Last update: 06/14/2021

Question:

I'm going to buy an apartment. Do I need to obtain a notarized consent from my spouse to purchase real estate?

Answer:

Let’s clarify right away that we are talking about a case where the purchase of real estate is registered in the name of only one of the spouses. If the apartment is registered in both hands at once, then both spouses become parties to the Sale and Purchase Agreement or the Equity Participation Agreement, and by signing the agreement, they obviously express their agreed actions.

A separate written consent of the spouse for the purchase of an apartment may be required only if the property is purchased during marriage and is registered in the name of one of the spouses. But is it necessary to formalize the consent of the other here? Is it required to buy an apartment? Is it possible to register a transaction without this document?

The short answer is that the consent of the spouse for the purchase of real estate is generally not necessary, but... in the market it is used. For what?

This is exactly the case when the ambiguity of the law leads different lawyers to different conclusions. But in general the situation is clear, and we will explain it based on existing market practice.

How to buy an apartment from a company? What are the features of buying a home from a legal entity - see the note at the link.

Is the consent of a spouse required to purchase an apartment - what does the law say?

Everything here is based on the joint property of the spouses - that is, on the fact that all property acquired during marriage is, by law, the common joint property of the husband and wife, regardless of who exactly this property is registered in (although there are exceptions, read more – see the Glossary at the link).

When it comes to disposing of the common property of spouses, it is assumed by default that both spouses always act by mutual consent (Clause 1, Article 35, RF IC). But at the same time, if one of the spouses sells an apartment (literally - for a “transaction on the disposal of property, the rights to which are subject to state registration”), he must obtain the notarized consent of the other spouse for alienation (clause 3, article 35, RF IC ).

But what if we are talking about managing “common” money that one of the spouses is going to spend on buying real estate ? Is it necessary to obtain notarized consent of the husband or wife for the transaction? The law does not give a clear answer here. Apparently, our Duma clerks did not analyze this situation very deeply.

Some lawyers believe that money is also the common property of the spouses, and the purchase of an apartment is a transaction “subject to mandatory state registration,” which means, according to the same paragraph 3, Article 35 of the RF IC, the notarial consent of the spouse is required here .

Other lawyers object that this clause of the article only implies the sale of an apartment (common property), and not its purchase. Apartment purchase and sale agreements are no longer registered (with the exception of mortgages). And the Supreme Court of the Russian Federation at one time indicated that transactions, although subject to state registration, but not related to the disposal of the spouses’ common property, do not require the consent of the other spouse to conclude them. The court does not recognize the purchase of real estate as a form of disposal of common property (see the ruling of the Supreme Court of the Russian Federation dated February 4, 2016 No. 308-KG15-13732).

In general, the laws, as always, are not ideal, and lawyers, as always, make money from their interpretation. What should apartment buyers do? Should I go to a notary for “spouse consent” or not? Let's turn to the almighty Rosreestr for an answer.

By what criteria to determine the reliability and stability of the Developer - see the corresponding step of the Instructions, following the link.

What is Rosreestr’s position on the issue of the spouse’s consent to the transaction?

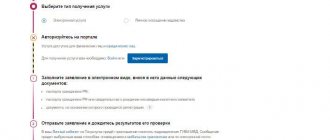

As part of the mandatory package of documents that Rosreestr requires for registration of rights and transfer of rights under a purchase and sale transaction, there is no consent of the spouse to purchase an apartment (for confirmation, see here - select “purchase and sale of apartment” in the list).

That is, registration of the transaction will take place without this document. Moreover, Rosreestr does not require the written consent of the spouse to complete a real estate transaction, not only when purchasing it, but even when selling it:

Message from Rosreestr (quote):

... “the registering authority does not have the right to require the consent of the spouse to carry out state registration of the transfer of ownership to the new owner and is not authorized to clarify the question of the presence or absence of such consent. That is, even in the absence of the spouse’s consent, registration will be carried out without suspension and prior notification of the parties to the transaction.”

Like this. This means that to register rights to real estate, it is not necessary to provide any notarial consent of the spouse . But... it is desirable, and in some cases the law even directly requires this (more on this below). Why is this paper needed?

The same article of the law (see link above) gives the right to the “forgotten” spouse, whose consent was not asked, to demand that the purchase and sale transaction be declared invalid. He is given one year to realize this opportunity. True, he will be able to challenge the deal only if he proves in court that he did not know and could not know that the other spouse was buying an apartment (on the sly!) with their common savings.

