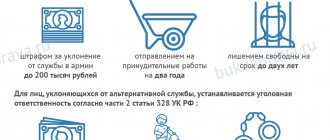

Malicious evasion by the head of an organization or a citizen from repaying accounts payable on a large scale or from paying for securities after the relevant judicial act has entered into legal force is punishable by a fine in the amount of up to two hundred thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to eighteen months, or compulsory labor for a term of up to four hundred eighty hours, or forced labor for a term of up to two years, or arrest for a term of up to six months, or imprisonment for a term of up to two years.

The law does not say what “malicious evasion” is.

This is an evaluative concept.

As a rule, the court recognizes evasion as malicious:

- if the debtor has funds, but does nothing to pay off the debt;

- if the head of the debtor company rudely refuses to comply with the demands of the bailiff;

- if the debtor sells or hides property, moves to another city and does not inform anyone about it.

note

The investigator can initiate a criminal case only if the amount of debt is more than 1,500,000 rubles. This requirement does not apply to evasion of payment for securities. Here the size of the debt does not matter.

Features of initiating a criminal case

Malicious evasion of debt payments is being investigated by police investigators.

As a rule, information about a crime comes to the police from the creditor company. But it happens that the judge who made the decision to collect the debt, or the bailiff who is tasked with executing this decision, signals the authorities.

To initiate a case, the investigator must study the court decision on debt collection. Then he will find out what enforcement measures the bailiff took.

The investigator will definitely talk with employees of the debtor company. He needs to establish whether the company had a real opportunity to pay the debt. If the debtor does not have money, the case will be refused.

Ways to solve the problem of non-payment of debt obligations

So, a forced defaulter, as a hostage to various unfavorable circumstances: delayed wages, dismissal due to staff reduction, deterioration of health or other valid reason, allows for several late payments.

What to do:

- You must immediately contact a bank employee and tell in detail about what happened. This will give the bank the opportunity to reconsider, if it finds your arguments truly justified, the amount of payment and timing of debt repayment, and in some cases, give a deferment. Otherwise, the situation may turn out to be disastrous, since the Legislator provides for criminal liability for non-payment of a loan, and it is not worth leading to such a development of events.

- There is no need to despair, carefully re-read the agreement with the bank, often the loan amount includes a commission fee, which is a contribution from the insurance company, and in the terms of the agreement or in the insurance rules there is a list of stipulated risks associated with non-payment of debt, it is quite possible that a specific moment that happened with you. Then the insurance company will be obliged to pay off the debts.

- When you are sure that you will find a certain amount in the near future, you can avoid unnecessary problems by obtaining a quick loan at interest. Do not forget that time plays a significant role here, so take money only when you know for sure that you are able to repay all loans in the near future.

Before taking out a loan, weigh the pros and cons, take into account all the nuances and think about the consequences. Do not take out borrowed funds if you do not have a stable income or are not sure that the money you earn for the month will be enough to pay all the bills and buy the necessary products.

Features of the investigation

By initiating a criminal case, the investigator will find out exactly how the debtor evaded repayment of the debt, how many times the victim demanded to repay the debt. This is necessary to prove the maliciousness of the evasion.

The investigator will definitely establish the amount of damage. This is not difficult to do. The amount of debt is indicated in the court decision. If it is less than 1,500,000 rubles, it will not be possible to bring the debtor to criminal liability.

At the bank, the investigator will seize the credit file of the debtor company, at the tax office - its balance sheets for the latest reporting periods (depending on how long the company evaded repayment of the debt).

The suspect will be questioned by the investigator about what needs the loan was used for, why it has not yet been repaid, etc. Employees of the financial department and accounting department will be questioned as witnesses. The investigator must establish whether the company had a real opportunity to repay the debt.

The investigator may order examinations: handwriting examinations to determine who signed the papers, and forensic accounting examinations to find out whether the company has financial difficulties and whether it conducted business activities after the court decided to collect the debt.

