Home / Real estate / Land / Ownership

Back

Published: 04/30/2017

Reading time: 10 min

0

1356

More and more often, the issue of renouncing land ownership is becoming an urgent issue for citizens. This may be due to the fact that some time ago land plots were transferred from the state free of charge. In addition, cases of land transfer by inheritance are common.

But over time, such plots turn out to be abandoned by their owners, and their actual ownership is confirmed only by documents. What to do if the existing piece of land brings only losses? How to waive your right to a plot? The answers to these and other questions can be found out by reading this article.

- Legislation

- When can you relinquish ownership of a plot of land?

- When you can't refuse

- How to abandon a plot of land that you own: step-by-step instructions

- What problems may arise

What is land ownership and waiver of this right?

“Land ownership” refers to a right that includes three main powers:

- possession,

- use,

- disposal of land.

The owner of the land can use it for agriculture, individual housing construction, country house, garage, as well as for other purposes that do not contradict the legislation.

“Relinquishment of land ownership” refers to the voluntary termination of rights to land. The possibility of renouncing ownership of a plot of land at the personal will of the owner is provided for by the Land Code of the Russian Federation. Payment of compensation to the previous owner is not provided.

Changes to the Land Code

Land legislation is regularly updated and may undergo changes in some areas. But on the issue of abandonment of land, no changes have been noted in recent years.

As before, you need to write an application to Rosreestr or the municipality, wait for a decision, and check that, according to Rosreestr, the land is registered in the name of the state.

When the former owner changes his mind, he can return the property in the form of a plot of land within a year.

Reasons for owners' refusal to relinquish land

Surely the question arises: why give up land if it can be sold. But there are cases when this is not possible. For example, a plot of land is located in a hard-to-reach area, for which there is unlikely to be a buyer. But this circumstance does not relieve the owner from the obligation to maintain this site, which may require considerable financial costs.

Another example is if there are any encumbrances - other citizens can move freely through the site. The owner is unlikely to like this circumstance.

The site may not be used for a long time or the need to use it for its intended purpose has disappeared.

Reluctance to pay land tax is also possible.

If a person simply does not use the site, then in some cases this may result in an offense for which liability is provided. For example, non-use of a land plot intended for agricultural production or housing or other construction for three years.

All reasons must be supported by relevant documents.

The law provides for the right of the owner to abandon his property. This possibility is reflected in Article 236 of the Civil Code of the Russian Federation. The procedure for applying and the conditions under which an application can be submitted are reflected in Article 53 of the Land Code of the Russian Federation.

But there are cases when it will be difficult to abandon a plot. This is due to the fact that there may be buildings, structures, and various structures on the land that are owned by the owner. It will be difficult to refuse if property, including land, is inherited. The plot cannot be transferred to the jurisdiction of the municipality, but must go to one of the other claimants for the inheritance according to the principle of priority right. If all other heirs have expressed a written refusal, then such land can be alienated by way of voluntary refusal.

If the owner of a land plot decides to renounce ownership of it, he needs to understand how this procedure occurs at the legislative level. Below we will look at how to renounce ownership of a land plot and what main points need to be taken into account.

In recent years, according to lawyers and notaries, the number of people wishing to voluntarily part with property has increased. Moreover, this applies to both apartments and land plots. What motivates these people and why don’t they just sell unwanted property? It turns out that not everything is so simple.

New tax rate and cadastral valuation “from the ceiling”

Imagine a situation where you have inherited a poorly developed plot of land in the most remote corner, where you have no reason to travel. And if you go, you need to spend at least 2-3 hours on the road (either traffic jams or rare trains). In general, you don’t really need the land, and you practically forget about it until you find a tax notice about the payment of land tax in your mailbox. And the amount in it will be such that you will never be able to forget about it. In the best case – 5 thousand, and maybe even 20 thousand rubles.

"For what? Why?" - these are precisely the rhetorical questions asked by people who have already decided to renounce ownership of their land. Of course, we are not talking about those families who live in villages and towns, where a plot of land is the place on which their only house stands. Although they are also incredibly outraged by the amount of tax they were charged in 2015. As an example, we can cite one of the rural settlements in the Naro-Fominsk region of the Moscow region, where in 13 settlements the land tax has increased significantly - from 2 to 20 thousand rubles. It's all about the new rules for calculating tax: if previously it was calculated from the inventory value of land, then since 2015 - from the cadastral value, which is close to the market value.