That is why, in practice, experienced realtors (in Moscow, for example) try to secure themselves with the spouse’s consent , even in cases where they could do without it. Moreover, such “insurance” does not present any difficulty.

Assignment of rights of claim under the DDU - how does this happen? Nuances, risks, features.

Consequences of lack of consent

There are situations when the other half categorically disagrees with the acquisition of a house or land and begins to challenge it.

So, for example, when disposing of undivided real estate on the part of a divorced spouse, there is a risk of challenging the purchase and sale within a year by the ex-husband or wife. If there are good reasons, supported by documents, the statute of limitations can be extended. If the parties have not verified the consent of the second spouse, there is a risk that the operation will be recognized as illegitimate due to dishonest waste of money from the family budget.

When registering the transfer of rights to a property from one owner to another, the register provides for the possibility of making a note about challenging the transaction. The recording is made in accordance with the court order if the outcome is positive. In this case, the contract is considered invalid and subject to termination. The seller returns the spent funds to the buyer in full.

Obtaining the consent of a husband or wife to purchase an apartment - market practice

In practice, in general, it is extremely unprofitable for the Buyer, as well as his wife, to challenge the completed transaction and declare it invalid. Why? Yes, because in this case the spouses risk losing not only the purchased apartment (common property), but also the money paid for it.

Yes, the court, of course, will apply bilateral restitution (i.e., oblige both parties to return everything received under the transaction) if it is declared invalid. But returning the apartment to the Seller is quick and easy; all you need to do is make a new entry in the State Real Estate Register (USRN). But returning the money to the Buyer is much more difficult, especially if the Seller declares that he no longer has this money (spent it). Then the court will oblige the Seller to return this money gradually, for example, by deducting a certain percentage from his official salary or pension.

If the Buyer’s spouse is of sound mind, then she is unlikely to initiate a challenge to the transaction herself. Although some family conflicts can even lead to such an unfavorable scenario for the spouses. For example, if the husband deliberately hid from his wife the purchase of real estate in his name. Or if, after a divorce, the wife decided to return the money that her husband withdrew from the division of common property by buying himself an apartment.

That is, there may well be reasons to challenge the transaction due to the lack of consent of the spouse.

Realtors here proceed from the principle - “it’s better to be safe than sorry”; there will definitely be no harm from this, but in the event of a conflict between spouses (when one disputes the other’s deal), this document will be very useful. Moreover, it will help not only the Buyer, whose spouse may make a claim, but also the Seller, who is also unlikely to like this gimmick.

Banks adhere to the same principle when issuing mortgages, and they have additional arguments for this (more on this below).

What does a marriage contract provide when buying an apartment? Examples from life.

Written consent of the spouse to purchase real estate with a mortgage

Banking lawyers also sometimes read the laws and also understand that “it’s better to be on the safe side,” that is, to reduce the risk where possible. Therefore, when issuing a mortgage to a client to purchase an apartment , they almost always require the notarized consent of the spouse to the transaction .

The arguments here are:

- firstly, the mortgage encumbrance on the purchased apartment is registered in the Unified State Register of Real Estate;

- secondly, the transfer of real estate as collateral to the bank is regarded by the court as a form of its disposal (determination of the Supreme Court of the Russian Federation dated March 17, 2020 No. 19-KG20-3). After all, in case of non-repayment of the loan, ownership of the apartment may go to the bank. Therefore, a spouse, having learned that their common apartment was mortgaged without his consent, can challenge the transaction within one year from the day he learned about it.

Thus, if real estate purchased with a mortgage is registered as the property of one of the spouses, then the other spouse still has the right to it (joint property). And here the law (Clause 1, Article 7, Federal Law-102 “On Mortgages...”) directly indicates the need to obtain the written consent of the spouse to obtain a mortgage, and therefore to purchase the apartment itself.

Of course, this consent is only necessary if the second spouse is not a co-borrower on the loan. If both spouses are co-borrowers, then a separate consent for the purchase is not required, since both spouses are already parties to the transaction.

Is it possible for a non-Russian citizen to buy an apartment ? The answer is in this article.

When is it required?

Most residential properties are purchased with a mortgage loan. In this case, the bank draws up an agreement with one of the spouses, who will be the borrower. If the second one officially works and has an income, then he becomes a co-borrower.

If there is no income, the bank will not be able to accept him as a co-borrower on the mortgage and cannot be sure that the family will be able to repay the debt if the borrower loses earnings. Typically, a mortgage is guaranteed by collateral - an apartment purchased with a loan.