Evasion of repayment of accounts payable

The term itself in the title of the article means that the borrower makes no effort to repay the borrowed money. Even if he does not have the financial ability to do this due to circumstances beyond his control (illness, loss of income, etc.), the borrower must inform the bank about this and together with him look for options to resolve the issue. Otherwise, his behavior can be considered as attempts at evasion.

Before the court deals with a problem loan, there are several stages through which an unscrupulous borrower who has violated Art. 307 of the Civil Code of the Russian Federation:

- Before the payment deadline approaches, the lender tries to contact the borrower to remind them about the debt and ask if there are any problems. This is the best time to contact the bank and try to negotiate.

- After the payment is overdue, the bank looks for the debtor using contacts known to him: telephone numbers (including work or relatives), postal address, etc. From the moment of delay, fines accumulate, credit history deteriorates (it will be more difficult to take out a loan). The bank's trust in the client decreases, the client ends up on the list of unreliable ones. It is now more difficult to reach an agreement with the bank.

- Realizing that it is cheaper to transfer the debt to collectors, the bank sends them to the creditor. There are two options: the debt can be sold to a collection agency or they can act as representatives of the bank. The issue of the loan will have to be resolved with the person who owns it.

- Sometimes credit organizations do not involve collectors, but immediately send the claim to court (the proceedings will be civil, not criminal). The court will likely side with the plaintiff, and if the borrower refuses to comply with the judgment, he may be charged with evasion, which is a criminal offense.

This system may change in the near future if the Ministry of Justice and the FSSP lobby for the law “On activities for the return of overdue debts of individuals.” Now such debts are collected in accordance with Federal Law No. 230. This law is aimed at protecting citizens from debt collectors and regulates the activities of microfinance organizations.

The new concept provides that the creditor will be able to go to court 30 days after the borrower has received an offer to repay the debt. The bank can do this the next day after the delay.

The maximum punishment under Art. 177 of the Criminal Code of the Russian Federation - two years in prison.

If the debtor tries to come to an agreement with the creditor and takes measures to repay the debt, he will not commit actions qualified by Art. 17.14 according to the Code of Administrative Offenses (interfering with enforcement proceedings), this will benefit him.

What do the courts do?

Criminal cases under this article rarely reach court. If the debtor does not have money or has at least partially repaid the debt, the investigator will not initiate a criminal case.

But there are still convictions.

As a rule, the court imposes a penalty in the form of a fine. In addition, the debtor must pay the creditor the entire amount of the debt. EXAMPLE

The debt of the publishing house "Periodika" to the publishing house "Molot" has been accumulating since the beginning of 2008. When the debt amounted to 3,300,000 rubles, the publishing houses signed an agreement to return it within five months. At the end of this period, the money was never received into Molot’s account. The publishing house filed a claim with the Arbitration Court against Periodicals to collect the debt. The claim was fully satisfied. However, even after this, the director of Periodicals, Vasiliev, continued to evade paying the debt. The Molot publishing house filed a complaint with the police. As a result, the criminal court found the director of Periodicals guilty of malicious evasion of repayment of accounts payable (Article 177 of the Criminal Code of the Russian Federation). And he was sentenced to a fine of 200,000 rubles. In addition, the court ordered the publishing house "Periodika" to pay the publishing house "Molot" the entire amount of the debt - 3,300,000 rubles.

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Legal aspects and status of Creditor - Debtor

Non-payment of loan

The word “credit” among the people has long acquired a negative semantic connotation, since the usual way of life is “broken” by it. In such cases, you really feel sorry for the person - he hoped to “re-borrow”, soon pay off the debt, in the end the situation did not work out in the best way, he had to ask for money again, and ended up in a debt trap.

No one is immune from unpleasant circumstances, and since this happened, of course, the debtor is interested in what consequences may arise for late payments, whether criminal liability may arise for non-payment of the loan, and how to properly solve a serious problem.

