Land plots, which can be inherited, include several categories and are registered both by law and by the will of the owner. Inheritance to a land plot, regardless of the purpose of its use, is registered in the name of legal successors in accordance with the legislation of the Russian Federation.

Categories of land plots may include: agricultural lands, settlements, forestry enterprises, reservoirs, lands of industrial and other purposeful functions, territorially protected possessions.

Owned land plots, as well as their belonging to untimely possession, can become hereditary real estate. Their inheritance occurs on a par with all other property and does not require special approval of rights.

What you need to know when registering an inheritance for land

In addition to the land itself, the hereditary mass includes everything that is located on its territory, these include buildings or residential premises, provided that during life, ownership of them was registered.

Registration of inheritance for a land plot is carried out by a notary at the place of its opening. It is he who must be contacted before the expiration of a 6-month period from the date of death of the owner whose land is inherited.

In this case, you need to submit the appropriate documents confirming the relationship. After which, after six months, a certificate will be issued, provided that no difficulties arise.

Attention important to know! When registering a land plot as a property by inheritance, the first step is to open a case and issue an official document - a certificate of inheritance, with which you can take further actions in order to acquire ownership rights to the inherited land, both its share and the entire plot.

If the heir does not apply within the prescribed period and ignores it, then the matter will take more serious turns, and the deadline for accepting the inheritance will have to be restored in court.

The court has the right to extend the period if the heir had valid reasons for the delay. There is another way - a claim for recognition of property rights by inheritance. We will describe this procedure in more detail in this article.

Inheritance nuances:

Right of unlimited use

The land plot may not belong to the person, but be issued from the municipal fund. The owner is the local government body, and organizations have the opportunity to use the site indefinitely (Article 39.9 of the Land Code of the Russian Federation). Ordinary citizens rarely receive such land, and if they do receive it, they are not the owners.

According to general rules, the right to perpetual use of a plot of land is not inherited.

However, there are exceptions:

- If a residential building, garden building or other construction projects were built on the land, instead of inheritance, it is possible to buy out the land.

- If the testator started registering property rights, but did not have time to complete it due to death, the heirs have the right to continue what they started - disputes are resolved in court.

Heirs or buyers will have to request a copy of the grant of the plot for perpetual use to the testator.

Common shared ownership

There is one plot of land, there are many applicants... what to do? Quite often, the land is distributed among all applicants - each of them will have to properly register ownership.

First of all, you will have to agree on the transfer of the land into common ownership. If disputes arise, litigation cannot be avoided.

If there are several heirs, the procedure will be as follows:

- Designate a plot of land.

- Draw up an agreement on the redistribution of shares.

- Draw up several copies of the agreement for all shareholders.

- Register changes with the Rosreestr authority.

It is important to stipulate the procedure for using the land and establish passages/entrances to the territory. Read more about this and more in our article “How to divide a house and land that are in common shared ownership?”.

Mortgage, lease or easement

Contractual relations that arose during the life of the testator do not always end with his death. Certain restrictions and prohibitions are inherited (Article 617 of the Civil Code of the Russian Federation).

When preparing documents, the beneficiary needs to analyze the circumstances that relate to the inheritance.

By accepting the property of a deceased citizen, the heir assumes his obligations under a lease, rent, pledge or easement . Such restrictions continue to apply even after the heirs have assumed their rights.

Example. In 2000, the testator entered into a land lease agreement for 49 years. The agreement was entered into the register of the state real estate cadastre. The man died in 2010 - the inheritance went to his adult daughter. Considering that 10 years have passed since the lease, the woman can use the land plot under the lease agreement for another 39 years. During his lifetime, the tenant managed to erect outbuildings on the land. They also become the property of the heiress. Obligations under the lease agreement are retained in full - we are talking about the intended use of the land and making payments. Failure to comply may result in the lease agreement with the new tenant being terminated.

Can a tenancy end with the death of the tenant? Yes, if the lease agreement directly states this, the presence of such a clause excludes the possibility of inheriting a plot rented by a deceased citizen. Read more about this in the article “Inheritance of the right to lease a land plot.”

Are there any restrictions on the period of entry into rights? Yes. The heir must take over as a tenant within 1 year. Missing deadlines will result in automatic termination of the contract.

If there is an easement, it is necessary to take into account the legal requirements and practices of the region where the land plot is located. The order in which the land is used plays a key role—how will the heir dispose of it?

For example, he will process it himself, rent it out, or find a buyer for the land. An easement establishes the right to use the land, and if the new owner is against this option, he has the authority to terminate the easement.

