A deed of gift for an apartment after the death of the donor comes with a lot of difficulties. And they affect not only the receipt of various important papers, of which you need quite a lot, but also unforeseen circumstances. The problem of donation becomes relevant in the case when the owner of the property tries to find an opportunity to record in the legal field his own will to provide a certain citizen with the legal basis for this property.

Execution of a gift agreement in the event of the death of the donor

Issues relating to these circumstances are regulated by the Civil Code. The right of ownership of housing and other property is not always accepted voluntarily and correctly by other applicants.

According to the law, a deed of gift for an apartment after the death of the donor is recognized as void (without force). The ability to carry out such actions is assigned to citizens from the moment of birth and throughout life. Therefore, if the paper contains a clause that the transfer of property should be made only after the death of its owner, it is considered illegal (Part 3 of Article 572 of the Civil Code).

But sometimes the opposite situation occurs when the recipient dies before the transferor of property. According to the requirements of regulatory acts, a gift agreement after the death of the donee is canceled only if such a possibility is provided for by the specified agreement. If the deed of gift does not provide for cancellation for this reason, the heirs of the new owner may claim the property. In such a situation, claims and litigation are rarely avoided.

Gift design features

Situations when a person wants to give real estate to close relatives happen quite often. It is for this purpose that in the Civil Code of Russia there is Chapter 32, which regulates all relations of the gift agreement. Thanks to the deed of gift, it is possible to donate your possessions, avoid unnecessary costs, and the transaction will be carried out in accordance with all legal aspects.

A deed of gift is a transaction made with property, it involves:

- donor – a person who wants to donate his property;

- recipient – the person who receives the gift.

The whole transaction is aimed at transferring one’s property as a gift from the donor to the donee, and this should happen on the basis of gratuitous use.

What needs to be indicated in the document:

- all parties to the transaction, all information about them, contacts, as well as the characteristics and responsibilities of each member of the agreement;

- the property being converted into a gift, a description of the property and the address of the actual location;

- the date on which the transaction is executed;

- emergency situations.

The gift agreement is valid for one year; if during this time the recipient has not registered his rights to the property, the transaction is considered invalid and subject to termination.

Agreements of this type are considered gratuitous and are concluded irrevocably. Only situations enshrined in Russian legislation are legal for terminating a transaction.

Forms of agreement

There are various types of deeds of gift for an apartment after the death of the owner. This is stipulated by Art. 574 Civil Code.

Oral

This form of agreement does not apply to real estate. Therefore, in a situation with an apartment or other housing, the following form of agreement should be used.

Writing

This type of document is suitable for transferring ownership of real estate or property to legal entities if the value exceeds 3 thousand rubles. It is also used when transferring a transaction to a future period.

Where to go

But this is not all the important and relevant information regarding the topic being studied. Some people are interested in where the registration of the gift deed is carried out. As already mentioned, the operation is often carried out through a notary. An authorized person certifies the validity of the transaction, after which you can proceed with the re-registration and re-registration of the property.

Thus, today the gift agreement is proposed to be signed:

- in any notary office (public or private);

- in the MFC;

- in the management of the Federal Registration Service.

The first option is the most common. Registration of a deed of gift is far from the most difficult operation. After checking the document, the notary will issue a certificate for re-registration of the property. You can contact Rosreestr with this paper (for example, if we are talking about real estate), after which the new owner will be able to fully use what was given to him.

Validity of the agreement

According to the above circumstances, in a situation where a deed of gift comes into force after the death of the donor, such a document cannot be considered valid. Therefore, the legal heirs have every right to challenge the agreement in court. And they have every reason to hope for a successful consideration of the issue. To whom the gifted apartment is inherited will be determined based on the results of the filed claim. A will executed during the owner's lifetime, if present, must also be taken into account.

Who owns the donated property?

The subject of the donation is personal property. He will not share in case of divorce. This is explained by the fact that no funds are spent on the acquisition of such property. Property is transferred to a specific person, which means his spouse cannot claim it. Only if something happens to the recipient will you have to enter into an inheritance. Then the donated apartment can go to the spouse - as the first-priority heir, as well as to other first-priority heirs.

Types of agreement

According to Art. 572 of the Civil Code, a classification of gifts is established. The main feature of this agreement is the voluntary and gratuitous transfer of property, when the recipient is not required to comply with any additional conditions, including material ones.

Real

This type provides for immediate re-registration of ownership of the property immediately after signing. Is it possible to cancel a donation agreement for an apartment if its previous owner suddenly changes his mind? Given the gratuitous nature of the transaction, the reverse procedure is impossible. Exceptions are allowed in the presence of certain circumstances - the recipient committed a crime against that former owner, irretrievably lost housing due to an incorrect order, etc.

Taking these points into account, there is no possibility of a positive decision on the question of whether a gift agreement has retroactive effect, except in certain situations. Therefore, it is necessary to carefully weigh the pros and cons, since it will not be easy to cancel the agreement.

Promise of Giving

Another variety is consensual. In this case, the transfer of rights is assumed within a certain period of time. A prerequisite for such an agreement is to indicate in it a detailed description of the living space and the exact timing of the transaction. A deferred deed of gift for an apartment without complying with the listed requirements is considered illegal.

