Transactions concerning the purchase and sale of real estate in favor of a third party (son, daughter, mother, father, girlfriend, etc.) are not the most common occurrence in the apartment market. Typically, a purchase and sale agreement of this type is concluded between relatives: for example, when parents want to buy an apartment for their children or vice versa.

Note that agreements to purchase apartments in favor of other persons may also be concluded for the purpose of money laundering, which entails problems with the law. Keep in mind that it is unlikely that you will be able to use dark schemes, especially if you involve a professional realtor in your work. But the so-called “black realtors” can easily agree to this.

Procedure

- Discuss with the future owner what kind of apartment is needed, what conditions to set, and so on. This point may not be relevant if the potential owner cannot make up his mind or asks the buyer to make all decisions independently.

- Find suitable accommodation.

- Discuss the terms of the transaction with the seller, especially noting the fact that the apartment will go to a third party. Despite the fact that this usually does not play any role for the seller, many people refuse the transaction only on the basis that they do not understand what risks may arise in such a situation. An experienced lawyer can help calm your fears.

- Check the apartment for encumbrances, debts and other potential problems.

- Draw up a purchase and sale agreement.

- Have the contract certified by a notary (optional, this is not a mandatory requirement, but it helps to minimize risks).

- Register the agreement in the registry.

- Register property rights and sign a housing acceptance certificate. The sequential nature of these actions may vary, since in some regions the act is needed already at the stage of registration of property rights.

- Complete the transaction by paying the entire remaining amount.

Lawyer's answers to frequently asked questions

From what value is personal income tax calculated when selling an apartment in favor of a third party - from the cadastral or market value?

How many copies of the DCP need to be drawn up if real estate is purchased in the name of another person?

You will need four copies of the agreement. One remains with the seller, the second with the buyer, the third with a third party, and the fourth is transferred to Rosreestr.

Why can’t I get a tax deduction if an apartment was bought by a relative in my favor?

A tax deduction is provided only if a person bought real estate and spent his own money. The third party does not bear any expenses.

Is it possible to issue a DPA in favor of third parties? My parents want to buy my sister and I an apartment for two.

Yes, you can. In the DCT, you need to determine the shares and indicate information about all beneficiaries.

Who signs the transfer and acceptance certificate when purchasing real estate for a third party?

The transfer deed is signed by the buyer, since he pays money for the housing and, according to the contract, undertakes to accept it.

Documentation

To purchase an apartment in favor of a third party, you need to provide the following package of documents:

- Passports of all parties, including the seller, buyer and third party.

- Documents for the apartment (extract from the Unified State Register, registration certificate, extract from the house register, certificate from the management company, agreement or document on the basis of which the seller at one time received ownership, and so on).

- Additional documents, if necessary (permission from the guardianship authorities, consent to the transaction from the spouse, and so on).

- Purchase and sale agreement (see below).

- The acceptance certificate (is an addition to the contract and is usually signed at the final stage of the transaction).

Tax deduction

For the purchase of housing, the state provides taxpayers with a tax deduction from an amount equal to 2 million rubles. 13% of this amount is subject to return from the state treasury - 260,000 rubles. This deduction is provided 1 time, but it can be divided into several parts (if the purchase amount is less than 2 million, then the taxpayer gets back 13% of the money spent, and he will use the rest when purchasing other real estate.

Is a property deduction allowed when drawing up a policy in favor of a third party? It will not be possible to receive a personal income tax refund - to confirm the right to deduction, you need to provide documents confirming the fact:

- making payment;

- transfer to the payer of ownership rights to the purchased housing.

Since a third party becomes the owner of the apartment, there are no grounds for returning personal income tax.

Costs and deadlines

Considering the fact that the transaction is made with the participation of three parties, the period may increase slightly. Despite the fact that the entire procedure can actually take several days, most often it takes about 1-3 months to discuss the conditions, prepare documents, and so on.

Costs also depend on what exactly the parties require. At a minimum, in addition to the cost of the apartment itself, you will only have to pay a state fee when registering property rights (2 thousand rubles per person).

Notary services can cost from 2 thousand rubles and more. A real estate agency, if you ask them to select housing and accompany the transaction, will take about 5% of the transaction amount.

Articles on the topic (click to view)

- The need to determine the composition of the common property of premises owners in apartment buildings

- Inheritance of an apartment under a deed of gift after the death of the donor

- Financial personal account from place of residence: receipt, contents and sample statement

- The emergence of ownership of real estate - how to confirm when it ceases?

