elderly relatives who own vehicles, invite them to enter into a vehicle donation agreement with the heir. The agreement is concluded in simple written form.

If the owner of the car agrees to the donation, then in the future the fate of the car will be decided much faster.

However, let's return to the situation of inheriting a car. After the heir has received a certificate of right to inheritance, he has 2 options :

- re-register the car in your name;

- sell or donate a car without registering with the traffic police.

Let's consider each of the situations in more detail.

How to sell the resulting car?

According to Art. 1110 of the Civil Code, the heir has the right to dispose of the property inherited to him at his own discretion. All procedures are carried out only after the official entry into inheritance and receipt of a certificate of inheritance rights from a notary. Next, we will consider in detail how to sell a car after inheriting.

Registered to yourself

After the procedures for re-registration and registration of the car in the name of the heir, he has the right to dispose of it at his own discretion. A citizen must remember that if he owns a car for less than 3 years, he will have to pay the state a tax amounting to 13% of the cost of the vehicle.

No self-registration

The heir is given a period of 10 days to register the car after receiving documents from the notary. During this period, he has the right to sell it without registering it in his name. To register a vehicle for the new owner, you need to visit the traffic police department and present the following documents:

- personal passport;

- certificate of inheritance;

- original papers for the car.

If a buyer could not be found within ten days, then the car must be registered in the name of the heir. For the procedure you will have to pay a fee of 500 rubles.

By proxy

The use of the services of a trustee is possible only after the heir has registered ownership of the car. If the vehicle has not been registered (the 10-day period has not expired), then sale by power of attorney is impossible.

The nuances of the transaction if the vehicle was inherited by two or three people

10 days after entering into inheritance rights, the car must be registered - there is only one owner - the decision is made by general agreement or by way of a court decision. Selling vehicles has its own nuances:

- the general consent of all interested parties is separately stated in the purchase and sale agreement;

- Attached separately is a document confirming the agreement of all heirs among themselves - with signatures.

The absence of certified papers on consent to the sale of a shared vehicle may be challenged in court.

Is it possible to sell the share of the transferred car?

The sale of a shared inheritance begins with an offer to buy part of the car to the second heir. A car is an indivisible property and it is unlikely that any stranger will want to buy half or part of it. In practice, the owners of the vehicle jointly sell it, and the money received is divided in accordance with the shares received under the will.

Art. 246 of the Civil Code of the Russian Federation states that the disposal of property in shared ownership can only be carried out by agreement of all owners.

Selling an inherited car

If you decide to sell a car that you inherited, things will be somewhat simpler. Currently, intermediate registration for an heir is not required , i.e. You can sell a car without contacting the traffic police.

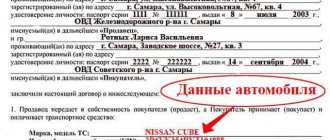

To do this, you need to find a buyer (how to sell a used car) and conclude a vehicle purchase and sale agreement with him.

Contract of sale

Similarly, you can donate a car by concluding a car donation agreement.

Donation agreement

List of documents

Preliminary preparation for selling a car involves collecting the following documentation:

- purchase and sale agreement between the heir and the person interested in purchasing the vehicle;

- document on the right of inheritance;

- receipt of paid state duty;

- buyer’s passport – it will be required to re-register the car;

- OSAGO policy;

- PTS;

- car registration certificate;

- Certificate of vehicle maintenance.

Registration of the contract

The agreement has a standard form, which includes the following points:

- passport details of the buying and selling person;

- place and time of drawing up the contract;

- information about the item of sale and purchase, its technical characteristics;

- vehicle registration certificate;

- car cost;

- signatures of citizens making a transaction.

The contract must indicate that the car is not under arrest, pledged or has already been sold.

How to draw up a DCT if there are several heirs?

The contract form has a standard form, with minor differences:

- the information indicates the passport details of all owners;

- the share of ownership of each participant in the purchase and sale process is included;

- the amount of money that each of the sellers will receive must be specified;

- The papers are signed by each of the heirs.

Transaction procedure

The sale of a car received into ownership is carried out according to the following algorithm:

- Search for a client. Information about the sale of vehicles is posted in newspapers and on car enthusiast websites. Exporting vehicles to a special market before registration of ownership documents is prohibited - before this procedure, you must go through the re-registration procedure.

- Drawing up a policy statement. The document is drawn up independently by the parties to the transaction; notarization of the sale and purchase form is not required. The final re-registration of vehicle rights takes place at the traffic police department.

- Handing over keys and documents, receiving money. The new owner is initially given papers: a photocopy of a certificate of inheritance or a car registration certificate, a written document.

In some cases, you may need a copy of the death certificate of the previous owner. After the transfer of documentation, the keys are handed over, the buyer at this moment pays the heir - in cash or by bank transfer of money to the seller’s account. - Registration in MREO by the buyer. Re-registration falls on the shoulders of the new owner.

He provides papers to the traffic police department, PTS, a purchase and sale agreement, a personal passport, an application for registration of the established form - it can be obtained on the spot, a receipt for payment of the state fee, and a maintenance document. The transaction is considered completed after receiving the car registration certificate, 2 copies of license plates and papers from the traffic police.