Conditions of receipt

Property passed by inheritance after the death of its owner is divided among a strictly narrow circle of persons receiving the inheritance in the order established by the Civil Code of the Russian Federation. According to the law, there can be a maximum of eight lines of successors.

The most likely legal successors may be the heirs of the first stage: wife, husband, mother, father, son, daughter. So to speak, close relatives. Therefore, as a rule, most often the registration of property occurs in relation to these persons.

It should be taken into account that if there is more than one heir and there is no specific will, the land plot passes into common shared ownership. In the future, if possible, everyone can allocate a separate plot of land for themselves.

This procedure is possible both by agreement between the co-owners and by a court decision if consensus is not found.

Important points

According to regulatory legal acts, heirs of one line have the right to claim a land plot in equal shares, however, on the basis of Article No. 1182 of the Civil Code of the Russian Federation, this is only possible when the size of the land plot allows such a division to be made.

The Civil Code establishes that if a land plot cannot be divided among all interested heirs, and such situations are not uncommon, then the inheritance of the land plot is assigned to the successor, who has a preemptive right by force of law.

This priority right is enjoyed by persons living together with the testator at the date of his death.

When starting the procedure for receiving an inheritance, you need to take this factor into account and understand that if there are competitors when receiving an inheritance, then it is most likely that the inheritance will be received by the person who lived together with the testator.

In law

Land property is transferred according to the priority established by law for succession. It should be understood that along with the right to property, responsibilities are also transferred.

That is, before accepting an inheritance, you need to understand that in addition to material values, you also acquire debts, if any. The heir, accepting the inheritance, undertakes to repay them.

Of course, we do not always foresee life’s circumstances, and people think about death to the least extent. Often people die unexpectedly, leaving no will behind.

And this means only one thing - the inheritance in such circumstances will have to be formalized according to the law.

According to the law, it is accepted under the following circumstances:

- Lack of a will.

- The will was declared invalid by the court.

- There is no indication of heirs in the will.

- The heir included in the will is found guilty of the death of the testator.

There are situations when the heir indicated in the testamentary document writes a refusal of the inheritance. In this case, the property also has to be given legal force on the basis of the Civil Code of the Russian Federation, taking into account that the will does not provide otherwise.

By will

Inheritance takes place if the testator has drawn up a written document called a “Will” and certified it by a notary.

It must indicate what exactly and to whom exactly he is inheriting. The transfer of property can be made not only to close relatives, but also to complete strangers.

Inheritance under a will to a land plot can also be transferred in favor of legal entities and constituent entities of the Russian Federation.

A will is valid only if it is drawn up personally by the owner without involving guarantors or attorneys in this operation. The document expresses the will of each testator separately and does not have the right to be of a public nature.

Sometimes, according to a will, only a share of the family land plot is transferred. The other part, not fixed in the document, is re-registered to the legal successors by law.

Actual acceptance of inheritance

In this case, it is possible to establish through the court the very fact of recognition of the right to property. It is necessary to draw up an appropriate claim to submit it to the court; it indicates the grounds on which the plaintiff asks the court to examine the issue and make a decision on the fact of accepting the inheritance in the form of land and recognizing the ownership of it.

The court analyzes each situation individually, examines supporting evidence, and takes into account all kinds of evidence that can influence its conclusion.

Supporting documents include:

- payment of taxes and debts on inherited land;

- carrying out repairs and earthworks related to improving conditions;

- use of the land plot together with the testator before and independently after his death;

- all funeral expenses, as well as the ritual process by the heir.

When going to court, if the requirements are: how to recognize ownership, then the state duty is paid based on the market value of the land and other inherited real estate.

Conditions for including land in the inheritance mass

In the event of opening an inheritance, it is necessary to find out whether it is possible to inherit the plot remaining after the death of the testator. The answer to this question can be obtained by finding out which category of land users the testator belonged to during his lifetime:

- property owner;

- a person who has the right of lifelong inheritable ownership;

- a person who has the right of permanent unlimited use;

- tenant of the property.

In the first case, if the property was owned by the testator, the successors can inherit it by law and by will.

The remaining property rights of persons who are not owners are listed in Art. 216 Civil Code. Thus, in the case of inherited ownership, it will not be possible to dispose of such a land plot, however, the transfer of rights to an allotment by inheritance is permissible by law. In cases of lease or permanent (indefinite) use, the heirs have the right to continue renting the plot.

It is impossible not to mention the situation in which the testator permanently uses the land plot, but cannot confirm the legal title of the immovable property. Under such circumstances, after the death of the testator, a plot of land that has not been properly registered cannot be included in the inheritance mass. Consequently, the relatives of the testator and other persons indicated by him in the will, but not having a blood relationship with him, cannot inherit such a piece of real estate.