- Apartment building management specialist (in accordance with professional standards)

- Compensation as a way to terminate an obligation under Art. 409 Civil Code of the Russian Federation

- Detailed answers to a number of important questions about buying and selling a communal apartment

Other additional costs may apply.

Another comment on Article 430 of the Civil Code of the Russian Federation

1. The design of an agreement in favor of a third party, used by civil law in the interests of facilitating and developing property turnover, is expressed in Art. 430 in general form and not complete enough.

Firstly, an agreement in favor of a third party can arise not only by agreement of the parties (clause 1 of the article), but also by virtue of the relevant instructions of the law. An example is a contract for the carriage of goods (Article 785 of the Civil Code) and certain types of personal insurance contracts (Article 929 of the Civil Code).

Secondly, some civil contracts, due to their content and purpose, cannot include conditions that give them the properties of a contract in favor of a third party (for example, a bank account, an order, a commission).

Expert opinion

Volkov Viktor Vladimirovich

Lawyer with 8 years of experience. Specialization: civil law. More than 3 years of experience in developing legal documentation.

Thirdly, an agreement in favor of a third party may create for this person not only the right to demand performance, but also impose certain obligations on him, as stated in Art. 430 is not mentioned.

The beneficiary in the insurance contract (Article 939 of the Civil Code), the consignee in the contract for the carriage of goods (Art.

35 UZhT, Art. 160 KTM) along with rights carry responsibilities.

It should be considered possible to assign certain responsibilities to a third party, in whose favor the contract is concluded, by agreement of the parties to the contract.

2. The third party in whose favor the agreement is concluded may be, in accordance with paragraph 1 of Art. 430 specified or not specified. The second case mainly refers to the rules of marine cargo insurance (clause 2 of Article 253 of the Code of Labor Code), when the insurance policies use the formula “in favor of whom it will be followed.”

3. For the specifics of a contract in favor of a third party for insurance, see Art. 956 of the Civil Code, and for bank deposits - Art. 842 Civil Code. In the latter case, the rules of Art. 430 apply if this does not contradict the essence of the bank deposit.

4. A contract in favor of a third party should be distinguished from a contract for performance to a third party (for example, when the supplied products are shipped not to the buyer, but to the recipients named in its order), when this third party can accept performance, but does not have the right to make demands on the debtor for performance agreement in your favor.

Accordingly, the rules of Art. 430 are not applicable to such agreements.

When distinguishing between these agreements, one should proceed from the fact that granting a third party the right to claim against the debtor must be clearly expressed in the relevant contractual terms; the mere fact of payment to a third party does not create an agreement in favor of the third party.

1. An agreement in favor of a third party is an agreement in which the parties have established that the debtor is obliged to perform the obligation not to the creditor, but to a third party specified or not specified in the agreement, who has the right to demand from the debtor the fulfillment of the obligation in his favor.

2. Unless otherwise provided by law, other legal acts or contract, from the moment a third party expresses to the debtor an intention to exercise their right under the contract, the parties cannot terminate or change the contract they have concluded without the consent of the third party.

3. The debtor in the contract has the right to raise objections against the claim of a third party that he could raise against the creditor.

4. In the event that a third party has renounced the right granted to him under the agreement, the creditor may exercise this right if this does not contradict the law, other legal acts and the agreement.

In whose interests is the transaction being made?

Art. 430 of the Civil Code of the Russian Federation does not limit the circle of persons in whose interests an agreement can be concluded, but in practice, housing is most often purchased for elderly relatives or children.

In its meaning, such an agreement is very similar to a donation, but it has a significant advantage - the procedure for transferring housing is significantly simplified. The buyer manages to get by with just one document (DCP); he does not have to spend time and money on drawing up a deed of gift.

Some parents take advantage of this feature - when purchasing housing as a wedding gift for their son/daughter, they draw up a purchase and sale agreement in favor of their child. Even if the couple eventually decides to divorce, the apartment will not be taken into account when dividing property, since according to the law it is not considered joint property.

This scheme is also useful if a person is physically unable to negotiate with the seller, go through the authorities, collect the necessary papers, or perform other actions - one of the relatives can take on the role of the buyer. At the same time, he will not have to spend money on drawing up a power of attorney, as would be necessary when conducting a transaction as a legal representative.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Sometimes children sign up for PrEP in this way in the interests of their parents. Being of advanced age, people do not always retain clarity of mind - it is very difficult for them to act as one of the parties to the transaction, to delve into the legal aspects of the process.