Consumer lending has rapidly gained momentum in recent years, due to the fact that the market has been flooded with an excessive amount of all kinds of household appliances. Sometimes you really want to pamper yourself with a new gadget or buy a really practical thing, but you can’t find the required amount at once, so it turns out that this kind of loans has gained an exorbitant scope.

In the era of democracy and the development of a market system of economic relations, lending to small and medium-sized businesses is rightfully considered an indispensable financial tool for solving problems with customers not paying for goods on time. Since, in order to produce a new batch of products, raw materials are required, and where to get the funds to purchase them, if buyers delay payment terms, you have to ask a financial institution for a certain amount of money.

A mortgage is also a forced measure, the housing stock is wearing out and aging, if not everyone, then many want to have a normal apartment, and the level of wages leaves much to be desired, so a person comes to the conclusion that he has no other alternative.

Can they be arrested for debt?

The investigation of cases under Article 177 is carried out by the investigator of the Federal Bailiff Service. A case can be initiated at the request of the injured creditor (bank or private individual), but this is not a mandatory condition - in cases where the fact of evasion from repaying the loan was revealed by the bailiffs themselves, an application is not required.

A suspect in a criminal case may even be detained, but in practice this almost never happens, says lawyer Shcherbinin. The most common preventive measure is a recognizance not to leave the place, but the law allows the investigator to both release the accused on cash bail and petition the court for house arrest. They will not be put in a pre-trial detention center: “The Code of Criminal Procedure directly prohibits the use of such a preventive measure as detention against a suspect or accused under Article 177 of the Criminal Code,” the lawyer emphasizes.

You can avoid criminal liability after a case has already been initiated by writing a confession and starting to repay the loan. This is what a resident of Petrozavodsk did, who took out a loan of more than 3 million rubles to buy an apartment in a building under construction. The developer went bankrupt, the shareholders were entitled to compensation, after receiving which the woman could pay off part of the debt, but she spent these funds on other purposes. The borrower also did not pay from her salary, although she was quite officially employed. But during the investigation, she paid a tenth of the amount - more than 300 thousand rubles - and provided the bailiffs with information about both her income and her husband’s salary account (he acted as a guarantor). In May 2012, the case was dropped “due to active repentance.”

Proceedings in court

Many borrowers are afraid of litigation, but there is nothing bad about such an outcome. If we take into account the fact that this outcome is caused by a situation where the debtor does not pay anything. It is necessary to attend the trial:

- The borrower may have circumstances that will delay the consideration of the case or force the plaintiff to reconsider the terms of the loan.

- The debtor always has the right to ask for a deferment, especially when a child has appeared in the family or one of the able-bodied relatives has fallen ill, which has shaken the financial situation.

In most cases, the courts meet borrowers halfway and give them a chance to pay off the debt without transferring the case to the FSSP. The main thing is to remember that the creditor must agree to a deferment or installment plan, but if the loan is not very large, it does not interfere with the court’s proposal.

The borrower always has the opportunity to challenge a court decision that was made in favor of the bank or collection agency. 10 days are allotted for this. During this period of time, an appeal must be filed. The appeal is granted if there is a clear violation of the proceedings. Therefore, when filing an appeal, it is necessary to know exactly what rights of the citizen were violated.

Installment or deferment is the maximum that can be achieved in court. Termination of the contract and forgiveness of debts is impossible, since the rights of the creditor will be violated. The court is not an interested party and makes all decisions in accordance with the existing law, and in most cases it is the trial that allows you to put an end to the existing dispute and helps you finally get rid of the debt.

What are the consequences of not repaying a loan?

If the borrower stops making payments and does not make any contact with the bank. This does not mean that the situation will turn against the debtor. The creditor receives the greatest damage in such a situation. An exception is loans secured by real estate, when the borrower may lose the security for the loan.

When money was taken with the firm intention that it was not going to be returned, sooner or later you will have to deal with bailiffs who can seize accounts, property, and so on. The only alternative is to hide from the creditor for three years, but such a decision is justified when we are talking about truly impressive amounts.

In other cases, banks undertake one of three schemes:

- assignment of rights under a loan;

- trial;

- forced debt collection.

