Home / Labor Law / Labor Code / Work experience

Back

Published: March 18, 2016

Reading time: 9 min

0

2803

A person’s work experience is the period of his life devoted to work and other activities useful to society. When calculating it, all recorded working hours are summed up. The concept of seniority is a general definition of several types of seniority. These include:

- General labor is all human activity.

- Continuous – the sum of work periods. If the intervals between them are less than a month.

- Special or other activity of public benefit.

We will talk about the latter in more detail.

- Concept

- Current legislature

- History of the concept

- Main types

- Experience of medical workers What is included in the experience?

- How to prove? Documentary

- Witness's testimonies

- What is included in the experience?

- How to calculate?

- How to calculate?

Concept

Special length of service is the recorded and documented duration of a person’s activity in specific conditions, special working conditions, positions, professions or jobs defined by law that are useful to society.

For example, guardianship or care for seriously ill people. It is taken into account when establishing salary supplements, benefits, calculating sick leave and other payments in some regions of the country, for example, the Far East, when assigning an old-age pension early or long service.

If the pension is assigned in the general manner, that is, upon reaching the age established by law, then the special length of service will be included in the general one.

The condition for receiving a long-service pension is the cessation of professional or other activities. Dismissal from office, resignation. This rule is mandatory for all categories of citizens who have special experience, except for teachers and medical personnel working in rural areas.

Lists of professions, industries and works for which a preferential pension is awarded

Approved by Resolution of the Council of Ministers of the USSR No. 10 dated January 26, 1991. Usually these are production facilities of categories I and II of negative impact on the environment (Resolution of the Council of Ministers No. 1029 of September 28, 2015).

The lists indicate those employed in production, for example:

- explosives, gunpowder, and ammunition supplies;

- building materials;

- refractories;

- hardware;

- glass, porcelain and earthenware;

- chemical;

- pulp and paper;

- dinas products;

- electrical engineering, electronic equipment and equipment, their repair;

- underground and mining works;

- at power plants, power trains, in the electric power industry;

- in healthcare and social welfare institutions;

- in transport and communications

- in construction and renovation of buildings;

- in the light and food industries;

- in nuclear energy and industry;

- on others.

Working conditions in such industries are associated with increased harmfulness, severity or danger. Harmfulness can be caused by an increased content of dust, gas, harmful substances in the air, exceeding normal levels of noise, vibration, radiation, humidity, high or low temperatures, and insufficient lighting. Working in such conditions can cause occupational disease, lead to industrial injury, complete or partial loss of ability to work.

Current legislature

Special experience is primarily regulated by:

- Federal Law – 340-1 dated November 20. 1990 “On state pensions”;

- regional legislative acts;

- and regulatory documents of local governments.

In addition to this law, special experience is regulated by a number of laws and regulations:

- Labor Code of the Russian Federation.

- Federal Law-76 “On the status of military personnel” in the latest edition dated June 28, 2002.

- Federal Law-3061-4 “On social protection..... of the Chernobyl Nuclear Power Plant”, latest edition 25.

- 06. 2002.

- Resolution (CM of the RSFSR) number 384 “On the assignment of... pensions... to flight test personnel”, last edition - 08/12/1002. Federal Law-10 “On Trade Unions...” dated July 25, 2002.

- Resolution of the Ministry of Labor, which explains the use of lists and lists of professions, jobs, positions, productions, in accordance with the Law of the Russian Federation “On Pensions”. It was published on May 22. 1996.

- By Decree of the Government of the Russian Federation No. 537 of July 18, 2002 “On lists...”.

- Presidential Decree No. 1141 dated September 20, 2010, as amended on May 19, 2011 “On the list of positions... for.. for length of service...”

History of the concept

This special service, which was not clearly expressed, began to exist during the reign of Peter 1. He paid his subjects a pension for “sovereign service.” However, there were no other pensions at that time. In 1918, the Soviet government established two types of pensions, which, in fact, required special length of service.