Acting independently, they can become a victim of scammers - buying an apartment for the benefit of elderly family members becomes a good solution.

Taxation

From the position of the tax service, the purchase of an apartment in favor of a third party is equivalent to a gift, and therefore, this gives grounds to levy tax on the beneficiary (provided that he is not a close relative of the buyer).

Close relatives include children, grandparents, parents, grandchildren, sisters/brothers. They do not pay tax when they transfer their property to each other under a gift deed. A similar situation arises when acquiring property in favor of a relative. Other categories of citizens are not exempt from tax (personal income tax rate is 13%). Non-residents (persons who have lived in another country for more than 183 days) must pay an increased rate of 30%.

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

In practice, tax can be avoided even if the scheme does not involve close relatives. Since the legislation does not directly refer to the taxation of the beneficiary under an agreement drawn up in his favor, and the DCT is not a gift agreement , demands to pay personal income tax cannot be called legal. If you have any claims from representatives of the tax authorities, you should contact a competent lawyer who will help you defend your interests.

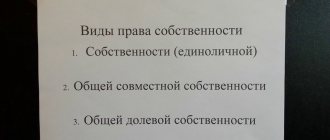

Registration of the contract

A DPA in favor of someone has its own characteristics, but for the most part this document is similar to a standard agreement. It is drawn up in writing and contains the following information:

- date, place, subject of the transaction;

- information about the seller/buyer;

- cost of housing (the amount must be written in words and numbers);

- execution procedure;

- procedure for accepting an apartment;

- obligations/rights, terms of termination, consequences of violation of agreements.

An important specificity of such an agreement is the presence in the text of information that it is concluded in favor of a person who is not a party to the transaction, and it is in relation to him that the obligations will be fulfilled.

In accordance with the law, you can include the passport details of the beneficiary in the text or not - freedom of choice is provided. Most often, the home buyer still indicates this information in the contract (contact information, full name).

The DCP also specifies the deadlines for execution, a list of actions on the part of the third party, the consequences that will occur in the event of failure to fulfill obligations in relation to him, and additional conditions. The person in whose favor the purchase of real estate is made must certify his consent in writing.

Buying a share

By issuing a DCT in favor of a third party, some try to circumvent the restrictions associated with shared ownership. The scheme is quite simple: one of the co-owners agrees with the other that he allegedly acquires his share. In fact, the money is paid by a third-party buyer, in whose favor the contract will be drawn up. It is highly not recommended to use this method of selling. The fact of violation of the interests of the remaining co-owners is obvious; it will not be difficult to prove it to interested parties. As a result, the transaction will be recognized as imaginary, which will lead to its cancellation.

What risks are involved in buying an apartment in favor of a third party and is it worth using such a scheme?

Each case is individual - the site’s lawyers will help you avoid potential risks and find the best way out in case of claims from the tax authorities. Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 1 ratings, average: 5.00 out of 5)

Author of the article

Maxim Privalov

Lawyer. 2 years of experience. I specialize in civil disputes in the field of housing and family law.

Author's rating

Articles written

610

Reasons why transactions are concluded in favor of a third party?

- For example, if the actual buyer does not have the money or time to pursue the transaction, he can do so through another person. He will sign the contract and pay the seller the required amount.

- The agreement is often concluded to circumvent marital obligations regarding the division of marital property between spouses. Let’s say that a certain abstract man, being married, can easily give his parents money by asking them to buy an apartment under an agreement in favor of a third party. At the same time, asking that ownership be registered in his name. In this case, the apartment will not be considered property acquired jointly during marriage. Therefore, during a divorce you will not have to share this apartment with your spouse.

- A purchase and sale transaction in favor of a third party is an alternative to a gift agreement. Children, for example, can purchase real estate for their parents, paying for it with their own funds, without using purchase and sale agreements and donations.

Prohibitions and restrictions on donations between individuals and legal entities

Prohibitions and restrictions on concluding a gift transaction are established by Art. Art. 575 and 576 of the Civil Code of the Russian Federation. If they are violated, the contract will be void or voidable.