Concepts

First, you need to understand what a deed of gift is, and after that, study the term called “deed of gift.”

A deed of gift is a method of transferring property from one citizen to another. The owner gives a part or all of his property to one person or another free of charge. Such a document eliminates property and inheritance disputes in the family.

A deed of gift is an analogue of a deed of gift. Then what is the difference between these terms? Nothing really. Deed of gift is a colloquial, common name for a gift agreement. The second term is used primarily by lawyers. Accordingly, today we have to find out all the features of registration of deeds of gift. What information will be useful to all citizens?

Alternative

Considering that the said agreement is not legally valid after the death of the original owner, another option is to draw up a will. In this case, the heir has every right to receive an apartment or other object after the former owner has died.

How to make a will?

The requirements for the preparation of this document are established by Chapter. 62 Civil Code. The document must be drawn up in writing in the presence of a notary certifying its authenticity. A prerequisite for the validity of a will is the citizen’s legal capacity and his ownership of property.

What is the difference between a gift and a will?

Quite often people want to gift their property to their immediate family, but only after their death. In such a situation, it is necessary to draw up not a deed of gift, but a will. All aspects relating to a will are regulated by the Civil Code of Russia in Chapter 62.

A person should go to a notary and make a will in writing. Where to indicate everyone to whom he leaves his property. The notary will certify this application and, after the death of the testator, will issue a certificate of inheritance to the persons specified in the will.

The main nuance when drawing up a will is that the property that the heirs will receive must be owned by the testator. It is also taken into account that the testator is legally capable and an adult. If these points are not met, the will becomes invalid. The person who owns the property can change the will he has written. Both in full and in part, when he considers it necessary.

There are differences between a deed of gift and a will:

- Under a deed of gift, the recipient receives the right to use and own an apartment or land plot after signing the appropriate documentation. According to the will, the heirs can begin to fully use the property only after the death of the testator.

- The will must be certified by a lawyer; this is not necessary for a deed of gift.

- In the will, the testator must allocate shares to some of the heirs, this is regulated by Article 1149 of the Civil Code. When signing a gift agreement, the donor gives all his property to one person.

- When registering a deed of gift, the consent of other owners may be required. When a will is made, the testator does not ask permission from third parties.

- The testator can rewrite the will at any time and an indefinite number of times. During the donation procedure, the contract is drawn up once and cannot be challenged.

Another nuance for both procedures is the payment of the state fee.

When deeding property between immediate relatives, no fees are paid.

When making a will, the heirs in any case must pay a state fee for the service provided to them.

Is it possible to challenge?

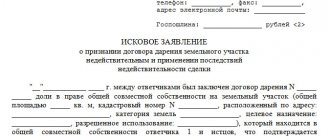

Situations when legal heirs have claims to a gift agreement are quite common. Often such cases become a pretext for consideration in the courtroom.

Many people are interested in whether it is possible to challenge a gift after the death of the donor. Considering the above arguments, the legal heirs have a valid reason to assert their rights and consider the contract invalid. This is explained by the fact that this action should be carried out only during life.

Heirs have a good chance of challenging the deed of gift after the death of the donor if the papers for ownership of the property were not completed before this fact. The date of complete transfer of ownership is the entry into the state registration authorities.

About cancellation

In fact, everyone should know about such cases. Registration of a deed of gift, as many believe, implies 100% transfer of property into ownership of a citizen. But that's not true. Under certain circumstances, the former owner of the property may demand it back.

Among such situations, the following circumstances are distinguished:

- fulfilling the terms of the deed of gift will significantly worsen the material or financial situation of the donor;

- the donee caused harm to the former owner or his relatives;

- the appeal of the new owner of the property leads to the destruction of the gift.

There are no other serious reasons for canceling deeds of gift. Therefore, the former owner of the property simply cannot return this or that item.

Paying tax

I would like to note in more detail what tax must be paid for the registration and exercise of rights under a deed of gift.

According to Russian law, donated property is considered income. (Article 41 of the Tax Code of the Russian Federation).

Consequently, after concluding a gift agreement, mandatory payment of personal income tax (Personal Income Tax) is required in the amount of 13 percent of the amount of the donated property. This condition applies only if the recipient is not a close relative. (exceptions are regulated by clause 18.1 of Article 217 of the Tax Code).

According to the Family Code of the Russian Federation, below is a list of relationships in which the obligation to pay personal income tax is removed. (according to paragraph two of clause 18.1 of Article 217 of the Tax Code of the Russian Federation)

- Children (including adopted ones).

- Parents.

- Spouses.

- Brothers and sisters.

- Grandfathers and grandmothers.

This list of kinship is “closed” - that is, it is not subject to expanded interpretation. The remaining relatives (not included in this list), as well as the rest of the donees, will be required to pay a 13 percent tax.

In fact, the amount of gift tax is calculated from the amount of real estate specified in the agreement. In theory, if the value of an object is not determined, the tax should be calculated based on the market price of the object.