Registration procedure

As mentioned above, the procedure for a potential successor in registering an inheritance to land begins with submitting an application to a notary. According to this statement, the notary must attest to the inherited powers of the applicant.

To do this, you will need a package of necessary documentation that fully proves the right to accept the inheritance, which the notary has the right to demand.

The procedure for registering an inheritance is a rather labor-intensive and lengthy process that requires compliance with all regulations and legal acts. It is for this purpose, and so that all interested potential heirs have time to declare their rights, a six-month period has been determined.

Inheritance of plots in horticultural, gardening and dacha societies

Often testators do not register ownership of their dacha and similar plots. Rights to plots are expressed in the form of membership in SNT, DNP, etc. and are confirmed by membership books.

Such lands and buildings located on them are inherited in the general manner according to a certificate of inheritance. The subject of inheritance is a share (share), which provides the authority to use and dispose of the deceased’s land allotment.

The certificate of inheritance and the application for admission to membership are presented to the chairman of the association, who raises the issue of admitting the heir to membership of the SNT, DNP at the general meeting of members of the partnership (partnership). But this is more of a ceremony than a real solution to the issue, since civil law does not allow the refusal to accept an heir as a member of the association instead of the deceased.

After this, the new owner is given a membership card, and he exercises the rights and obligations in relation to the allotment to the same extent as the testator had.

Required documents

It is necessary to submit documents to obtain a certificate of inheritance right before the expiration of 6 months. If you submit them later, the deadline will expire and it will be possible to restore it only through the court.

Evidence will be required that there were unforeseen circumstances as a result of which they did not have time to formalize the inheritance on time.

Reasons for this may be:

- long-term illness;

- foreign business trip;

- lack of information about the death of the testator.

There is frequent confusion when people believe that they need to file documents for inheritance rights after the expiration of six months. However, this is a false assumption.

Based on Article No. 1153 of the Civil Code of the Russian Federation, the notary will require the following documents for entering into an inheritance of land (except for the application itself):

- Passport of a citizen of the Russian Federation - heir.

- A document certifying the death of the testator (certificate).

- Certificate from housing and communal services, form No. 9, about the place of residence of the deceased.

- Documentation proving relationship or will.

- A will certified by the notary who drew up this document (if there is one) and that there were no changes in it at the time of opening the inheritance.

- Certified cadastral project of a plot of land.

- Documentation confirming land ownership (sale and purchase agreement, deed of gift, certificate of land ownership, confirmation of state registration, document of perpetual ownership of the plot, etc.).

- An extract of form B1 from the register of land users, it indicates the cadastral price of the land.

- Plan of a plot of land with outlined boundaries.

- Documents evidencing the dominant order of land ownership (resolution on the transfer of land into ownership).

- Agreement for establishing shared shares of a land plot.

Following Federal Law No. 259, which came into force on October 12, 2015, and on the basis of the provisions on notaries in Article 47.1, the notary does not ask the legal successors to present excerpts from the Unified State Register, because this information is available to them in electronic form.

Timing and cost

Preparation of documents for inheritance of land depends on several factors. You will need to pay a state fee for the work of a notary office. Its amount varies depending on the price of the land.

The activities of specialized firms licensed for market valuation of property allow this calculation to be made.

As a rule, this service is also paid and will range from 5 to 9 thousand rubles, depending on many factors (distance from the city, communications) and whether a specialist will need to travel to the site or the assessment is carried out remotely.

The state fee for registering the certificate will be 0.3% of the value of the land plot, but not more than 100 thousand rubles for relatives and 0.6%, but not more than 1 million rubles for other heirs.

Who is eligible for benefits?

A certain category of persons is entitled to a reduced cost of the fee for registration of inheritance or a cancellation of payment completely.

This category includes disabled people of groups I and II, who pay 50% of the cost of the state duty. As well as young children, disabled, who lived with the deceased in a private house, if the inherited land plot relates to this house.

Beneficiaries must provide documentary evidence of their status. In this regard, it is necessary to provide medical and other types of certificates, a birth certificate and a certificate of family composition.

A certificate of the right to inherit land can be obtained no earlier than 6 months after the death of the testator; the main thing is to open an inheritance case on time.

Registration of land ownership

The transaction is completed after the completion of the procedure for registering the land as an inheritance with a notary. If there are no other legal barriers, the notary is obliged to issue a certificate of succession to the plot of land.

Land is real estate, and by law it must be registered. According to Article No. 223 of the Civil Code of the Russian Federation, after the inherited land property is entered into Rosreestr, the heir has the right of ownership to it and can dispose of it at his own discretion

State registration is carried out by the Federal Service for State Registration of Cadastre and Cartography (Rosreestr), regional branches of this service and the MFC. The registration regime for the right to own a land property is prescribed in the provisions of F3-122.