In relations between individuals and legal entities, it is prohibited to give gifts whose value exceeds 3,000 rubles:

- If the recipient is a state or municipal official, and the delivery of the gift is not due to official (protocol) events, but is related to the position held and related functions.

- If the party to the transaction is the legal representative of an incapacitated or minor citizen and gives a gift on his behalf.

Restrictions on donations between an organization and an individual are associated with the need to comply with a certain procedure for completing a transaction:

- Legal entities are allowed, but only with the consent of the owner, to donate property that is under their operational management or economic control. The exception is gifts that are not of great value and are considered ordinary.

- If the gift is jointly owned, the consent of all owners is required to conclude the transaction.

Unlike gifts between citizens, in transactions between them and organizations, gifts are often not things, but rights. Therefore, the following are distinguished as specific gift transactions :

- donation of the right of claim to another person is a gratuitous assignment of debt to the recipient;

- giving through debt forgiveness;

- donation by fulfilling an obligation to another person, including by transferring a debt to oneself, is the gratuitous repayment (assuming) of the debt of the donee.

When concluding these agreements, it is not enough to be guided only by the norms of the Civil Code of the Russian Federation on gift transactions. It is necessary to take into account the procedure for making a debt assignment, debt forgiveness, taking on someone else’s obligations, as well as the peculiarities of the transfer of rights and obligations in such transactions.

Commentary to Art. 430 Civil Code of the Russian Federation

1. Paragraph 1 of the commented article defines an agreement in favor of a third party. The following features are distinguished:

- all contracts are concluded in order to satisfy the needs of the parties, and a contract in favor of a third party is intended to satisfy the needs of one party and a third party (or only a third party);

- the third party may or may not be named in the agreement;

- a third party has the right to demand from the debtor the fulfillment of an obligation in his favor.

The scope of application of an agreement in favor of a third party is quite wide. Thus, the contract for the carriage of goods is constructed as a contract in favor of a third party (clause

1 tbsp. 785 of the Civil Code) (unless the consignee is not the consignor).

The deposit can be made to the bank in the name of a specific legal entity (clause 1 of Art.

Expert opinion

Volkov Viktor Vladimirovich

Lawyer with 8 years of experience. Specialization: civil law. More than 3 years of experience in developing legal documentation.

842 Civil Code). (In practice, banks often shy away from concluding such contracts.) Under a property insurance contract, the beneficiary can be not only the policyholder, but also a third party (clause

1 tbsp. 929 Civil Code).

The beneficiary under the property trust management agreement can be the founder of the management or the person specified by him (clause 1 of Art.

1012 Civil Code). Lifetime annuity can be established for the life of the citizen transferring property for payment of annuity, or for the life of another citizen specified by him (clause

1 tbsp. 596 Civil Code), etc.

2. A third party has the right to demand performance from the debtor.

But, firstly, in some cases a third party not only has rights, but also bears responsibilities. Thus, the consignee bears a number of responsibilities.

Secondly, until the third party expresses to the debtor the intention to exercise their right, the parties to the contract can change or terminate the contract according to the general rules for changing and terminating contracts, without asking the consent of the third party. Consequently, after such a moment, modification or termination of the contract is permitted only with the consent of the third party.

This is the general rule. Exceptions may be established by law, other legal acts or agreement.

For example, under a bank deposit agreement, a third party acquires the rights of a depositor only from the moment he presents the first demand to the bank or expresses to the bank in another way his intention to exercise such rights, unless otherwise provided by the agreement (Clause 1 of Art.

842 Civil Code). Thus, until this moment, the third party has no right of claim at all.

He has only the right to receive the right (the right to the right). Thirdly, although a third party has the right to demand that the debtor fulfill an obligation, this does not mean that he replaces the creditor or becomes a co-creditor.

The creditor continues to be a party to the agreement and obligation. This is clearly visible from the text of the commented article.

Thus, by virtue of clause 2, the parties to the contract can change or terminate the contract (depending on the circumstances specified here, with or without the consent of a third party).

The creditor may, if there is a fact specified in paragraph 4 of the commented article, take advantage of the right that belonged to a third party.

If the contract is bilaterally binding, the creditor remains obligated.

3. The emergence of a third party’s right of claim against the debtor is due to the will of the creditor.

It follows from the agreement between the creditor and the debtor. Therefore, it is logical that if, suppose, the contract is invalid, then the third party has no right of claim.

Likewise, it cannot demand anything if the obligation has already been properly performed (if this is possible).