These are pensions:

- Civil servants.

- Military personnel.

Subsequently, the list of persons with special experience expanded. It included people who worked in enterprises with hazardous working conditions, who received special merit for their activities, and a number of others.

But for the first time, special length of service, as a separate type in the pension system, was allocated by the legislator only in the Russian Federation, in 1996.

The concept and legal significance of special experience under the Federal Law

According to Article 27, prescribed in the Federal Law “On Labor Pensions in the Russian Federation,” the designation of special length of service means the total amount of duration of a specific type of output. Dangerous working conditions or employment in the Far North is the main legal factor giving the right to receive an early pension.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Citizens with such length of service go on a well-deserved retirement earlier than the usual retirement age is reached.

Main types

Special experience, in fact, is understood as a taken into account time period of activity useful for society. For example, the work of a teacher or doctor. When we talk about this type of internship, we proceed from the fact that its main purpose is:

- Assignment of early pension.

- Long service pensions.

- Salary supplements, compensating or incentives.

- Grounds for appointment to a position, government or other socially important.

Citizens for whom special length of service is calculated and who have the right to claim the above security include:

- Civil servants.

- Military personnel.

- Persons undergoing service equivalent to military service. For example, employees of the Ministry of Internal Affairs, FSB, Ministry of Emergency Situations, etc.

- Persons employed in hazardous work.

- Persons living and working in regions defined by the legislator as unfavorable for work and life. For example, in the Far North.

- Astronauts.

- Flight test crew.

- And a number of others, for example, temporarily disabled people, pregnant women, and giving birth.

Now let’s take a closer look at some of the categories, how experience is formed, and how to confirm it.

Experience of medical workers

When calculating the special length of service of a medical worker that gives the right to early retirement, one must take into account the requirements set out in the “Law on Pensions” (Article 27). It establishes that a person who has worked as a doctor in a rural area can apply for early retirement if his length of service is:

- 25 years in the village;

- 30 years in the city.

But at the same time, the position he held must be taken into account in the “List of Positions..” (Government Decree No. 781 of October 29, 2002) and be called as it is called in the “Nomenclature of Positions” approved by the Order of the Ministry of Health and Social Development.

(27.04.2009, No. 210). She must meet the qualification requirements set out in order No. 415 of the same ministry dated July 7, 2009. Otherwise, the pension will be assigned according to general principles. When calculating special experience, you must be guided by the Rules for its calculation established by the Government.

What is included in the experience?

The time of residency training is not included in the length of service.

The length of service includes both the duration of medical activity and time of temporary disability, maternity leave, bulletin, etc.

If a person worked both in a village and in a city, then the so-called mixed length of service .

In this case, the time spent working in a village or in urban-type settlements is counted as follows: 1 and three months are counted for one year.

For a number of health workers, a correction factor has been established when calculating special length of service. For example, junior surgeons (operating personnel) working in operating rooms, traumatology, ophthalmology, and surgical departments count 1 year and 6 months as their length of service for one year of work.

Persons associated with anesthesia and resuscitation, both doctors and nurses, count 1 and 6 months in one year.

It should be noted that the calculation of the special length of service of medical workers and the appointment of early pensions are regulated by a large number of regulations. Therefore, when calculating your length of service, you should consult a specialist, a PF employee or a lawyer.

How to prove?

The main proof of work experience is a work book. If all

the periods of work activity are recorded in it, the records are made correctly, then there will be no problems with the assignment of a pension.

If some records are made inaccurately, incorrectly, or are missing from certain periods of work, then there are two ways to prove the existence of length of service:

- documentary;

- witness's testimonies.

Documentary

In the first case, certificates from the organization where the doctor worked are used for proof. If there is no entry in the employment record, an employment contract or a certificate from the organization can serve as confirmation.

If the organization has ceased to exist, then you need to make a request to the archive. After receiving a response from the Pension Fund, an application is drawn up with a request to restore the length of service.