It should be understood that debt collectors rarely sue. This usually occurs when the loan was purchased by an agency. If they represent the rights of the bank, they are not interested in the court hearing.

The concept of a willful defaulter and related concepts.

Signs of a willful defaulter and the practice of identifying him.

The composition of the arbitration court considering the case cannot include persons who are relatives.

3. On the grounds provided for in Part 1 of this article, the arbitration assessor is also subject to challenge.

Thus, we are essentially talking about three situations. We should consider them in more detail:

Is a relative of the person participating in the case or his representative

The factor of relationship puts pressure on the judge, as a result of which he may make wrong decisions. Moreover, we are talking about kinship, without indicating a specific degree of kinship. Thus, it is necessary to determine: what degree of relationship is defined by law as preventing the administration of justice. The Civil Code does not indicate the degree of relationship. Thus, the search must be carried out in other legislative sources, namely in family law.

The solution to this problem is the following: in civil law we are talking about those degrees of relationship that can influence the judge’s decision. And all degrees of relationship can influence his decision. Thus, we are talking primarily about spouses, parents and children. We also need to talk about full and half brothers and sisters, as well as grandparents and grandchildren. We are also talking about adoptive parents, adopted children, stepmothers and stepfathers. And finally, we are talking about more distant relatives, i.e. about uncles, aunts, nephews, cousins and others.

The issue with the property is resolved in a similar way. Property is the legally significant relationship between the relatives of the husband and wife, as well as the relationship of the husband with the relatives of the wife and the wife with the relatives of the husband. Accordingly, it is necessary to talk about the following relatives: Mother-in-law, father-in-law, brother-in-law, sister-in-law, brother-in-law, etc. When considering this problem, you need to understand that we are talking about those persons who can equally, if not more, influence the judge’s decision. Therefore, in-laws belong to the same category as relatives.

Arbitration assessors are also subject to recusal in a similar case.

Personally, directly or indirectly interested in the outcome of the case or there are other circumstances that may raise doubts about his impartiality

This factor means that the judge has some kind of interest in the outcome of the case: material, personal and other. Moreover, interest is divided into direct and indirect.

Direct interest is understood as a direct material, personal or other interest as a result of the resolution of the case.

This ground is a fairly common basis for challenge, but each time it is necessary to present compelling arguments in order to initiate the procedure for challenging a judge or arbitration assessor.

Signs of a willful defaulter and the practice of identifying him.

The concept of a willful defaulter and related concepts.

The concept of “willful defaulter” is used everywhere. It is used mainly for convenience. Therefore, in order to use it as a fundamental concept for this study, it is necessary to understand its essence and identify its characteristics.

What meaning does this concept have? This term is mainly used in legislation, journalism, and in the business of credit institutions to designate an entity that does not fulfill its obligations for a long time. In particular, we are talking about the execution of a bank loan agreement, the payment of alimony and other similar situations.

Thus, “Director K. Suslov believes that the term “willful defaulter” can only be applied to those bank clients who initially planned to disappear with the money they received, and the loan was issued through “linden” and through “black” brokers.”

S. Kapustin (Director of Risk Assessment and Methodology at OTP Bank): “A “willful defaulter” is a borrower who prefers to hide from the bank, regardless of whether he planned to repay the debt or not.”

D. Somovidis (Managing Partner at Morgan & Stout): “A willful defaulter is someone who initially takes out a loan and does not intend to repay it.”

Article 157 of the Criminal Code of the Russian Federation talks about malicious evasion of payment of funds for the maintenance of children or disabled parents. In accordance with this article, the evasion of parents from paying court-ordered funds for the maintenance of children in the theory of criminal law and in practice is traditionally understood not only as a direct refusal to pay child support awarded by the court, but also by a person concealing his actual earnings, changing jobs or places residence in order to avoid deduction under a writ of execution, evasion from work for the same purpose and other actions indicating evasion of payment of funds for the maintenance of children by a court decision.