4. As a general rule, a creditor cannot take advantage of a right belonging to a third party.

The creditor can exercise the corresponding right only if the third party renounces the right granted to him under the agreement. The refusal of a third party is carried out by taking active actions.

Silence does not indicate refusal. Only in some exceptional cases can silence be qualified as a waiver of a right.

It should be emphasized that in the commented article we are talking specifically about the renunciation of the right, but not about the refusal to exercise the right (cf.

4 of the commented article and paragraph 2 of Art.

9 Civil Code).

Exceptions to this general rule may arise from law, other legal acts and agreements. So, by virtue of paragraph 2 of Art. 842 of the Civil Code of the Russian Federation, before a third party expresses an intention to exercise the rights of a depositor, a person who has entered into a bank deposit agreement may exercise the rights of a depositor in relation to the funds deposited by him into the deposit account.

The acquisition of real estate in favor of a third party is regulated by Art. 430 Civil Code of the Russian Federation.

This is relevant for parents who want to buy an apartment for their son or daughter, but so that it is not shared with the second spouse in the event of a divorce. Such a purchase and sale agreement (hereinafter referred to as the PSA) is concluded if the future owner cannot independently engage in the transaction.

Let's look at the main features of buying a home this way, step-by-step procedures, possible expenses and taxation.

Judicial practice under Article 430 of the Civil Code of the Russian Federation

At the same time, the terms of the Contract provide for the obligation of the investor, within six months after the conclusion of the Contract, to ensure the involvement of all owners and tenants of the reconstructed buildings as co-investors at the expense of the investor’s share. However, in violation of the specified condition of the Contract, the investor did not attract co-investors; there was no evidence that the Bukinist company refused to exercise its right to participate in the controversial Contract (clause 4 of Article 430 of the Civil Code of the Russian Federation).

In the cassation appeal, the company asks for the cancellation of judicial acts as contrary to Article 430 of the Civil Code of the Russian Federation, indicating that the requirement for the recovery of damages arises from the purchase and sale agreement dated October 19, 2016 N 133/03-28/16, containing a condition on contractual jurisdiction, which also applies to the plaintiff, who is the person in whose favor the contract was concluded.

The applicant’s argument about the existence of grounds for refusal to pay insurance compensation in connection with the failure of the insurer to notify the replacement of the beneficiary is unfounded, since the insured and the beneficiary are parties to the insurance contract on the creditor’s side and, by virtue of Articles 430 and 452 of the Civil Code of the Russian Federation, the policyholder’s appeal to the insurer with an application for payment of insurance compensation in its favor does not indicate the latter’s intention to amend the insurance contract and replace the beneficiary, who is his creditor, within the amount of obligations under the leasing agreement that were not fulfilled at the time of payment of insurance compensation.

The courts, based on the assessment of the evidence presented in the case materials according to the rules of Chapter 7 of the Arbitration Procedural Code of the Russian Federation, guided by the provisions of Articles 307, 430, 784, 792, 793 of the Civil Code of the Russian Federation, Articles 47, 99, 100, 119 of the Federal Law of January 10. 2003 N 18-FZ “Charter of Railway Transport of the Russian Federation”, having established that an agreement for the operation of a non-public railway track between the Krasnoyarskkraigaz company and the Russian Railways company was not concluded, we came to a reasonable conclusion that there were no relations between these parties that would allow applying to to the Russian Railways company the requested measure of liability, they rightfully refused to satisfy the claims.

The applicant points out that it is necessary to apply both the rules on major repairs set out in the Housing Code of the Russian Federation and the provisions of Article 430 of the Civil Code of the Russian Federation to the legal relations that have developed between the HOA, the State Civil Institution and LLC StroyInvestHolding. Believes that the provisions of Articles 722, 724, 755 of the Civil Code of the Russian Federation are not applicable in the present case.

Believes that the courts violated the rules of procedural law.

The courts, based on the assessment of the evidence presented in the case materials according to the rules of Chapter 7 of the Arbitration Procedural Code of the Russian Federation, having properly distributed the burden of proof, guided by the provisions of Articles 10, 15, 309, 310, 430, 451, 453 of the Civil Code of the Russian Federation, the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 06.06.2014 N 35 “On the consequences of termination of the contract”, establishing numerous violations of contractual obligations on the part of the Medconsult company, the lack of proof by the Medconsult company of the damages claimed for recovery and reasonably stating signs of the unilateral refusal of the Medconsult company to perform obligations under the contract, rightfully refused to satisfy the initial claim and satisfied the counterclaims.