Supporting documents are attached to it. Some periods of activity can be restored and included in the length of service through the court. For example, studying at a university, but only if the person studied during Soviet times. Then study was included in the experience. But only on condition that the person worked before training and immediately after.

Witness's testimonies

It happens that the organization’s documents are not in the archive. In this situation, the law allows that witness testimony can serve as proof of experience. They are attached to the application to the Pension Fund with a request for restoration. There must be at least two witnesses. They must have documentary evidence of the fact that they worked together with the applicant during the period of time that he requests to be reinstated in his seniority.

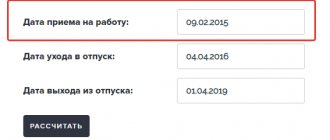

How is it calculated?

Calendar order

Subject to the conditions allowing for the accrual of early retirement (different conditions for each category), the calculation of professional experience is carried out in calendar order, years are converted into months, each month into thirty days.

For example:

Kovalev P.L. From March 1985 to August 1995, he worked as a timber harvester at the Zvezda enterprise, after which in the same month he moved to , where he worked in the same specialty until September 2001. Then he worked at OJSC Giatsint until 2010.

1. It is necessary to write down periods of work activity.

| Hiring dates | Dates of dismissal |

| 12.03.1985 | 07.08.1995 |

| 10.08.1995 | 10.09.2001 |

| 15.09.2001 | 12.11.2010 |

2. Add the dates of both columns separately:

- 12.03.1985 + 10.08.1995 + 15.09.2001 = 37.20.5981

- 07.08.1995 + 10.09.2001 + 12.11.2010 = 29.28.6006

From the second amount we subtract the first: 29.28.6006 - 37.20.5981 = 22.07.0025

Since when subtracting in the days column we got a negative value, we

decreased the number of months by one, converting them to 30 days, which were then added to the negative number (-8+30).

We will also add one day from each period, since it was lost during the calculations (the day of dismissal).

Thus, Kovalev P.L. 25 years, seven months and 25 days of professional experience.

Teachers' experience

Special experience includes the time during which a person conducted teaching activities. It also includes:

- periods of postgraduate study;

- Military service;

- work in elected positions;

- other work, in addition to teaching, in the educational field, for example, in the Ministry of Education;

- periods of temporary disability;

- and a number of other activities related to teaching work.

What is included in the experience?

In a short article it is impossible to outline all the provisions of regulations and legislation governing the special experience of a teacher. Mark the main ones. Teaching experience is counted primarily for teaching activities and work related to them.

A teacher receives the right to early retirement if he has at least 25 years of experience.

Just like with medical workers, when calculating teaching experience, one should be guided by the List of Positions, the qualification characteristics of a teacher, the Rules for calculating special experience, and regulations approved by the Government.

How to prove?

A general procedure has been established to confirm special experience. The main document is the work book. In case of controversial situations, the existence of experience is confirmed either by documents or by witness testimony. We have already talked about all this in more detail in the section “Experience of Medical Workers”.

What is included in the insurance period

2 groups of periods are counted in the insurance period:

- insurance;

- not insurance;

The difference between insurance periods and non-insurance periods is the calculation and payment of contributions to the Pension Fund. The legislation contains a closed list of such non-insurance periods:

- military service;

- receiving temporary disability benefits;

- the time specified for caring for each child until he reaches 1.5 years of age (only for one parent, chosen independently);

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child, or a person who has reached the age of 80;

- for persons rehabilitated as a result of repression, or persons unjustifiably brought to criminal liability;

- the time of receiving unemployment benefits, participating in paid public works, moving or relocating in the direction of the state employment service to another area for employment;

- a period of cooperation as the main activity on the basis of a contract between citizens and bodies carrying out operational investigative activities.

In order to include non-insurance periods in the insurance period, a mandatory condition must be met: insurance periods must follow before or after such periods. The duration of labor or other activity does not play a role in this case.