In this case, the bank must obtain notarized consent from the second spouse that he does not object to the transfer of the acquired property as collateral. Consent is only needed for the credit institution and is not required for the registration authority. This norm is established in paragraph 1 of Art. 7 of the Federal Law “On Mortgage”.

How to obtain your spouse’s consent to purchase an apartment?

The same article of the law (clause 3, article 35, RF IC - see link above) clearly indicates that the spouse’s consent to a real estate transaction must be certified by a notary.

The composition (text) of this document does not have strict regulations - the main thing is that it is clear from it who, to whom, and what exactly is giving consent. You can indicate the address of a specific apartment there, or you can “give the go-ahead” for the purchase of any apartment at a price and on conditions at the buyer’s discretion. The validity period for the spouse's consent is usually not indicated in the document, i.e. it is given for an indefinite period (but if desired, it can be limited in terms of time).

A sample of a spouse’s consent to purchase real estate – see the link below.

For registration, the notary will need to provide the passport of the spouse who gives consent and a marriage certificate. The personal presence of the other spouse (title Buyer) is not necessary for this.

The cost of notarization of a spouse's consent is low - around 1-2 thousand rubles. Price may vary slightly in different regions.

A sample of a spouse's consent to purchase an apartment - see HERE (SERVICES)

Do I need permission from my husband (wife) to purchase land?

Just 6 years ago, for any real estate transaction, purchase or sale, the consent of the spouse was required. After changes to the laws (Federal Law No. 302 of December 30, 2012) regulating this area of civil law, written confirmation of the transaction from the wife (husband) is no longer required.

Property acquired during marriage is considered joint property, regardless of whose name it is registered in or which member of the couple paid for the purchase. The only case when property acquired during marriage can belong only to the wife or husband is if, before the official registration of the relationship, a marriage contract was signed, providing for other forms of division of jointly acquired property. When a married couple has such a document, permission to purchase a plot of land or a home is not required from the second spouse.

No changes in this area of law are expected in 2021. An agreement for the purchase of real estate does not need to be registered, and accordingly, approval of the purchase is not required from the second member of the couple.

Partner consent is not always required

When is it necessary to obtain your spouse's consent for a purchase?

For some cases, the law (same clause 3, article 35, RF IC - see link above) establishes the mandatory receipt of notarial consent of the spouse for a real estate transaction. These are the cases, for example, when the contract for the sale and purchase of an apartment is certified by a notary.

In general, there is no need to have a contract certified by a notary. But for some situations such a requirement exists (more about this in the link). And if the transaction goes through a notary, then the consent of the spouse to purchase the apartment is required .

The same applies to cases of purchasing apartments on a mortgage, purchasing a new building under a DDU or an Assignment Agreement - since all these agreements (unlike the Sale and Purchase Agreement) are subject to registration. This means that they are subject to the same clause 3, Article 35, of the RF IC, which states the need for notarized consent of the spouse for transactions “subject to mandatory state registration.”

In addition, this paper, for the sake of insurance, may be required for the transaction by the Seller of the resale apartment (or his realtor).

Do you need consent to buy an apartment from your ex-spouse?

What about ex-spouses? What if real estate is purchased after a divorce?

The principles of forming and disposing of the common property of spouses lead to the fact that even after a divorce, the notarized may still be needed to purchase an apartment It will have legal meaning only if after the divorce there was no division of the spouses’ common property (by voluntary agreement or by court decision).

It turns out that even an ex-husband or wife can challenge a transaction for the acquisition of property, since formally their common money (not yet divided after the divorce) was spent on it. Or - demand a share in the apartment purchased by your ex-spouse.

Additional expenses when buying an apartment - what threatens the Buyer?

Law on joint purchase of real estate

By law, funds acquired by both spouses during marriage are joint. To manage finances, notarization is not required. In the event of a divorce, the purchased plot or house is divided in half physically or in monetary terms.

Until 2013, real estate transactions required a mandatory permit from the other half, certified by a notary. This procedure prevents unfair fraud of property by one of the family members. Mandatory registration of sales and purchase agreements has now been cancelled:

- a private house or part thereof;

- apartments or rooms;

- land plot;

- garage and other facilities.

For a transaction to be considered valid, the content of the agreement must comply with the regulations of the state. It must contain all the necessary signatures of the parties. And registration is needed to formalize ownership rights to an object or for notarization. In this case, mandatory confirmation of the operation by both family members is not required. This issue is not regulated in the Family Code of the Russian Federation.