There is another concept in business that is close to the concept of “willful defaulter”, but at the same time has significant differences from it. This concept is a “problem borrower”. To understand the difference between these two concepts, it is necessary to find out what semantic meaning the concept of “problem borrower” has.

S. Kapustin: “A “problem borrower” comes to the bank and honestly talks about his difficulties (preferably with a folder of documents confirming these difficulties), and with a request for debt restructuring.”

E. Lapshina (project manager “Customer Loyalty Management of CB “Let’s Go!”, FG Life, certified member of the Net promoter association) “A problem borrower is one that creates problems.”

However, in order to understand the semantic load of these concepts, it is still necessary to take into account the specifics of the areas in which this concept is applied. This specificity is expressed in what is considered the so-called “point of departure” of legal relations regarding non-payment.

The “point of departure” of legal relations should be understood as the time and place of fulfillment of the obligation. However, in this case, we are not talking about the actual fulfillment of an obligation, which may simply not exist, but about the fulfillment of an obligation that could have occurred if both parties had acted in good faith.

The time of fulfillment of the obligation, in accordance with the Civil Code, is the day or within the period provided for by agreement of the parties. There is, however, such a problematic concept as a “reasonable period”. However, what are the criteria for determining a reasonable period?

“A reasonable time is a fallback option when all other options fail. A “reasonable period” is ultimately determined by the court in the event of a dispute about the delay in fulfilling an obligation.” Thus, the court must determine what period should be reasonable.

“If a dispute arises, the “reasonableness” of the execution period is determined by the court. The burden of proving delay (violation of a reasonable period) rests on the creditor, based on the general presumption of reasonableness of the actions of participants in civil legal relations.”

Thus, it should be borne in mind that a reasonable period is set by the court.

An example of this practice is:

“It is the prerogative of the court, not the parties, to determine what period of time is reasonable for the performance of an obligation. The latter can only express their opinion regarding exactly what period should be accepted as reasonable (see Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.12.1997 N 1282/97, as well as Resolution of the FAS ZSO dated 16.12.2001 N F04/3177-962/A27 -2001; dated 04/07/2004 N F04/1848-224/A75-2004; dated 03/17/2005 N F04-934/2005(9060-A70-16); FAS VSO dated 02/28/2005 N A10-7449/04-F02 -636/06-С2). For example, in one of the cases, the district court overturned the decision of the lower court and sent the case for a new trial for the following reason: in the decision, the court indicated that the obligation was fulfilled within a reasonable time; Meanwhile, the decision lacked information about what period of repayment of the debt, in the opinion of the court, is reasonable, with justification for this conclusion (see the resolution of the FAS VSO dated August 10, 2000 N A19-8766/99-38-F02-1500/00- C2)".

It also seems true that the parties are also required to prove the time frame of this period, since it is the parties who are direct participants in the conflict (with the exception of such participants as the prosecutor). In this regard, they are the ones who are most capable of influencing the court’s decision. “A reasonable period is determined based on the specific, factual circumstances and nature of the obligation to be performed.” And it is the parties who are those participants in the court session who have the most complete information on the merits of this dispute.

However, the interests of the parties cannot be ignored. That is why the role of the court in establishing a reasonable period is to take into account the views of the parties when determining it, and not to determine a reasonable period based on the opinions of the parties on this matter. This position seems correct based on the fact that:

1. The parties, being interested parties, are inclined to present the facts that took place in such a light that the decision is made in their favor. Based on this, the parties may present evidence from which completely different conclusions can be drawn. The duty of the court is to make the most complete and informed decision. The parties often seek to mislead the court by presenting completely different interpretations of what period should be considered reasonable in a given dispute. Thus, the court, guided by the goal of providing the most complete picture of the dispute, should rely, first of all, on those information about the facts that, with a high degree of probability, took place.