In 1990-2000, the state sought to transfer as much state property as possible to private individuals, while practically freeing owners from the burden of property taxes, which are traditionally paid in all developed countries and amount to considerable amounts. After the collapse of the USSR, the times of powerful state support for the population became a thing of the past; the state gradually began to instill the culture of Western capitalism, where you have to pay for everything. Accordingly, with the joy of acquiring real estate comes a “fly in the ointment” - you need to pay more and more for this real estate every year. In October 2014, Federal Law 284-FZ “On Amendments to Articles 12 and 85 of Part One and Part Two of the Tax Code of the Russian Federation and Revocation of the Law of the Russian Federation “On Taxes on Property of Individuals” was adopted, in accordance with which tax payment for premises, apartments, buildings is no longer carried out according to the inventory value, but is carried out according to the cadastral value (i.e. the value is close to the market value). Moreover, in cities of federal significance - Moscow, St. Petersburg and Sevastopol - the tax rate specified in the law can be increased by municipal authorities. The full transition to the new tax payment procedure will take place before January 1, 2021.

At the same time, the cadastral valuation of land occurs according to a system of mass valuation based on average indicators, which, as judicial practice shows, is fraught with large inaccuracies, as a rule, in the direction of overestimating the cadastral value. The range of standards for calculating the cadastral valuation of a square meter of land in Russia varies from 20 to 600 rubles per square meter. According to Art. 394 of the Tax Code of the Russian Federation, land tax rates are established by regulatory documents of municipalities or laws of cities of federal significance. The maximum permissible rate is 0.3% of the cadastral valuation of the site per year. If, for example, we consider the Leningrad region, then the rate for the main type (private farming, gardening, vegetable gardening, etc.) of land is the specified maximum value. The situation is similar in many other regions of Russia.

The cadastral valuation of land carried out in 2013 by independent appraisers, in fact, turned out to be biased, since, according to mk.ru, appraisers took information about land prices in a particular area from open sources, without taking into account a number of real factors. This has led to the fact that the cost of plots in two villages located several kilometers from each other can differ tens of times. And, oddly enough, sometimes the cost of a small plot in a godforsaken place can be equal to the price of land in some comfortable elite village.

"Where's the justice!" - People were outraged and began to sue. According to Rosreestr (from the report on the results of activities for 2014), if in 2008 there were no more than 1000 cases of judicial challenge to the cadastral valuation of land, then by 2014 their number increased to almost 15 thousand. As for the above-mentioned village near Moscow, the Ministry of Property approved corrections to the cadastral value of almost 800 plots. True, this issue was resolved pre-trial - the residents of the settlement “took” the officials with their numbers and tenacity.

What to do with unnecessary property?

It is one thing when the plot is a place of permanent residence, and quite another when there is a summer house on the plot or it is completely empty. In the first case, it makes sense to fight to reduce the cadastral value. And in the second, people often immediately decide to get rid of the site. The only question is, how?

For example, after the adoption of the “Regulations for the maintenance of dacha plots” in the Moscow region, for many reasons it became unprofitable for summer residents to keep plots, and therefore realtors are already seeing an increase in offers for dacha lands. And the new tax rate helped those who were still undecided whether to leave the land or not make a decision.

Let's take the Moscow region as an example, where the land tax rate is on average 1.5% of the cadastral value. Next, let's look at the financial situation of the owner: what is his income, does he have benefits for paying taxes on a land plot, is the land plot with a house the only place of residence of the owner. Depending on the answers to these questions, it will become clear whether there is a desire to own a plot of land and pay an annual tax for it.

If you no longer want to own land, you can simply sell it and receive a certain amount of money for it. However, experts say that selling a plot that is located far from home is not profitable. And for people strapped for funds, as a rule, organizing the sale of unwanted land becomes an expensive process. And those who understand in advance that such a sale may turn out to be unprofitable, decide to renounce the property, which is enshrined in Art. 30.2 of Federal Law No. 122 of July 21, 1997 (as amended on July 13, 2015) “On state registration of rights to real estate and transactions with it.”

For example, in the Volgograd region there are plots of land for sale starting from 70 thousand rubles for 10-20 acres, which have been on display for years, despite the fact that they are located near urban settlements. If you calculate the services of an agent, the cost of conducting a transaction, collecting documents, travel and other costs, then such a sale may not result in income, but a loss.