Considering that decision-making on these issues is not within the competence of the sole executive body of the company, based on the literal meaning of the terms of the partnership agreement, the district court indicated that a party to the partnership agreement should be considered its participant, and not the company itself. Based on the literal meaning of the terms of the partnership agreement, which do not provide for the fulfillment of obligations under it in favor of a third party (company), the district court agreed with the conclusions of the court of first and appellate instances that Bernard E.V.

monetary obligation directly to society itself. The conclusions of the cassation court correspond to the provisions of paragraphs 1, 5 and 9 of Article 67.2, 430 of the Civil Code of the Russian Federation, paragraph 3 of Article 8 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” and the content of the circumstances of the case.

In resolving the dispute, the courts of first and appellate instances, having assessed the evidence presented in accordance with the rules of Articles 65, 71 and 168 of the Arbitration Procedural Code of the Russian Federation and guided by the provisions of Articles 430, 929 and 956 of the Civil Code of the Russian Federation, proceeded from the fact that an insured event had occurred due to insurance contract dated January 16, 2015, in connection with which the stated claims are subject to satisfaction.

When accepting the appealed judicial acts, the courts of the first and appellate instances, guided by the provisions of Articles 309, 310, 393, 421, 430, 431 of the Civil Code of the Russian Federation, taking into account clause 8.2 of the Contract on the acceptance by Profile LLC of the obligation to pay before the acceptance committee signs the form acceptance certificate N KS-14 heat, water, electricity, sewerage of the facility and communication services, as well as taking into account evidence of the incurrence of expenses for utility bills by the State Budgetary Institution of the Pskov Region "Pskov Regional Oncology Dispensary", having established that the act of acceptance of the facility form N KS- 14 was not signed by the acceptance committee due to the work being carried out with deficiencies; in the absence of evidence of the guilt of third parties in the occurrence of such deficiencies, the courts came to the conclusion that Profile LLC was obliged to reimburse the State Budgetary Institution of the Pskov Region "Pskov Regional Oncology Dispensary" for the amount of expenses presented for collection.

When resolving the dispute, the courts were guided by paragraphs 1, 2 of Article 167, paragraphs 1, 2 of Article 168, Article 426, paragraph 2 of Article 430 of the Civil Code of the Russian Federation, part 4 of Article 154, part 2 of Article 157 of the Housing Code of the Russian Federation, article 6 of the Budget Code of the Russian Federation Federation, paragraph 10 of Article 40, paragraph 4 of Article 340 of the Tax Code of the Russian Federation, paragraph 4 of Part 1 of Article 16 of the Federal Law of October 6, 2003 N 167-FZ “On General Principles of Local Self-Government”, Part 6 of Article 7 of the Federal Law of July 27, 2010 N 190-FZ “On Heat Supply”, Article 19, parts 4.1, 5 of Article 20, Article 49 of Law N 131-FZ, explanations set out in paragraph 5 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 18, 2007 N 64 “On some issues , related to the application of the provisions of the Tax Code of the Russian Federation on the tax on the extraction of mineral resources, the tax base for which is determined based on their value", paragraph 20 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 17, 2004 N 85 "Review of the practice of resolving disputes under the contract commission”, paragraph 80 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 N 25 “On the application by courts of certain provisions of Section I of Part One of the Civil Code of the Russian Federation.”

In this case, the company refers to the provisions of Article 430 of the Civil Code of the Russian Federation, according to which an agreement in favor of a third party is an agreement in which the parties have established that the debtor is obliged to perform the performance not to the creditor, but to a third party specified or not specified in the agreement, who has the right to demand from the debtor fulfills the obligation in his favor.

Transactions concerning the purchase and sale of real estate in favor of a third party (son, daughter, mother, father, girlfriend, etc.) are not the most common occurrence in the apartment market. Typically, a purchase and sale agreement of this type is concluded between relatives: for example, when parents want to buy an apartment for their children or vice versa.

Note that agreements to purchase apartments in favor of other persons may also be concluded for the purpose of money laundering, which entails problems with the law. Keep in mind that it is unlikely that you will be able to use dark schemes, especially if you involve a professional realtor in your work.

But the so-called “black realtors” can easily agree to this.