The question arises: Doesn’t this provision contradict the fact that no evidence should have greater evidentiary power in comparison with other evidence? It seems to be a negative answer to this question due to the fact that, setting itself the goal of constructing the most complete picture of the facts that took place, the court is inevitably obliged to “weed out” the information that is unreliable. Based on the fact that the parties tend to present facts in a light favorable to them, the court would have to re-check all the facts on which one or another party bases its point of view. However, this appears to be incorrect due to the fact that collecting information would require an unreasonably long time. Moreover, the court, checking these opinions of the parties, would perform multiple tasks, which also seems inappropriate.

In view of this and much more, the court should form its own point of view, based on those facts that are most reliable.

2. The parties may misinterpret certain circumstances. This can happen due to the fact that a person tends to forget certain facts, the situation itself, being stressful, “puts pressure” on the person and he may incorrectly “prioritize” in assessing certain facts; pressure may be exerted on one of the parties, causing for which she will be inclined to remain silent about certain facts that could decide the case in her favor.

Summarizing all of the above, I would like to conclude: legal relations regarding debt collection begin from the moment when the party would be obliged, if it had acted in good faith, to fulfill (begin to fulfill) its payment obligations.

Thus, speaking about the difference between the concepts of “willful defaulter” and “problem borrower”, I would like to note that, based on the above concepts, we can conclude that there are 2 points of view:

1. There are no differences between the concepts. This point of view is very simplified and expresses the fact that both a willful defaulter and a problem borrower create problems for the lender. This point of view is valid only in the sense that it is of a purely “utilitarian” nature

2. The concept of “willful defaulter” should be understood as a person who, when applying for a loan, did not initially intend to repay it. A “problem borrower” is understood as a person who would like, but is not currently , to repay the obligatory loan payment. At the moment, because, essentially, we are talking about “category”.

It is necessary to clarify what is meant by the concept of “category” in this case. Thus, the concept of “category” can be discussed from three points of view:

1. “Category”, as any concept that is “extremely general” or close to it. those. it is necessary, in this case, to talk about something more or less established. So, for example, we can talk about categories that are established in science.

2. “Category”, as a type of any concept. This point of view was used by I. Kant. This concept also characterizes a category as something static, such as the category of quantity, category of quality, relationship and modality).

3. “Category” as dynamics. In this case, we are talking about social relations and the characteristics of a particular subject. In essence, we are talking about the fact that when evaluating a particular subject through the analysis of certain of its characteristics, we compare the characteristics that correspond to this concept and the characteristics of a real subject in order to affirm or deny the similarity of the characteristics of the concept and the real subject. Thus, having established the identity of the characteristics, we establish that the given subject fits this concept and we attach this concept to the given subject. The dynamics is that in each specific situation we do this anew. This is accomplished by establishing certain qualifications. Roughly speaking, by drawing the characteristics of a particular concept through a set of certain qualifications, we each time attach this or that concept to this or that subject. The need for a third approach arises when we are talking about something impermanent. Such as, for example, this or that legal relationship.

Returning to the classification of the concepts “willful defaulter” and “problem borrower”, I would like to clarify that the concept “category” is used from a dynamic point of view, because Each time it is necessary to carry out an analysis to determine whether a particular borrower is in good faith or not.

Based on the foregoing, we can conclude that the only difference is the presence or absence of intent to evade debt payment. However, the question arises: How to distinguish between these concepts in practice? After all, it is impossible to understand what is going on in a person’s head during the conclusion of an agreement.

The answer to this question seems to be the following: it is necessary in each specific case to consider the entire credit history of a given borrower in order to assess who the borrower is - a “willful defaulter” or a “problem borrower.” If the borrower, when the deadline approaches, begins to take any actions aimed at extending the payment period (comes to the lender and begins, roughly speaking, to complain and ask to wait a little longer with a promise to fulfill his obligations (often even indicating a specific or approximate period), and actually fulfills its obligations within a given period, then in this case there is no talk about the fact that this borrower is a “problem”, and even less so about the fact that he is a “willful defaulter”.

A borrower becomes “problematic” and “malicious” in a situation where, even after a given period, the borrower does not fulfill his obligations. And in this situation, the truly defining moment is intent, which is expressed precisely in the desire to evade fulfillment of one’s obligations.