The assignee entering into ownership of a land plot is required to write to one of the above-mentioned states. authorities application for registration.

The application must be accompanied by a set of documents:

- certificate of inheritance;

- passport of a citizen of the Russian Federation;

- a complete set of documents confirming the right to inherited land.

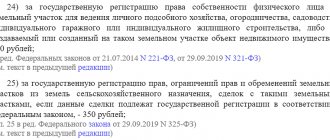

Before submitting documents for registration, you will need to pay a small fee (Article 333.33 of the Tax Code) in the amount of 2,000 rubles.

Upon acceptance of documents, a receipt is issued. Next, the documents are checked by Rosreestr for compliance with legal requirements, information is entered into the Unified State Register, and the necessary confirming stamps and visas are affixed to the submitted documentation.

According to the standards of Federal Law-122, Article No. 13, paragraph 3, registration lasts up to ten working days, after which the heir, along with the rest of the documents submitted by him for registration, is issued a certificate of land ownership.

Procedure for registering property rights

To fully complete the procedure for registering a plot, the heir must register his rights to it.

To do this, he needs to contact Rosreestr with a package of necessary documents:

- certificate of entry into inheritance rights;

- applicant's passport;

- application for registration of transfer of ownership;

- cadastral passport;

- boundary passport;

- receipt of payment of state duty;

- power of attorney (if the legal representative of the owner applies).

If there are no problems with the availability and execution of documents, the application is accepted for consideration. The period usually ranges from 7 to 10 days, but in some cases this procedure may take a little longer.

As a result, the applicant will receive a document confirming his rights to the site - a certificate of ownership.

If the heir is a young child (that is, under 14 years of age), the preparation and submission of all documents is carried out by his legal representatives - parents, guardians, trustees.

If the minor is older (from 14 to 18 years old), then he can perform all actions himself, but only with written permission from his legal representative.

Taxation

According to the innovation since 2006 in Ch. 23 of the Tax Code of the Russian Federation, concerning land tax upon entering into an inheritance, in the event that there is a will from the testator, the property is not subject to taxation except for certain episodes related to intellectual property.

If previously 13% personal income tax was levied on persons who inherited real estate, currently heirs - close relatives who took ownership of the land under a will - do not pay tax.

At the same time, if the heir is a non-resident of the Russian Federation, then he pays an amount of 30%, if an outsider inherited the land under a will, he pays 13%.

It is worth noting once again that in the absence of a direct tax on a plot of land transferred to the heirs, they, regardless of family ties with the deceased testator, are required to pay a state fee upon registration.

Deadline for inheritance

It is worth considering that in order to enter into inheritance rights, the law establishes a certain period during which this procedure must take place.

According to general rules, it is six months .

The beginning of deductions for this period, depending on the situation, is:

- day of death of the testator;

- the date he was declared dead (based on a court decision);

- the moment when the heir learned about one of the events listed above.

If entry into the inheritance does not occur within the established six-month period, then the recipient of the property must apply to the court for further exercise of his rights.

A time limit has also been established for this - three years (from the same moment as in the first case).

At the same time, he will have to prove that he did not receive the inheritance for a good reason.

In some situations, entry into rights does not occur even within

these three years, and also for serious reasons.

For example, the heir was abroad for a long time, was ill, was not aware of the death of the owner of the property, etc. In this case, he also needs to go to court and prove this in order to exercise his rights.

This procedure is usually complex and lengthy, but there is still a chance of success.

What problems may arise

There is a possibility that the registration authority will refuse to register property rights. Such a refusal is certainly motivated and, usually, it is due to the fact that the registration authority believes that some document is missing or some of the documents are found to be defective.

In this case, it is necessary to eliminate the impeding cause and satisfy the request of the registration authority, transfer the missing documentation or correct the existing one. Ultimately, after this, land ownership is registered.

Is land inherited under the right of perpetual use, under a lease agreement?

As a general rule, land owned by a deceased person under the right of perpetual use is not inherited. However, there are 2 important nuances:

- if a house or other structure is built on the plot, then the heir is given the right to buy the land without litigation;

- if the deceased began to register the right to the plot during his lifetime, then his heirs can complete this procedure and receive ownership of the land, even if there are no buildings on it.

Sometimes the issue of inheritance may concern a plot leased by the deceased. The tenant does not have ownership rights, which means he cannot transfer the land to his heirs. However, they can use the plot during the validity of the lease agreement under the same conditions.

Read: How to get a death certificate