How to re-register a car as an inheritance?

To re-register a car by inheritance, it is necessary to carry out the procedure for making changes to the registration data of the vehicle. In 2021, this can be done in any subject of the Russian Federation, regardless of your place of registration.

Registering a car with the traffic police

The registration details of the car must be changed within 10 days from the date of receipt of the certificate of inheritance.

Please note that to register a car with the State Traffic Safety Inspectorate you will need a valid MTPL policy. To obtain the policy, you will need a diagnostic card issued by the technical inspection operator.

Therefore, after receiving a certificate of inheritance, you need to do the following:

- Pass a technical inspection and receive a diagnostic card;

- Buy an MTPL policy;

To re-register a car by inheritance, you will need the following documents :

- Statement.

- Passport of a citizen of the Russian Federation.

- Vehicle Passport (PVC).

- Vehicle registration certificate.

- Certificate of right to inheritance.

- MTPL insurance policy (the original policy is provided by the driver upon request, but insurance must be issued in any case).

- Receipts for payment of government fees (receipts are provided by the driver upon request, but the fees themselves must be paid).

Amount of state duty in 2021:

- 350 rubles for making changes to the PTS;

- 500 rubles (1,500 rubles) for issuing a paper (plastic) certificate of registration;

- 2,000 rubles for issuing numbers, if you want to get new numbers.

Attention! When registering a car through the government services portal, you can get a 30 percent discount on state fees. Those. the total registration costs in this case will be 1,995 rubles . The discount is valid from January 1, 2021 to January 1, 2023. You can find out more about it in this article.

In addition, I recommend making photocopies of all the documents listed above in advance.

The traffic police also requires you to provide the car itself for inspection .

In general, re-registration of a car by inheritance is not so difficult. It will take no more than one day to do everything. And if there is no queue at the department, you can complete the registration within an hour.

Note. If there are several heirs, then you should either sell/donate all the shares to one of them, or issue written consent to register the car with the traffic police.

State duties and fees

After receiving a certificate of inheritance from a notary's office, a citizen must pay a state fee. A tariff of 0.3% of the total cost of the car applies to the following applicants:

- child of the deceased;

- spouse;

- one of the parents;

- brother or sister - only to relatives and full-blooded ones.

All other heirs pay 0.6% of the total value of the inherited property. For the first applicants, the total payment amount cannot exceed 100 thousand rubles, for the rest - 1 million rubles.

State sizes fees for notarial acts are specified in Art. 333.24 Tax Code of the Russian Federation.

Registration of inheritance for a car

Today, inheritance of vehicles is the most common type of inheritance and raises a considerable number of questions. In this article we will answer in detail the question: how to register an inheritance for a car?

And so we’ll figure out what the heir should do in order to inherit the car.

To begin with, it must be said that ownership of a car does not automatically pass to the heirs. In order to enter into an inheritance, you must accept it. At the same time, when accepting an inheritance, the heir accepts all the property, as well as all the obligations of the testator, and not just certain ones (you cannot inherit only a car without accepting, for example, other property and debts). Often, the estate includes significant debts that exceed the value of the car, so whether or not to accept the inheritance is an important issue on which the heir must decide before accepting the inheritance.

On the Internet you can find a division of methods of accepting inheritance into extrajudicial and judicial. However, this division is not entirely correct. However, there are really two ways to accept an inheritance.

- The first way to accept an inheritance is to contact a notary with an application to accept the inheritance. That is, in this case, the heir expresses in writing his desire to accept the inheritance.

- The second method of accepting an inheritance is the actual acceptance of the inheritance. The legislator indicates that the heir is considered to have accepted the inheritance also if he has performed actions indicating the actual acceptance of the inheritance, which manifests the heir’s attitude towards the inheritance as his own property. In this case, the law does not require the heir to submit an application for acceptance of the inheritance, but you will still have to contact a notary to obtain a certificate of the right to inheritance, attaching evidence of the actual acceptance of the inheritance. Read about evidence of actual acceptance of inheritance in this article.

Regardless of the basis for inheriting a car: by will or by law (without a will), the heirs can accept the inheritance in any of these ways.

A car can be inherited either by will or by law. But, at the same time, if the right passes to the heir under the will, then it should not be canceled or changed during the life of the testator, which can be confirmed by the notary who certified the will. In case of transfer of the right to a car by inheritance, according to the law, you will need documents indicating the relationship of the heirs and the testator.

The general period for accepting an inheritance by any method is 6 months.

Sales taxes

If a citizen decides to sell a car within the first 3 years from the date of inheritance or its value exceeds 250 thousand rubles, then he must pay tax. Art. 212 of the Tax Code of the Russian Federation states:

- heirs with Russian citizenship pay 13% tax;

- persons who are nationals of another state pay 30% of taxes.

The tax amount may be reduced if you provide documentation of expensive car repairs. The tax is not paid when the vehicle was acquired as a property more than 3 years ago. Receivers have the right to take advantage of a tax deduction: if the difference between the initial price of the car and the sale amount does not exceed 250 thousand rubles, personal income tax is not paid.

In this article, we examined the sale of a car after its inheritance. Read also about how the car valuation procedure for a notary goes.