Are debts inherited?

If a person took out loans, did not pay on them and died, banks and other creditors do not lose hope of getting their money back, at least partially: obligations are inherited along with the property. Fortunately for the heirs, they can recover from them no more than they received: if the debt is 5 million rubles, and the apartment left as an inheritance costs 3 million rubles, you will not have to pay an additional 2 million from your own pocket, but you will have to give the apartment back.

“In his right mind, no heir will accept exclusively debts as an inheritance,” says lawyer Shcherbinin, but calls for careful consideration of accepting an inheritance if it is known that the deceased took out loans and did not pay them, but a court decision on these debts has not yet been made : “Theoretically, it is possible that after the heir receives the inheritance, the testator’s creditor will file a claim against the heir, the court will satisfy his claim, and the heir will form an account payable.” After the decision comes into force, the heir will have to pay, and if he decides to evade, he may well become accused under Article 177.

Existing measures of influence on the debtor

The agreement with the credit institution must clearly state:

- Credit rate;

- Fees and commissions;

- Payment schedule.

The nature of liability for failure to meet payment deadlines is penalties and fines.

For late payment on the loan, penalties will be charged from the first day, and, as a rule, this amount is a significant percentage of the total amount of debt and increases every 24 hours in geometric progression.

A delay in payment of more than two months will result in additional penalties, which are regardless of the accrued penalties.

Measures to influence the debtor

Long-term non-payment may result in contacting a collection agency, and the bank is able, in accordance with the law, to complete a transaction and completely cede the right to demand fulfillment of obligations. And the borrower will begin to be harassed by round-the-clock calls, and possibly threats.

When all the deadlines have expired, the bank turns to the judicial authorities considering civil cases for violation of material obligations.

It is obvious that the decision in the case will be made unequivocally - to collect the debt. Then the bailiffs will get down to business.

It is important to note that the defendant in such cases, even before a decision on the case is made, may be restricted from traveling outside the Russian Federation.

Seizure of property

As an interim measure, the court has the right to describe your property and prohibit its disposal. This is primarily used if the client has taken out a secured loan. The creditor will immediately file a claim to recover the property included as collateral.

If the car was pawned, the bailiffs will arrest it. Then the owner of the car will be deprived of the right to sell. Also, it is not recommended to hide it. Any of these attempts risks criminal liability and is considered avoidance of duties. The bailiffs will sell the car, and the proceeds will be used to repay the loan. Any excess proceeds are returned.

Seizure of property

An apartment can also be seized if the debtor has other housing. In cases where a person owns one property, the bailiffs will not take it away, but will describe all the furniture and equipment that can be sold. Clothing, personal items and food are not included in the inventory.

When a citizen signs a loan agreement, he must impeccably fulfill its terms. Before signing the agreement, a person must soberly assess his financial capabilities, have a clear purpose for the loan, and take into account the possibility of unforeseen circumstances. Failure to repay the loan will result in adverse consequences.

Why is it important?

It would seem that the FSSP has a certain position on what is considered malicious evasion, whether it is a good position or not, but it exists, and that’s enough.

The fact is that all or part of what is said in this analysis can be used in one form or another by a lawyer when considering a specific case in court, where the lawyer will always return the prosecutor’s office to the arguments of the FSSP of the Russian Federation with questions about why everything said by the FSSP of the Russian Federation is marked “ this and this is malicious” cannot have the marker “this and this is as common as it is malicious,” and with the questions “How in this or that example does the FSSP of the Russian Federation formulate the difference between ordinary and malicious evasion, when in fact to any ordinary “The term malicious is completely arbitrarily added to the deviation with the intonation of auto-da-fé as a victorious sermon designed for blind faith and not for critical, thoughtful comprehension?”

And the court, if it turns out to be impartial, is not at all obliged to follow the peremptory judgments of the FSSP of the Russian Federation, but may well ask exactly the same question - why.