In some cases, new owners do not want to burden themselves with a sale due to low demand for a particular plot of land or the need to bring the plot into proper shape. For example, on a land plot inherited and classified as “agricultural land”, a landfill is located, so the potential profit is equal to the cost of bringing the site into proper condition.

If a plot of land is often abandoned, not wanting to bother about selling it or paying for maintenance and taxes, then the situation with apartments is a little different. As a rule, people rarely hand over their living quarters to the state just like that. According to lawyers, deprivatization more often takes place, which is ensured by the norm of Article Art. 9.1 of the Law of the Russian Federation dated July 4, 1991 No. 1541-1 (as amended on October 16, 2012) “On the privatization of housing stock in the Russian Federation.”

Only a privatized apartment can be deprivatized, where privatization is the basis for the emergence of ownership of housing. If an apartment or room is owned on the basis of a purchase and sale transaction, donation, exchange, etc., such housing cannot be deprivatized. The deprivatized housing must be the only suitable place for the owner to live; this housing should not be encumbered with obligations (loan, right of residence of other persons, etc.). Privatization ends on March 1, 2016; after this period, it will be impossible to deprivatize real estate unless, of course, the law of the same name discussed is adopted.

We are going to refuse: legal subtleties

It is worth remembering that renunciation of property rights is not just an internal desire of the owner to maintain the property, carry out economic activities, or even live there. Your refusal must be documented.

The law allows for the legal possibility of relinquishing ownership rights. According to Art. 236 of the Civil Code of the Russian Federation, a citizen or legal entity may renounce ownership of property owned by him by declaring this or taking other actions that definitely indicate his removal from ownership, use and disposal of property without the intention of retaining any rights to this property.

In this case, the waiver of ownership rights does not entail the termination of the rights and obligations of the owner in relation to the relevant property until the acquisition of ownership rights to it by another person.

In order to officially renounce the right of ownership of real estate, it is necessary to make this refusal officially, by submitting a written application for refusal at the location of the real estate to the local government body, which will subsequently take appropriate measures to register this property with Rosreestr (Federal State Registration Service , cadastre and cartography), according to the procedure established by Order of the Ministry of Economic Development of Russia dated November 22, 2013 No. 701.

If a new owner is ready to move into a house or apartment that belongs to you, then you can formalize a real estate donation transaction, providing the new owner with a legal basis for living in housing that you did not need at all.

If the specified land plot is encumbered with the rights of third parties (for example, the right of passage through your plot - an easement), it seems that this encumbrance cannot serve as an obstacle to the renunciation of ownership of the land belonging to you, despite the fact that the regulation of such conditions in case of renunciation is by law are not expressly provided. And if real estate is located on the owned land plot, in respect of which the ownership right is registered, then it will not be possible to abandon the land plot. Art. 35 of the Land Code of the Russian Federation directly prohibits the alienation of a land plot if a building or structure owned by the same person is located on it.

To renounce your ownership rights, you can immediately contact the territorial body of Rosreestr. You must have a passport with you, as well as a document confirming ownership of real estate. If the owner cannot visit the institution on his own, he will need to issue a notarized power of attorney for his representative. The power of attorney must necessarily indicate the powers that give the representative the right to perform this particular procedure.

Registration of unnecessary real estate is carried out in the order of registration of ownerless real estate by making an appropriate entry in the Unified State Register no later than eighteen days from the date of receipt of the application and necessary documents by the body carrying out state registration of rights (Clause 3 of Article 9 of the Federal Law “On State Registration” rights to real estate and transactions with it" and Order of the Ministry of Economic Development of Russia dated November 22, 2013 No. 701).

Within ten working days, the institution registers the transfer of ownership, after which the property will become the property of a subject of the Russian Federation or a local government body. After Rosreestr registers the unwanted property, the former owner receives a documented notification that the real estate item has been registered. From this moment, according to Art. 236 of the Civil Code of the Russian Federation, the owner officially relieves himself of the obligation to maintain unwanted real estate. And after ten days, for peace of mind, you can receive an extract from Rosreestr confirming that this property no longer belongs to you.

Realty.dmir.ru

How to relinquish ownership of a land plot?

The refusal procedure is regulated by Art. 53 of the Land Code of the Russian Federation.