In 2015, a mandatory condition for assigning an insurance pension is the presence of at least 6 years of insurance experience and 6.6 pension coefficients. Each subsequent year these figures will increase. According to the Pension Fund, by 2024 it will be necessary to have 15 years of insurance experience and 30 pension coefficients.

Length of service

Categories of citizens who receive credit for length of service:

- Civil servants.

- Military personnel.

- Persons undergoing military service.

- Citizens employed in hazardous production.

- Working in specific conditions.

- Busy with hard work. Miners and a number of others.

How to calculate?

Persons who have served 25 years are entitled to early retirement. For federal civil servants, the length of service is 15 years.

When calculating length of service, all periods of the specified activity are included in it. Correction factors are used. Depending on the category, working conditions and other circumstances specified by law, the coefficient can be 2.0 or more. So, in the case of an established coefficient of 2.0, a year of service is counted as two.

How to prove?

The procedure for confirming length of service is no different from the general procedure established for special length of service. The main document is a work book or other document confirming work experience. See above for more details.

There is, however, one difference. Studying during length of service is counted towards length of service .

Calculation order

When calculating the STS for assigning a pension, you must first of all be guided by legal norms that define the list of jobs, specialties and working conditions that can be classified as special or special.

The following are included in the total STS:

- probationary period, after which the applicant is/is not granted a job;

- the period of professional activity in special conditions that are determined to be harmful, dangerous or difficult. STS is not necessarily continuous. This is the total period of time spent in such work;

- inter-shift and inter-shift rest is counted equally with STS;

- pregnancy, as well as subsequent maternity leave. It is taken into account even if the woman has transferred to a regular job, which cannot be assigned “special” or “special” characteristics;

- periods of officially recorded illness (temporary disability);

- regular (paid/unpaid) vacations;

- violation of a contract (labor/collective) by the management of the enterprise, namely: illegal dismissal or forced absenteeism.

An important nuance of accounting for STS: it is taken into account provided that the work activity was carried out on a full-time (not shortened) working day. When production volume decreases and the total working time during the work week is reduced, the CTC is counted solely based on the time actually worked.

Depending on the conditions of employment, special work experience is accrued differently. For example:

- One full season of work (navigation period) is taken as a year of normal work activity.

- One-and-a-half times the length of work experience is assigned based on the presence of STS in the Far North or in similar conditions.

- A double calculation coefficient was established for workers of anti-plague institutions and leper colonies. The action covered the period of the Great Patriotic War.

- Triple – for participants in military operations; survivors of the siege of Leningrad; rehabilitated concentration camp prisoners and repressed citizens.

The length of service for hard work is added to the normal length of service. This sequence is provided for when calculating pensions for employees:

- special enterprises and their separate divisions;

- occupied with radiation sources, harmful radiation and rare earth metals.

When calculating special work experience, it is recommended to seek clarification from specialists due to the large amount of information and numerous amendments made at different times. HR specialists, legal consultants, as well as pension fund employees are fluent in the legislative framework on duty.

Experience of pilots and testers

For this category of persons it is established that they have the right to receive a pension:

- early;

- according to length of service.

How to calculate?

When determining length of service, it is taken into account that the maximum age for retirement is established:

- men – 55 years old;

- women – 50.

Professional experience must be five, 10 or 15 years. The insurance period is also taken into account, which is:

- 25 years for men;

- 20 years for women.

For persons working in Civil Aviation length of service:

- 25 years old - men;

- 20 years old – women.

If a person retires due to health reasons, then the length of service is reduced when calculating. In this case, it will be 20 years for men, 15 years for women.

How to prove?

We described in detail the process of confirming experience above. It is valid for all categories of citizens with special experience.

How to get sick leave at a clinic - a complete guide. If you want to find out how long you will be paid maternity benefits, then our information will be useful to you.

Find out more about the state pension for disabled people here.