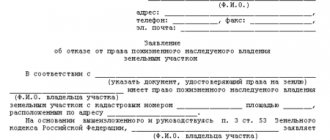

First. We submit an application to the Rosreestr Office of the constituent entity of the Russian Federation in which the land plot is located.

The application is written by hand or compiled on a computer according to the established template. The application must indicate the name of the government body to which the application is submitted, full name. applicant, his contact details, name of the application. The main part of the application contains information about the location of the land plot. It is necessary to clarify what legal documents are available. At the end of the application, the applicant’s signature and date are placed, and the documents that are annexed are also listed.

A sample application is available.

The application is submitted through any branch of the MFC. If the land plot is located in another region, and accordingly the Rosreestr Office, the owner can submit an application through the regional (local) Rosreestr Office on an extraterritorial basis (remotely).

Applicants are exempt from paying state fees.

What package of documents must be submitted along with the application?

Required documentsthat are attached to the application:

1. For individuals:

— a copy of the citizen’s identity document (passport);

— cadastral passport for the land plot, if it was previously issued;

- documents confirming ownership of the land plot (for example: certificate, extract). If the right to a land plot is not registered in the Unified State Register of Real Estate, then the provision of the specified document is not required;

- documents confirming the presence of a real estate property on the land plot (for example: BTI certificate, certificate of registration of ownership, extract).

2. For legal entities:

— documents confirming the authority to act on behalf of a legal entity (notarized power of attorney, decision of the founders (founder), extract from the Unified State Register of Legal Entities);

— copies of constituent documents (certificate of registration of a legal entity, charter);

— consent of the meeting of founders (founder) to renounce ownership of the land plot;

— cadastral passport for the land plot, if previously issued;

- documents confirming ownership of the land plot (for example: certificate, extract). If the right to a land plot is not registered in the Unified State Register of Real Estate, then the provision of the specified document is not required;

- documents confirming the presence of a real estate property on the land plot (for example: BTI certificate, certificate of registration of ownership, extract).

Additionally, other documents may be required during the procedure. For example, a notarized consent from the spouse, if the property belongs to jointly acquired property and there is no agreement on the division of shares. If a mortgage or loan was issued for the property upon purchase, then when submitting an application, a certificate of full repayment of the debt and an agreement to terminate the contract with the bank are provided. Without this, the refusal is considered invalid due to the existence of debts against third parties and the presence of debts to pay the redemption price.

It should be remembered that if a real estate object (house, or other building) is located on a land plot, then the waiver of rights to the land plot simultaneously applies to such a real estate object, that is, it is impossible to retain ownership of the real estate object, any compensation for the object real estate is not paid (paragraph 2, part 4, article 35 of the Land Code of the Russian Federation).

The period for consideration of the application is 1 month, a copy of the decision based on the results of consideration of the application is sent to the applicant within 3 days from the date of its acceptance.

Important nuances

The procedure for renouncing land ownership is generally quite simple, but there are some nuances here. In particular, the fact of the presence of buildings of any purpose on the site is a controversial issue. In such a situation, in order to avoid disagreements with the authorized bodies, it is best to seek advice from a specialist competent in this matter.

According to Art. 35 of the Land Code, the alienation of land is unacceptable without buildings located on its territory, if they belong to the same owner and generally exist. In other words, if there are buildings for various purposes on the site, the refusal also applies to them. It will not be possible to get rid of the land while retaining ownership of the house.

In addition, the abandonment of possessions does not imply the removal of obligations to pay taxes for a building erected on the territory. A citizen must pay the established amount until the construction becomes the property of another person.

Termination of ownership of a land plot

Relinquishment of ownership of a land plot is subject to state registration and terminates from the date of state registration of the renunciation of ownership of a land plot (Article 56 of the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate”).

Now the former owner of the land plot (share) is exempt from paying land tax and loses the right to own, use and dispose of the land plot (share).

The land plot (share) becomes the property of a constituent entity of the Russian Federation or a municipal entity.

Necessity

It is not always possible to deal with land plots. For example, there may simply be no interest in such real estate or plans for it. Maybe there is simply no time to deal with the plot or it does not meet the needs. Regardless of whether the owner uses his property or land, the tax office will charge land tax.

IMPORTANT! In order not to pay money for unnecessary property, it is easier and more rational to refuse it. It is not always possible to sell land; sometimes it is even difficult to find a buyer.

If buildings are erected on the site, the owner must take into account that they will also need to be abandoned. It may be easier to pay taxes and maintain the land.